PDF Attached

I

will be out part of Wednesday attending a personal matter.

USDA

reported under their 24-hour reporting system 240,000 tons of soybeans for delivery to unknown for 2021-22 delivery.

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat areas received rain and snow Monday and early today - The

precipitation was a little lighter than expected in a part of the west-central high Plains region while significant in the east - Rain

totals were less than 0.50 inch in western Kansas and some immediate neighboring areas as well as areas southwest into the northwestern Texas Panhandle - Moisture

totals of 1.00 to more than 2.00 inches occurred from south-central Oklahoma into southeastern wheat areas of Kansas - East-central

and southeastern parts of the Texas Panhandle received more than 1.00 inch of moisture - The

bottom line for hard red winter wheat areas after recent waves of rain and snow is one of improved soil moisture which will result in better greening conditions and a great opportunity for crop repair to begin. Root and leaf mass repair is already beginning,

and new tillers will likely be set in areas that have had the biggest boost in soil moisture recently. The more favorable weather of late must continue through the next few weeks to restore production potential and World Weather, Inc. believes a turn back

to drier and warmer biased conditions will likely occur in the second half of April – if not a little sooner. Short term improvements in crop conditions are certainly expected. More moisture is needed, but the environment has certainly improved for the near

term. - Not

much rain is expected in West or South Texas and the lower Texas Coastal Bend area will also receive restricted moisture - U.S.

Delta, Tennessee River Basin and a few neighboring areas will be too wet for a while the remainder of this week - Saturated

soil and some flooding is already underway and additional rainfall today and early Wednesday is likely to have some impact on worsening the flood situation for a little while - Better

weather should evolve later this week into the weekend - U.S.

southeastern states will get a good mix of rain and sunshine during the next ten days defying a more traditional dry biased pattern that is normally associated with spring La Nina events - California

has potential to receive some much needed moisture during the late weekend and early part of next week - The

moisture will be welcome, but not nearly enough to change water supply or the status of drought - Frequent

follow up rain is needed and not likely - U.S.

northwestern Plains and southwestern Canada’s Prairies are unlikely to receive significant moisture through the coming week, but parts of the region may get a little moisture in the following week - U.S.

Midwest crop areas will get sufficient rain and snow to maintain moisture abundance in the east and to lift topsoil moisture in the west - Some

of the improving soil moisture trend has already begun in the western Corn Belt with the latest rain and snow event

- Argentina

will experience rain in the northeast today and Wednesday and over a larger part of eastern Argentina late Wednesday into Thursday before occurring in La Pampa and Buenos Aires Thursday into Friday - Significant

relief to dryness is expected in southwestern parts of Argentina where little precipitation has fallen recently

- Rain

in northeastern and east-central Argentina will maintain moisture abundance for future crop use

- Argentina’s

weather this weekend and next week should trend drier, although some rain may fall briefly early next week and east-central parts of the nation once again - Most

of Brazil will receive significant rain during the next ten days - All

areas will benefit except from central and northern Minas Gerais into central Bahia where little rain is likely - Some

of this region is already quite dry and minor grain, oilseeds, coffee and sugarcane are being stressed by the drier weather - This

trend will continue for the next ten days to possibly two weeks - Europe

rainfall this week is expected mostly in Rain Spain and Portugal while any showers that occur elsewhere (and there will be some) are expected to be too light and brief to have much impact on soil moisture which should slowly decline - A

few east-central Spain coastal areas may get more than 5.00 inches of rain resulting in some flooding - Temperatures

will be near to above normal this week and probably next week as well - Much

of Russia, Ukraine, northern Kazakhstan, Belarus and the Baltic States were dry again Monday as they were during the weekend while a little rain fell in southern parts of Russia’s Southern Region and areas east into southeastern Kazakhstan - Temperatures

have been warming sufficiently to melt snow in western Russia where highest temperatures were in the 40s and 50s Fahrenheit.

- Some

increase in precipitation is expected in the CIS this weekend and next week as waves of snow and rain evolve across the region - Temperatures

will be seasonable, although trending cooler this weekend into next week - India

weather will continue mostly dry and seasonably warm to hot through the next ten days

- There

is some risk of showers and thunderstorms in Kerala and immediate neighboring areas of Karnataka and Tamil Nadu as well as in the far Eastern States and extreme northern most parts of the nation - China’s

rain Monday was greatest in the Yangtze River Basin 1.00 to 5.00 inches resulted - The

rainy weather started during the weekend north of the Yangtze River and it was expected to advance to the south over the next few days - Flooding

is expected to continue today and then begin to diminish thereafter - Southeastern

China will experience waves of rain for a while and some of it will be heavy in the coastal provinces - Flooding

will be possible along with some delay to early rice and corn planting progress - Less

rain in the Yangtze River Basin will help rapeseed and minor wheat conditions improve - Australia

rainfall this weekend into early next week will be light and sporadic enough to limit its impact on maturing cotton and sorghum - Some

temporary discoloring of cotton fiber is possible - Tropical

Cyclone Charlotte is still advertised to stay west of Australia over the next several days - The

storm should only produce light rain in the southwestern coastal areas of the nation as it passes by late this week and into the weekend - Rain

in Western Australia from the storm could boost topsoil moisture, although autumn planting of wheat and barley will not begin before late April - South

Africa weather will include mild to warm temperatures over the next week ten days while rainfall is sporadic and light.

- The

environment should be good for late season crop development, early crop maturation and harvest progress - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south this week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers and thunderstorms during the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been most significant in Tanzania - Ethiopia

has been dry biased along with northern Uganda and parts of southwestern Kenya

- Some

rain will develop in Ethiopia, Kenya and Uganda in the coming week easing some dryness, but more will be needed - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +13.81 - The

index will slowly level off this week into early next week and may then move a little more erratically for a while - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; southeastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

- EU

weekly grain, oilseed import and export data

Wednesday,

March 23:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Pakistan

Thursday,

March 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

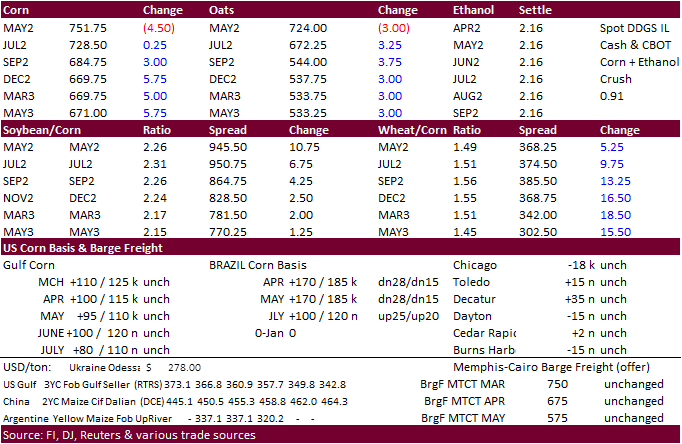

Corn

·

CBOT corn

was higher for the back months (May 3.25 cents lower) on follow through. May traded two-sided by early morning. The bear spreading was in part to weakness in lower spot energy prices.

·

US feed demand destruction is in play with another major bird house culling units after a bird flu outbreak.

·

South Dakota Kills 85,000 Birds as Avian Flu Outbreak Spreads to State – Newsweek

https://www.newsweek.com/south-dakota-kills-85000-birds-avian-flu-outbreak-spreads-state-1690016

·

Problem we see is that corn is more sensitive to the Black Sea supply crisis and energy prices rather than the underlying industrial and feed fundamentals.

·

Traders should monitor the EU if shipments increase amid Black Sea supply constraints. We heard Spain may have bought more than expected US corn but waiting for confirmation. The GMO issue remains in place.

·

CP’s rail worker strike in day 2 is already getting the trade nervous over grain and fertilizer shipments.

·

A Bloomberg poll looks for weekly US ethanol production to be up 2,000 barrels to 1.028 million (1015-1038 range) from the previous week and stocks up 145,000 barrels to 26.090 million.

Export

developments.

- Turkey

seeks 325,000 tons of corn on March 28. Optional origin for April 8 and May 5 shipment. They also seek 175 tons of local corn. 500k total makes us wonder if they are covered for reserves.

Updated

3/14/22

May

corn is seen in a $6.75 and $8.40 range

December

corn is seen in a wide $5.50-$7.50 range

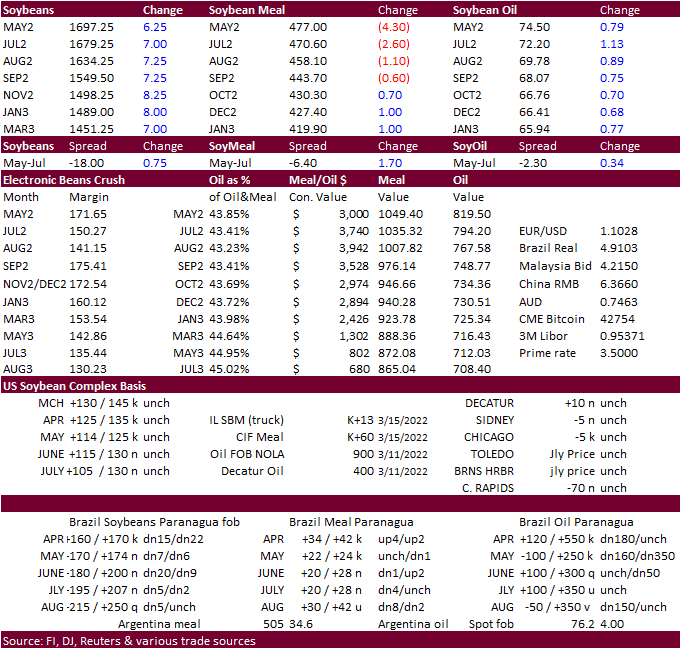

·

CBOT soybeans were higher on follow through bullish sentiment amid Argentina product shipment concerns. Nearby meal is lower on technical selling and product spreading. Egypt’s import tender for vegetable oils are fetching high

prices.

·

Spot US corn and soybean basis was unchanged to higher on Tuesday.

- Egypt

bought 80,000 tons of vegetable oils for arrival May 5-25. - USDA

reported under their 24-hour reporting system 240,000 tons of soybeans for delivery to unknown for 2021-22 delivery.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

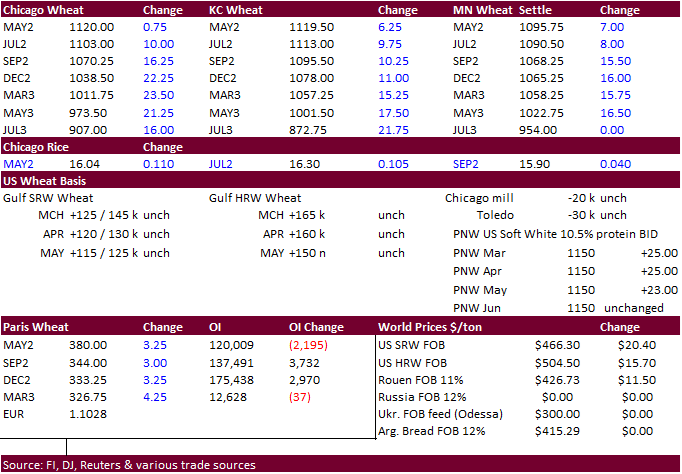

·

US wheat futures were mostly higher on follow through buying with little developments in news. Escalating Black Sea conflict is the main driver.

·

There are concerns Ukraine’s grain harvest could be halved this year. If realized, look for a 20+ million ton trade flow shift to other countries.

·

May Paris wheat futures were up 3.25 euros to 379 euros.

·

Iraq may need to buy more wheat as stockpiles are apparently less than three months of consumption.

·

Iraq extended their deadline to buy 50,000 tons of hard milling wheat until March 22.

·

Lebanon is in talks with India to buy wheat, but payment arrangements need to be sorted out.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

·

Turkey seeks another 210,000 tons of wheat on March 23.

·

Jordan seeks 120,000 tons of barley on March 23. Possible shipment combinations are between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4.

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.