PDF Attached

CME

raised soybean futures maintenance margins by 11.7% to $3,350 per contract from $3,000 for May 2021, effective April 5. Initial margins are 110% of that level.

Look

for updated FI S&D’s for the US on Monday. Trade estimates for the USDA report may be released as early as Monday evening.

![]()

World

Weather Inc.

CHANGES

OVERNIGHT

- Both

the GFS and European models increased rain in Argentina for mid- to late-week next week and into the following weekend

o

Some of the increase was needed

- Both

the GFS and European forecast models reduced rain in interior southern Brazil for the coming ten days; the change was not substantial, but notable

o

The drier scenario does make a little more sense for a little while longer

- U.S.

Northern Plains and Canada’s Prairies were advertised drier for next week

o

Too much moisture was removed from the outlook

o

Rain and some snow are still expected in the region during the early to middle part of next week, although there will still be a big need for more moisture

- 00z

GFS model run generated too much rain from Colorado through the southern Plains for the second weekend of the outlook

o

This was corrected on by the 06z GFS model run and should not verify

o

The precipitation event was overdone

- Warm

to hot temperatures in the U.S. Great Plains will evolve Saturday and be most significant Sunday and Monday before retreating to the south Tuesday and Wednesday

o

Extreme highs in the 80s Fahrenheit will occur from the Northern Plains to West Texas resulting in livestock stress and fast drying conditions across the Plains

- Western

Europe was advertised a little warmer during the April 8-15 period

o

Some of this increase was needed

- A

new tropical cyclone was advertised to brush along the lower east coast of Queensland and the upper New South Wales coast early to mid-week next week

o

This increased rain event should only impact the coast and there is still time for the forecast to change

o

Crop areas should stay free of this storm system

- A

tropical cyclone will evolve south of Timor in Indonesia in the next day or two and then run parallel to the northwestern Australia coast late this weekend into next week

o

The storm could impact the northwest coast of Australia during mid-week next week with heavy rain and strong wind speeds in a small part of the coast

MOST

IMPORTANT WEATHER IN THE WORLD TODAY

- Unusually

warm weather in the central United States and central Canada this weekend into early next week will accelerate drying rates and raise the need for significant rain

o

Highest temperatures in the upper 70s and 80s will impact the U.S. Plains and far western Corn Belt with a few extremes near 90 possible

- Sunday

and Monday will be hottest, but the heat will already be expanding from some areas Saturday and the heat will linger in the southern Plains into Tuesday

o

Hard red winter wheat areas will experience a quick decline in soil moisture raising the need for rain later this month

o

The heat and dryness in the Northern Plains will worsen drought and put much more pressure on the region to get a general soaking of rain soon to support spring planting this month

o

Livestock stress will be high during the weekend as temperatures get quite warm to hot after being chilly the past couple of days

o

Some concern about limited rainfall remains after the heat wave breaks, but some scattered showers and thunderstorms should evolve

- Favoring

the east and not the west, though - Northern

U.S. Plains and a part of Canada’s Prairies will have a chance for rain during mid-week next week as a disturbance comes into the region from the southwest

o

Limited moisture will be available, but some rain will likely evolve in a part of the region

- U.S.

Delta and southeastern states will see less rain less significantly during the next two weeks

o

One disturbance is expected late next week that will disrupt drying between now and then and that which is expected in the following weekend

- U.S.

Midwest planting is expected to begin in the lower Midwest during the coming week while soil moisture is favorable and in decline while warming impacts the region - West

Texas is still too dry and unlikely to get much rain for the next ten days - South

Texas and the Texas Coastal Bend region still need substantial rainfall in unirrigated crop areas, but not much is expected for a while - U.S.

hard freeze Friday and Saturday mornings will occur in the Carolinas and Virginia resulting in some damage to fruit trees and some minor winter wheat

o

Wheat production losses will not be significant enough to impact the nation’s bottom line

o

Fruit tree damage may be significant, however

- Dryness

remains in the Yakima Valley of Washington and southward into Oregon threatening some of the unirrigated winter crops as they break from dormancy - Canada’s

Prairies received significant snow Monday and it will melt over the next couple of days adding a little moisture to the soil

o

Much more precipitation is needed before drought status is changed and the moisture is needed to support early season planting next month

- Canada’s

eastern Prairies will get another round of rain and some snow during mid-week next week to further improve topsoil moisture for better planting potentials later in April

- Argentina

will see mostly good weather for the next ten days with net drying for many areas into Tuesday and then rain late next week and into the following weekend.

o

Subsoil moisture will carry normal crop development during the drying period

o

Soil moisture is abundant enough to carry on normal late season crop development without much need for new precipitation

- Enough

new rain will occur next week to ensure good soil moisture through mid-month - Brazil

weather has become more favorably mixed and it will continue that way for the next ten days

o

There is much interest about potential dryness in late April and May because of unusually late planted Safrinha crops; yield potentials may be much lower than usual if there is not abundant rainfall through May

- The

odds are good that below average precipitation will occur in April, but some of the rain that does fall should be well timed and beneficial

o

Less rain was advertised for interior southern Brazil and parts of center south Brazil for the coming ten days today relative to that of Wednesday

- Snow

remains on the ground in much of western and northern Russia and additional precipitation is expected during the snow melt season possibly raising the potential for flooding - Ukraine

topsoil moisture is favorably rated, but there is still need for routinely occurring precipitation this spring to ensure dryness does not make a comeback; this is especially true for eastern Ukraine

o

Soil temperatures are rising and will support some greening later this month

- Recent

rain in Russia’s Southern Region and Kazakhstan was welcome and good for spring planting and winter crop development; however, there is need for much more rainfall this spring to end multiple years of drought - Western

Europe will dry down in this coming week and then cool off with some timely rainfall in the following week

o

Soil and winter crop conditions should remain favorably rated, despite the drying bias in western areas

- Rain

will have to occur in April to replenish topsoil moisture - North

Africa is drying down and there is need for rain in northwestern Algeria and southwestern Morocco

o

Relief is not very likely in the coming week, but may evolve in the following weekend

- China

weather remains almost ideal for early season fieldwork and winter crop development in the Yellow River Basin, North China Plain and northeastern provinces, although warming is needed - China’s

Yangtze River Basin has been a little wet this month and drier and warmer weather is needed to induce better rapeseed and southern wheat conditions, but no significant loss in production potential has occurred - Yunnan,

China is still too dry and needs significant rain for its rice, corn and sugarcane

o

Rain has been removed from the outlook today relative to that of Wednesday

- Australia’s

Queensland and New South Wales crop areas are trending drier, but that is welcome from a summer crop maturation and harvest perspective after recent rain - India

weather will be almost ideal for crop maturation and harvesting in the next few weeks. The nation may have lost a little production this year because of dryness during reproduction, but another big crop is expected - Indonesia

and Malaysia weather has been and will continue to be good for all crops, although there is need for rain in northern parts of Peninsular Malaysia - A

tropical disturbance in the southern Bay of Bengal will be closely monitored for additional development, but recent model runs have diminished this event

o

There is no longer a threat to southern Myanmar from this potential system unless it regenerates over the weekend

- Philippines

weather has been and will continue to be good for most of its crops, although some areas in the north may develop a greater need for rain soon - Mainland

Southeast Asia crop areas need a boost in precipitation to induce better early season planting conditions for corn and sugarcane development as well

o

March precipitation was below average and not very supportive of early season corn and rice planting; dryness was also a concern for the start of sugarcane development

o

Rain is expected to improve over the next two weeks and the moisture boost will be beneficial for planting and early season crop development

- West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well

o

Rainfall will be a little lighter and less frequent over the next ten days, but crop conditions should remain favorable

- East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia in April while Tanzania begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops

o

Net drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress

o

Temperatures will be warmer than usual and that will dry out the soil relatively quickly

- New

Zealand weather is drier than usual and precipitation will remain below average during the next ten days

o

Temperatures will be seasonable

- Southern

Oscillation Index this morning was -0.13 and the index is expected to stay in a relatively narrow range of change over the next week.

Source:

World Weather inc.

Bloomberg

Ag Calendar

Thursday,

April 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Australia

commodity index - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - HOLIDAY:

Mexico, Argentina and several other Latin American countries

Friday,

April 2:

- CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Good Friday holiday across most of Europe, Africa, Americas and parts of Asia

Source:

Bloomberg and FI

USDA

export sales

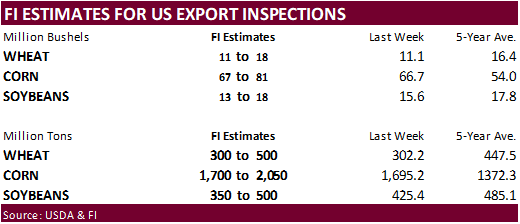

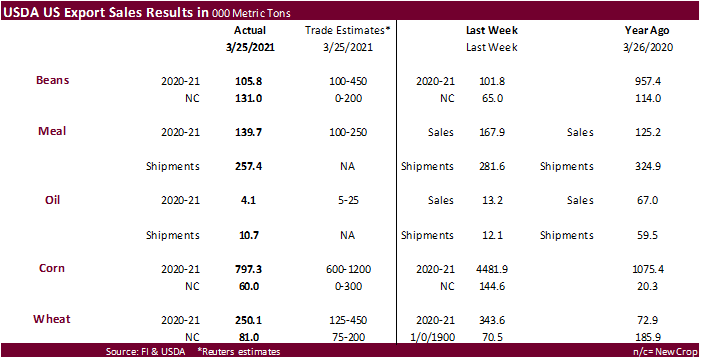

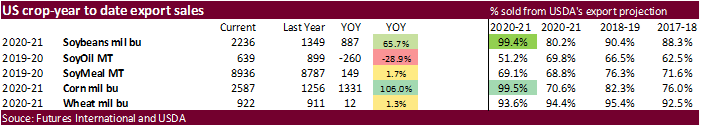

US

export sales for the soybean complex came in on the light side for all three commodities. Soybean sales of 105,800 tons old crop included 124,000 tons for China (66k switched from unknown). New crop soybean sales were 131,000 tons. USDA soybean shipments

were a marketing year low of 460,900 tons. Soybean meal shipments were good at 257,400 tons and SBO shipments were 10,700 tons (down from 13,200 tons previous week). Corn export sales were 797,300 tons old-crop, lower end of trade expectations (no China).

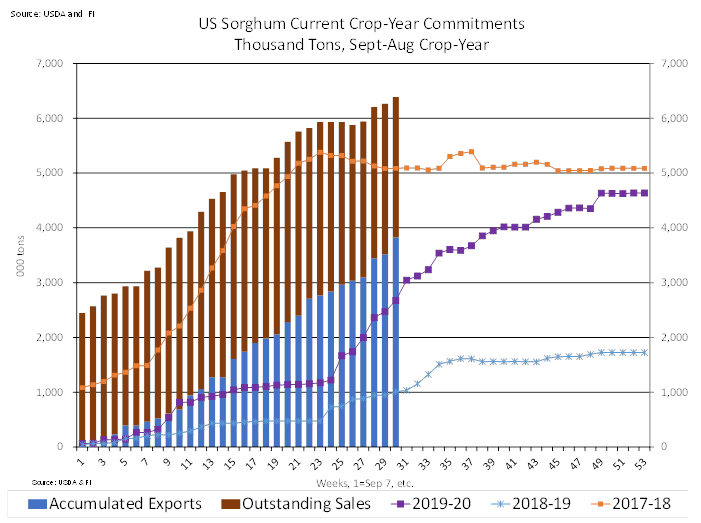

All-wheat sales of 250,100 tons for 2020-21 were within expectations but new-crop was light at 81,000 tons. The wheat sales include China switching 130,000 tons from unknown. Pork sales were a large 61,000 tons-a marketing year high. Sorghum sales of 121,000

tons were good and included China for 176,000 tons (55k switched from unknown) & decreases for unknown.

Macro

US

Initial Jobless Claims Mar 27: 719K (est 675K; prevR 658K; prev 684K)

US

Continuing Claims Mar 20: 3794K (est 3750K; prevR 3840K; prev 3870K)

Canadian

MLI Leading Indicator (M/M) Feb: 0.2% (prevR 0.2%; prev 0.1%)

Canadian

Building Permits (M/M) Feb: 2.1% (est -1.4%; prev 8.2%)

US

Markit Manufacturing PMI Mar F: 59.1 (est 59.1; prev 59.0)

US

March PMI At Second-Highest On Record Amid Marked New Order Growth And Supply Chain Disruptions – Markit

US

ISM Manufacturing PMI Mar: 64.7 (est 61.5; prev 60.8)

–

Prices Paid: 85.6 (est 85.0; prev 86.0)

–

New Orders: 68.0 (est 67.0; prev 64.8)

–

Employment: 59.6 (prev 54.4)

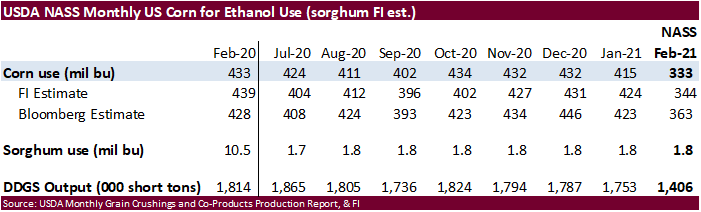

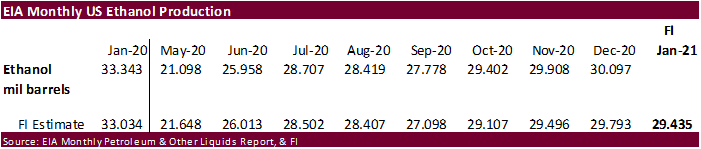

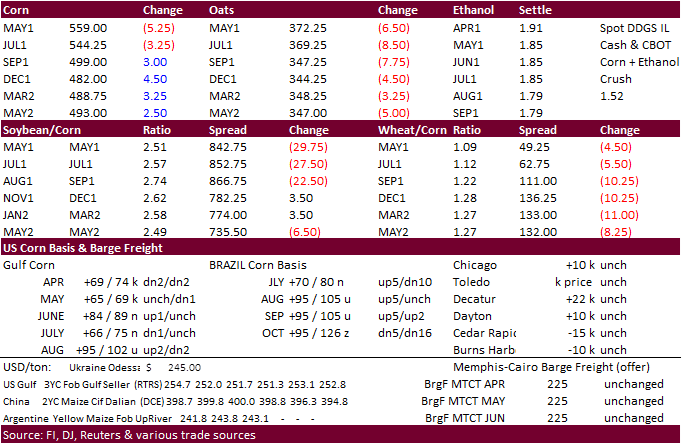

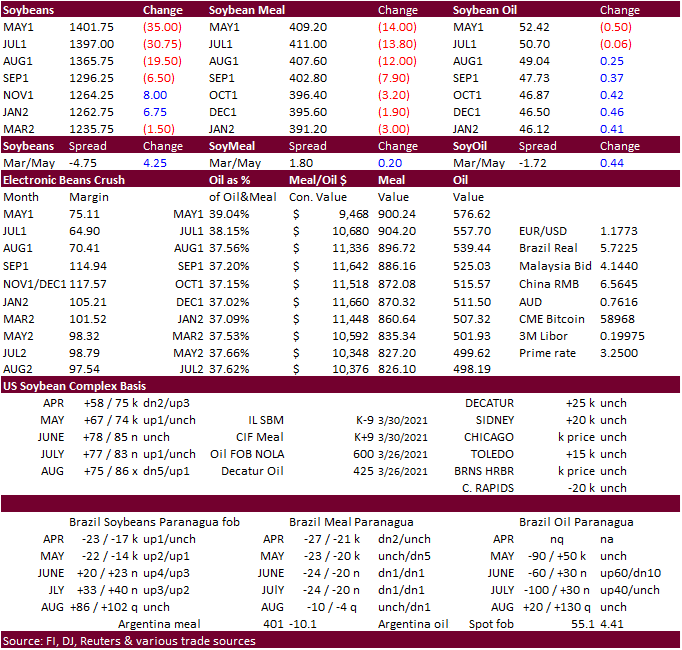

- CBOT

started higher on follow through buying post bullish USDA Prospective Plantings report but gains were trimmed after nearby soybeans sold off. Positioning ahead of the long holiday weekend and profit taking led to spreading. It was a very unusual day for

traders, with large ranges posted for many contract months for corn and the soybean complex. Nearby rolling prices hit their highest level since 2013 but ended lower. May gapped higher ($5.72 last absolute high early Feb.) but that was filled. We may see

additional weakness and strength in back months early next week. USDA reported a less than expected corn for ethanol use for the month of February. USDA export sales were at the low end of expectations. We like owning new-crop over old.

- Funds

on Thursday sold an estimated net 4,000 corn contracts. - A

Reuters story mentioned ASF affected about 20 percent of the pig heard in the latest wave of outbreaks across the northeast, northern China and Henan. It’s unknown the number of total hogs were lost during over the past six months. However, grain demand remains

very strong. - DataGro

sees the Brazil corn crop at 109.30 million tons, down from 109.62 million tons previous.

- CFTC

COT will be released Friday. - StoneX

sees the Brazil second corn crop at 77.65 million tons, down from 81.3 million tons previous.

- ADM

plans to restart two of its dry mill plants that have been offline for about a year because of slowing demand, located in Cedar Rapids, Iowa, and Columbus, Nebraska. Yesterday EIA reported weekly

US ethanol production was up 43,000 barrels,

but production remains about 10 percent below pracademic levels. - US

February corn use for ethanol came in below trade expectations during the month of February and with ethanol production rebounding at a slower rate during the start of the spring months, this could prompt USDA to lower its corn for ethanol use by 25 million

bushels from 4.950 billion to 4.925 billion.

Western

Illinois University via farmdoc daily

Franken,

J. “A Bullish Supply Shock.” farmdoc daily (11):50, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 31, 2021.

EIA:

State gasoline taxes average about 30 cents per gallon

https://www.eia.gov/todayinenergy/detail.php?id=47376&src=email#

Export

developments.

- None

reported

May

corn is seen in a $5.40 and $6.00 range

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

- Extremely

choppy session with May contract collapsing to close 34.75 cents lower and November 7.50 cents higher. Bottomline is new crop is too cheap relative to 2020-21 contracts, and traders are starting to correct the discrepancy with spreads. November is currently

$12.6375, a discount of $1.33 to the July contract. We see this spread headed to $1.00 after USDA reported lower than expected soybean plantings for the US that will keep 2021-22 US carryout stocks tight.

Poor

export sales for the soybean complex added to the negative undertone for nearby May.

Like

corn, we like owing new crop against old. - The

bearish sentiment for May soybeans could continue into Sunday night after USDA NASS reported negative February crush and product stocks data.

- Funds

on Thursday sold an estimated net 8,000 soybean contracts, sold 8,000 soybean meal and sold an estimated 2,000 soybean oil.

- We

are hearing it’s getting harder and harder to source SBO across the western Corn Belt.

- China

cash crush margins on our analysis were 159 (167 previous) vs. 169 cents late last week and compares to 207 cents year earlier.

- Euronext

May rapeseed settled 20 euros lower, or 3.9%, at 494.00 euros. - DataGro

sees the Brazil soybean crop at 135.47 million tons, down from 135.68 million tons previous.

- StoneX

sees the Brazil soybean crop at 134 million tons, up from 133.47 million tons previously.

- US

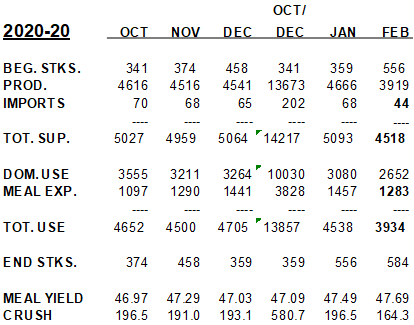

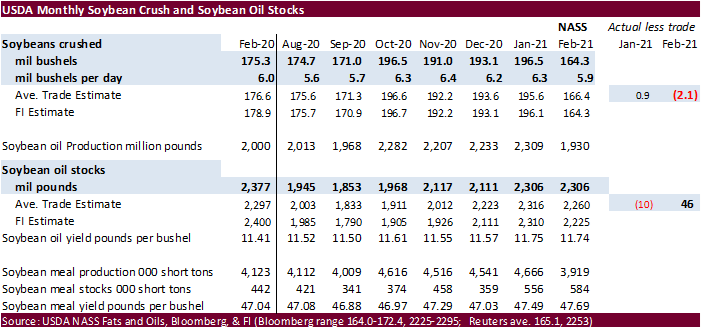

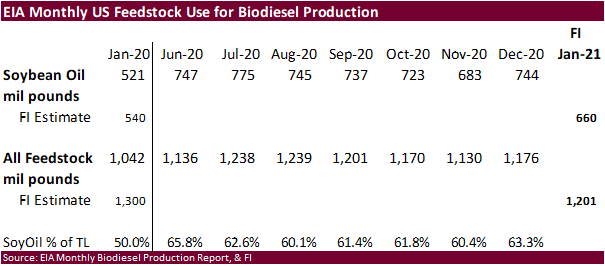

February US NASS crush came in 2.1 million bushels less than expectations and soybean oil stocks 46 million pounds below a Bloomberg trade guess. We believe this might be slightly bearish the soybean complex Sunday night. Soybean meal stocks were 584,000

short tons, up from 556,000 at the end of January and above 442,000 short tons year ago. This is a head scratcher since soybean meal exports during the month of February were very good. If that is the case (US export data out later next week), then the weather

events during February did indeed put a major dent into soybean meal feed demand (corn stocks were also reported higher than expected as of March 1) for the month of February. At 2.306 billion pounds for the soybean oil stocks, they are roughly 70 million

pounds below year ago. Note the SBO yield fell to 11.74 from 11.75 for January and this also implies soybean oil use during February was lower than trade expectations.

Oct-Feb

soybean meal monthly S&D

Export

Developments

- The

USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4-liter plastic bottles/cans) on April 6 for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

May

soybeans are seen in a $13.75 and $15.75 range.

November $10.50-$14.50

May

soymeal is seen in a $395 and $425 range.

December $325-$5.00

May

soybean oil is seen in a 50 and 55 cent range

December 40-60 cent wide range

- US

wheat futures were

most consistent out of the three benchmark CBOT commodities for trading today. Unlike corn and soybeans, wheat remained in a one-sided, lower direction, after traders divorced the commodity away from the bullish data for corn and soy released by USDA on Wednesday.

The lower trade in wheat reflected profit taking ahead of the long holiday weekend, and upward revision to the US winter wheat area by USDA yesterday. We see the US carryout remaining at a large level.

- After

the close Egypt

announced they seek wheat for August 1-10 shipment on Tuesday, April 6, with offers valid for 24 hours.

- May

Paris milling wheat settled down 6.25 euros, or 2.9%, at 209.25 euros a ton. During the session it fell to its lowest level since December 28 and below a previous three-month low struck this week. - Funds

on Thursday sold an estimated net 7,000 CBOT SRW wheat contracts.

- Egypt

seeks wheat for August 1-10 shipment on Tuesday, April 6, with offers valid for 24 hours.

- Saudi

Arabia’s SAGO seeks 295,000 tons of 12.5% protein wheat on Friday for arrival during May and June. - Reuters

noted SK millers bought another 65,000 tons of US wheat for July and August shipment. 80k was bought from US and Canada on Wednesday.

- Yesterday

Algeria’s OAIC bought optional-origin milling wheat. Some people put it at around 400,000-550,000 tons at around $279 a ton c&f (April-May shipment).

- Jordan

seeks 120,000 tons of animal feed barley on April 6. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Pakistan reversed their decision to allow imports of cotton and sugar per cabinet move.

·

Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/1/21

May Chicago wheat is seen in a $6.00‐$6.65 range

May KC wheat is seen in a $5.75‐$6.15 range

May MN wheat is seen in a $5.90‐$6.40 range (dn 10, unch)

USDA export sales data:

This

summary is based on reports from exporters for the period March 19 – 25, 2021.

Wheat: Net

sales of 250,100 metric tons (MT) for 2020/2021 were down 27 percent from the previous week and 22 percent from the prior 4-week average. Increases primarily for China (130,000 MT, switched from unknown destinations), the Philippines (123,300 MT, including

60,000 MT switched from Indonesia and decreases of 700 MT), South Korea (104,000 MT), Bangladesh (55,000 MT, switched from Indonesia), and Algeria (30,000 MT), were offset by reductions primarily for unknown destinations (120,000 MT) and Indonesia (114,900

MT). For 2021/2022, net sales of 81,000 MT were reported for the Philippines (52,000 MT), South Korea (21,000 MT), and Mexico (8,000 MT). Exports of 268,700 MT were down 59 percent from the previous week and 51 percent from the prior 4-week average. The

destinations were primarily to Nigeria (80,100 MT), the Philippines (58,300 MT), Japan (30,600 MT), the Dominican Republic (27,100 MT), and Vietnam (26,000 MT).

Corn:

Net sales of 797,300 MT for 2020/2021 were down 82 percent from the previous week and 46 percent from the prior 4-week average. Increases primarily for Japan (273,100 MT, including 143,700 MT switched from unknown destinations and decreases of 600 MT), Colombia

(245,000 MT, including 41,000 MT switched from unknown destinations and decreases of 106,800 MT), Saudi Arabia (139,200 MT, including 74,200 MT switched from unknown destinations), South Korea (123,500 MT, including decreases of 6,500 MT), and Mexico (83,800

MT, including decreases of 24,400 MT), were offset by reductions primarily for unknown destinations (228,800 MT). For 2021/2022, total net sales of 60,000 MT were for Mexico. Exports of 1,977,500 MT were unchanged from the previous week, but up 2 percent

from the prior 4-week average. The destinations were primarily to Japan (434,200 MT), Mexico (298,100 MT), China (275,000 MT), Colombia (263,900 MT), and Taiwan (165,900 MT).

Optional

Origin Sales:

For 2020/2021, new optional origin sales of 5,300 MT were reported for the China (4,800 MT) and unknown destinations (500 MT). Options were exercised to export 65,000 MT to South Korea from the United States. The current outstanding balance of 830,700 MT

is for South Korea (484,000 MT), unknown destinations (244,500 MT), China (69,800 MT), and the Ukraine (32,400 MT).

Export

Adjustment:

Accumulated exports of corn to Egypt were adjusted down 58,000 MT for week ending March 18th. The correct destination was Saudi Arabia.

Barley:

For 2020/2021, net sales of 100 MT were primarily for Taiwan. Export of 400 MT were down 41 percent from the previous week, but up 22 percent from the prior 4-week average. The destinations were primarily to Taiwan (200 MT) and Canada (200 MT).

Sorghum:

For 2020/2021, net sales of 121,000 MT resulting in increases for China (176,000 MT, including 55,000 MT switched from unknown destinations, decreases of 13,200 MT, and 59,300 MT – late), were offset by reductions for unknown destinations (55,000 MT). For

2021/2022, total net sales of 63,000 MT were for China. Exports of 306,300 MT were up noticeably from the previous week and from the prior 4-week average. The destination was China (including 59,300 MT – late).

Late

Reporting:

For 2020/2021, net sales and exports totaling 59,300 MT were reported late for China.

Rice:

Net sales of 55,500 MT for 2020/2021 were up 4 percent from the previous week, but down 23 percent from the prior 4-week average. Increases primarily for Japan (25,000 MT), Guatemala (10,500 MT, including 2,400 MT switched from El Salvador), Nicaragua (8,700

MT), Mexico (5,600 MT), and Canada (2,300 MT), were offset by reductions primarily for Honduras (1,200 MT). Exports of 62,300 MT were up noticeably from the previous week, but down 19 percent from the prior 4-week average. The destinations were primarily

to Honduras (24,100 MT), Haiti (7,000 MT), El Salvador (6,800 MT), Guatemala (4,700 MT), and Canada (4,300 MT).

Soybeans:

Net sales of 105,800 MT for 2020/2021 were up 4 percent from the previous week, but down 54 percent from the prior 4-week average. Increases primarily for China (124,000 MT, including 66,000 MT switched from unknown destinations), Egypt (49,300 MT, switched

from unknown destinations), Japan (44,100 MT, including 52,500 MT switched from unknown destinations and decreases of 11,900 MT), Belgium (27,700 MT, including 30,000 MT switched from unknown destinations and decreases of 2,300 MT), and Colombia (19,700 MT,

including 8,000 MT switched from unknown destinations and decreases of 2,100 MT), were offset by reductions primarily for unknown destinations (216,500 MT). For 2021/2022, net sales of 131,000 MT were reported for Pakistan (55,000 MT), unknown destinations

(42,000 MT), and Mexico (34,000 MT). Exports of 460,900 MT–a marketing-year low–were down 8 percent from the previous week and 35 percent from the prior 4-week average. The destinations were primarily to Japan (90,600 MT), Mexico (89,700 MT), China (79,000

MT), Egypt (49,300 MT), and Belgium (27,700 MT).

Exports

for Own Account:

The current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 139,700 MT for 2020/2021 were down 17 percent from the previous week and 34 percent from the prior 4-week average. Increases primarily for Colombia (66,200 MT, including decreases of 2,500 MT), Canada (19,900 MT, including decreases of 100 MT),

Guatemala (10,000 MT, including 6,000 MT switched from Nicaragua, 4,700 MT switched from El Salvador, and decreases of 1,300 MT), Jamaica (9,000 MT), and Mexico (9,000 MT, including decreases of 100 MT), were offset by reductions primarily for Nicaragua (5,300

MT) and El Salvador (2,900 MT). For 2021/2022, total net sales reductions of 300 MT were for Canada. Exports of 257,400 MT were down 9 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Colombia

(70,600 MT), the Philippines (50,400 MT), Mexico (33,400 MT), Honduras (24,300 MT), and Canada (22,700 MT).

Soybean

Oil:

Net sales of 4,100 MT for 2020/2021 were down 69 percent from the previous week and 62 percent from the prior 4-week average. Increases primarily for Nicaragua (2,200 MT), the Dominican Republic (1,700 MT), El Salvador (1,300 MT), and Mexico (500 MT), were

offset by reductions for Canada (900 MT) and Jamaica (700 MT). Exports of 10,700 MT were down 12 percent from the previous week and 66 percent from the prior 4-week average. The destinations were primarily to Colombia (5,000 MT), the Dominican Republic (4,200

MT), Mexico (1,000 MT), and Canada (400 MT).

Cotton:

Net sales of 78,400 RB for 2020/2021 were down 71 percent from the previous week and from the prior 4-week average. Increases primarily for Vietnam (97,300 RB, including 13,600 RB switched from China, 1,400 RB switched from South Korea, and 400 RB switched

from Japan), Pakistan (37,300 RB), Turkey (28,100 RB, including decreases of 8,800 RB), Mexico (14,100 RB, including decreases of 100 RB), and China (13,500 RB, including decreases of 24,200 RB), were offset by reductions primarily for Indonesia (119,500 RB).

For 2021/2022, net sales of 41,400 RB primarily for South Korea (19,800 RB), Vietnam (13,200 RB), Turkey (9,700 RB), Mexico (2,000 RB), and Pakistan (1,800 RB), were offset by reductions for Indonesia (6,300 RB). Exports of 324,700 RB were up 4 percent from

the previous week, but down 7 percent from the prior 4-week average. Exports were primarily to Vietnam (70,300 RB), China (63,300 RB), Pakistan (56,300 RB), Turkey (35,200 RB), and Bangladesh (24,000 RB). Net sales of Pima totaling 4,300 RB–a marketing-year

low–were down 38 percent from the previous week and 49 percent from the prior 4-week average. Increases primarily for India (3,100 RB), Japan (600 RB), Bangladesh (300 RB), South Korea (300 RB), and Indonesia (100 RB), were offset by reductions primarily

for Italy (100 RB). Exports of 14,300 RB were up 54 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to India (11,300 RB), Peru (1,000 RB), Pakistan (900 RB), Vietnam (500 RB), and South Korea (400

RB).

Exports

for Own Account:

For 2020/2021, new exports for own account totaling 500 RB were to Vietnam. Exports for own account totaling 4,700 RB to Vietnam (3,100 RB) and China (1,600 RB) were applied to new or outstanding sales. The current exports for own account outstanding balance

of 30,200 RB is for China (23,600 RB), Vietnam (6,200 RB), and Bangladesh (400 RB).

Hides

and Skins:

Net sales of 357,600 pieces for 2021 were down 36 percent from the previous week and 28 percent from the prior 4-week average. Increases primarily for China (193,900 whole cattle hides, including decreases of 26,700 pieces), South Korea (72,500 whole cattle

hides, including decreases of 2,400 pieces), Thailand (47,700 whole cattle hides, including decreases of 800 pieces), Mexico (27,900 whole cattle hides, including decreases of 3,400 pieces), and Spain (5,700 whole cattle hides), were offset by reductions primarily

for Taiwan (700 pieces) and Brazil (100 pieces). Total

net sales reductions of 300 calf skins were for Italy. In additions, total net sales of 1,800 kip skins, including decreases of 1,000 pieces, were for Belgium.

Exports of 411,100 pieces for 2021 were up 9 percent from the previous week and 8 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (259,500 pieces), South Korea (63,800 pieces), Mexico

(33,400 pieces), Thailand (29,900 pieces), and Taiwan (11,400 pieces). Exports of 800 calf skins were to Italy. Additionally, exports of 3,500 kip skins were primarily to Belgium (2,600 kip skins).

Net

sales of 222,900 wet blues for 2021 were up 1 percent from the previous week and 67 percent from the prior 4-week average. Increases primarily for Italy (83,500 unsplit), China (75,600 unsplit and 2,300 grain splits), Mexico (42,900 grain splits), Vietnam

(15,700 unsplit), and South Korea (1,600 grain split), were offset by reductions primarily for Thailand (100 unsplit). Exports of 165,400 wet blues for 2021 were up 65 percent from the previous week and 64 percent from the prior 4-week average. The destinations

were primarily to China (50,700 unsplit and 4,800 grain splits), Vietnam (34,500 unsplit), Italy (17,200 unsplit and 6,400 grain splits), Mexico (14,700 grain splits and 1,000 unsplit), and Thailand (13,300 unsplit). Net sales of 161,500 splits were primarily

for Taiwan (86,000 pounds), China (71,700 pounds), and Italy (3,100 pounds). Exports of 329,100 pounds were to Vietnam (237,800 pounds), Italy (47,100 pounds), and China (44,200 pounds).

Beef:

Net

sales of 18,700 MT reported for 2021 were down 1 percent from the previous week and 15 percent from the prior 4-week average. Increases primarily for Japan (6,000 MT, including decreases of 700 MT), China (5,900 MT, including decreases of 100 MT), South Korea

(2,600 MT, including decreases of 600 MT), Canada (1,100 MT, including decreases of 100 MT), and Hong Kong (800 MT, including decreases of 100 MT),

were

offset by reductions primarily for Kuwait (100 MT).

Exports of 18,600 MT were unchanged from the previous week, but up 1 percent from the prior 4-week average. The destinations were primarily to Japan (5,400 MT), South Korea (5,100 MT), China (2,900 MT), Mexico (1,400 MT), and Canada (800 MT).

Pork:

Net

sales of 61,000 MT reported for 2021–a marketing-year high–were up 58 percent from the previous week and 43 percent from the prior 4-week average. Increases were primarily for China (29,700 MT, including decreases of 1,200 MT), Mexico (15,800 MT, including

decreases of 500 MT), Japan (4,600 MT, including decreases of 200 MT), Canada (3,700 MT, including decreases of 400 MT), and Australia (2,200 MT, including decreases of 300 MT). Exports of 40,400 MT were up 5 percent from the previous week and 2 percent from

the prior 4-week average. The destinations were primarily to China (11,900 MT), Mexico (9,900 MT), Japan (5,200 MT), South Korea (4,000 MT), and Colombia (1,800 MT).

U.S. EXPORT SALES FOR WEEK ENDING 3/25/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

98.0 |

1,426.7 |

1,812.1 |

70.1 |

7,087.1 |

7,492.2 |

13.0 |

296.5 |

|

SRW |

-11.5 |

331.4 |

279.2 |

11.7 |

1,451.5 |

2,060.1 |

4.0 |

317.3 |

|

HRS |

61.7 |

1,550.7 |

1,537.5 |

159.2 |

5,927.0 |

5,710.2 |

58.5 |

368.5 |

|

WHITE |

101.8 |

2,030.7 |

1,148.5 |

27.6 |

4,628.6 |

3,830.3 |

5.5 |

188.8 |

|

DURUM |

0.0 |

78.3 |

230.4 |

0.0 |

592.1 |

682.3 |

0.0 |

5.0 |

|

TOTAL |

250.1 |

5,417.7 |

5,007.7 |

268.7 |

19,686.3 |

19,775.1 |

81.0 |

1,176.1 |

|

BARLEY |

0.1 |

5.8 |

10.7 |

0.4 |

23.1 |

38.7 |

0.0 |

20.2 |

|

CORN |

797.3 |

31,808.4 |

13,600.8 |

1,977.5 |

33,917.6 |

18,306.6 |

60.0 |

1,999.5 |

|

SORGHUM |

121.0 |

2,562.8 |

1,255.6 |

306.3 |

3,824.7 |

1,417.2 |

63.0 |

819.0 |

|

SOYBEANS |

105.8 |

6,024.9 |

5,102.0 |

460.9 |

54,816.7 |

31,607.2 |

131.0 |

5,272.2 |

|

SOY MEAL |

139.7 |

2,476.8 |

2,851.5 |

257.4 |

6,459.6 |

5,935.4 |

-0.3 |

250.0 |

|

SOY OIL |

4.1 |

107.4 |

286.4 |

10.7 |

531.8 |

612.6 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

25.1 |

316.2 |

328.3 |

39.4 |

1,092.6 |

979.0 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

5.3 |

44.4 |

0.0 |

23.5 |

24.9 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

3.7 |

20.7 |

0.5 |

33.9 |

36.7 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

69.0 |

63.1 |

0.6 |

84.4 |

45.2 |

0.0 |

0.0 |

|

L G MLD |

3.7 |

49.4 |

94.0 |

12.6 |

453.6 |

648.8 |

0.0 |

0.0 |

|

M S MLD |

26.6 |

261.1 |

255.0 |

9.2 |

369.7 |

405.3 |

0.0 |

0.0 |

|

TOTAL |

55.5 |

704.7 |

805.4 |

62.3 |

2,057.6 |

2,139.9 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

78.4 |

5,105.5 |

6,665.1 |

324.7 |

9,471.5 |

8,627.3 |

41.4 |

1,542.9 |

|

PIMA |

4.3 |

247.5 |

211.4 |

14.3 |

491.8 |

328.2 |

0.0 |

1.1 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.