Higher

trade in CBOT soybean complex and nearby corn. Wheat trended lower on improving US weather.

Brazil

will see a drier bias over the next several days. Monsoon rains are expected to withdraw later in April. Argentina will see additional rains Wednesday into Friday. South Cordoba and southeast BA will miss on some of the rains. The US southern and central

Great Plains (HRW) bias eastern areas will see additional rain this week. Northern Plains & Canadian Prairies will be in focus this week as it remains too dry but the second week of the forecast calls for precipitation for the dry areas of Alberta. Rest of

the US will be ok with exception of too much precipitation for the Delta that will slow fieldwork activity. Midwest will not start planting for a week or two so there is no concern there except for the Ten River Basin where too much rain will occur. Eastern

Australia will dry down this week.

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Argentina

will receive significant rain in the south, east and north-central parts of the nation today into Friday

o

Sufficient rain will fall over some of the wettest areas of the northeast to induce flooding

o

Some new flooding might evolve in local areas in northeastern Buenos Aires

o

Southern Cordoba to southern Santa Fe may not get nearly as much rain as other areas in the nation

o

Net drying will occur for at least a full week following the rain event

o

Late season summer crops will finish out their development in a favorable environment because of good soil moisture and no excessive heat

- Brazil

will experience net drying from the southeastern half of Mato Grosso, Mato Grosso do Sul and western and northern Parana to Bahia, Minas Gerais and Sao Paulo during the coming week; this will be ideal for getting late season soybean harvesting and Safrinha

corn planting completed - Rain

in Brazil during the last days of March and early April will be erratic and a close watch on soil moisture will be warranted; the monsoon season is not ending early, but the drier biased conditions will raise some market and producer worry in early April

o

Greater rain will be needed in April to maintain the best soil conditions for late season corn and cotton

- Rio

Grande do Sul, Brazil and neighboring areas of Brazil and Paraguay will get timely rainfall during the coming week to support ongoing development for late season crops

o

Net drying will occur for nearly a week after rain ends Monday

- U.S.

Midwest will be a little wet in the coming ten days, but the outlook for spring planting is favorable; planting will begin next month and it will have to advance around periods of rain

o

The lower Ohio River Valley area may be a little wet at the beginning of the planting period

- U.S.

hard red winter wheat production areas received some welcome rain Monday and Tuesday and more would be welcome especially in the west and south, but crop conditions are improving after recent bouts of rain

o

Additional precipitation is expected periodically, but west-central areas may be driest for a while

- U.S.

northern Plains and Canada’s Prairies need significant rain and it will not likely come in great enough quantities anytime soon to make much difference

o

Today’s GFS model run suggested greater precipitation Sunday and Monday in the southern and eastern Prairies, but World Weather, Inc. believes this event was overdone and will only verify as a weaker event

- U.S.

West and South Texas and the Texas Coastal Bend need significant rain from unirrigated areas, but precipitation in the coming week will be restricted leaving dryness an ongoing concern

o

There is “some” potential for a more active weather pattern to evolve in West Texas during the first week of April, though confidence is a little low

- U.S.

Delta and Tennessee River Basin will likely be too wet for much field progress in the next ten days; drying and warming is needed

o

Multiple inches of rain will fall across these areas in the coming week inducing new flooding and causing more planting delays

- U.S.

southeastern states will see a good mix of weather, especially in southern Georgia, northern Florida and southeastern Alabama to support early season planting and crop development - Southwestern

U.S. weather will remain dry biased and mild through the next ten days supporting some fieldwork - U.S.

Pacific Northwest needs greater precipitation in the valleys especially the Yakima Valley into central Oregon where the ground is too dry for unirrigated winter crops - Mexico

drought remains serious and unlikely to change prior to the arrival of seasonal rainfall this summer - India

weather will be almost ideal for crop maturation and harvesting in the next few weeks’ the nation may have lost a little production this year because of dryness during reproduction, but another big crop is expected - China

weather remains almost ideal for early season fieldwork and winter crop development in the Yellow River Basin, North China Plain and northeastern provinces, although warming is needed - China’s

Yangtze River Basin has been a little wet this month and drier and warmer weather is needed to induce better rapeseed and southern wheat conditions, but no significant loss in production potential has occurred - Yunnan,

China is still too dry and needs significant rain for its rice, corn and sugarcane - Australia’s

Queensland and New South Wales crop areas are moving into a drier biased weather pattern for the next ten days improving crop and field conditions after recent abundant rainfall - Severe

flooding in coastal areas of New South Wales, Australia should be abating and the cleanup efforts are getting under way - Indonesia

and Malaysia weather has been and will continue to be good for all crops, although there is need for rain in northern parts of Peninsular Malaysia - Philippines

weather has been and will continue to be good for most of its crops - Mainland

Southeast Asia crop areas need a boost in precipitation to induce better early season planting conditions for corn and sugarcane development as well - Eastern

Ukraine into Kazakhstan will receive rain over the next few days and the moisture boost will be very good for future crop development

- Much

of western and northern Russia is still snow bound and needs to experience additional melting and a bout of dry and warm weather to get the remaining snow to melt - Europe

weather is rated mostly very good, although cool conditions have delayed the greening of some crops - Soil

moisture in Europe is rated favorably with some drying in Spain that will need to be eased in April to ensure the best dryland crop conditions

o

additional drying is expected in much of the continent during the coming week to ten days – especially in the west

- North

Africa will be drying down in the coming week to ten days; recent rain has been good for early season wheat and barley development - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia in April while Tanzania begins to dry down - South

Africa weather will continue favorably mixed for early maturing summer crops and the development of late season crops

- New

Zealand weather is expected to turn a little wetter in the coming week, but rain amounts will still be lighter than usual except along the west coast of Southern Island - Southern

Oscillation Index this morning was -2.15 ending a notable fall in the index from +15.24 on Feb. 24; the fall is indicative of the decaying La Nina event

o

The index will level off the remainder of this week and into the weekend

Source:

World Weather inc.

Bloomberg

Ag Calendar

Wednesday,

March 24:

- EIA

weekly U.S. ethanol inventories, production - Bursa

Malaysia Derivatives virtual palm oil conference 2021, day 2 - U.S.

poultry slaughter - EARNINGS:

JBS - HOLIDAY:

Argentina

Thursday,

March 25:

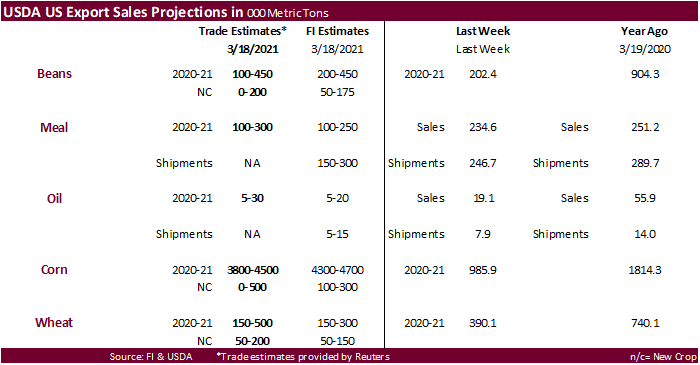

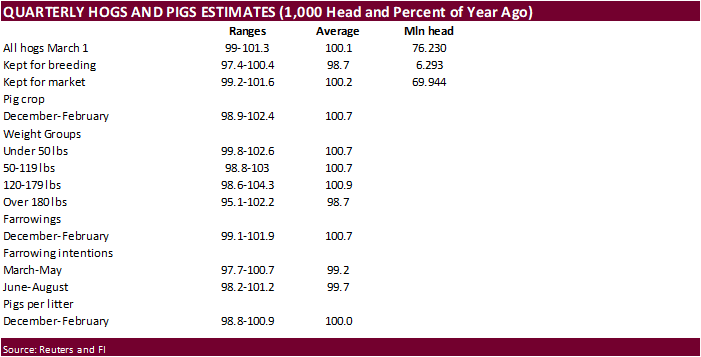

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Seminar

on sustainable palm oil in India by the Solvent Extractors’ Association and the Malaysian Palm Oil Board - International

Grains Council monthly report - Port

of Rouen data on French grain exports - Malaysia’s

March 1-25 palm oil export data - USDA

hogs & pigs Inventory, red meat production

Friday,

March 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Macro

US

Durable Goods Orders (FebP): – 1.1% (est 0.5%, prev 3.4%)

US

Durable Ex Transportation (FebP): -0.9% (est 0.5%, prev 1.3%)

US

Cap Goods Orders Nondef Ex Air (FebP): -0.8% (est 0.5%, prev 0.4%)

US

Cap Goods Ship Nondef Ex Air (FebP): -1.0% (est -1.0%, prev 1.8%)

Markit

US Manufacturing PMI (MarP): 59 (est 59.5, prev 58.6)

Markit

US Services PMI (MarP): 60 (est 60.1, prev 59.8)

Markit

US Composite PMI (MarP): 59.1 (prev 59.5)

More

Than 70 US House Democrats Press Biden To Take Tougher Line On Boosting Vehicle Emissions Standards – RTRS Cites Letter

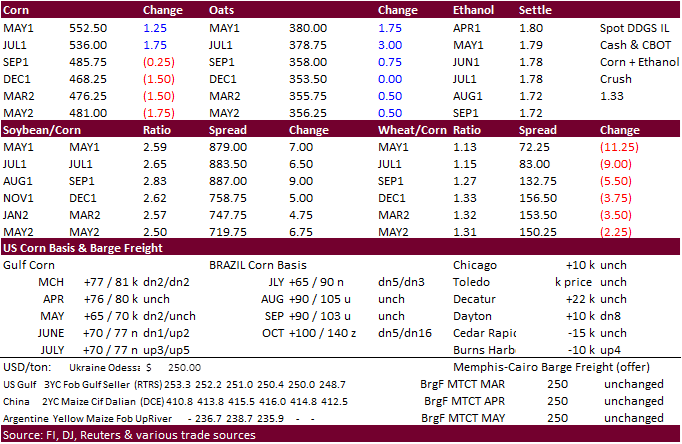

Corn

- CBOT

corn traded two-sided on lower wheat and higher soybeans. The market ended mixed with May up 2.0 cents and December down 0.75. Higher USD limited rallies. We see corn trading in a narrow two-sided trading range for the rest of the week unless we see a surprise

in USDA export sales due out Tuesday morning. US corn acreage estimates are likely to be in focus for the balance of the week. Farm Futures pegged the US corn area at 93.6 million acres, up from 90.8 million a year ago. Analysts deadline to submit their

findings to reporters for polls is today for the March 31 USDA intentions report. There were no global export developments overnight but there were rumors China seeks corn for June shipment. There were no 24-hour announcements this morning.

- May

corn support is seen at $5.46, then $5.40.75. Low

today was $5.4825. - WTI

crude rallied after a container ship that ran aground in the Suez Canal, blocking up around 100 ships. It was up about $3.00 at the grain close and this supported nearby corn spreads.

- The

weekly USDA Broiler report showed US eggs set down 2 percent and chicks placed 2 percent from this time a year ago. Cumulative placements from the week ending January 9, 2021 through March 20, 2021 for the United States were 2.05 billion. Cumulative placements

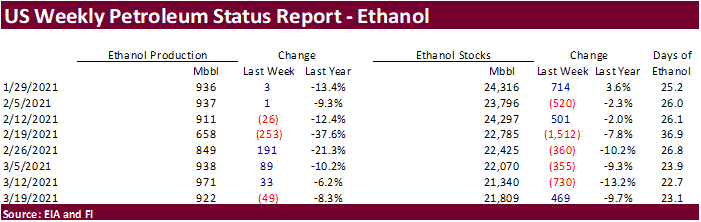

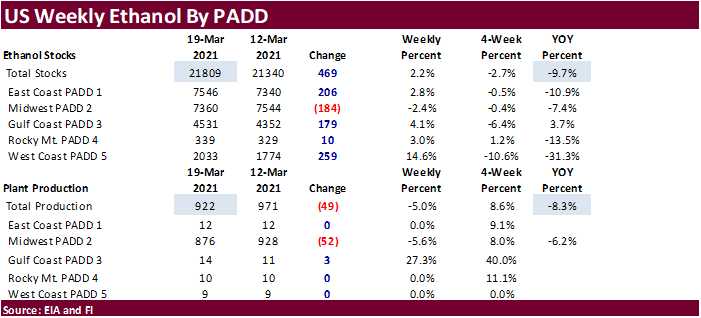

were down 2 percent from the same period a year earlier. - Weekly

US ethanol production fell a large 49,000 barrels to 922,000 (trade was looking for 3,000-barrel increase) and stocks increased 469,000 barrels to 21.809 million (trade was looking for 12,000 increase). The unexpected drop in production is slightly bearish

for CBOT corn futures.

Export

developments.

- There

were no USDA 24-hour sales.

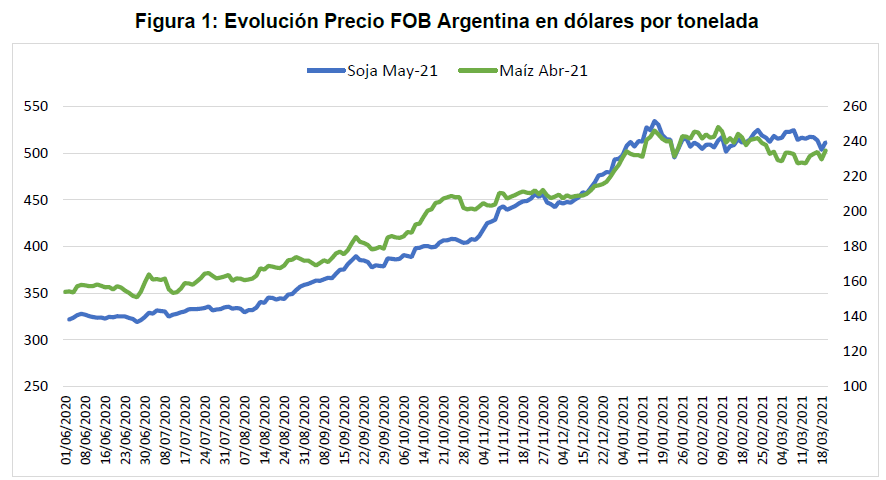

Fuente:

FOB Bolsa de Cereales

Updated

3/24/21

May

corn is seen in a $5.35 and $5.55 range. (unchanged, down 20)

July

is seen in a $5.10 and $5.75 range.

December

corn is seen in a $3.85-$5.50 range.

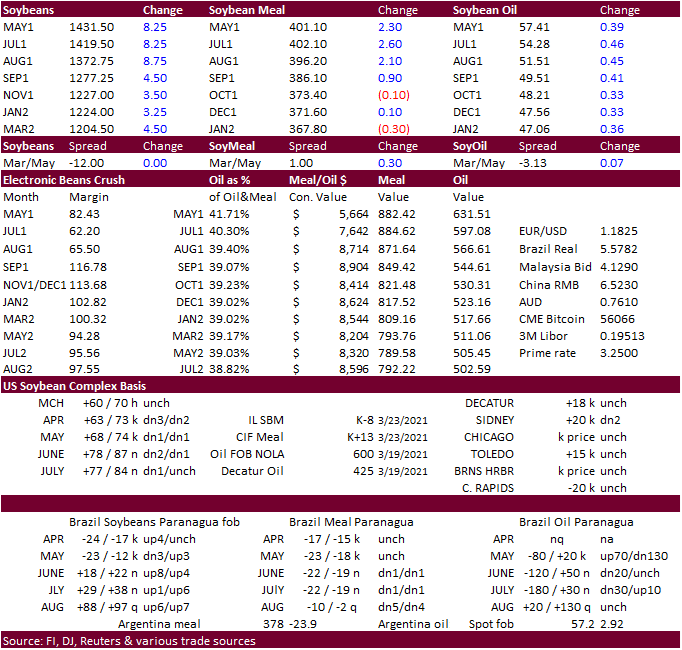

- CBOT

soybeans ended 9.50 cents higher in May (up 4 sessions) in part to a rebound in WTI crude oil (up about $3.00 at the grain close) despite a higher USD (up 17 points). Crush margins rebounded with May up 1.50 cents. CBOT soybean meal was higher for 2020-21

crop and $0.10 lowed for December, and SBO started lower but caught a bid to end 46-61 points higher. May SBO failed to fill the gap of 56.37. Overnight it hit an 8-year high. China cash crush margins deteriorated. Canola futures were up $13.30 or nearly

2 percent basis May to $796.10/ton. - Some

traders monitoring an Asian vegetable oil conference suggest overall comments/forecasts are slightly bearish for palm oil.

Some notes via Reuters for the Virtual Palm and Lauric Oils Price Outlook Conference: - Oil

World: - Global

palm oil production is estimated to grow by 3.2 million tons through the 12 months to Sep. 30 - Indonesian

output is estimated to grow by 3.3 million tons - Malaysia

will experience a drop of half a million ton - World

palm oil consumption may rise by less than one million ton this year - Edible

oil prices to peak in the next four weeks - James

Fry - Malaysia’s

crude palm oil prices forecast to fall to near 3,300 ringgit by end-2021 if crude oil is at $65 a barrel. - Malaysia’s

2021 crude palm oil production below 19.5 million ton - Indonesia’s

output is seen growing over 3.5 million tons - Indonesian

Palm Oil Association (GAPKI) - Indonesia

palm oil inventories shrink by almost half to 2.67 million tons by the end of 2021 - Production

in the Southeast Asian nation seen rising 4% from 2020 to 49 million tons - Exports

seen rising to 37.6 million tons in 2021 from 34 million tons last year - Indonesian

crude palm oil to trade at $1,000-$1,150 per ton during the first half of this year. - Dorab

Mistry - Malaysia’s

crude palm oil futures hold at 3,300 ringgit ($799.22) a ton up to June, before bottoming out at 2,700 ringgit in the second half of the year, likely around September - 2021

palm oil production in Malaysia 19.6 million tons and 48 million tons for Indonesia - World

palm oil supply will expand by 3 million tons in 2021 - Anec:

Brazil soybean exports 16.1 million tons. - The

U.S. EPA is finalizing a proposal to extend the deadlines for oil refiners to prove their compliance with RFS standards for 2019 and 2020. Refiners now have until Jan. 31, 2022, to submit compliance documentation for the 2020 year, and until Nov. 30, 2021,

to submit for 2019.

Export

Developments

- None

reported.

Updated

3/24/21

May

soybeans are seen in a $13.75 and $14.75 range.

May

soymeal is seen in a $390 and $420 range. (up 5, down 5)

May

soybean oil is seen in a 55 and 58 cent range (up

100, unch)

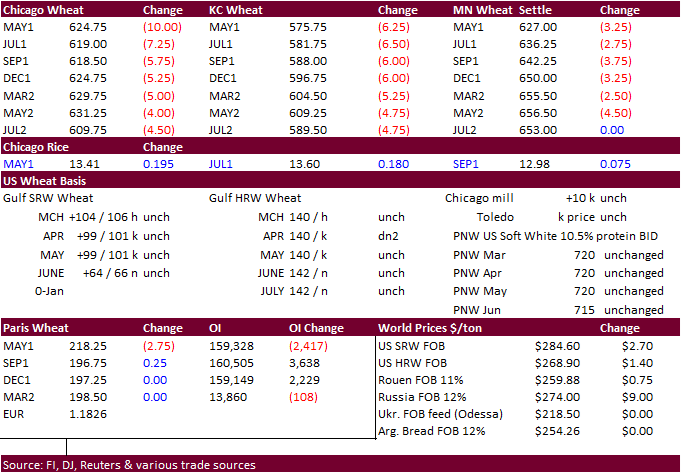

- CBOT

Chicago wheat ended 4-10 cents lower (bias May to the downside) on a higher USD, improving US HRW wheat conditions and several countries passing on wheat imports due to high prices.

- Next

support level for May Chicago is seen at $6.1975 (corrected), then $6.16. We look for KC to lose ground to Chicago wheat, but funds, dominant in Chicago wheat, have trumped this spread. We like owning MN wheat due to weather problems (too dry) for the Northern

Great Plains & Canadian Prairies. - EU

May milling wheat was 2.50 lower at 218.50 euros. Support is seen at 216.00 (up from 215 previous).

- Iraq

sees domestic wheat production is seen at 5 million tons, enough for consumption.

- South

Korea’s (MFG) bought 66,000 tons of animal feed wheat at an estimated $274.99 a ton c&f for arrival in South Korea around Oct. 5. Its optional origin. Then they bought another 66,000 tons of feed wheat at $269.65/ton for Aug/Sep shipment.

- South

Korea’s (MFG) bought 66,000 tons of animal feed wheat at an estimated $274.99 a ton c&f for arrival in South Korea around Oct. 5. Its optional origin. - South

Korea’s (FLC) bought 65,000 tons of animal feed wheat at an estimated $271.99 a ton c&f for arrival in South Korea around Oct. 15. Its optional origin except Denmark, Argentina, China and India, traders said. - Thailand

passed on 430,000 tons of animal feed wheat for shipment during May and December. Prices were regarded as too high. - The

Philippines passed on 155,000 tons of milling wheat and animal feed wheat for shipment between April and July. Prices were regarded as too high. Feed wheat offers were believed to be over $300 a ton c&f. - Japan

bought only 600 tons of feed barley under its SBS import system. They were in for 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by August 26. - Jordan

will be back in for feed barley on March 30. Possible shipment combinations are Oct. 1-15, Oct. 16-31, Nov. 1-15 and Nov. 16-30, the same periods as sought in the previous two tenders.

- Results

awaited: South Korean group SPC seeks 35,000 tons of milling wheat from the United States and Canada on March 23. for arrival in July.

Rice/Other

·

Sinograin estimated China’s cotton crop at 5.95 million tons up from an estimated 5.8 million tons in 2019-20.

·

Bangladesh has two separate rice tenders and lowest offer for latest 50,000 tons of rice was $416.00/ton CIF.

·

Bangladesh bought 50,000 tons of rice from Vietnam at $522/ton.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 208,217 tons of rice, on March 25 for arrival in South Korea in 2021 between May 1 and Oct. 31. 64,444 tons of non-glutinous brown rice is sought

from the United States. Rest from Thailand, China, Australia and Vietnam.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

Updated

3/18/21

May

Chicago wheat is seen in a $6.15‐$6.75 range

May

KC wheat is seen in a $5.65‐$6.60 range

May

MN wheat is seen in a $6.15‐$6.50 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.