PDF Attached

Day

27. Impressive strong start to the week for the US agriculture markets on good global wheat demand and Argentina tax developments. The USD was up about 25 points as of 4:00 pm CT, WTI crude oil over $7.50 higher and equities mixed.

CBOT

limits reset for some smaller traded products https://www.cmegroup.com/trading/price-limits.html

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

weather this week will be plenty wet from portions of the central and southern Plains through the Midwest, Delta and Tennessee River Basin. - Rainfall

by Thursday morning will range from 0.50 to 2.00 inches with a few 2.00- to nearly 4.00-inch totals - Wettest

in the Delta and lower Ohio River Valley - Hard

red winter wheat production areas will get 0.50 to 1.50 inches of moisture with a few greater amounts except in the northwest where 0.05 to 0.60 inch will result - Some

heavy snowfall is expected in western Kansas into the northern Texas Panhandle and southeastern Colorado - West

and far South Texas cotton, corn and sorghum areas are unlikely to get significant moisture this week

- U.S.

southeastern states rainfall this week will vary from 0.30 to 1.00 inch with a few 1.00- to 2.00-inch amounts - Not

much precipitation will fall in the northwestern Plains, Canada’s southwestern Prairies or in the southwestern desert region - Rain

and mountain snow will fall lightly in California, but not enough moisture will result to turn around the poor snowpack and runoff potential - As

of March 19, the state average snowpack in California was 55% of normal and 54% of the April 1 average.

- Northern

and eastern parts of Canada’s Prairies will get most of that region’s precipitation over the next week ten days.

- Today

and Tuesday will be wettest this week - Next

storm to impact the central U.S. Plains is possible March 28-31. - Confidence

is low - The

storm would ultimately move through the Midwest during the second week of the outlook maintaining wet field conditions - U.S.

temperatures that were very warm biased Sunday in the central U.S. will shift briefly to the east early this week as the next large storm system impacts the Plains and Midwest - Cooling

will follow the storm. - Average

temperatures will turn cooler in the eastern half of the nation this week while the west trend very warm due to a strong ridge of high pressure expected - The

warm weather in the west and cool air in the east late this week and into the weekend will give way to more seasonable temperatures next seek - U.S.

weekend rainfall was greatest Friday into Saturday when most of the Midwest was impacted by rain and a little snow - Moisture

totals varied from 0.35 to 0.92 inch with a few amounts greater than 1.00 inch in western Ohio, southeastern Michigan and eastern Indiana - Up

to 4 inches of snow accumulated in the northwestern Corn Belt Friday - Heavy

rain fell in the southeastern states with southern Alabama, northwestern Florida and southeastern Georgia reporting 1.00 to 3.00 inches and local totals to 6.00 inches - Southeastern

Alabama was wettest and flooding resulted - A

few lighter showers occurred in the far western states with the mountains wettest - U.S.

weekend temperatures were warming and peaked out Sunday when highs were in the 70s Fahrenheit from central South Dakota to Texas - A

few extremes reached into the lower 80s in parts of Texas and central Oklahoma.

- Breezy

conditions occurred as well Sunday with wind speeds of 20 to 40 mph at times in the central and southern Plains - Sunday

afternoon temperatures were also in the 70s in the Delta and southeastern states while in the 50s and 60s in the Midwest - Lowest

morning temperatures were in the teens and 20s in the central and northern Plains and upper Midwest while in the 20s and 30s in the lower eastern Midwest and in the 30s and 40s in the Delta and southeastern states - Frost

was noted in southern Buenos Aires during the weekend with extreme lows in the middle and upper 30s Fahrenheit - No

reports of freezes were received, but temperatures were low enough for soft frost to accumulate on some of the vegetation - The

impact on immature summer crops should have been low - Temperatures

in Argentina will average close to normal during the next week, but a little cooler bias is expected and that may continue next week with lowest temperatures next week possibly slipping back to the frost threshold in a few areas - Argentina

weekend precipitation was limited with most of the nation experiencing net drying conditions - Argentina

will experience rain in the northeast Monday and Tuesday and over a larger part of eastern Argentina Wednesday before occurring in La Pampa and southwestern Buenos Aires Thursday and southern Buenos Aires Friday - Rain

totals by Saturday in Chaco, Formosa and Corrientes will range from 2.00 to 6.00 inches with some potential for up to 10.00-inch amounts near the Corrientes, Paraguay and Chaco common border - Rainfall

in Entre Rios, Santa Fe, southern Corrientes and areas south into northern Buenos Aires and a part of southeastern Cordoba will range from 0.75 to 2.00 inches

- Southwestern

Buenos Aires, eastern La Pampa and southern Cordoba will receive 2.00 to 4.00 inches of rain Thursday into Friday with locally more, but there is time for the rain intensity to be reduced later this week - Far

west-central and northwestern Argentina are not advertised to receive much moisture this week - Argentina’s

weather next week should trend drier, although some rain may fall briefly early next week in northeastern parts of the nation once again - Brazil

rainfall during the weekend was greatest in the interior south-center south and a few center west crop areas - Rain

totals varied from 1.25 to more than 2.50 inches randomly from northern Parana through central Sao Paulo to south-central parts of Minas Gerais - Most

other areas reported only light rainfall and warm temperatures leading to some net drying - Highest

temperatures were in the 80s and lower to a few middle 90s Fahrenheit - Most

of Brazil will receive significant rain during the next ten days - Rain

totals of 1.50 to 4.00 inches will result except from northern Minas Gerais to central Bahia where rainfall will be less than 0.50 inch and some areas may be left dry - Days

11-15 do not offer many changes to the predicted weather - Temperatures

will be seasonable - Europe

weather was drier than usual again during the weekend extending a period of unusually quiet weather even further - Rain

is expected this week in Spain and Portugal while any showers that occur elsewhere (and there will be some) are expected to be too light and brief to have much impact on soil moisture which should slowly decline - Rainfall

in Italy and the Iberian Peninsula will vary from 0.50 to 2.00 inches with a few local totals of 2.00 to more than 4.00 inches - A

few east-central Spain coastal areas may get more than 8.00 inches of rain resulting in some flooding - Temperatures

will be near to above normal this week and probably next week as well - Much

of Russia, Ukraine, northern Kazakhstan, Belarus and the Baltic States were dry during the weekend while a little rain fell in southern parts of Russia’s Southern Region and areas east into southeastern Kazakhstan - Temperatures

were warming sufficiently to melt snow in western Russia where highest temperatures were in the 40s and to near 50 Fahrenheit.

- Lowest

morning temperatures were in the teens and 20s except from the middle Volga River Basin to northern Kazakhstan and southern parts of Russia’s Southern region where negative and positive single digit readings were noted.

- Some

increase in precipitation is expected in the CIS later this week into next week as waves of snow and rain evolve across the region - Temperatures

will be seasonable - India

weather during the weekend was heating up with highest temperatures in the upper 80s and 90s Fahrenheit with a few extremes over 100 - Precipitation

was minimal - India

weather will continue mostly dry and seasonably warm to hot through the next ten days

- There

is some risk of showers and thunderstorms in Kerala and immediate neighboring areas of Karnataka and Tamil Nadu as well as in the far Eastern States and extreme northern most parts of the nation - Eastern

China will experience waves of rain from the Yangtze River Basin early this week and southward to the southern coastal provinces followed by drier weather - Rain

totals will vary from 2.00 to 6.00 inches with a few amounts reaching close to 8.00 inches - Some

flooding is possible in the southeast corner of the nation - Rapeseed

and early corn and rice production areas may need drier weather soon to provide better planting and crop development conditions - Some

of that drying is possible later this week into next week - Temperatures

will be warm biased in the north and a little cooler than usual in the wetter areas of the south - China’s

weekend precipitation was greatest in central Inner Mongolia and parts of the North China Plains where moisture totals varied up to 1.00 inch and in the northern Yangtze River Basin where 1.00 to more than 5.00 inches resulted - Too

much rain will impact the Yangtze River Basin early this week culminating in some flooding. - Australia

late week rainfall this week into early next week will be light and sporadic enough to limit its impact on maturing cotton and sorghum - The

forecast is drier today than advertised Sunday - Australia

summer crop areas were relatively dry during the weekend while rain fell along the New South Wales coast and along the eastern slopes of the Great Dividing Range.

- Tropical

Cyclone 21S was named Charlotte overnight and it should pass to the west of Western Australia during the weekend - The

storm was still evolving in the eastern Indian Ocean 453 miles north northwest of Learmonth, Australia at 15.5 south, 110.8 east at 2100 GMT today. The storm was moving southwesterly at 11 mph and producing maximum sustained wind speeds of 86 mph near its

center - The

storm will intensify additionally today and then begin weakening Tuesday and Wednesday as the storm turns to the south - The

storm should pass to the west of Western Australia this weekend, but some rain may impact the coast

- Rain

in Western Australia from the storm could boost topsoil moisture, although autumn planting of wheat and barley will not begin before late April - South

Africa weekend precipitation fell in western fringes of summer crop country leaving most other areas dry - Moisture

totals were rarely more than 0.40 inch, but up to 1.07 inches was noted in eastern parts of Northern Cape.

- South

Africa weather will include mild to warm temperatures over the next week ten days while rainfall is sporadic and light.

- The

environment should be good for late season crop development, early crop maturation and harvest progress - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south this week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers and thunderstorms during the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - A

weak tropical disturbance will move into southwestern and west-central Myanmar early this week resulting in some moderate to heavy rainfall, but no crop or property damage is expected - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been most significant in Tanzania - Ethiopia

has been dry biased along with northern Uganda and parts of southwestern Kenya

- Some

rain will develop in Ethiopia, Kenya and Uganda in the coming week easing some dryness, but more will be needed - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +13.73 - The

index will slowly level off this week into early next week and may then move a little more erratically for a while - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; southeastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- EU

weekly grain, oilseed import and export data

Wednesday,

March 23:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Pakistan

Thursday,

March 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

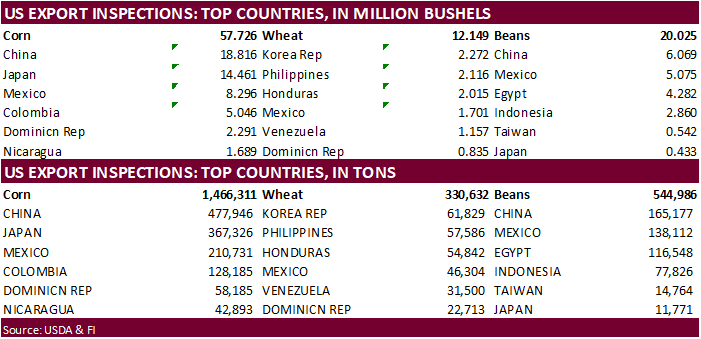

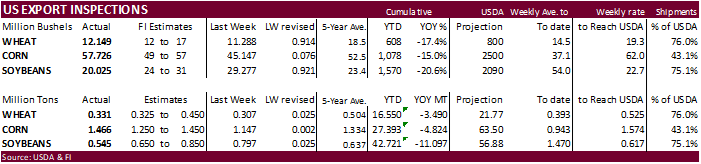

USDA

inspections versus Reuters trade range

Wheat

330,632 versus 275000-500000 range

Corn

1,466,311 versus 1140000-1600000 range

Soybeans

544,986 versus 500000-850000 range

China

was a good buyer of corn and soybeans, but we have yet to see significant wheat sales.

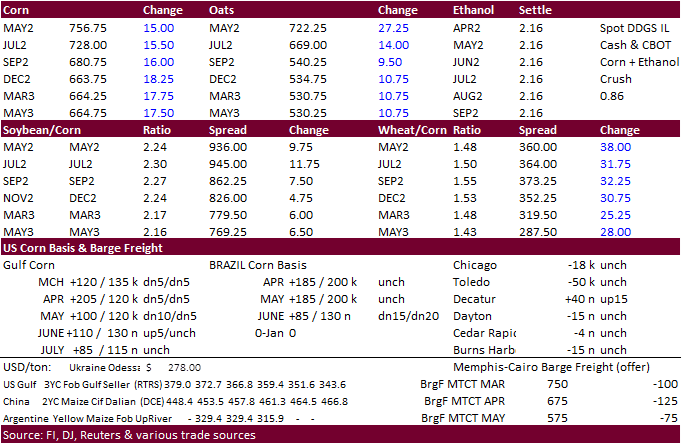

Corn

·

CBOT corn

was higher (bear spreading) following a rally in wheat and concerns Ukraine summer corn production could plummet this year.

·

News was light.

·

USD was higher, WTI crude oil up more than $7.50 and US equities mixed.

·

2022 National Ethanol Conference in New Orleans started this week.

https://www.nationalethanolconference.com/

Export

developments.

·

South Korea’s KOCOPIA bought 60,000 tons of corn from the United States at an estimated $426 a ton c&f for arrival around June 15.

Updated

3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

·

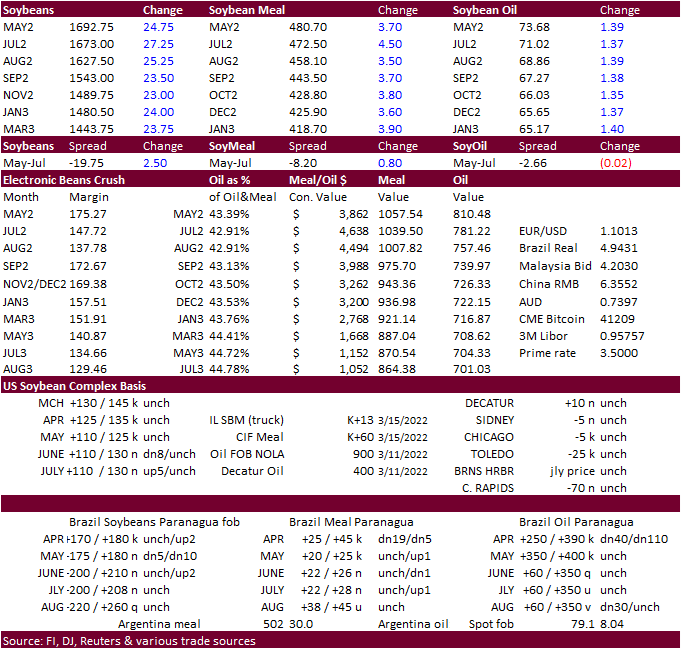

CBOT soybeans at the beginning of the week higher led by the products with traders looking for US meal and soybean oil demand increase after Argentina raised export taxes. CBOT crush basis May was up 9.50 cents to $1.86.

·

Argentina raised export taxes for soybean oil and soybean meal products by 2 points to 33 percent until the end of the year. They are looking to combat inflation, which is running at about 50% annually. Back in 2020 they reduced

taxes. There might be a good amount of pushback by producers and the local crushing association. Some suggest the action is illegal and required a vote.

·

China ended up buying 3.51 million tons of soybeans from Brazil during the Jan-Feb period, more than double year ago.

·

Cargo surveyor SGS reported month to date March 20 Malaysian palm exports at 723,997 tons, 93,091 tons below the same period a month ago or down 11.4%, and 9,671 tons below the same period a year ago or down 1.3%. AmSpec reported

744,841 tons. ITS 755,977 tons, down 8.4 percent.

- Egypt

seeks international and local vegetable oils on Monday. Amounts are unknown.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

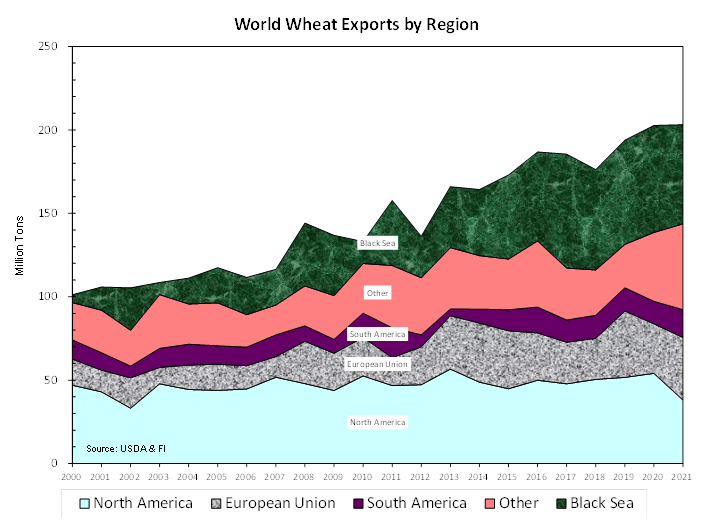

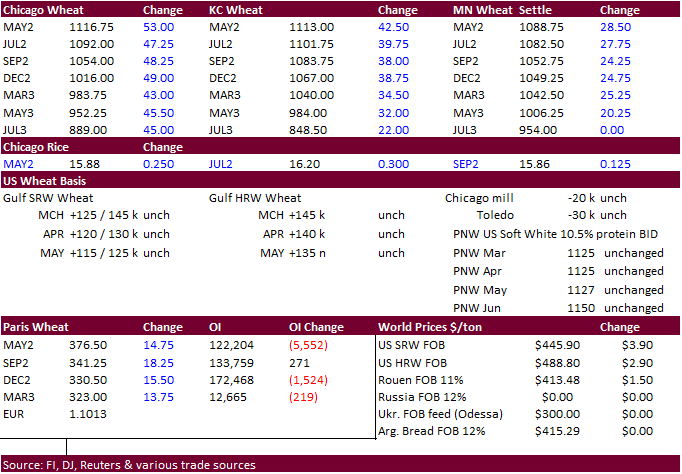

US wheat futures were on strong global export developments and no end in sight with the Ukraine/Russia situation.

·

May Paris wheat closed up 14.75 euros, or 4.08%, at 376.25 euros ($414.89) a ton.

·

India is in talks with Egypt, Turkey, China, Bosnia, Sudan, Nigeria, Iran and other countries to export wheat. The government has started investing in logistics to take advantage of the high global wheat prices.

·

Ukraine’s presidential adviser Oleh Ustenko warned Ukraine may not produce enough crops to export if this year’s sowing campaigns is disrupted by Russia’s special operation. Ukraine dies have enough grain and food reserves for

a year’s worth of consumption.

·

Brazil lowered their wheat import tariff in case they need to import from non-traditional countries.

·

Turkey seeks another 210,000 tons of wheat on March 23

·

The Philippines bought an unspecified amount of Australian wheat. Originally one

tender was for 215,000 tons in four consignments for shipment between May 3 and Aug. 20. The second tender seeks at least 55,000 tons for July/October shipment.

·

South Korean flour millers bought 45,000 tons of wheat from the US for May 16-Jun 15 shipment. Soft white wheat 11% protein was bought near $420s a ton and soft white wheat of 9% protein bought in the mid $470s a ton. Hard red

winter wheat of 11.5% protein was purchased near low $480s a ton and northern spring/dark northern spring wheat of 14% protein in the high $440s a ton. (Reuters)

·

China sold 522,804 tons of wheat on March 16 out of auction, nearly 100 percent of what was offered.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

·

(Reuters) – South Korea’s state-backed Agro-Fisheries & Food Trade Corp. purchased an estimated 26,791 tons of rice to be sourced from Vietnam in an international tender which closed in late February, European traders said on

Monday. The purchase all involved Vietnamese long grain rice, with 9,000 tons bought at $510.70 a ton c&f for arrival in South Korea around June 30, 9,000 tons bought at $507.99 a ton c&f for arrival around Sept. 30 and 8,791 tons bought at $517 a ton c&f

also for arrival around Sept. 30, traders said.

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.