PDF Attached

FOMC

Hikes By 25Bps; Target Range Stands At 4.75% – 5.00%

–

Interest Rate On Reserves Balances Raised By 25Bps To 4.90%

Attached

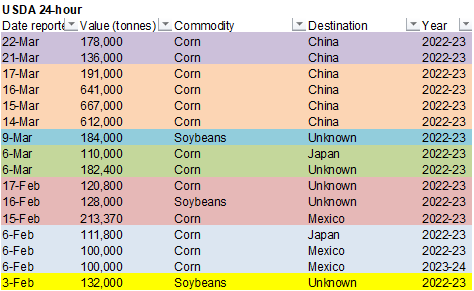

are our US corn and wheat S&D’s. USDA: Private exporters reported sales of 178,000 metric tons of corn for delivery to China during the 2022/2023 marketing year. US agriculture commodities were mostly lower on long liquidation for various reasons. Corn ended

mixed with May and July higher after China confirmed additional US corn purchases. Wheat and soybeans were sharply lower. Oats ended higher. Inflation remains a concern for major global economies. US wheat country will see additional rain this week, but the

southwestern growing areas may see the least amount. EU weather is favorable. It’s mostly dry for Western Canada.

Weather

World

Weather Inc.

-

Heavy

rain fell across portions of central Argentina Tuesday and early today -

7.72

inches of rain fell near the northeastern San Luis/Cordoba border while many other 1.00 to more than 3.00-inch totals were noted surrounded by 0.60- to 1.80-inch amounts -

The

region from Cordoba to central Entre Rios was most impacted -

The

remainder of Argentina was dry and temperatures turned much cooler in the heavy rain areas with highs in the 60s and 70s -

Warm

temperatures continued elsewhere with 90s to near 100 in the north and 70s farther south -

Argentina

weather will continue active with additional rain expected in some central and northern parts of the nation during the coming week -

The

additional precipitation will further expand the area impacted by improved rainfall and better soil moisture -

Much

of the rain in Argentina comes too late for serious improvement in nationwide summer crop production, but a few late season crops will benefit greatly -

Southern

Argentina will dry out for a while with little to no rain for the next week and possibly a little longer -

Central

Brazil crop areas from Mato Grosso do Sul and Parana to Minas Gerais will not receive much rain for a while -

The

next ten days will bring along some welcome drying favoring late season soybean harvesting and any unplanted Safrinha corn will be planted as well -

This

region was already drying down during the weekend and over the past two days -

Rain

will fall periodically in northern Brazil crop areas during the next ten days and some rain from Argentina will reach into Rio Grande do Sul, Brazil as well -

These

areas will experience ongoing favorable crop development conditions -

Some

delay to farming activity is likely periodically from Mato Grosso through Tocantins to Maranhao and Piaui -

North

Africa will continue dry for the next ten days continuing to pressure wheat and barley yields lower -

Pakistan

will receive significant rainfall over the next few days resulting in a notable boost in soil moisture and some increase in mountain snowpack in the north -

The

moisture will be good for water supply, but not so great for maturing wheat

-

Wheat

quality declines are likely -

The

moisture will be good for early season cotton planting and development -

Northern

India will receive significant rain again Thursday into Saturday raising the potential for more damaging weather -

Far

northern Uttar Pradesh, Uttarakhand, Himachal Pradesh, Punjab, Haryana and portions of Himachal Pradesh were most impacted by rain and hail last weekend and they will receive another 0.30 to 1.25 inches of rain with a few amounts to 1.50 inches -

The

additional precipitation will add to damage in grain quality that began last weekend

-

Some

production cuts are possible -

Rapeseed

and mustard quality may also be negative impacted along with a few pulse crops -

Southern

India will also experience some additional rain in the coming week that will benefit some rice and sugarcane, but may also threaten the quality of a few crops -

Northwestern

Russia continues to experience snowmelt and significant runoff -

Rain

is expected to develop during the weekend and last through most of next week resulting in some significant additional runoff that may worsen flooding that may already be under way -

U.S.

southwestern Plains dryness will continue into the last days of March -

Some

longer range forecast models have been hinting at some potential for better rainfall in April in Texas, Oklahoma and Kansas -

The

forecast is not a very high confident one yet, but it is important to note in previous years of multi-year La Nina that abated in this solar cycle did produce some welcome rain -

The

strongly negative PDO of this year, however, may work against some of that potential rainfall and the situation needs to be closely monitored -

U.S.

flood potentials in the Red River Basin of the North are still high and rising with another 2 to 7 inches of snowfall occurring overnight with up to 0.65 inch of moisture in it -

The

speed in which the snow melts and whether or not there is any rain that accompanies the snowmelt season will determine much about the flood potential and the extent of it -

Flooding

from the Red River of the North is also expected to impact southern Manitoba, Canada later this spring as the river flows northward into Lake Winnipeg.

-

Upper

portions of the Mississippi River Basin may also be threatened with significant runoff and possible flooding in April -

The

region needs to be closely monitored, although the Mississippi should be low enough to handle most of the flood water and the soil in the upper Midwest still has room to absorb some of the snowmelt -

California

flooding is a viable concern too for this spring as significant mountain snowpack runs off into water reservoirs that are likely to become full -

China

rainfall over the next ten days will be greatest in the southern half of the Yangtze River Basin and southern coastal provinces benefiting rapeseed development and early season rice planting -

Additional

rain totals of 3.00 to 8.00 inches may occur near and south of the Yangtze River reaching into Guangdong, Fujian and Zhejiang -

Limited

precipitation in the lower Yellow River Basin and North China Plain will leave some wheat areas in need or greater precipitation especially in April -

Cooling

is expected in eastern China late this week into next week which may help to slow drying rates in winter wheat areas of the north and conserve soil moisture in the south -

Europe

will continue warmer and drier than usual for a few more days and then precipitation will increase in the north and west-central parts of the continent late this week into next week

-

Temperatures

will begin cooling next week as precipitation increases -

Eastern

Spain will remain one of the driest areas in the continent for a while possibly threatening dryland winter crops and some of the planting of spring crops -

West-central

Africa precipitation will be sporadic and light for another day or two, but will increase late this week and continue into next week -

Recent

precipitation has been lighter than usual and temperatures warmer biased raising some concern over crop development -

Rain

later this week into next week will be very important for coffee, cocoa, rice and sugarcane -

Australia

rainfall resumed in the southeast overnight and it will continue into late week this week and then it may expand into southeastern Queensland and northeastern New South Wales next week

-

Temperatures

will continue warmer than usual this week and then trend a little cooler this weekend and next week – at least in eastern crop areas -

Mexico

is still dealing with a winter drought and there is need for precipitation to support corn, sorghum and cotton in unirrigated areas -

There

is also need for moisture in some citrus and sugarcane areas, although the situation for these two crops is not critical outside of the far northeast part of the nation -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in Honduras and Nicaragua -

Drought

continues a concern in Canada’s southwestern Prairies -

Some

snow fell earlier this month in a part of the drought region, but snow water equivalents were not great enough to offer a tremendous improvement, although some benefit did occur as the snow melted -

Not

much precipitation of significance will occur in the dry areas over the next week, although some light precipitation will be possible infrequently -

Greater

precipitation may occur in the last days of March and early April -

U.S.

Delta, Tennessee River Basin and lower eastern Midwest will be quite wet over the next ten days -

Delays

in spring planting is likely and a few areas of light flooding will result -

Southern

U.S. Plains, Delta and southeastern States to be quick in heating back up this week with 70- and 80-degree highs expected by mid-week and will last into the weekend before cooling again next week -

South

Texas and the Texas Coastal Bend planting of corn, sorghum and some cotton is underway, but dryland production areas (especially in the south) need significant rain -

Some

precipitation is expected over the next ten days, but it has been reduced from that of last week and much more will be needed to bolster soil moisture for long term crop development especially in unirrigated areas -

South

Africa crop weather has been very good this year, although the nation is drying out now -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects on fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after weekend rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will also experience a boost in precipitation -

Syria,

northern Iraq and much of Iran will receive significant rainfall as will some areas in Afghanistan and northern Pakistan -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will receive very little rain of significance through Sunday, but a notable boost in rain may occur in the last days of this month -

Eastern

Africa precipitation is expected to scatter from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -0.52 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Wednesday,

March 22:

- EIA

weekly US ethanol inventories, production, 10:30am - EARNINGS:

Syngenta - HOLIDAY:

Indonesia

Thursday,

March 23:

- USDA

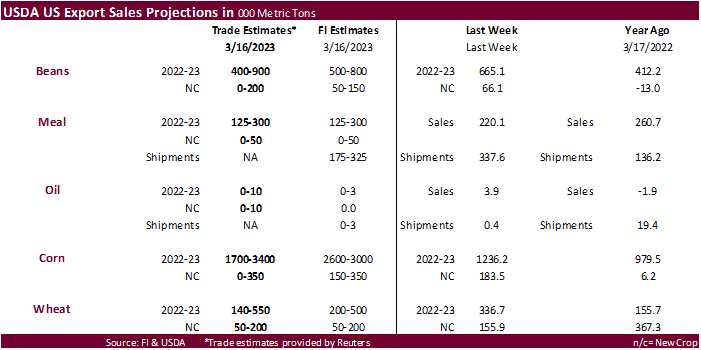

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Rabobank

Farm2Fork Summit, Sydney - Russian

Grain Union holds conference in Kazan - Brazil’s

Unica may release cane crush and sugar output data (tentative) - USDA

red meat production, 3pm - US

cold storage data for pork, poultry and beef, 3pm - HOLIDAY:

Indonesia

Friday,

March 24:

- Marine

Insurance London conference - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - US

poultry slaughter - HOLIDAY:

Argentina

Source:

Bloomberg and FI

Macros

FOMC

Hikes By 25Bps; Target Range Stands At 4.75% – 5.00%

–

Interest Rate On Reserves Balances Raised By 25Bps To 4.90%

104

Counterparties Take $2.280 Tln At Fed Reverse Repo Op. (prev $2.195 Tln, 104 Bids)

US

MBA Mortgage Applications Mar-17: 3.0% (prev 6.5%)

MBA

30-Year Mortgage Rate Mar-17: 6.48% (prev 6.71%)

·

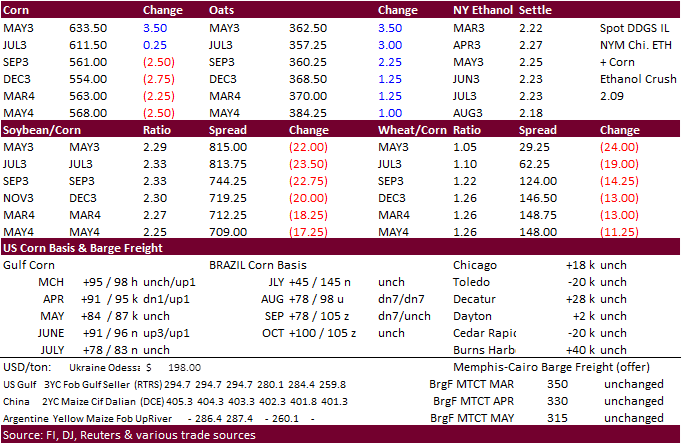

Corn futures closed mixed with spreads very firm after China bought additional US corn. Back months were lower from weakness in wheat, rapid Brazil corn plantings, and improving US weather. Earlier there was chatter that additional

banks could get in trouble, but for the grains we think inflation concerns weighed on prices.

·

CFTC reported a large long liquidation in corn and soybean oil as of March 14. This may create upcoming volatility if short covering kicks in due to US planting delays. Still too early to talk about that, IMO, but should be monitored

as we move in April.

·

News has not changed much from that of yesterday.

·

Ukraine’s AgMin looks for a 15.2% decrease in the 2023 corn production to 21.7 million tons from 25.6 million year earlier. Corn so far this season made up 58% of its overall grain exports. Ukraine expects “millions more hectares

of sunflower” could be sown (Reuters). Ukraine 2022-23 grain exports were 36.3 MMT as of March 22, well down from 44.8 MMT as of March 28, 2022 (one additional week).

·

The USDA Broiler Report showed eggs set in the US up slightly from year ago and chicks placed also up slightly. Cumulative placements were up 1 percent from the same period a year earlier.

·

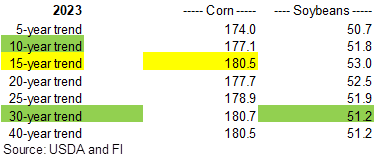

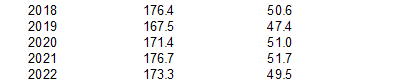

We adjusted our US 2023 US corn yield upward to 180.5 from a working 177.0 bushels per acre. We are using 50.0 for soybeans.

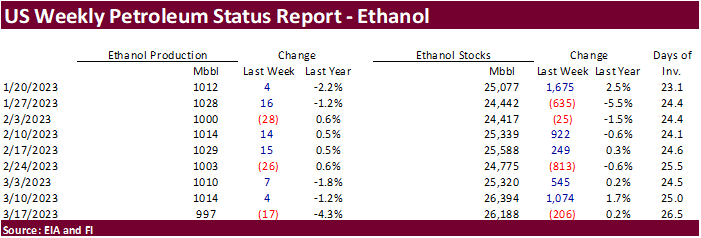

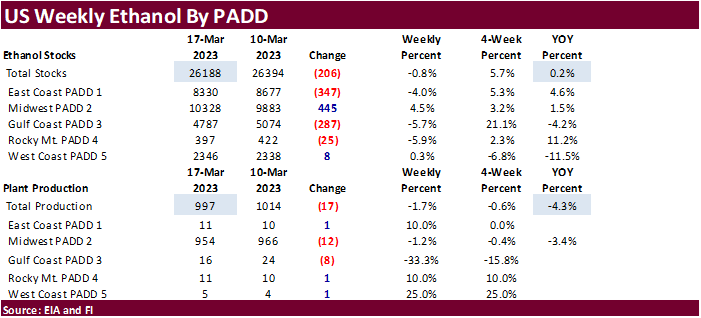

US

weekly ethanol production

fell 17,000 barrels to 997,000, lowest since January 6, and stocks decreased 206,000 barrels to 26.188 million. For comparison, a

Bloomberg

poll looked for weekly US ethanol production to be up 8,000 thousand and stocks down 400,000 barrels. Early Sep 2022 to date ethanol production is running about 3.9 percent below the same period year earlier. UUS gasoline stocks of 229.6 million barrels were

down 6.4 million from the previous week, its fifth weekly consecutive decline. Implied gasoline demand was 8.960 million barrels, a 366,000 barrel increase from the previous week. Gasoline demand, when looking at the past 4 weeks, is running slightly below

year ago. Ethanol blended into finished motor gasoline fell to 89.7% from 92.3% previous week. We are in the process of reforecasting US corn for ethanol demand for last half 2022-23, but likely remain more than 25 million bushels below USDA.

US

DoE Crude Oil Inventories (W/W) 17-Mar: +1.117M (est -1.800M; prev +1.550M)

–

Distillate Inventories: -3.313M (est -1.500M; prev -2.537M)

–

Cushing OK Crude Inventories: -1.063M (prev -1.916M)

–

Gasoline Inventories: -6.399M (est -2.364M; prev -2.061M)

–

Refinery Utilization: 0.40% (est 1.00%; prev 2.20%)

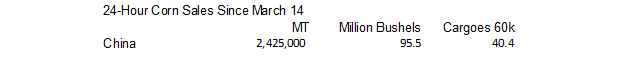

Export

developments.

-

Under

the USDA 24-hour reporting system, private exporters reported sales of 178,000 tons of corn for delivery to China during the 2022-23 marketing year.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

·

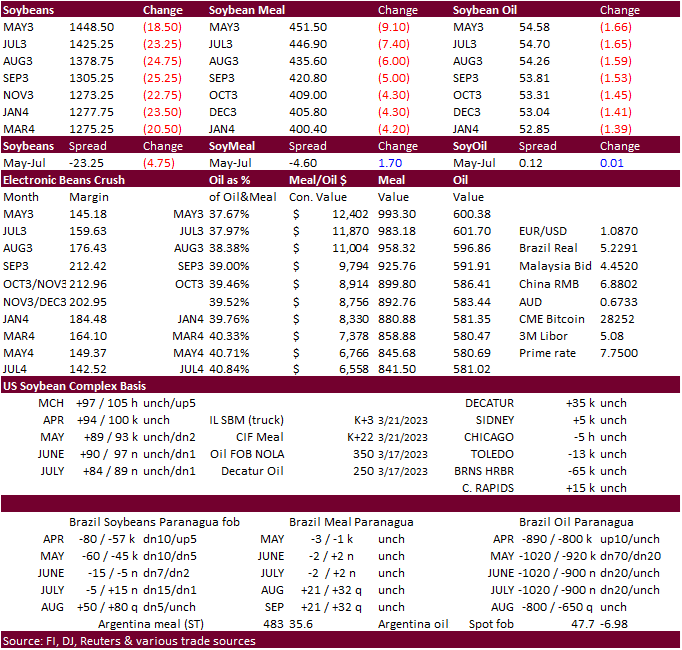

Lower outside related vegetable oil and oilseed markets sent the US soybean complex, along with harvesting pressure in Brazil. Long liquidation was seen ahead of the US interest rate hike decision. Palm oil futures hit a five

month low after trading 3 percent lower. May soybeans are trading near its 200-day moving average.

·

Nearby soybeans gained on back months in part to slow Argentina soybean crushing amid lackluster producer selling. Sep-Feb Argentina crush fell to 15.2 million tons from 18.1 million year earlier, according to Oil World.

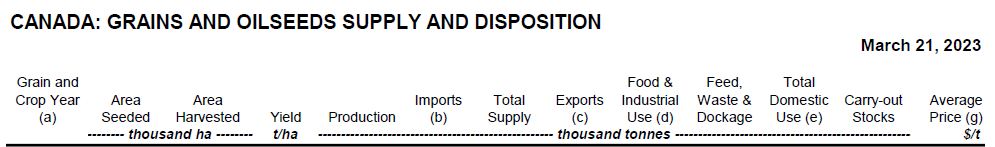

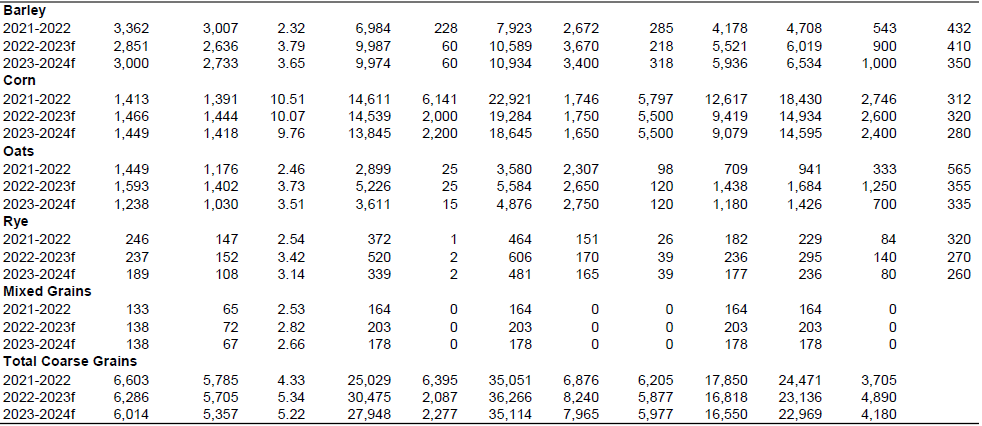

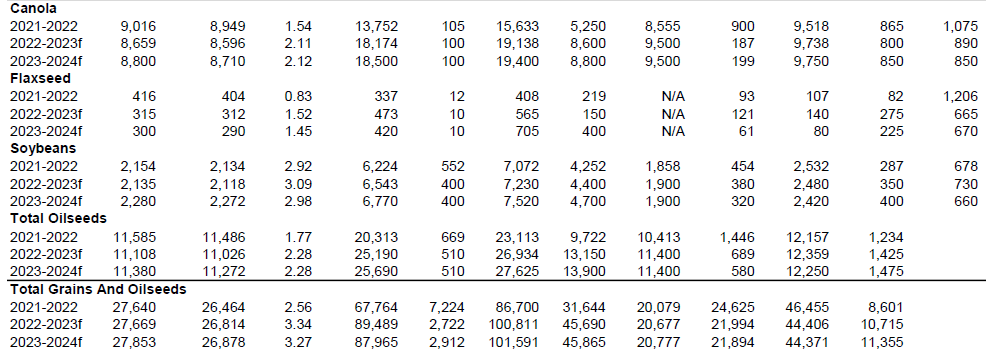

https://agriculture.canada.ca/en/sector/crops/reports-statistics

Export

Developments

·

None reported

Updated

03/21/23

Soybeans

– May $14.00-$15.50

Soybean

meal – May $425-$500

Soybean

oil – May 52-58

·

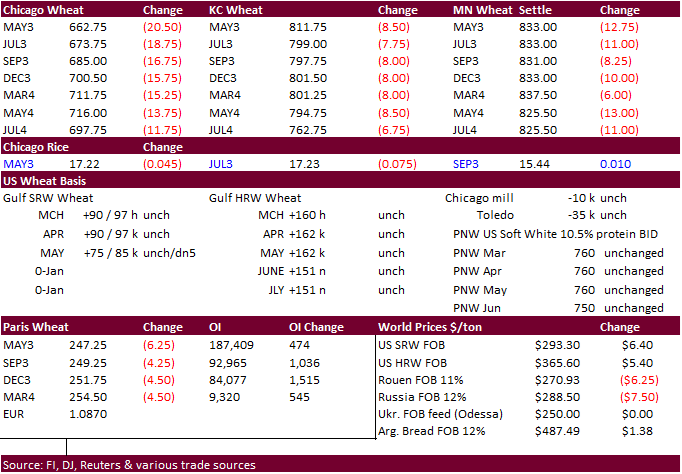

US wheat futures traded lower again on Wednesday from follow through selling on improving US and EU weather, and the extension of the Black Sea grain deal. Not all countries are in good shape for weather/crop conditions. India’s

major production wheat area saw unfavorable heavy rains and hail earlier this week.

·

Paris May wheat was lower by 6.25 euros at 248.00 per ton, a fresh multi-month low.

·

Interfax reported Russia winter crops are in good shape with 94%-95% good or satisfactory condition.

May Paris wheat

https://agriculture.canada.ca/en/sector/crops/reports-statistics

·

Jordan bought about 110,000 tons of feed barley at $267/ton for Aug. Shipment.

·

Jordan seeks 120,000 tons of wheat on March 28 for Sep-Oct shipment.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 29.

Rice/Other

·

Results awaited: South Korea seeks 121,800 tons of rice, most of it from China.

·

(Reuters) – Thailand increased its rice export target for this year to 8 million tons, a senior government official said on Wednesday, up from a previous target of 7.5 million tons.

·

(Bloomberg) — Sugar futures surged to the highest in more than six years in London, amid concern that Egypt’s export restrictions will further tighten global supply. Egypt’s decree, issued in the Official Gazette, said that exports

of any kind of sugar were restricted for three months, with the exception of that which is surplus to local market needs.

Updated

03/21/23

KC

– May $7.60-$8.75

MN

– May

$8.00-$9.50

#non-promo