PDF Attached does not include daily estimate of funds.

Day

22. Another reversal in many commodity prices following headlines. Negative news over the Ukraine/Russia situation trickled out early this morning. Then EIA noted they look for an eventual US crude oil shortage, sending WTI higher. USD was down more than

70 points when the CBOT ag markets closed. USDA export sales were good for SBO & corn.

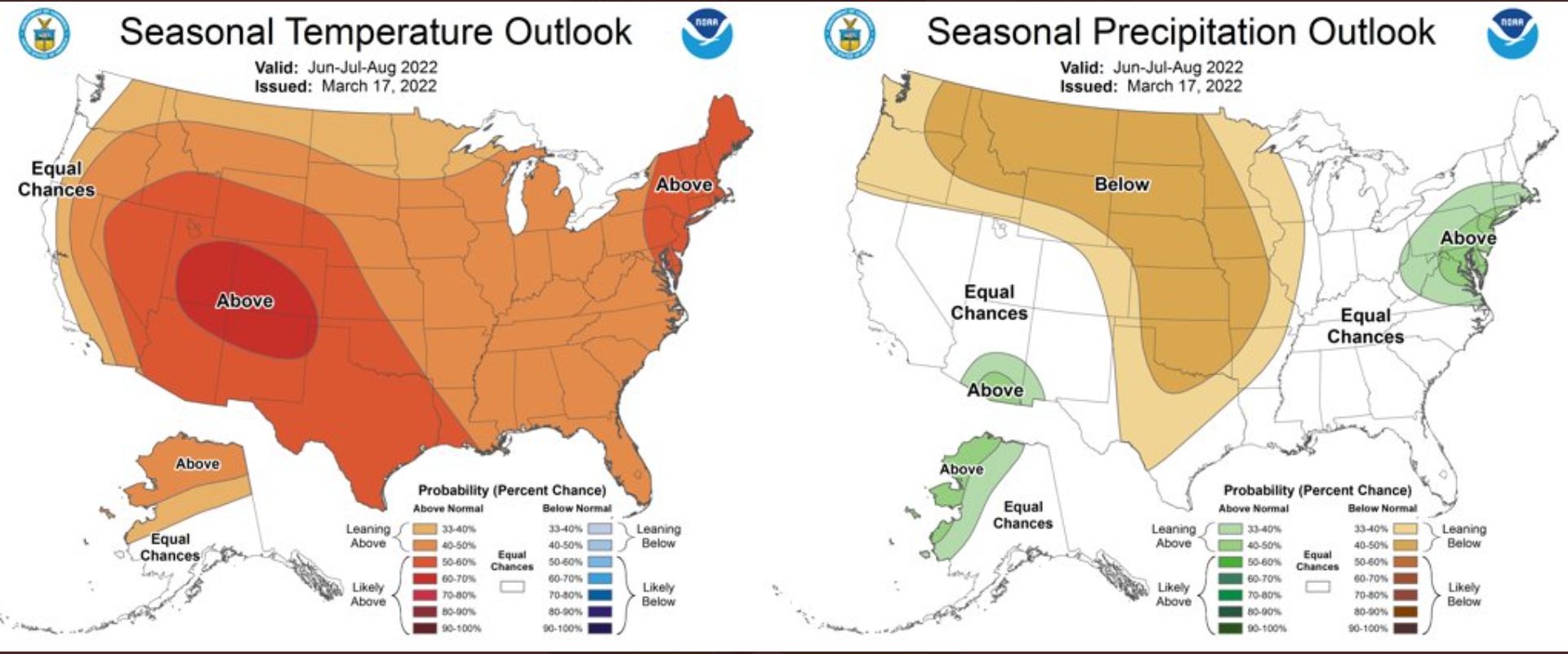

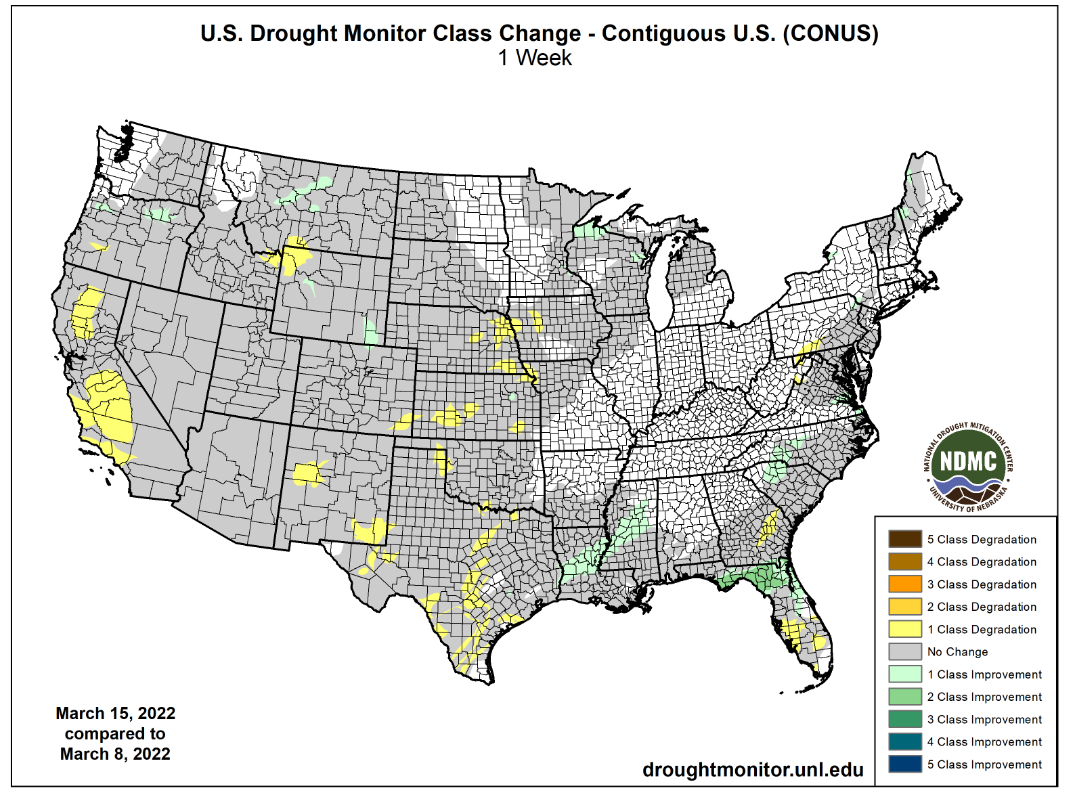

NOAA

looks for major flooding this spring on the Red River near the Canadian border, potentially impacting wheat plantings. They also expect minor flooding this spring along the Mississippi River.

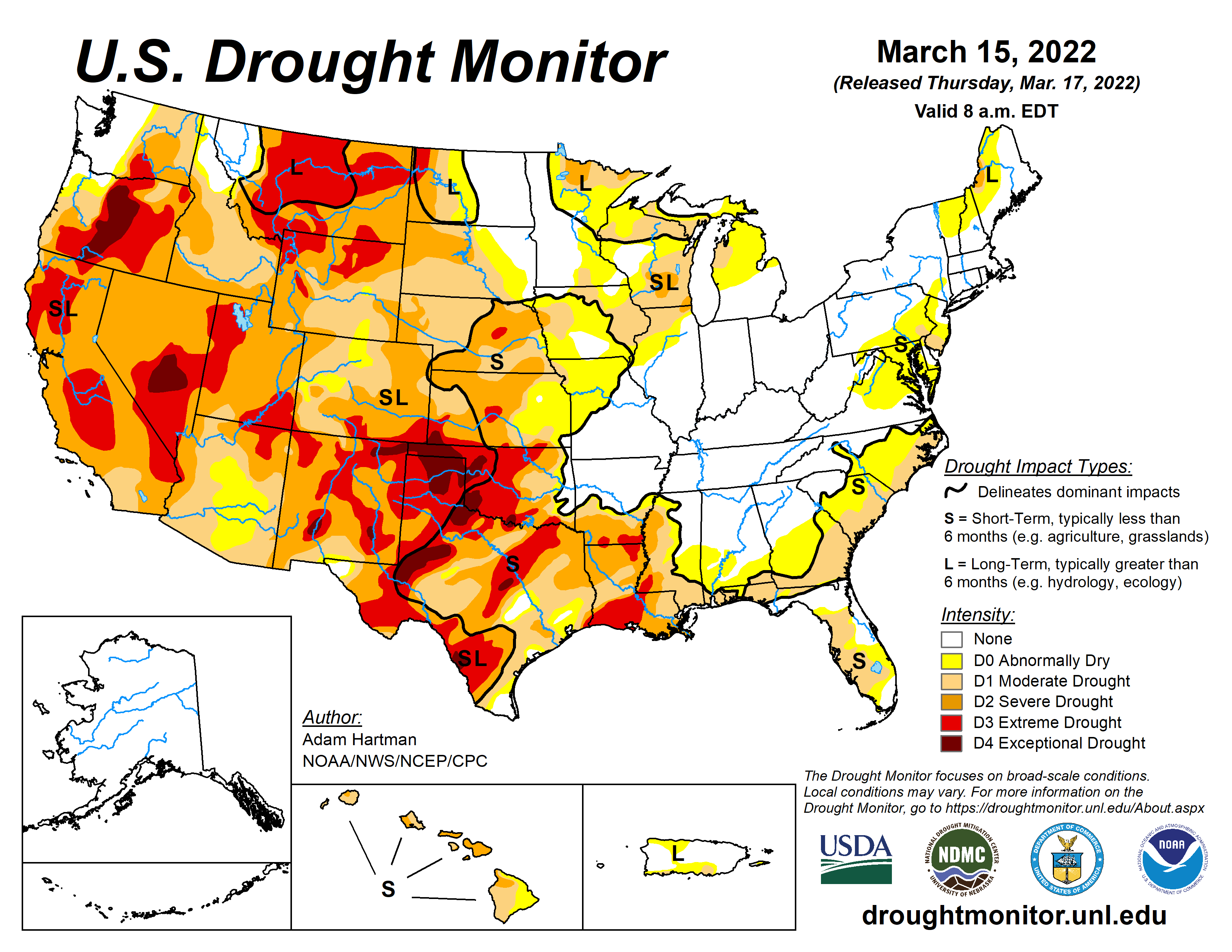

NOAA

also looks for drought conditions to persists into this spring (though June) bias the western US. 60 percent of the US is currently expiring some type of drought conditions.

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat areas are still advertised to receive significant rain and snowfall from two storm systems: one today into Friday and the other early next week - Between

the two events all of the wheat production region gets rain and amounts are advertised to range from 0.50 to 1.50 inches with some areas getting 2.00 inches - Colorado,

southwestern Nebraska, northwestern Kansas and areas from eastern Kansas into north-central Oklahoma will be wettest between the two events - There

is some potential for 2.00-3.00 inches of moisture, but mostly in eastern portions of Kansas and north-central Oklahoma - Crop

conditions may improve greatly in portions of wheat country if the two events occur as advertised

- The

moisture will induce generalized greening - The

moisture would also begin crop repair after winter damage from heaving topsoil, leaf damage from bitter cold temperatures and no snow cover and drought - World

Weather, Inc. still sees some potential for the storm early next week to be shifted a little to the northeast possibly reducing rain in the southwestern Plains in future model runs - That

area is already advertised to receive the lightest precipitation - U.S.

Delta and southeastern states will experience waves of rain during the next ten days favoring spring planting moisture - A

few areas may become a little too wet, especially in the Delta and a part of the Tennessee River Basin - Good

planting moisture is expected in the southeastern states, although fieldwork might be disrupted periodically - Waves

of rain are still expected in the U.S. Midwest over the next ten days maintaining moisture abundance for some areas and improving soil moisture in some western Corn Belt crop areas - Iowa

and Missouri will benefit most from the precipitation, although portions of eastern Nebraska and Kansas will also benefit - Northern

U.S. Plains will experience limited precipitation through the weekend - Brief

periods of snow and rain will develop early next week and again March 25-26 in portions of the region - Another

chance for rain and snow may evolve at the end of this month - West

Texas precipitation will be limited until Sunday into Monday when there is potential for 0.05 to 0.50 inch of moisture from showers and thunderstorms - Greater

rainfall may occur in southwestern Oklahoma and in the Texas Rolling Plains where some eastern crop areas might get 0.50 to 1.00 inch of moisture Monday - Confidence

in this precipitation event is a little low and there is potential that future forecast model runs will reduce the moisture advertised

- South

Texas and portions of the Texas Coastal Bend will also receive received precipitation for a while - California

is still not likely to get much needed moisture for the next ten days - Concern

remains over 2022 water supply - Portions

of Canada’s Prairies will continue to miss significant precipitation events for at least the next ten days - Temperatures

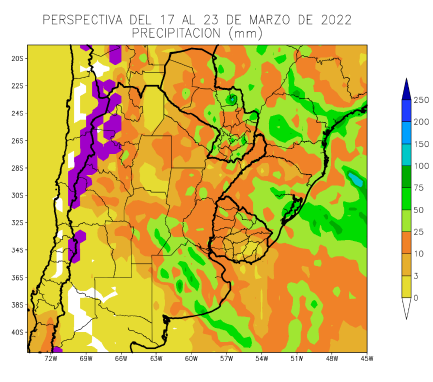

will be a little warmer than usual in the coming week which may help to stimulate a little snow melt - Argentina

weather has not changed much today - Precipitation

is expected in central parts of the nation today into Friday with northeastern areas getting rain early to mid-week next week - The

moisture will be good in maintaining favorable soil moisture in those areas, but net drying will continue in the southwest half of Buenos Aires, La Pampa, San Luis and far southern Cordoba through the next ten days - Subsoil

moisture in these areas should carry crop development relatively well, but the need for rain will steadily rise - All

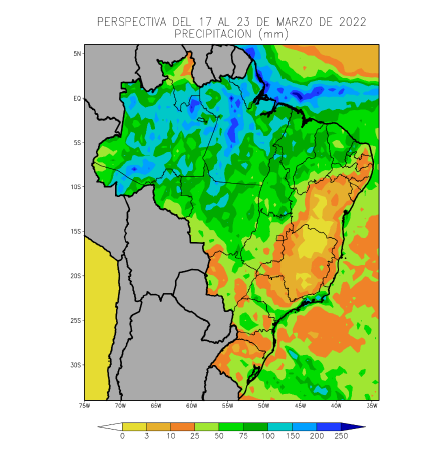

of Brazil will get rain during the next ten days and sufficient amounts will occur to support Safrinha corn and cotton - However,

net drying is expected in central and northern Minas Gerais and southern Bahia resulting in some crop stress for some late season crops, including sugarcane and some minor coffee production areas - Southwestern

Europe, northwestern Africa and a part of the southern Balkan Countries in Europe will receive periodic rainfall over the next two weeks resulting in a good environment for winter crop development and spring planting - Central,

northeastern and east-central Europe will experience net drying conditions for an extended period of time - Crops

are still dormant or semi-dormant and the need for moisture will remain low for a little while longer, but rain will be needed later this month and in April to prevent some areas from getting too dry - A

good distribution of rain is expected from eastern Turkey and some immediate neighboring areas through Turkmenistan, Uzbekistan, southern Kazakhstan and Tajikistan as well as in the mountains of western Xinjiang, China during the coming week - Some

rain and snow has already impacted the area and the precipitation has improved topsoil moisture - Better

wheat development and improved outlooks for the planting of cotton and corn will result from this pattern - East-central

China will get a little too much rain in the coming week to ten days as frequent rain and some thunderstorms evolve - The

Yangtze River Basin will be wettest resulting in some local flooding - Planting

delays for rice and corn might occur if the wet weather lasts too long - Wheat

and rapeseed will need drier and warmer weather soon - Crop

and field conditions in the North China Plain and northeastern provinces of China are suspected of being good for this time of year - Mild

to cool and drier biased weather in western Russia and Ukraine has not had any adverse weather on the region - Snow

cover remains significant and there has been no winterkill of significance this year - Soil

moisture in western Russia beneath the snow is abundant which might lead to some flooding in the spring if precipitation resumes during the snow melt season - Ukraine

is snow free except in the northeast - India’s

weather remains mostly tranquil with little change likely - Not

much precipitation and near to above normal temperatures are expected for the next ten days - Eastern

Australia soil moisture is decreasing, but irrigated crops are developing well - Dryness

in some sorghum and cotton fields will promote crop maturation and could lead to faster than usual harvest progress - Late

season crop yields from unirrigated fields may be lower than expected, especially in parts of Queensland

- Good

moisture early in the season has still provided a very good production year for most crops

- South

Africa rainfall will be favorably distributed and intermixed with periods of sunshine during the next ten days

- The

environment should prove to be favorable for most of the summer crops and early maturing crops will experience favorable conditions for harvesting - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days: wettest in the south next week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers starting today and lasting through the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - A

tropical cyclone may evolve and move into southwestern Myanmar early next week resulting in some heavy rain and flooding - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda in the coming week and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +11.87 - The

index will continue to move higher into the weekend - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; eastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Source:

Bloomberg and FI

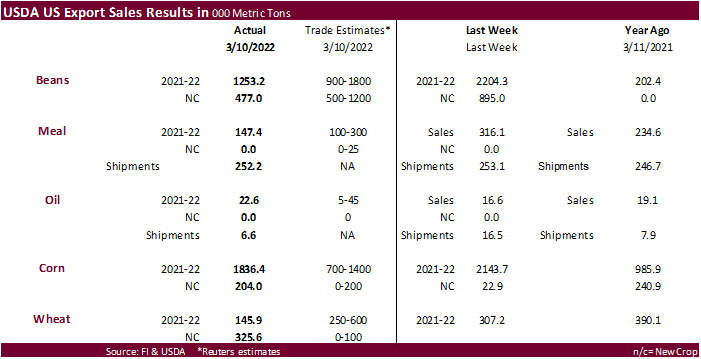

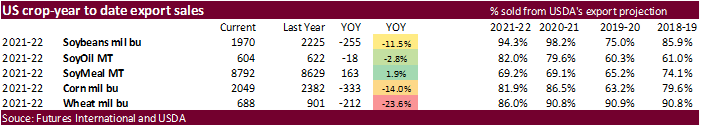

USDA

Export Sales

USDA

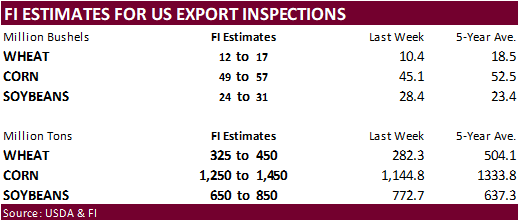

export sales for corn and oil looked good and rest of the major commodities ok.

Soybean

oil sales of 22,600 tons were within expectations and included 20,000 tons for unknown. Soybean sales of 1.253 million tons old crop and 477,000 new were within expectations and included 2021-22 sales to China (395,500 MT, including 66,000 MT switched from

unknown destinations and decreases of 66,700 MT), unknown destinations (267,600 MT), and Egypt (241,800 MT, including decreases of 1,200MT). Soybean new-crop sales included China (406,000 MT) and unknown destinations (71,000 MT). Soybean meal sales were 147,400

tons for old crop and shipments were ok at 252,200 tons.

USDA

reported corn sales for 2021-22 were 1.836 million tons and included Japan (538,400 MT, including 94,500 MT switched from unknown destinations), unknown destinations (303,000 MT), Mexico (235,100 MT, including decreases of 35,400 MT), and Colombia (179,800

MT, including 40,000 MT switched from unknown destinations and decreases of 6,900 MT). Total net sales of 204,000 MT for 2022-23 were for China.

Sorghum

sales were 108,300 tons and included China (128,300 MT, including 130,000 MT switched from unknown destinations and decreases of 7,900 MT), were offset by reductions for unknown destinations (20,000 MT).

Pork

sales were 38,300 tons, primarily for Mexico, Japan and Australia.

All-wheat

sales were poor for current crop year at 145,900 tons but new-crop exceeded expectations at 325,600 tons.

US

Initial Jobless Claims Mar 12: 214K (est 220K; prev 227K)

US

Continuing Claims Mar 5: 1419K (est 1480K; prev 1494K)

US

Philadelphia Fed Business Outlook Mar: 27.4 (est 14.5; prev 16.0)

US

Housing Starts Feb: 1769K (est 1700K; prev 1638K; prevR 1657K)

US

Housing Starts (M/M) Feb: 6.8% (est 3.8%; prev -4.1%; prevR -5.5%)

Privately‐owned

housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,859,000. This is 1.9 percent below the revised January rate of 1,895,000 but is 7.7 percent above the February 2021 rate of 1,726,000.

US

Philadelphia Fed Prices Paid Index March 81.0 Vs February 69.3

New

Orders Index March 25.8 Vs February 14.2

Employment

Index March 38.9 Vs February 32.3

Six-Month

Business Conditions March 22.7 Vs February 28.1

Six-Month

Capital Expenditures Outlook March 24.8 Vs February 21.5

US

30-Year Fixed Rate Mortgages 4.16 Pct March 17 Week Vs 3.85 Pct Prior Week -Freddie Mac

US

EIA Natural Gas Storage Change Mar 11: -79 (est -74; prev -124)

US

EIA Working Natural Gas Implied Flow Mar 11: -79 (est -74; prev -124)

US

Salt Dome Cavern NatGas Stocks: 8 BCF (prev 12 BCF)

86

Counterparties Take $1.660 Tln At Fed Reverse Repo Op (prev $1.614 Tln, 84 Bids)

LME

Increases Daily Price Limits For Nickel From 8% To 12% From March 18

U.S.

GENERATED 395 MLN BIODIESEL (D4) BLENDING CREDITS IN FEBRUARY, VS 355 MLN IN JANUARY

U.S.

GENERATED 1.07 BLN ETHANOL (D6) BLENDING CREDITS IN FEBRUARY, VS 1.21 BLN IN JANUARY

2021

February D4 was 300 million and D6 was 1.08 billion for February

2021

January D4 was 447 & D6 was 1.15 bil.

·

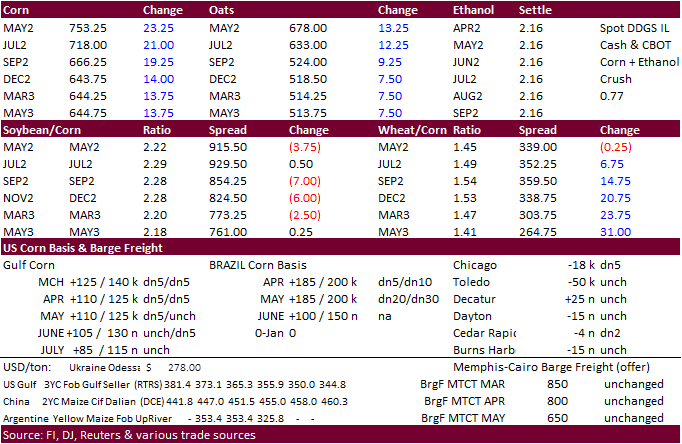

CBOT corn ended

24.50 cents higher in the May contract to $7.5450. The trading range was nearly identical to yesterday’s high/low. The big rebound in WTI crude oil initially supported corn. The USD was down 71 points as of 1:25 pm CT. . USDA export sales for corn were very

good.

·

May WTI crude oil futures rose above $102 per barrel during the morning session after the EIA warned of supply shortages.

·

China bought 200,000 tons of new-crop US corn last week per USDA export sales report, one of many purchases we see going forward.

·

A Agroconsult field crop survey suggested Brazil’s second corn crop at 92.2 million tons, same as a previous estimate and compares to 60.9 million tons last season. Total corn was pegged at 116.1 million tons, down from 116.5

million previous estimate.

·

Canadian Pacific Railway will lock out its employees in 72 hours (announced Wednesday) if there is no agreement with a union. Thinking about CP’s potential strike, if the merger of Canadian Pacific and Kansas City Southern would

have been completed sooner, that would have created a 19,200-mile logistical mess from Canada through and Mexico for many products, including fertilizers, grains, and coal.

https://www.trains.com/trn/canadian-pacific-kansas-city-southern-merger-to-redraw-class-i-railroad-map/

·

The IGC raised its forecast for global corn production in 2021-22 by 4 million tons to 1.207 billion tons. Ukraine’s corn export outlook was cut to 21.0 million tons from 31.9 million.

·

A Ukraine official mentioned corn stocks are large enough to cover 1.5 years of consumption.

Export

developments.

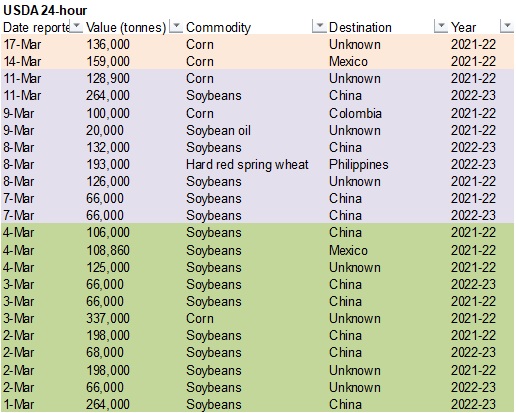

- USDA

under the 24-hour reporting system reported private exporters reported sales of 136,000 tons of corn for delivery to unknown destinations during the 2021-22 marketing year.

- The

Korea Feed Association (KFA) bought 65,000 tons of optional origin corn at $418.00 a ton c&f for June arrival.

- On

Wednesday Iran opened a new import tender for corn, barley and soybean meal that was set to close March 16.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment. - Egypt’s

GASC seeks a minimum 1,000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

Updated 3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

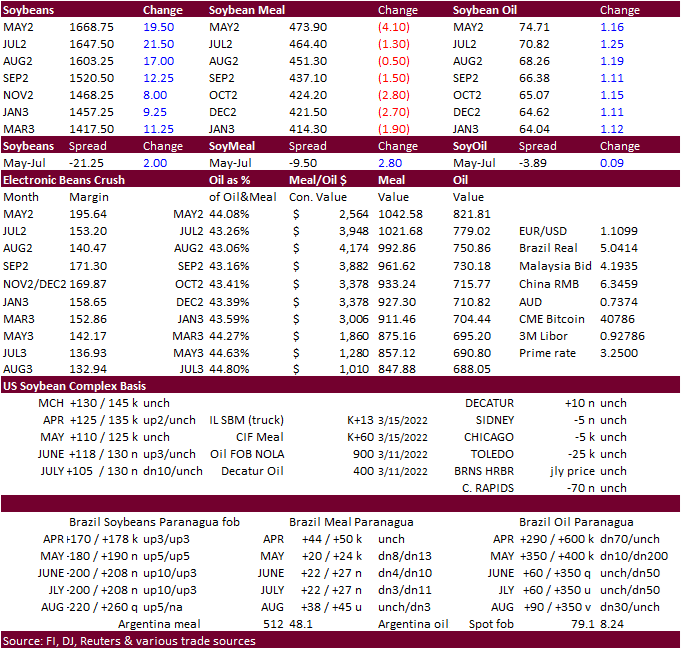

·

The soybean complex ended mixed with May soybeans up 19.25 cents, May meal down $3.90, and May soybean oil up 108 points.

·

Soybean meal saw pressure during the session on oil/meal spreading. The strong rebound in WTI crude oil and very good USDA export sales supported soybean oil futures. Soybeans were higher on decent export sales report, commodity

money inflow and ongoing concerns over South American production. May CBOT crush was under a good amount of pressure (down 17.25 cents to $1.9425) with the lower trade in soybean meal.

·

A Agroconsult field crop survey suggested Brazil’s soybean production will reach 124.6 million tons, below a previous forecast of 125.8 million tons, and well below their 139.4 million ton forecast for 2020-21. They are using

78 million tons for soybean exports.

·

The Buenos Aires grains exchange warned the soybean, corn and sunflower harvest forecasts could be cut further due to lower yields than expected from poor weather. The current estimates include soybeans at 42 million tons, corn

at 51 million tons and sunflower harvest at 3.3 million tons.

·

Spot US soybean meal basis offers increased across several Midwestern locations by $2-$5. Mankato, MN truck offers were up $8/short ton. IL soybean meal was up $3 and Gulf was down $3.

·

China National Grain and Oils Information Center (CNGOIC) estimates China producers will expand soybean plantings by 1.3 million hectares. USDA showed China planted 8.4 million hectares of soybeans in 2021-22, down from 9.883

million in 2020-21 and 9.332 million for 2019-20.

·

CNGOIC – China sold 186,000 tons of imported soybean oil and 256,000 tons of imported soybeans from its reserves between late February and March 14.

·

Germany’s association of farm cooperatives estimated the 2022 winter rapeseed crop up 11.6% from last summer’s crop to 3.90 million tons after an increase of 8.6% in the area planted.

·

A Ukraine official looks for a reduction in 2022 sunflower plantings and for producers to maximize milling wheat sowings.

·

Malaysian palm futures were lower on Thursday (before the third session). Indonesia changed its tune on restricting palm exports by removing the export volume for palm oil products and raise export levy ceiling instead. “The ceiling

of palm export tax and levy would be raised from a combined maximum of $375 per ton to $675 per toe. The maximum crude palm oil tax would be applied when prices reach $1,500 per ton.” (Reuters)

- Iran’s

GTC issued a tender (3/15) to buy about 30,000 tons of soyoil, set to close March 16. They are also seeking offers for sunflower oil and palm olein oil.

- Iran’s

SLAL issued a tender (3/15) to buy about 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal, set to close March 16. - From

last week – Results awaited: Iran’s state purchasing agency GTC has issued an international tender to purchase about 30,000 tons of soyoil for March and April shipment.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

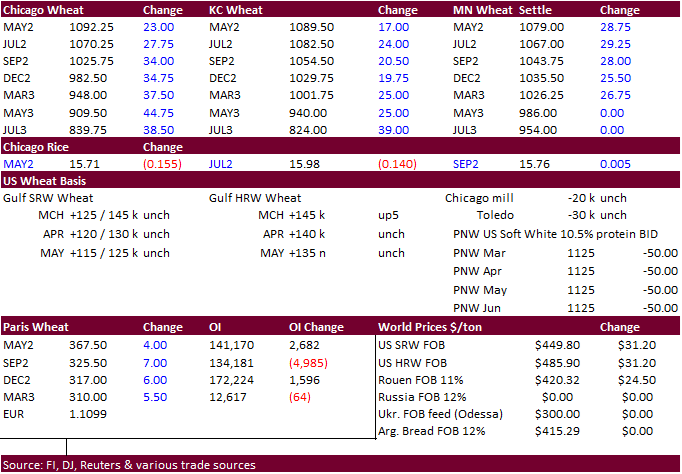

US wheat futures traded higher on negative headlines over the Ukraine/Russia situation, sharply lower USD, and general commodity buying. KC wheat futures were lagging MN and Chicago as rains moved into the US HRW wheat country

today, last into Friday, bias central Plains with additional precipitation in the southern Plains during Sunday through Tuesday (heavier event). The southwestern Plains may miss out on the event. U.S. northwestern Plains and southwestern Canada’s Prairies

will stay dry for the next ten days. The rain also may have prompted bear spreading in all three markets.

·

The IGC left their global wheat production unchanged for 2021-22 at 781 million tons. Ukraine’s wheat export outlook was cut to 20.8 million from 24.5 million.

·

Strategie Grains lowered their EU-27 soft wheat estimate for 2022-23 to 126.9 million tons from 128.0 previously. They left barley and corn production unchanged at 51.9 and 66.8 million tons, respectively. Strategie Grains warned

the Ukraine/Russia situation could remove from the world market about 11 million tons of Black Sea wheat exports for the remainder of 2021-22 and about 12 million tons of corn. This does not include new-crop.

·

May Paris wheat futures were up 4.00 euros or 1.1% to 367.75 euros earlier.

·

Most European wheat growing regions will be dry over the next 7-10 days.

·

Germany’s association of farm cooperatives estimated the 2022 wheat crop up 5.8% on the year to 22.61 million tons.

·

Ukraine’s Deputy Agriculture Minister reported winter wheat crops are in good condition and the country will have enough bread this year. Summer production is unpredictable. Earlier this week APK-Inform estimated Ukraine’s 2022

spring grain crop plantings could fall 39% to 4.7 million hectares.

·

Ukraine started spring plantings in some areas but the AgMin said it’s not possible to estimate a figure at this time.

·

Egypt is looking to set new rules to ensure local producers sell their wheat for government reserves. Egyptian farmers will have to sell at least 60% of their wheat to the government this season or risk losing financial support,

according to Reuters.

·

A Bloomberg chat user posted the following:

Indian

wheat $335 fob Kandla

HRW

fob Gulf $460

·

South Korean flour mills seek 45,000 tons of US milling wheat this Friday, March 18, for shipment between May 16 and June 15.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Algeria bought 50,000 tons of barley at around $470/ton c&f, for April 1-15 and April 16-30 shipment.

·

Iraq’s lowest offer for 50,000 tons of optional origin hard wheat was $528.00/ton c&f from Australia. Price offers are valid until the 22nd. Lowest price offered for U.S. wheat was $648 a ton c&f liner out, followed

by $659. Canadian wheat was offered at $554.50 and $564 a ton c&f liner out. German wheat was offered at $570 a ton and Romanian at $569.

·

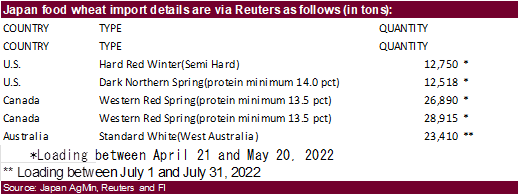

Japan’s AgMin bought 104,483 tons of food wheat from the United States, Canada and Australia. Original details as follows:

·

Iran’s GTC seeks 60,000 tons of milling wheat for shipment in April and May.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

Two

Philippine groups are in for a combined 270,000 tons of feed wheat. One tender seeks 215,000 tons in four consignments for shipment between May 3 and Aug. 20. The second tender seeks at least 55,000 tons for July/October shipment.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated 3/14/22

Chicago May $9.35 to $12.50 range

KC May $9.25 to $12.50 range

MN May $10.00‐$13.00

U.S. EXPORT SALES FOR WEEK ENDING 3/10/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

-4.6 |

1,705.4 |

1,428.2 |

65.3 |

5,720.6 |

6,896.9 |

49.1 |

245.4 |

|

SRW |

84.0 |

621.6 |

387.9 |

47.0 |

2,149.0 |

1,377.7 |

18.5 |

231.0 |

|

HRS |

64.7 |

1,080.9 |

1,765.4 |

111.9 |

4,006.9 |

5,537.0 |

203.0 |

310.6 |

|

WHITE |

1.9 |

527.9 |

2,016.8 |

25.3 |

2,734.5 |

4,428.8 |

55.0 |

172.0 |

|

DURUM |

0.0 |

18.8 |

153.3 |

0.0 |

169.7 |

518.4 |

0.0 |

47.0 |

|

TOTAL |

145.9 |

3,954.5 |

5,751.6 |

249.5 |

14,780.7 |

18,758.8 |

325.6 |

1,006.0 |

|

BARLEY |

0.0 |

13.8 |

11.5 |

0.0 |

14.7 |

22.0 |

0.0 |

0.0 |

|

CORN |

1,836.4 |

23,232.1 |

30,542.7 |

1,273.5 |

28,806.5 |

29,962.1 |

204.0 |

2,132.6 |

|

SORGHUM |

108.3 |

3,536.3 |

2,758.4 |

259.3 |

3,246.5 |

3,447.3 |

0.0 |

0.0 |

|

SOYBEANS |

1,253.2 |

11,298.5 |

6,779.6 |

714.3 |

42,325.5 |

53,777.4 |

477.0 |

8,123.8 |

|

SOY MEAL |

147.4 |

3,098.6 |

2,708.2 |

252.2 |

5,693.2 |

5,920.6 |

0.0 |

234.7 |

|

SOY OIL |

22.6 |

188.6 |

112.9 |

6.6 |

415.8 |

509.0 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

15.1 |

242.3 |

308.5 |

22.3 |

890.5 |

1,043.2 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.3 |

5.4 |

0.2 |

5.3 |

23.5 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

17.0 |

4.1 |

0.8 |

32.7 |

33.1 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

43.9 |

70.2 |

0.2 |

42.2 |

82.4 |

0.0 |

0.0 |

|

L G MLD |

12.1 |

67.4 |

57.5 |

33.2 |

558.0 |

436.2 |

0.0 |

0.0 |

|

M S MLD |

14.0 |

204.1 |

234.0 |

2.0 |

252.9 |

355.0 |

0.0 |

0.0 |

|

TOTAL |

41.3 |

583.1 |

679.7 |

58.8 |

1,781.5 |

1,973.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

371.4 |

7,806.0 |

5,394.1 |

325.5 |

5,849.7 |

8,833.3 |

49.0 |

2,285.0 |

|

PIMA |

12.3 |

163.6 |

259.8 |

7.8 |

264.7 |

468.1 |

1.3 |

15.0 |

This

summary is based on reports from exporters for the period March 4-10, 2022.

Wheat: Net sales of 145,900 metric tons (MT) for 2021/2022 were down 53 percent from the previous week and from the prior 4-week average. Increases

primarily for Colombia (46,200 MT), Mexico (42,700 MT, including decreases of 100 MT), Chile (29,300 MT, including 27,400 MT switched from unknown destinations and decreases of 100 MT), Vietnam (25,500 MT, including 24,500 MT switched from unknown destinations

and decreases of 200 MT), and Nigeria (23,600 MT), were offset by reductions primarily for unknown destinations (91,400 MT). Net sales of 325,600 MT for 2022/2023 were reported for the Philippines (258,000 MT), Guatemala (45,600 MT), and Mexico (22,000 MT).

Exports of 249,500 MT were down 35 percent from the previous week and 42 percent from the prior 4-week average. The destinations were primarily to Mexico (81,000 MT), the Philippines (35,200 MT), Chile (29,300 MT), Vietnam (25,500 MT), and Malaysia (21,900

MT).

Corn: Net sales of 1,836,400 MT for 2021/2022 were down 14 percent from the previous week, but up 64 percent from the prior 4-week average.

Increases primarily for Japan (538,400 MT, including 94,500 MT switched from unknown destinations), unknown destinations (303,000 MT), Mexico (235,100 MT, including decreases of 35,400 MT), Colombia (179,800 MT, including 40,000 MT switched from unknown destinations

and decreases of 6,900 MT), and South Korea (133,600 MT), were offset by reductions for China (2,100 MT) and Guatemala (400 MT). Total net sales of 204,000 MT for 2022/2023 were for China. Exports of 1,273,500 MT were down 28 percent from the previous week

and 25 percent from the prior 4-week average. The destinations were primarily to China (335,900 MT), Mexico (279,500 MT), Colombia (175,000 MT), Japan (94,700 MT), and Guatemala (87,300 MT).

Optional Origin Sales:

For 2021/2022, new optional origin sales of 60,000 MT were reported for Morocco. The current outstanding balance of 345,800 MT is for unknown destinations (180,000 MT), South Korea (65,000 MT), Morocco (60,000 MT), Italy (31,800

MT), and Saudi Arabia (9,000 MT). For 2022/2023, the current outstanding balance of 3,900 MT is for Italy.

Barley: No net sales or exports were reported for the week.

Sorghum: Net sales of 108,300 MT for 2021/2022 were up noticeably from the previous week and up 36 percent from the prior 4-week average. Increases

reported for China (128,300 MT, including 130,000 MT switched from unknown destinations and decreases of 7,900 MT), were offset by reductions for unknown destinations (20,000 MT). Exports of 259,300 MT were up 26 percent from the previous week and 40 percent

from the prior 4-week average. The destination was primarily to China (257,400 MT).

Rice: Net sales of 41,300 MT for 2021/2022 were up 13 percent from the previous week, but down 23 percent from the prior 4-week average. Increases

were primarily for Mexico (14,600 MT), Japan (13,000 MT), Haiti (7,300 MT), Saudi Arabia (3,100 MT), and Canada (1,800 MT, including decreases of 400 MT). Exports of 58,800 MT were up noticeably from the previous week, but down 17 percent from the prior 4-week

average. The destinations were primarily to Haiti (30,500 MT), Guatemala (16,000 MT), Mexico (7,000 MT), Canada (2,600 MT), and Saudi Arabia (1,200 MT).

Soybeans: Net sales of 1,253,200 MT for 2021/2022 were down 43 percent from the previous week and 11 percent from the prior 4-week average.

Increases primarily for China (395,500 MT, including 66,000 MT switched from unknown destinations and decreases of 66,700 MT), unknown destinations (267,600 MT), Egypt (241,800 MT, including decreases of 1,200 MT), Taiwan (162,500 MT), and Indonesia (83,200

MT, including 70,600 MT switched from unknown destinations and decreases of 200 MT), were offset by reductions for Costa Rica (800 MT). Net sales of 477,000 MT for 2022/2023 were reported for China (406,000 MT) and unknown destinations (71,000 MT). Exports

of 714,300 MT were down 14 percent from the previous week and 29 percent from the prior 4-week average. The destinations were primarily to China (370,200 MT), Mexico (120,600 MT), Indonesia (87,700 MT), Egypt (61,800 MT), and Taiwan (22,200 MT).

Export for Own Account: For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Soybean Cake and Meal: Net sales of 147,400 MT for 2021/2022 were down 53 percent from the previous week and 36 percent from the prior 4-week

average. Increases primarily for Mexico (20,800 MT), Colombia (17,400 MT, including 10,000 MT switched from unknown destinations), Venezuela (15,000 MT), Israel (15,000 MT), and Honduras (12,000 MT), were offset by reductions for Guatemala (2,500 MT), Malaysia

(300 MT), and Sri Lanka (200 MT). Exports of 252,200 MT were unchanged from the previous week, but up 7 percent from the prior 4-week average. The destinations were primarily to the Philippines (69,700 MT), Colombia (41,000 MT), Mexico (31,100 MT), Canada

(21,200 MT), and Morocco (18,400 MT).

Soybean Oil: Net sales of 22,600 MT for 2021/2022 were up 36 percent from the previous week, but down 4 percent from the prior 4-week average.

Increases reported for unknown destinations (20,000 MT), Colombia (4,000 MT), and Mexico (100 MT), were offset by reductions for Canada (1,000 MT) and the Dominican Republic (500 MT). Exports of 6,600 MT were down 60 percent from the previous week and 71

percent from the prior 4-week average. The destinations were to Colombia (4,000 MT), Mexico (2,100 MT), and Canada (500 MT).

Cotton: Net sales of 371,400 RB for 2021/2022 were up 5 percent from the previous week and 34 percent from the prior 4-week average. Increases

primarily for China (144,700 RB), Turkey (59,300 RB, including decreases of 100 RB), Pakistan (36,900 RB, including 900 RB switched from the United Arab Emirates), Vietnam (28,500 RB, including 800 RB switched from Indonesia, 300 RB switched from South Korea,

and 100 RB switched from Japan), and Nicaragua (19,600 RB), were offset by reductions for the United Arab Emirates (900 RB). Net sales of 49,000 RB for 2022/2023 were primarily for Pakistan (20,100 RB), Turkey (9,700 RB), Vietnam (6,600 RB), Thailand (4,000

RB), and Indonesia (2,600 RB). Exports of 325,500 RB were up 1 percent from the previous week, but down 2 percent from the prior 4-week average. The destinations were primarily to China (121,700 RB), Pakistan (59,500 RB), Turkey (37,900 RB), Vietnam (27,600

RB), and Mexico (16,800 RB). Net sales of Pima totaling 12,300 RB were up noticeably from the previous week and from the prior 4-week average. Increases were reported for India (11,600 RB, including decreases of 100 RB), China (400 RB), Turkey (200 RB),

and Malaysia (100 RB). Net sales of 1,300 RB for 2022/2023 were reported for India (900 RB) and Japan (400 RB). Exports of 7,800 RB were down 65 percent from the previous week and 45 percent from the prior 4-week average. The destinations were primarily

to Peru (2,900 RB), India (2,800 RB), Honduras (600 RB), Turkey (400 RB), and Indonesia (300 RB).

Optional Origin Sales: For 2021/2022, the current outstanding balance of 61,600 RB is for Vietnam (52,800 RB) and Pakistan (8,800 RB).

Exports for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides and Skins:

Net sales of 463,100 pieces for 2022 were up 37 percent from the previous week and 15 percent from the prior 4-week average. Increases primarily for China (243,300 whole cattle hides, including decreases of 24,600 pieces), Mexico (53,800 whole cattle hides,

including decreases of 600 pieces), South Korea (53,200 whole cattle hides, including decreases of 1,100 pieces), Thailand (52,000 whole cattle hides, including decreases of 1,000 pieces), and Indonesia (33,100 whole cattle hides, including decreases of 1,100

pieces), were offset by reductions for Taiwan (300 pieces). Total net sales of 800 calf skins were for Italy. In addition, net sales reductions of 300-kip skins were primarily for Belgium. Exports of 430,300 pieces were down 5 percent from the previous

week, but up 6 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (287,500 pieces), South Korea (45,600 pieces), Mexico (38,900 pieces), Thailand (23,600 pieces), and Indonesia (9,800 pieces). In addition, exports of

3,900-kip skins were to Belgium (2,600-kip skins) and Italy (1,300-kip skins).

Net sales of 28,400 wet blues for 2022 were down 78 percent from the previous week

and 74 percent from the prior 4-week average. Increases reported for Italy (11,100 unsplit and 100 grain splits), Vietnam (9,600 unsplit), and China (8,000 unsplit),

were offset by reductions for Portugal (200 grain splits), Thailand (100 unsplit), and Hong Kong (100 unsplit). Exports of 119,200 wet blues were down 23 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily

to Italy (27,400 unsplit and 19,200 grain splits), Vietnam (37,200 unsplit), China (17,600 unsplit), Mexico (4,300 unsplit and 2,000 grain splits), and Thailand (3,100 unsplit). Net sales of 402,000 splits were for Vietnam (353,200 pounds, including decreases

of 11,700 pounds), China (36,000 pounds), and South Korea (12,800 pounds). Exports of 563,800 pounds were to Vietnam (482,100 pounds) and South Korea (81,700 pounds).

Beef: Net sales of 19,700 MT for 2022 were down 28 percent from the previous week and 11 percent from the prior 4-week average. Increases were

primarily for China (6,600 MT, including decreases of 100 MT), Japan (5,200 MT, including decreases of 800 MT), South Korea (2,600 MT, including decreases of 700 MT), Mexico (1,700 MT), and Taiwan (1,300 MT, including decreases of 100 MT). Exports of 16,300

MT were up 2 percent from the previous week, but unchanged from the prior 4-week average. The destinations were primarily to South Korea (4,600 MT), Japan (3,600 MT), China (2,700 MT), Taiwan (1,800 MT), and Canada (900 MT).

Pork: Net sales of 38,300 MT for 2022 were up 51 percent from the previous week and 36 percent from the prior 4-week average. Increases were

primarily for Mexico (21,700 MT, including decreases of 200 MT), Japan (6,100 MT, including decreases of 100 MT), Australia (2,700 MT, including decreases of 100 MT), Honduras (1,500 MT), and South Korea (1,400 MT, including decreases of 700 MT). Exports

of 26,000 MT were down 9 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Mexico (10,900 MT), Japan (3,900 MT), China (3,800 MT), South Korea (2,100 MT), and Canada (1,400 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.