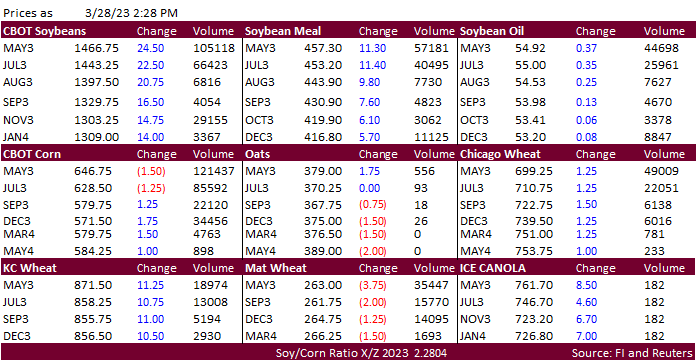

PDF Attached

USDA

reported private exporters reported sales of 136,000 metric tons of corn for delivery to China during the 2022/2023 marketing year. Longs were dominant today in the agriculture markets. US winter wheat problems coupled by SE Asia oilmeal demand interest hinted

a higher trade. The KC/Chicago wheat spread hit a new 12-year high.

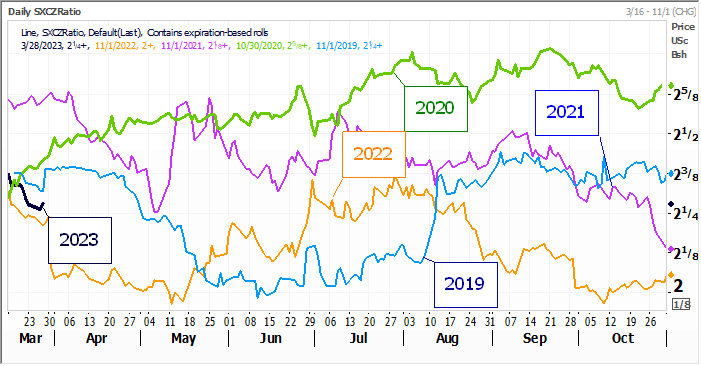

SX/CZ

US acreage battle far from over

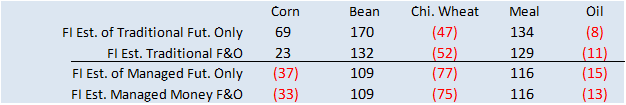

Fund

estimates as of March 28

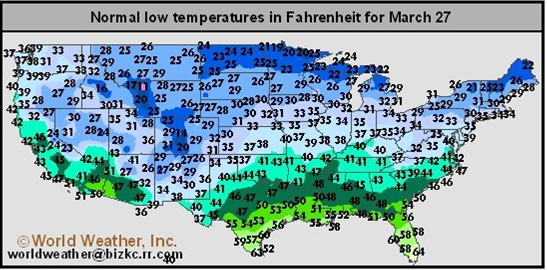

Weather

Weather

World

Weather Inc.

WEATHER

TO WATCH

-

North

Africa and eastern Spain are still dry and unlikely to get much rain for the coming week impacting durum wheat and barley among other crops in Spain -

Irrigated

crops are likely performing well -

Precipitation

has been suggested for next week in a part of North Africa, but the GFS model is overdoing the precipitation and future model runs will likely remove some of the moisture -

Production

cuts are expected in Tunisia without some significant rain soon. Algeria and Morocco crop stress will rise as temperatures trend warmer -

Northern

Morocco crops are in better shape than last year at this time, but the southwest drought prevented much planting from occurring for the second year in a row -

U.S.

southwestern hard red winter wheat and West Texas cotton areas are still notably drought stricken with little opportunity for rain for the next ten days -

South

Texas and the Texas Coastal Bend rain prospects are good, but only for light showers and a general soaking is still eluding the region raising concern over dryland corn, cotton and sorghum prospects for 2023 -

U.S.

Red River Valley and upper Midwest flood potentials remain high because of significant snowpack and little to no melting for another ten days -

Two

additional storms are likely in the coming week producing at least some additional rain and snowfall -

The

first event is expected at the end of this workweek when some significant snowfall and rain are possible from South Dakota to the western Great Lakes region -

A

second precipitation event is expected for late in the weekend or early next week, although it will likely be a weaker storm

-

Computer

forecast model divergence remains significant on both of these storms and the situation will be closely monitored -

Warmer

temperatures and potential for some rain in April will induce significant runoff that is likely to resulting in the start of flooding -

U.S.

Delta, Tennessee River Basin and parts of the lower Midwest will be wet enough or too wet to advance planting in a significant manner during the next two ten days to two weeks -

Planting

delays are under way and will continue for a while -

Mountain

snowpack in California is still more than double the norm for this time of year and water reservoirs in the state are already above historical averages raising the potential for flooding this spring as the significant snowmelt raises water reservoir levels

to full capacity warranting and significant spillage of water down the various river systems -

Irrigated

fruit, vegetable and other crops will likely yield better in 2023 than they did in 2022 because of improved water supply -

Argentina

and Brazil forecast weather has not changed today relative to recent past days -

Argentina

will experience some increase in precipitation late this week and mostly next week

-

In

the meantime, fieldwork and crop maturation will advance well -

Brazil

will see rain in the south and in the far north maintaining favorable to abundant soil moisture -

Center

south Brazil continues to experience net drying which is needed to get the remaining Safrinha crops planted and support additional soybean harvesting -

Abundant

rain is expected in Brazil’s Amazon River Basin as well as Peru, Colombia and surrounding areas -

Northern

India will receive additional rainfall later this week maintaining concern over winter wheat and other crop quality -

Dry

and warm weather is needed to expedite crop maturation and harvest progress -

Other

areas in India are experiencing favorable weather for this time of year -

Subsurface

ocean water temperatures are warming in the eastern equatorial Pacific Ocean supporting the idea that El Nino is coming later this year -

China’s

North China Plain and Yellow River Basin are still advertised to receive some significant moisture next week -

The

event is far enough out in time to leave room for forecast models to reduce some of the intensity of rain and the situation will be closely monitored -

The

moisture would be a boon to wheat and barley development this early spring and could induce better spring planting conditions as well -

China’s

southernmost provinces (excepting Yunnan) are excessively wet and need a period of drying time to support early rice planting and other spring planting and fieldwork -

China’s

rapeseed crop is rated favorably -

Southwestern

China (mostly Yunnan) needs rain for cotton and rice planting -

Europe

will experience waves of rain over the next ten days to two weeks -

Eastern

Spain will remain one of the driest areas in the continent for a while and temperatures will be warmer than usual throughout the next ten days possibly threatening dryland winter crops and some of the planting of spring crops -

Abundant

moisture is likely elsewhere with “some” relief to dryness in Romania and the lower Danube River Basin during the second week of the outlook -

Western

CIS crop areas; including Ukraine, Belarus, far western Russia and the Baltic States will experience increasing precipitation and a continuation of wet field conditions for a while -

Some

flooding is expected in northern Russia where significant snowmelt is under way -

Mexico

drought will continue into April, although there will be some periodic opportunity for rain in eastern parts of the nation starting at mid-week this week and lasting into next week -

Canada’s

Prairies will continue drier than usual this week especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

-

Precipitation

is expected to increase during April -

West-central

Africa precipitation will be erratically distributed over the next few days, but it may increase next week -

Recent

precipitation has been erratic with some areas getting plenty of rain and others need more -

Rain

is expected periodically throughout the next couple of weeks with most areas getting at least some rain -

Some

of the rain will be locally heavy -

Eastern

Australia rainfall will occur periodically over the next ten days improving soil moisture for some areas and disrupting fieldwork in other areas.

-

The

change will be good for a few late season crops, but drier weather may be needed to protect early maturing cotton in the open boll stage -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in portions of Honduras and Nicaragua -

South

Africa crop weather has been very good this year, although portions of the nation are drying out now and the trend may continue for a while -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects are fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after recent rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East have been experiencing a boost in precipitation -

This

week’s precipitation will be greatest in Turkey, Iraq and western Iran -

Improving

soil moisture throughout the Middle East is improving rice and cotton planting prospects (among other crops) and winter wheat conditions are improving -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will experience a general boost in precipitation this week and next week which is normal at this time of year.

-

Recent

temperatures have been heating up while it has been dry and that, too, is typical of this time of year ahead of the coming monsoon season -

Eastern

Africa precipitation is expected to scatter daily from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -0.77 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Tuesday,

March 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 29:

- EIA

weekly US ethanol inventories, production, 10:30am - Coffee,

rice and rubber exports from Vietnam

Thursday,

March 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

hogs & pigs inventory, 3pm - HOLIDAY:

India

Friday,

March 31:

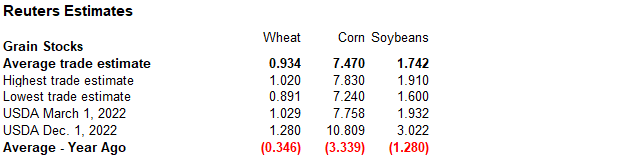

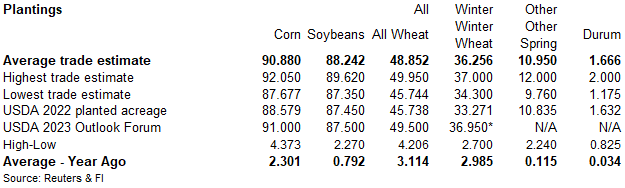

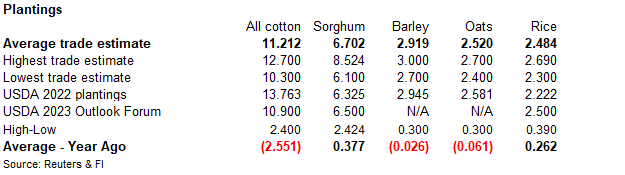

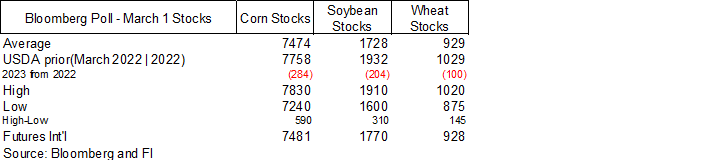

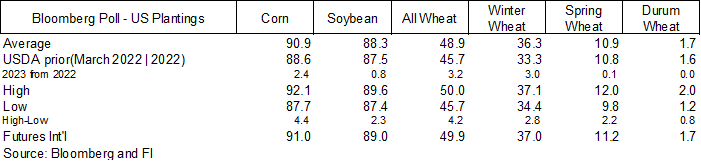

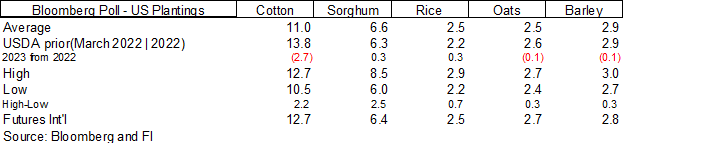

- US

prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon - USDA’s

quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Malaysia’s

March palm oil export data - US

agricultural prices paid and received, 3pm

Source:

Bloomberg and FI

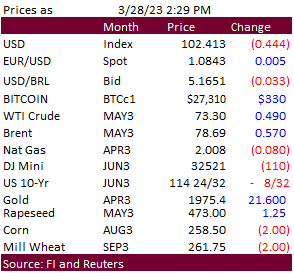

Goldman

Sees 35% Odds Of Us Recession In 12-Mths, Up From 25%

98

Counterparties Take $2.220 Tln At Fed Reverse Repo Op. (prev $2.218 Tln, 100 Bids)

CME

FedWatch Tool

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Macros

US

FHFA House Price Index (M/M) Jan: 0.2% (est -0.3%; prev -0.1%)

·

After a lower start, long positioning got behind corn futures and spreading against wheat and soybeans limited losses, but in the end, the front two-month contracts lost while back months found a bid. Second day of limited news

for US corn futures, other than China adding onto US corn commitments. Traders are trying to figure out if USDA will surprise the trade with 2023 US corn initial plantings on Friday. We look for commercials and specs to lift trades headed into the report over

the next couple of days.

·

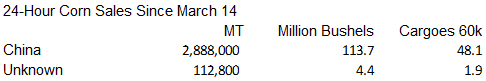

USDA reported additional corn sales to China. Nearly 3 million tons of corn has been reported by USDA to be sold under the 24-hour reporting system to China since March 14.

·

Anec: Brazil March corn exports seen at 836,428 tons, down from 898,632 previous.

·

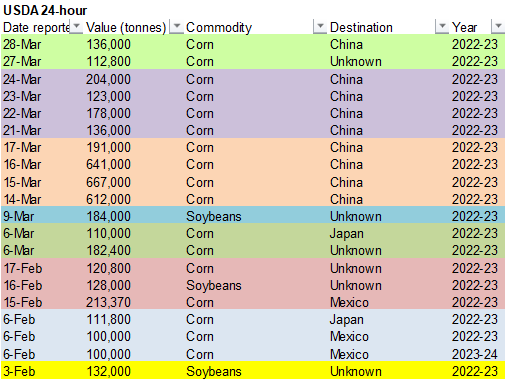

USDA hogs and pigs report is due out Thursday and a Bloomberg poll sees the US hag herd as of March 1 seen rising 0.4% from a year earlier to 72.97 million head. A Reuters poll see a 0.2% increase. Reuters trade estimates are

below the export development section.

·

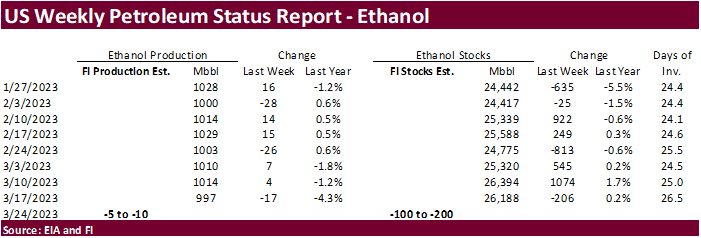

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 thousand barrels to 1001k (989-1020 range) from the previous week and stocks down 196,000 barrels to 25.992 million.

Export

developments.

-

USDA

reported private exporters reported sales of 136,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

·

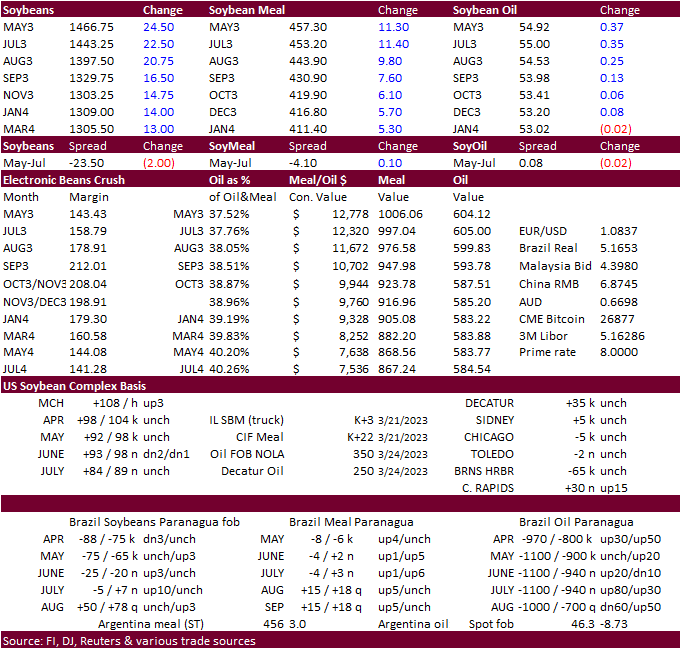

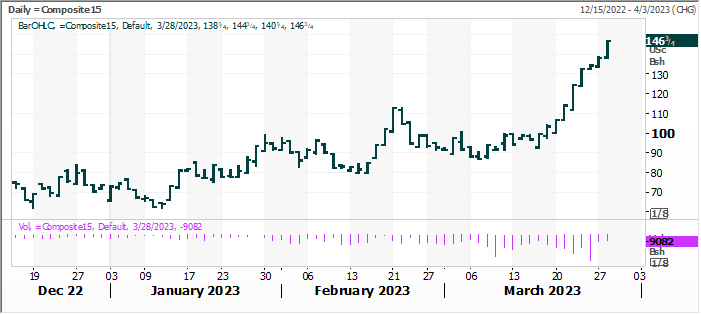

US soybeans ripped higher following a strong rally in soybean meal while soybean oil was, at least earlier, on the defensive before trending higher by mid-session. Offshore values did suggest meal should gain over soybean oil,

but the pronounced reversal in oil share was unexpected. We like SBO over meal if competing outside vegetable oil markets continue to recover this week.

·

We heard there was a large soybean meal trade with and/or within China. Details lacked, and a little frustrating given the uncertainty earlier over the rise in meal futures. Also noted was the overdone selling for soybean meal

futures, so technicals can’t be overlooked.

·

Anec: Brazil March soybean exports seen at 15.197 million tons, down from 15.388 previous. Meal exports 1.757 million tons, down from 1.787 million previous.

·

Argentina may soon roll out a “support package” for producers, last 5 months. Details were not revealed. A new “soybean dollar” could be issued for the April-July time period, as rumored.

·

Cargo surveyor SGS reported March 1-25 Malaysian palm oil exports up 18.5 percent from the same period month ago.

·

(Reuters) – Indonesia plans to set its crude palm oil (CPO) reference price for the April 1-15 period at $898.29 per ton. That price would put the export tax and levy at $74 and $95 per ton respectively, unchanged from the current

level. A decree officially stating the reference price had yet to be published.

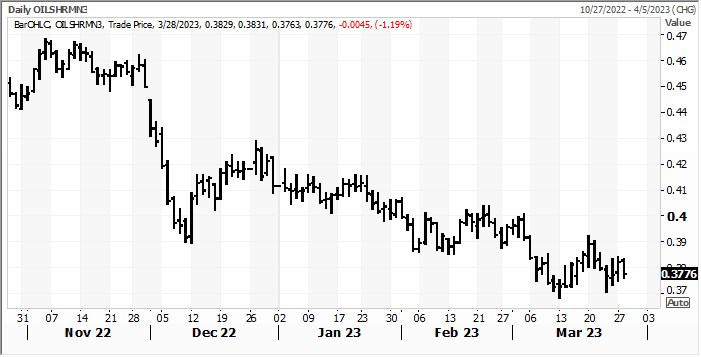

Soybean

oil share – July (as of 1:15 CT)

Export

Developments

·

None reported

Updated

03/28/23

Soybeans

– May $13.75-$15.00

Soybean

meal – May $375-$450 (both ranges revised higher for products)

Soybean

oil – May 51.50-56.50

·

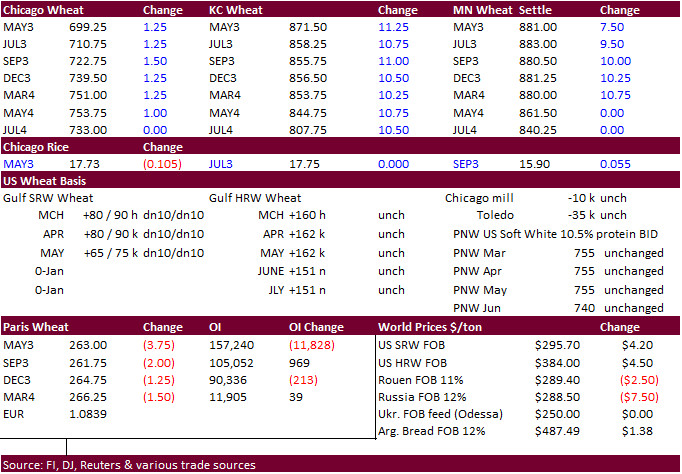

Dumpy trade in US wheat futures, trending higher again for most of the day and close. We think US wheat fund buying is running out of short term steam, but stand by KV and MN type wheat on commercial pricing. US producer selling

for all classes have been lackluster for the US after the large decline in general cash prices. Bottom in cash prices may cure the recent lows? US crop conditions were mixed yesterday but a couple key state ratings declined. US weather turned slightly unfavorable

for the US plains for this week, but some southwestern wheat area will see some precipitation.

·

US will see cold temps across the upper Great Plains over the next few days.

·

The KC/Chicago wheat spread hit a new 12-year high. KWN3-WN3…

·

Selected state winter wheat ratings were released late yesterday. Kansas was rated only 19 percent good/excellent (unchanged from previous week). Colorado winter wheat fell to 28 percent from 36 percent previous week. Oklahoma

increased to 34 percent from 29 percent. Texas decreased to 18 percent from 23 percent.

·

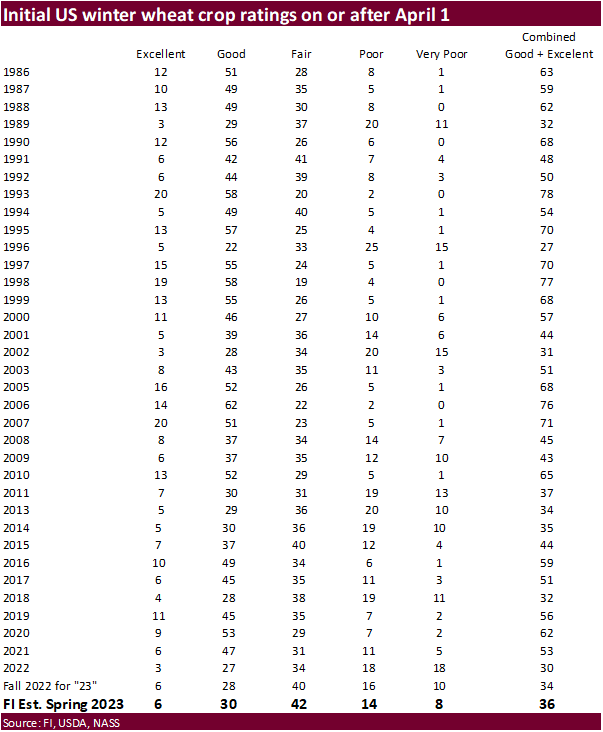

USDA will resume national winter wheat crop ratings Monday, April 3. Our initial estimate for the US combined winter wheat good and excellent categories below.

·

Paris May wheat was down 3.75 euros at 263.00 per ton.

·

China will auction off 900,000 tons of wheat from state reserves on April 4.

·

Jordan bought 60,000 tons of wheat for first half September shipment at $308.50/ton c&f.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 29.

They announced more, and that’s a warning they may slow physical imports.

Rice/Other

·

Results awaited: South Korea seeks 121,800 tons of rice, most of it from China.

Updated

03/28/23

KC

– May $8.00-9.25 (about 50 cents higher)

MN

– May

$8.50-$9.50

#non-promo