PDF Attached

World

Weather Inc.

MOST

IMPORTANT WEATHER IN THE WORLD

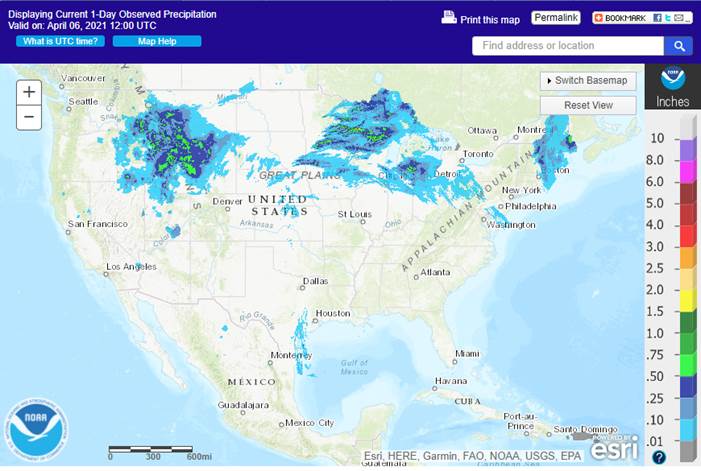

- Northwestern

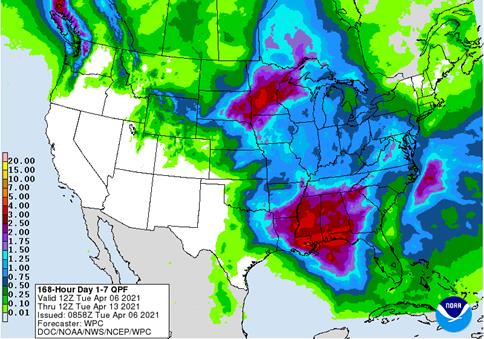

U.S. Plains and Canada’s Prairies will continue dry biased and in need of significant moisture; not much relief is expected for a while - U.S.

Delta will be a little wetter than desired for cotton, corn and early soybean planting, but there is time for improvement - U.S.

Southeastern States will experience a good mix of weather over the next two weeks supporting early planted crop development and future planting as well - U.S.

west-central and southwestern Plains are drying down and this process will continue for the next ten days slowly raising crop moisture stress in unirrigated areas - Central

Washington into Central Oregon is too dry and needs rain for unirrigated crops - California

and the southwestern desert region will remain dry and in need of significant moisture, but irrigation is sufficient to carry on most agricultural needs - Brazil’s

Mato Grosso and Goias will experience well timed rainfall and seasonable temperatures to support Safrinha corn and cotton during the next two weeks - Brazil’s

interior south and center south will dry down for another week to ten days - Many

areas have short to very short topsoil moisture, but subsoil moisture will carry on normal crop developin7g during this drier period - A

boost in precipitation will be very important during the second week of the outlook and into the second half of this month - Some

of that moisture boost is expected, but a close watch is warranted for fear that the rain fails to develop - Argentina

will get generalized rainfall during the second half of this week and into the weekend bolstering topsoil moisture once again and support great late season corn, sorghum, peanut and soybean development - Mainland

areas of Southeast Asia will experience a net boost in precipitation soon that will further improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas - Some

beneficial rain fell across parts of this region last weekend, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - Flooding

in Timor and Flores is abating, but serious crop and property damage occurred in parts of both islands - India

weather will continue good for this time of year with restricted rainfall and warm temperatures supporting winter crop maturation and harvest progress - Rain

may fall heavily in Bangladesh and neighboring areas of India briefly next week - China

weather remains mostly very good, although portions of the Yangtze River Basin are too wet and need to dry down - Northern

crop areas in China are favorably moist and poised to support aggressive winter and spring crop development this year once additional warming takes place - Western

Europe will continue to dry down through Thursday raising the need for rain - Temperatures

will be very warm early this week and then cool later this week and during the weekend as precipitation begins to evolve - Precipitation

will be erratic and somewhat light late this week and into the weekend, but all of it will be welcome - Next

week trends drier once again and some warming is expected - CIS

precipitation during the holiday weekend was greatest from central Ukraine through the heart of western Russia maintaining moisture abundance in those areas - Precipitation

elsewhere was more limited, but soil moisture was still favorable from past precipitation events and melting snow - Warming

has been occurring recently helping to melt snow at a faster pace - Greening

may be occurring now in a part of Ukraine and Russia’s Southern Region - Temperatures

will be mild over the next ten days to two weeks and precipitation will be erratic

- Most

interior crop areas of Australia will not be bothered by significant rain this week - Rain

in Western Australia late this weekend and early next week will be dependent upon the tropical cyclones noted above

- Good

drying conditions are likely in key summer grain, oilseed and cotton areas in Eastern Australia this week favoring summer crop maturation and good harvest progress. - North

Africa will experience a favorable mix of weather over the next ten days, although resulting rainfall is not likely to be very great - All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture - Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Rainfall

will be a little lighter and less frequent over the next ten days, but crop conditions should remain favorable - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops - Net

drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand weather is drier than usual and precipitation will slowly improve during the next ten days - Temperatures

will be seasonable - Canada’s

Prairies will receive restricted amounts of precipitation and continue warmer biased next ten days - Southeastern

Canada will see below average precipitation and warmer than usual temperatures over the next ten days - Southern

Oscillation Index this morning was +0.59 and the index is expected to move in a narrow range the rest of this week

Source:

World Weather inc.

Bloomberg

Ag Calendar

Tuesday,

April 6:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - HOLIDAY:

Hong Kong, Thailand

Wednesday,

April 7:

- EIA

weekly U.S. ethanol inventories, production - ANZ

Commodity Price

Thursday,

April 8:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish soybean and corn reports - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Port

of Rouen data on French grain exports

Friday,

April 9:

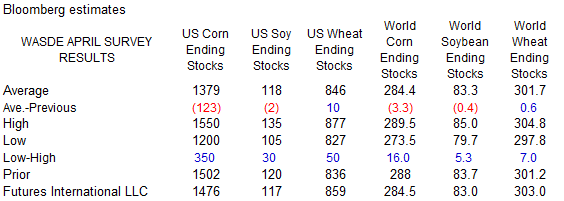

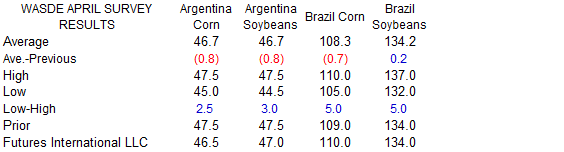

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

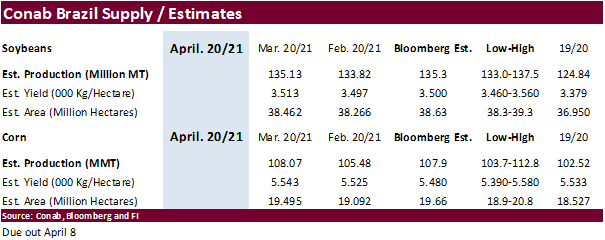

Conab

is due out with April Brazil supply on April 8

Macro

NIH’s

Fauci: US Is On Brink Of Another Covid Surge

IMF

Raises World GDP Growth Forecast To 6% Vs. 5.5% In January Forecast

-Sees

World GDP Up Most In 4 Decades

-Raises

2021 US GDP Forecasts To +6.4% Y/Y (Jan Est: +5.1%)

-Raises

2021 China GDP Estimate To +8.4% Y/Y (Jan Est: +8.1%)

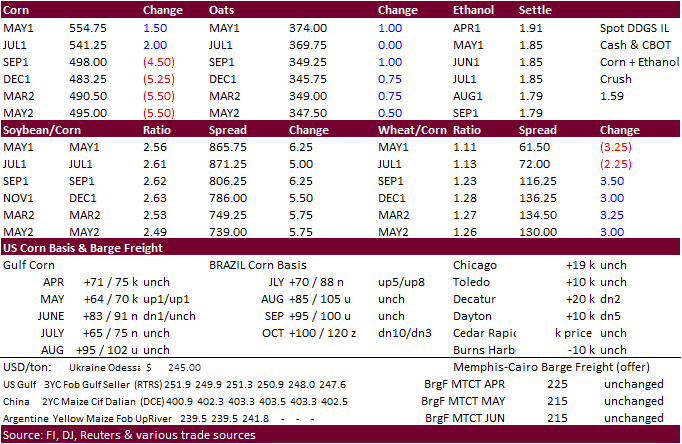

Corn

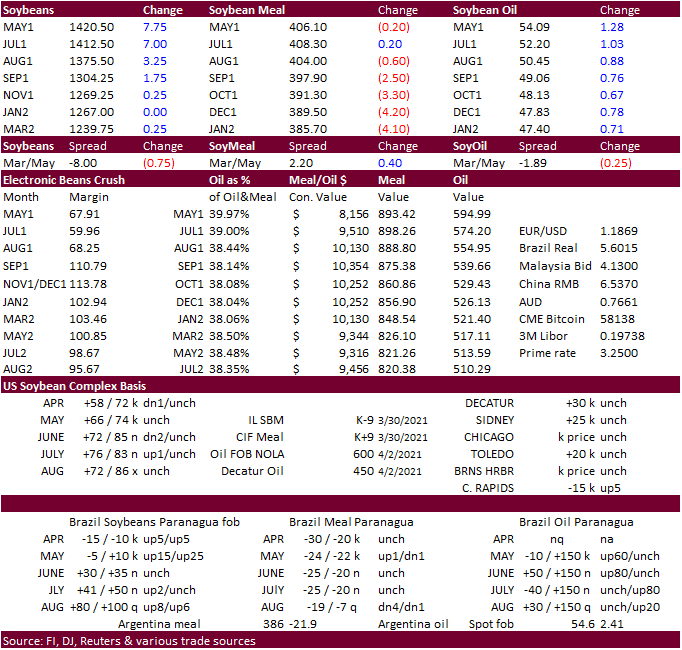

- CBOT

corn ended 1-1.75 cents higher in the front two month contracts on renewed fund buying, rebound in US energies, and higher soybeans.

Back

months were 4.25-5.25 cents lower on good US weather. Initial support for May corn is seen at $5.4950. Brazilian crop concerns were noted for today’s trade. Agroconsult projected Brazil’s second corn crop at 78.3 million tons versus 82.8 million tons.

They warned 38 percent of the second crop at high risk climate window in Mato Grosso. USDA is at 109 million tons for the total Brazil corn crop, versus 102 million for 2019-20.

- Funds

on Tuesday bought an estimated net 1,000 corn contracts. - There

are several factors to watch over the next month most notably Brazilian weather with late planted corn, Brazil soybean shipments pushing back Brazil’s export campaign (driving business to the US), and US weather for upcoming paintings. We think USDA is 3.5

million acres too low for their 15 major crop area plantings, and in the June report US corn acreage will increase. Spreads are expected to remain active this week. The “Goldman” roll starts Thursday.

- IL

and IA corn crop planting insurances are starting to open. April 11 is a key date for IA. Crops planted before the specified county level early planting date will not be eligible for replanting payments.

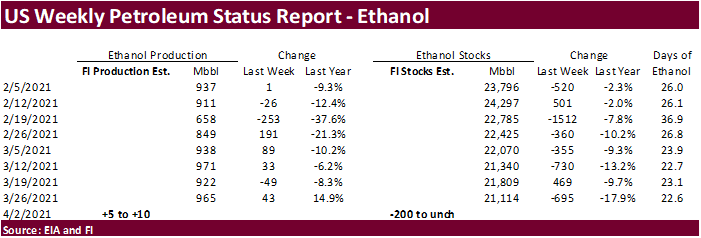

- A

Bloomberg poll looks for weekly US ethanol production to be down 3,000 barrels (935-975 range) from the previous week and stocks up 55,000 barrels to 21.169 million.

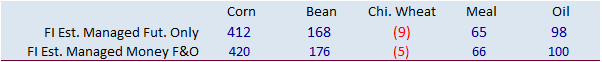

- Bloomberg

trade estimates were released after the close yesterday and consensus is traders look for much tighter US corn stocks (-123) in the upcoming Friday report.

Export

developments.

- None

reported

May

corn is seen in a $5.40 and $6.00 range

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

- CBOT

soybeans and soybean oil were higher as money managers added to long positions. Soybean basis at selected WCB locations were higher from Monday morning by 5-10 cents. May soybeans found support at its 20-day MA, around 14.13. Weather is mostly unchanged

for the US. Planting delays are expected for the Delta over the next several days while the Midwest looks good for fieldwork progress. USD was about 23 points lower at the CBOT ag close. US energies rebounded. Soybean meal settled mixed on product spreading.

Earlier there was talk of tight spot global soybean supplies due to Brazil’s delay in harvesting of soybeans is also underpinning the market. May canola was $17.50 higher or 2.3% to $785.10 per ton.

- Agroconsult

projected Brazil’s soybean crop at 137.1 million tons versus 132.4 million tons. USDA is at 134 million tons. As of Thursday, Brazil was 78% complete on collecting soybeans, down from 83% year ago.

- Funds

on Tuesday bought an estimated net 4,000 soybean contracts, were flat in soybean meal and bought an estimated 2,000 soybean oil.

- Strategie

Grains lowered its forecast for the 2021 EU rapeseed harvest to 16.8 million tons from 17.05 million forecast last month and is now 3.4% above 2020. - The

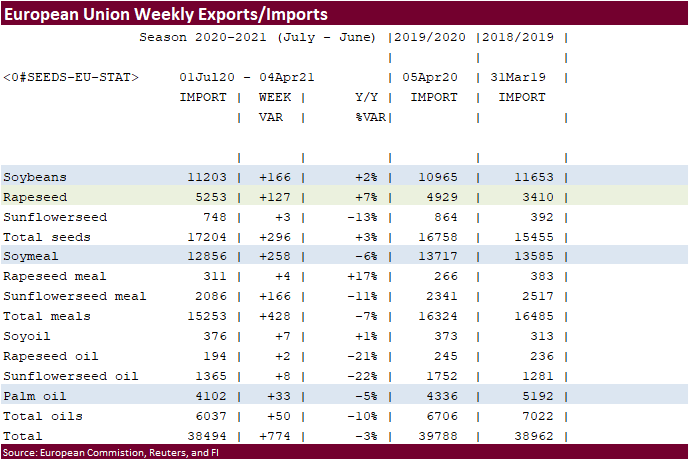

European Union reported soybean import licenses since July 1 at 11.203 million tons, above 10.965 million tons a year ago. European Union soybean meal import licenses are running at 12.856 million tons so far for 2020-21, below 13.717 million tons a year ago.

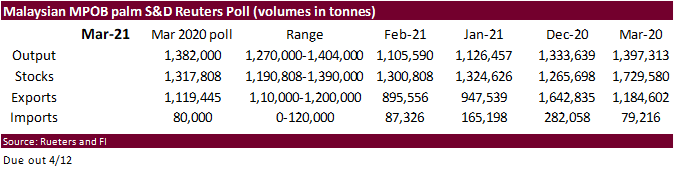

EU palm oil import licenses are running at 4.102 million tons for 2020-21, below 4.336 million tons a year ago, or down 5 percent. - A

Reuters poll for Malaysia’s palm oil inventories shows March stocks expected to rise 1.3% from February to 1.32 million tons, production to slightly decline, and exports to be up 25% to 1.12 million tons. The Malaysian Palm Oil Board will release the official

data on April 12.

Export

Developments

- South

Korea’s bought around 12,000 tons of non-GMO soybeans on April 2, at $724 a ton c&f and $733.60 a ton for arrival in South Korea between June 15 and Sept. 20.

- Today

the USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4-liter plastic bottles/cans) for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

May

soybeans are seen in a $13.75 and $15.75 range.

November $10.50-$14.50

May

soymeal is seen in a $395 and $425 range.

December $325-$5.00

May

soybean oil is seen in a 50 and 55 cent range

December 40-60 cent wide range

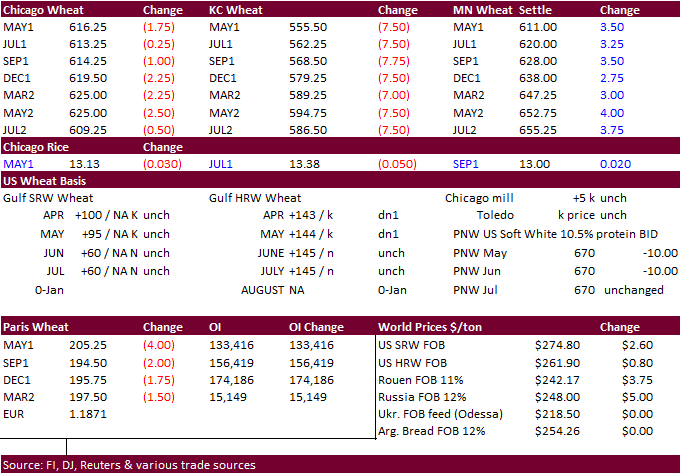

- Chicago

wheat started higher but a decline in EU and KC wheat futures weighted on Chicago type SRW wheat. Net drying across the western Canadian Prairies supported MN type wheat. A

fresh wave of import tenders this week and lower USD limited downside risk. Egypt bought 345,000 tons of Black Sea wheat. Thailand, Taiwan, and Ethiopia are in for wheat. Algeria seeks wheat on Wednesday.

- Funds

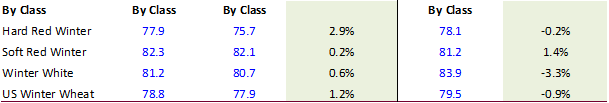

on Tuesday sold an estimated net 1,000 CBOT SRW wheat contracts. - KC

wheat was under pressure in part to improvement in HRW wheat ratings from last fall. Below is our adjusted rating.

- 53%

of the US wheat crop was rated G/E, near expectations. - TX,

OK, KS, CO, and NE make up 61 percent of the US winter wheat planted area. Colorado posted the lowest rating, adjusted, in USDA’s selected state crop progress report. Texas was second worst.

- Weather

was mostly unchanged. The northern Plains and Delta rain will increase by the end of the week. The western Canadian Prairies are dry and need rain and will see only scattered showers this week.

- Paris

wheat traded higher early but settled 3.50 euros lower at 205.75 ($243.79/ton).

- China

sold 1.6 million tons of wheat out of auction from 4.022 million tons offered, bringing 2021 sales to 26 million tons (out of 48MMT offered).

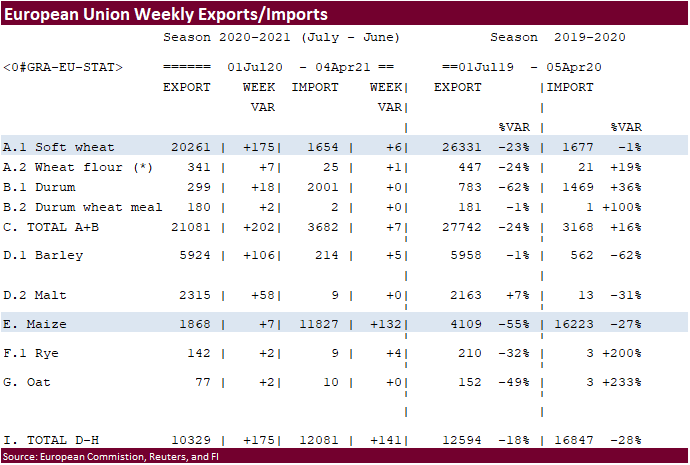

- The

European Union granted export licenses for 175,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 20.261 MMT, well down from 26.331 million tons committed at this time last year, a 23 percent decrease. Imports are

near unchanged from year ago at 1.677 million tons.

- Egypt

bought 345,000 tons of wheat including 290,000 tons Russian and 55,000 tons Ukrainian, for August 1-10 shipment. Reuters breakdown:

55,000

tons of Russian wheat at $234.00 and $18.75 freight equating to $252.75

55,000

tons of Russian wheat at $234.00 and $18.75 freight equating to $252.75

60,000

tons of Russian wheat at $234.00 and $18.00 freight equating to $252.00

60,000

tons of Russian wheat at $234.00 and $18.00 freight equating to $252.00

55,000

tons of Ukrainian wheat at $232.90 and $19.25 freight equating to $252.15

60,000

tons of Russian wheat at $233.00 and $18.00 freight equating to $251.00

- Thailand’s

TFMA group seeks up to 504,000 tons of animal feed wheat on April 7 for shipment between May and December. - Taiwan

seeks 96,485 tons of US wheat on April 8. - Ethiopia

seeks 30,000 tons of wheat on April 16. - Jordan

postponed their 120,000 ton import tender of animal feed barley on April 6 to April 13.

- Algeria’s

OAIC seeks optional-origin milling wheat on Wednesday. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Thailand lowest price @ $569.50/ton: Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

Ethiopia

seeks 170,000 tons of parboiled rice on April 20.

Updated

4/5/21

May Chicago wheat is seen in a $6.00‐$6.65 range

May KC wheat is seen in a $5.50‐$6.00 range

May MN wheat is seen in a $5.90‐$6.40 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.