PDF Attached

Private

exporters reported the following activity:

-128,900

metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year

-264,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

Day

16. Grains rallied on Friday while meal and soybeans traded lower on light profit taking. Soybean oil was up sharply after WTI rallied. US soybean meal basis offers were up sharply this week.

WEATHER

EVENTS AND FEATURES TO WATCH

- Russia

cold weather will be persistent for the next week to ten days - Sufficient

snow over will protect dormant winter crops - Precipitation

will be restricted while the cold air is in place - Turkey

through Turkmenistan, Uzbekistan, southern Kazakhstan, Tajikistan and areas northeast into the northwestern mountains of Xinjiang, China will experience frequent bouts of rain and snow in the next week to ten days

- Moisture

improvements will be great for winter wheat and especially good for future cotton planting - Xinjiang

snowfall in the mountains will be helpful in raising the snowpack for improved runoff into corn and cotton areas in the nation later this spring and summer - Southwestern

Europe and northwestern parts of Africa will receive welcome rain in the coming week to ten days - The

moisture is needed to improve winter crops ahead of reproduction and to improve spring planting conditions of unirrigated areas - Spain,

Portugal, Morocco and southern France will be wettest - Central

and eastern Europe and western parts of the Commonwealth of Independent States will experience less than usual precipitation during the next ten days - The

drying will occur while temperatures are mild to cool which will conserve soil moisture and prevent the drying trend from making any area too dry - A

wet late spring and summer is predicted for southern and east-central Europe this year

- Argentina

will experience a week to ten days of net drying - No

excessive heat is expected and soil conditions will slowly dry down - Recent

rain in the central and north has the ground saturated and the drying will be welcome - Far

southern Argentina has missed rain recently, but has good subsoil moisture that will support late season crops during this lull in precipitation - All

of Brazil will see a favorable mix of rain and sunshine during the next ten days to two weeks - A

few areas in the north may be too wet, but the wet field conditions in much of the nation will be great for Safrinha corn and cotton development and for other late season crop development

- Citrus

and sugarcane will benefit too - There

is some concern over drying in parts of Minas Gerais due to some late season sugarcane and coffee that might eventually become rather dry - Coffee

areas from Zona de Mata to Bahia will be driest - Significant

snowfall Thursday in west-central and northern Kansas was ideal for lifting topsoil moisture when the snow melts this weekend into early next week - Improved

greening conditions and some early season crop development will take place during the next period of warmer than usual weather expected next week - Snowfall

of 3 to 13 inches occurred with moisture totals to 0.50 inch in the wetter areas of west-central and northern Kansas - Much

less precipitation occurred farther to the south - Drought

remains in place, despite the snowfall - Snow

cover in the central Plains will leave winter wheat adequately protected against another cold night tonight - No

crop damage is expected - U.S.

hard red winter wheat areas have received snow overnight in Nebraska, eastern Colorado and central and northern Kansas - Accumulations

varied from 1 to 5 inches from southern Nebraska across northern Kansas, but greater accumulations in central Kansas have occurred with 13 inches in Sharon Springs (west-central Kansas), 12 inches at Quinter (west-central Kansas) and nearly 10 inches near

Ash grove (central Kansas) - Moisture

totals have varied from a trace to 0.46 inch through dawn today with most areas getting less than 0.20 inch of moisture - The

precipitation has not and will not dramatically raise topsoil moisture, but a small improvement in surface moisture will result as the snow melts - The

snow cover will be important in protecting winter crops from temperatures that will slip to the positive single digits Fahrenheit over the next two nights - A

few temperatures extremes near or slightly below zero Fahrenheit cannot be ruled out for a few areas, but snow will be on the ground to protect crops in those areas - U.S.

hard red winter wheat areas are expecting a couple of other minor weather systems in the next two weeks, but they will disfavor the high Plains – especially west-central and southwestern parts of the region - The

moisture will help induce more greening and help to stimulate some initial crop developing which may include plant repair form the harsh conditions in recent months - A

cool and moist spring is needed to induce new root and tiller development after drought, heaving topsoil and bouts of bitter cold without adequate snow cover impacted the crops at various times during the late autumn and winter - West

Texas cotton areas will not get much moisture from today’s precipitation event - A

trace to 0.15 inch is most likely - Drought

will prevail - West

and South Texas precipitation is expected to remain restricted for the next two weeks, although completely dry conditions are not likely - The

Texas Coastal Bend will also struggle for greater rainfall - Texas

Blacklands, the U.S. Delta and U.S. southeastern states will be impacted by precipitation periodically over the next two weeks - Drought

easing rainfall is expected in northern Florida, southern Georgia, southeastern Alabama and southern South Carolina in the next ten days, but dryness will return a little later this spring - Sufficient

amounts will occur to improve spring planting for corn, and other early season crops - Waves

of rain are still expected this spring in the lower and eastern U.S. Midwest, Delta and Tennessee River Basin that may eventually interfere with spring planting for corn, rice, cotton and early soybeans - How

significant the disruption to spring planting will be remains to be seen, but the situation will be closely monitored - Frost

and freezes are likely in the U.S. southern Plains, Delta and southeastern states Saturday and Sunday causing some damage to fruit and vegetable crops - Winter

wheat should not be seriously harmed in any key production area - Southwestern

Canada’s Prairies and the northern U.S. Plains and upper Midwest

will experience limited precipitation over the next ten days - Drought

remains serious in the southwestern Canada Prairies and the northwestern U.S. Plains - California’s

central valleys are not likely to get much precipitation over the next ten days - Some

snow in the Sierra Nevada is expected after March 20, but amounts will be too light to seriously change the snowpack or spring runoff potential.

- Some

beneficial moisture is expected to continue in Greece and a few neighboring areas in the Balkan Countries during the coming week - Parts

of Romania are still dry and in need of moisture - China

weather will experience a mix of rain and sunshine through the next ten days - Waves

of precipitation are expected this weekend and next week that will bolster topsoil moisture for use by crops in the spring - The

precipitation will occur as snow and rain with most of eastern China impacted at one time or another - Temperatures

will be well above normal and that will likely bring winter crops out of dormancy in southern wheat and rapeseed areas - The

warming trend will also raise soil temperatures for early rice and corn planting - Australia

weather over the next ten days will be most active in New South Wales and along the Pacific Coast - Rain

will occur most often and most significantly in sugarcane areas along the central and lower Queensland coast and east of the Great Dividing range - A

few cotton and sorghum areas will be impacted too, but most of the interior crop areas in Queensland will not be seriously impacted by the frequent rain - Western

fringes of crop country in eastern Queensland and the heart of New South Wales will receive the most frequent rain - India

weather will be relatively tranquil over the next ten days - the

environment will be great for winter crops that are filling and maturing, although a little rain might still be welcome of the latest reproducing crops - Southeast

Asia rainfall will occur frequently and abundantly this week - Flooding

may impact southern and eastern parts of the Philippines, northwestern Sumatra, parts of peninsula Malaysia and in a few western Java locations - Mainland

areas of Southeast Asia will receive more rain starting Tuesday and occurring nearly every day into the following weekend - The

moisture will be good for immature winter crops and for prepping the soil for spring planting of corn, rice and other crops - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive infrequent bouts of rain beginning late this weekend and lasting through all of next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired resulting in a need for more moisture - Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations - The

greatest and most widespread precipitation is expected next week - South

Africa precipitation over the next ten days will be good for late season summer crop development, although some drier weather might be good for early maturing crops - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this weekend and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +8.34 - The

index will move erratically over the coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

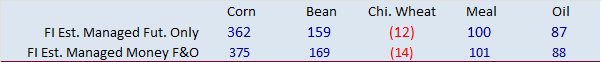

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - New

Zealand Food Prices

Monday,

March 14:

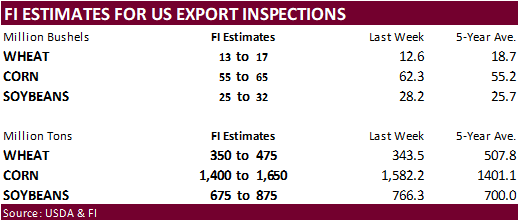

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

March 15:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Malaysia’s

March 1-15 palm oil export data

Wednesday,

March 16:

- EIA

weekly U.S. ethanol inventories, production, 11am

Thursday,

March 17:

- International

Grains Council’s monthly market report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Bangladesh

Friday,

March 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

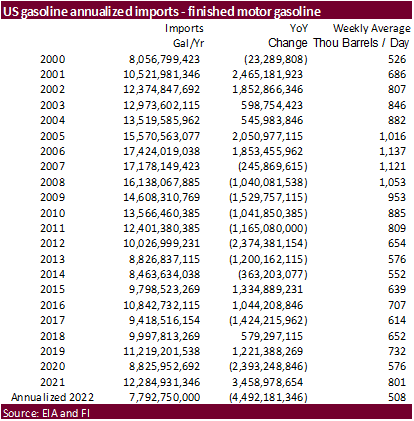

US

2022 (January through March 3) gasoline imports, annualized, on pace to be lowest since 1998.

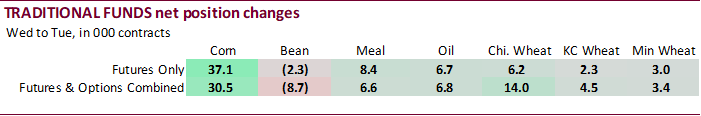

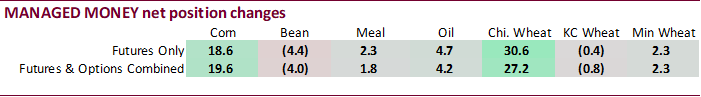

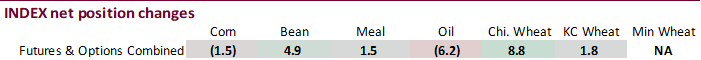

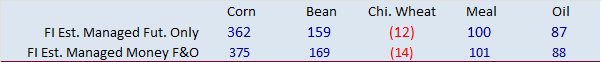

Index

funds for the major commodity markets are at record net long.

Reuters

table via CFTC

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

324,098 30,336 442,534 -1,475 -733,875 -18,620

Soybeans

129,222 -10,778 194,374 4,914 -294,096 3,481

Soyoil

57,500 10,914 118,969 -6,169 -193,052 -6,422

CBOT

wheat -27,361 3,938 158,596 8,772 -122,756 -11,518

KCBT

wheat 25,286 4,125 59,497 1,829 -84,316 -4,288

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

368,784 19,561 296,182 -5,705 -731,987 -14,576

Soybeans

171,714 -4,007 137,078 3,209 -302,167 3,126

Soymeal

96,627 1,797 93,793 -1,041 -239,954 -9,226

Soyoil

85,669 4,239 91,883 1,118 -199,119 -9,612

CBOT

wheat 20,208 27,244 84,596 -4,121 -99,142 -8,678

KCBT

wheat 44,706 -775 26,095 923 -72,785 -3,719

MGEX

wheat 12,914 2,312 927 -712 -24,864 -4,233

———- ———- ———- ———- ———- ———-

Total

wheat 77,828 28,781 111,618 -3,910 -196,791 -16,630

Live

cattle 38,551 -21,600 81,687 -211 -126,617 18,746

Feeder

cattle -4,132 -256 7,003 9 2,538 -586

Lean

hogs 66,019 -8,488 61,376 -250 -121,057 9,921

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

99,777 10,961 -32,756 -10,241 2,054,595 76,867

Soybeans

22,873 -4,712 -29,499 2,383 1,003,054 -4,261

Soymeal

17,059 4,781 32,477 3,688 439,326 -12,939

Soyoil

4,984 2,579 16,582 1,677 418,231 -21,535

CBOT

wheat 2,818 -13,253 -8,480 -1,191 518,859 10,572

KCBT

wheat 2,451 5,237 -467 -1,665 214,381 -19,793

MGEX

wheat 6,060 1,099 4,963 1,534 69,700 -1,337

———- ———- ———- ———- ———- ———-

Total

wheat 11,329 -6,917 -3,984 -1,322 802,940 -10,558

Live

cattle 18,634 1,043 -12,256 2,023 386,272 -30,035

Feeder

cattle 1,042 393 -6,451 441 62,488 -622

Lean

hogs 3,883 -2,014 -10,221 830 324,248 -32,607

=================================================================================

Macros

83

Counterparties Take $1.558 Tln At Fed Reverse Repo Op (prev $1.569 Tln, 80 Bids)

US

Univ. Of Michigan Sentiment Mar P: 59.7 (est 61.0; prev 62.8)

–

Current Conditions: 67.8 (est 65.8; prev 68.2)

–

Expectations: 54.4 (est 57.0; prev 59.4)

–

1-Year Inflation: 5.4% (est 5.1%; prev 4.9%)

–

5-10 Year Inflation: 3.0% (prev 3.0%)

Canadian

Net Change In Employment Feb: 336.6K (est 127.5K; prev -200.1K)

Canadian

Unemployment Rate Feb: 5.5% (est 6.2%; prev 6.5%)

Canadian

Capacity Utilization Rate Q4: 82.9% (est 81.9%; prev 81.4%)

Brent

Crude Futures Settle At $112.67/Bbl, Up $3.34 Or 3.05%

·

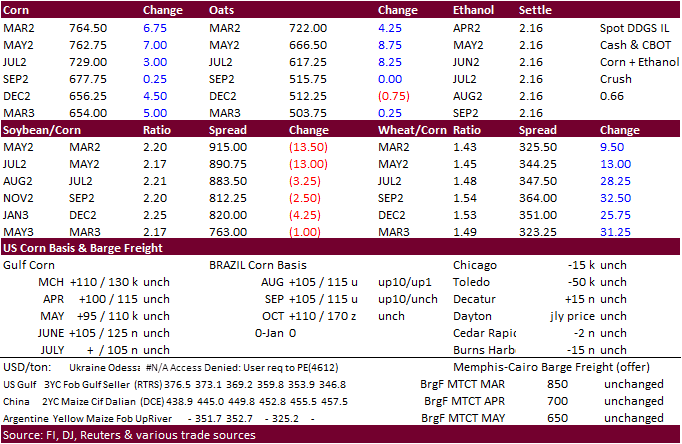

CBOT corn traded two-sided. It sold off early this morning from a break in WTI crude oil and headlines that Ukraine/Russia talks “improved.” But rallied after WTI rebounded and wheat traded higher. The font non-expiring month

led the contracts higher. May was up 6.75 cents and September fell 0.50 cent.

·

There was not much news in the corn market. We heard of increasing US corn export interest and this morning USDA announced 128,900 tons of corn was sold to unknown.

·

Iowa reported a highly lethal outbreak of bird flu in a chicken farm on Friday, third known IA case we know of for this year.

·

US corn cash markets are strong. Corn bids firmed at a river terminal in Seneca, Illinois and a Cincinnati, Ohio elevator, according to Reuters.

·

For the week, May CBOT corn was up 1.1%.

Export

developments.

- Private

exporters reported 128,900 tons of corn for delivery to unknown destinations during the 2021/2022 marketing year.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment.

Updated

3/3/22

May

corn is seen in a $6.50 and $8.50 range

December

corn is seen in a wide $5.50-$7.50 range

·

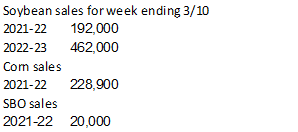

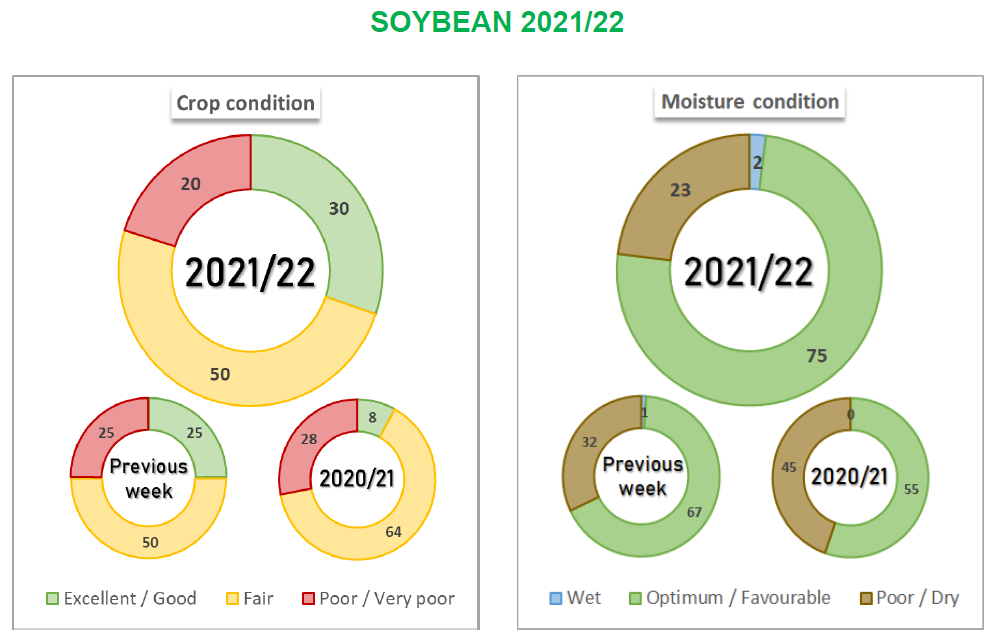

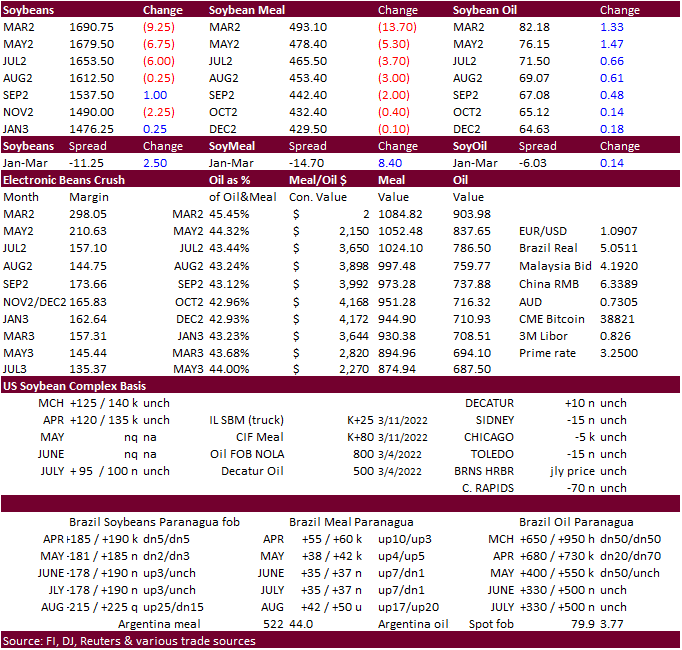

The soybean complex sold off early on headline trading, rallied and closed mixed. Soybeans and meal ended the day lower and soybean oil higher led by a sharp rally in the May position.

·

For the week May soybean futures were up 0.9%, soymeal up 3.6%, and soyoil up 4.4%.

·

There was a reported Southeastern US soybean meal basis was up another $8-$9 today after being up $6 Thursday. Export demand is strong and a Georgia processing plant is having some issues.

·

Selected IL/IN meal locations were up $8-9/short ton. KC was up $15. The ask for Gulf meal was last 80 over the May per Reuters.

·

We are hearing SA soybean premiums are now favored for major importers and US corn is now attractive.

·

This morning there was chatter Canada sold a few soybean and corn cargoes sold out of the lakes for export. High ocean rates are starting to become a problem for exporters.

·

Indonesia’s January palm oil exports were 2.18 million tons, down 23.8% from the same month last year, and down 11.4% from December. January production was 3.86 million tons of crude palm oil (CPO) and about 0.37 million tons

of palm kernel oil, down from December’s output of 3.98 million tons of CPO. January’s ending stock stood at 4.68 million tons, up from 4.13 million tons a month earlier.

·

May Malaysian palm oil settled 254 ringgit lower. Cash palm was down $47.50/ton to $1,747.50/ton.

·

Argentina’s north and central growing regions will see heavy rains over the next couple days.

·

Brazil’s Agriculture Ministry announced a fertilizer plan to reduce imports to 45% of total domestic fertilizer consumption by 2050, from 85% currently.

·

China plans to sell 295,596 tons of soybeans from reserves on March 14.

·

On Tuesday, China will adjust fees for some futures contracts including palm oil, soybean oil and soybean meal.

·

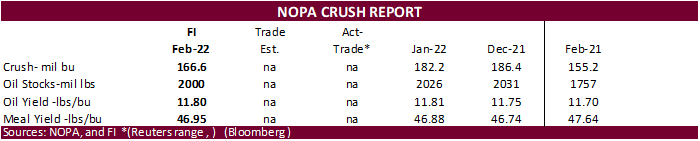

A Reuters NOPA survey calls for the February US crush representing a majority of the countries crush output to end up near 165.0 million bushels, down from 182.2 million last month, but up from 6.4 percent a year earlier, but

not exceeded during the record 166.3 million for February 2021.

- Private

exporters reported 264,000 tons of soybeans for delivery to China during the 2022/2023 marketing year.

- Results

awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

24-hour

USDA:

Updated

3/1/22

Soybeans

– May $15.75-$18.25

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$520

·

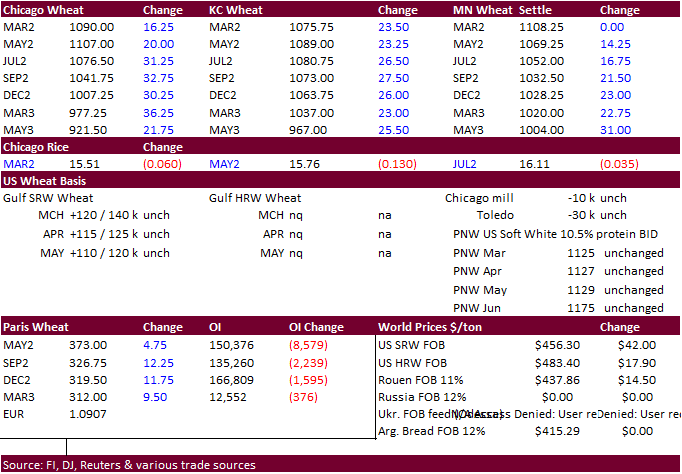

For the week, May Chicago wheat fell 8.5%. KC was down 10.3% and Minn down 6.8%.

·

President Joe Biden called for an end of regular trade relations with Russia.

·

Ukraine grain exporters are looking to export grain by trains, which much of it would be in the western part of the country.

·

Ukraine announced they intend to plant as many crops as possible this spring. But many obstacles main hinder sowings including a shortage of fuel and obviously conflicts.

·

Russian January wheat exports decreased to 1.4 million tons from 3.1 million tons a year ago.

·

Russia’s export duty on wheat exports from March 16 to 22, 2022 will drop to $86.30 per ton versus $86.90 per ton a week earlier. Barley will increase from $72.30 to $77.40 per ton and corn will rise from $53.90 to $54.10 per

ton.

·

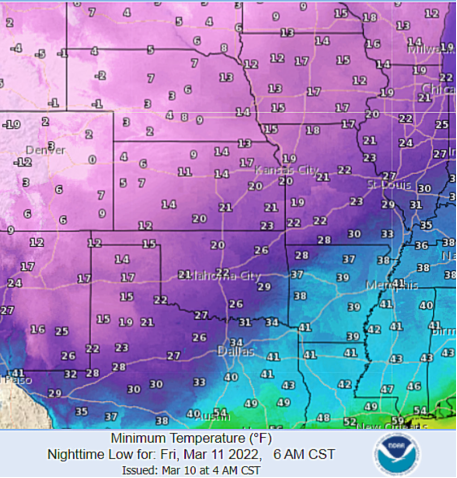

Northern Kansas yesterday saw up 0.50 inch in precipitation from a snow event that should help not only protect winter crops from a cold snap that will last until Saturday but provide enough moisture that will aid in spring crop

development. More moisture for the region is much needed to replenish soil moisture.

·

Paris May wheat settled up 2.50 euros, or 0.7%, at 370.75 euros ($404.75) a ton.

·

The French soft wheat crop was rated 92% good/excellent condition as of March 7, down from 93% a week earlier but above a year-earlier rating of 88%. Winter barley and durum wheat were rated 89% and 88%, respectively, slightly

below week earlier.

·

Morocco has wheat stocks to last five months.

·

China’s weather department warned of disease risk for the wheat crop as warm weather arrived this week.

US

Friday night temp probability

·

Tunisia bought about 125,000 tons of soft wheat and 100,000 tons of feed barley for shipment between March 20-May 20. The wheat was bought in five consignments each of about 25,000 tons, at $491.68, $499.69, $505.68 and $508.89

per ton c&f. One cargo was sold at $497.25. The barley was bought in four 25,000-ton consignments at $484.68 a ton c&f, $489.98, $492.49 and $494.97 per ton c&f.

·

Taiwan bought 50,000 tons of US PNW milling wheat for April 23-May 7 shipment.

-30,970

tons of U.S. dark northern spring wheat of 14.5% protein content bought at $454.51 a ton FOB U.S. Pacific Northwest coast.

-13,570

tons of hard red winter wheat of 12.5% protein was bought at $494.93 a ton FOB and 5,460 tons of soft white wheat of 10.5% protein was bought at $437.98 a ton FOB.

·

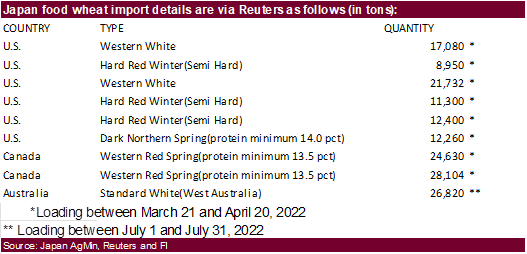

Japan bought 163,276 tons of food wheat. Original details as follows:

·

Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

·

Japan’s AgMin in a SBS import tender on March 16 seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by Aug. 25.

·

Jordan seeks 120,000 tons of wheat on March 16. Possible shipment combinations are for May 16-31, June 16-30, July 1-15 and July 16-31.

Rice/Other

·

None reported

Updated

3/8/22

Chicago

May $8.50 to $13.6350 range (eventually $10.5975 initial pull back)

KC

May $8.50 to $13.50 range

MN

May $9.25‐$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.