PDF Attached

Day

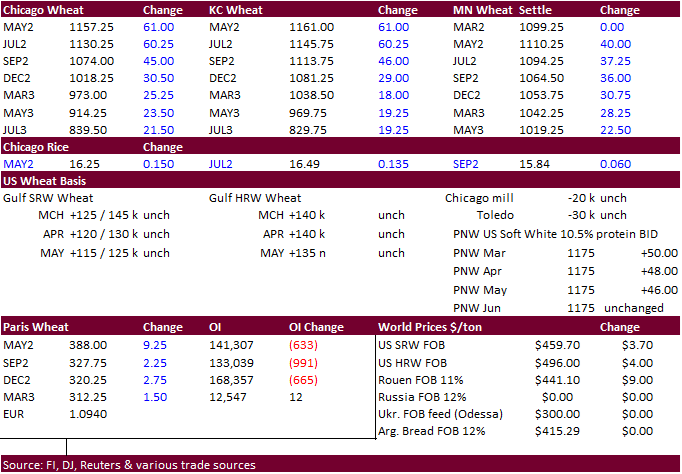

20. Surging coronavirus cases in China and expectation for a US interest rate hike sent WTI April crude oil below $94/barrel earlier today. The soybean complex ended lower (well off session lows), corn mixed (bull spreading), and wheat sharply higher. Wheat

saw strength in part from deteriorating US winter wheat crop conditions, strong global wheat demand and Black Sea supply concerns.

WEATHER

EVENTS AND FEATURES TO WATCH

- Europe

Drying is of little concern for now - Wetter

weather is expected later in the spring and summer this year - Drought

is not expected to be an issue - Cool

temperatures will keep soil moisture conserved while drier conditions prevail - Spain,

southern France, Portugal and some areas east into Italy and the southern Balkan Countries have reported rain recently and more is expected - These

areas will either experience status quo soil moisture of a net improving trend - Northwestern

Africa rainfall is expected to increase again as time moves along in the next ten days - The

moisture will be ideal in spurring on spring crop development - Parts

of the region were too dry during the winter and some were too dry last autumn as well - Southwestern

Morocco is in a multi-year drought and since most of its winter crop is irrigated and water supply has dwindle much of the planting was not completed - Rain

in southwestern Morocco this spring would be of use to the region as drinking water and will not change winter crop production potentials for 2022 - Russia’s

weather remains cold, but snow cover has protected crops and it will continue to do so as the cool conditions prevail for another week - Winter

crops are dormant and very little winterkill has likely occurred this year - Rain

from the Middle East into Uzbekistan, southern Kazakhstan and the mountains of western Xinjiang, China during the next week will improve topsoil moisture and some mountain snowpack for use during the growing season - East-central

and southeastern China will receive frequent rain over the next ten days resulting in saturated soil and a rising potential for flooding.

- Recent

warm weather has brought winter crops out of dormancy in the Yangtze River Basin and some of the rapeseed and wheat would benefit from less rain for a while - Recent

rain in China’s North China Plain has been good for early spring season crop development once additional warming takes place - Eastern

Australia soil moisture is decreasing, but irrigated crops are developing well - Dryness

in some sorghum and cotton fields will promote crop maturation and could lead to faster than usual harvest progress - Late

season crop yields from unirrigated fields may be lower than expected, especially in parts of Queensland

- Good

moisture early in the season has still provided a very good production year for most crops

- Argentina

weather will be good for most crops during the next ten days, although some additional net drying is expected in the southwest part of the nation

- Rain

will fall Thursday into Friday of this week and again during mid-week next week - In

both cases the precipitation may disfavor far southern and especially southwestern parts of the nation - Very

little threat to production is expected despite dry weather due to favorable sub soil moisture - Brazil

weather will be well mixed over the next ten days with sufficient rain in all major crop areas supporting normally development - There

may be some growing interest in late season sugarcane, citrus and coffee production in Minas Gerais and eastern Bahia to net drying, but the impact will be very low - U.S.

hard red winter wheat areas will get rain and some snow Thursday into Friday of this week and again early next week - In

both cases precipitation will be limited in the southwestern Plains - Favorable

topsoil moisture for greening is expected this spring in eastern Colorado, western, northern and eastern Kansas and Nebraska as well as central Oklahoma, but greater rain is needed to bolster soil moisture in such a manner as to ensure no crop stress during

short term bouts of dry and warm weather - Such

a boost in precipitation is not very likely - West

and South Texas precipitation should be minimal for the next ten days - Texas

Coastal Bend crop areas are also unlikely to experience much precipitation of significance - U.S.

Delta and southeastern states will continue to experience periodic rainfall during the next ten days to two weeks - Soil

moisture will be great enough to ease recent dryness in the southeastern states - There

will be breaks in the rain at which time spring planting is expected - Temperatures

will be near to above normal - U.S.

Interior Northwestern states are unlikely to experience much rain, but the mountains on either side of the Yakima and Colombia River Valleys will get some rain and mountain snowfall

- Temperatures

will be near to above normal

- California

is not likely to get much precipitation for a while, although the Sierra Nevada range may get some snow and rain briefly today and again this weekend

- U.S.

northwestern Plains and southwestern Canada’s Prairies are unlikely to get much rain or snow through the next two weeks - South

Africa weekend precipitation will be favorably distributed and intermixed with periods of sunshine during the next ten days

- The

environment should prove to be favorable for most of the summer crops and early maturing crops will experience favorable conditions for harvesting - India

is not likely to see much precipitation of significance for a while - Temperatures

will be warmer than usual which may accelerate crops through the filling state of development a little faster than usual - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be frequent and abundant - Mainland

areas of Southeast Asia will also experience a near-daily occurrence of rain beginning March 16 - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic rain this week and again later next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this week and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +9.75 - The

index will move higher during the balance of this week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; eastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- New

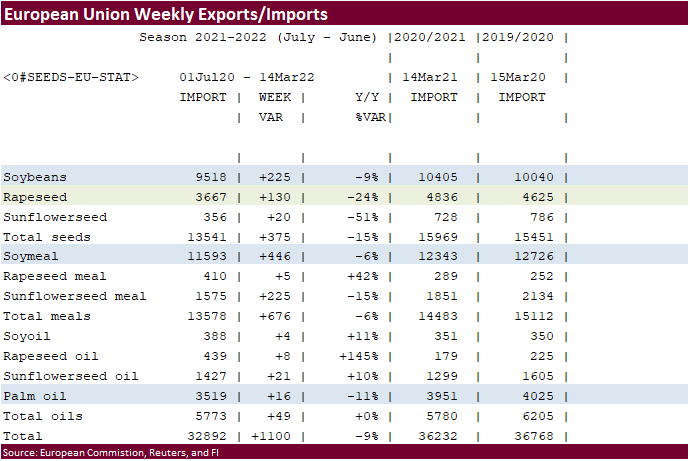

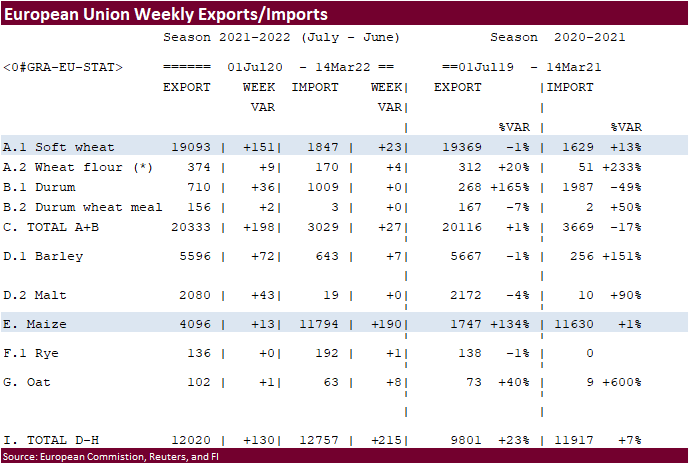

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Malaysia’s

March 1-15 palm oil export data

Wednesday,

March 16:

- EIA

weekly U.S. ethanol inventories, production, 11am

Thursday,

March 17:

- International

Grains Council’s monthly market report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Bangladesh

Friday,

March 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

2021/22

Brazil Soybean Estimate Lowered 1.0 mt to 123.0 Million (Conab 122.7 Million)

2021/22

Argentina Soybean Estimate Unchanged at 39.0 Million Tons

2021/22

Paraguay Soybean Estimate Unchanged at 5.0 Million Tons

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

US

Crude Oil Futures Settle At $96.44/Bbl, Down $6.57 Or 6.38%

Brent

Crude Futures Settle At $99.91/Bbl, Down $6.99 Or 6.54%

US

PPI Final Demand (M/M) Feb: 0.8% (est 0.9%; prev 1.0%; prevR 1.2%)

US

PPI Final Demand (Y/Y) Feb: 10.0% (est 10.0%; prev 9.7%; prevR 10.0%)

US

PPI Ex Food And Energy (M/M) Feb: 0.2% (est 0.6%; prev 0.8%; prevR 1.0%)

US

Empire Manufacturing Mar: -11.8 (est 6.1; prev 3.1)

Canadian

Manufacturing Sales (M/M) Jan: 0.6% (est 1.2%; prev 0.7%)

Canadian

Housing Starts Feb: 247.3K (est 240.0K; prev 230.8K)

·

CBOT corn traded

lower following weakness in WTI crude oil and demand destruction over rising US bird flu cases resulting in a smaller animal unit population. The May and July contracts rebounded to close higher following strength in wheat.

·

2.75 million chickens will be culled after USDA reported highly lethal bird flu at a commercial flock of egg-laying chickens in Jefferson County, Wisconsin.

·

Canadian Pacific Railway workers threatened to strike as early as today, over wages, benefits, and pensions. This could threaten fertilizer and grain movement for the US, Canada, and overseas buyers.

·

US corn planting were 11% complete in Louisiana and 1% complete in Mississippi.

·

We heard Argentina rumors of tax increases on corn and wheat will probably persist.

·

China plans to buy a third round of pork for reserves.

·

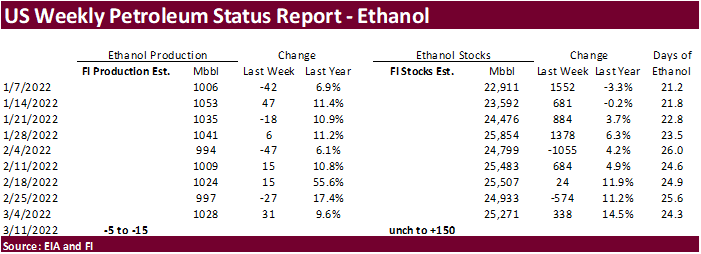

A Bloomberg poll looks for weekly US ethanol production to be down 5,000 barrels to 1.023 million (1.015-1.035 range) from the previous week and stocks up 21,000 barrels to 25.292 million.

Export

developments.

- South

Korea’s FLC bought 65,000 tons of optional origin corn at an estimated $412.90 a ton c&f for arrival in South Korea around June 15. - South

Korea’s MFG bought about 201,000 tons of corn in three consignments of between 55,000 tons and 70,000 tons. Arrival in South Korea was for around June 23 ($412.50 c&f), July 3 ($412.50), and around July 14 ($413.90). - Egypt’s

GASC seeks a minimum 1,000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment.

Updated

3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

·

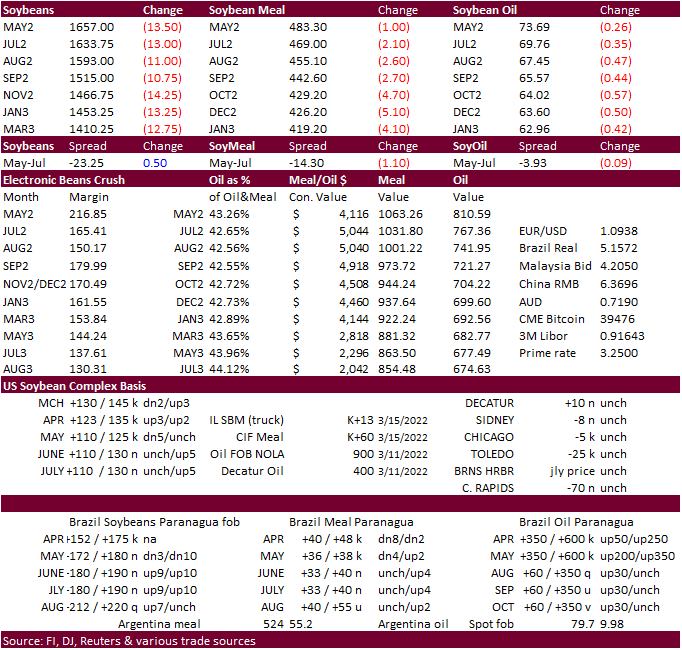

The soybean complex ended lower but well-off session lows on China Covid-19 lockdown concerns and sharply lower WTI crude oil. Palm oil futures were down for the 4th consecutive day. NOPA reported the crush within expectations

and soybean oil stocks were reported above an average trade guess. We look for the US 2021-22 soybean oil yield to end up at a record (see below and attached US soybean complex S&D’s). Soybean oil futures recovered during the second half of the trade in part

to a partial recovery in WTI crude oil.

·

May soybeans traded below its 20-MA but recovered to close above that level.

·

Traders are waiting for Argentina soybean meal and soybean oil tax increase developments.

·

Indonesia looks to end their caps on packaged cooking oil prices and replace it with subsidies.

·

Cargo surveyor SGS reported month to date March 15 Malaysian palm exports at 574,893 tons, 67,220 tons above the same period a month ago or up 13.2%, and 25,620 tons above the same period a year ago or up 4.7%. ITS reported Malaysian

palm oil products for March 1 – 15 period up 15.6% to 585,277 tons from 506,183 tons shipped during February 1 – 15. AmSpec reported a 14.2% increase to 567,637 tons from 496,983 tons previous month.

·

India oilmeal exports during February were 187,320 tons, up 5.9% from 176,967 tons month earlier, and included 33,760 tons of soybean meal versus 52,771 tons during January.

·

Anec sees March Brazil soybean exports reaching 12.9 million tons, down from 13.769 million previous.

NOPA

reported

the US February crush at 165.1 million bushels, in line with trade expectations, down from 182.2 million last month, but up from a year earlier of 155.2 million bushels. The daily crush 0.3% above January. It was the second-largest NOPA February crush on record,

behind 2020. Soybean oil stocks were 2.059 billion pounds, 74 million pounds above trade expectations and largest end-of-month stocks since April 2020. They were down from 2.026 billion at the end of January and well up from 1.757 billion year earlier. End

of January stocks slightly dipped from end of December. One reason stocks were so high was that the soybean oil yield increased to 11.93 pounds per bushel for February from 11.81 for January. This was a record for the month of February in our recorded history.

It ties the second largest yield for any month of 11.93 back in July 2013 and behind the all-time record of 11.94 back in March 2013. The soybean meal yield improved from the previous month to 46.99 versus 46.88 for January but below 47.64 million year earlier.

SBO

yield projected at record.

11.82

was the record US soybean oil crop-year yield, established 2012-13. We see some similarities for this crop year for the October-February period and look for 2021-22 soybean oil yield to end up at a record 11.86 pounds per bushel.

- Results

awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

US wheat futures traded two-sided before surging on renewed hopes US wheat export interest will soon increase. Also supporting wheat were US winter wheat condition concerns, recent increase in global import demand, lower USD,

and Black Sea shipping problems.

·

Russian President Vladimir Putin said Tuesday that Ukraine wasn’t “serious” about finding a peaceful resolution to the ongoing conflict. (Bloomberg)

·

USDA reported 23% of the Kansas winter wheat crop in good to excellent condition, down from 24% a week earlier. Texas winter wheat ratings for the G/E were only 6%, down from 7% the previous week. The USDA rated 75% of the Texas

crop as poor to very poor, unchanged from the previous week. Oklahoma’s rating increased to 24% of, up from 15% a week earlier. Colorado was rated 18%, down from 21% from previous.

·

May Paris wheat futures were up 9.25 euros at 386.50 euros, a 2.4% increase.

·

Ukraine is working up plan to finance a loan program for producers that will provide around 845 million dollars and new tax breaks.

·

France is loading a 30,000-ton wheat vessel destined for Egypt.

·

Russia said there is no domestic food shortages.

·

U.S. hard red winter wheat areas will see rain Thursday in the central Plains with additional precipitation in the southern Plains during mid-week next week. Totals will vary from trace amounts to 0.6” in the first event this

week with another 0.20 to 0.75 inch elsewhere next week. The southwestern Plains may miss out on the event.

·

U.S. northwestern Plains and southwestern Canada’s Prairies will stay dry for the next ten days.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

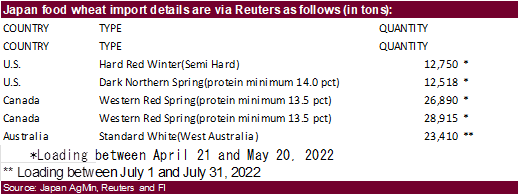

Japan’s AgMin seeks 104,483 tons of food wheat from the United States, Canada and Australia on Thursday.

·

Jordan’s state grains buyer passed on 120,000 tons of feed barley. Shipment was for between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Bangladesh seeks 50,000 tons of milling wheat on March 16 for shipment within 40 days of contract signing.

·

Japan’s AgMin in a SBS import tender on March 16 seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by Aug. 25.

·

Jordan seeks 120,000 tons of wheat on March 16. Possible shipment combinations are for May 16-31, June 16-30, July 1-15 and July 16-31.

·

Turkey’s TMO seeks 270,000 tons of milling wheat on March 17 for March 25 – April 22 shipment.

·

Algeria seeks 50,000 tons of barley on Thursday, March 17, for April 1-15 and April 16-30 shipment.

·

Iraq’s trade ministry seeks 50,000 tons of optional origin hard wheat on March 17, open until the 22nd.

Rice/Other

·

None reported

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.