PDF Attached

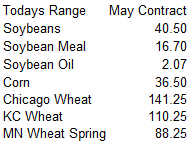

Russia

banned many raw material and finished products for export to selected western countries, including grains. Wheat futures were sharply lower led by the May Chicago contract. It is rumored that another 8 cargos of French wheat have been sold to Mexico. Corn

ripped higher on good export sales, lending strength to soybean meal. Soybeans and soybean oil traded higher. USDA export sales for soybeans were very good.

Attached

is our updated US 2022 acreage estimates. We took corn up 350,000 acres to 92.550 million and soybeans down 1.350 million to 88.200. Rice was lowered 25,000 acres. Note some estimates for soybeans are now around 84 million.

![]()

WEATHER

EVENTS AND FEATURES TO WATCH

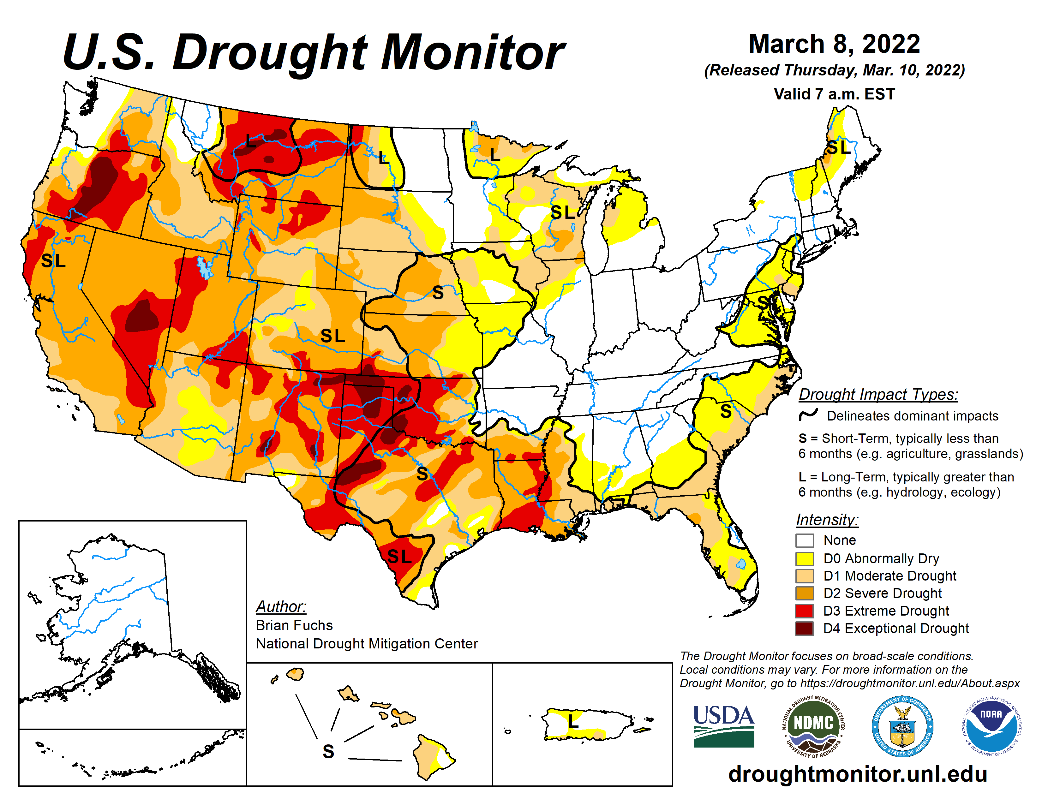

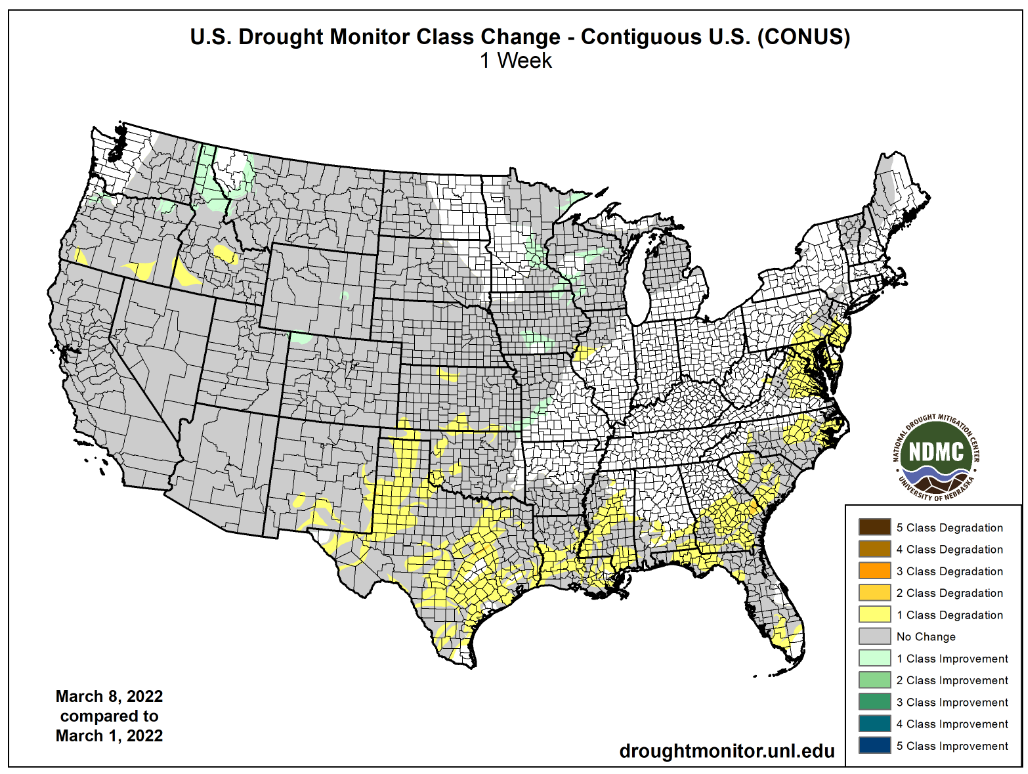

- U.S.

hard red winter wheat areas have received snow overnight in Nebraska, eastern Colorado and central and northern Kansas - Accumulations

varied from 1 to 5 inches from southern Nebraska across northern Kansas, but greater accumulations in central Kansas have occurred with 13 inches in Sharon Springs (west-central Kansas), 12 inches at Quinter (west-central Kansas) and nearly 10 inches near

Ash grove (central Kansas) - Moisture

totals have varied from a trace to 0.46 inch through dawn today with most areas getting less than 0.20 inch of moisture - The

precipitation has not and will not dramatically raise topsoil moisture, but a small improvement in surface moisture will result as the snow melts - The

snow cover will be important in protecting winter crops from temperatures that will slip to the positive single digits Fahrenheit over the next two nights - A

few temperatures extremes near or slightly below zero Fahrenheit cannot be ruled out for a few areas, but snow will be on the ground to protect crops in those areas - Southern

and eastern U.S. hard red winter wheat production areas will get a little snow and rain today from the same system noted above - Snowfall

will vary from a trace to 3 inches will result - Very

few areas will get moisture totals more than 0.25 inch - The

precipitation will reach as far south as the Texas Panhandle and north-central Texas - U.S.

hard red winter wheat areas are expecting a couple of other weather systems in the next two weeks, but they will disfavor the high Plains – especially west-central and southwestern parts of the region - The

moisture will help induce more greening and help to stimulate some initial crop developing which may include plant repair form the harsh conditions in recent months - A

cool and moist spring is needed to induce new root and tiller development after drought, heaving topsoil and bouts of bitter cold without adequate snow cover impacted the crops at various times during the late autumn and winter - West

Texas cotton areas will not get much moisture from today’s precipitation event - A

trace to 0.15 inch is most likely with a few totals to 0.25 inch - Drought

will prevail - West

and South Texas precipitation is expected to remain restricted for the next two weeks, although completely dry conditions are not likely - The

Texas Coastal Bend will also struggle for greater rainfall - Texas

Blacklands, the U.S. Delta and U.S. southeastern states will be impacted by precipitation periodically over the next two weeks - Drought

easing rainfall is expected in northern Florida, southern Georgia, southeastern Alabama and southern South Carolina in the next ten days, but dryness will return a little later this spring - Sufficient

amounts will occur to improve spring planting for corn, and other early season crops - Waves

of rain are still expected this spring in the lower and eastern U.S. Midwest, Delta and Tennessee River Basin that may eventually interfere with spring planting for corn, rice, cotton and early soybeans - How

significant the disruption to spring planting will be remains to be seen, but the situation will be closely monitored - Frost

and freezes are likely in the U.S. southern Plains, Delta and southeastern states Saturday and Sunday causing some damage to fruit and vegetable crops - Winter

wheat should not be seriously harmed in any key production area - Southwestern

Canada’s Prairies and the northern U.S. Plains and upper Midwest

will experience limited precipitation over the next ten days - Drought

remains serious in the southwestern Canada Prairies and the northwestern U.S. Plains - California’s

central valleys are not likely to get much precipitation over the next ten days - Some

snow in the Sierra Nevada is expected after March 20, but amounts will be too light to seriously change the snowpack or spring runoff potential.

- Southwestern

Europe is expected to receive more frequent rainfall over the next ten days

- Spain,

Portugal and parts of France will benefit most from the rain - Portions

of Spain that have been dry for quite a while will benefit most from the moisture - Northwestern

Africa will also experience more rain late this week and especially next week with moisture totals greatest in Morocco

- Central,

east-central and northeastern Europe will be dry biased over the next ten days - Subsoil

moisture is favorable to carry on normal crop development - Some

beneficial moisture will fall in Greece and a few neighboring areas in the Balkan Countries during the coming week - Parts

of Romania are still dry and in need of moisture - Waves

of rain and some snow will occur from the Middle East through Uzbekistan and southern and eastern Kazakhstan and Tajikistan to the mountains of western Xinjiang, China during the coming week to ten days - The

moisture will be ideal for raising soil moisture ahead of cotton and other crop planting - Improved

mountain snowpack is expected - Heavy

precipitation will occur near Kyrgyzstan, including neighboring areas of Uzbekistan and Tajikistan

- Russia

and Ukraine precipitation is expected to be relatively light over the next ten days - Snow

cover will remain sufficient to protect Russian winter crops from bitter cold that will be present during the balance of this week and into next week - Southern

Argentina will be dry biased during the next ten days - The

area impacted will be central and southwestern Buenos Aires, La Pampa, southern Cordoba and southern San Luis - These

areas have good subsoil moisture today and should manage through the drier biased period without much trouble - Temperatures

will be seasonable - A

boost in precipitation will be needed, though, for later this month especially for late season crops; including double-cropped soybeans - Additional

rain is still expected across central and northern Argentina into Thursday

- The

moisture will continue to ensure dryness is over for these areas, although the precipitation comes a little late in the growing season to make much difference in production potentials

- Formosa

and northern Chaco will have need for more rainfall - Much

of Argentina will be dry Saturday through Friday, March 18 - The

drier weather will be good for areas that have received significant rain recently and that which is still coming into Friday - All

of Brazil will get rain at one time or another during the next ten days, although far southern areas will trend drier this weekend for a little while before additional rain falls in the second week of the outlook - Most

of the rain expected in Rio Grande do Sul to Parana and Mato Grosso do Sul will occur through Friday

- Sufficient

amounts are expected to bolster soil moisture and support long term crop needs

- Follow

up rain will occur again in the weekend of March 18-20. - Increased

rainfall in center west and center south Brazil next week will slow late season soybean harvest progress - Some

areas in northern Mato Grosso will remain quite wet - China

weather will experience a mix of rain and sunshine through the next ten days - Waves

of precipitation are expected this weekend and next week that will bolster topsoil moisture for use by crops in the spring - The

precipitation will occur as snow and rain with most of eastern China impacted at one time or another - Temperatures

will be well above normal and that will likely bring winter crops out of dormancy in southern wheat and rapeseed areas - The

warming trend will also raise soil temperatures for early rice and corn planting - Australia

weather over the next ten days will be most active near the Pacific Coast - Rain

will occur most often and most significantly in sugarcane areas along the central and lower Queensland coast and east of the Great Dividing range - A

few cotton and sorghum areas will be impacted too, but most of the interior crop areas in Queensland will not be seriously impacted by the frequent rain - Western

fringes of crop country in Australia and New South Wales will receive some rain. - India

weather will be relatively tranquil over the next ten days - the

environment will be great for winter crops that are filling and maturing, although a little rain might still be welcome of the latest reproducing crops - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and eastern parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia will receive more rain starting Tuesday and occurring nearly every day into the following weekend - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive infrequent bouts of rain beginning late this weekend and lasting through all of next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired resulting in a need for more moisture - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - The

greatest and most widespread precipitation is expected next week - Xinjiang,

China precipitation will continue restricted over the next ten days, although periods of snow and a little rain will fall in the mountains improving run off potential in the spring - South

Africa precipitation over the next ten days will be good for late season summer crop development, although some drier weather might be good for early maturing crops - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this weekend and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +8.49 - The

index will slowly rise in this coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- USDA

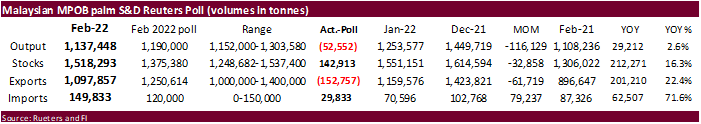

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Malaysian

Palm Oil Board’s monthly data for output, exports and stockpiles - U.S.

National Coffee Association Virtual Convention, day 3 - Malaysia’s

March 1-10 palm oil export data - Brazil’s

Unica may release cane crush and sugar output data (tentative)

Friday,

March 11:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

USDA

export sales

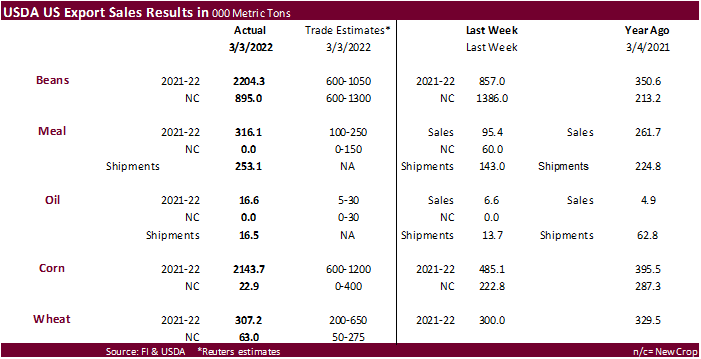

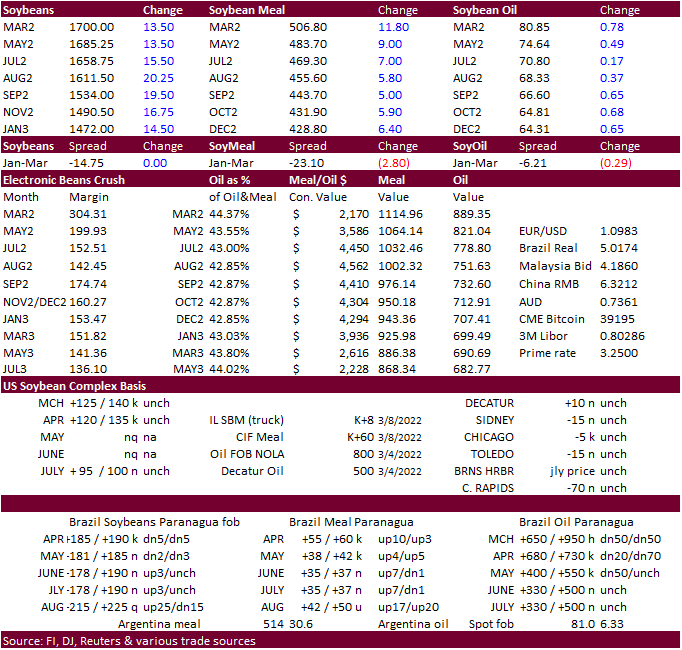

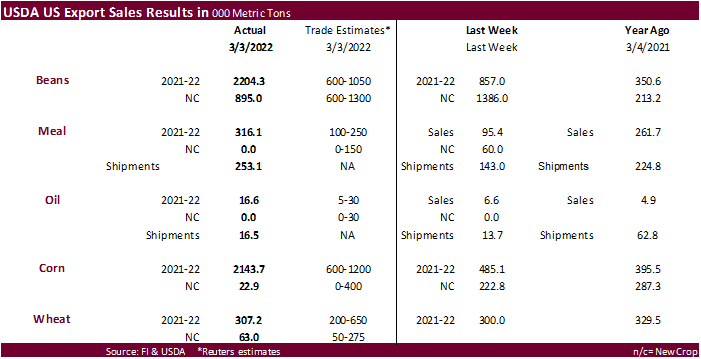

Very

good sales were posted for soybeans, corn and meal. Corn sales were a marketing year high (unknown 800,600 tons) and China was a large 2021-22 taker of soybeans.

Macros

US

CPI (M/M) Feb: 0.8% (est 0.8%; prev 0.6%)

US

CPI Ex Food And Energy (M/M) Feb: 0.5% (est 0.5%; prev 0.6%)

US

CPI (Y/Y) Feb: 7.9% (est 7.9%; prev 7.5%)

US

CPI Ex Food And Energy (Y/Y) Feb: 6.4% (est 6.4%; prev 6.0%)

US

CPI Index NSA Feb: 283.716 (est 283.700; prev 281.148)

80

Counterparties Take $1.569 Tln At Fed Reverse Repo Op (prev $1.543 Tln, 81 Bids)

·

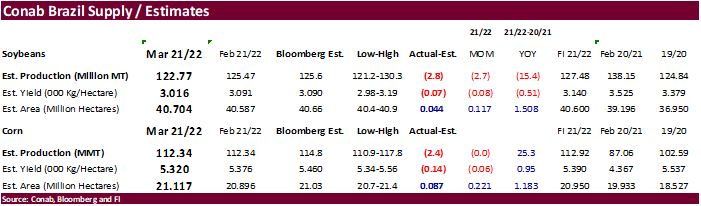

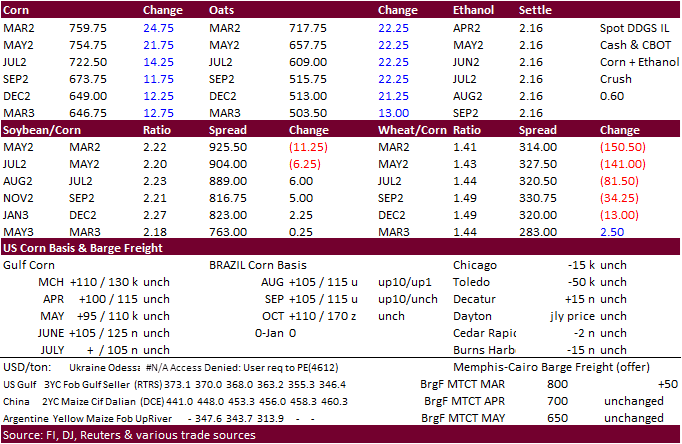

CBOT corn was up sharply (bull spreading) in part to very good USDA export sales and thoughts China is starting to look at US grains for imports. SA corn supplies continue to shrink. Conab slightly lowered their outlook for Brazil

corn production when the trade was looking for an upward revision.

·

Argentina’s Rosario grains exchange lowered its corn production outlook to 47.7 million tons from 48 million tons previously.

Export

developments.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment.

Updated

3/3/22

May

corn is seen in a $6.50 and $8.50 range

December

corn is seen in a wide $5.50-$7.50 range

·

Soybeans, soybean meal and soybean oil futures rallied on smaller South American soybean crop estimates and USDA soybean export sales exceeding expectations. Demand for US soybean meal and soybean oil should be strong throughout

2022 on tighter SA supplies. US domestic soybean meal basis appreciated this week and that lent some support to soybean meal futures.

·

Conab cut their Brazil soybean production estimate by 2.7 million tons from the previous month to 122.8 million tons. USDA is at 127 million tons.

·

Argentina’s Rosario grains exchange lowered their estimate for soybean production to 40 million tons from 40.5 million tons previously.

·

Argentina’s north and central growing regions will see heavy rains over the next few days. – Buenos Aires grains exchange

·

A large international grain company that have a crushing plant within Russia announced they will continue to produce products for the domestic market and comply with suspending new export business from Russia.

·

There were no USDA 24-hour sales announcements this morning.

·

China plans to sell 295,596 tons of soybeans from reserves on March 14.

·

AmSpec reported Malaysian palm oil exports for the March 1-10 period at 370,492 tons versus 320,508 tons for the same period month earlier. ITS reported a 18% increase to 374,422 from Feb 1-10. SGS had 322,754 tons, only a 6

percent increase.

·

MPOB reported a higher than expected February palm oil inventories despite production reported below expectations. Exports during February fell from the previous month.

- Iran’s

GTC was thought to have bought 60,000 tons of South American soymeal for March and April shipment. - Results

awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

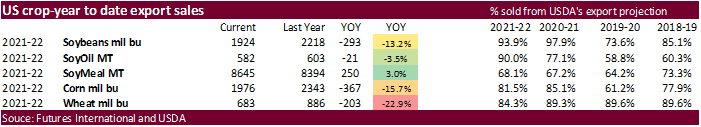

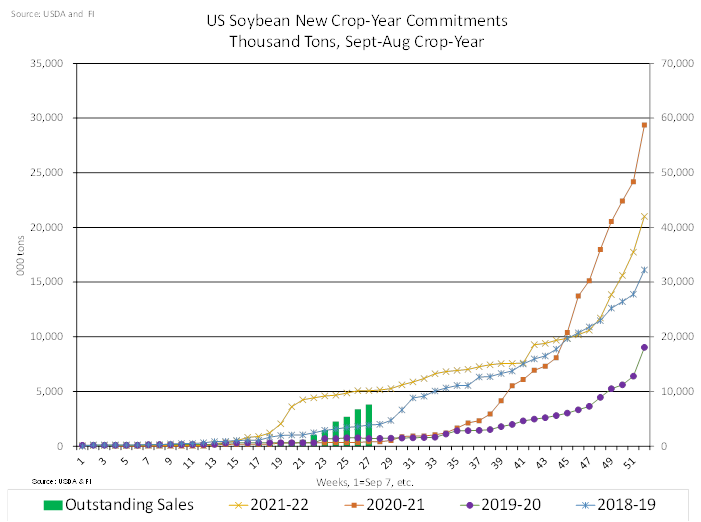

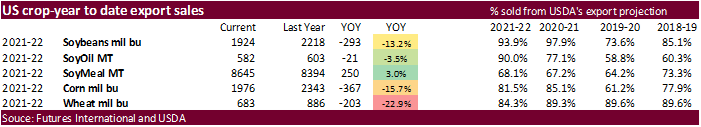

New

crop soybean export commitments are starting to pick up

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

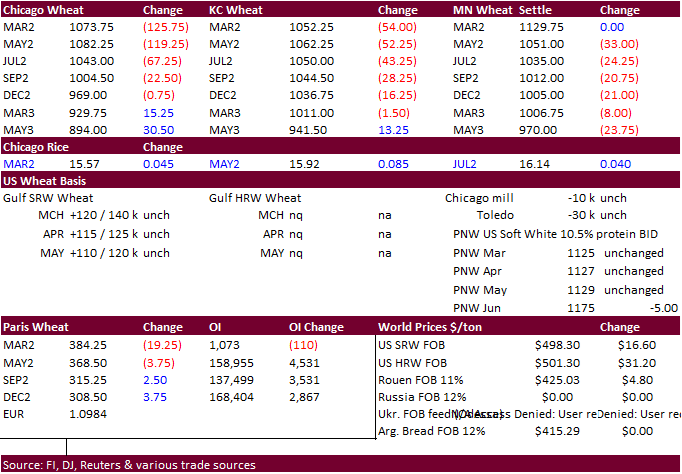

US wheat futures fell on poor USDA export sales despite Russia formally announcing they are suspending wheat and grain exports to selected countries (Eurasian Economic Union) until August 31. That cuts into 2 months into their

grain marketing year and could benefit US new-crop US wheat exports.

·

USDA yesterday lowered US wheat exports by 10 million bushels, which caught the trade off guard. We are not as pessimistic as USDA after February inspections came in roughly 10 million bushels above our working estimate. We look

for US wheat exports to end up near 833 million bushels, 33 million (about 900,000 tons) above USDA, with a bias to lower that figure. But we need to see more 2021-22 sales to reach that figure. Some of the trade is disappointed that US wheat sales have been

sluggish since the Russia/Ukraine situation started. Attached is our updated US wheat balance sheet.

·

It was rumored that another 8 cargos of French wheat was sold to Mexico.

·

The US weather forecaster estimated that there is a 53% chance of La Nina conditions continuing during the Northern Hemisphere summer.

·

May Paris wheat futures settled 3.75 euros lower at 368.25 euros.

·

Iran’s GTC was thought to have bought 240,000 tons of milling wheat from Europe at an unknown price for March and/or April shipment.

·

Algeria bought 600,000 to 700,000 tons of milling wheat at around $485 a ton c&f for May shipment.

·

Tunisia seeks 125,000 tons of soft wheat and 100,000 tons of feed barley on Friday for shipment between March 20-May 20.

·

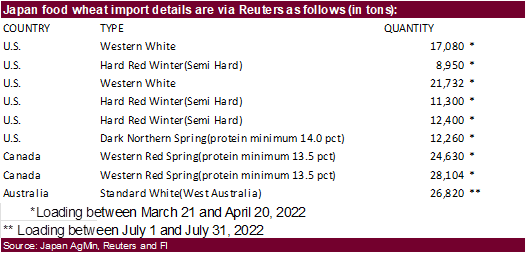

Japan seeks 163,276 tons of food wheat on Friday.

·

Taiwan seeks 50,000 tons of US PNW milling wheat on March 11 for April 23-May 7 shipment.

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

·

Japan’s AgMin in a SBS import tender on March 16 seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by Aug. 25.

·

Jordan seeks 120,000 tons of wheat on March 16. Possible shipment combinations are for May 16-31, June 16-30, July 1-15 and July 16-31.

Rice/Other

·

None reported

Updated

3/8/22

Chicago

May $8.50 to $13.6350 range (eventually $10.5975 initial pull back)

KC

May $8.50 to $13.50 range

MN

May $9.25‐$14.00

Very good sales were posted for soybeans, corn and meal. Corn sales were a marketing year high (unknown) and China was a large 2021-22 taker of soybeans.

This

summary is based on reports from exporters for the period February 25-March 3, 2022.

Wheat: Net

sales of 307,200 metric tons (MT) for 2021/2022 were up 2 percent from the previous week and 21 percent from the prior 4-week average. Increases primarily for the Philippines (133,100 MT), Mexico (111,700 MT, including decreases of 26,300 MT), Japan (26,200

MT), Colombia (17,400 MT), and the Dominican Republic (13,100 MT, including decreases of 100 MT), were offset by reductions for El Salvador (1,400 MT), South Korea (1,000 MT), and Taiwan (100 MT). Net sales of 63,000 MT for 2022/2023 were reported for the

Philippines (50,000 MT) and Mexico (13,000 MT). Exports of 384,500 MT were up 5 percent from the previous week, but down 10 percent from the prior 4-week average. The destinations were primarily to Mexico (88,200 MT), Japan (66,600 MT), the Philippines (65,100

MT), Thailand (58,500 MT), and Guatemala (52,100 MT).

Corn:

Net sales of 2,143,700 MT for 2021/2022–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases primarily for unknown destinations (800,600 MT), Japan (398,400 MT, including 37,500 MT switched from unknown

destinations and decreases of 21,000 MT), Mexico (290,200 MT, including decreases of 40,600 MT), Saudi Arabia (140,000 MT, including 140,000 MT switched from unknown destinations and decreases 2,600 MT), and Colombia (129,600 MT, including 50,000 MT switched

from unknown destinations and decreases of 125,300 MT), were offset by reductions for El Salvador (22,500 MT) and Costa Rica (2,900 MT). Total net sales of 22,900 MT for 2022/2023 were for Mexico. Exports of 1,763,300 MT were up 14 percent from the previous

week and from the prior 4-week average. The destinations were primarily to China (555,100 MT), Mexico (371,700 MT), Colombia (258,400 MT), Japan (205,100 MT), and Saudi Arabia (140,000 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 115,000 MT were reported for unknown destinations. The current outstanding balance of 285,800 MT is for unknown destinations (180,000 MT), South Korea (65,000 MT), Italy (31,800 MT), and

Saudi Arabia (9,000 MT). For 2022/2023, the current outstanding balance of 3,900 MT is for Italy.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 7,100 MT for 2021/2022 were down 93 percent from the previous week and 94 percent from the prior 4-week average. Increases reported for China (72,100 MT, including 65,000 MT switched from unknown destinations and decreases of 400 MT), were offset

by reductions for unknown destinations (65,000 MT). Exports of 206,100 MT were up 49 percent from the previous week and 19 percent from the prior 4-week average. The destination was primarily to China (204,900 MT).

Rice:

Net sales of 36,700 MT for 2021/2022 were down 48 percent from the previous week and 61 percent from the prior 4-week average. Increases primarily for Mexico (14,700 MT), Japan (13,300 MT), Nicaragua (5,400 MT), Canada (2,500 MT), and Guatemala (1,500 MT),

were offset by reductions for Costa Rica (1,500 MT). Exports of 21,600 MT were down 73 percent from the previous week and 74 percent from the prior 4-week average. The destinations were primarily to Haiti (15,300 MT), Canada (3,200 MT), Mexico (2,000 MT),

Taiwan (300 MT), and Hong Kong (200 MT).

Exports

for Own Account:

For 2021/2022, exports for own account totaling 100 MT to Canada were applied to new or outstanding sales.

Soybeans:

Net sales of 2,204,300 MT for 2021/2022 were up noticeably from the previous week and up 76 percent from the prior 4-week average. Increases were primarily for China (1,096,400 MT, including 66,000 MT switched from unknown destinations and decreases of 500

MT), unknown destinations (334,000 MT), Egypt (181,000 MT, including 55,000 MT switched from unknown destinations and decreases of 2,700 MT), Mexico (142,700 MT, including decreases of 80,000 MT), and Vietnam (114,700 MT, including decreases 100 MT). Net

sales of 895,000 MT for 2022/2023 were reported for China (797,000 MT), unknown destinations (66,000 MT), and Mexico (32,000 MT). Exports of 834,900 MT were up 11 percent from the previous week, but down 26 percent from the prior 4-week average. The destinations

were primarily to China (304,600 MT), Egypt (173,000 MT), Mexico (75,800 MT), Indonesia (73,200 MT), and Japan (68,000 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 316,100 MT for 2021/2022 were up noticeably from the previous week and up 49 percent from the prior 4-week average. Increases primarily for unknown destinations (47,500 MT), Vietnam (45,000 MT), the Philippines (44,600 MT, including decreases

of 400 MT), Mexico (38,900 MT), and Colombia (37,800 MT, including 19,200 MT switched from unknown destinations and decreases of 300 MT), were offset by reductions primarily for Honduras (3,000 MT), Ecuador (2,900 MT), Belgium (600 MT), Costa Rica (200 MT),

and Taiwan (100 MT). Exports of 253,100 MT were up 77 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to Colombia (66,300 MT), the Dominican Republic (38,900 MT), Mexico (31,600 MT), Venezuela (30,000

MT), and Morocco (19,700 MT).

Soybean

Oil:

Net sales of 16,600 MT for 2021/2022 were up noticeably from the previous week, but down 17 percent from the prior 4-week average. Increases reported for India (18,000 MT switched from Bangladesh), South Korea (12,000 MT), Mexico (5,000 MT, including decreases

of 200 MT), and Canada (200 MT), were offset by reductions for Bangladesh (18,000 MT), the Dominican Republic (500 MT), and Colombia (100 MT). Exports of 16,500 MT were up 21 percent from the previous week, but down 24 percent from the prior 4-week average.

The destinations were to Colombia (6,900 MT), Mexico (3,500 MT), Jamaica (3,500 MT), the Dominican Republic (2,200 MT), and Canada (400 MT).

Cotton:

Net sales of 354,200 RB for 2021/2022 were up 2 percent from the previous week and 51 percent from the prior 4-week average. Increases primarily for China (170,300 RB, including decreases of 800 RB), Turkey (70,500 RB, including decreases of 300 RB), Pakistan

(49,600 RB), Vietnam (35,400 RB, including 1,100 RB switched from Japan), and Indonesia (7,100 RB, including 300 RB switched from Japan and decreases of 900 RB), were offset by reductions for India (4,000 RB) and Nicaragua (100 RB). Net sales of 68,200 RB

for 2022/2023 were primarily for Turkey (28,600 RB), Pakistan (12,600 RB), China (8,800 RB), Mexico (8,200 RB), and Colombia (5,100 RB). Exports of 321,300 RB were down 9 percent from the previous week and 1 percent from the prior 4-week average. The destinations

were primarily to China (108,800 RB), Pakistan (61,800 RB), Turkey (30,400 RB), Vietnam (30,300 RB), and Mexico (26,100 RB). Net sales of Pima totaling 700 RB were down 91 percent from the previous week and 87 percent from the prior 4-week average. Increases

were reported for Italy (500 RB), Indonesia (100 RB), and India (100 RB). Exports of 22,500 RB–a marketing-year high–were up noticeably from the previous week and up 65 percent from the prior 4-week average. The destinations were primarily to India (7,900

RB), China (3,700 RB), Vietnam (3,100 RB), Peru (2,100 RB), and Pakistan (1,700 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 61,600 RB is for Vietnam (52,800 RB) and Pakistan (8,800 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 338,500 pieces for 2022 were down 25 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for China (251,200 whole cattle hides, including decreases of 22,300 pieces), South Korea (34,600 whole cattle

hides, including decreases of 1,900 pieces), Mexico (26,000 whole cattle hides, including decreases of 600 pieces), Taiwan (15,600 whole cattle hides), and Indonesia (7,200 whole cattle hides, including decreases of 600 pieces), were offset by reductions primarily

for Thailand (2,000 pieces) and Spain (500 pieces). Total net sales reductions of 800 calf skins were for Italy. Exports of 451,700 pieces were up 28 percent from the previous and 21 percent from the prior 4-week average. Whole cattle hides exports were

primarily to China (272,900 pieces), South Korea (76,100 pieces), Mexico (35,300 pieces), Thailand (25,900 pieces), and Indonesia (12,300 pieces).

Net

sales of 129,200 wet blues for 2022 were up noticeably from the previous week and up 56 percent from the prior 4-week average. Increases reported for Italy (49,700 unsplit and 100 grain splits), Vietnam (30,900 unsplit, including decreases of 100 unsplit),

Thailand (21,600 unsplit), China (20,800 unsplit), and Taiwan (6,700 unsplit),

were offset by reductions for Portugal (500 grain splits). Exports of 155,000 wet blues were up noticeably from the previous week and up 48 percent from the prior 4-week average. The destinations were primarily to Italy (30,200 unsplit and 22,600 grain splits),

Vietnam (47,200 unsplit), China (38,100 unsplit), Mexico (2,600 unsplit and 1,900 grain splits), and Portugal (4,300 grain splits). Net sales of 1,897,100 splits resulting in increases for Vietnam (1,908,300 pounds, including decreases of 32,100 pounds),

were offset by reductions for South Korea (11,200 pounds). Exports of 393,300 pounds were to Vietnam.

Beef:

Net sales of 27,500 MT for 2022–a marketing-year high–were up 16 percent from the previous week and 36 percent from the prior 4-week average. Increases were primarily for China (10,400 MT, including decreases of 100 MT), Japan (6,400 MT, including decreases

of 300 MT), South Korea (3,700 MT, including decreases of 500 MT), Canada (1,300 MT), and Taiwan (1,100 MT, including decreases of 100 MT). Exports of 15,900 MT were down 10 percent from the previous week and 1 percent from the prior 4-week average. The

destinations were primarily to South Korea (4,500 MT), Japan (4,100 MT), China (2,600 MT), Taiwan (1,500 MT), and Mexico (1,000 MT).

Pork:

Net sales of 25,400 MT for 2022 were down 40 percent from the previous week and 4 percent from the prior 4-week average. Increases primarily for Mexico (12,800 MT, including decreases of 200 MT), China (3,600 MT, including decreases of 300 MT), South Korea

(2,100 MT, including decreases of 100 MT), Japan (2,000 MT, including decreases of 500 MT), and Honduras (1,200 MT), were offset by reductions for Chile (100 MT). Exports of 28,500 MT were down 5 percent from the previous week and 6 percent from the prior

4-week average. The destinations were primarily to Mexico (11,900 MT), Japan (5,200 MT), China (3,600 MT), South Korea (2,600 MT), and Canada (1,500 MT).

U.S. EXPORT SALES FOR WEEK ENDING 3/3/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

73.3 |

1,775.3 |

1,376.1 |

182.4 |

5,655.3 |

6,782.8 |

13.0 |

196.3 |

|

SRW |

12.5 |

584.6 |

413.9 |

17.2 |

2,102.0 |

1,340.7 |

0.0 |

212.5 |

|

HRS |

167.3 |

1,128.1 |

1,941.5 |

99.2 |

3,895.0 |

5,218.6 |

24.0 |

107.6 |

|

WHITE |

54.1 |

551.3 |

2,138.1 |

85.7 |

2,709.1 |

4,236.0 |

26.0 |

117.0 |

|

DURUM |

0.0 |

18.8 |

154.2 |

0.0 |

169.7 |

518.4 |

0.0 |

47.0 |

|

TOTAL |

307.2 |

4,058.0 |

6,023.8 |

384.5 |

14,531.2 |

18,096.5 |

63.0 |

680.4 |

|

BARLEY |

0.0 |

13.8 |

11.5 |

0.0 |

14.7 |

22.0 |

0.0 |

0.0 |

|

CORN |

2,143.7 |

22,669.2 |

31,756.3 |

1,763.3 |

27,533.0 |

27,762.7 |

22.9 |

1,928.6 |

|

SORGHUM |

7.1 |

3,687.4 |

2,844.4 |

206.1 |

2,987.2 |

3,094.1 |

0.0 |

0.0 |

|

SOYBEANS |

2,204.3 |

10,759.6 |

7,111.4 |

834.9 |

41,611.2 |

53,243.3 |

895.0 |

7,646.8 |

|

SOY MEAL |

316.1 |

3,203.5 |

2,720.2 |

253.1 |

5,441.0 |

5,673.9 |

0.0 |

234.7 |

|

SOY OIL |

16.6 |

172.6 |

101.8 |

16.5 |

409.2 |

501.1 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

21.6 |

249.6 |

264.6 |

0.6 |

868.1 |

1,007.8 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.5 |

9.9 |

0.5 |

5.2 |

19.0 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

17.6 |

12.6 |

0.5 |

31.9 |

24.5 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

44.0 |

70.7 |

0.1 |

42.0 |

81.9 |

0.0 |

0.0 |

|

L G MLD |

0.1 |

88.6 |

76.1 |

18.3 |

524.7 |

401.1 |

0.0 |

0.0 |

|

M S MLD |

14.8 |

192.2 |

224.7 |

1.7 |

250.9 |

347.8 |

0.0 |

0.0 |

|

TOTAL |

36.7 |

600.5 |

658.7 |

21.6 |

1,722.7 |

1,882.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

354.2 |

7,760.1 |

5,308.2 |

321.3 |

5,524.3 |

8,481.5 |

68.2 |

2,236.0 |

|

PIMA |

0.7 |

159.0 |

263.2 |

22.5 |

256.9 |

457.8 |

0.0 |

13.6 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.