PDF Attached

Day

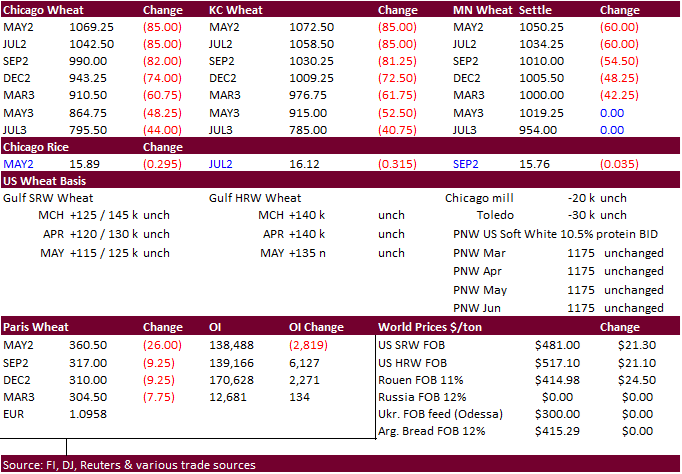

21. Feds increased US interest rates by 25 points. Positive news on the Ukraine/Russia situation sent wheat limit lower. $10.59 we heard for May Chicago synthetic. Covid concerns are increasing as Europe and Asia pressured the soybean complex. WTI crude

traded two-sided. Global wheat export develops are very strong.

Attached

is our updated US corn balance sheet.

-

Imports

were lowered to 23 from 36 million -

Food/Industrial

was raised 4 million to 1.409 billion -

Corn

for ethanol use was increased 50 million to 5.400 billion. Note we look for a strong push for year-round E15 blend.

-

No

changes in feed use or exports from previous forecast. -

STU

now 9.1% (USDA 9.6%)

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat areas are advertised to receive greater rainfall from two storm systems; one Thursday into Friday of this week and the other early next week - Between

the two events all of the wheat production region gets rain and amounts are advertised to range from 0.50 to 1.50 inches with some areas getting 2.00 inches - Colorado,

southwestern Nebraska, northwestern Kansas and areas from eastern Kansas into north-central Oklahoma will be wettest between the two events - The

set up for these two events is favorable for the rain to evolve - Crop

conditions may improve greatly if the two events occur as advertised today - The

moisture will induce generalized greening - The

moisture would also begin crop repair after winter damage from heaving topsoil, leaf damage from bitter cold temperatures and no snow cover and drought - World

Weather, Inc. still sees some potential for the storm early next week to be shifted a little to the northeast possibly reducing rain in the southwestern Plains in future model runs - U.S.

Delta and southeastern states will experience waves of rain during the next ten days favoring spring planting moisture - A

few areas may become a little too wet, especially in the Delta and a part of the Tennessee River Basin - Waves

of rain are still expected in the U.S. Midwest over the next ten days maintaining moisture abundance for some areas and improving soil moisture in some western Corn Belt crop areas - Northern

U.S. Plains will experience limited precipitation through the weekend - Rain

and snow are advertised to be more significant during the March 24-26 period, although confidence is a little low - West

Texas precipitation will be limited until Sunday into Monday when there is potential for 0.10 to 0.60 inch of moisture from showers and thunderstorms - Greater

rainfall may occur in southwestern Oklahoma and in the Texas Rolling Plains.

- Confidence

in this precipitation event is a little low and there is potential that future forecast model runs will reduce the moisture advertised

- California

is still not likely to get much needed moisture for the next ten days - Concern

remains over 2022 water supply - Portions

of Canada’s Prairies will continue to miss significant precipitation events for at least the next ten days - Temperatures

will be a little warmer than usual in the coming week which may help to stimulate a little snow melt - Argentina

weather has not changed much today - Precipitation

is expected in central parts of the nation Thursday into Friday with northeastern areas getting rain early to mid-week next week - The

moisture will be good in maintaining favorable soil moisture in those areas, but net drying will continue in the southwest half of Buenos Aires, La Pampa, San Luis and far southern Cordoba through the next ten days - Subsoil

moisture in these areas should carry crop development relatively well, but the need for rain will steadily rise - All

of Brazil will get rain during the next ten days and sufficient amounts will occur to support Safrinha corn and cotton - Net

drying is expected in central and northern Minas Gerais and southern Bahia resulting in some crop stress for some late season crops; including sugarcane and some minor coffee production areas - Southwestern

Europe, northwestern Africa and a part of the southern Balkan Countries in Europe will receive periodic rainfall over the next two weeks resulting in a good environment for winter crop development and spring planting - Central,

northeastern and east-central Europe will experience net drying conditions for an extended period of time - Crops

are still dormant or semi-dormant and the need for moisture will remain low for a little while longer, but rain will be needed later this month and in April to prevent some areas from getting too dry - A

good distribution of rain is expected from eastern Turkey and some immediate neighboring areas through Turkmenistan, Uzbekistan, southern Kazakhstan and Tajikistan as well as in the mountains of western Xinjiang, China during the coming week - Some

rain and snow has already impacted the area and the precipitation has improved topsoil moisture - Better

wheat development and improved outlooks for the planting of cotton and corn will result from this pattern - East-central

China will get a little too much rain in the coming week to ten days as frequent rain and some thunderstorms evolve - The

Yangtze River Basin will be wettest resulting in some local flooding - Planting

delays for rice and corn might occur if the wet weather lasts too long - Wheat

and rapeseed will need drier and warmer weather soon - Crop

and field conditions in the North China Plain and northeastern provinces of China are suspected of being good for this time of year - Cool

and drier biased weather in western Russia and Ukraine has not had any adverse weather on the region - Snow

cover remains significant and there has been no winterkill of significance this year - Soil

moisture in western Russia beneath the snow is abundant which might lead to some flooding in the spring if precipitation resumes during the snow melt season - India’s

weather remains mostly tranquil with little change likely - Not

much precipitation and near to above normal temperatures are expected for the next ten days - Eastern

Australia soil moisture is decreasing, but irrigated crops are developing well - Dryness

in some sorghum and cotton fields will promote crop maturation and could lead to faster than usual harvest progress - Late

season crop yields from unirrigated fields may be lower than expected, especially in parts of Queensland

- Good

moisture early in the season has still provided a very good production year for most crops

- South

Africa weekend precipitation will be favorably distributed and intermixed with periods of sunshine during the next ten days

- The

environment should prove to be favorable for most of the summer crops and early maturing crops will experience favorable conditions for harvesting - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south next week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers starting today and lasting through the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda this week and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +10.86 - The

index will move higher during the balance of this week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; eastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

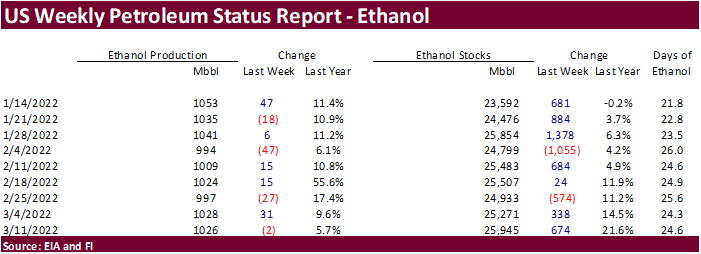

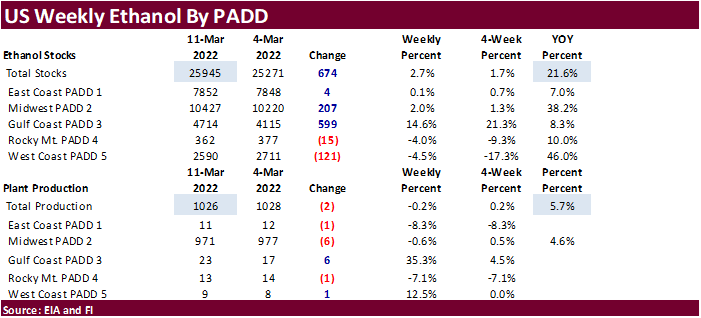

- EIA

weekly U.S. ethanol inventories, production, 11am

Thursday,

March 17:

- International

Grains Council’s monthly market report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Bangladesh

Friday,

March 18:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

US

MBA Mortgage Applications Mar 11: -1.2% (prev 8.5%)

US

MBA 30 Year Mortgage Rate Mar 11: 4.3% (prev 4.1%)

US

Retail Sales Advance (M/M) Feb: 0.3% (est 0.4%; prev 3.8%)

US

Retail Sales Ex Auto Feb: 0.2% (est 0.9%; prev 3.3%)

US

Retail Sales Ex Auto And Gas Feb: -0.4% (est 0.4%; prev 3.8%)

US

Retail Sales Control Group Feb: -1.2% (est 0.3%; prev 4.8%)

US

Import Price Index (M/M) Feb: 1.4% (est 1.6%; prev 2.0%)

US

Import Price Index Ex Petroleum (M/M) Feb: 0.7% (est 0.8%; prev 1.4%)

US

Import Price Index (Y/Y) Feb: 10.9% (est 11.3%; prev 10.8%)

Canadian

CPI (Y/Y) Feb: 5.7% (est 5.5%; prev 5.1%)

Canadian

CPI NSA (M/M) Feb: 1.0% (est 0.9%; prev 0.9%)

Canadian

CPI Core Median (Y/Y) Feb: 3.5% (est 3.5%; prev 3.3%)

Canadian

CPI Core Common (Y/Y) Feb: 2.6% (est 2.4%; prev 2.3%)

Canadian

CPI Core Trim (Y/Y) Feb: 4.2% (est 4.2%; prev 4.0%)

Canadian

Wholesale Trade Sales (M/M) Jan: 4.2% (est 3.9%; prev 0.6%)

US

NAHB Housing Market Index Mar: 79 (est 81; prev 82; prevR 81)

US

Business Inventories Jan: 1.1% (est 1.1%; prev 2.1%)

US

DoE Crude Oil Inventories (W/W) 11-Mar: 4345K (est -1800K; prev -1863K)

–

Distillate Inventories: 332K (est -1759K; prev -5230K)

–

Cushing OK Crude Inventories: 1786K (prev -585K)

–

Gasoline Inventories: -3615K (est -1462K; prev -1405K)

–

Refinery Utilization: 1.10% (est 0.40%; prev 1.60%)

·

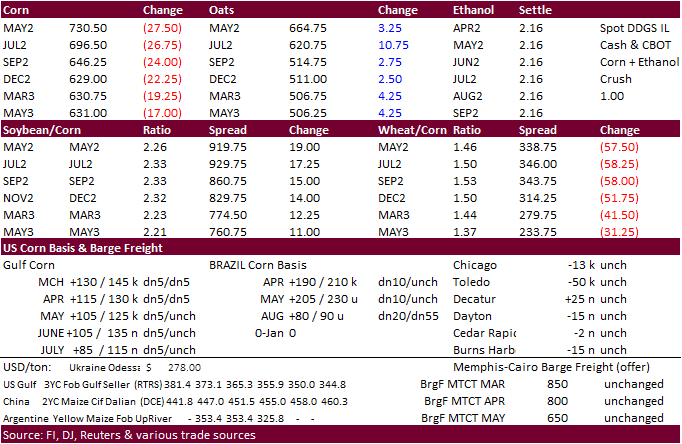

CBOT corn was

lower following weakness in wheat and slowing global import tender developments.

·

Outside of geopolitical headlines and talk of Ukraine/Russia peace talks improving, news for the corn market was light.

·

Allendale: US corn acres 92.421 vs. 92.0 USDA Outlook Forum

·

Trade is waiting for developments over the potential Canadian Pacific Railway worker strike. A strike could threaten fertilizer and grain movement for the US, Canada, and overseas buyers.

·

USDA’s Broiler Report showed eggs set in the US up 1 percent from a year ago and chicks placed up 2 percent. Cumulative placements from the week ending January 8, 2022 through March 12, 2022 for the United States were 1.85 billion.

Cumulative placements were down slightly from the same period a year earlier.

US

DoE Crude Oil Inventories (W/W) 11-Mar: 4345K (est -1800K; prev -1863K)

–

Distillate Inventories: 332K (est -1759K; prev -5230K)

–

Cushing OK Crude Inventories: 1786K (prev -585K)

–

Gasoline Inventories: -3615K (est -1462K; prev -1405K)

–

Refinery Utilization: 1.10% (est 0.40%; prev 1.60%)

Export

developments.

- Iran

opened a new import tender for corn, barley and soybean meal that was set to close March 16.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment. - Egypt’s

GASC seeks a minimum 1,000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

EIA

expects crude oil prices higher than $100 per barrel in coming months

https://www.eia.gov/todayinenergy/detail.php?id=51658&src=email

Updated

Updated

3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

·

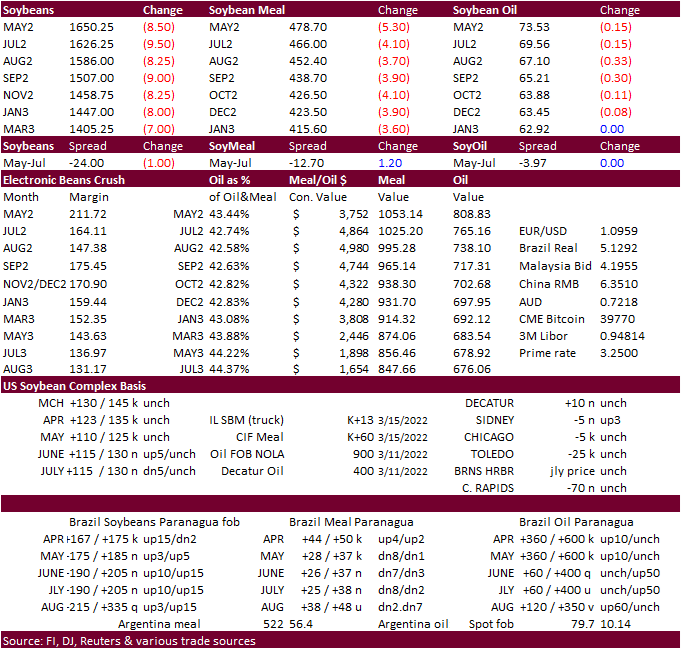

Earlier the soybean complex traded higher led by soybean oil but prices settled lower on weakness in grains and widespread commodity selling. We are hearing a good amount of money flow out of commodities back into equities.

·

Rising Covid-19 cases are thought to be bearish as traders brace for potential China port closures.

Allendale:

US soybean acres 89.281 vs. 88.0 USDA Outlook Forum

·

Several countries are adjusting policies to open up or make it easier to import vegetable oil.

·

Bangladesh lowered their import VAT tax from 15% to 5% for soybean oil and palm oil.

- Iran’s

GTC issued a tender (3/15) to buy about 30,000 tons of soyoil, set to close March 16. They are also seeking offers for sunflower oil and palm olein oil.

- Iran’s

SLAL issued a tender (3/15) to buy about 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal, set to close March 16. - From

last week – Results awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4. - (Bloomberg)

— Ethiopia to Import 150m Liters of Cooking Oil, Waives Import Tax. Ethiopia has procured 12.5 million liters of cooking oil to stabilize the market and plans to import 150 million liters over three months, Minister for Finance Ahmed Shide says on broadcaster

Fana Corp.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

US wheat futures ended limit lower for the front month Chicago and KC markets. $10.57 was last we heard for the Chicago May synthetic. Headlines over improving peace talks between Ukraine and Russia kicked off the selling.

·

Note wheat was up sharply yesterday on talk Ukraine spring plantings could decline nearly 40 percent per APK-Inform. It’s too early to tell how Ukraine spring plantings will end up. The government is taking many measures to support

producers.

·

France’s feed makers’ association SNIA requested that the government curb grain exports in order to ensure security of 800,000 to 1 million tons of cereals are available each month for feed.

·

Allendale: US all-wheat acres 48.892 vs. 48.0 USDA Outlook Forum

·

Global import demand remains very strong.

·

India is taking measures to boost wheat exports. India exported 6.12 million tons of wheat last year from 1.12 million tons year earlier.

·

Traders on Tuesday reported large shipments of wheat from Germany to Iran.

·

May Paris wheat futures were down 26 euros at 363.50 euros.

·

Ukraine is working up plan to finance a loan program for producers that will provide around 845 million dollars and new tax breaks.

·

U.S. hard red winter wheat areas will see rain Thursday and Friday in the central Plains with additional precipitation in the southern Plains during Sunday through Tuesday. The southwestern Plains may miss out on the event. U.S.

northwestern Plains and southwestern Canada’s Prairies will stay dry for the next ten days.

·

Note US weekly crop progress reports start April 4.

·

(Reuters) – Egypt’s cabinet on Wednesday agreed to add 65 Egyptian pounds ($4.15) per ardeb (150 kilograms) to its procurement price of local wheat as an incentive for farmers to sell more of the local crop to the government ahead

of the harvest. The government will now pay 865-885 Egyptian pounds per ardeb depending on purity levels, the cabinet said.

·

Iran’s GTC seeks 60,000 tons of milling wheat for shipment in April and May.

·

Bangladesh’s lowest offer for 50,000 tons of milling wheat was $409.97/ton CIF for shipment within 40 days of contract signing.

·

Japan’s AgMin in a SBS import tender bought only 760 tons of feed barley. The original tender called for 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by Aug. 25.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Jordan passed on 120,000 tons of wheat. Possible shipment combinations were for May 16-31, June 16-30, July 1-15 and July 16-31.

·

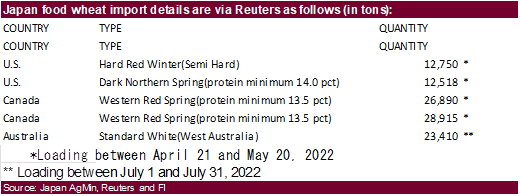

Japan’s AgMin seeks 104,483 tons of food wheat from the United States, Canada and Australia on Thursday.

·

Turkey’s TMO seeks 270,000 tons of milling wheat on March 17 for March 25 – April 22 shipment.

·

Algeria seeks 50,000 tons of barley on Thursday, March 17, for April 1-15 and April 16-30 shipment.

·

Iraq’s trade ministry seeks 50,000 tons of optional origin hard wheat on March 17, open until the 22nd.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

(Bloomberg) – Zambia to Import 100,000 Tons of Wheat to Fill Deficit: Times

Zambia

will start importing wheat in two weeks to fill a shortfall, state-owned Times of Zambia newspaper reports, citing Millers Association of Zambia President Andrew Chintala.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.