PDF Attached

Private

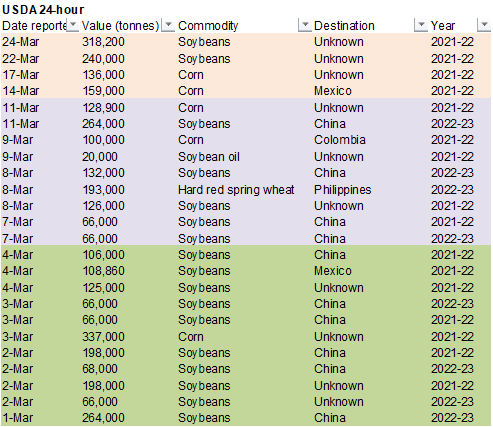

exporters reported sales of 318,200 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Bear

spreading CBOT agriculture markets was another feature today as some traders shore up positions early ahead of the weekend and upcoming USDA reports due out a week from today. SA premiums were soft over last week and SA hedging started to increase, at least

for corn. USD was higher, crude oil lower, and equities higher, at the time CBOT ags closed.

US

President Joe Biden is in Brussels for meetings on the situation in Ukraine (NATO, G7 and European Council).

![]()

(Bloomberg)

— U.S. farmers seen increasing soybean planting this year by 1.7m acres over last year’s amount, while decreasing corn by 1.4m acres, according to the avg est. of as many as 33 analysts surveyed by Bloomberg.

-

Soybean

planting seen at 88.9m acres vs 87.2m in 2021. The USDA at its annual Outlook Forum in Feb. estimated 88m acres -

Corn

seen at 92m acres which is the same as USDA’s Feb. est.; acreage was 93.4m in 2021 -

Wheat

seen at 47.9m acres, only slightly lower than USDA’s Feb. est., and 1.2m acres above 2021

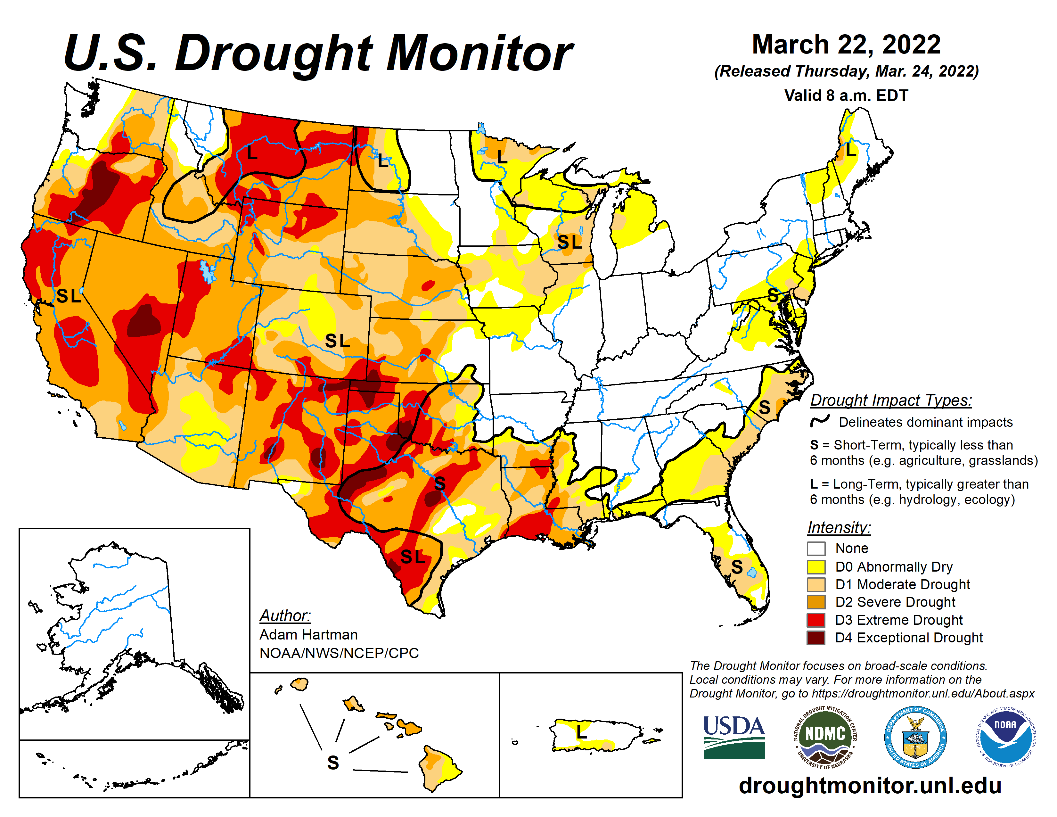

WEATHER

EVENTS AND FEATURES TO WATCH

- Rain

fell heavily across northern Rio Grande do Sul and some areas in Misiones, Argentina Wednesday and overnight.

- Amounts

varying from 1.00 to more than 5.00 inches resulted in some local flooding - This

expanded flooding that began on Tuesday in southern Paraguay into northern Rio Grande do Sul

- Rain

also continued in western Parana, southern Paraguay and in western Santa Catarina with the western parts of Santa Catarina also reporting 2.00 to more than 4.00 inches - Significant

rain also occurred in southwestern and south-central Buenos Aires overnight with rain totals of 1.00 to 2.25 inches and a few amounts to 2.87 inches - Rain

elsewhere in Argentina was more varied mostly light ranging from 0.05 to 0.88 inch with a few amounts of 1.00 to 2.00 inches in northern and central Buenos Aires - South

America’s weather has not changed greatly today for the next ten days to two weeks relative to the outlook Wednesday - Net

drying is expected in far western Argentina after today, but the moisture profile is still favorable in most of the summer crop areas to minimize any concern over the drying trend - Eastern

and northern Argentina will get some additional precipitation next week - All

of Brazil will get rain at one time or another during the next ten days to two weeks except in the heart of Bahia and northern Minas Gerais where net drying is expected to continue - Too

much dryness is already stressing minor grain, oilseed, sugarcane and coffee areas from Zona de Mata through northern Minas Gerais to central Bahia and change is not very likely for the next ten days - Safrinha

cotton and corn in Brazil will continue to have moisture abundance for ongoing crop development - Production

of these crops should be high this year - West

and South Texas and southern parts of the Texas Coastal Bend region will be left dry or mostly dry for the next ten days to two weeks - The

drying bias remains a threat to unirrigated cotton, corn and sorghum in each of these areas - U.S.

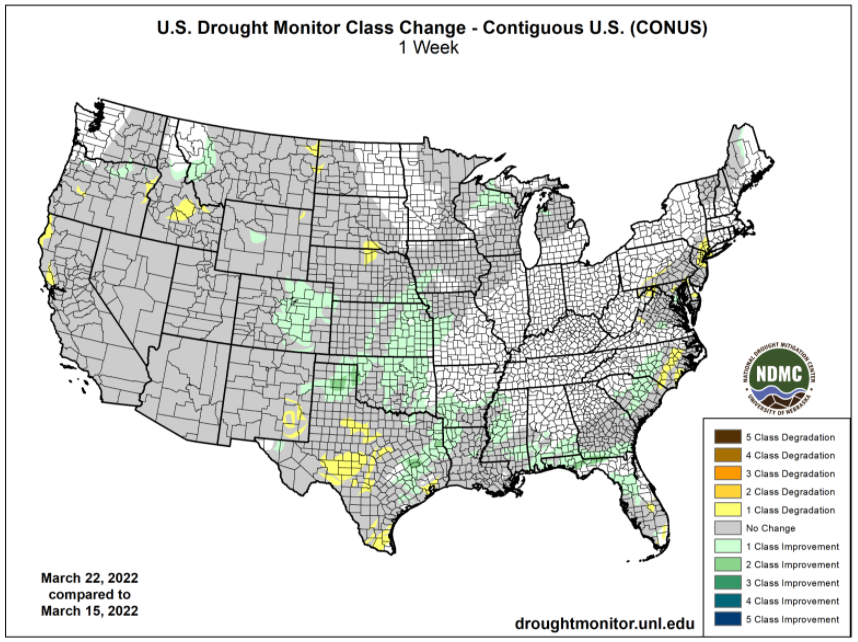

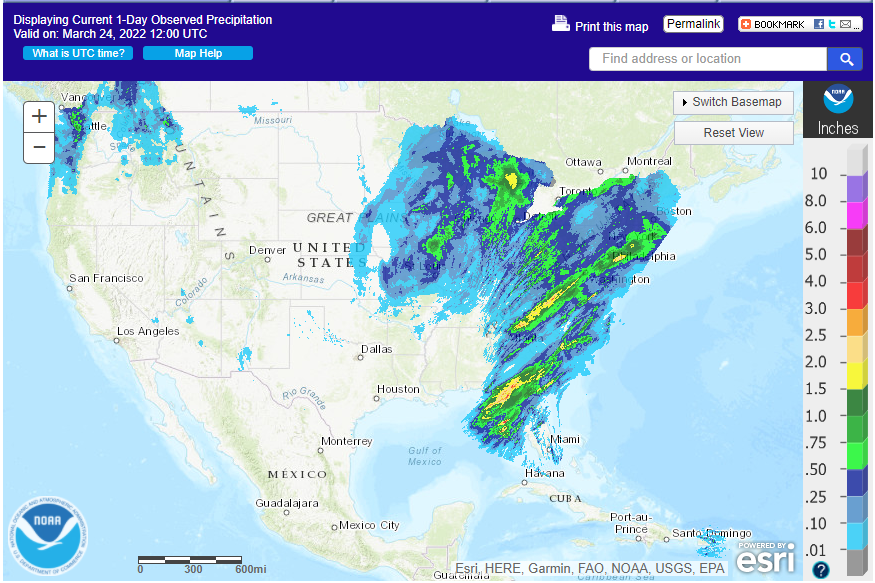

Midwest, Delta and portions of the southeastern states are too wet today and need drying - Limited

precipitation is expected over the coming week which should help reduce runoff, slow some of the flooding and begin to firm the topsoil in well-drained areas - Planting

delays in the Delta, Tennessee River Basin and parts of the southeastern states will continue for the next few days, but conditions should improve late this weekend into early next week for a little fieldwork.

- U.S.

Northwestern Plains and southwestern Canada’s Prairies may get some precipitation briefly early next week, but the outlook is not very great for follow up precipitation and subsoil moisture will remain low - California

will receive some needed rain and mountain snowfall Sunday into Monday, but the moisture will not change the bottom line on drought status or water supply - Europe

rainfall in the coming week is expected mostly in Spain and Portugal while any showers that occur elsewhere (and there will be some) are expected to be too light and brief to have much impact on soil moisture which should slowly decline - Greater

rainfall is expected in central and eastern Europe starting during the middle to latter part of next week and continuing through the first full week in April - Temperatures

will be near to above normal this week and probably next week as well - Much

of Russia, Ukraine, northern Kazakhstan, Belarus and the Baltic States were dry again Wednesday while a little rain fell in southern parts of Russia’s Southern Region and areas east into southeastern Kazakhstan - Temperatures

have been warming sufficiently to melt snow in western Russia where recent highest temperatures were in the 40s and 50s Fahrenheit.

- Some

60-degree highs occurred in Ukraine the past two days - Some

increase in precipitation is expected in the CIS this weekend and next week as waves of snow and rain evolve across the region - Temperatures

will be seasonable, although trending cooler this weekend into next week - The

precipitation may perpetuate some flood potential since there is so much snow to melt this year and significant runoff has already occurred - India

weather will continue mostly dry and seasonably warm to hot through the next ten days

- There

is some risk of showers and thunderstorms in Kerala and immediate neighboring areas of Karnataka and Tamil Nadu as well as in the far Eastern States and extreme northern most parts of the nation - China’s

rain Wednesday became confined to the coast areas of Guangxi and Guangdong leaving the rest of the nation in a net drying mode - Additional

drying is needed in the Yangtze River Basin and areas to the south to induce the best spring planting conditions - China’s

Yangtze River Basin and southern provinces will continue additional rain into the weekend - Minor

flooding will be possible along with some delay to early rice and corn planting progress - Drier

conditions are likely late this weekend and next week resulting in improved rapeseed and minor wheat conditions and to support better corn and rice planting conditions - Australia

rainfall today into early next week will be great enough to bring some increase in soil moisture to southeastern Queensland and northeastern New South Wales - The

precipitation may raise a little concern over cotton fiber quality since most bolls are open or opening - Some

temporary discoloring of cotton fiber is possible - Tropical

Cyclone Charlotte dissipated northwest of Australia Wednesday, but its remnants are still advertised to impact parts of southwestern Australia this weekend - The

storm needs to be closely monitored because of some potential that it or its remnants will bring rain to Western Australia this weekend into early next week - Rain

in Western Australia from the storm could boost topsoil moisture, although autumn planting of wheat and barley will not begin before late April - South

Africa weather will include mild to warm temperatures over the next week ten days while rainfall is sporadic and light.

- The

environment should be good for late season crop development, early crop maturation and harvest progress - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south this week

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers and thunderstorms during the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive erratic rainfall over the next week - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain is still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected over the next few days - East-central

Africa precipitation has been most significant in Tanzania - Ethiopia

has been dry biased along with northern Uganda and parts of southwestern Kenya

- Some

rain will develop in Ethiopia, Kenya and Uganda over the next few days easing some dryness, but more will be needed - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +13.33 - The

index will slowly slip lower over the coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; southeastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

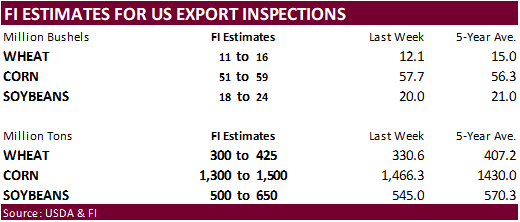

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef - Brazil’s

Unica may release cane crush, sugar output data - USDA

red meat production, 3pm - HOLIDAY:

Argentina

Friday,

March 25:

- ICE

Futures Europe weekly commitments of traders report, ~2:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Malaysia’s

March 1-25 palm oil export data - U.S.

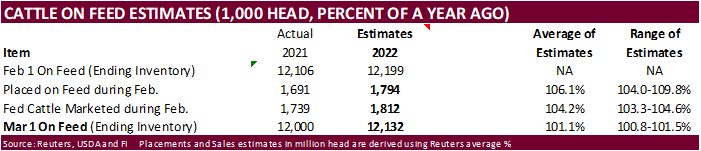

cattle on feed, poultry slaughter

Source:

Bloomberg and FI

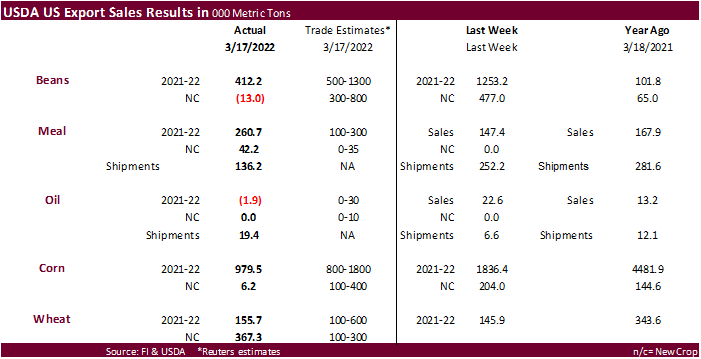

USDA

Export sales

Poor

soybean, soybean oil & sorghum export sales.

Soybeans

export sales for 2021-22 were only 412,200 tons, below a range of trade expectations and included Algeria (84,000 MT), Egypt (76,500 MT), Mexico (75,100 MT), Indonesia (66,200MT), and China (32,500 MT), were offset by reductions for unknown destinations (57,700

MT). Switches from unknown were noted for many countries. New-crop soybean export sales were negative 13,000 tons were for China.

Soybean

meal sales of 260,700 tons old crop and 42,200 tons new crop improved from the previous week and were within expectations. The Philippines and Ecuador were largest buyers. Soybean meal shipments were 136,200 tons, down from 252,200 tons previous week.

Soybean

oil sales of negative 1,900 old crop included reductions for Mexico and Canada. There were no new-crop sales. Shipments of 19,400 tons improved from the previous week.

Corn

export sales of 979,500 tons were near the low end of expectations and included Mexico (265,300 MT), Colombia (153,900 MT, including 49,000 MT switched from unknown destinations and decreases of 4,000 MT), South Korea (127,200 MT), and unknown destinations

(92,600 MT). New crop sales were only 6,200 tons. Sorghum sales were negative 6,400 tons.

All-wheat

export sales of 155,700 tons old crop and 367,300 tons new-crop were within expectations. New-crop sales included unknown destinations (142,200 MT), Colombia (69,700 MT), and Nigeria (46,000 MT),

US

Crude Oil Futures Settle At $112.34/Bbl, Down $2.59 Or 2.25%

US

Mortgage Rates Surge To 4.42%, Highest Since January 2019

88

Counterparties Take $1.708 Tln At Fed Reverse Repo Op (prev $1.803 Tln, 89 Bids)

US

EIA Natural Gas Storage Change (BCF) 18-Mar: -51 (est -59; prev -79)

–

Salt Dome Cavern NatGas Stocks (BCF): -3 (prev -8)

US

Initial Jobless Claims Mar19: 187K (est 2210K; prev 214K)

US

Continuing Claims Mar 12: 1350K (est 1400K; prev 1419K)

US

Durable Goods Orders Feb P: -2.2% (est -0.6%; prev 1.6%)

US

Durables Ex Transportation Feb P: -0.6% (est 0.6%; prev 0.7%)

US

Current Account Balance Q4: -$217.9Bln (est -$218.0Bln; prev -$214.8Bln; prevR -$219.9)

·

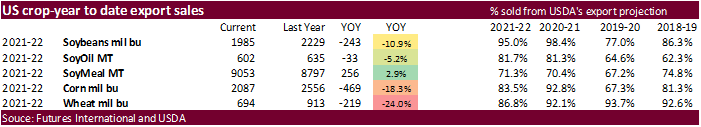

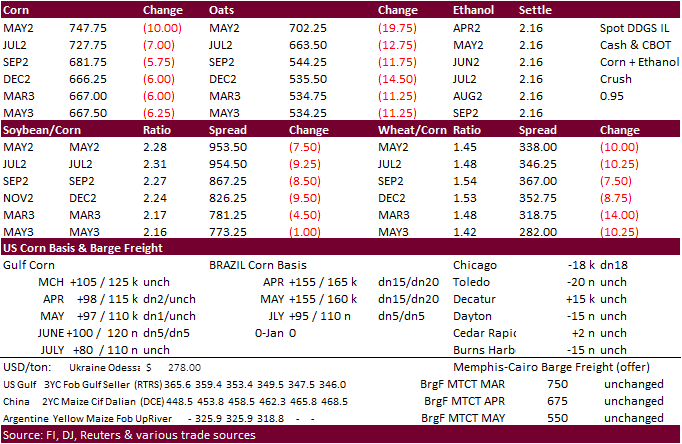

CBOT corn futures fell on lower WTI crude oil and light long liquidation. SA corn hedging las increased over the past couple of weeks with favorable weather improving Brazil’s second crop production potential. May CBOT corn

traded $7.50 for the 16th session in a row. Today May settled at $7.4825, down 9.50 cents. USDA export sales were reported near the low end of trade expectations.

·

Safras mentioned Brazil corn exports could end up near 34.5 million tons, a 66 percent increase from last season. Safras will revise their Brazil crop production estimate next week. They are currently at 115.7MMT Brazil total.

·

Argentina’s Buenos Aires grains exchange lowered their outlook for the corn production to 49 million tons versus 51 million tons previously.

·

Seven US agriculture groups asked the USDA to open CRP land. If realized, we think only a minimal amount would be adequately used for grain production as it takes about a year for CRP areas to adjust to “normal” conditions for

optimal growing conditions. Producers need time to turn the ground over and apply fertilizers. The organizations look for about 4 million acres to be utilized. Nearly 21 million acres are currently enrolled.

·

Japan and the US reached an agreement on beef tariffs which should open the door for an increase in US exports. Exports of U.S. beef to Japan were nearly $2.4 billion in 2021, according to Reuters.

Export

developments.

- Turkey

seeks 325,000 tons of corn on March 28. Optional origin for April 8 and May 5 shipment. They also seek 175 tons of local corn. 500k total makes us wonder if they are covered for reserves.

Updated

3/23/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$7.50 range

·

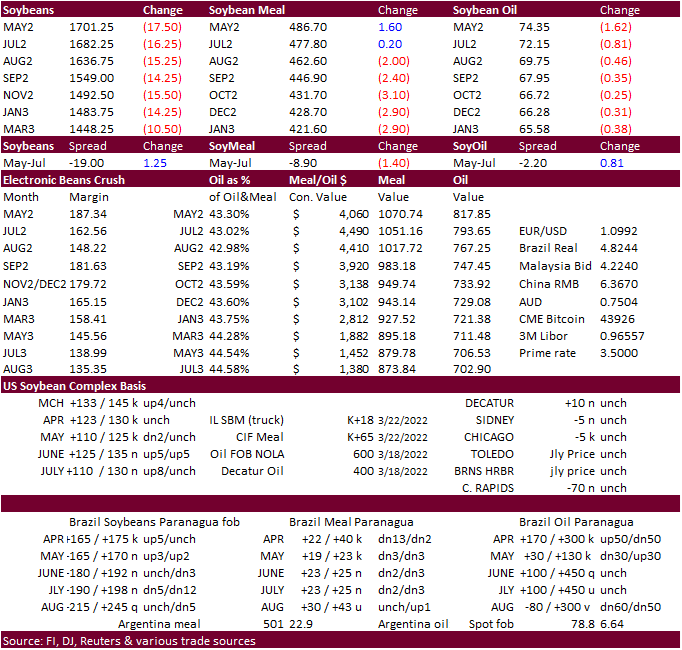

CBOT soybeans

traded lower led by bear spreading (SA premiums softer over past week) in part to sharply lower soybean oil and weaker WTI crude. USDA export sales were poor for soybeans and soybean oil. New-crop soybean sales posted a net reduction of 13,000 tons. Again,

we are hearing China soybean interest for late 2021-22 shipment, but new-crop interest is quiet. Meanwhile, China crush rates declined over the past 4 consecutive weeks in part to rising Covid-19 cases.

·

Under the 24 hour reporting system, USDA announced 318,200 tons of 2021-22 soybeans sold to unknown.

·

SBO was under pressure led by the May position after palm oil futures fell 4 percent on Thursday and poor USDA export sales. Soybean meal gained over oil on decent export sales and spreading, settling moderately higher for May

and lower for the back months.

·

Argentina was on holiday.

·

Brazil and Argentina will see beneficial rains this week and next week.

·

Argentina’s Buenos Aires grains exchange left their 2021-22 soybean production estimate unchanged at 42 million tons and sunflower production at 3.3 million tons.

·

China soybean crush for the week ending March 20 fell 140,000 tons from the previous week to 1.30MMT, down 270,000 tons from year earlier. This is the fourth consecutive weekly decline, according to AgriCensus. Covid-19 was a

factor for the slowdown.

·

Ukraine’s Agriculture Minister Roman Leshchenko has submitted his resignation, but it needs to be approved by Parliament. The Ministry earlier said the Ukraine spring crop planted area may end up around 7 million hectares for

2022, versus 15 million hectares expected before the invasion.

·

Meanwhile APK-Inform now sees the 2022 Ukraine sunseed harvest at around 9.6 million tons, down 42 percent from their 2021 estimate. The rapeseed production could fall by 19% to 2.52 million tons and soybean production down 23%

to 2.74 million tons.

·

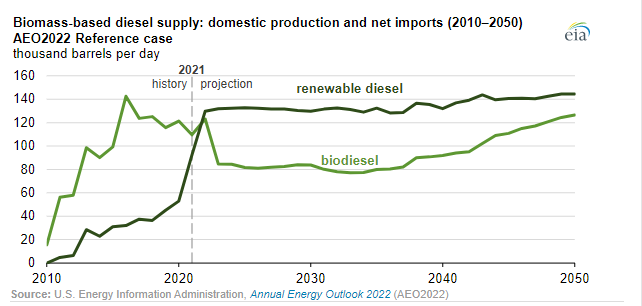

Indonesia will export 1 million kiloliters of biodiesel this year according to the Vice Chairman of the Indonesia Biofuel Producer. Last year exports were only 91,500 kiloliters in 2021.

·

Officials from Indonesia and Malaysia told Reuters that they are still committed to their biodiesel programs. Indonesia since early 2020 is currently at B30. Malaysia wants to achieve 30 percent. They have set B20 by the end of

2022.

USDA

Indonesia Oilseeds and Products Annual

- Under

the 24-hour reporting system, private exporters reported sales of 318,200 tons of soybeans for delivery to unknown destinations during the 2021-22 marketing year. - Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

EIA

projects U.S. renewable diesel supply to surpass biodiesel in AEO2022

https://www.eia.gov/todayinenergy/detail.php?id=51778&src=email#

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

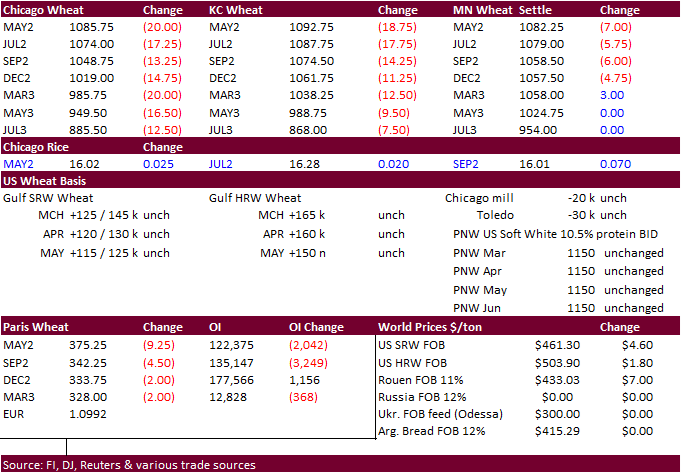

Chicago and KC wheat futures were lower in a risk off trade and precipitation this week falling across the dry areas of US HRW wheat country. MN wheat traded tow-sided, ending lower but not as weak as the other two US markets.

Bear spreading was a feature. 2021-22 all-wheat export sales were only 155,700 tons but new crop were 367,300 tons and included 119,200 tons 2022-23 HRW.

·

May Paris wheat futures were down 9.25 euros to 376.50 euros.

·

India export commitments are increasing with latest sale to Thailand.

·

Egypt is still looking to open additional avenues of sourcing wheat by extending talks with Argentina, India and the US.

·

Egypt’s supply ministry will begin offering flour to private sector mills at 8,600 Egyptian pounds ($471.23) per ton as of Saturday after setting a fixed price for bread earlier this week.

·

Thailand bought 70,000 tons of feed wheat from India at $369/ton CIFLO (Cost, Insurance and Freight Liner Out) for May shipment.

·

Jordan cancelled their import tender for 120,000 tons of milling wheat. Possible shipment combinations were May 16-31, June 16-30, July 1-15 and July 16-31.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Rice/Other

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

U.S.

EXPORT SALES FOR WEEK ENDING 3/17/2022

|

|

CURRENT |

NEXT |

||||||

|

COMMODITY |

NET |

OUTSTANDING |

WEEKLY |

ACCUMULATED |

NET |

OUTSTANDING |

||

|

CURRENT |

YEAR |

CURRENT |

YEAR |

|||||

|

|

THOUSAND |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

|

34.1 |

1,586.8 |

1,398.7 |

152.7 |

5,873.3 |

7,017.1 |

119.2 |

364.6 |

|

|

-14.7 |

567.6 |

354.6 |

39.3 |

2,188.3 |

1,439.8 |

133.0 |

364.0 |

|

|

91.4 |

1,067.2 |

1,648.2 |

105.1 |

4,112.0 |

5,767.7 |

62.1 |

372.7 |

|

|

44.8 |

503.8 |

1,956.5 |

69.0 |

2,803.4 |

4,600.9 |

50.6 |

222.6 |

|

|

0.0 |

18.8 |

78.3 |

0.0 |

169.7 |

592.1 |

2.4 |

49.4 |

|

|

155.7 |

3,744.1 |

5,436.3 |

366.1 |

15,146.7 |

19,417.6 |

367.3 |

1,373.3 |

|

BARLEY |

0.1 |

13.9 |

6.1 |

0.0 |

14.7 |

22.7 |

0.0 |

0.0 |

|

CORN |

979.5 |

22,719.4 |

32,988.6 |

1,492.1 |

30,298.6 |

31,940.1 |

6.1 |

2,138.7 |

|

SORGHUM |

-6.4 |

3,274.7 |

2,748.1 |

255.2 |

3,501.7 |

3,518.4 |

0.0 |

0.0 |

|

SOYBEANS |

412.2 |

11,161.5 |

6,380.1 |

549.2 |

42,874.7 |

54,278.8 |

-13.0 |

8,110.8 |

|

SOY |

260.7 |

3,223.1 |

2,594.5 |

136.2 |

5,829.4 |

6,202.2 |

42.2 |

276.9 |

|

SOY |

-2.0 |

167.2 |

114.0 |

19.4 |

435.2 |

521.1 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

|

24.4 |

234.2 |

330.5 |

32.5 |

922.9 |

1,053.2 |

0.0 |

0.0 |

|

|

0.5 |

3.5 |

5.3 |

5.3 |

10.7 |

23.5 |

0.0 |

0.0 |

|

|

0.1 |

16.5 |

4.0 |

0.6 |

33.2 |

33.4 |

0.0 |

0.0 |

|

|

0.2 |

43.9 |

69.6 |

0.1 |

42.3 |

83.8 |

0.0 |

0.0 |

|

|

17.6 |

73.9 |

58.3 |

11.2 |

569.2 |

440.9 |

0.0 |

0.0 |

|

|

41.0 |

240.4 |

243.7 |

4.6 |

257.5 |

360.4 |

0.0 |

0.0 |

|

|

83.8 |

612.5 |

711.4 |

54.4 |

1,835.9 |

1,995.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND |

||||||

|

UPLAND |

307.5 |

7,670.9 |

5,351.8 |

442.7 |

6,292.4 |

9,146.8 |

67.4 |

2,352.4 |

|

|

3.0 |

160.7 |

257.5 |

5.8 |

270.5 |

477.4 |

0.0 |

15.0 |

This

summary is based on reports from exporters for the period March 11-17, 2022.

Wheat: Net

sales of 155,700 metric tons (MT) for 2021/2022 were up 7 percent from the previous week, but down 51 percent from the prior 4-week average. Increases primarily for Japan (109,800 MT), Taiwan (50,100 MT), Venezuela (31,500 MT, including 30,000 MT switched

from unknown destinations), Mexico (29,900 MT, including decreases of 29,400 MT), and Chile (12,000 MT), were offset by reductions primarily for Nigeria (35,700 MT), unknown destinations (31,400 MT), and Colombia (14,500 MT). Net sales of 367,300 MT for 2022/2023

were primarily for unknown destinations (142,200 MT), Colombia (69,700 MT), Nigeria (46,000 MT), Panama (44,400 MT), and the Philippines (30,500 MT), were offset by reductions for Nicaragua (2,100 MT). Exports of 366,100 MT were up 47 percent from the previous

week, but down 5 percent from the prior 4-week average. The destinations were primarily to South Korea (83,300 MT), the Philippines (57,600 MT), Mexico (57,000 MT), Honduras (34,100 MT), and Venezuela (31,500 MT).

Corn:

Net sales of 979,500 MT for 2021/2022 were down 47 percent from the previous week and 29 percent from the prior 4-week average. Increases primarily for Mexico (265,300 MT, including decreases of 400 MT), Colombia (153,900 MT, including 49,000 MT switched

from unknown destinations and decreases of 4,000 MT), South Korea (127,200 MT), unknown destinations (92,600 MT), and Israel (69,700 MT, including 65,000 MT switched from unknown destinations), were offset by reductions reported for Costa Rica (1,800 MT) and

Nicaragua (1,300 MT). Total net sales of 6,100 MT for 2022/2023 were for Mexico. Exports of 1,492,100 MT were up 17 percent from the previous week, but down 8 percent from the prior 4-week average. The destinations were primarily to China (477,900 MT),

Japan (295,400 MT), Mexico (260,700 MT), Colombia (108,400 MT), and Canada (90,100 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 190,000 MT were reported for unknown destinations (125,000 MT) and South Korea (65,000 MT). The current outstanding balance of 535,800 MT is for unknown destinations (305,000 MT), South

Korea (130,000 MT), Morocco (60,000 MT), Italy (31,800 MT), and Saudi Arabia (9,000 MT). For 2022/2023, the current outstanding balance of 3,900 MT is for Italy.

Barley:

Total net sales of 100 MT for 2021/2022 were unchanged from the previous week and from the prior 4-week average. The destination was South Korea. No exports were reported for the week.

Sorghum:

Net sales reductions of 6,400 MT for 2021/2022–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases reported for China (126,600 MT, including 133,000 MT switched from unknown destinations and decreases

of 12,300 MT), were more than offset by reductions for unknown destinations (133,000 MT). Exports of 255,200 MT were down 2 percent from the previous week, but up 19 percent from the prior 4-week average. The destination was to China (255,000 MT) and Mexico

(200 MT).

Rice:

Net sales of 83,800 MT for 2021/2022 were up noticeably from the previous week and up 44 percent from the prior 4-week average. Increases were primarily for Japan (38,000 MT), Colombia (22,000 MT), Haiti (15,200 MT, including decreases of 100 MT), Canada

(2,200 MT), and El Salvador (1,500 MT). Exports of 54,400 MT were down 8 percent from the previous week and 22 percent from the prior 4-week average. The destinations were primarily to Mexico (27,800 MT), Honduras (12,100 MT), Haiti (7,100 MT), Canada (3,000

MT), and Jordan (1,400 MT).

Exports

for Own Account:

For 2021/2022, new exports for own account totaling 100 MT were to Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 412,200 MT for 2021/2022 were down 67 percent from the previous week and 70 percent from the prior 4-week average. Increases primarily for Algeria (84,000 MT), Egypt (76,500 MT, including 65,000 MT switched from unknown destinations and decreases

of 900 MT), Mexico (75,100 MT, including decreases of 1,000 MT), Indonesia (66,200 MT, including 55,000 MT switched from unknown destinations and decreases of 100 MT), and China (32,500 MT), were offset by reductions for unknown destinations (57,700 MT).

Total net sales reductions of 13,000 MT for 2022/2023 were for China. Exports of 549,200 MT were down 23 percent from the previous week and 38 percent from the prior 4-week average. The destinations were primarily to China (161,700 MT), Mexico (138,400 MT),

Egypt (116,500 MT), Indonesia (80,300 MT), and Japan (16,700 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 260,700 MT for 2021/2022 were up 77 percent from the previous week and 32 percent from the prior 4-week average. Increases primarily for the Philippines (88,000 MT), Ecuador (87,000 MT, including decreases of 5,000 MT), Colombia (31,300 MT, including

20,000 MT switched from unknown destinations), Venezuela (24,000 MT), and Morocco (21,000 MT), were offset by reductions primarily for Ireland (30,000 MT) and unknown destinations (27,200 MT). Net sales of 42,200 MT for 2022/2023 were reported for Ireland

(30,000 MT), Mexico (12,000 MT), and Canada (200 MT). Exports of 136,200 MT–a marketing-year low–were down 46 percent from the previous week and from the prior 4-week average. The destinations were primarily to Ecuador (32,500 MT), Mexico (27,800 MT),

Colombia (16,800 MT), Morocco (13,000 MT), and Canada (9,700 MT).

Soybean

Oil:

Net sales reductions of 2,000 MT for 2021/2022 were down noticeably from the previous week and from the prior 4-week average. Increases reported for India (800 MT, including decreases of 300 MT), were more than offset by reductions for Mexico (2,700 MT) and

Canada (100 MT). Exports of 19,400 MT were up noticeably from the previous week and up 21 percent from the prior 4-week average. The destinations were primarily to India (17,700 MT) and Mexico (1,300 MT).

Cotton:

Net sales of 307,500 RB for 2021/2022 were down 17 percent from the previous week and 7 percent from the prior 4-week average. Increases primarily for China (130,200 RB, including decreases of 8,900 RB), Turkey (71,700 RB, including decreases of 200 RB),

Bangladesh (26,500 RB), Pakistan (25,700 RB, including 200 RB switched from the United Arab Emirates and decreases of 100 RB), and Vietnam (23,400 RB, including 1,400 RB switched from South Korea, 500 RB switched from Indonesia, 500 RB switched from Japan,

and decreases of 200 RB), were offset by reductions for South Korea (1,400 RB), Guatemala (200 RB), and the United Arabia Emirates (200 RB). Net sales of 67,400 RB for 2022/2023 were primarily for China (21,800 RB), Thailand (13,600 RB), Pakistan (9,700 RB),

Turkey (7,900 RB), and Guatemala (6,100 RB). Exports of 442,700 RB–a marketing-year high–were up 36 percent from the previous week and 29 percent from the prior 4-week average. The destinations were primarily to China (173,500 RB, including 46,000 RB –

late), Vietnam (74,700 RB, including 12,500 RB – late), Turkey (50,400 RB, including 5,500 RB late), Pakistan (37,100 RB, including 2,300 RB – late), and Mexico (23,700 RB). Net sales of Pima totaling 3,000 RB were down 76 percent from the previous week and

53 percent from the prior 4-week average. Increases were primarily for India (1,200 RB), China (700 RB), and Turkey (600 RB). Exports of 5,800 RB were down 25 percent from the previous week and 61 percent from the prior 4-week average. The destinations

were primarily to China (2,000 RB), Peru (1,700 RB), and Vietnam (1,500 RB).

Optional

Origin Sales:

For 2021/2022, options were exercised to export 4,400 RB to Pakistan from the United States. The current outstanding balance of 57,200 RB is for Vietnam (52,800 RB) and Pakistan (4,400 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Late

Reporting:

For 2021/2022, exports

totaling 80,600 RB of upland cotton were reported late to China (46,000 RB), Vietnam (12,500 RB), Bangladesh (5,900 RB), Turkey (5,500 RB), South Korea (3,600 RB), Indonesia (2,600 RB), Pakistan (2,300 RB), Thailand (700 RB), India (600 RB), Guatemala (500

RB), and Peru (400 RB).

Hides

and Skins:

Net sales of 413,500 pieces for 2022 were down 11 percent from the previous week, but up 1 percent from the prior 4-week average. Increases primarily for China (256,800 whole cattle hides, including decreases of 6,900 pieces), South Korea (71,200 whole cattle

hides, including decreases of 1,100 pieces), Italy (26,600 whole cattle hides, including decreases of 700 pieces), Thailand (24,300 whole cattle hides, including decreases of 400 pieces), and Mexico (18,300 whole cattle hides, including decreases of 700 pieces),

were offset by reductions for Indonesia (400 pieces) and Brazil (100 pieces). Total net sales of 100 calf skins, including decreases of 100 calf skins were for Italy. In addition, net sales reductions of 400 kip skins were reported for Belgium (300 kip skins)

and Italy (100 kip skins). Exports of 487,200 pieces were up 13 percent from the previous week and 19 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (293,100 pieces), South Korea (79,100 pieces), Mexico (31,100

pieces), Taiwan (19,000 pieces), and Thailand (15,700 pieces). Total exports of 1,900 calf skins were to Italy. In addition, exports of 5,100 kip skins were primarily to Belgium (2,600 kip skins) and China (1,300 kip skins).

Net

sales of 328,700 wet blues for 2022 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Vietnam (111,400 unsplit, including decreases of 6,000 unsplit), Italy (88,900 unsplit, 35,200 grain splits, including

decreases of 100 unsplit and 400 grain splits), China (63,800 unsplit, including decreases of 5,000 unsplit), Thailand (20,200 unsplit), and Mexico (9,800 unsplit),

were offset by reductions for Mexico (1,000 grain splits), Taiwan (300 unsplit), and Portugal (200 grain splits). Exports of 193,700 wet blues were up 63 percent from the previous week and 71 percent from the prior 4-week average. The destinations were primarily

to Italy (52,300 unsplit and 20,700 grain splits), China (45,800 unsplit), Vietnam (40,300 unsplit), Thailand (12,600 unsplit), and Hong Kong (8,000 unsplit). Net sales reductions of 61,200 splits were down noticeably from the previous week and from the prior

4-week average. The destinations reported for China (30,400 pounds, including decreases of 13,600 pounds) and South Korea (300 pounds, including decreases of 1,200 pounds), were offset by reductions for Taiwan (86,500 pounds) and Vietnam (5,400 pounds).

Exports of 324,000 pounds were to Vietnam (240,800 pounds) and China (83,200 pounds).

Beef:

Net sales of 27,500 MT for 2022–a marketing-year high–were up 40 percent from the previous week and 29 percent from the prior 4-week average. Increases were primarily for South Korea (9,000 MT, including decreases of 700 MT), China (7,600 MT, including

decreases of 100 MT), Japan (6,000 MT, including decreases of 500 MT), Hong Kong (1,100 MT), and Taiwan (900 MT, including decreases of 100 MT). Exports of 41,800 MT–a marketing-year high–were up noticeably from the previous week and from the prior 4-week

average. The destinations were primarily to Japan (11,300 MT, including 6,500 MT – late), China (8,700 MT, including 6,600 MT – late), South Korea (6,400 MT, including 1,900 MT – late), Mexico (4,400 MT, including 3,300 MT – late), and the Netherlands (2,200

MT, including 2,000 – late).

Late

Reporting:

For 2022, exports

totaling 25,600 MT of beef were reported late to China (6,600 MT), Japan (6,500 MT), Mexico (3,300 MT), the Netherlands (2,000 MT), South Korea (1,900 MT), Egypt (1,500 MT), Italy (1,200 MT), Indonesia (900 MT), Philippines (400 MT), Hong Kong (300 MT), Guatemala

(200 MT), Singapore (200 MT), Chile (100 MT), Peru (100 MT), Switzerland (100 MT), the United Arab Emirates (100 MT), Brazil (100 MT), and Taiwan (100 MT).

Pork:

Net sales of 23,200 MT for 2022 were down 39 percent from the previous week and 30 percent from the prior 4-week average. Increases primarily for Mexico (9,200 MT, including decreases of 300 MT), South Korea (4,800 MT, including decreases of 300 MT), Japan

(3,300 MT, including decreases of 200 MT), Colombia (1,800 MT), and Australia (800 MT, including decreases of 100 MT), were offset by reductions for Nicaragua (200 MT). Exports of 29,100 MT were up 12 percent from the previous week and 1 percent from the

prior 4-week average. The destinations were primarily to Mexico (12,800 MT), Japan (4,600 MT), China (3,800 MT), South Korea (2,000 MT), and Canada (1,600 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.