PDF Attached

USD

was higher, crude oil up more than $5.80, and equities lower.

Wheat

saw some risk off trading that pressured the spreads. The soybean comp[lex was sharply higher on SA shipment concerns, good demand for US soybeans, and contract highs hit in canola. Corn ended higher on higher WTI. An outbreak of bird flu will result in the

culling of 570,000 chickens in NE. Argentina will be on holiday Thursday.

![]()

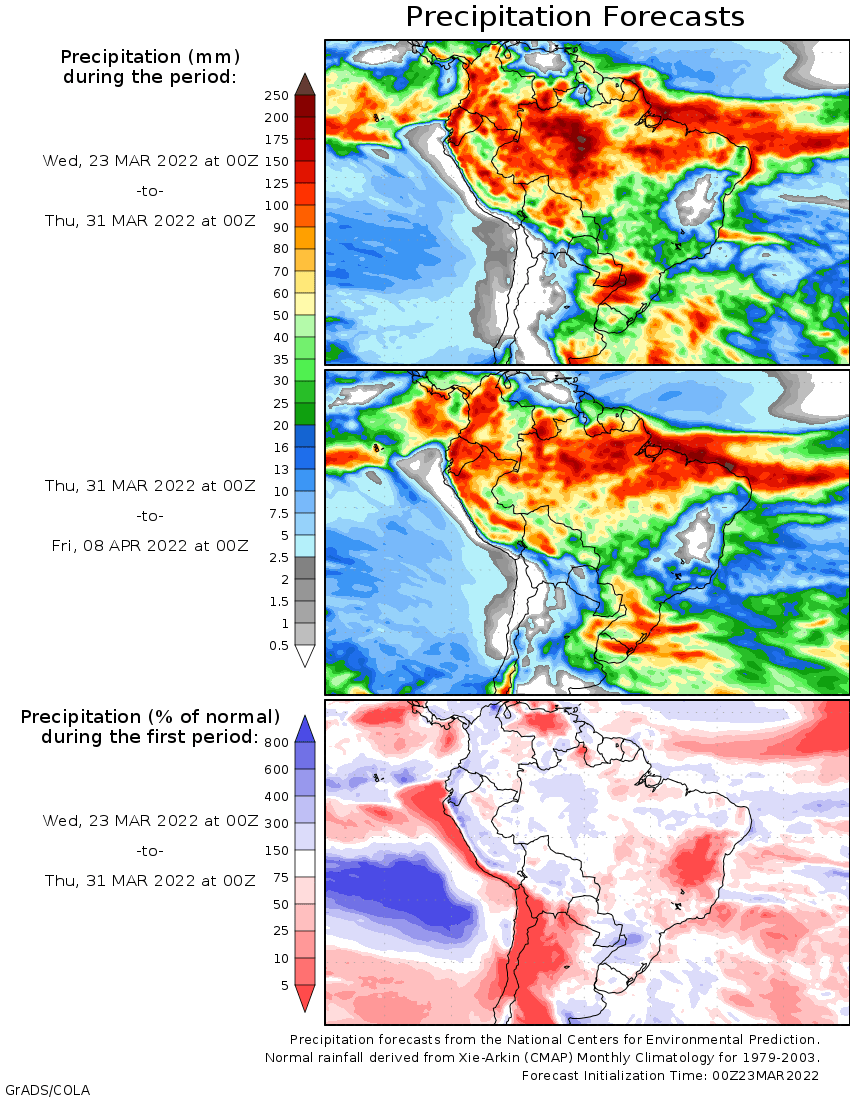

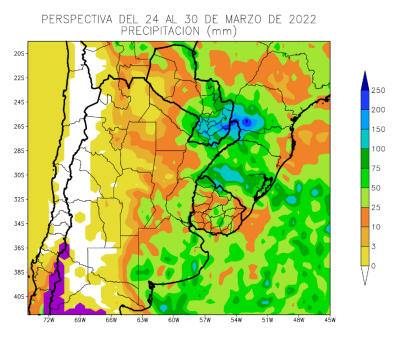

WEATHER

EVENTS AND FEATURES TO WATCH

- Locally

heavy rain fell in central Chaco, Argentina and southern Paraguay, Brazil Tuesday and early today - Up

to 6.13 inches occurred in central Chaco while three locations in southern Paraguay reported around 5.00 inches - Local

flooding was suspected - Additional

rain of significance is expected into Friday from northern parts of Rio Grande do Sul through Paraguay to western Parana resulting in an expansion of flooding

- Additional

rainfall of 2.00 to more than 6.00 inches is expected by Friday morning - Heavy

rain is also expected in southwestern Buenos Aires, Argentina and some immediate neighboring areas tonight into Friday with 2.00 to 6.00 inches and locally more expected - Flooding

is possible in this region as well. - Very

little rain will impact west-central or northwestern Argentina for a while, but all other areas in the nation will be plenty moist supporting late season crop development - Net

drying is expected from central Minas Gerais into central Bahia during the next ten days to two weeks - Northern

Minas Gerais and central Bahia are already too dry, although the region is considered to be a minor production region - Some

corn, sugarcane, coffee, cocoa, soybeans and rice are produced in the region - Most

of Brazil and Argentina will experience a good weather pattern over the next two weeks supporting late season crops; including Safrinha corn and cotton in Brazil. The southern parts of Brazil and Paraguay will need to dry down after Friday, though, to protect

crop conditions - U.S.

Midwest received additional rain Wednesday resulting in a further expansion of saturated soil - Drier

weather is needed to improve field conditions for planting next Month - Additional

waves of rain and cool weather may occur periodically in the region raising worry over lower Midwest spring fieldwork in April, but there is plenty of time for change - U.S.

Delta, Tennessee River Basin and southeastern states are too wet for fieldwork - Early

season planting has begun, but field progress may fall behind normal without a period of dry and warm weather

- U.S.

hard red winter wheat areas will be drier for a few days, but a new storm system is expected during the early to middle part of next week bringing back “some” rain - The

storm system will not likely produce much moisture in the high Plains region - Cold

temperatures are back into the central U.S. today and Thursday with low temperatures dropping below freezing in many wheat production areas that were recently in the 70s and lower 80s - The

wild swings in temperature continue to induce some heaving topsoil which could be threatening to crops, although with recent rain and snowfall the moisture profile has improved enough to allow some crop improvement in the next few weeks - Warming

will return late this week through early next week with high temperatures reaching into the 70s and 80s Fahrenheit once again

- The

warm up will stimulate some new season crop development after recent rain - Some

cooling will return later next week - Not

much rain is expected in West or South Texas and the lower Texas Coastal Bend area will also receive restricted moisture - California

has potential to receive some much needed moisture during the late weekend and early part of next week - The

moisture will be welcome, but not nearly enough to change water supply or the status of drought - Frequent

follow up rain is needed and not likely - The

European forecast model does not agree with the GFS about this system and confidence is low that there would be enough moisture to make much difference to the bottom line on soil moisture or water supply - U.S.

northwestern Plains and southwestern Canada’s Prairies are unlikely to receive significant moisture through the coming week to ten days - Europe

rainfall in the coming week is expected mostly in Spain and Portugal while any showers that occur elsewhere (and there will be some) are expected to be too light and brief to have much impact on soil moisture which should slowly decline - Greater

rainfall is expected in central and eastern Europe next week - Temperatures

will be near to above normal this week and probably next week as well - Much

of Russia, Ukraine, northern Kazakhstan, Belarus and the Baltic States were dry again Tuesday as they were during the weekend and much of the past week while a little rain fell in southern parts of Russia’s Southern Region and areas east into southeastern

Kazakhstan - Temperatures

have been warming sufficiently to melt snow in western Russia where recent highest temperatures were in the 40s and 50s Fahrenheit.

- Some

increase in precipitation is expected in the CIS this weekend and next week as waves of snow and rain evolve across the region - Temperatures

will be seasonable, although trending cooler this weekend into next week - India

weather will continue mostly dry and seasonably warm to hot through the next ten days

- There

is some risk of showers and thunderstorms in Kerala and immediate neighboring areas of Karnataka and Tamil Nadu as well as in the far Eastern States and extreme northern most parts of the nation - China’s

rain Tuesday was greatest in the southern coastal provinces where amounts of 2.00 to more than 5.00 inches resulted - Drying

is needed in the Yangtze River Basin and areas to the south to induce the best spring planting conditions - Some

welcome drying occurred Tuesday in the Yangtze Basin - China’s

Yangtze River Basin and southern provinces will continue to see waves of rain into the weekend - Flooding

will be possible along with some delay to early rice and corn planting progress - Less

rain in the Yangtze River Basin will be needed to improve rapeseed and minor wheat conditions and to support better corn and rice planting conditions - Australia

rainfall Thursday into early next week will be great enough to bring some increase in soil moisture to southeastern Queensland and northeastern New South Wales - The

precipitation may raise a little concern in cotton fiber quality since most bolls are open or opening - Some

temporary discoloring of cotton fiber is possible - Tropical

Cyclone Charlotte is still advertised to stay west of Australia over the next several days - The

storm needs to be closely monitored because of some potential that it or its remnants will bring rain to Western Australia this weekend into early next week - Rain

in Western Australia from the storm could boost topsoil moisture, although autumn planting of wheat and barley will not begin before late April - South

Africa weather will include mild to warm temperatures over the next week ten days while rainfall is sporadic and light.

- The

environment should be good for late season crop development, early crop maturation and harvest progress - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south this week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers and thunderstorms during the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive periodic over the next week easing recent dryness and improving the soil for coffee, and cocoa flowering - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain will still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected next week - East-central

Africa precipitation has been most significant in Tanzania - Ethiopia

has been dry biased along with northern Uganda and parts of southwestern Kenya

- Some

rain will develop in Ethiopia, Kenya and Uganda over the next few days easing some dryness, but more will be needed - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +13.62 - The

index will slowly weaken over the next week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; southeastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

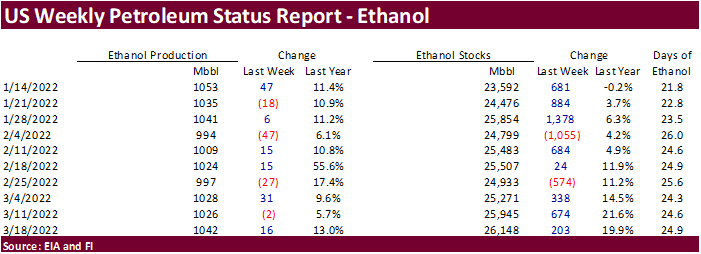

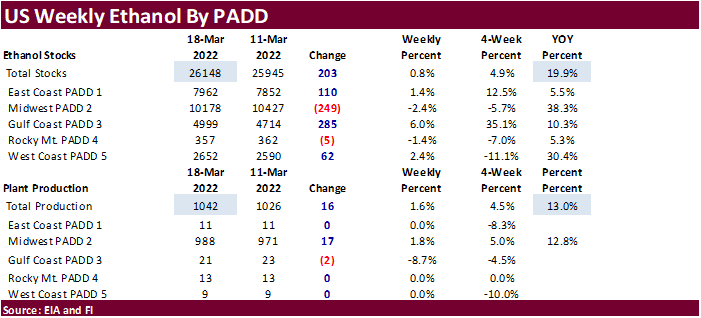

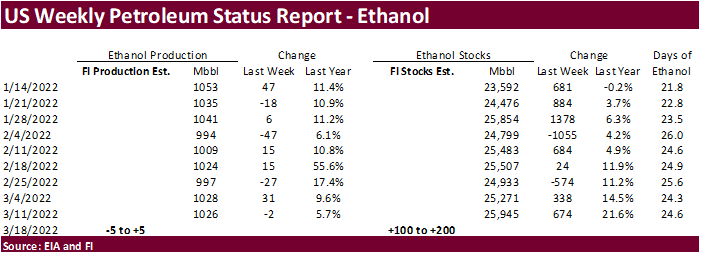

- EIA

weekly U.S. ethanol inventories, production, 10:30am - U.S.

cold storage data for beef, pork and poultry, 3pm - HOLIDAY:

Pakistan

Thursday,

March 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

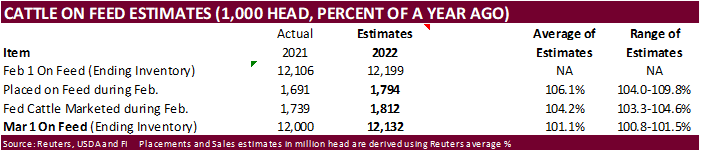

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

US

New Home Sales Feb: 772K (est 810K; prev 801K)

US

New Home Sales (M/M) Feb: -2.0% (est 1.1%; prev -4.5%)

US

Median Sale Price Feb: $400,600 (prev $423,300) +10.7% From Feb 2021

US

MBA Mortgage Applications Mar 18: -8.1% (prev -1.2%)

US

MBA 30 Yr Mortgage Rate Mar 18: 4.50% (prev 4.27%)

ARS

CB raises 200bps to 44.5%

US

DOE Crude Oil Inventories Mar 18: -2508K (est -750K; prev 4345K)

US

DOE Distillate Inventory Mar 18: -2071K (est -1050K; prev 332K)

US

DOE Cushing Inventory Mar 18: 1235K (prev 1786K)

US

DOE Gasoline Inventories Mar 18: -2948K (est -1850K; prev -3615K)

US

DOE Refinery Utilisation Mar 18: 0.70K (est 0.20%; prev 1.10%)

US

Distillate Stockpiles At Lowest Level Since April 2014

·

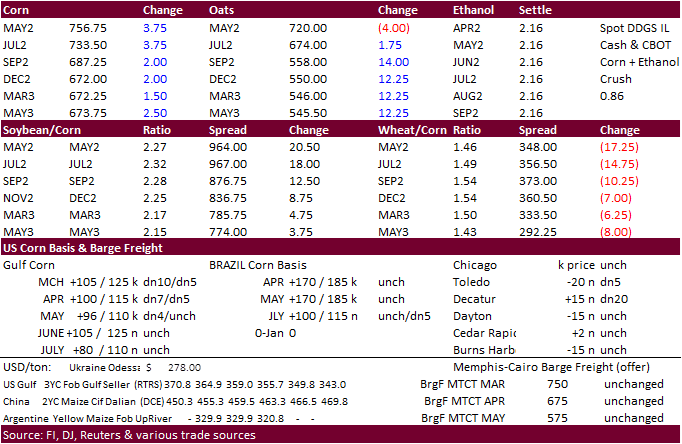

May CBOT corn

settled 4.75 cents higher and July up 5 cents, in part to a rally in soybeans and WTI crude oil. May is back over $7.50. A breakout above $7.6750 could provide support. We think contract highs will eventually be tested but note demand destruction for the

US feed sector is looming over the market.

·

570K chickens to be destroyed in Nebraska fight against bird flu | TheHill

·

USDA Broiler Report showed eggs set in the US up 1 percent from a year ago and chicks placed down 1 percent. Cumulative placements from the week ending January 8, 2022 through March 19, 2022 for the United States were 2.04 billion.

Cumulative placements were down slightly from the same period a year earlier.

·

The European Commission proposed setting up a fund to distribute 500 million euros ($550 million) to help farmers and expand acreage. They will also provide relief for Ukraine producers.

·

Trade estimates for USDA’s March Intentions and stocks should be out later this week. One group calls for the US corn area to decline to 90.7 million acres from 93.36 million in 2021. USDA Ag Forum was at 92 million. We are at

92.55 million for corn and 88.2 million for soybeans (87.195 year ago). Our US acreage table attached.

·

Brazil’s Ministry of Economy suspended its 18% tariff on ethanol imports for the rest of 2022 to combat inflation, which could further open the door to the US market. Brazil also cut sugar and soybean oil import duties but that

might have little impact on imports. For ethanol, some noted the steep devaluation of the Brazilian real will keep the import arbitrage from US closed. Local Brazil anhydrous is currently below the landed price of US ethanol, by roughly 348 real, according

to S&P Global.

Weekly

US ethanol production

was up 16,000 barrels to 1.042 million (trade looked for a 2,000 barrel increase) from the previous week and stocks up 203,000 barrels to 26.148 million (trade was looking for up 145k).

The report was viewed positive for US corn futures. Ethanol production was highest since January 14. Early September to date US ethanol production is running 10.6% above the same period year earlier but down 0.4% from the comparable

period 2019-2020. US gasoline stocks fell 2.948 million barrels to 238.04 million. Ethanol blended into finished motor gasoline is running near 91.1%.

US

DOE Crude Oil Inventories Mar 18: -2508K (est -750K; prev 4345K)

US

DOE Distillate Inventory Mar 18: -2071K (est -1050K; prev 332K)

US

DOE Cushing Inventory Mar 18: 1235K (prev 1786K)

US

DOE Gasoline Inventories Mar 18: -2948K (est -1850K; prev -3615K)

US

DOE Refinery Utilization Mar 18: 0.70K (est 0.20%; prev 1.10%)

US

Distillate Stockpiles At Lowest Level Since April 2014

9:48:03

AM livesquawk European Gas Surges 34% As Russian Pres. Putin Seeks Payments In Roubles

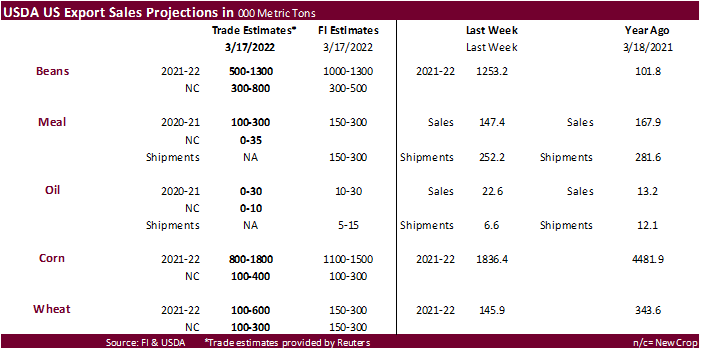

Export

developments.

Updated

3/23/22

May

corn is seen in a $6.75 and $8.10 range (unchanged down 30 cents back end)

December

corn is seen in a wide $5.50-$7.50 range

·

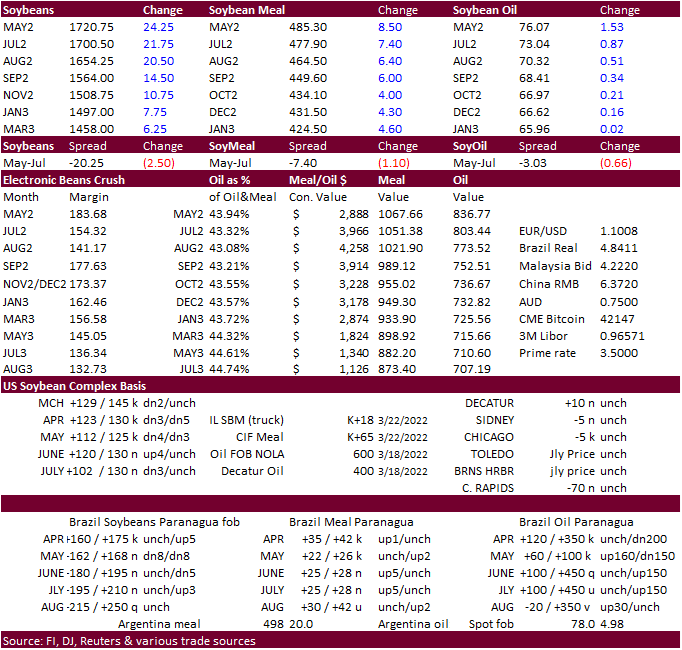

Strong finish to soybean meal underpinned soybeans. Soybean oil settled higher. CBOT

May

soybeans, back over $17.00, is shy of its respected contract highs. US soybean demand is strong with good crush margins and increasing export demand. Yesterday 240,000 tons was reported to unknown. There were no USDA 24-hour announcements today. Earlier we

heard Chinese soybean interest for N/Q (old crop) while new crop was again quiet.

·

EU May rapeseed oil hit a contract high today. Canadian canola also reached a contract high. Rapeseed and canola supplies remain very tight.

·

In a Reuters article, Canada’s drought monitor suggest much of the Canadian Prairies are in need of precipitation, with exception to southern Manitoba. southern Alberta and central Saskatchewan in extreme drought conditions as

of Feb. 28.

·

US soybean basis along selected river locations were up 6-8 cents.

·

Russia is looking into setting up sunflower oil export quotas, per recommendation by the minister. No details were provided.

·

A protest by Brazil tax collectors are stalling payments to exporters, according to the National Association of Grain Exporters (Anec). The protest at the Santos port in Sao Paulo is delaying the issuance of phytosanitary certificates.

·

Brazil is seen getting beneficial rains this week and next week.

- Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

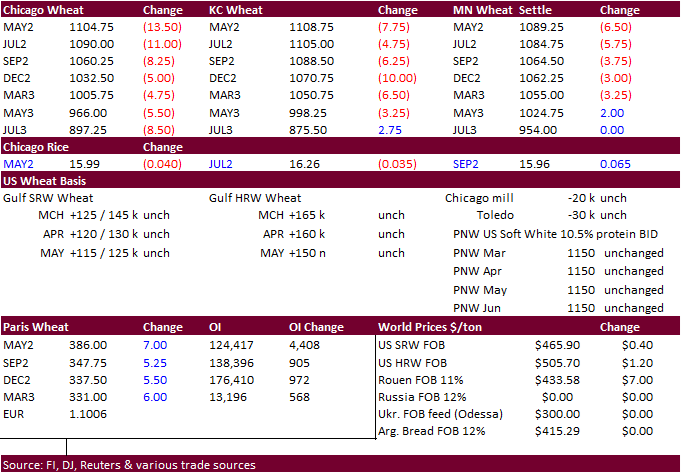

US wheat futures were higher to start this morning on Ukraine grain production uncertainty and higher outside related commodity markets but sold off in a light volume. Prices tried to crawl back but sold off again. One reason

we see was some light risk off trade, followed by little positioning with the USDA report due out in a week. Spreads were weaker.

·

Ukraine should start sowing sunflower and other summer grains soon but it’s hard to tell how much of the area will be lost this year.

·

APK-Inform estimated 2022 Ukraine grain harvest at 38.9 million tons, down 54.6% from 2021 and 2022-23 grain exports at 30 million tons, down 32%. The wheat crop was seen at 14.9 million and corn 18.5MMT. Ukraine March through

June wheat exports may only reach 200,000 tons, according to APK-Inform.

·

Good Russia winter grain weather favored early development for the 2022 crop. Russia is expected to raise this year’s grain crop, including both winter and spring grains, to 123 million tons, according to the latest agriculture

ministry forecast, up from 121.3 million tons in 2021.

·

China’s wheat crop still looks dire and but it’s unknown if the country will soon increase imports as they are actively selling wheat out of reserves.

·

May Paris wheat futures were up 7.00 euros to 384.50 euros.

·

Nestle SA, the world’s largest food maker, said it’s suspending manufacturing in Russia (Bloomberg).

Ukrainian

fightback gains ground west of Kyiv

·

Cancelled: Jordan

was seeking 120,000 tons of barley. Possible shipment combinations were between July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15.

·

Results awaited: Iraq extended their deadline to buy 50,000 tons of hard milling wheat until March 22.

·

Jordan seeks 120,000 tons of milling wheat on March 24. Possible shipment combinations are May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.