PDF Attached does not include daily estimate of funds as they were NA.

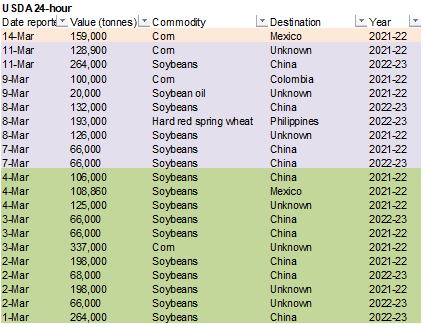

Private

exporters reported sales of 159,000 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year.

Day

19. WTI crude oil was more than $7.00/barrel lower, USD down 17, US equities lower around 1:45 pm CT. The soybean complex ended mixed. Soybean meal hit a 7-year high. Soybeans and oil ended lower. Corn and Chicago wheat were lower while higher protein wheat

mixed.

WEATHER

EVENTS AND FEATURES TO WATCH

- Not

much change occurred around the world today relative to that of Sunday. - U.S.

weather during the weekend was relatively tranquil, although rain in the southeastern states was locally heavy

- Rainfall

reached over 5.00 inches in northeastern Florida - Rainfall

in the Carolinas and Virginia varied from 0.76 to 1.56 inches - Georgia

and Alabama received 0.33 to 1.07 inches - Net

drying occurred in the heart of the Midwest and in much of the central and northern Plains and areas southwest into California and the southwestern desert region - U.S.

temperatures turned cold in the Gulf of Mexico States with frost occurring along the coast and freezes into northern Florida. Lows in the teens and 20s occurred in the Mid-south region and interior southeastern states as well as in parts of Texas and Oklahoma - The

cold burned back vegetative growth in many crops - Damage

was done to flowering fruit trees and other fruit and vegetable crops grown near the ground in the southern states.

- Single

digit and teen lows were noted in the central Plains and western Midwest, though little crop damage resulted due to snow cover in the more susceptible crop areas - Strong

warming was already noted Saturday afternoon and Sunday in the Plains with highs rising into the 60s and 70s Fahrenheit

- Saturday

morning was coldest in the Plains while the southeastern states were coldest Sunday - U.S.

hard red winter wheat areas will get some needed moisture Thursday in the central Plains with follow up precipitation in the southern Plains during mid-week next week - Moisture

totals will vary from 0.05 to 0.60 inch in the first event this week with another 0.20 to 0.75 inch elsewhere across the region early next week.

- Some

of the rain next week will be locally greater surpassing 1.00 inch, according the GFS and ECMWF model runs today, but World Weather, Inc. believes the rain intensity is overdone.

- The

southwestern Plains should continue to be missed by “significant” rain - Temperatures

will frequently be warmer than usual during the next ten days to two weeks keeping evaporation rates higher than usual and temperatures warm enough to bring some southern crops out of dormancy.

- West

and South Texas precipitation should be minimal for the next ten days - Texas

Coastal Bend crop areas are also unlikely to experience much precipitation of significance - U.S.

Delta and Southeastern states will continue to experience periodic rainfall during the next ten days to two weeks - Soil

moisture will be great enough to ease recent dryness in the southeastern states - There

will be breaks in the rain at which time spring planting is expected - Temperatures

will be near to above normal - U.S.

Interior Northwestern states are unlikely to experience much rain, but the mountains on either side of the Yakima and Colombia River Valleys will get some rain and mountain snowfall

- Temperatures

will be near to above normal

- California

is not likely to get much precipitation for a while, although the Sierra Nevada range may get some snow and rain briefly Tuesday and again this weekend

- U.S.

northwestern Plains and southwestern Canada’s Prairies are unlikely to get much rain or snow through the next two weeks - Argentina

is not advertised to receive much rain over the next nine days - Temperatures

will be near to below average at times which may help conserve soil moisture through slower evaporation - Net

drying is still expected - Subsoil

moisture remains favorably rated for now, but there will be a growing need for moisture later this month to support late season soybean, corn and peanuts production potential - Argentina

weekend precipitation was minimal, although up to 0.50 inch occurred in northeastern La Pampa - Highest

temperatures were in the 70s and lower 80s Fahrenheit followed by lowest readings s in the 40s and 50s

- Brazil

weekend rainfall was greatest from Santa Catarina to southern Minas Gerais and northwest into Mato Gross and Mato Grosso do Sul.

- Rain

totals varied from 1.00 to 3.00 inches across much of the region with a few totals of 3.00 to 4.35 inches.

- The

rain was greater than expected and more disruptive to farming activity - Southern

and far northeastern Brazil failed to get enough rain to counter evaporation.

- Temperatures

were seasonable - Brazil

weather over the next ten days to two weeks will be favorably mixed resulting in good ongoing crop development - Brazil

Safrinha crops should move into the dry season with abundant soil moisture,

although the dry season is still several weeks away - Late

full season crops and Safrinha crops are expected to perform well over the next two weeks - Temperatures

will be seasonable - Australia

weather will be good for its summer sorghum, cotton and other crops during the next two weeks - Showers

will occur infrequently and lightly - Temperatures

will trend warmer than usual overtime and that might result in faster drying rates in parts of the south - No

area will become too dry and no threats to production over those of earlier this growing season are expected - South

Africa weekend precipitation was mostly confined to the western part of the nation outside of summer crop areas - Net

drying occurred in sorghum, cotton, soybean, peanut and sunseed production areas supporting crop maturation and harvest progress - Temperatures

were seasonably warm - South

Africa will experience periodic showers and thunderstorms through the next two weeks with all crop areas impacted at one time or another - The

more infrequent rainfall advertised will be ideal for advancing summer crops into maturation and early harvesting. Showers will be good for the late maturing crops - Rain

developed in Western Europe during the weekend as expected impacting areas from the Iberian Peninsula to the United Kingdom leaving the remainder of Europe dry - Rain

totals were mostly less than 1.00 inch except in southern France and northeastern and far southwestern Spain where more than 2.00 inches resulted - Other

areas in Europe were dry - Temperatures

were mild to cool in the east and a little warmer in the west, but not warmer than usual - Europe

weather over the next ten days will be wettest in the south from southern France, Italy and a part of the Balkan countries into Spain and Portugal - Significant

relief from dryness is expected in Spain, Portugal and parts of both France and Spain - Temperatures

will be near normal except in southeastern Europe where they will be cooler than usual - Central

and northeastern Europe will need a boost in precipitation late this month and in April as seasonal warming arrives to ensure a good start to winter crop development - The

lack of precipitation until then should be irrelevant while crops are dormant or semi-dormant and buried in snow

- There

is not much snow on the ground in eastern Europe, but temperatures are not threatening - Russia,

Ukraine and immediate neighboring areas will be kept quite cool over the next ten days.

- Snow

cover should protect dormant winter crops from the coldest conditions - There

will soon be need for warming and snow melt, but as long as it stays bitterly cold the snow cover is imperative in keeping winter crops adequately protected from the cold - Warming

and some rain and snow increases are likely after March 23 - CIS

weekend precipitation was limited while temperatures were mild to cool - Highest

temperatures were in the 30s and 40s Fahrenheit in northwestern Russia, the Baltic States, Belarus and western Ukraine while in the teens and 20s in most other areas - Lowest

morning temperatures were below zero Fahrenheit from the snow-covered areas of northeastern Ukraine into the eastern Russia New Lands and Kazakhstan - Some

extremes slipped into the -30s and -20s Fahrenheit - No

crop damage resulted because of the cold and none was expected for a while either - North

Africa reported mostly light rain during the weekend - Moisture

totals of 0.05 to 0.20 inch occurred from northern Morocco through northern Algeria to northern Tunisia - A

few amounts in the east varied from 0.20 to 1.10 inches - Most

of Morocco away from the far northern coast was left dry - Temperatures

were near to above normal - Morocco

may be the wettest part of North Africa during the coming week to ten days.

- The

precipitation will bolster soil moisture for improved soil moisture and water supply - Southwestern

Morocco is in a multi-year drought and no amount of rain will restore production for this year because the planting season is over - Other

areas in northern Africa will get a mix of light rain and sunshine along with seasonable temperatures during the next tens - Turkey

through Turkmenistan, Uzbekistan, southern Kazakhstan, Tajikistan and areas northeast into the northwestern mountains of Xinjiang, China will experience frequent bouts of rain and snow in the next week

- Moisture

improvements will be great for winter wheat and especially good for future cotton planting - Xinjiang,

China snowfall in the mountains will be helpful in raising the snowpack for improved runoff into corn and cotton areas in the nation later this spring and summer - China

will experience cooler temperatures in the northeast this week while precipitation ramps up with waves of snow and rain expected - East-central

and interior southeastern parts of the nation will get frequent rainfall over the next couple of weeks maintaining wet field conditions in corn, rapeseed, rice and minor cotton areas of the Yangtze River Basin

- Some

early season planting delays are expected in the wettest areas - India

is not likely to see much precipitation of significance for a while - Temperatures

will be warmer than usual which may accelerate crops through the filling state of development a little faster than usual - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be frequent and abundant - Mainland

areas of Southeast Asia will also experience a near-daily occurrence of rain beginning March 16 - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic rain this week and again later next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this week and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +9.17 - The

index will move higher during the coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; eastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

March 15:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Malaysia’s

March 1-15 palm oil export data

Wednesday,

March 16:

- EIA

weekly U.S. ethanol inventories, production, 11am

Thursday,

March 17:

- International

Grains Council’s monthly market report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Bangladesh

Friday,

March 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

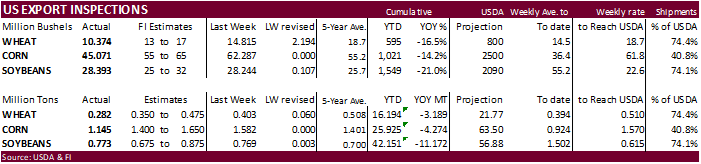

USDA

inspections versus Reuters trade range

Wheat

282,344 versus 300000-550000 range

Corn

1,144,850 versus 1000000-1650000 range

Soybeans

772,719 versus 600000-875000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 10, 2022

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/10/2022 03/03/2022 03/11/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 31,023

CORN

1,144,850 1,582,167 2,274,441 25,925,281 30,199,718

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 400 3,617

RYE

0 0 0 0 0

SORGHUM

258,842 204,845 356,147 3,484,767 4,133,346

SOYBEANS

772,719 768,674 548,951 42,150,838 53,323,035

SUNFLOWER

0 0 0 432 0

WHEAT

282,344 403,187 715,052 16,194,257 19,383,021

Total

2,458,755 2,958,873 3,894,591 87,766,309 107,074,269

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

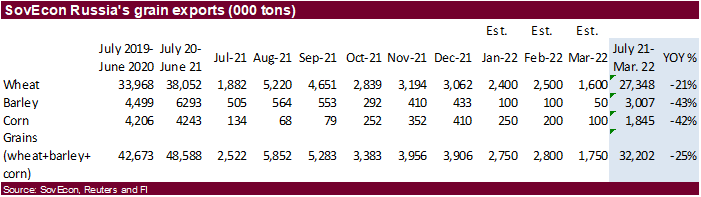

Russian

Stock Market Trading Halt Extended to March 18

83

Counterparties Take $1.608 Tln At Fed Reverse Repo Op (prev $1.558 Tln, 83 Bids)

Brent

Crude Futures Settle At $106.90/Bbl, Down $5.77 Or 5.12%

·

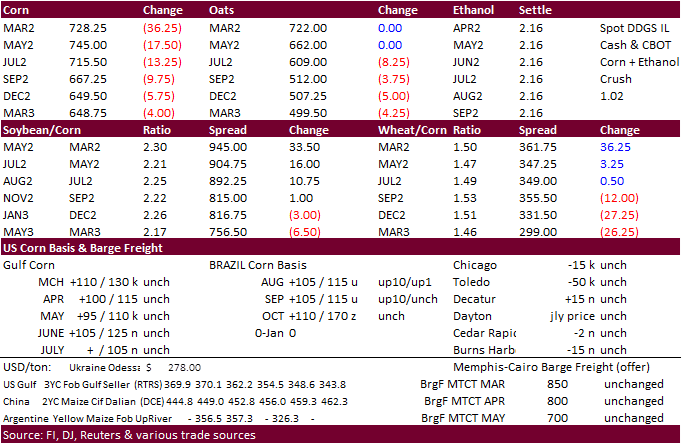

CBOT corn traded two-sided on sharply lower WTI crude oil and speculation there might be a breakthrough with Ukraine/Russia peace talks. $7.2975 is seen for initial support for May corn. Resistance $782.75, then $8.00-$8.10

area. WTI

crude fell below $100 a barrel for the first time since March 1. Slow US shipments weighted on the front month contracts, but some traders are anticipating an increase in US grain shipments to non-traditional markets due to unavailability of spot Black Sea

supplies.

·

The US Grains Council noted there were ships loading 35,000 tons of US corn destined for Spain and 35,000 tons of US corn destined for Italy.

Per export sales report, Italy had 35,000 tons outstanding on the books and Spain didn’t have any commitments. Spain is considered a renewed market. The EU has not imported much corn from the US since 2017-18 due to GMO rules.

·

Spain granted emergency Brazil and Argentina corn buying approval.

·

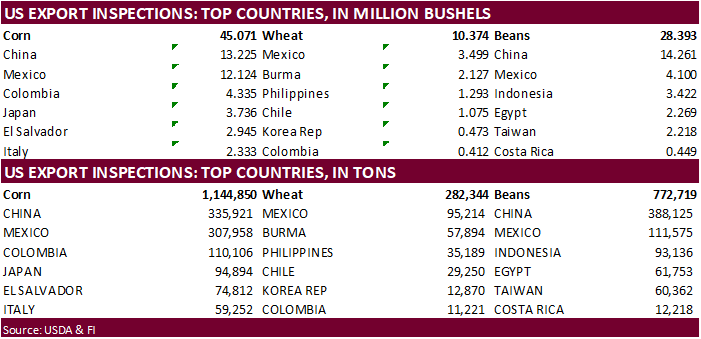

USDA US corn export inspections as of March 10, 2022 were 1,144,850 tons, within a range of trade expectations, below 1,582,167 tons previous week and compares to 2,274,441 tons year ago. Major countries included China for 335,921

tons, Mexico for 307,958 tons, and Colombia for 110,106 tons.

·

Brazil’s weather pattern will be mixed over the next two weeks and with abundant rain occurring over the past few weeks, the second corn crop should be fine when entering the dry season that starts around now.

·

Brazil had planted 94 percent of its second corn crop as of Monday, according to AgRural, up 20 points from this time last year.

·

Egypt on Saturday banned corn and wheat exports along with commodities for three months to combat rising food prices. They have enough wheat to last through the end of the year after buying domestic supplies.

·

Ukraine banned exports of fertilizers amid Russian/Ukraine situation. This adds to a growing list that already includes wheat, corn and sunflower oil.

·

Ukraine has made several announcements they intend to ensure domestic food security. Spring plantings normally begin in late February and early March. Mid-March is a new target the AgMin projected. We are unsure what “safe”

areas will look like for sowings, but it appears the far east and far west will see fieldwork progress. Ukraine’s agriculture producers’ union earned producers will likely reduce corn and oilseed area and plant more cereals such as buckwheat, oats and millet.

·

Ukraine stockpiles of corn sit at 15 million tons and 6 million for wheat.

·

Look out for E15 US blending talk as the spread between RBOB and ethanol widened out to over 70 cents last week.

·

Canada granted imports of Brazil beef and pork.

·

USDA reported highly lethal bird flu at a commercial flock of egg-laying chickens in Jefferson County, Wisconsin.

Export

developments.

- USDA:

Private

exporters reported sales of 159,000 metric tons of corn for delivery to Mexico during the 2021/2022 marketing year. - Egypt’s

GASC seeks a minimum 1000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment.

Updated

3/14/22

May

corn is seen in a $6.75 and $8.40 range (up 25, down 10 cents back end)

December

corn is seen in a wide $5.50-$7.50 range

·

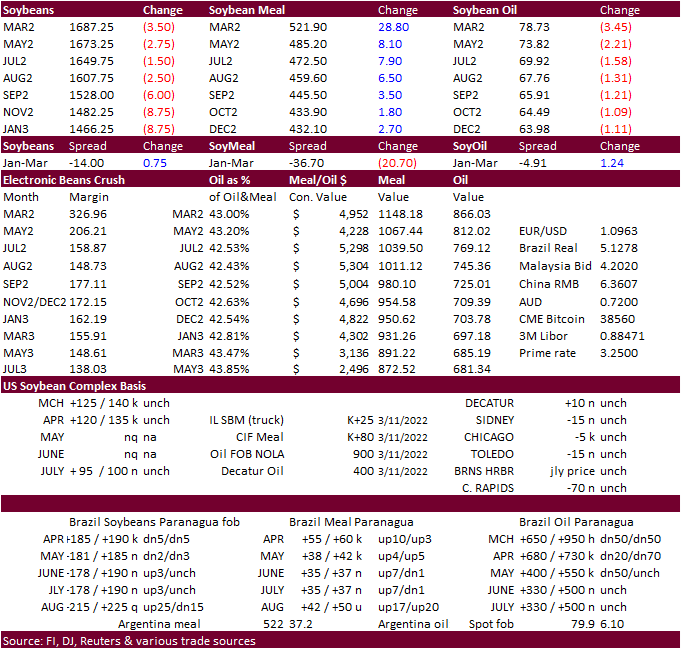

The soybean complex was mixed, with soybeans lower, meal higher, and soybean oil sharply lower. Soybean meal hit a 7-year high on expectations SA product demand will shift to the US. A sharply lower trade in WTI crude oil and

dive in palm oil futures pressured soybean oil. China is releasing vegetable oils out of reserves. Soybeans are mixed/lower from weakness in outside related commodity markets and lower trade on corn & wheat.

·

Argentina suspended new registrations for soybean meal and soybean oil for export. Speculation is that soybean meal and oil taxes will increase from current 31 percent to 33 percent. One of the local grains exchange said a rise

in export taxes would force up costs and producers threatening (farmer) protests in response. Argentina harvests their soybeans during the April and May period. New-crop producer sales amount to 2.17 million tons through March 2. Reuters: The country (Argentina)

is forecast to account for 41% of global soymeal exports and 48% of world soy oil exports in the 2021-22 crop year, according to the U.S. Department of Agriculture.

·

Argentina will see net drying over the next ten days. Brazil will see a mixed pattern over the next two weeks.

·

Brazil 2022 soybean exports were seen by Safras at 78 million tons, down from 86.1 million in 2021. Brazil’s crush was seen at 47.5 million tons versus 46.5 million in 2021. Stocks were pegged at 2.77 million tons at the end of

2022, down 52% from end of 2021.

·

USDA US soybean export inspections as of March 10, 2022 were 772,719 tons, within a range of trade expectations, above 768,674 tons previous week and compares to 548,951 tons year ago. Major countries included China for 388,125

tons, Mexico for 111,575 tons, and Indonesia for 93,136 tons.

·

Today China planned to sell 295,596 tons of soybeans from reserves.

·

Egypt on Saturday banned vegetable oil exports along with other food staples including corn, wheat, flour, past, lentils and fava beans, for three months to combat rising food prices.

·

Palm oil futures traded sharply lower on Monday after China plans to release cooking oils out of stockpiles and demand destruction.

·

China’s Sinograin plans to auction 4,066 tons of rapeseed oil produced in 2020 Thursday afternoon. They sold 10,778 tons of rapeseed oil, accounting for 10% of the volume it planned to sell, last Friday.

·

India February palm oil imports fell to a 12-month low at 454,794 tons, down from 553,084 tons month earlier and compares to 391,158 tons for February 2021. India soybean oil imports during February were 376,594 tons, down from

391,158 tons in January. Port stocks as of end-February dipped to their lowest since May 2021.

·

(Bloomberg) — Turkish ships carrying sunflower oil have been permitted to exit the Azov Sea, Turkey’s Transportation Minister Adil Karaismailoglu said, after transit in the waterway linked to the Black Sea was suspended following

Russia’s attack on Ukraine.

·

Russia will raise its export tax for sunflower oil to $313/ton for April, up from $260.10/ton in March.

·

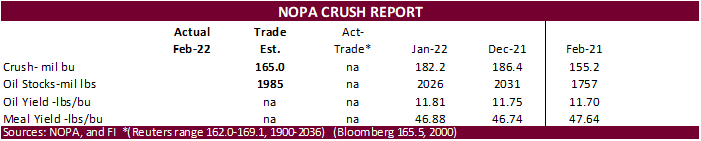

A Reuters NOPA survey calls for the February US crush to end up near 165.0 million bushels (162.0-169.1 million range), down from 182.2 million last month, but up 6.4% percent a year earlier of 155.2 million. The record for the

month of February was 166.3 back in 2020. If the 165.0-million-bushel trade estimate for February 2022 is realized, that would put the daily crush 0.3% above January. End of February soybean oil stocks were estimated at 1.985 billion pounds, down from 2.026

billion at the end of January and well up from 1.757 billion year earlier. Trade range was from 1.900 to 2.036 billion pounds. End of January stocks slightly dipped from end of December.

- Last

week the Foreign Ag Service reported the purchase on 13,620 tons of soybean meal under the Food For Progress export program. Price paid was reported at $616.96 per ton. Delivery was set for Apr 1-10. - Results

awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

Updated

3/14/22

Soybeans

– May $16.00-$18.00 (up 25, down 25)

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520 (up $5, unch)

Soybean

oil – May 72.00-79.00

(unch, down 100)

·

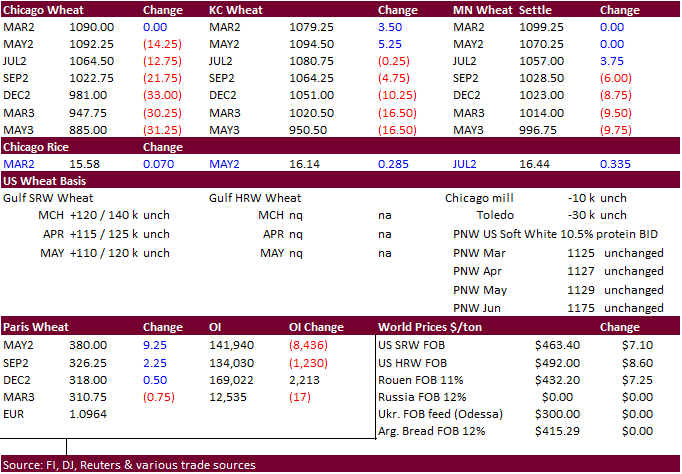

Volatile session for US wheat futures. Chicago ended lower while KC and MN settled mixed.

·

Forecast for rainfall across the US HRW wheat country were weighing on prices earlier in the day. During the day session Russia announced they are mulling over a grain export ban (all countries) until June 30. The potential ban

includes wheat, corn, barley and rye. Later in the morning Deputy Prime Minister Viktoria Abramchenko on social media said Russian grain exports will still be possible.

·

Around 9:20 am CT, US wheat futures rocketed higher. Initially 1300 lots of May Chicago wheat traded, and within five minutes wheat rallied 30 cents. Apparently, the trade thought the buying was overdone.

·

Russia has a history banning or limiting grain exports late in the crop year to ensure there is enough domestic supplies and/or keep prices in check, before new-crop comes online.

·

Remember on March 10, Russia already announced a ban on wheat, corn, rye, barley and meslin exports to Eurasian Economic Union until Aug 31.

·

Some traders look for business to shift the US for high protein wheat.

10-Min

May Chicago wheat chart

·

May Paris wheat futures closed 9.25 higher or 2.4% at 380.00 euros ($417.09) a ton.

·

USDA US all-wheat export inspections as of March 10, 2022 were 282,344 tons, below a range of trade expectations, below 403,187 tons previous week and compares to 715,052 tons year ago. Major countries included Mexico for 95,214

tons, Burma for 57,894 tons, and Philippines for 35,189 tons.

·

U.S. hard red winter wheat areas will see rain Thursday in the central Plains with additional precipitation in the southern Plains during mid-week next week. Totals will vary from trace amounts to 0.6” in the first event this

week with another 0.20 to 0.75 inch elsewhere next week. The southwestern Plains may miss out on the event.

·

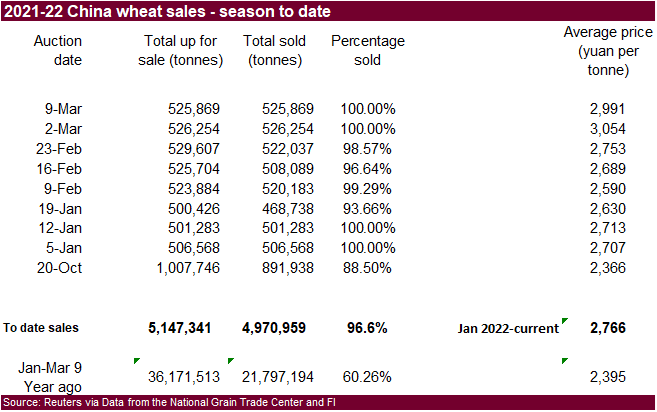

China sold 525,869 tons of wheat out of auction on March 9 at an average price of 2,991 yuan per ton ($471.16/ton).

·

Egypt will soon unload 189,000 tons of Black Sea wheat that was previously contracted, from Russia, Romania and Ukraine, according to a Rueters article. We are unsure if the wheat was already loaded onto vessels awaiting to leave

the ports or if the wheat was recently loaded. On March 8 Egypt received a shipment of 63,000 tons of French wheat. They also received a similar amount of Romanian wheat on March 5.

·

Egypt looks to produce more than 6 million tons of wheat this season that starts April. They produce on average a total 8.5 million tons a year.

·

Algeria banned exporting sugar, vegetable oils, pasta, semolina and wheat derivatives.

·

Iraq’s strategic wheat reserves are sufficient until next month, which is when the local procurement season starts. They opened a new import tender for hard wheat and are currently reviewing American and German offers for an

import tender that was set to close last week.

Ukraine-Russia

Conflict – Agricultural Ramifications

K-State

College of Agriculture had an excellent online conference last week over the Ukraine-Russia situation. Presentations are available here…

https://agmanager.info/2022-risk-and-profit-online-mini-conference-presentations

·

Turkey’s TMO seeks 270,000 tons of milling wheat on March 17 for March 25 – April 22 shipment.

·

Algeria seeks 50,000 tons of barley on Thursday, March 17, for April 1-15 and April 16-30 shipment.

·

Iraq’s trade ministry seeks 50,000 tons of optional origin hard wheat on March 17, open until the 22nd.

·

Results awaited: Jordan’s state grains buyer seeks 120,000 tons of feed barley on March 15. Shipment is between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

·

Japan’s AgMin in a SBS import tender on March 16 seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by Aug. 25.

·

Jordan seeks 120,000 tons of wheat on March 16. Possible shipment combinations are for May 16-31, June 16-30, July 1-15 and July 16-31.

Rice/Other

·

None reported

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.