PDF Attached

Attached

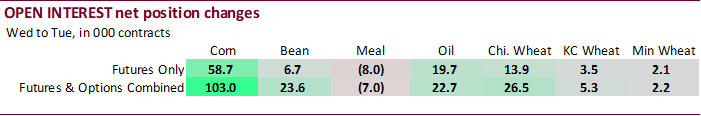

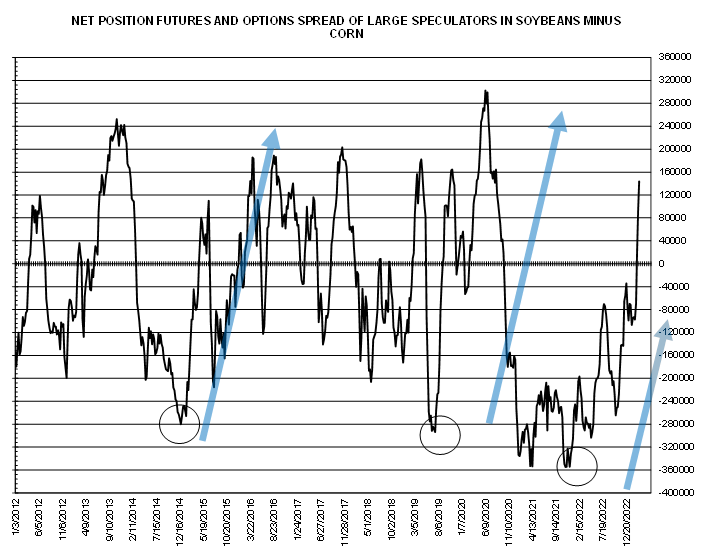

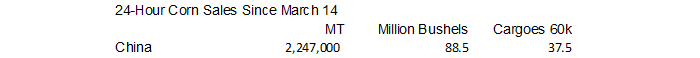

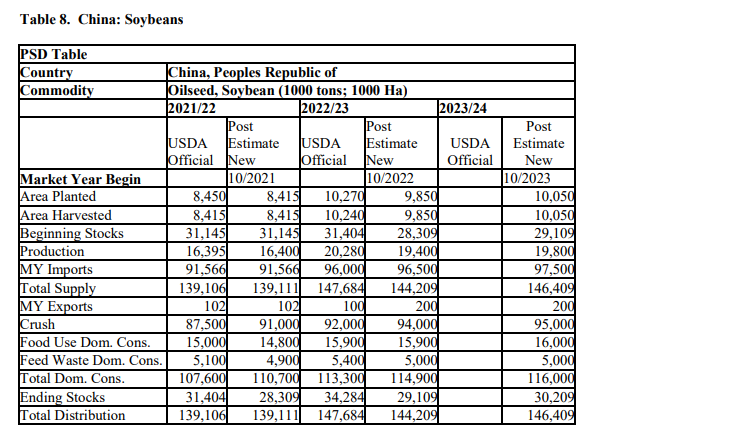

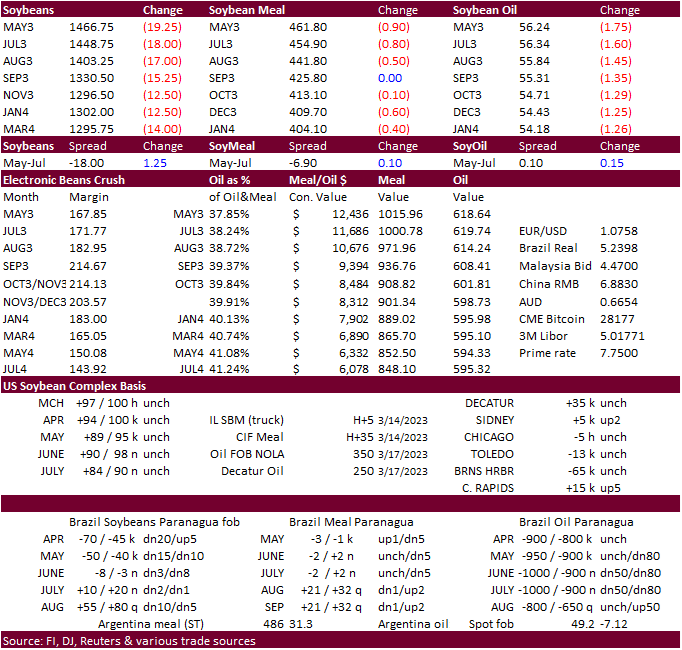

are our updated US 2023 acreage and US soybean complex S&D’ tables. For area, we made a small downward revision to all-wheat (-150), hay, cotton, and soybeans (-300 from previous). CFTC COT report as of March 14 showed another large reduction for corn and

soybean oil longs. The US agriculture markets fell today led by Chicago wheat, soybeans and soybean

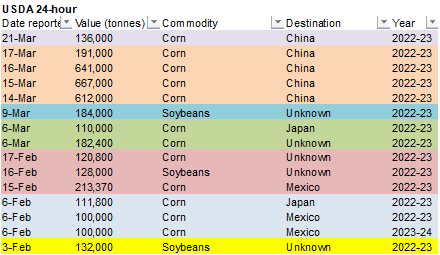

oil. Talk of vegetable oils backing up in Europe and improving selected winter wheat state ratings prompted fund selling, for starters. Soybeans were sharply lower. Losses in corn were limited after USDA reported additional China sales. Private exporters reported

sales of 136,000 tons of corn for delivery to China during the 2022/2023 marketing year.

Weather

World

Weather Inc.

-

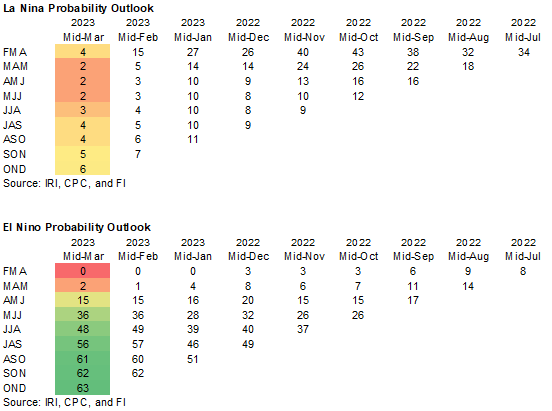

PDO

continues strongly negative and may be a significant influence on spring and summer weather in North America -

NOAA’s

ENSO forecast model continues to show an aggressive forecast for El Nino to be in place during June – World Weather, Inc. still believes the model is being a little too aggressive even though warming in the eastern equatorial Pacific Ocean has been significant

recently along with cooling in the western equatorial Pacific Ocean -

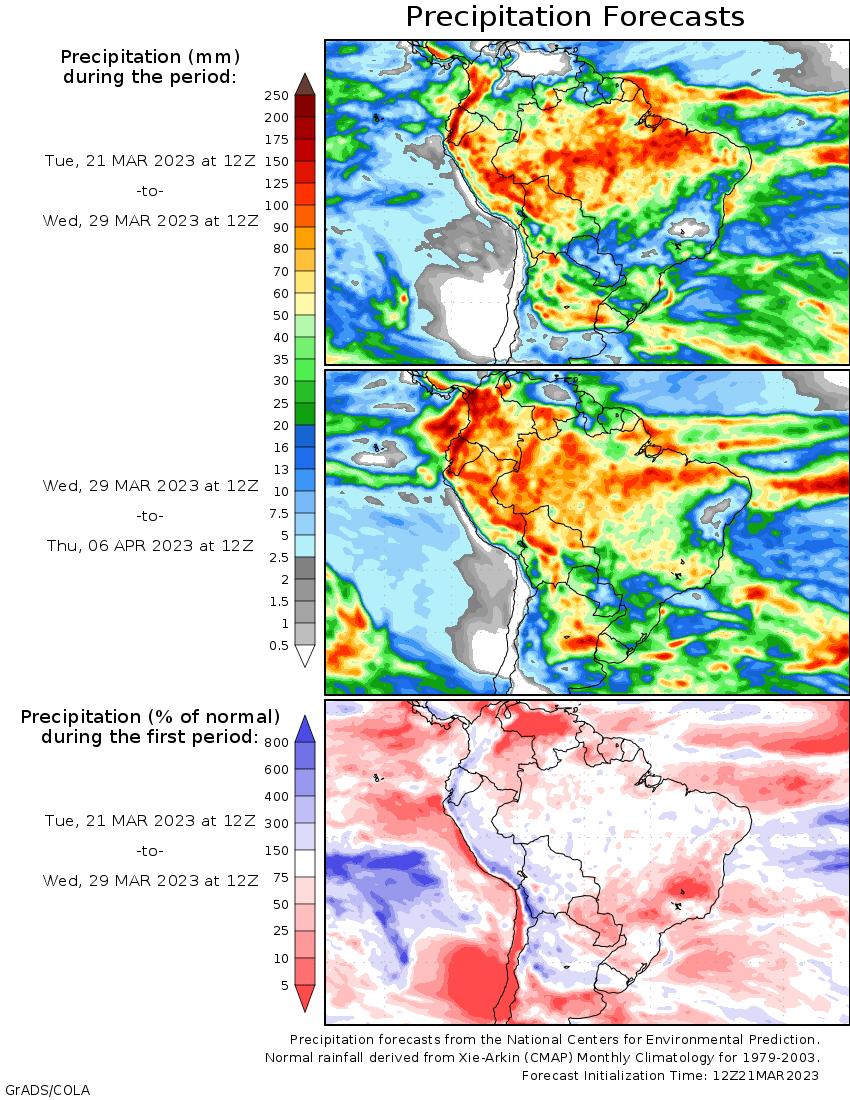

Argentina

is still expecting to receive waves of rain in the central and north over the next ten days that will induce much wetter soil conditions -

Flooding

is not much a concern right now due to the very dry state of the soil, although if heavy rain occurs some temporary flooding will be possible -

Brazil’s

center south crop areas that were too wet for many weeks from Mato Grosso do Sul and Parana into Minas Gerais are drying down favorably this week and that should translate into better late season soybean harvesting and allow any remaining Safrinha crop planting

to conclude soon -

Brazil

monsoonal rainfall is still expected to abate in mid-April adding some pressure on late planted Safrinha crops to produce favorably

-

Unexpected

late season rainfall will be needed during reproduction and filling to get crop yields as high as possible

-

Rio

Grande do Sul, Brazil should get some timely rainfall over the next two weeks to support late season crops.

-

Some

of the rain may be heavy in time -

U.S.

southwestern Plains dryness will continue into the last days of March -

Some

longer range forecast models have been hinting at some potential for better rainfall in April in Texas, Oklahoma and Kansas -

The

forecast is not a very high confident one yet, but it is important to note in previous years of multi-year La Nina that abated in this solar cycle did produce some welcome rain -

The

strongly negative PDO of this year, however, may work against some of that potential rainfall and the situation needs to be closely monitored -

U.S.

flood potentials in the Red River Basin of the North are still high and rising with another 2 to 8 inches of snowfall expected to accumulate there by Friday with much of that occurring this afternoon and tonight -

The

speed in which the snow melts and whether or not there is any rain that accompanies the snowmelt season will determine much about the flood potential and the extent of it -

Flooding

from the Red River of the North is also expected to impact southern Manitoba, Canada later this spring as the river flows northward into Lake Winnipeg.

-

Upper

portions of the Mississippi River Basin may also be threatened with significant runoff and possible flooding in April -

The

region needs to be closely monitored, although the Mississippi should be low enough to handle most of the flood water and the soil in the upper Midwest still has room to absorb some of the snowmelt -

California

flooding is a viable concern too for this spring as significant mountain snowpack runs off into water reservoirs that are likely to become full -

India’s

reports of crop damage were numerous Monday following the rain and thunderstorm activity during the weekend; however, the damage may not be as extensive as some articles have suggested -

India

will continue to receive periodic rainfall in the next ten days especially in northern and eastern parts of the nation possibly raising more concern over winter crop conditions -

North

Africa will continue dealing with dryness over the next ten days with temperatures ebbing a little warmer than usual -

Crop

moisture stress is already an issue for interior Tunisia and portions of Morocco and Algeria, although Tunisia will likely experience the greatest decline in potential production relative to that of last year.

-

China

rainfall over the next ten days will be greatest in the southern half of the Yangtze River Basin and southern coastal provinces benefiting rapeseed development and early season rice planting -

Additional

rain totals of 3.00 to 8.00 inches may occur near and south of the Yangtze River reaching into Guangdong, Fujian and Zhejiang -

Limited

precipitation in the lower Yellow River Basin and North China Plain will leave some wheat areas in need or greater precipitation especially in April -

Cooling

is expected in eastern China late this week into next week which may help to slow drying rates in winter wheat areas of the north and conserve soil moisture in the south -

CIS

precipitation decreased during the weekend and remained light Monday especially in the west which may have helped reduce flooding as snow continued to melt.

-

Very

few freezes occurred overnight last night keeping the snow melt ongoing -

CIS

temperatures will continue warmer than usual in the west over the next week to ten days -

Precipitation

will be restricted this workweek, but it will increase during the weekend and next week raising runoff once again -

Some

additional flooding will occur as temperatures trend warmer and precipitation increases once again -

Europe

will continue warmer and drier than usual for a few more days and then precipitation will increase in the north and west-central parts of the continent late this week into next week

-

Temperatures

will begin cooling next week as precipitation increases -

Eastern

Spain will remain one of the driest areas in the continent for a while possibly threatening dryland winter crops and some of the planting of spring crops -

West-central

Africa precipitation will be sporadic and light for another day or two, but will increase late this week and continue into next week -

Recent

precipitation has been lighter than usual and temperatures warmer biased raising some concern over crop development -

Rain

later this week into next week will be very important for coffee, cocoa, rice and sugarcane -

Australia

rainfall will resume in the southeast during mid- to late week this week and then to southeastern Queensland and northeastern New South Wales next week

-

Temperatures

will continue warmer than usual this week and then trend a little cooler this weekend and next week – at least in eastern crop areas -

Mexico

is still dealing with a winter drought and there is need for precipitation to support corn, sorghum and cotton in unirrigated areas -

There

is also need for moisture in some citrus and sugarcane areas, although the situation for these two crops is not critical outside of the far northeast part of the nation -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in Honduras and Nicaragua -

Drought

continues a concern in Canada’s southwestern Prairies -

Some

snow fell earlier this month in a part of the drought region, but snow water equivalents were not great enough to offer a tremendous improvement, although some benefit did occur as the snow melted -

Not

much precipitation of significance will occur in the dry areas over the next week, although some light precipitation will be possible infrequently -

Greater

precipitation may occur in the last days of March and early April -

Drought

in the U.S. western Plains is the most serious out of all dryness in North America,

but it could also be fixed faster than some other areas because “normal” rainfall is not all that great -

Dryness

is most serious from West Texas cotton and wheat areas north into western Kansas and eastern Colorado, although a part of the region from western Nebraska to Montana is also considered to be too dry -

Relief

from dryness in the southwestern Plains is unlikely in the next ten days and probably longer -

Some

rain and snow will fall in Nebraska, Kansas and Colorado periodically over the next ten days, but serious relief from drought may be difficult to come by

-

“Partial”

relief from dryness is possible in “some” areas -

U.S.

southeastern states had been drying out in recent weeks, but the region has not been seriously impacted except in Florida where drought is a concern for long term crop development -

Relief

is expected in the interior southeastern parts of the United States in the coming ten days to two weeks with rain likely in many areas, but some areas will get more rain than others -

Florida

will get the least amount of rain and will continue notably drier biased -

Southern

U.S. Plains, Delta and southeastern States to be quick in heating back up this week with 70- and 80-degree highs expected by mid-week and will last into the weekend before cooling again next week -

South

Texas and the Texas Coastal Bend planting of corn, sorghum and some cotton is underway, but dryland production areas (especially in the south) need significant rain -

Some

precipitation is expected over the next ten days, but it has been reduced from that of last week and much more will be needed to bolster soil moisture for long term crop development especially in unirrigated areas -

Portions

of the U.S. Midwest, Delta and Tennessee River Basin are quite wet and need drier weather to improve planting conditions in the next few weeks -

South

Africa crop weather has been very good this year, although the nation is drying out now -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects on fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after weekend rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will also experience a boost in precipitation -

Syria,

northern Iraq and much of Iran will receive significant rainfall as will some areas in Afghanistan and northern Pakistan -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will receive very little rain of significance through Sunday, but a notable boost in rain may occur in the last days of this month -

Eastern

Africa precipitation is expected to scatter from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -0.38 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Wednesday,

March 22:

- EIA

weekly US ethanol inventories, production, 10:30am - EARNINGS:

Syngenta - HOLIDAY:

Indonesia

Thursday,

March 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Rabobank

Farm2Fork Summit, Sydney - Russian

Grain Union holds conference in Kazan - Brazil’s

Unica may release cane crush and sugar output data (tentative) - USDA

red meat production, 3pm - US

cold storage data for pork, poultry and beef, 3pm - HOLIDAY:

Indonesia

Friday,

March 24:

- Marine

Insurance London conference - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - US

poultry slaughter - HOLIDAY:

Argentina

Source:

Bloomberg and FI

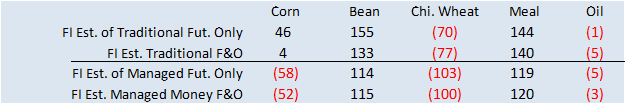

CFTC

Commitment of Traders

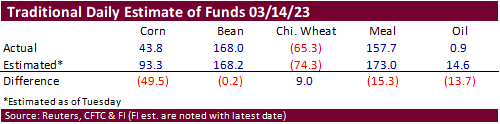

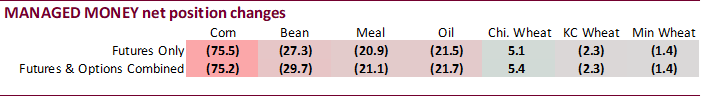

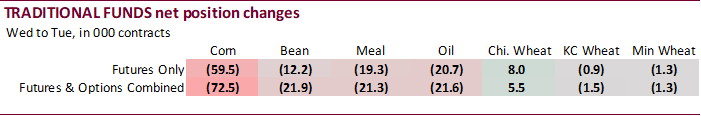

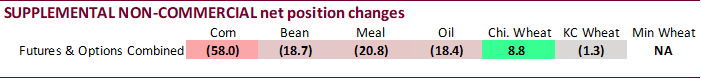

The

net long position for corn and soybean oil really took a hit over the past 4 weeks (might be related to crude oil).

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

-77,633 -58,021 298,363 -13,468 -153,888 73,554

Soybeans

110,690 -18,657 127,514 -6,983 -195,006 24,573

Soyoil

-23,589 -18,395 98,897 -2,263 -75,866 22,245

CBOT

wheat -87,954 8,823 81,916 -5,368 4,224 -1,822

KCBT

wheat -21,245 -1,315 42,743 -720 -20,104 1,647

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-54,134

-75,192 230,515 8,766 -165,518 65,848

Soybeans

127,661 -29,669 94,280 -2,505 -196,708 23,336

Soymeal

133,970 -21,094 82,920 2,907 -255,693 18,927

Soyoil

-1,189 -21,715 102,967 701 -101,002 22,460

CBOT

wheat -95,257 5,379 64,592 329 5,446 -4,166

KCBT

wheat -12,732 -2,313 36,144 -158 -22,286 1,286

MGEX

wheat -4,447 -1,418 1,320 -32 1,348 1,410

———- ———- ———- ———- ———- ———-

Total

wheat -112,436 1,648 102,056 139 -15,492 -1,470

Live

cattle 92,565 -20,040 46,276 -1,496 -149,701 16,851

Feeder

cattle 10,368 83 1,600 -58 -3,215 -2,053

Lean

hogs 2,136 4,215 46,958 1,587 -46,871 -5,079

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

55,980 2,644 -66,842 -2,066 1,667,603 103,001

Soybeans

17,964 7,771 -43,196 1,066 840,290 23,599

Soymeal

19,585 -251 19,218 -489 489,810 -6,966

Soyoil

-1,334 139 557 -1,587 501,748 22,739

CBOT

wheat 23,405 90 1,813 -1,633 459,299 26,549

KCBT

wheat 268 797 -1,393 387 191,175 5,305

MGEX

wheat 3,098 120 -1,319 -80 57,302 2,172

———- ———- ———- ———- ———- ———-

Total

wheat 26,771 1,007 -899 -1,326 707,776 34,026

Live

cattle 23,559 2,879 -12,701 1,806 421,743 -15,508

Feeder

cattle 2,768 1,692 -11,520 335 75,782 4,965

Lean

hogs -2,082 -33 -141 -690 282,563 -6,500

FI

Corn

91.000

Soybeans

89.000

All-wheat

49.850

Allendale

Corn

90.414

Soybeans

87.768

All-wheat

48.706

S&P

Corn

90.900

Soybeans

88.200

All-wheat

49.247

104

Counterparties Take $2.195 Tln At Fed Reverse Repo Op. (prev $2.098 Tln, 97 Bids)

US

Existing Home Sales Feb: 4.58M (est 4.2M; prev 4.0M)

US

Existing Home Sales (M/M) Feb: 14.5% (est 5.0%; prev -0.7%)

US

Feb National Median Home Price For Existing Homes $363,000, -0.2% From Feb 2022 (prev $359,000)

Canadian

CPI NSA (M/M) Feb: 0.4% (est 0.5%; prev 0.5%)

Canadian

CPI (Y/Y) Feb: 5.2% (est 5.4%; prev 5.9%)

Canadian

CPI Core- Median (Y/Y) Feb: 4.9% (est 4.8%; prev 5.0%)

Canadian

CPI Core- Trim (Y/Y) Feb: 4.8% (est 4.9%; prev 5.1%)

·

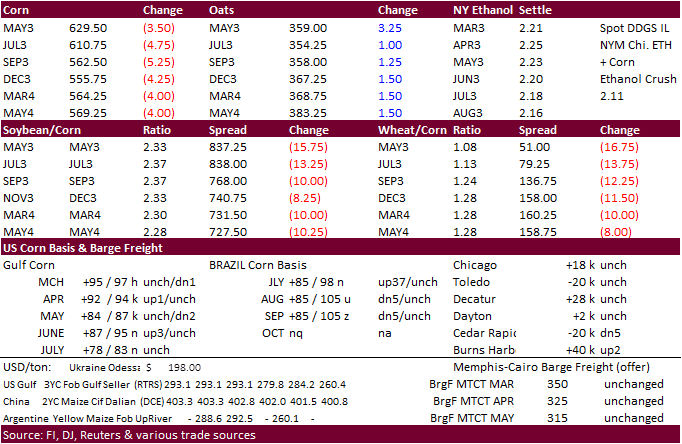

Corn traded lower on fund selling but losses were limited from China buying additional US corn and higher WTI crude oil. News was light. Funds sold an estimated net 3,000 corn contracts.

·

The US is expected to see additional rain over the next week that should help set up favorable early crop development if plantings get in at a timely manner.

·

Trade estimates for US acreage should be out later this week. Early estimates for the US corn crop call for over 90 million acres. Note the survey was conducted from March 1 to March 14. The acreage fight is not over. There is

still some time to switch to soybeans. The new-crop ratio is 2.33, lowest in a month.

·

Anec: Brazil corn exports seen reaching up to 898,632 tons in March versus up to 845,063 tons forecast in previous week.

·

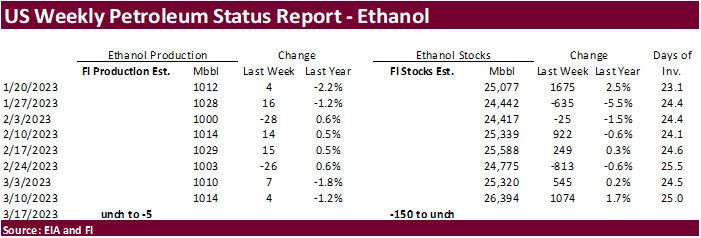

A Bloomberg poll looks for weekly US ethanol production to be up 8,000 thousand barrels to 1022k (1012-1025 range) from the previous week and stocks down 400,000 barrels to 25.994 million.

·

US corn plantings:

TX

40% vs. 35% average

LA

87%

MS

7%

AR

1%

Export

developments.

-

USDA:

Private exporters reported sales of 136,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

·

Soybeans traded sharply lower from weakness in soybean oil and upward revision to the Brazil soybean crop by Agroconsult. There were rumors again China might be in for US soybeans, but there were no USDA announcements. Soybean

spreads saw a slight correction today. Crush margins fell led by the May position. Funds sold an estimated net 9,000 soybean contracts, 1,000 meal and 6,000 soybean oil.

·

Despite favorable rain falling across Argentina over the weekend with additional precipitation expected this week, we are hearing it’s too late to improve crop conditions. This morning it was noted recently harvested soybeans

are coming in green.

·

Producer selling is still slow in Argentina as they are likely waiting to see if a new soybean dollar will be rolled out.

·

Soybean oil was lower on product spreading and talk of slowing US renewable biofuel expansion. We heard Low Carbon Fuel Standard Credit prices dropped to their lowest level since 2015 after dropping about 12 percent from the previous

month.

·

We also caught wind that vegetable oil supplies are starting to flood the EU market.

·

A slowdown in US crush is not seen over the short term. We are slightly higher than USDA for product crush for the current marketing year. Although US soybean meal export headlines have settled down over the last week.

·

Agroconsult estimated the Brazil 2022-23 soybean crop at 155 million tons, up from 153 previous. They pegged Brazil soybean exports at 96 million tons and corn exports at 51.9 million.

·

Anec: Brazil soy exports seen reaching 15.388 million tons in March versus 14.893 million tons forecast in previous week.

·

Anec: Brazil soymeal exports seen reaching 1.787 million tons in March versus 2.091 million tons forecast in previous week.

·

Cargo surveyor SGS reported month to date March 20 Malaysian palm exports at 929,274 tons, 216,534 tons above the same period a month ago or up 30.4%, and 205,277 tons above the same period a year ago or up 28.4%.

·

The USDA Attaché sees new-crop Indonesia palm oil production at 46 million tons, 3 percent increase from 2022-23.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Annual_Jakarta_Indonesia_ID2023-0005

China

Attaché: Oilseeds and Products Annual

Imports

boosted to 97 million tons (92 year earlier)

Export

Developments

·

None reported

Updated

03/21/23

Soybeans

– May $14.00-$15.50

Soybean

meal – May $425-$500

Soybean

oil – May 52-58

Wheat

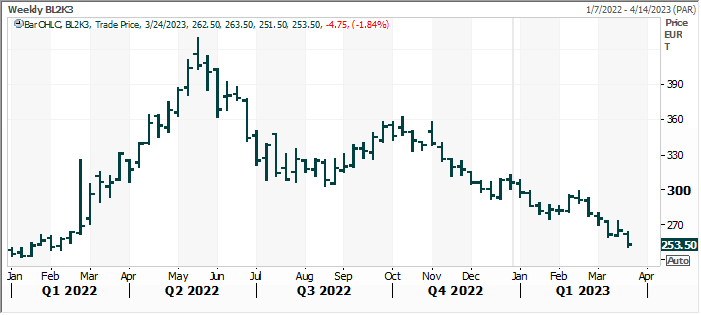

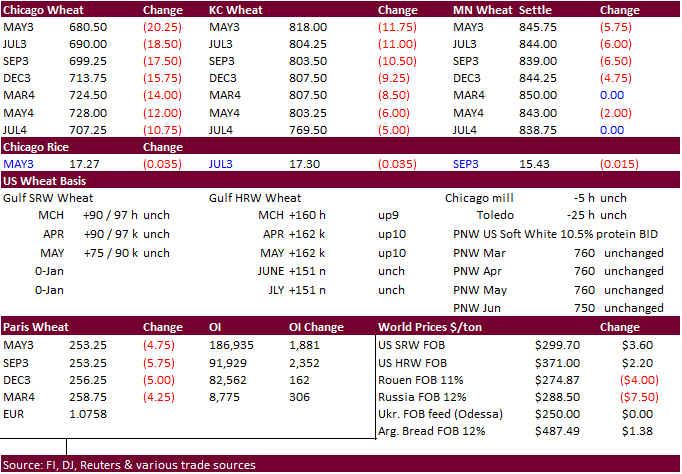

·

US wheat futures started the day higher but swiftly fell on fund selling. Positioning ahead of the USDA reports next week was likely. Funds are holding a large short position in wheat so don’t discount short covering later this

week. USDA reported a general improvement in US wheat conditions, but many states remain at historically low levels for the G/E categories. EU wheat fell again and settled near its 18 month low.

·

US winter wheat ratings on a national basis resume early April. For late November 2022, before the crop went into dormancy, were nationally rated 34 percent G/E, lowest since 2012, according to Reuters.

·

May Paris milling wheat officially closed down 4.75 euros, or 1.8%, at 253.50 euros a ton (about $272.79/ton).

·

Anec: Brazil wheat exports seen reaching 727,815 tons in March versus 728,594 tons forecast in previous week.

·

Ukraine grain exports stand at 35.8 million tons, down 20 percent from the same period year earlier.

o

21m tons of corn, up 2% y/y

o

12.3m tons of wheat, down 34% y/y

o

2.2m tons of barley, down 61% y/y (Bloomberg)

Bloomberg

Good/Excellent W/w Change

Kansas 19% +2

Oklahoma 29% -1

Texas 23% +6

Colorado 36% -4

EU

wheat

·

Jordan passed on 120,000 tons of milling wheat for Sep-Oct shipment.

·

Jordan seeks 120,000 tons of feed barley on March 22.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 22.

Rice/Other

·

South Korea seeks 121,800 tons of rice, most of it from China, on March 21.

Updated

03/21/23

KC

– May $7.60-$8.75

MN

– May

$8.00-$9.50

#non-promo