PDF Attached

Yo-yo

trade from another headline trading session. Soybean complex was higher in part to strength in Brazil premiums. Chicago and KC wheat reached limit lower in the front non expiring months, only to rebound hard after Russia indicated they may ban certain products

and raw material exports. This comes after a French article mentioned Ukraine is no longer interested in NATO. A pull back to $10.59 for May Chicago is not out of question. That would fill a couple gap higher trades. Corn ended mixed. WTI crude was sharply

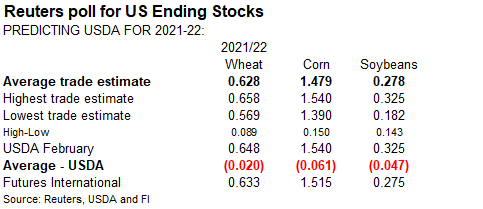

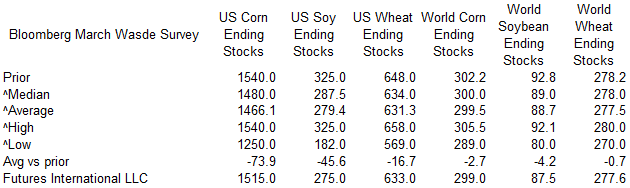

higher. The USD traded much of the ag session lower. USDA

will update S&D’s on Wednesday.

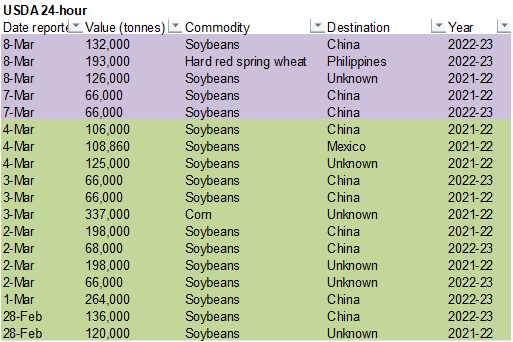

Private

exporters reported the following activity:

-193,000

metric tons of hard red spring wheat for delivery to the Philippines during the 2022/2023 marketing year

-132,000

metric tons of soybeans for delivery to China for delivery during 2022/2023 marketing year

-126,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

WEATHER

EVENTS AND FEATURES TO WATCH

- Southwestern

Argentina will be dry biased during the next ten days - The

area impacted will be central and southwestern Buenos Aires, La Pampa, southern Cordoba and southern San Luis - These

areas have good subsoil moisture today and should manage through the drier biased period without much trouble - Temperatures

will be seasonable - A

boost in precipitation will be needed, though, for later this month especially for late season crops; including double-cropped soybeans - Additional

rain is still expected across central and northern Argentina today into Thursday with some significant rain already noted overnight

- Rain

fell Monday from northern Entre Rios and Corrientes to Salta, Chaco and Santiago del Estero where totals through dawn today varied from 0.62 to 2.71 inches - Temperatures

were mild except in the far north where cotton areas were again over 100 degrees Fahrenheit - Additional

rainfall by Friday morning will vary from 1.00 to 4.00 inches and a few amounts of 4.00 to 6.00 inches

- Much

of Argentina will be dry Saturday through Thursday, March 17 - The

drier weather will be good for areas that have received significant rain recently and that which is still coming into Friday - All

of Brazil will get rain at one time or another during the next ten days, although far southern areas will trend drier this weekend and continue in that mode for another week and perhaps a little longer - Most

of the rain expected in Rio Grande do Sul to Parana and Mato Grosso do Sul will occur through Friday

- Sufficient

amounts are expected to bolster soil moisture and support long term crop needs

- Increased

rainfall in center west and center south Brazil next week will slow late season soybean harvest progress - Some

areas in northern Mato Grosso will remain quite wet - U.S.

hard red winter wheat areas will get some snow and rain late Wednesday into Friday - This

storm system has not changed much from that advertised Monday with moisture totals to 0.50 inch - There

is some potential for a few amounts of 0.50 to 0.75 inch - Favoring

Nebraska and northern and western Kansas as well as some eastern Oklahoma locations - Snowfall

will vary from 2 to 6 inches with a few amounts of 6-11 inches – Kansas will be most favored for the greatest snowfall - Limited

moisture is expected in the southwestern Plains - A

storm advertised by the GFS model for the central U.S. late next week is overdone and will not likely verify from today’s morning model run - West

Texas precipitation will continue minimal through the next ten days - South

Texas and lower parts of the Texas Coastal Bend will not get much precipitation in the next ten days, although some rain is expected today and again late next week - The

precipitation events will impact the middle and upper Texas coast far more than the lower coast

- Dryness

will continue a concern in most of far southern Texas in unirrigated areas - U.S.

southeastern states will experience some waves of rain later today into the weekend - The

moisture will bring some needed relief to recent dry and warm to hot conditions - Frost

and freezes are likely in the U.S. southeastern states Sunday causing some damage to fruit and vegetable crops - U.S.

Delta, Tennessee River Basin and lower Midwest will continue abundantly to excessively wet for an extended period of time, although no serious flooding is expected in the near term - Minor

flooding is already under way, though, including areas from the northern Delta into southern and some central Illinois, central Indiana and random Ohio locations. A few areas in southern Illinois and southeastern Indiana are experiencing moderate flooding

- Additional

rainfall over the next ten days will not likely be great enough to induce a more serious flood - An

extended period of drying is needed - Southwestern

Canada’s Prairies and the northern U.S. Plains and upper Midwest will experience limited precipitation over the next ten days

- Drought

remains serious in the southwestern Canada Prairies and the northwestern U.S. Plains - California’s

central valleys are not likely to get much precipitation over the next ten days - Some

snow in the Sierra Nevada is expected next week, but amounts will be too light to seriously change the snowpack or spring runoff potential.

- Southwestern

Europe is expected to receive more frequent rainfall beginning late this week and continuing into mid-month.

- Spain,

Portugal and parts of France will benefit most from the rain - Portions

of Spain that have been so dry for quite a while will benefit most from the moisture - Northwestern

Africa will also experience more rain late this week through next week with moisture totals greatest in Morocco and northwestern Algeria - Central,

east-central and northeastern Europe will be dry over the next ten days - Subsoil

moisture is favorable to carry on normal crop development - Some

beneficial moisture will fall in Greece and a few neighboring areas during the coming week - Romania

is still dry and in need of moisture - Waves

of rain and some snow will occur from the Middle East through Uzbekistan and southern and eastern Kazakhstan to the mountains west of Xinjiang, China during the coming week to ten days - The

moisture will be ideal for raising soil moisture ahead of cotton and other crop planting - Improved

mountain snowpack is expected - Heavy

precipitation will occur near Kyrgyzstan, including neighboring areas of Uzbekistan and Tajikistan

- Russia

and Ukraine precipitation is expected to be relatively light over the next ten days - Snow

cover will remain sufficient to protect Russian winter crops from bitter cold that will be present during the balance of this week and into next week - China

weather will be relatively dry for the next few days and the trend wetter - Waves

of precipitation are expected this weekend and next week that will bolster topsoil moisture for use by crops in the spring - The

precipitation will occur as snow and rain with most of eastern China impacted at one time or another - Temperatures

will be well above normal and that will likely bring winter crops out of dormancy in southern wheat and rapeseed areas - The

warming trend will also raise soil temperatures for early rice and corn planting - Australia

weather over the next ten days will be most active near the Pacific Coast - Rain

will occur most often and most significantly in sugarcane areas along the central and lower Queensland coast and east of the Great Dividing Range - A

few cotton and sorghum areas will be impacted too, but most of the interior crop areas in Queensland will not be seriously impacted by the frequent rain - India

weather will be relatively tranquil over the next ten days - the

environment will be great for winter crops that are filling and maturing, although a little rain might still be welcome of the latest reproducing crops - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and east-central parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia received rain Monday and will see it again next week, but several days of drying are now expected - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive infrequent bouts of rain in the coming week easing recent dryness and improving the soil for coffee, and cocoa flowering - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - The

greatest and most widespread precipitation is expected next week - Xinjiang,

China precipitation will continue restricted over the next ten days, although periods of snow and a little rain will fall in the mountains improving run off potential in the spring - South

Africa precipitation during the weekend was scattered across the heart of summer crop country and the moisture was supportive of late season crop development - The

pattern of alternating periods of rain and sun will continue through the next ten days which is normal for the nation - The

environment will be good for summer crop development - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this weekend and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +8.29 - The

index will slowly rise in this coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - U.S.

National Coffee Association Virtual Convention, day 2 - FranceAgriMer

monthly French grains outlook - EIA

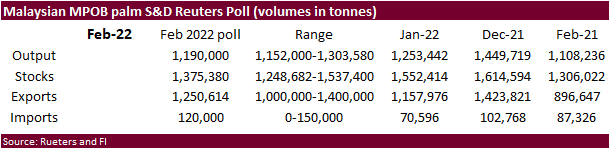

weekly U.S. ethanol inventories, production, 11am - Bursa

Malaysia Palm Oil Conference, day 3 - HOLIDAY:

South Korea

Thursday,

March 10:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s monthly data for output, exports and stockpiles - U.S.

National Coffee Association Virtual Convention, day 3 - Malaysia’s

March 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Friday,

March 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Source:

Bloomberg and FI

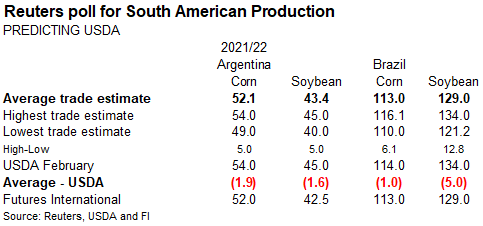

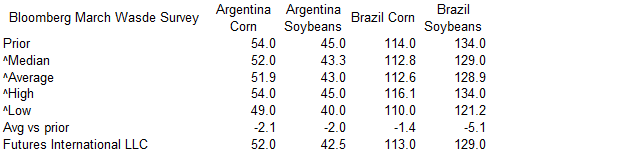

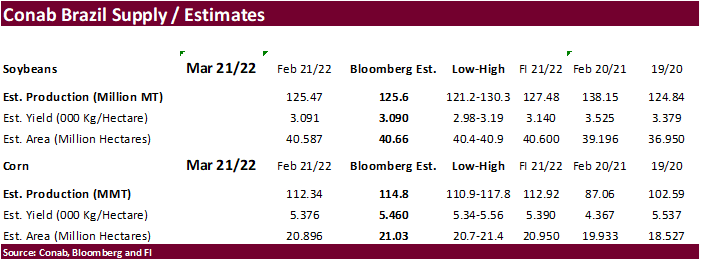

Soybean

and Corn Advisory

2021/22

Brazil Soybean Estimate Unchanged at 124.0 Million Tons

2021//22

Argentina Soy Estimate Unchanged at 39.0 Million Tons

2021/22

Paraguay Soybean Estimate Unchanged at 5.0 Million Tons

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

Macros

Putin

Instructed To Limit The Export Of Certain Products And Raw Materials Abroad – RIA

(Bloomberg)

— The Biden administration will impose a ban on U.S. imports of Russian energy

EIA:

US Crude Output To Gain 850K Bpd To 12.03M Bpd In 2022 (Vs +770K Bpd Forecast Last Month)

–

Crude Output To Rise 960K Bpd To 12.99M Bpd In 2023 (Vs +630K Bpd Forecast Last Month)

Some

firms have a $200 WTI upside target.

US

Wholesale Inventories (M/M) Jan F: 0.8% (est 0.8%; prev 0.8%)

–

Wholesale Trade Sales (M/M) Jan: 4.0% (est 1.0%; prev 0.2%) US Trade Balance Jan: -$89.7Bln (est -$87.3Bln; prev -$80.7Bln)

Energy

giant Shell said Tuesday that it will stop buying Russian oil and natural gas and shut down its service stations, aviation fuels and other operations in the country amid international pressure for companies to sever ties over the invasion of Ukraine.

Bloomberg

– The U.K. government plans to phase out all imports of Russian oil, its latest sanctions move against Vladimir Putin’s administration over the war in Ukraine, a person familiar with the matter said.

Moscow

Stock Trading To Be Closed 9th March

McDonald’s

To Temporarily Close 850 Stores In Russia – AP

·

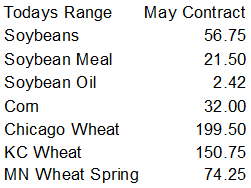

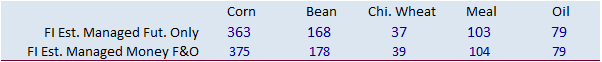

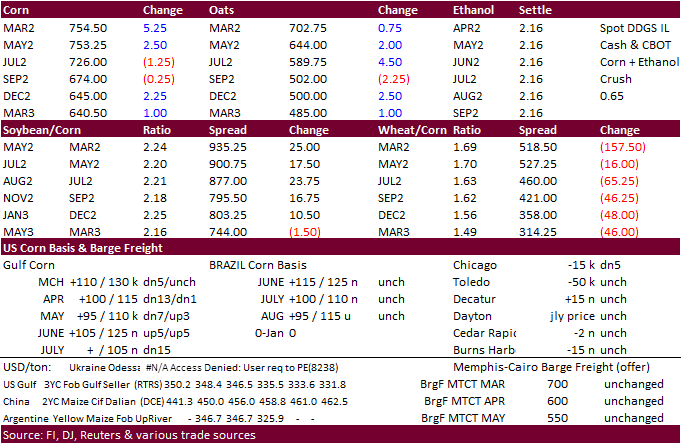

CBOT corn futures

traded two-sided, ending mixed with higher soybeans and lower wheat. Positioning ahead of the USDA report was noted. Rumors are still floating around that China was in for US corn, but we have yet to see large flash sales.

·

WTI crude oil limited losses for corn during the session. April crude rallied more than $8.00 per barrel to around $128/barrel by mid-morning, and was over $4.00 higher by 1:50 pm CT. Some FCM’s raised their margin requirement

for selected energy products.

·

We are hearing more and more talk of forward US producer selling, more so with soybeans compared with corn. We think new-crop corn prices are cheap relative to 2021-22 and some producers are holding out for higher prices.

·

China looks to buy 38,000 tons of frozen pork for state reserves on March 10. They bought pork last week, making the March 10 tender second for the crop year.

·

USDA reported that a highly pathogenic form of bird flu was reported in a commercial turkey flock in Buena Vista County, Iowa, second reported outbreak in that state.

·

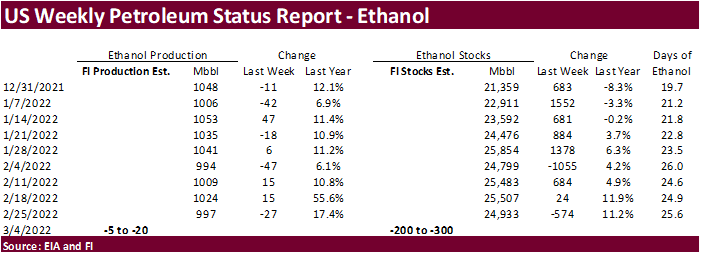

A Bloomberg poll looks for weekly US ethanol production to be up 6,000 barrels to 1.003 million (980-1024 range) from the previous week and stocks down 3,000 barrels to 24.930 million.

Export

developments.

- None

reported

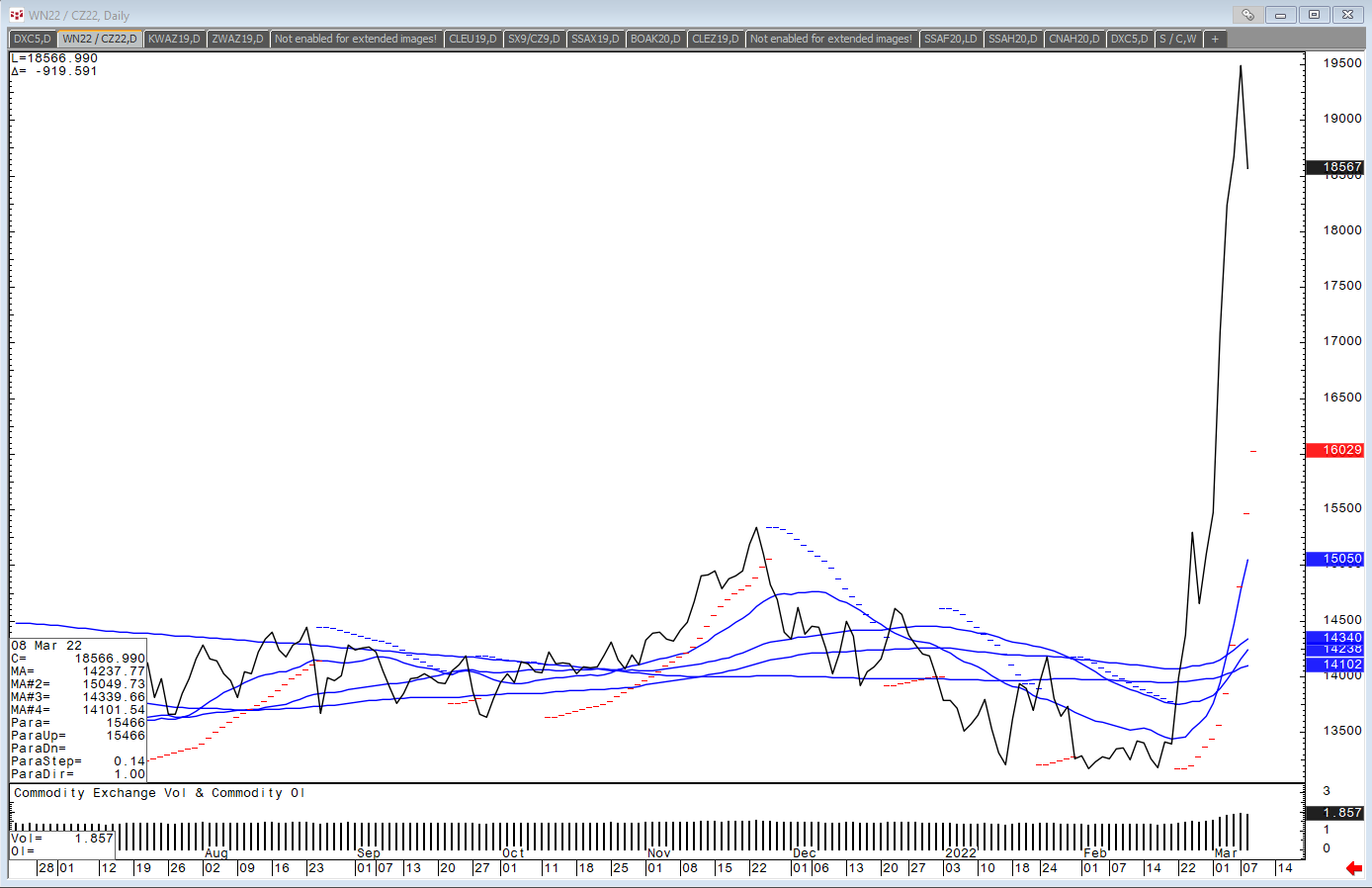

Chicago

July wheat / July corn ratio

Updated

3/3/22

May

corn is seen in a $6.50 and $8.50 range

December

corn is seen in a wide $5.50-$7.50 range

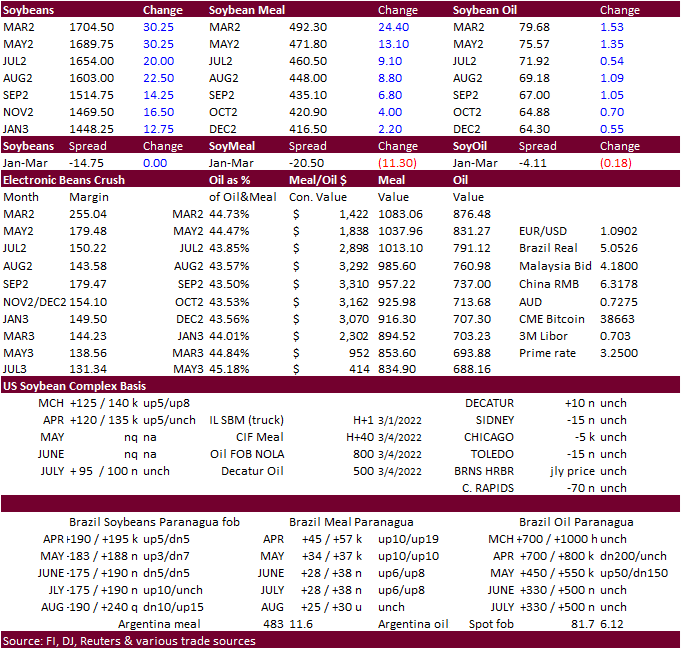

·

CBOT

soybeans, meal and soybean oil were all higher on fund buying and soybean spreading against grains. Higher WTI crude oil lent support to soybean oil, while Brazil soybean meal premiums aided CBOT meal. Some predict upside in WTI crude oil could be around

$200 / barrel.

·

Paris May rapeseed contract hit a record high today, ending around 2.2% higher.

·

(Reuters) – China’s Zhengzhou Commodity Exchange said on Tuesday it will adjust the margin requirement for its thermal coal futures contracts for June 2022 to March 2023 delivery to 50% from settlement of March 10 onwards. It

also adjusted the transaction fee for its rapeseed meal futures contracts for May 2022 delivery to 12 yuan per lot from the night trading session of March 9.

·

Anec estimated March Brazil soybean exports at 13.769 million tons, up from 11.775 million previous.

·

South American rains improved and that should limit additional downside risk for estimated 2022 Argentina and southern Brazil soybean crop estimates going forward.

- Iran’s

state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil on Wed for March and April shipment.

- Iran’s

SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal on Wednesday for March and April shipment. - Private

exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China for delivery during 2022/2023 marketing year.

-126,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

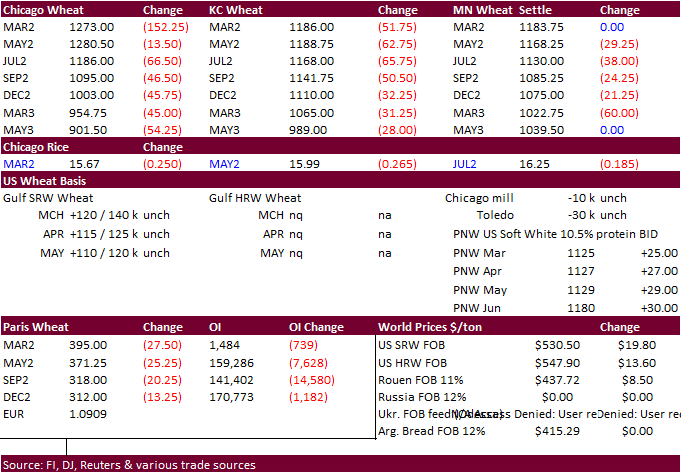

During the session Chicago, KC and MN wheat reached limit lower in the front non expiring months, but rebounded on concerns over Black Sea exports. Earlier a French article mentioned Ukraine is no longer interested in NATO.

https://www.france24.com/en/live-news/20220308-in-nod-to-russia-ukraine-says-no-longer-insisting-on-nato-membership?ref=tw

·

Shortly after that headline, Russia mentioned they may limit or ban exports on selected raw materials and products. The confusion added to the volatility.

·

After gaining six consecutive sessions, the lower Chicago May wheat contract close is technically bearish. A pull back to $10.59 for May Chicago wheat might be treasonable for an initial setback. That would fill a few gaps.

·

Today we saw a another very wide trading range in the May contracts. Wheat futures moved more in a few 20 min bursts than what we have seen in some years in total.

·

Several import tenders were announced so far this week and more expected if US futures continue to sell off.

·

USDA announced HRS wheat was sold to the Philippines.

·

Paris May wheat settled down 26.5 euros, or 6.7%, at 370.00 euros ($404.63) a ton. Monday its hit a contract high of 424.00 euros.

·

Russia may ban exports of certain raw material and products until the end of the year. Unsure if they will include agriculture products. Banning grain exports could be a blow to their economy.

·

While Ukrainian ports remain shut, Ukraine did announce they plan to issue grain export licenses within 24 hours. Ukraine is sitting on about 17 million tons of exportable grain supplies (43MMT/60MMT shipped through Feb 23).

·

Traders are getting nervous Ukraine producers will not be able to apply fertilizers this spring to their fields if the conflict drags on, potentially lowering wheat yields.

·

(Reuters) – A Ukrainian ship loaded with 11,000 tons of wheat has arrived at the port of Tripoli in northern Lebanon on Tuesday, the state news agency NNA reported. 1.5-2.0 months of grain reserves are seen for Lebanon.

·

US HRW wheat precipitation fell well below average and one weather forecaster mentioned it was 3rd driest on record, behind 2006 and 1904.

·

Egypt does not need additional wheat shipments over the sort or medium term.

·

India signed a deal to export 500,000 tons of wheat for about $340-$350/ton. India is on track to export 7 million tons this year.

·

Private exporters reported the following activity:

-193,000

metric tons of hard red spring wheat for delivery to the Philippines during the 2022/2023 marketing year. The last 24-hour HRS sale was July 2020 of 190k to China.

·

Postponed until Wednesday: Algeria seeks 50,000 tons of soft milling wheat, optional origin, on March 8, opening until the 9th, for May shipment.

·

Tunisia passed on 125,000 tons of soft wheat and 100,000 tons of barley, optional origin, on Tuesday. Shipment is for March through May. Prices were too high.

·

South Korea’s NOFI group rejected all offers for up to 130,000 tons of animal feed wheat. Prices were regarded as too high. The first consignment was sought for arrival in South Korea between May 1 and June 30. The lowest price

offered for the first consignment was said to be $428.86 a ton c&f. The second shipment was sought for arrival around July 15 and lowest offer was $435.00 a ton c&f.

·

Iran seeks 60,000 tons of milling wheat with United States included as a possible origin, on Wednesday, for rapid shipment in March and April.

·

Jordan’s state grains buyer seeks 120,000 tons of milling wheat on March 9. Shipment is between LH May and LH July.

·

Taiwan seeks 50,000 tons of US PNW milling wheat on March 11 for April 23-May 7 shipment.

·

Iraq seeks two million tons of wheat to provide a strategic reserve. Iraq looked for offers from international companies over the weekend.

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

Rice/Other

·

(Reuters) – Vietnam will exempt import tax on 300,000 tons of rice from Cambodia this year, the government said in a statement on Tuesday. Though Vietnam is one of the world’s largest rice exporters, Cambodian grains are also

consumed in the country and used by some Vietnamese traders to meet their rice export contracts.

·

(Bloomberg) — U.S. 2021-22 cotton ending stocks seen at 3.37m bales, 127,000 bales below USDA’s previous est., according to the avg in a Bloomberg survey of seven analysts.

-Estimates range from 3.1m to 3.65m bales

-Global ending stocks seen unchanged at 84.31m bales

Updated

3/8/22

Chicago

May $8.50 to $13.6350 range ($10.59 initial pull back if bearish news develops this week)

KC

May $8.50 to $13.50 range

MN

May $9.25‐$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.