PDF Attached

Europe

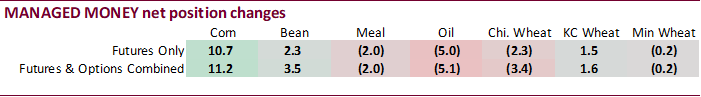

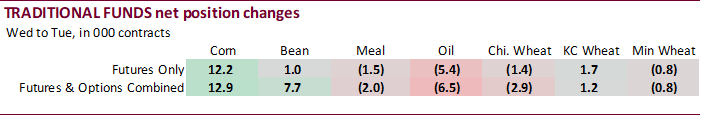

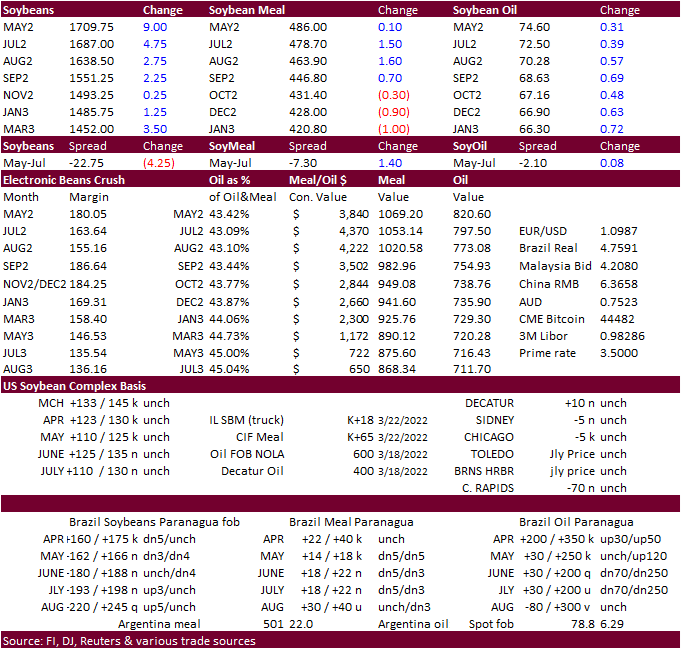

changes their clocks Sunday. Private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year. CFTC COT showed index funds and managed money extended long positions in agriculture, on a combined

basis. CBOT grain and soybean complex ended the week on a higher note, in part from a rebound in WTI crude oil.

WEATHER

EVENTS AND FEATURES TO WATCH

- Too

much rain has fallen in southern Brazil and southern Paraguay this this week - Drying

is needed and should evolve in time to support most crop needs - Too

much moisture and flooding has disrupted farming activity and raised some concern over unharvested soybean and other crop quality.

- Drying

will occur in time to prevent any lasting negative impact - Moisture

abundance in Brazil will ensure Safrinha crops have abundant moisture to carry on crop development after the monsoonal rains end - Monsoonal

precipitation is expected to linger longer than usual this year because of La Nina and that should translate into a good environment for reproducing Safrinha crops when that time comes around in late April and May - Bahia

and northern Minas Gerais soil moisture is running very short resulting in some crop stress for late season crops - The

production region is host to a minor amount of corn and soybeans, sugarcane and coffee, but the dryness is not likely to have a huge impact on production - Some

sugarcane could be stunted with rising sucrose levels - Coffee

should mature quickly with a slight negative impact on quality for these minor production areas - Cotton,

corn and soybeans produced in western Bahia have not been significant impacted by the drier bias in central Bahia - Argentina’s

rain in the south this week bolstered soil moisture substantially in Buenos Aires and will see it that late double cropped soybeans and late season corn have plenty of moisture to development with well into April without additional moisture - Temperatures

in Argentina will be mild enough to conserve soil moisture during the coming period of drier biased weather - Western

Argentina will experience the least amount of rain for a while and the ground is expected to firm up, but no serious impact on production is expected due to mild temperatures and lingering subsoil moisture - U.S.

central Plains precipitation so far this month has been great enough to improve crop conditions during the warmer days that lie ahead - Another

storm system due into the region during mid-week next week will maintain the favorable crop development potential, but drying is still expected to resume later in April and May to threaten some production of wheat and possibly summer grain and oilseed crops - U.S.

Midwest soil conditions are wet and flood conditions have been reported recently in several areas - Drying

in the coming five days will be welcome, but more rain during the middle to latter part of next week is expected to return wet field conditions possibly delaying the start of spring fieldwork.

- U.S.

Delta and Tennessee River Basin remains too wet and unlikely to see ideal planting weather in the next couple of weeks - Some

planting will occur after several days of drying, but additional rain expected during the middle to latter part of next week will saturate the soil again inducing some new planting delays - West

and South Texas are dry and expected to remain that way through most of the next two weeks - Some

rain may fall in the Rolling Plains, but the high Plains and South Texas will continue too dry.

- Rain

will fall in the Blacklands and upper Texas Coast next week maintaining favorable soil and field conditions in those areas - A

mix of rain and sunshine will impact the southeastern U.S. during the next two weeks supporting spring fieldwork and early season crop development - California

will receive rain and mountain snow briefly Sunday into Monday - The

storm is not the beginning of a trend change, but the moisture will be welcome - Any

precipitation is better than none, but this event will be too light and brief to have much impact on drought conditions or water supply

- U.S.

northwestern Plains and southwestern Canada’s Prairies will continue drier than usual resulting in ongoing concern over spring planting conditions - Some

moisture is possible in the next few weeks, but April is expected to be drier and warmer than usual once again - Europe

rainfall through the weekend is expected mostly in Spain and Portugal while any showers that occur elsewhere (and there will be some) are expected to be too light and brief to have much impact on soil moisture which should slowly decline - Greater

rainfall is expected in central and eastern Europe starting during the middle to latter part of next week and continuing through the first full week in April - The

moisture will be good in improving spring planting and early winter crop development potentials over time - Temperatures

will be near to above normal this week and probably next week as well - Much

of Russia, northern Kazakhstan and the Baltic States were dry again Thursday while a little rain fell in north-central Ukraine and eastern Belarus

- Temperatures

have been warming sufficiently to melt snow in western Russia where recent highest temperatures were in the 40s and 50s Fahrenheit.

- Some

60-degree highs occurred in Ukraine the past few days - Some

increase in precipitation is expected in the western CIS this weekend and next week as waves of snow and rain evolve across the region - Temperatures

will be seasonable, although trending cooler this weekend into next week - The

precipitation may perpetuate some flood potential since there is so much snow to melt this year and significant runoff has already occurred - India

weather will continue mostly dry and seasonably warm to hot through the next ten days

- There

is some risk of showers and thunderstorms in Kerala and immediate neighboring areas of Karnataka and Tamil Nadu as well as in the far Eastern States and extreme northern most parts of the nation - China’s

rain Thursday was widespread in the Yangtze River Basin and areas south to the southern coastal provinces while snow and rain fell in northeastern parts of the nation.

- Drying

is needed in east-central and southeastern China were too much rain has fallen this month - Flooding

could be threatening to some rapeseed and a few other crops in the Yangtze River Basin.

- China’s

will see a better mix of rain and sunshine during the next week to ten days - Improving

crop and field working conditions are expected - Australia

rainfall Thursday and that expected into early next week will be great enough to bring some increase in soil moisture to southeastern Queensland and northeastern New South Wales - The

precipitation may raise a little concern over cotton fiber quality since most bolls are open or opening - Some

temporary discoloring of cotton fiber is possible - South

Africa weather will include mild to warm temperatures over the next week ten days while rainfall is sporadic and light.

- The

environment should be good for late season crop development, early crop maturation and harvest progress - Indonesia

and Malaysia rainfall will be abundant during the next ten days with rain falling every day in portions of the region

- Some

local flooding will be possible - Philippines

rainfall is expected to be periodic and mostly beneficial during the next ten days; wettest in the south and east over the next ten days

- Mainland

areas of Southeast Asia will also experience a near-daily occurrence of showers and thunderstorms during the next ten days - The

environment will be very good for crop development and helpful in raising topsoil moisture for corn and rice planting - A

tropical disturbance may impact the Vietnam coast during the second half of next week, although confidence is low

- Colombia,

Ecuador, western Venezuela and parts of Peru will remain plenty wet during the next ten days - Frequent

rain is expected - The

moisture will be great for coffee and cocoa flowering and well as support of all crops - Ghana

and Ivory Coast will receive erratic rainfall over the next week - The

precipitation may be a little more erratic than desired outside of Ivory Coast and Ghana in the remainder of west-central Africa.

- Greater

rain is still be needed in interior Nigeria and interior Cameroon as well as some Benin locations, despite a little rain this week - The

greatest and most widespread precipitation is expected over the next few days - East-central

Africa precipitation has been most significant in Tanzania - Ethiopia

has been dry biased along with much of Kenya - Some

rain will develop in Ethiopia, Kenya and Uganda over the next few days easing some dryness, but more will be needed - The

moisture boost will be welcome. - Today’s

Southern Oscillation Index is +13.11 - The

index will slowly slip lower over the coming week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week; southeastern areas will be wettest - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica - Guatemala

will also get some showers periodically

Source:

World Weather Inc.

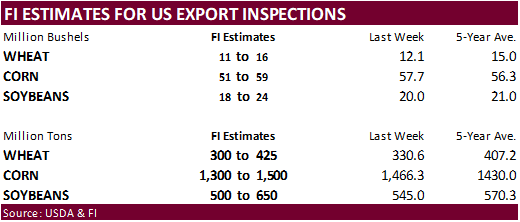

- USDA

export inspections – corn, soybeans, wheat, 11am - Ivory

Coast cocoa arrivals

Tuesday,

March 29:

- EU

weekly grain, oilseed import and export data - Vietnam’s

General Statistics Department releases March export data for coffee, rice and rubber

Wednesday,

March 30:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - USDA

hogs and pigs inventory, 3pm

Thursday,

March 31:

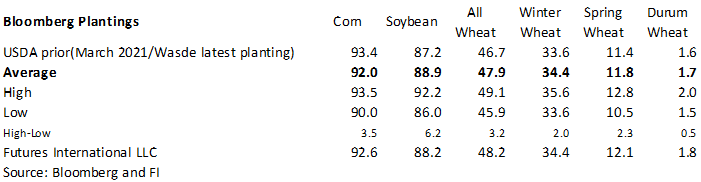

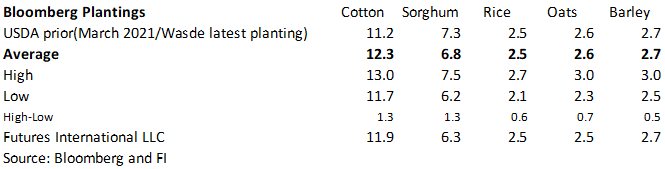

- U.S.

annual acreage prospective planting data for various farm commodities, including wheat, barley, corn, cotton, soybeans and sunflower, noon - USDA

quarterly stockpile data for wheat, barley, corn, oats, soybeans and sorghum, noon - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - U.S.

agricultural prices paid, 3pm - Malaysia’s

March palm oil export data

Friday,

April 1:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Australia

Commodity Index - USDA

soybean crush, DDGS output, corn for ethanol, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

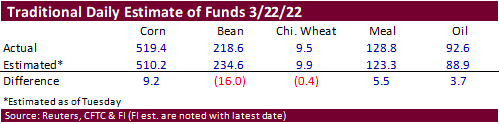

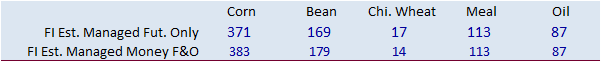

Combined

soybeans, soybean oil, soybean meal, corn, soft wheat and KC wheat net long managed money position was again a record at 808,835 contracts. As true for the combined soybeans, soybean oil, soybean meal, corn, soft wheat and KC wheat net long index fund position

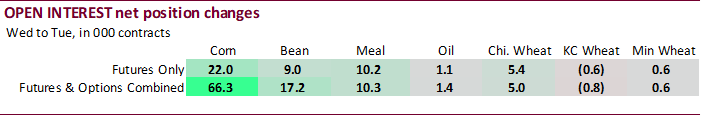

at a record 1,171,253 contracts. Open

interest for the week ending 3/22 was up sharply for corn.

Reuters

Table via CFTC

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

304,695 8,651 474,754 7,722 -743,092 -7,291

Soybeans

112,072 6,028 217,249 9,224 -302,760 -14,468

Soyoil

53,412 -5,849 117,878 -995 -189,426 3,333

CBOT

wheat -41,255 -3,782 165,037 -412 -120,684 829

KCBT

wheat 16,289 731 64,996 -317 -80,695 506

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

384,101 11,192 282,310 6,910 -737,088 -10,770

Soybeans

174,192 3,502 124,835 -4,166 -298,311 -2,769

Soymeal

101,164 -1,995 92,830 426 -245,261 2,372

Soyoil

84,078 -5,093 88,244 41 -194,523 2,962

CBOT

wheat 19,511 -3,434 79,089 -2,186 -95,401 1,741

KCBT

wheat 45,789 1,553 23,138 -1,540 -71,045 1,288

MGEX

wheat 14,222 -165 602 -179 -27,004 339

———- ———- ———- ———- ———- ———-

Total

wheat 79,522 -2,046 102,829 -3,905 -193,450 3,368

Live

cattle 41,878 1,734 76,583 -1,030 -125,848 73

Feeder

cattle -1,382 1,682 6,562 -349 1,267 -929

Lean

hogs 62,434 -910 58,954 475 -114,381 2,093

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

107,034 1,749 -36,358 -9,082 2,149,285 66,274

Soybeans

25,846 4,218 -26,562 -786 1,016,326 17,229

Soymeal

19,100 -1 32,166 -802 457,776 10,279

Soyoil

4,064 -1,421 18,137 3,512 415,464 1,447

CBOT

wheat -100 515 -3,098 3,364 518,617 5,021

KCBT

wheat 2,707 -379 -589 -921 208,907 -785

MGEX

wheat 6,920 -655 5,261 661 68,469 554

———- ———- ———- ———- ———- ———-

Total

wheat 9,527 -519 1,574 3,104 795,993 4,790

Live

cattle 22,021 -148 -14,634 -630 366,192 -2,904

Feeder

cattle 859 -502 -7,306 98 58,366 -1,316

Lean

hogs 3,134 -1,271 -10,142 -388 315,861 -6,763

=================================================================================

86

Counterparties Take $1.677 Tln At Fed Reverse Repo Op (prev $1.708 Tln, 88 Bids)

US

Pending Home Sales (M/M) Feb: -4.1% (est 1.0%; prev -5.7%; prevR -5.8%)

US

Pending Home Sales NSA (Y/Y) Feb: -5.4% (est -2.2%; prev -9.1%; prevR -9.2%)

US

University Of Michigan Sentiment Mar F: 59.4 (est 59.7; prev 59.7)

US

University Of Michigan Current Conditions Mar F: 67.2 (est 67.6; prev 67.8)

US

University Of Michigan Expectations Mar F: 54.3 (est 54.4; prev 54.4)

·

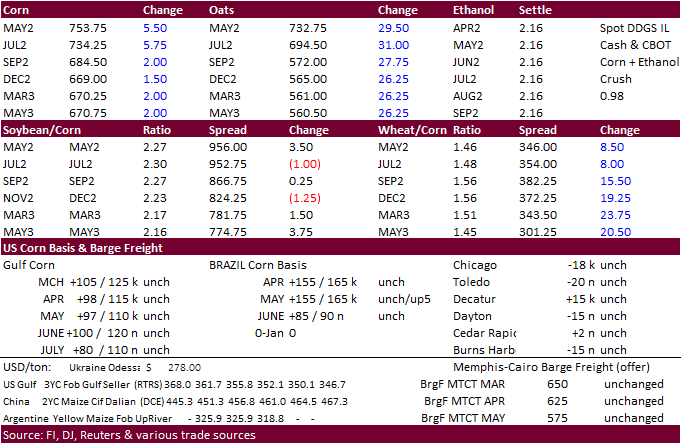

US corn futures ended higher at the electronic close on weaker WTI crude and higher wheat. News was thin.

May

CBOT corn

traded at $7.50 for the 17th consecutive session, settling at $7.54, up 5.75 cents.

·

For the week corn was up 1.7%.

·

SA corn is cheaper than US for May/June positions by 20-30 cents.

·

US crude oil settled at $113.90/Bbl, up $1.56 or 1.39%.

·

Ukraine lifted the requirement for export licenses for corn and sunflower oil for 2021-22 season. Export restrictions remain in place for other staple crops to ensure domestic supplies.

(Bloomberg)

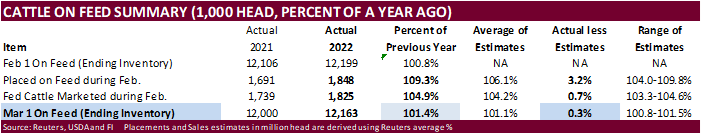

— March 1 hog inventory seen falling to 73.05m head vs 73.93m head in the same period last year, according to the avg in a Bloomberg survey of eight analysts. That would be the sixth straight quarter of y/y declines. Breeding inventory seen down 0.1% y/y,

and market hogs seen falling 1.3% y/y. The pig crop seen rising 1.3% y/y. Dec.-Feb. farrowing seen up slightly (+0.4%) y/y, while farrowing intentions for March-May seen down slightly (-0.3%). Report is due out on March 30.

Export

developments.

- South

Korea’s NOFI group bought 137,000 tons of SA origin corn at $403.90/ton and $404.89 for June 25-July 1 arrival. They also bought feed wheat from India.

- Turkey

bought 175,000 tons of corn from domestic warehouses at $389.75/ton for April 8 through May 5 delivery.

- Results

awaited in Turkey seeking 325,000 tons of corn. Optional origin for April 8 and May 5 shipment. They also seek 175 tons of local corn.

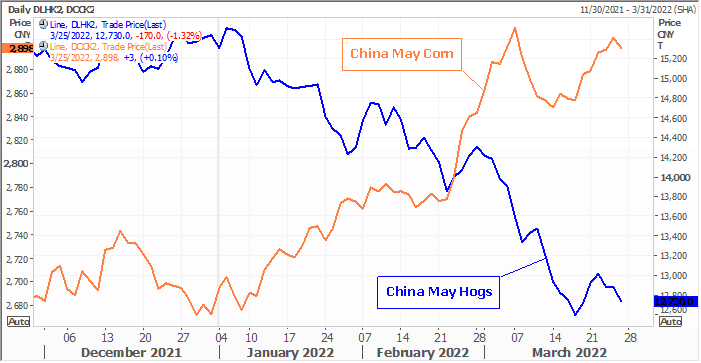

China

hog producers

are seeing profits further erode from higher feedgrain costs and weaker pig prices. China soybean meal futures are up about 35% while live hog futures recently fell to their lowest since the contract launched in early 2021. China May corn futures are up about

7.5 percent on a nearby rolling basis.

Source:

Reuters and FI

Updated

3/23/22

May

corn is seen in a $6.75 and $8.10 range

December

corn is seen in a wide $5.50-$7.50 range

·

CBOT May

soybeans and soybean oil started lower but a reversal in WTI and other outside commodity markets turned prices higher. Soybean meal was higher for the majority of the day session. US SBM basis remains firm. May soybeans finished 9.50 cents higher at $17.1025,

May meal up $2 at $487.90, and May SBO up 46 at 74.75 cents.

·

For the week, soybeans were up 2.5%, soymeal up 2.3% and soyoil was up 3.4%.

·

USDA announced 132,000 tons of current crop year soybeans were sold to China.

·

Ukraine lifted the requirement for export licenses for corn and sunflower oil for 2021-22 season due to ample supplies. Export restrictions remain in place for other staple crops to ensure domestic supplies.

·

We are hearing some sunflower oil is trying to make its way out of Ukraine through rail.

·

AmSpec reported Malaysian March 1-25 palm exports at 1.009 million tons, down nearly 5 percent from the same period month ago. ITS shows a 4.9% decrease.

·

Malaysian palm oil gained 7 percent this week.

- Under

the 24-hour reporting system, private exporters reported sales of 132,000 tons of soybeans for delivery to China during the 2021-22 marketing year. - Qatar

seeks to buy 960k cartons of corn oil in a tender closing April 4.

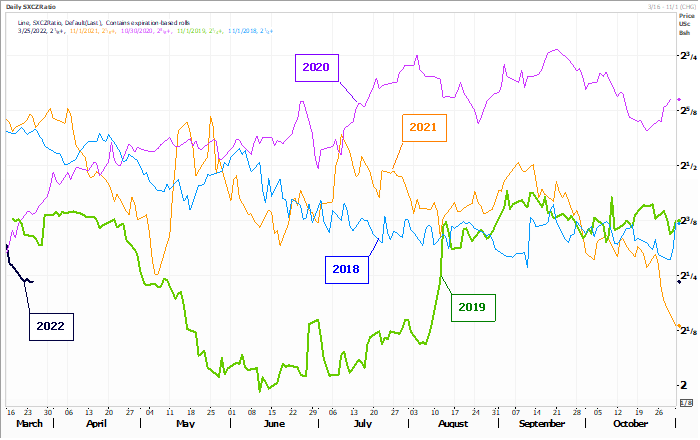

Seasonal

November Soybean / December Corn ratio – new crop soybean look cheap relative to corn

Source:

Reuters and FI

Updated

3/14/22

Soybeans

– May $16.00-$18.00

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $430-$520

·

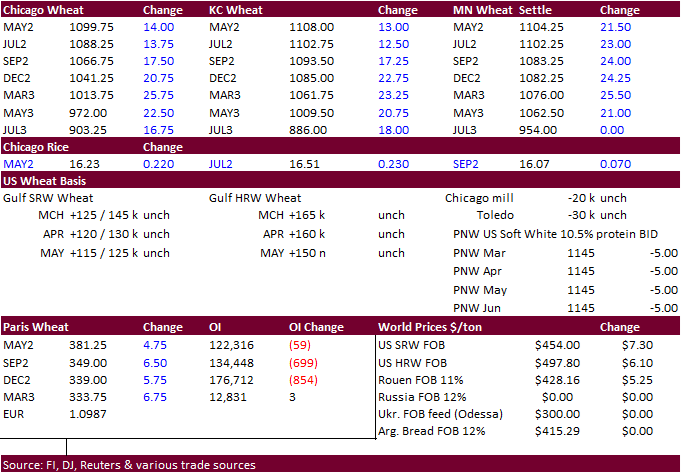

US wheat futures were higher on ongoing Black Sea shipping concerns and drought conditions across the southern Great Plains. Texas and surrounding states are still abnormally dry.

More

than half of Kansas was classified as under severe drought or worse as of March 8.

·

May Chicago wheat was up 16.50 to $11.0225, May KC up 15.75 to $11.1075, and May MN up 26 cents to $11.0875.

·

For the week Chicago was 3.6% higher, KC up 3.5% and MN up 4.0%.

·

Prices did grind lower earlier on talk of slowing global import tender development. Since the Ukraine/Russia situation started, major importers dependent on Black Sea supplies are switching to alternative origins, but some traders

may think the transition is slower than expected.

·

Emerging alternative markets are increasing commitments, such as India, and this is seen as potential loss in US market share.

·

Canadian wheat exports as of March 20 were about 155,000 tons, down 35 percent from the previous week and crop-year to date exports are off 40 percent from a year earlier at 7.35 million tons.

·

Ukraine planted 150,000 hectares of spring grains so far this season.

·

Russia’s wheat export duty as of March 30 increases to $87 from $86.40 per ton. Barley decreases $75.80 from $79.60 per ton and corn will rise to $58.30 from $53.20 per ton.

·

Iran plans to send wheat to Lebanon where stocks are very thin.

·

French soft wheat conditions were rated 92 percent G/E as of March 21, unchanged from the previous week and up from 87 percent year earlier. Winter barley and durum wheat are both 88%.

·

May Paris milling wheat settled up 4.75 euros, or 1.3%, at 381.25 euros ($418.80) a ton.

·

Qatar seeks 105,000 tons of optional origin animal feed barley on March 27 shipment in April, May and June.

·

South Korea’s NOFI group bought 65,000 tons of Indian feed wheat at $379.86/ton for July arrival.

·

Bangladesh is in for 50,000 tons of wheat with a deadline of April 4.

Rice/Other

·

US cotton futures were up limit on US drought concerns, this trade, and USDA export sales hitting a marketing year high last week. More than half of Kansas was classified as under severe drought or worse as of March 8.

·

(Bloomberg) — Qatar is seeking to buy 1.2m bags of rice in a tender that closes April 4, according to the Ministry of Commerce and Industry’s website. Qatar also seeks to buy 960k cartons of corn oil in a tender closing April

4

Updated

3/14/22

Chicago

May $9.35 to $12.50 range

KC

May $9.25 to $12.50 range

MN

May $10.00‐$13.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.