TX,

OK, and KS winter wheat ratings declined from the previous week. Choppy and slow trade ahead of USDA’s end of March reports. Soybean oil saw a wide trading range, ending higher. Soybeans, meal and corn closed lower. Wheat traded two-sided with late session

buying in Chicago and KC.

World

Weather Inc.

CHANGES

Sunday into Monday

- Brazil’s

forecast was drier this morning relative to that of Sunday for both center west and center south during the second week of the outlook

o

Too much rain was removed from the outlook

- Argentina

was drier on the latest model run as well, especially in the southeastern part of the nation next week

o

A little too much rain may have been removed

- U.S.

Midwest was advertised wetter for mid- to late week next week while less rain was noted in the southeastern Plains

o

Some of these changes were needed

- Some

of the model data offered greater rain to the northern U.S. Plains next week, but confidence over moisture availability is low today

o

Some rain and snow will fall, but the amounts may be a little light and certainly lighter than some model runs have suggested

- If

the Gulf of Mexico opens as a better moisture source confidence would rise over that potential rain event

CHANGES

SINCE FRIDAY

- U.S.

hard red winter wheat areas are advertised drier for the next ten days to two weeks - West

Texas rain potentials are very low through the next two weeks - Net

drying is expected in the U.S. southeastern states after mid-week this week

MOST

IMPORTANT WEATHER IN THE WORLD

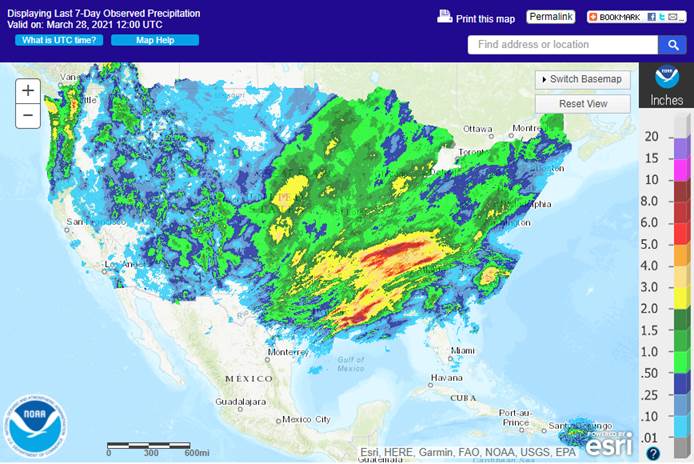

- Central

Tennessee received excessive rainfall during the weekend resulting in flooding

o

Rain totals of 3.00 to 7.49 inches resulted across the heart of the state while neighboring areas of northern Mississippi, northern Alabama, southeastern Kentucky and some of the western slopes of the Appalachian Mountains received

1.00 to 2.50 inches of rain.

o

Additional rain is expected in some of this region Tuesday with 0.50 to 1.50 inches possible

- Southeastern

U.S. will receive additional rain Tuesday and Wednesday of this week followed by at least a full week and possibly ten days of drying beginning Thursday

o

Rain will fall again late Tuesday and Wednesday

- Additional

amounts will vary from 0.20 to 0.80 inch in northern Florida, southeastern Georgia and southern South Carolina while varying from 0.50 to 2.00 inches elsewhere.

o

The drying trend will firm the soil and improve spring planting conditions after some farming delay because of rain and wet fields this week

- U.S.

Midwest received rain during the weekend, but most amounts were light staying under 0.75 inch with many areas getting 0.10 to 0.50 inch

o

Local totals to 1.03 inches occurred along the southwestern Indiana/southeastern Illinois border and up to 0.97 inch in south-central Iowa near the Missouri border.

- A

few areas were left dry - Highest

U.S. temperatures during the weekend were in the 80s Fahrenheit from Texas to the Carolinas, Georgia and northern Florida with a few temperatures over 90 in South Texas, Florida and southern Georgia

o

Warming occurred in the northern Plains and upper Midwest with warmer than usual conditions in the Pacific Northwest

- Central

U.S. temperatures today will soar to the 70s and 80s across the central and southern Great Plains and in the eastern Dakotas and Minnesota

o

High wind speeds and low humidity will accompany the heat removing large amounts of topsoil moisture in a relatively short period of time

o

Notable cooling is expected Tuesday with the northern Plains high temperatures limited to the upper 20s and 30s north and 30s and 40s from South Dakota and southern Minnesota into Nebraska and Colorado

- Low

temperatures will fall to the teens and 20s in the northern Plains and 20s and 30s in the southwestern Plains - Livestock

stress is expected - Winter

wheat is not expected to be permanently damaged by the freezes

o

A new warming trend will begin late this week and this second wave of heat will last longer extending from Friday through the middle part of next week

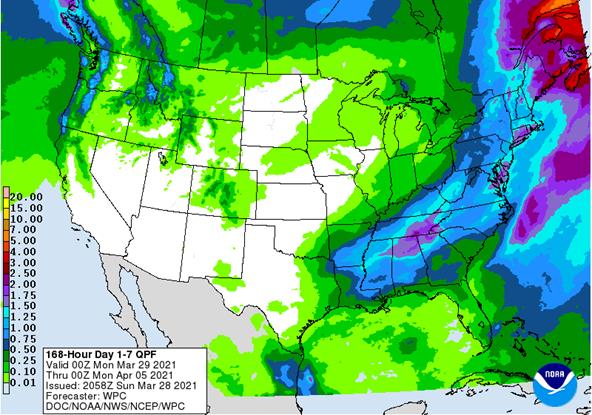

- Periods

of strong wind speeds will also occur during the warmest period with low humidity limiting rain potentials until mid-week next week - Soft

wheat areas in the Midwest, Delta and southeastern states will experience freezes during mid- to late-week this week

o

Permanent crop damage is not likely, although crops in Tennessee will see temperatures fall to the upper 20s and the same may occur in northernmost Alabama and northern Georgia as well as parts of the Carolinas

- Some

burning of new vegetative growth is expected - A

couple of low pressure centers will evolve in the U.S. Great Plains and western Corn Belt during the middle to latter part of next week at which time showers and thunderstorms are expected

o

Resulting rainfall will be light, but many areas will be impacted in the Midwest and both the northern and eastern Great Plains as well as the Delta with at least a little rainfall

- Some

of this potential precipitation in the Plains was reduced overnight

o

Cooling will accompany and follow this rainfall

o

One more wave of heat and dryness will then follow April 11-13

- THE

BOTTOM LINE FOR U.S. CROP AREAS

o

The Yakima Valley and areas south into Oregon will remain dry for the next two weeks stressing unirrigated winter crops as the come out of dormancy

o

Most of the San Joaquin Valley and southwestern desert region will remain dry for the next two weeks

o

West Texas precipitation will be too light and sporadic to counter evaporative moisture losses

o

South Texas will receive some rain, but no general soaking is expected

o

Some relief to dryness may impact Montana and a few areas in the Dakotas during mid-week next week, but confidence in the event is low because of sufficient time for the outlook to change between now and then and because of limited

atmospheric moisture

o

Below average precipitation is advertised from the west-central and southwestern U.S. Plains through Nebraska to the eastern Dakotas, western Minnesota resulting in net drying

- Some

showers are expected, but greater rainfall will be needed to make a difference in soil moisture - Dryness

may be returning to parts of hard red winter wheat areas

o

The Delta, southeastern states, Tennessee River Basin and the majority of the Midwest will get 0.30 to 1.0 inch of rain over the next two weeks with many areas getting 1.00 to 2.00 inches

- Much

of that will occur during mid- to late-week next week with some lighter amounts expected during mid-week this week

Sufficient

moisture and warming is expected over the next couple of weeks to stimulate some fieldwork from the lower Midwest into the Delta and southeastern states. Some planting will also begin for early season crops in the northern Plains and Canada’s Prairies, but

only if significant rain falls and that remains questionable since the advertised event is a week away for the northern Plains. Warming is also needed in Canada to raise soil temperatures enough to support early season planting.

- Southern

Argentina received moderate to heavy rain from northeastern La Pampa through the heart of Buenos Aires during the weekend where 1.00 to 4.00 inches resulted

o

One location along the southeast coast of Buenos Aires received over 5.00 inches of rain

- Northeastern

Argentina also received significant weekend rainfall of 1.00 to 2.50 inches impacting Formosa, Chaco and northern Corrientes as well as southern Paraguay - Central

Argentina dried down during the weekend after receiving welcome rain last week - Highest

Argentina weekend temperatures were in the 60s and 70s Fahrenheit except in the far north where readings were in the 90s early in the weekend

o

Lowest morning temperatures were in the 40s and 50s with an extreme of 36 in east-central San Luis

- Argentina

will experience net drying for the coming week to ten days

o

Periodic showers and thunderstorms are expected later next week and many areas will get some timely rainfall to maintain favorable moisture for late season crop development

o

Cooling will come late next week

Argentina’s

bottom line looks quite favorable for crops and fieldwork during the next two weeks. Dry and mild weather this week will give way to warming this weekend and then some rain next week followed by additional cooling. The mix should suffice all crop needs and

maintain a non-threatening environment for late season crop development. Early season harvesting will advance this week while dry weather prevails.

- Brazil’s

drying trend continued to expand with little to no rain in center west, center south and northeastern parts of the nation Friday through Sunday morning

o

Rain was reported in Paraguay, western Santa Catarina and Rio Grande do Sul

- Amounts

ranged from 0.40 to 2.75 inches - Northern

soybean areas of Rio Grande do Sul and southwestern Paraguay were wettest

o

Brazil high temperatures peaked in the 90s Fahrenheit with Mato Grosso and western Mato Grosso do Sul reporting middle and upper 90s

- Not

much rain is expected for the next ten days from southeastern Bolivia southeastern Mato Grosso and southern Goias into western Sao Paulo, central and western Sao Paulo and northern and western Parana, Brazil

o

Limited rainfall was also advertised for Rio Grande do Sul

o

Some relief will come to much of Brazil late next week and into the following weekend

The

bottom line for Brazil should be mostly very good as long as rain resumes late next week and into the following weekend as advertised. Dry weather until then will be excellent for getting late season soybean harvesting completed and the rest of Safrinha crops

put into the ground. Low yields are expected for late season corn because of late planting and questionable rainfall later this season. However, a few cold air masses coming in late April and May could help induce some needed rain, but confidence is still

a little low.

- Canada’s

Prairies will continue drier biased in the southwestern Prairies including much of southern Alberta and western Saskatchewan during the coming two weeks

o

Rain and snow are possible farther to the east and in far western Alberta

o

Concern over dryness will remain in the drier biased areas, although there is still time for improvement before the planting season begins

o

Moisture in the eastern Prairies will improve planting moisture, although some of the precipitation advertised is overdone

- China

weather remains almost ideal for early season fieldwork and winter crop development in the Yellow River Basin, North China Plain and northeastern provinces, although warming is needed - China’s

Yangtze River Basin has been a little wet this month and drier and warmer weather is needed to induce better rapeseed and southern wheat conditions, but no significant loss in production potential has occurred - Yunnan,

China is still too dry and needs significant rain for its rice, corn and sugarcane

o

Rain is expected this weekend as a dissipated tropical cyclone spreads rain into the region from Myanmar

- Australia’s

Queensland and New South Wales crop areas trended drier during the weekend and will stay in that mode for the next ten days

o

The environment will be great for maturation and harvesting of summer crops. A boost in precipitation will be needed in late April and May to restore favorable soil moisture in all winter crop areas prior to the planting of wheat,

barley and canola

- India

weather will be almost ideal for crop maturation and harvesting in the next few weeks. The nation may have lost a little production this year because of dryness during reproduction, but another big crop is expected - Indonesia

and Malaysia weather has been and will continue to be good for all crops, although there is need for rain in northern parts of Peninsular Malaysia - A

tropical disturbance in the southern Bay of Bengal will be closely monitored for additional development this week

o

The system may eventually become a threat to southern coastal areas of Myanmar and the Andaman Islands mid-to late-week this week

o

The Bago, Ayeyarwady and Yangon, Myanmar rice production areas will be threatened by this storm

- Philippines

weather has been and will continue to be good for most of its crops, although some areas in the north may develop a greater need for rain soon - Mainland

Southeast Asia crop areas need a boost in precipitation to induce better early season planting conditions for corn and sugarcane development as well

o

March precipitation was below average and not very supportive of early season corn and rice planting; dryness was also a concern for the start of sugarcane development

o

Rain is expected to improve over the next two weeks and the moisture boost will be beneficial for planting and early season crop development

- Ukraine

will receive additional rain over the next two weeks, although precipitation this week is expected to be light.

o

The moisture boost will be very good for future crop development

o

Temperatures will be near normal, but not much greening is expected in winter crops – at least not yet

- Much

of western and northern Russia is still snow bound and needs additional warm weather to get the remaining snow to melt

o

Waves of light rain and snow will continue throughout the forecast period complicating the runoff from melting snow

o

Temperatures will be seasonable which may slow snow melt in the north, but southern areas will continue to see the snow cover whittle down

o

Soil temperatures in Ukraine and Russia’s Southern Region will slowly rise, but greening of winter crops will be slow to come

- Europe

weather is rated mostly very good, although cool conditions have delayed the greening of some crops

o

Warming is expected in this coming week, but it will be slow

- Soil

moisture in Europe is rated favorably with some drying in Spain that will need to be eased in April to ensure the best dryland crop conditions

o

Additional drying is expected in much of the continent during the coming week especially in the west where the need for precipitation will be on the rise as April begins.

- North

Africa will be drying down in the coming week; recent rain was good for early season wheat and barley development, although northwestern Algeria and southwestern Morocco are still too dry

o

Weekend weather was dry and warmer and similar conditions will prevail until late next week when some showers will begin

- West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well

o

Rainfall will be a little lighter and less frequent over the next ten days, but crop conditions should remain favorable

- East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia in April while Tanzania begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops

o

Net drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress

o

Temperatures will be warmer than usual and that will dry out the soil relatively quickly

- New

Zealand weather is expected to turn a little wetter in the coming week with North Island and west coastal areas of South Island getting most of this week’s rain

o

Other areas in South Island will continue drier biased

- Southern

Oscillation Index this morning was -0.47 and the index is expected to rise slightly for a while this week

Source:

World Weather inc.

Bloomberg

Ag Calendar

Monday,

March 29:

- Ivory

Coast cocoa arrivals - USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - U.S.

winter wheat condition, 4pm (selected states) - HOLIDAY:

India

Tuesday,

March 30:

- EARNINGS:

WH Group

Wednesday,

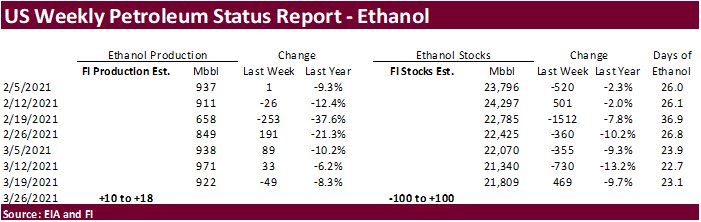

March 31:

- EIA

weekly U.S. ethanol inventories, production - USDA

stocks and prospective planting – corn, wheat, soy, barley, sorghum - EIA

monthly ethanol and biodiesel / renewable / biodiesel fuel reports - Malaysia’s

March palm oil export data - Unica

report on cane crush and sugar production in Brazil (tentative) - U.S.

agricultural prices paid, received, 3pm

Thursday,

April 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - HOLIDAY:

Mexico, Argentina and several other Latin American countries

Friday,

April 2:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Good Friday holiday across most of Europe, Africa, Americas and parts of Asia

Source:

Bloomberg and FI

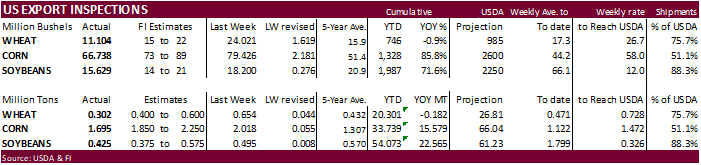

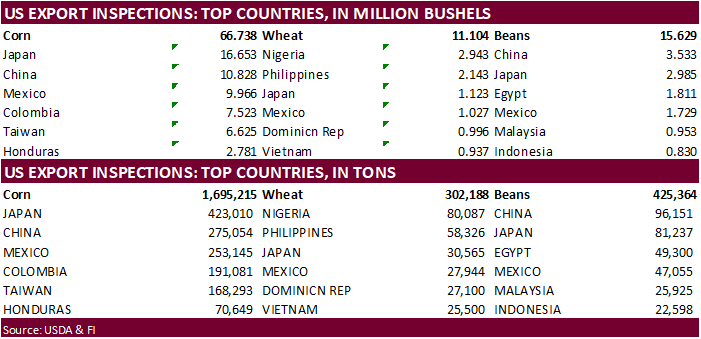

USDA

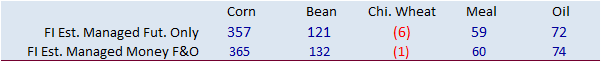

inspections versus Reuters trade range

Wheat

302,188 versus 350000-600000 range

Corn

1,695,215 versus 1200000-2250000 range

Soybeans

425,364 versus 150000-575000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 25, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/25/2021 03/18/2021 03/26/2020 TO DATE TO DATE

BARLEY

1,497 0 122 32,520 30,499

CORN

1,695,215 2,017,525 1,270,152 33,739,147 18,160,616

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

399 699 0 3,591 3,243

RYE

0 0 0 0 0

SORGHUM

244,739 71,199 139,220 4,446,933 1,777,956

SOYBEANS

425,364 495,329 414,054 54,072,870 31,508,116

SUNFLOWER

0 0 0 0 0

WHEAT

302,188 653,755 385,957 20,301,174 20,483,343

Total

2,669,402 3,238,507 2,209,505 112,596,744 71,964,293

———————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Soybeans

and Corn Advisory:

2020/21

Brazil Soybean Estimate Increased 1.0 mt to 133.0 Million

2020/21

Argentina Soybean Estimate Unchanged at 46.0 Million Tons

2020/21

Brazil Corn Estimate Unchanged at 105.0 Million Tons

2020/21

Argentina Corn Estimate Unchanged at 45.5 Million Tons

- May

corn fell 5.75 cents to $5.4675 (below 20 and 50-day MA) and new-crop Dec dropped 5.25 cents to $4.6125, in part to positioning ahead of the March 31 USDA report, favorable SA & US weather, higher USD, and lack of US corn export developments.

Despite

the anticipating rise in US corn export shipments, US corn export inspections fell for the second consecutive week to 66.7 million bushels after peaking for the season at 89.5 million for the week ending March 11.

The

container ship that ran aground in the Suez Canal was freed. - Funds

on Monday sold an estimated net 16,000 contracts. -

50%

of the TX corn crop had been planted versus 46 average. - USDA

US corn export inspections as of March 25, 2021 were 1,695,215 tons, within a range of trade expectations, below 2,017,525 tons previous week and compares to 1,270,152 tons year ago. Major countries included Japan for 423,010 tons, China for 275,054 tons,

and Mexico for 253,145 tons. - China

corn futures fell 1.5% (hit a 2021 low on Monday). - Mexico’s

upcoming ban on GMO corn imports will not include corn for feed. - The

newswires made a revision to their USDA’s trade estimates, slightly altering the average for grain stocks. See tables above.

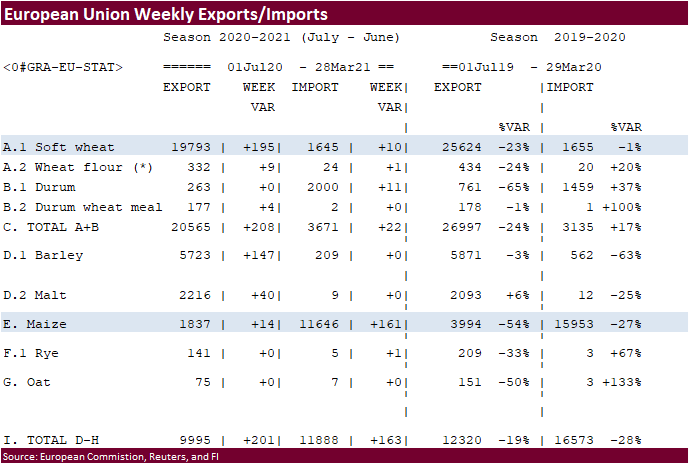

- The

European Union granted imports licenses for 161,000 tons of corn imports, bringing cumulative 2020-21 imports to 11.646 MMT, 27 percent below same period year ago.

Export

developments.

- None

reported

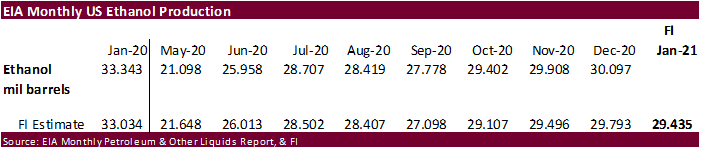

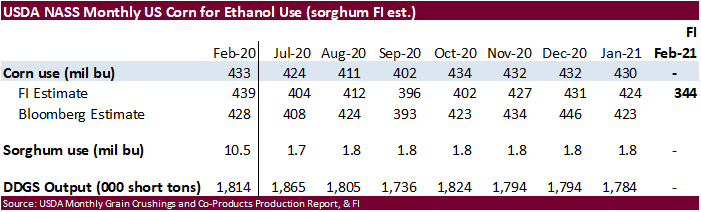

Monthly

Biofuels Capacity and Feedstocks Update (repeat

with link) The EIA (Energy Information Administration) will expand their biofuel data in its monthly report to by adding renewable fuels on March 31, including production capacities for biodiesel and feedstocks used in the production. It will be called Monthly

Biofuels Capacity and Feedstocks Update, replacing Monthly Biodiesel Production Report. USDA will adopt the data. Press release:

https://www.eia.gov/pressroom/releases/press477.php

Updated

3/24/21

May

corn is seen in a $5.35 and $5.55 range.

July

is seen in a $5.10 and $5.75 range.

December

corn is seen in a $3.85-$5.50 range.

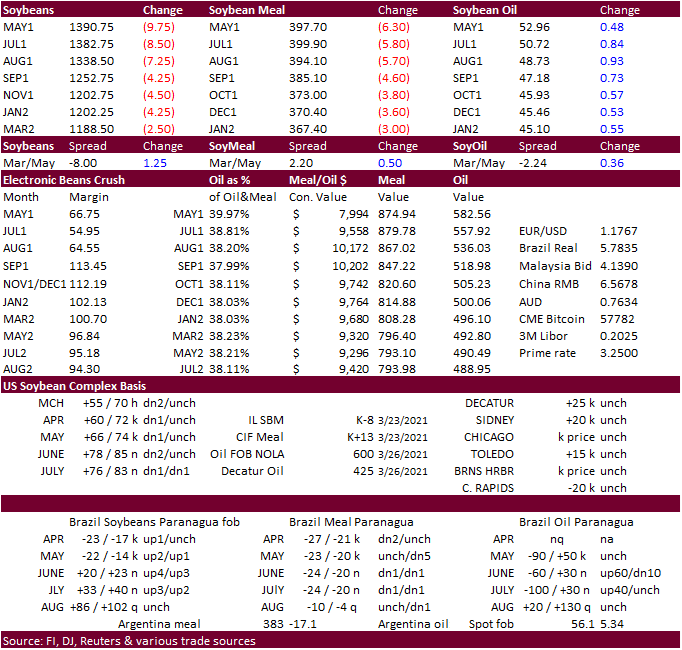

- May

soybeans were down 7.50 cents to $13.93 (on its 50-day MA), below the psychological $14/bushel mark, first time since March 18. Longs reduced positions ahead of the USDA March 31 planting intentions report and fundamentals were largely bearish headed into

today’s trade. Large SA crop prospects, lack of China demand for US and Brazilian soybeans (China crush margins declined from late last week) and slowing US exports are negative futures. US soybean inspections fell for the 4th consecutive week.

- Funds

on Monday sold an estimated net 6,000 soybean contracts, sold 4,000 soybean meal and bought an estimated 5,000 soybean oil.

- CBOT

soybean oil saw a higher trade on technical rebound, failure for offshore values to follow CBOT’s Friday move higher, and appreciation in energy prices. May settled 48 higher at 52.96, below its 20-day MA. Palm oil futures reached a 5-week low on Monday

but rebounded to settle 55MYR higher (cash down $10) on India demand. Indonesia will see heavy rain today over most parts of Sumatra and Kalimantan.

- May

soybean meal fell $5.90 at $398.10. Support is seen at $395. - USDA

US soybean export inspections as of March 25, 2021 were 425,364 tons, within a range of trade expectations, below 495,329 tons previous week and compares to 414,054 tons year ago. Major countries included China for 96,151 tons, Japan for 81,237 tons, and Egypt

for 49,300 tons. - Last

week US western cash crude soybean oil basis surged to a nominal 1,000 in large part to renewable fuel producer demand.

- Ukraine

may produce 5.920 million tons of sunflower oil in the 2020-21 and export 5.520 million tons, according to the economic ministry, down from around 7 million tons produced in 2019-20.

- The

European Union reported soybean import licenses since July 1 at 11.024 million tons, above 10.609 million tons a year ago. European Union soybean meal import licenses are running at 12.565 million tons so far for 2020-21, below 13.308 million tons a year ago.

EU palm oil import licenses are running at 4.068 million tons for 2020-21, below 4.290 million tons a year ago, or down 5 percent. - European

Union rapeseed import licenses since July 1 were 4.942 million tons, above 4.929 million tons from the same period a year ago.

Export

Developments

- The

USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4 liter cans and 70 tons in 4 liter plastic bottles/cans) on April 6 for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

Updated

3/29/21

May

soybeans are seen in a $13.75 and $14.75 range.

May

soymeal is seen in a $390 and $420 range.

May

soybean oil is seen in a 52 and 57 cent range

(upper end down 100)

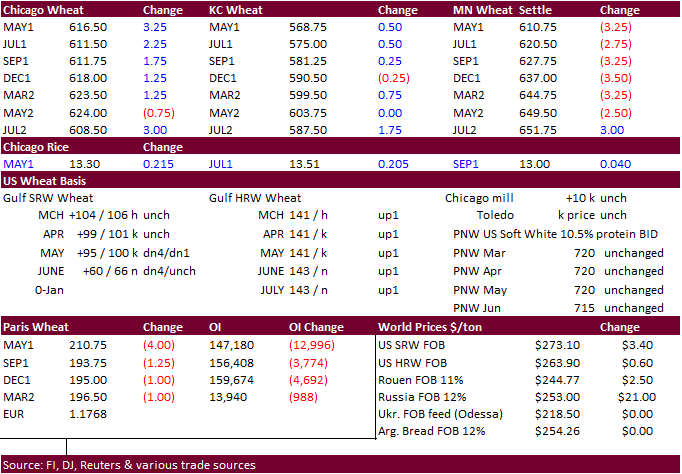

- Wheat

traded lower this morning for all three US markets on falling Black Sea cash export prices, improving US weather and forecast for precipitation across the dry areas of the Canadian Prairies, but a late rally lifted Chicago and KC wheat to close higher. US

all-wheat inspections were lowest since January 14. EU

May milling wheat was down 4.00 at 210.75 euros, 0.50 above its session low.

- Chicago

May settled 3.50 cents higher at $6.1675. Support is seen at the $5.9375.

- Funds

on Monday

bought

an estimated net 2,000 CBOT SRW wheat contracts. - KS

winter wheat conditions were 50% good and excellent. down from 45 previous week.

- TX

winter wheat conditions were 28% good and excellent, down from 29 previous week.

- OK

winter wheat conditions were 61% good and excellent, down from 62 previous week.

- USDA

US all-wheat export inspections as of March 25, 2021 were 302,188 tons, below a range of trade expectations, below 653,755 tons previous week and compares to 385,957 tons year ago. Major countries included Nigeria for 80,087 tons, Philippines for 58,326 tons,

and Japan for 30,565 tons. - Russian

12.5% protein wheat export prices for April position fell $16/ton at $257 a ton FOB at the end of last week, according to IKAR. SovEcon showed wheat down $21 to $253 a ton and barley fell by $8 to $240 a ton.

- China

sold 1,030,397 tons of wheat from auction, 25.8% of wheat was offered at an average price of 2,354 yuan per ton. 122 million tons had been offered since June 22, 2020, and 44.04 million tons had been sold, at an average price of 2,355 yuan per ton. 2021

sales alone amount to 26.6 million tons. - The

European Union granted export licenses for 195,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 19.793 MMT, well down from 25.624 million tons committed at this time last year, a 23 percent decrease. Imports are

near unchanged from year ago at 1.655 million tons.

- Algeria

seeks at least 50,000 tons of milling wheat on Wednesday for May shipment.

- Jordan

will be back in for feed barley on March 30. Possible shipment combinations are Oct. 1-15, Oct. 16-31, Nov. 1-15 and Nov. 16-30, the same periods as sought in the previous two tenders.

- Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Bangladesh lowest offered for 50,000 tons of rice was $411.93/ton CIF for shipment within 40 days of contract signing.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

3/25/21

May

Chicago wheat is seen in a $6.00‐$6.60 range

May

KC wheat is seen in a $5.55‐$6.50 range

May

MN wheat is seen in a $6.05‐$6.40 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.