PDF Attached

Day

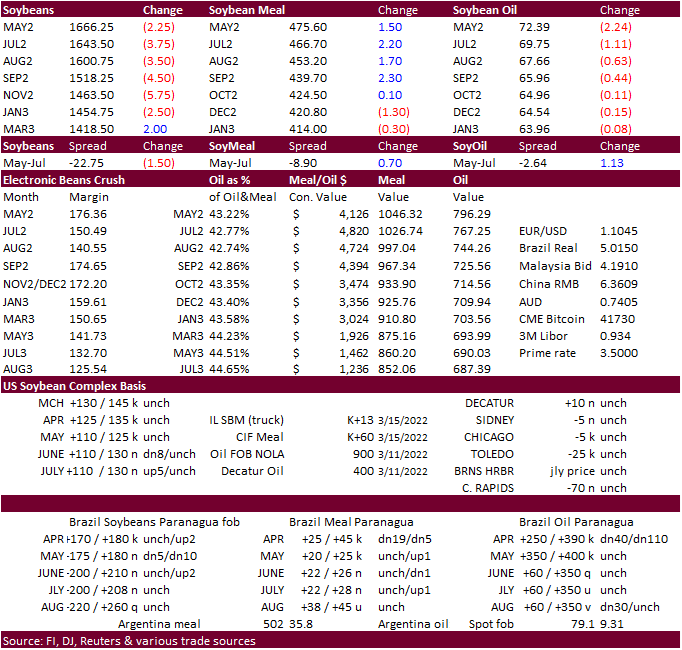

23. USD was higher and WTI higher. Grains were mixed with spot positions mainly lower with exception of meal up on a reversal in product spreading.

WEATHER

EVENTS AND FEATURES TO WATCH

- Rain

and snow fell in U.S. hard red winter wheat production areas Thursday and early today with moisture totals of 0.20 to 0.60 inch in the heart of the production region - Local

totals reached 0.88 inch southwest of Wichita, KS and 0.85 inch in north-central Kansas while a few locations between Oklahoma City and Wichita, KS reporting 1.00 to 2.00 inches - Much

less rain fell in the high Plains region - U.S.

hard red winter wheat areas will experience another storm system Sunday night through Tuesday with more rain and snowfall - Moisture

totals will vary from 0.50 to 1.50 inches and a few areas might get more - Southwestern

portions of the region (Texas Panhandle into far southwestern Kansas) will be driest

- Significant

snow will fall from eastern Colorado to South Dakota - U.S.

hard red winter wheat areas will experience a general improvement in soil moisture with drought status to be reduced in some areas. The change will bring a very good opportunity for much improved greening conditions and crops will take the moisture and put

it toward improvements in root, tillers and leaves after much damage occurred over the past few months. Follow up precipitation will be imperative if production potential is going to improve significantly. The coming ten days that follow the early week storm

are expected to be drier biased once again. - West

and South Texas and the coastal bend area of Texas will experience very little precipitation for a while - Concern

over early spring planting, emergence and establishment for corn, sorghum and cotton is rising - U.S.

Delta and southeastern states will experience waves of rain during the next ten days favoring spring planting moisture - A

few areas will become a little too wet, especially in the Delta and a part of the Tennessee River Basin - Flooding

is possible in this region early to mid-week next week because of rainfall varying from 1.50 to more than 5.00 inches

- Good

planting moisture is expected in the southeastern states, although fieldwork might be disrupted periodically - Waves

of rain are still expected in the U.S. Midwest over the next ten days maintaining moisture abundance for some areas and improving soil moisture in some western Corn Belt crop areas - Iowa

and Missouri will benefit most from the precipitation, although portions of eastern Nebraska and Kansas will also benefit - Northern

U.S. Plains will experience limited precipitation through the weekend - Brief

periods of snow and rain will develop early next week and again March 26-28 in portions of the region - The

precipitation events will attempt to improve topsoil moisture in a few western areas, but the greatest precipitation is expected in the east - California

is still not likely to get much needed moisture for the next ten days - Concern

remains over 2022 water supply - Portions

of Canada’s Prairies will continue to miss significant precipitation events for at least the coming week - Temperatures

will be a little warmer than usual in the coming week which may help to stimulate a little snow melt - Argentina

weather has not changed much today - Precipitation

is expected in central parts of the nation today after developing Thursday and overnight

- The

precipitation was helpful in maintaining good soil moisture in central parts of the nation - Additional

precipitation is expected in east-central and northeastern parts of the nation early next week - The

moisture Thursday, today and early next week will be good in maintaining favorable soil moisture in those areas, but net drying will continue in the southwest half of Buenos Aires, La Pampa, San Luis and far southern Cordoba through the next ten days - Subsoil

moisture in these areas should carry crop development relatively well, but the need for rain will steadily rise - Most

of Brazil will get rain during the next ten days and sufficient amounts will occur to support Safrinha corn and cotton - However,

net drying is expected in central and northern Minas Gerais and southern Bahia resulting in some crop stress for some late season crops; including sugarcane and some minor coffee production areas - A

few coffee and sugarcane areas are expected to become a little too dry as time moves along and greater moisture will soon be needed - Southwestern

Europe, northwestern Africa and a part of the southern Balkan Countries in Europe will receive periodic rainfall over the next two weeks resulting in a good environment for winter crop development and spring planting - Central,

northeastern and east-central Europe will experience net drying conditions for an extended period of time - Crops

are still dormant or semi-dormant and the need for moisture will remain low for a little while longer, but rain will be needed later this month and in April to prevent some areas from getting too dry - A

good distribution of rain is expected from eastern Turkey and some immediate neighboring areas through Turkmenistan, Uzbekistan, southern Kazakhstan and Tajikistan as well as in the mountains of western Xinjiang, China during the coming week - Some

rain and snow has already impacted the area and the precipitation has improved topsoil moisture - Better

wheat development and improved outlooks for the planting of cotton and corn will result from this pattern - East-central

China will get a little too much rain in the coming week to ten days as frequent rain and some thunderstorms evolve - The

Yangtze River Basin will be wettest resulting in some local flooding - Planting

delays for rice and corn might occur if the wet weather lasts too long - Wheat

and rapeseed will need drier and warmer weather soon - Crop

and field conditions in the North China Plain and northeastern provinces of China are suspected of being good for this time of year - Mild

to cool and drier biased weather in western Russia and Ukraine has not had any adverse weather on the region - Snow

cover remains significant and there has been no winterkill of significance this year - Soil

moisture in western Russia beneath the snow is abundant which might lead to some flooding in the spring if precipitation resumes during the snow melt season - Ukraine

is snow free except in the northeast - India’s

weather remains mostly tranquil with little change likely - Not

much precipitation and near to above normal temperatures are expected for the next ten days - Eastern

Australia soil moisture is decreasing, but irrigated crops are developing well - Dryness

in some sorghum and cotton fields will promote crop maturation and could lead to faster than usual harvest progress - Late

season crop yields from unirrigated fields may be lower than expected, especially in parts of Queensland

- Good

moisture early in the season has still provided a very good production year for most crops

- South

Africa rainfall will be favorably distributed and intermixed with periods of sunshine during the next ten days

- The

environment should prove to be favorable for most of the summer crops and early maturing crops will experience favorable conditions for harvesting - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south next week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers starting today and lasting through the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - A

tropical disturbance will move into southwestern Myanmar early next week resulting in some heavy rain and flooding - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and parts of southwestern Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda in the coming week and especially next week - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +12.16 - The

index will slowly level off this weekend into early next week and may then move a little more erratically for a while - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; eastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

second-batch of Feb. imports for corn, pork and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

India

Monday,

March 21:

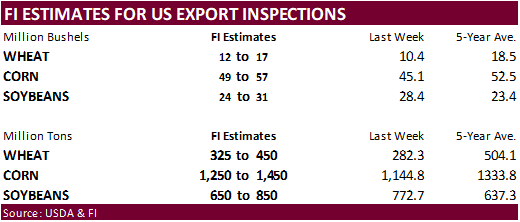

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals - Malaysia’s

March 1-20 palm oil export data - USDA

total milk production, 3pm - HOLIDAY:

Japan

Tuesday,

March 22:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 23:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Pakistan

Thursday,

March 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

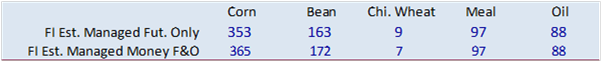

CFTC

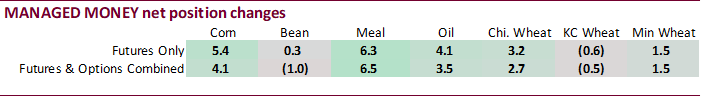

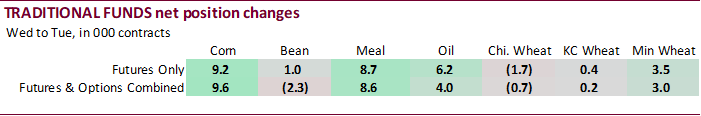

Commitment of Traders

Combined

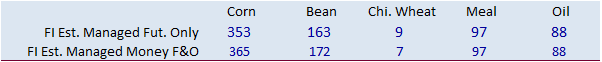

soybeans, meal, oil, corn, Chicago wheat and KC wheat managed money futures and options net long positions were a record at 803,110 net long contracts.

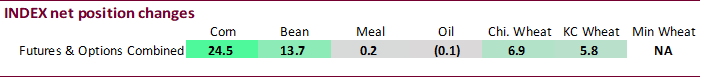

Combined

soybeans, meal, oil, corn, Chicago wheat and KC wheat net long Index Fund positions were a record at 1,155,009 net long contracts.

Index

funds bought a large amount of corn.

Reuters

table via CFTC

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

296,044 -28,054 467,032 24,499 -735,800 -1,925

Soybeans

106,044 -23,177 208,025 13,651 -288,292 5,804

Soyoil

59,260 1,760 118,873 -97 -192,759 293

CBOT

wheat -37,473 -10,113 165,449 6,853 -121,513 1,242

KCBT

wheat 15,558 -9,728 65,314 5,816 -81,202 3,114

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

372,909 4,125 275,400 -20,782 -726,318 5,670

Soybeans

170,690 -1,024 129,002 -8,076 -295,542 6,625

Soymeal

103,159 6,532 92,404 -1,388 -247,633 -7,679

Soyoil

89,171 3,502 88,204 -3,679 -197,486 1,633

CBOT

wheat 22,945 2,736 81,275 -3,322 -97,143 2,000

KCBT

wheat 44,236 -470 24,679 -1,417 -72,332 453

MGEX

wheat 14,387 1,473 781 -146 -27,343 -2,479

———- ———- ———- ———- ———- ———-

Total

wheat 81,568 3,739 106,735 -4,885 -196,818 -26

Live

cattle 40,144 1,593 77,612 -4,074 -125,921 696

Feeder

cattle -3,065 1,067 6,912 -92 2,196 -342

Lean

hogs 63,345 -2,674 58,479 -2,897 -116,474 4,583

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

105,284 5,506 -27,276 5,481 2,083,011 28,416

Soybeans

21,627 -1,246 -25,777 3,721 999,098 -3,956

Soymeal

19,101 2,042 32,968 492 447,497 8,171

Soyoil

5,485 502 14,626 -1,957 414,017 -4,214

CBOT

wheat -615 -3,433 -6,462 2,018 513,596 -5,262

KCBT

wheat 3,087 636 330 799 209,692 -4,688

MGEX

wheat 7,575 1,515 4,601 -362 67,915 -1,784

———- ———- ———- ———- ———- ———-

Total

wheat 10,047 -1,282 -1,531 2,455 791,203 -11,734

Live

cattle 22,169 3,534 -14,004 -1,748 369,096 -17,176

Feeder

cattle 1,361 321 -7,405 -953 59,682 -2,805

Lean

hogs 4,405 522 -9,755 466 322,624 -1,624

=================================================================================

Canadian

Retail Sales (M/M) Jan: 3.2% (est 2.4%; prev -1.8%)

Canadian

Retail Sales Ex Auto (M/M) Jan: 2.5% (est 2.2%; prev -2.5%)

Canada

Feb Retail Sales Most Likely Fell 0.5% – StatsCan Flash Estimate

Canada

Feb New Housing Prices +1.1Pct Vs +0.9Pct In Jan; +10.9Pct On Year

US

Existing Home Sales Feb: 6.02Mln (est 6.10Mln; prev 6.50Mln; prevR 6.49Mln)

US

Existing Homes Sales (M/M) Feb: -7.2% (est -6.2%; prev 6.7%; prevR 6.6%)

US

Lending Index Feb: 0.3% (est 0.3%; prev -0.3%; prevR -0.5%)

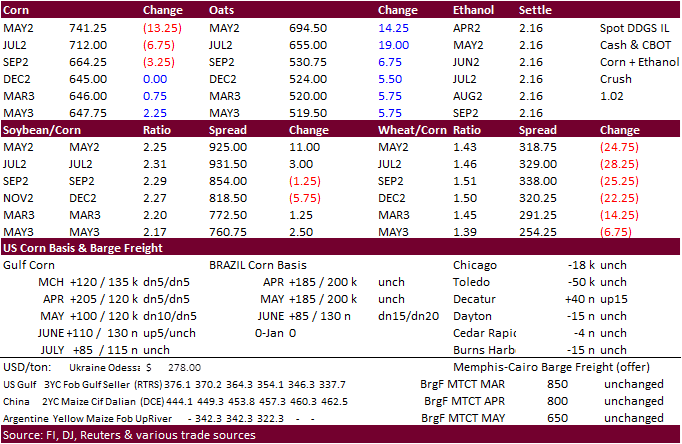

Corn

·

CBOT corn ended

lower Friday led by bear spreading following weakness in wheat and higher USD.

·

US Crude Oil Futures Settle At $104.70/Bbl, Up $1.72 Or 1.67%. – ICE Chat

·

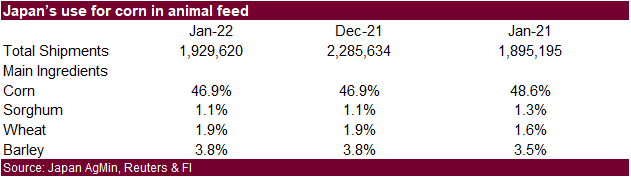

China corn imports during the month of February were 1.93 million tons, up 8.4% from year ago and Jan-Feb stand at 4.68 million tons, down 2.3 percent form year earlier.

·

China is restarting fertilizer plants that have been previously shut down to ensure domestic consumption requirements.

·

A Ukraine official mentioned corn stocks are large enough to cover 1.5 years of consumption.

·

A trucker strike in Spain is disrupting food distribution.

War

in Ukraine and its Effect on Fertilizer Exports to Brazil and the U.S.

Colussi,

J., G. Schnitkey and C. Zulauf. “War in Ukraine and its Effect on Fertilizer Exports to Brazil and the U.S..”

farmdoc

daily

(12):34, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 17, 2022.

Export

developments.

- No

fresh business we see on Friday. - Results

awaited: On

Wednesday Iran opened a new import tender for corn, barley and soybean meal that was set to close March 16.

- Results

awaited: Iran’s SLAL seeks up to 60,000 tons of feed barley, 60,000 tons of feed corn and 60,000 tons of soymeal for March and April shipment. - Results

awaited: Egypt’s GASC seeks a minimum 1,000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

Updated 3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

·

CBOT soybeans were higher to start but settled lower bias bull spreading. Soybean meal (product reversal) was higher on concerns over Argentina meal and soybean oil export taxes that may shift business to north America. SA production

woes may continue into 2022-23. Soybean oil posted a big loss for the front month in part to weakness in palm oil and lacking US export developments.

·

CBOT crush margins fell again on Friday with May down a large 20.25 cents to $1.7525.

·

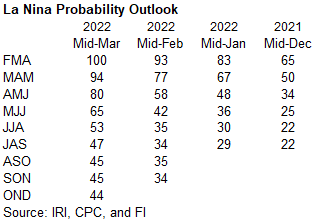

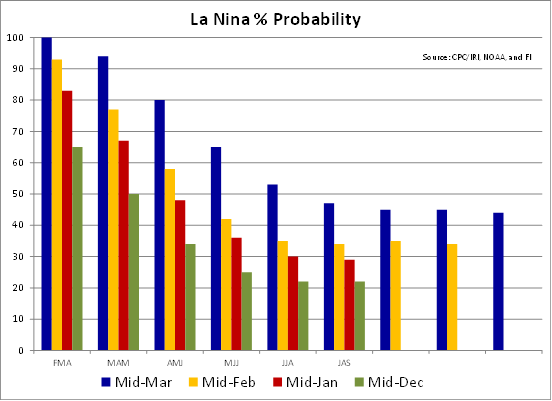

The Rosario grains exchange warned Argentina producers could be hit by a third straight La Nina event that could impact production next season. It has been 20 years since the last time Argentina faced three straight La Nina’s,

according to the exchange.

·

We agree, the latest IRI report showed a 44 percent change of La Nina conditions during the OND period. They increased La Nina probability to 100 percent for the FMA 2022 period. See weather section.

·

China is urging local governments to minimize the impact of Covid-19 to ensure spring plantings don’t get disrupted.

·

Malaysian palm oil futures on Friday dropped more than 5%. Palm fell 16% for the week, mainly on demand destruction from high global vegetable oil prices and Indonesia reversing their stance to restrict exports over the short

term.

·

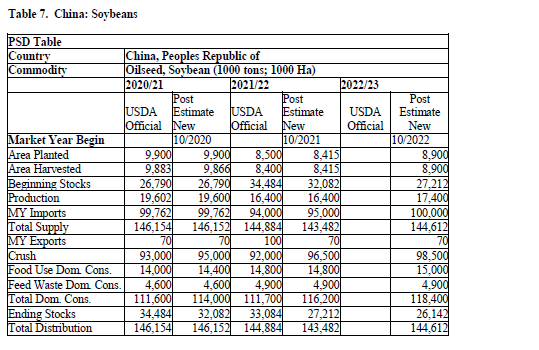

USDA’s Attaché sees China 2022-23 soybean imports at 100 million tons, a record if realized.

- Egypt’s

GASC seeks an unspecified amount of vegetable oils on March 22 for arrival May 5-25 for payment at sight and 180-day letters of credit. They are also seeking local vegetable oils.

- Results

awaited: Iran’s GTC issued a tender (3/15) to buy about 30,000 tons of soyoil, set to close March 16. They are also seeking offers for sunflower oil and palm olein oil.

- Results

awaited: Iran’s SLAL issued a tender (3/15) to buy about 60,000 tons of barley, 60,000 tons of corn and 60,000 tons of soybean meal, set to close March 16. - Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

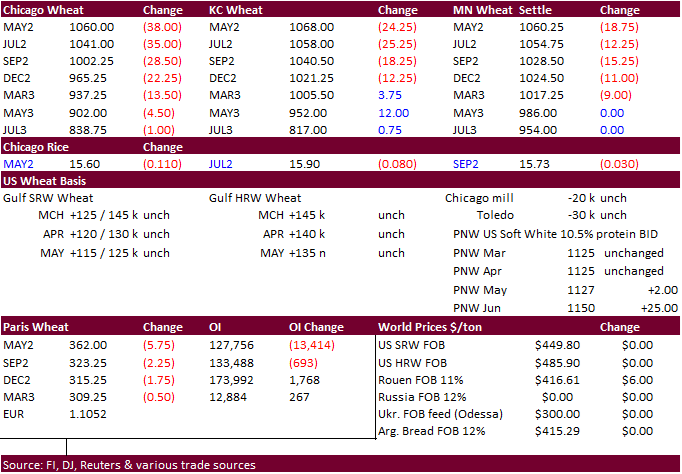

Another wild week in US wheat futures trading, with all three US nearby positions ending lower Friday on Black Sea shipping uncertainty, technical selling ahead of the weekend, and geopolitical headline trading. Spring plantings

for the Black Sea region are concerning as the conflict drags on. We wonder how long it will take Ukraine to rebound back to pre-crises levels for shipping given the unknown amount of damage to elevators and port facilities.

·

US wheat futures also traded lower from improving US Great Plains weather with a current event providing some rain followed by a heavier event starting Sunday.

·

French soft wheat ratings for the good and excellent categories were steady at 92 percent as of March 14 from the previous week (87% year ago). Spring barley was 90 percent planted.

·

May Paris wheat futures were down 5.75 euros or 1.6% to 361.75 euros.

·

Effective March 29, Russia’s export duty will increase to $86.40 from $86.30 per ton. Barley will rise to $79.60 from $77.40 per ton and corn to $53.20 from $54.10 per ton.

·

Algeria’s wheat supply is large enough to last until August.

·

Germany’s association of farm cooperatives estimated the 2022 wheat crop up 5.8% on the year to 22.61 million tons.

·

Results awaited: South Korean flour mills seek 45,000 tons of US milling wheat for shipment between May 16 and June 15.

·

Results awaited: Iran’s GTC seeks 60,000 tons of milling wheat for shipment in April and May.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

Two

Philippine groups are in for a combined 270,000 tons of feed wheat. One tender seeks 215,000 tons in four consignments for shipment between May 3 and Aug. 20. The second tender seeks at least 55,000 tons for July/October shipment.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated 3/14/22

Chicago May $9.35 to $12.50 range

KC May $9.25 to $12.50 range

MN May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.