PDF Attached

Bullish

USDA Prospective Plantings report sent soybeans, soybean oil and corn limit higher for both crop years. Limits in corn expand to 40 cents. Since at least one commodity in the soybean complex ended limit higher, the other two expand. Soybean crush expands

to $2.37, soybean futures will go to 105 cents, SBO to 400 points and SBM to $40/short ton.

https://www.cmegroup.com/trading/price-limits.html

COT

Commitment of Traders and the US unemployment report will be released on Friday. Tomorrow is a full trading day. CBOT will be closed Friday, opening back up Sunday night.

![]()

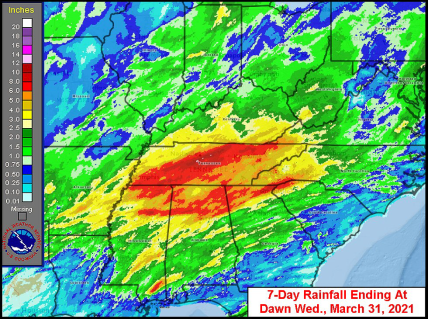

Weather

looks good for the US for FH April but keep an eye on net drying for the Great Plains. We look for the total US 15-major row crop area to expand when updated in June.

The

area for the 15-major crop area for the United States was reported at 312.6 million acres, lowest for the March Prospective Plantings in our working history that goes back three decades and compares to 314.5 million acres intended a year ago. Grain stocks

were above expectations for soybeans and wheat, below for corn. Price reaction to this report is similar to the end of March stocks and planting reports back in 2009. New-crop corn and soybeans were up limit back in 2009. What happened after that? Looking

at the new-crop December corn and November soybean seasonal, prices trended higher for a couple month in soybeans & corn. The seasonal charts below DO NOT include the limit higher trade made today in corn and soybeans.

December

2021 corn (blue line through 3/30 & 2009 December corn (dark line) – seasonal

November

2021 soybean (blue line through 3/30 & 2009 November soybean (dark line) – seasonal

Acreage

for the 7 major row crops came in less than expected and missed trade expectations by 3.5 million acres, at the expense to much lower soybeans at 87.6 million acres (2.4 million below trade) and corn at 91.14 million acres (2.1 million below a Reuters trade

guess). The US winter wheat area came in 1.4 million acres above trade expectations at 33.079 million acres. Spring wheat was 11.74 million acres, slightly above trade expectations and durum at 1.54 million, 101,000 acres below expectations.

Based

on the latest data, following table is our prediction for US supply.

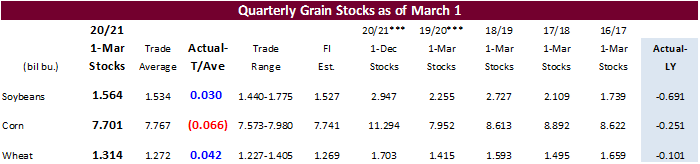

Grain

stocks were 30 million bushels above expectations for soybeans, 66 million less for corn, and 42 million higher for all-wheat. The miss in estimates was due in part to revisions for the fall quarter. USDA revised higher December 1 soybean stocks by 14 million

bushels, lowered Dec 1 corn stocks by 28 million, and took all-wheat up 29 million bushels. We look for the “extra” soybean supply to get absorbed by crush and exports by the end of the crop year. For corn, we already look for USDA to raise exports by at

least 100 million bushels and reduce feed. Post stocks report, we see the US corn carryout shrinking 100-150 million bushels in April, bullish in our opinion. For wheat stocks are expected to remain ample and US carryout stocks could increase 20 million

bushels in the April S&D update.

Look

for the trade to shift focus to US weather. This could stall the bullish sentiment in agriculture futures over the short term, but long term we remain bullish led by soybean oil.

USDA

NASS executive summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

World

Weather Inc.

MOST

IMPORTANT WEATHER IN THE WORLD TODAY

- U.S.

northern Plains were bitterly cold today with lows in the single digits and teens after being in the 70s and lower 80s Fahrenheit Monday afternoon

o

This has been a stressful week for livestock

o

High wind speeds occurred both Monday and Tuesday

- U.S.

central Plains and Midwest turned colder Tuesday with freezes occurring this morning as far south as the northern Texas Panhandle, northwestern Missouri, southern Iowa and southern Wisconsin

o

Freezes will occur Thursday morning throughout the Midwest and again in the portions of hard red winter wheat country

- No

permanent crop damage is expected in either area - U.S.

hard freeze Friday morning will occur Friday and Saturday in the Carolinas and Virginia resulting in some damage to fruit trees and some minor winter wheat

o

Wheat production losses will not be significant enough to impact the nation’s bottom line

- U.S.

heatwave is expected to evolve in the western United States late this week and shift into the Great Plains this weekend

o

Extreme highs in the 80s will occur from West Texas and eastern New Mexico to eastern South Dakota and southwestern Minnesota this weekend

o

Extreme highs pressing in on 90 degrees will be possible

o

Some of the heat will continue into early next week, but the wind will subside

- Stress

to livestock will return again - Moisture

losses in the Plains and western Corn Belt will be significant - Excessive

wind and low humidity will occur in the Plains and upper Midwest again Thursday into Friday with accelerating moisture losses from the topsoil

o

Travel will be hampered and there may be a few power outages and structural damage in local areas

- U.S.

Delta and southeastern states will dry down as the cold air arrives and at least a week and possibly more of dry weather is expected to favor fieldwork - Net

drying in the U.S. Midwest, Delta and Plains this week will give the ground a chance to dry down in the wetter areas which may help stimulate fieldwork when warmer days return - West

Texas is still too dry and unlikely to get much rain for the next ten days - South

Texas and the Texas Coastal Bend region still need substantial rainfall in unirrigated crop areas, but not much is expected for a while - U.S.

northern Plains will remain too dry, although there is “some” potential for “partial” relief next week as a frontal system moves into the region; however, very warm, dry, and windy conditions are expected late this week into next week - Dryness

remains in the Yakima Valley of Washington and southward into Oregon threatening some of the unirrigated winter crops as they break from dormancy - Canada’s

Prairies received significant snow Monday and it will melt over the next couple of days adding a little moisture to the soil

o

Much more precipitation is needed before drought status is changed and the moisture is needed to support early season planting next month

- Canada’s

eastern Prairies will get another round of rain and snow during mid-week next week to further improve topsoil moisture for better planting potentials later in April

- Argentina

will see mostly good weather for the next ten days with net drying for many areas, but subsoil moisture will carry normal crop development during that period of time

o

Some rain will fall in northern cotton areas Sunday into Monday

o

Rain is also expected late next week in the south

o

Soil moisture is abundant enough to carry on normal late season crop development without much need for new precipitation

- Brazil

weather has become more favorably mixed and it will continue that way for the next ten days

o

There is much interest about potential dryness in late April and May because of unusually late planted Safrinha crops; yield potentials may be much lower than usual if there is not abundant rainfall through May

- The

odds are good that below average precipitation will occur in April, but some of the rain that does fall should be well timed and beneficial

o

Scattered showers and thunderstorms will occur periodically over the next ten days with Rio Grande do Sul, eastern Mato Grosso do Sul, western Sao Paulo and northwestern Parana among the driest areas

- Snow

remains on the ground in much of western and northern Russia and additional precipitation is expected during the snow melt season possibly raising the potential for flooding - Ukraine

topsoil moisture is favorably rated, but there is still need for routinely occurring precipitation this spring to ensure dryness does not make a comeback; this is especially true for eastern Ukraine - Recent

rain in Russia’s Southern Region and Kazakhstan was welcome and good for spring planting and winter crop development; however, there is need for much more rainfall this spring to end multiple years of drought - Western

Europe will dry down in this coming week and then cool off with some timely rainfall in the following week

o

Soil and winter crop conditions should remain favorably rated, despite the drying bias in western areas

- Rain

will have to occur in April to replenish topsoil moisture - North

Africa is drying down and there is need for rain in northwestern Algeria and southwestern Morocco

o

Relief is not very likely this week, but may evolve next week

- China

weather remains almost ideal for early season fieldwork and winter crop development in the Yellow River Basin, North China Plain and northeastern provinces, although warming is needed - China’s

Yangtze River Basin has been a little wet this month and drier and warmer weather is needed to induce better rapeseed and southern wheat conditions, but no significant loss in production potential has occurred - Yunnan,

China is still too dry and needs significant rain for its rice, corn and sugarcane

o

Rain is expected this weekend as a dissipated tropical cyclone spreads rain into the region from Myanmar

- Australia’s

Queensland and New South Wales crop areas are trending drier, but that is welcome from a summer crop maturation and harvest perspective after recent rain - India

weather will be almost ideal for crop maturation and harvesting in the next few weeks. The nation may have lost a little production this year because of dryness during reproduction, but another big crop is expected - Indonesia

and Malaysia weather has been and will continue to be good for all crops, although there is need for rain in northern parts of Peninsular Malaysia - A

tropical disturbance in the southern Bay of Bengal will be closely monitored for additional development this week

o

The system is much weaker in the forecast model runs today than earlier in the week reducing the risk of heavy rain to Myanmar next week

- Philippines

weather has been and will continue to be good for most of its crops, although some areas in the north may develop a greater need for rain soon - Mainland

Southeast Asia crop areas need a boost in precipitation to induce better early season planting conditions for corn and sugarcane development as well

o

March precipitation was below average and not very supportive of early season corn and rice planting; dryness was also a concern for the start of sugarcane development

o

Rain is expected to improve over the next two weeks and the moisture boost will be beneficial for planting and early season crop development

- West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well

o

Rainfall will be a little lighter and less frequent over the next ten days, but crop conditions should remain favorable

- East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia in April while Tanzania begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops

o

Net drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress

o

Temperatures will be warmer than usual and that will dry out the soil relatively quickly

- New

Zealand weather is drier than usual and precipitation will remain below average during the next ten days

o

Temperatures will be seasonable

- Southern

Oscillation Index this morning was -0.19 and the index is expected to stay in a relatively narrow range of change over the next week.

Source:

World Weather inc.

Lower

Midwest/upper Delt should see better weather during early April

Source:

World Weather inc.

Bloomberg

Ag Calendar

Wednesday,

March 31:

- EIA

weekly U.S. ethanol inventories, production - USDA

stocks and prospective planting – corn, wheat, soy, barley, sorghum - EIA

monthly ethanol and biodiesel / renewable / biodiesel fuel reports - Malaysia’s

March palm oil export data - Unica

report on cane crush and sugar production in Brazil (tentative) - U.S.

agricultural prices paid, received, 3pm

Thursday,

April 1:

- USDA

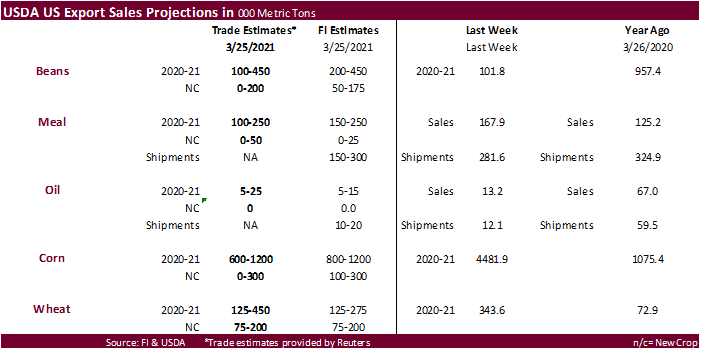

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - HOLIDAY:

Mexico, Argentina and several other Latin American countries

Friday,

April 2:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Good Friday holiday across most of Europe, Africa, Americas and parts of Asia

Source:

Bloomberg and FI

Macro

US

ADP Employment Change Mar: 517K (est 550K; prevR 176K; prev 117K)

Canadian

GDP (M/M) Jan: 0.7% (est 0.5%; prev 0.1%)

Canadian

GDP (Y/Y) Jan: -2.3% (est -2.6%; prev -3.0%)

7:32:07

AM livesquawk Canadian Industrial Product Price (M/M) Feb: 2.6% (est 2.5%; prev 2.0%)

Canadian

Raw Materials Price Index (M/M) Feb: 6.6% (prev 5.7%)

Bloomberg

Ag Calendar

Wednesday,

March 31:

- EIA

weekly U.S. ethanol inventories, production - USDA

stocks and prospective planting – corn, wheat, soy, barley, sorghum - EIA

monthly ethanol and biodiesel / renewable / biodiesel fuel reports - Malaysia’s

March palm oil export data - Unica

report on cane crush and sugar production in Brazil (tentative) - U.S.

agricultural prices paid, received, 3pm

Thursday,

April 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - HOLIDAY:

Mexico, Argentina and several other Latin American countries

Friday,

April 2:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Good Friday holiday across most of Europe, Africa, Americas and parts of Asia

Source:

Bloomberg and FI

- CBOT

corn was mixed early, rallied after the open, and locked limit up post USDA report. Nearby rolling corn ended at its highest level since 2013. Corn futures limit expand to 40 cents. Corn for feed was greater than expected and new-crop corn plantings a much

less than expected 2.1 million acres. Texas is slated of lose the largest amount of corn acres on a percentage basis. See recap on pages 1-3. US and SA weather was largely unchanged. North America will see warmer temperatures 2nd half this week

into next week. The Great Plains and WCB will see net drying. Keep an eye on net drying bias western crop areas during FH April.

- Our

working estimate for US corn production is 14.645 billion bushels, 462 million above 2020 and 298 million below our previous estimate. On Thursday we will be working on adjustments for our US corn balance. - From

Corn Options: Corn synthetic settles

May

577

July

559 1/4

Sept

506 1/2

Dec

486 1/2

- Funds

on Wednesday bought an estimated net 35,000 corn contracts. - CFTC

Commitment of Traders will be released Friday. - The

USDA Broiler Report showed eggs set in the US down slightly and chicks placed down 2 percent. Cumulative placements from the week ending January 9, 2021 through March 27, 2021 for the United States were 2.24 billion. Cumulative placements were down 2 percent

from the same period a year earlier. - Weekly

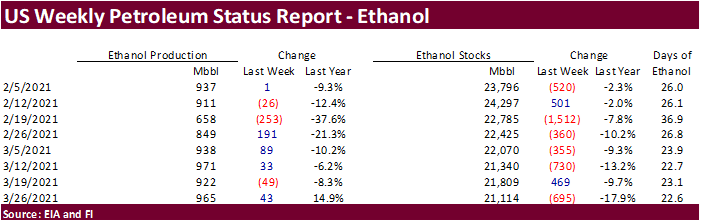

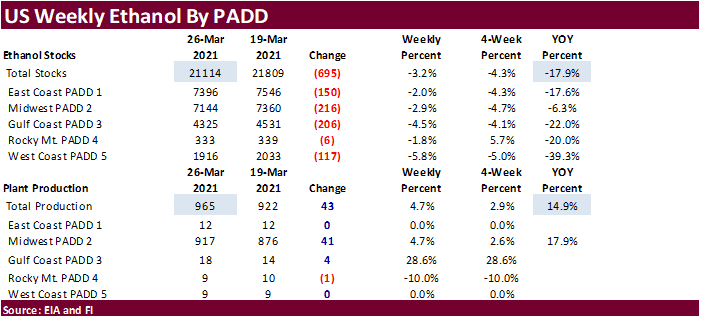

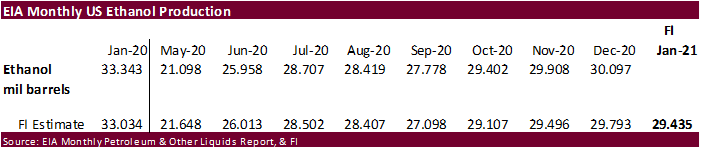

US ethanol production was up 43,000 barrels (trade looking for 12k) from the previous week and stocks off a large 695,000 barrels (trade looking for 62k increase).

We

see no influence on CBOT corn prices based on the recent report. The 4-week average weekly change is up 29,000 for ethanol production. Stocks are at their lowest level since November 20. September through March 26 US ethanol production is running nearly

10 percent below the same period a year earlier. Production needs to improve from now until the end of August in order to reach USDA 4.950-billion-bushel estimate.

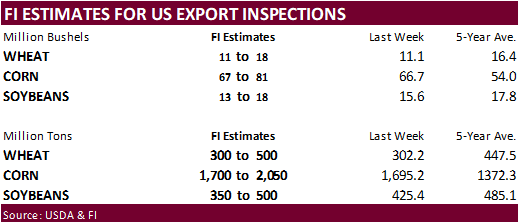

Export

developments.

- None

reported

USDA

Attaché Mexico: Food Processing Ingredients

In

2019 Mexico represented the second largest export market for U.S. agricultural products, totaling U.S. $19.2 billion. Processed food exports to Mexico totaled U.S. $5.8 billion in 2020. Despite the pandemic, and with United States-Mexico-Canada Agreement (USMCA)

in place, Mexico continues to be a growth market for U.S. food processing ingredients. It is important to note that some data used in this report will not yet reflect real affectations caused by the COVID-19 pandemic and the temporary closure of some sectors

and businesses in Mexico during 2020. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Food%20Processing%20Ingredients_Mexico%20CIty%20ATO_Mexico_03-30-2021

May

corn is seen in a $5.40 and $6.00 range (up 15, up 50).

July

is seen in a $5.25 and $6.00 range (up 15, up 50).

December

corn is seen in a $3.85-$5.50 range.

- CBOT

soybeans saw their largest gains in years as USDA reported a much less than expected 2021 US soybean planted area. Soybean stocks as of March 31 indicate about 30 million bushels of extra soybeans could be used for the remainder of the 2020-21 season. We

look for USDA to raise the 2020 US soybean crop by 10-15 million bushels in September. Soybean meal and soybean oil followed soybeans higher. Soybean oil, like soybeans, were limit higher.

- Our

working estimate for US soybean production is 4.421 billion bushels, 285 million above 2020 and 222 million below our previous estimate.

- CBOT

soybean crush limits expands to $2.37, soybean futures will go to 105 cents, SBO to 400 points and SBM to $40/short ton.

- South

Korea bought a couple of soybean meal cargoes this week (one from SA). - Funds

on Wednesday bought an estimated net 33,000 soybean contracts, bought 18,000 soybean meal and bought an estimated 15,000 soybean oil.

- CONAB

Brazil crop survey is due out April 8. - AmSpec

reported Malaysian palm exports during March totaled 1.277 million tons, 27.6% above 1.001 million during February. ITS reported a 26.8% increase to 1.270 million tons.

Export

Developments

- South

Korea’s NOFI bought 60,000 tons of South America soybean meal at an estimated $479.35 a ton c&f for arrival in South Korea around Sept. 25. Yesterday AgriCensus noted South Korea’s KFA bought 57,000 tons of soybean meal at $479.29/ton CFR for July 12-Aug

16 shipment. - The

USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4-liter plastic bottles/cans) on April 6 for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

May

soybeans are seen in a $13.75 and $15.75 range. (up 75 and up 125)

November $10.50-$14.50 (unch, up 50)

May

soymeal is seen in a $395 and $425 range. (up $10, up $25)

December $325-$5.00 (unch, up $25)

May

soybean oil is seen in a 50 and 55 cent range (up 150, up 200)

December 40-60 cent wide range

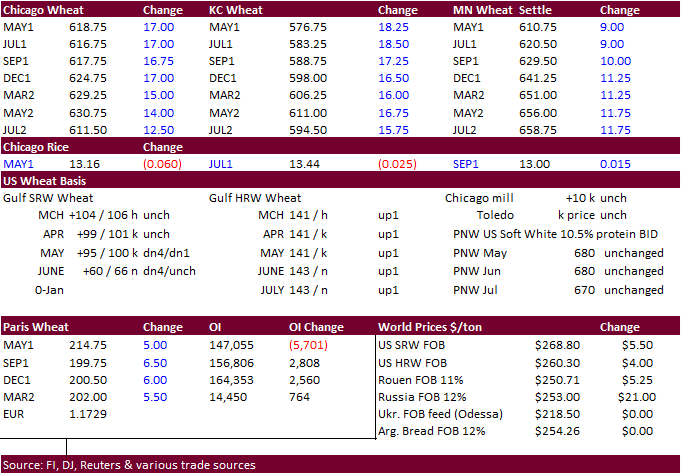

- US

wheat futures rallied

following limit up corn and soybeans. Funds led Chicago to end 16.25 cents higher basis the May position while May KC increased 17.25 cents and May MN up 9.0 cents. US all-wheat stocks as of March 1 were reported 42 million bushels over an average trade

guess. All wheat 2021 plantings were 46.4 million acres, 1.4 million above trade expectations, in large part to a large 1.3-million-acre upward revision in winter wheat seedings. If it were not for the bullish undertone in soybeans and corn, wheat futures

may have traded lower today. Our working 2021 all-wheat production for the US is now 27 million bushels higher at 1.901 billion bushels (subject for revision after we look at each state). We will see initial US winter wheat ratings for 2021 on Monday by

USDA. Selected states call for better ratings than that of last fall and year ago.

- Algeria

bought several cargoes of wheat. Thailand passed on optional origin wheat.

- Keep

an eye on the US Prairies over the next two weeks as net drying from warm temperatures could start to impact crop development.

- EU

May milling wheat was up 5.75 at 215.50 euros today. - Funds

on Wednesday bought an estimated net 13,000 CBOT SRW wheat contracts. - Ukrainian

wheat export prices fell to a 5-month low according to APK-Inform, to $251-$256 per ton FOB Black Sea, down $23 from the beginning of the previous week. Spot demand is weak. Ukraine’s grain exports have fallen by nearly 23.3% to 35.06 million tons so far

this season. - Ukraine

from April will ban imports of wheat, sunflower oil from Russia.

- Algeria’s

OAIC bought an unknown small amount of optional-origin milling wheat. Some people put it at around 400,000-550,000 tons at around $279 a ton c&f (April-May shipment).

- Thailand

passed on 504,000 tons of optional origin feed wheat for shipment by end of 2021. Offers were said to be around $280 a ton c&f. - Jordan

seeks 120,000 tons of animal feed barley on April 6. - South

Korea millers bought US and Canadian wheat for shipment between July 1 and July 31.

- 21,900

tons of soft white wheat of 9.5% to 10.5% protein bought at an estimated $245.71 a ton - 2,200

tons of soft white wheat of a maximum 8.5% protein bought at $249.39 - 10,530

tons of hard red winter of a minimum 11.5% protein bought at $251.59 a ton - 15,370

tons of northern spring wheat of 14% minimum protein bought at $267.30 a ton - 30,000

tons of Canadian western red spring wheat with a minimum 13.5% protein at $272 to $273 a ton FOB.

- Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Pakistan lifted a nearly two-year old ban on Indian sugar and cotton imports.

·

3/30 Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

3/31/21

May Chicago wheat is seen in a $6.00‐$6.65 range

May KC wheat is seen in a $5.75‐$6.15 range

May MN wheat is seen in a $6.00‐$6.40 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.