PDF Attached

There

were no USDA 24-hour sales this morning. Rumors of a large US corn sale Friday had rallied corn futures. The break in corn futures at the day session was warranted, IMO. 2020-21 current crop-year corn futures ended the day higher, wheat lower, soybeans up

3.50-7.00 cents, SBO higher and meal lower.

Kansas

winter wheat ratings declined one point in the G/E to 36 percent as of 3/7 from the previous week and are down from 40% as of February 22 and 43% as of Jan 25.

USDA

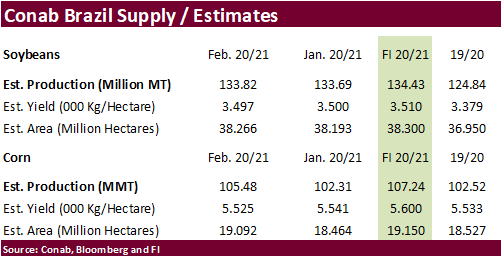

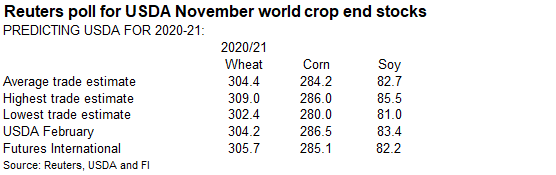

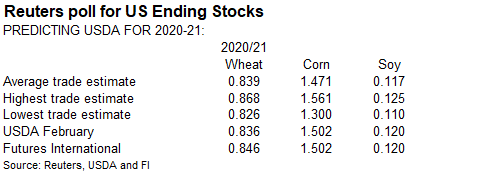

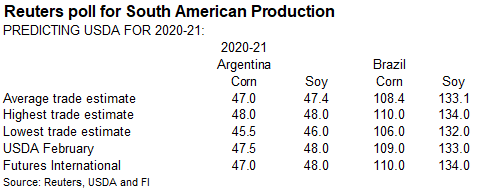

will release its updated S&D report on Tuesday. FI snapshot attached.

Weather

World

Weather Inc.

CHANGES

OVERNIGHT

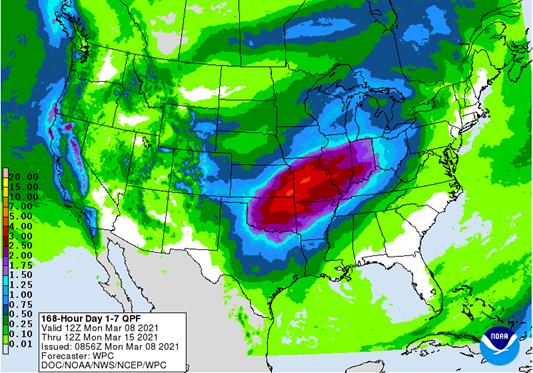

- A

little better model agreement about late week and weekend U.S. weather was noted overnight with both the European and GFS model runs now suggesting significant rain from eastern Kansas and parts of Oklahoma into the lower Midwest while heavy snow falls from

eastern Colorado into Nebraska and parts of Kansas - The

snow event raises a serious threat to livestock since this is the height of the calving season in the central Plains - Animal

deaths were reported in February’s bitter cold and snow event and there is concern for newborn losses if the heavy snow event occurs as advertised - The

storm is still several days away and will likely change somewhat, but ranchers and farmers need to be watching this event very closely - If

the late week and weekend storm occurs in the U.S. Plains and Midwest as expected a significant boosting in soil moisture would occur to hard red winter wheat areas in Kansas, Oklahoma, Nebraska and northeastern Colorado improving the early season prospects

for that crop and adding more potential for crop recovery after freeze damage last month - Winterkill

will soon be assessable as greening begins in the central U.S. Plains. - Rain

this week coupled with warming soil temperatures should induce a green up - Freezes

returning to the central and southern Plains late this weekend and next week will not cause any permanent damage to wheat that is greening

- U.S.

lower Midwest will receive flooding rainfall late this week and during the weekend with multiple inches of moisture possible - Early

indications suggest 2.00 to 4.00 inches and local totals to 6.00 inches with more in Missouri and southeastern Kansas possible, although changes in this predicted storm are still yet to come - Despite,

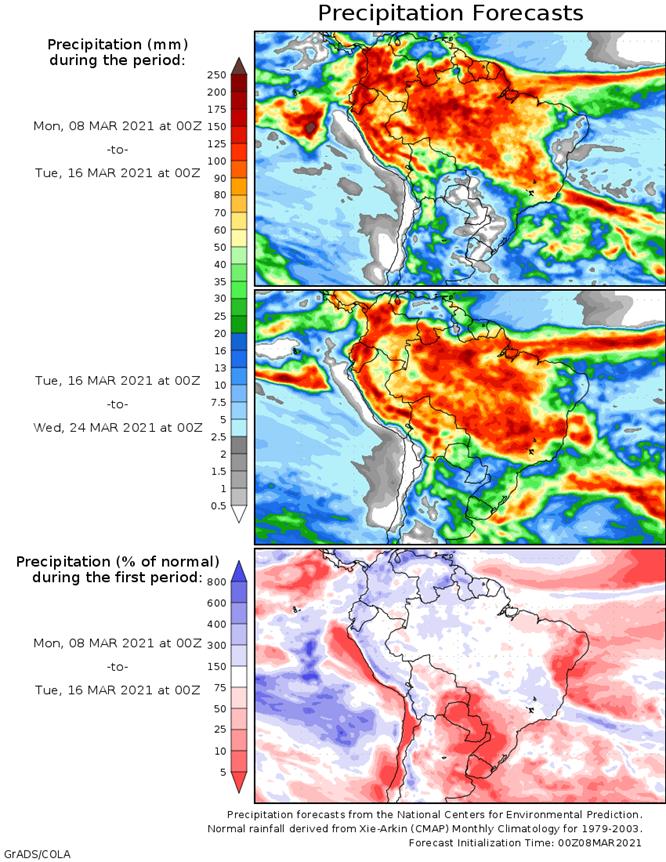

World Weather, Inc.’s reporting of rain in western Buenos Aires and eastern La Pampa Sunday – some in the marketplace this morning are claiming the rain was a surprise - Please

note that the European model accurately predicted the event Friday and we had it in our forecast and covered this event in Sunday’s report so it should not be surprise to the marketplace today - Argentina’s

outlook is wetter for late this weekend into early next week relative to Sunday’s forecast with a better distribution of showers and thunderstorms across the nation - Resulting

rainfall will still not be great enough to stop the worry over soil and crop conditions, but as more of the crop finishes the reproductive process the need for rain will begin to diminish

- Not

many other changes were noted overnight

WEATHER

ELSEWHERE IN THE WORLD

- Rain

in Brazil during the weekend occurred from Mato Grosso to central and southern Minas Gerais, Sao Paulo and Parana with amounts varying from 0.70 to 2.75 inches

- An

extreme amount of 3.98 inches occurred in central Mato Grosso - Temperatures

were seasonable - Brazil

will experience waves of rain from Mato Grosso to Minas Gerais, Sao Paulo and northern Parana during the coming ten days while southern Brazil gradually dries down - Fieldwork

will advance sluggishly in the wetter areas, but some progress in the soybean harvest and Safrinha planting will take place - Argentina

precipitation Friday through dawn today was greatest in southwestern Buenos Aires, eastern La Pampa and southern Cordoba - Rain

totals varied from 0.05 to 0.79 inch with a few totals over 1.00 inch - Temperatures

were warmer than usual with highs in the 80s and lower 90s Fahrenheit - Some

low temperatures were in the 40s and lower 50s in the southeast part of the nation - U.S.

precipitation during the weekend was minimal, although some rain Friday morning moved from the southern Plains into the Delta and into Florida Saturday - Rainfall

was less than 0.40 inch except in southern Florida where up to 1.41 inches resulted.

- Most

of the Delta, interior southeastern states, Midwest, northern Plains, southwestern Plains were left dry - Rain

fell from northern California to western Washington during the weekend with more than 2.00 inches near the coast in northern California

- U.S.

temperatures were well above average in the northern Plains with highs in the 60s and lower 70s

- Strong

wind speeds and very low humidity were noted Sunday across most of the Great Plains and into the western Corn Belt - Rapid

drying was noted - Canada’s

Prairies received very little precipitation during the weekend, although some snow and rain occurred in western Alberta crop areas

- Temperatures

will be near to above average - Southeast

Canada will experience near to below average precipitation and near to above average temperatures during the coming week to ten days - North

Africa rainfall during the weekend scattered across many areas from Morocco to Tunisia with rainfall of 0.08 to 0.92 inch common and a few amounts over 1.00 inch in northern Morocco - The

moisture boost will continue into Wednesday with another 0.20 to 0.60 inch of rain resulting and locally more - The

moisture will be welcome, but more will be needed to ensure the best yields later this spring - Ivory

Coast, Ghana, Benin and southern Nigeria began to receive rain during the weekend and more is expected through the coming week favoring coffee and cocoa flowering

- Rainfall

through dawn today varied from 0.60 to 1.10 inches with a local total to 1.61 inches in Ivory Coast - This

week’s rain will be well distributed and supportive of ongoing flowering and pollination - New

rain totals will vary from 0.50 to 3.00 inches and locally more - East-central

Africa rainfall will continue greatest in Tanzania this week and probably next week, as well - A

more erratic and light precipitation pattern is expected elsewhere with net drying in Ethiopia, northern Uganda and in a few southwestern Kenya locations - South

Africa will experience an erratic rainfall pattern through the next two weeks with temperatures mostly a little warmer than usual

- Showers

will be greatest in Natal and eastern portions of both Mpumalanga and Limpopo this week, but net drying is expected nationwide - The

drying trend will encourage early season crop maturation, but subsoil moisture and irrigation will support late season crops

- Summer

crop conditions will remain favorably rated, although there will be a growing need for showers by mid-March - Some

increase in precipitation is expected next week, although it will not be heavy in very many locations - India

was mostly dry Friday through Sunday and more of the same was expected for the coming ten days - A

few showers were noted in the Eastern States and far north with rainfall to 0.84 inch in Bangladesh and less than 0.40 inch in northern India - Temperatures

will be near normal in the south and warmer than usual in the north - Some

showers will develop late this week in north-central areas and again late next week in the southeast, but resulting rainfall will not be enough to change crop or field conditions - Some

mild crop stress has already been occurring in unirrigated crop areas and similar conditions were expected for the next ten days - Some

yield loss may result for late season unirrigated crops - Rain

is needed to support the best potential yields before filling ends this month - China

weather during the weekend brought rain to the Yangtze River Valley and areas south to the South China Sea coast - Rainfall

varied from 1.00 to 3.58 inches with local totals reaching 5.27 inches in northeastern Fujian - Some

local flooding may have occurred - Precipitation

elsewhere in China was not very great and temperatures were near to above average - Yunnan

continued quite dry and warm - Frost

and freezes occurred in the North China Plain which is not unusual at this time of year and had no negative impact on crops - China

weather over the next ten days will continue dry in Yunnan while periodic rain and thunderstorms occur near and south of the Yangtze River

- Rainfall

will be greatest in Guizhou, Hunan and northern Guangxi where 2.00 to 6.00 inches and local totals to more than 8.00 inches will result - Other

showers and thunderstorms will occur in east-central China periodically during the next ten days, but periods of sunshine will also occur and rain totals will be mostly under 1.00 inch

- Northeastern

Sichuan and immediate neighboring areas will receive 1.00 to 3.00 inches of rain

- Northeastern

China and the Yellow River Basin will see alternating periods of precipitation and sunshine through the next two weeks maintaining a very good outlook for winter crop development when seasonal warming begins - Spring

planting prospects remain exceptionally good. but seasonal warming is needed in many areas - Temperatures

will be above normal in most of the nation during the coming week to ten days

- Winter

crops will continue to come out of dormancy in the central and south. Spring planting will advance around periods of rain in the south

- Australia

weather in the coming week is expected to bring back scattered showers and thunderstorms to northeastern New South Wales and southern Queensland this week into next week - The

precipitation will be good for late season crops and for improving topsoil moisture for autumn planting - Early

maturing cotton might not welcome the precipitation and could become a little too wet - Australia

weekend precipitation was mostly dry and seasonably warm - Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation - Water

supply is low in some areas and a notable improvement in rainfall is needed, but not very likely - Dryland

winter crops are stressed and will yield poorly - Freeze

damage is common in northern parts of the nation due to a couple of cold surges this winter - Rain

in the coming week will be mostly confined to the east coast and temperatures will be seasonable with a slight warmer bias in the driest areas - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast receives the lightest and most erratic rainfall, but some precipitation will fall especially in Costa Rica and Panama. - Southeast

Asia rainfall will occur relatively normally over the next two weeks - Mainland

areas will experience few showers periodically in the next week to ten days - The

resulting rainfall will be sporadic and light with net drying probably continuing in many areas for a while longer - Philippines

rainfall will be scattered and mostly light to moderate until mid- to late-week this week when a boost in precipitation is expected due to a tropical disturbance impacting the nation - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - A

boost in precipitation is expected and will be welcome - Sumatra,

Peninsular Malaysia and western parts of Borneo have been drying out recently and greater rain is needed especially in Peninsular Malaysia - Indonesia

and Malaysia rainfall began to increase over the weekend with many areas from central Sumatra to western Borneo and in parts of both Sulawesi and Java ranged from 1.00 to 2.50 inches with a few totals over 4.00 inches - New

Zealand weather over the next ten days will include a mix of sunshine and rain while temperatures are a little cooler than usual

- The

nation’s soil moisture has drifted below average especially in the north - Southern

Oscillation Index has been falling and was at +7.02 this morning. The index is expected to continue to fall over the next several days - Europe

weather will be mixed over the next two weeks with periods of rain, mountain snow and sunshine occurring while temperatures are seasonable - The

environment will be good in maintaining moisture abundance in much of the continent and seasonal warming will bring more winter crops out of dormancy in parts of the west and south - Western

CIS temperatures will be cooler than usual this week while waves of snow and rain prevail - The

environment will be good for spring crop development, but for now there will not be much greening or crop development for a while longer - Too

much moisture is also present in the soil in western Russia and flooding may be an issue for a while this spring as a deep layer of snow melts while new precipitation falls

Source:

World Weather inc.

Bloomberg

Ag Calendar

Monday,

March 8:

- USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - China

National People’s Congress in Beijing - Ivory

Coast cocoa arrivals - HOLIDAY:

Russia - EARNINGS:

Marfrig

Tuesday,

March 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

National People’s Congress in Beijing

Wednesday,

March 10:

- EIA

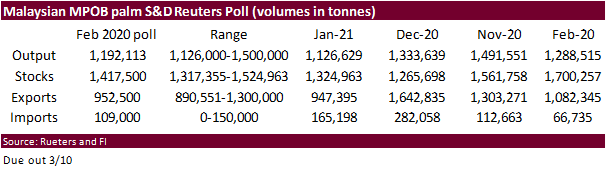

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board data on February palm oil end-stockpiles, output, exports - China

National People’s Congress in Beijing - Malaysia’s

March 1-10 palm oil export data - ISO

sugar conference - FranceAgriMer

monthly grains report

Thursday,

March 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - China

National People’s Congress in Beijing - New

Zealand Food Prices - Conab’s

data on yield, area and output of corn and soybeans in Brazil - HOLIDAY:

India, Indonesia

Friday,

March 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

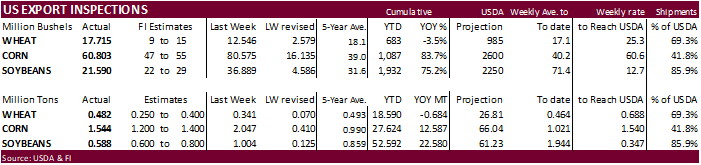

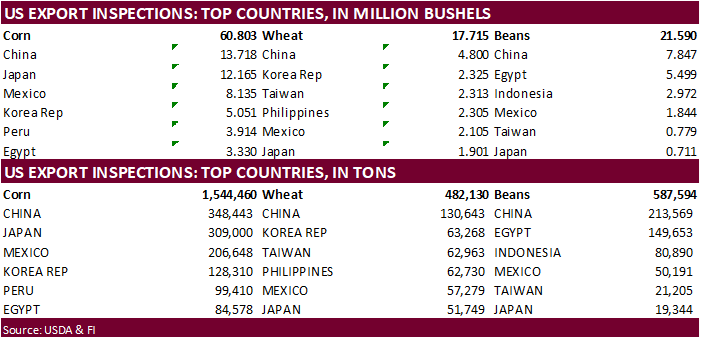

USDA

inspections versus Reuters trade range

Wheat

482,130 versus 250000-500000 range

Corn

1,544,460 versus 1200000-1800000 range

Soybeans

587,594 versus 400000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 04, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/04/2021 02/25/2021 03/05/2020 TO DATE TO DATE

BARLEY

0 2,395 0 31,023 29,131

CORN

1,544,460 2,046,712 829,865 27,623,735 15,036,394

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

0 0 0 2,493 3,143

RYE

0 0 0 0 0

SORGHUM

191,103 121,151 58,711 3,774,848 1,460,388

SOYBEANS

587,594 1,003,955 589,900 52,591,502 30,011,758

SUNFLOWER

0 0 0 0 0

WHEAT

482,130 341,438 459,865 18,590,132 19,273,729

Total

2,805,287 3,515,651 1,938,341 102,614,242 65,815,063

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Wholesale Inventories (M/M) Jan F: 1.3% (est 1/3%; prev 1.3%)

–

Wholesale Trade Sales (M/M) Jan: 4.9% (est 1.0%; prev R 1.9%)

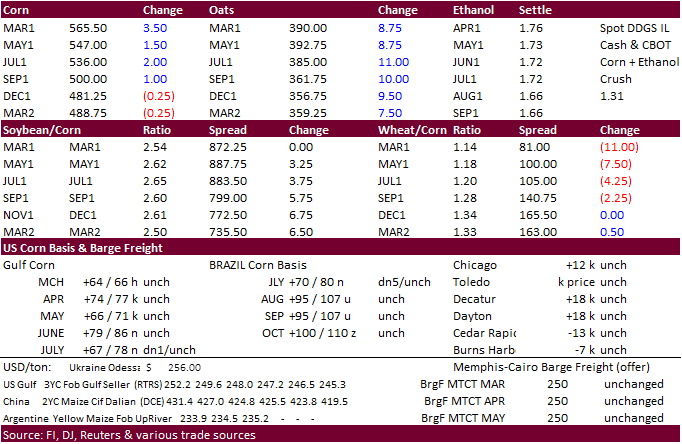

Corn

- Corn

futures traded two-sided, ending higher in the current crop year. December and March 2022 finished unchanged. A choppy trade in soybeans, reversal in WTI to the downside, and lower US wheat futures kept corn in limbo. But more importantly traders looking

for USDA 24-hour corn export sales did not get to see them. Corn was very strong prior to the day session. Overnight Brent crude oil surpassed $70 for first time since the pandemic began and this was supporting corn overnight. It will be a busy week. Tuesday

USDA will update their S&D’s, followed by MPOB palm data Wednesday and Conab Thursday. Later this week traders will also get February US CPI inflation data (Wed), projected to increase 0.4% from the previous month and up 1.7% from year ago (1.4% rise in Jan.).

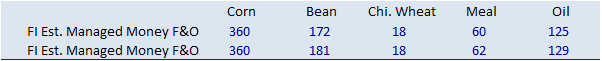

- Funds

were net buyers of 4,000 corn contracts on the session. - USDA

US corn export inspections as of March 04, 2021 were 1,544,460 tons, within a range of trade expectations, below 2,046,712 tons previous week and compares to 829,865 tons year ago. Major countries included China for 348,443 tons, Japan for 309,000 tons, and

Mexico for 206,648 tons. - Weather

personal are starting to release long term weather forecasts. With weakening La Nina, 2011 is considered an analog year for the US planting season. The Corn Belt is expected to be wet during the 2021 planting season. What happened with corn during 2011?

Production declined 1% YoY and yields were -5.6bpa. Planting began slowly and delays continued through May, finishing by the 2nd week of June. Early July weather promoted rapid development. The second half of July through August saw much above normal temperatures,

negatively impacting the crop. Harvest proceeded at a normal pace. Soybean production was down 8% from the prior year, yield -2bpa. Planting and emergence were slower than normal through the end of June. Crop conditions were rated below the 2010 crop through

most of the growing season. - Empty

containers are hard to find for nearby shipment across the US. Some locations it’s nearly impossible to booked for less than three weeks. Los Angeles port is very backed up, for example. Expect DDGS export pace to remain slow over the next couple of months.

- China

plans to crack down harder on fake ASF vaccines. - China’s

Jan-Feb crude oil imports were 89.57 million tons, up 4.1% from a year ago and up 9.5% from the same period in 2019. - US

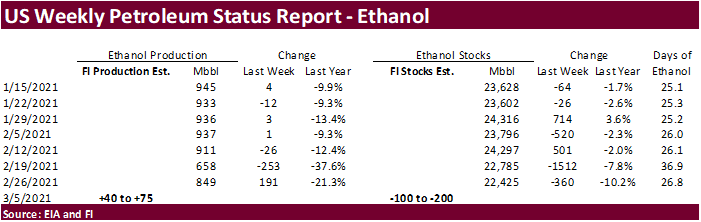

ethanol exported during January 2021 was 164.6 million gallons, up 48% from December 2020. India took 53.2 million gallons and China 22.7 million.

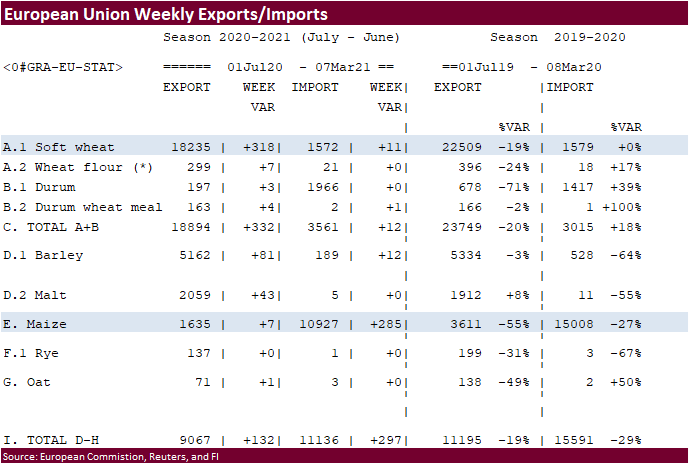

- The

European Union granted imports licenses for 285,000 tons of corn imports, bringing cumulative 2020-21 imports to 110.927 MMT, 27 percent below same period year ago

Export

developments.

- None

reported

Updated

3/1/21

May

corn is seen in a $5.20 and $5.75 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.85-$5.50 range.

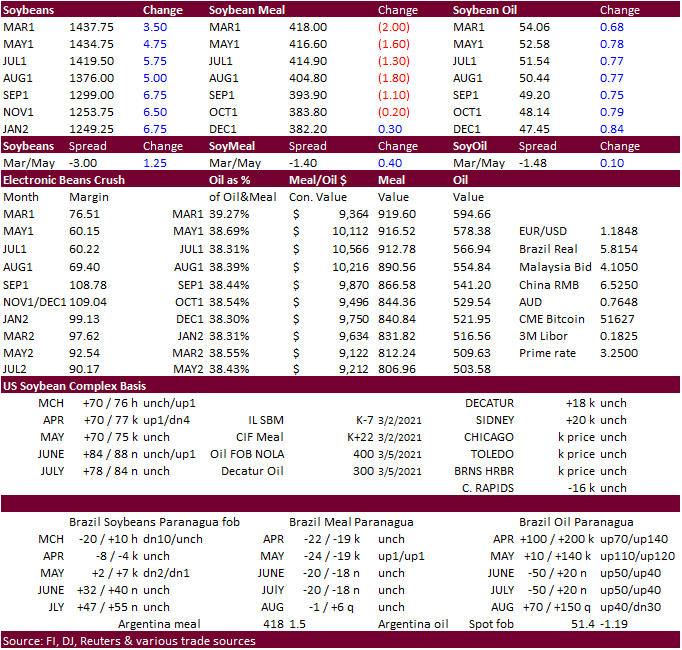

- Soybeans

reached a 2014 high during the trade on SA crop concerns, tight global oilseed inventories and higher soybean oil. Soybeans basis May ended 3.75 cents higher at $14.3375. There was some consolidation ahead of the USDA report due out tomorrow. Strategie

Grains lowered its forecast for EU and UK rapeseed ending stocks. Pakistan bought 594,000 tons of soybean in recent weeks. Soybean meal failed to hold gains, ending mostly lower. Soybean oil was up 66-75 points. Malaysian palm climbed 137 MRY to 3875 and

cash was up $25.00/ton to $996.50. - The

funds were net buyers 4,000 soybean contracts, sellers of 2,000 soybean meal contracts and net buyers of 5,000 bean oil contracts. - USDA

US soybean export inspections as of March 04, 2021 were 587,594 tons, within a range of trade expectations, below 1,003,955 tons previous week and compares to 589,900 tons year ago. Major countries included China for 213,569 tons, Egypt for 149,653 tons, and

Indonesia for 80,890 tons. - Brazil

weather forecast has not changed greatly from Friday. Argentina is slightly weather for this week from that of Sunday. Argentina’s soybean crop is seeing crop stress. One forecaster expects severe losses on 30% of total soybean area.

- AgRural

reported Brazil soybean harvest progress as of Thursday was 35%, up 10 points from previous week, slowest pace in a decade and compares to 49% year earlier. AgRural noted 54% of the second corn crop was planted, compared with 80% in 2020. - China

January through February soybean imports were 13.41 million tons, down 0.8% from 13.51 million tons a year earlier. China’s imports of edible vegetable oils imports during the two-month period increased a large 48 percent from the same period in 2020 to 2.04

million tons. On a macro level China’s exports surged from a rebound in global demand amid Covid-19 recovery.

- Paris

rapeseed hit an all-time high, up 10 sessions, longest rally since 2016. - Strategie

Grains lowered its forecast for EU and UK rapeseed ending stocks this season by 180,000 tons to 1.1 million tons, down 800,000 tons from last season. They also lowered its 2021-22 rapeseed crop to 17.05 million tons, down 90,000 tons from its previous estimate

but still 800,000 tons above last season. - Special

note. USDA will add demand for renewable diesel to its US soybean oil balance sheet, but not until they collect EIA data. The EIA is planning to begin incorporating renewable diesel data in its Petroleum Supply Monthly report. Soyoil use for renewable diesel

is currently included in the food and industrial category. See attached FI example. Note our renewable use is a best guess.

- Indonesia’s

Sumatra and Kalimantan, and Malaysia’s Sabah and Sarawak, will see heavy rain early this week.

- Switzerland

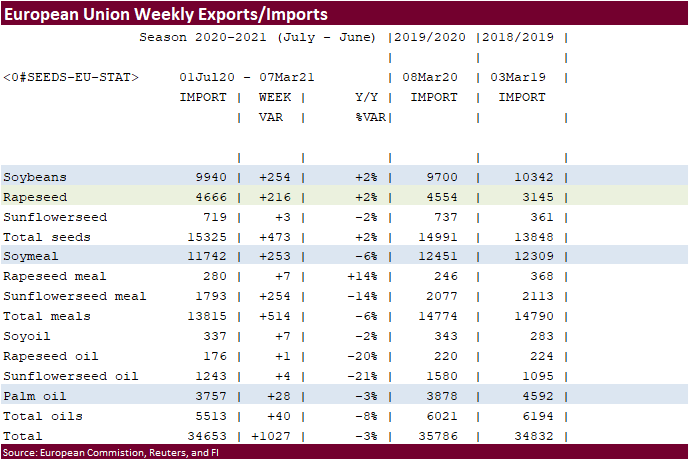

voted and approved a free trade agreement with Indonesia that will gradually lower tariffs on palm oil by about 20%-40% for up to 12,500 tons per year, but only if sustainability standards are met. - The

European Union reported soybean import licenses since July 1 at 9.940 million tons, above 9.700 million tons a year ago. European Union soybean meal import licenses are running at 11.742 million tons so far for 2020-21, below 12.309 million tons a year ago.

EU palm oil import licenses are running at 3.757 million tons for 2020-21, below 3.878 million tons a year ago, or down 3 percent. - European

Union rapeseed import licenses since July 1 were 4.666 million tons, above 4.554 million tons from the same period a year ago.

Export

Developments

- Pakistan

bought 594,000 tons of soybean in recent weeks from Brazil and the US. Pakistan is currently buying 200,000 to 250,000 tons of soybeans per month.

- The

USDA CCC seeks 2,030 tons of packaged oil on March 16 for shipment Apr 16 – May 15.

Updated

3/4/21

May

soybeans are seen in a $13.50 and $15.00 range.

May

soymeal is seen in a $400 and $460 range.

May

soybean oil is seen in a 49.00 and 54.00 cent range.

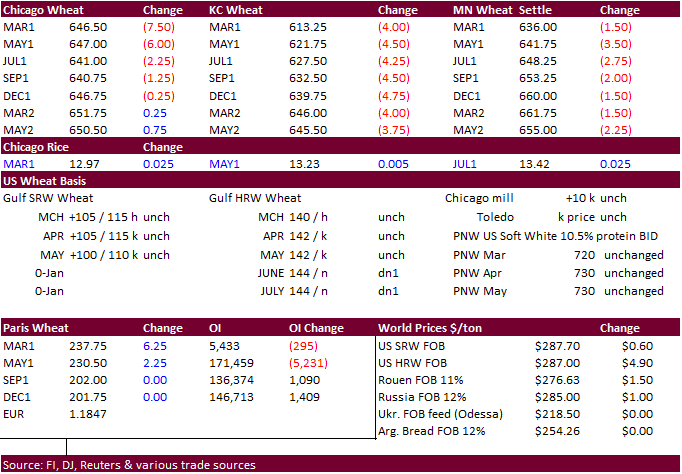

- US

wheat futures were sharply higher earlier on global export developments but weather forecasts, bias European models, called for rain relief for the US Great Plains later this week. The GFS model has the bulk of the US rain forecast for the Corn Belt. The

USD was up 43 points by 33:15 pm CT. Over the weekend Algeria announced they are in for more wheat, 50,000 tons on Tuesday. Iran bought 40,000 tons of barley. Saudi Arabia bought 660,000 tons of barley. Pakistan seeks 300,000 tons of wheat. Bangladesh

seeks 50,000 tons of rice. Wheat prices this week could be influenced over changes in US selected state crop conditions, US rainfall, USDA S&D changes, fluctuations in the USD, and global export developments. - Kansas

winter wheat ratings declined one point in the G/E to 36 percent as of 3/7 from the previous week and are down from 40% as of February 22 and 43% as of Jan 25.

- Funds

were net sellers of 5,000 net soft wheat contracts on the session. - USDA

export inspections of 482,000 tons of wheat improved from the previous week and included 130,643 tons for China.

- China

sold about 2 million tons of wheat from state reserves during March 2-3, about half of the 4 million tons offered.

- EU

May milling wheat was up 2.00 at 230.50 euros. Black

Sea market was on a partial holiday today. - The

European Union granted export licenses for 318,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 18.235 MMT, well down from 22.509 million tons committed at this time last year, a 19 percent decrease. Imports are

near unchanged from year ago at 1.572 million tons.

Export

Developments.

- Pakistan

seeks 300,000 tons of wheat on March 16 for April-August shipment. - Algeria

is in for more wheat. They seek 50,000 tons of wheat on Tuesday, valid until Wednesday for March or April shipment, depending on origin.

- Iran

bought 40,000 tons of barley out of 400,000 sought, for March/April shipment.

- Saudi

Arabia bought 660,000 tons of barley at an average price of $279.77 a ton c&f for arrival in Saudi Arabia during April and May.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on March 18.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

Updated

3/4/21

May

Chicago wheat is seen in a $6.25‐$6.90 range.

May

KC wheat is seen in a $5.50‐$6.75 range.

May

MN wheat is seen in a $6.20‐$6.65 range.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.