PDF Attached

Lower trade in corn, wheat, and soybeans on continued liquidation, while HRW closed higher on weather. Soymeal saw value buying midsession after traders were willing the step in and lend support following this week’s losses. USDA export sales showed a couple new-crop commodity cancellations by China. Other news was light pre-holiday. Note some countries will be off on Monday including EuroNext Paris Milling wheat. US futures reopen Sunday night at the normal time. Non-farm payrolls and CFTC data will be released tomorrow.

MOST IMPORTANT FOR THE COMING WEEK

- North Africa dryness seems to be expanding northward into Spain and Portugal and some computer forecast models have been suggesting some further expansion to the north into southern France is possible in the coming week

- Temperatures will be above normal while precipitation is minimal

- Unirrigated winter and spring crops will experience some moisture stress in the driest areas

- Welcome drying will continue through the weekend and into much of next week in western and northern Russia where it has become quite wet earlier this season when rain and snow were falling frequently while snow was melting

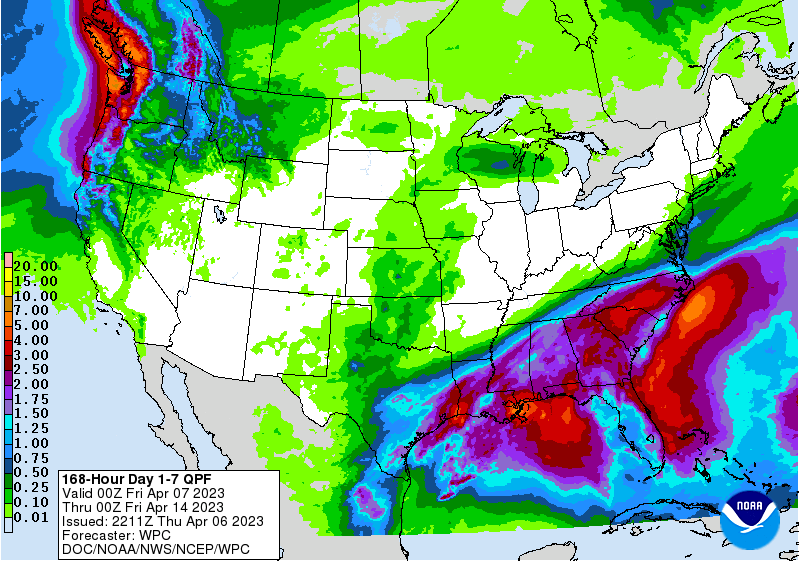

- U.S. Midwest will be drier and warmer over the coming full week resulting in much better field working conditions in the south during the middle and latter part of next week

- Flooding will begin this weekend and especially next week across the upper U.S. Midwest and Red River Basin of the North due to rapid snowmelt

- No new precipitation events are expected for a while which may help to prevent the worst possible flood from occurring

- Rain will resume around mid-month, although it is not advertised to be heavy

- Western U.S. hard red winter wheat areas are unlikely to get substantia rain, but some showers may evolve periodically during the next few weeks

- Central and eastern wheat production areas will be wettest during the same period of time and long term crop production is likely to advance normally

- Central Texas to eastern Kansas, Missouri and Iowa rainfall boosting is expected by mid-month

- The moisture will be good for spring planting and the development of winter wheat

- U.S. southeastern states will be wet and stormy today into Saturday with significant moisture likely

- The precipitation will bolster soil moisture significantly and will delay fieldwork

- Follow up rain at the end of next week seems to be rather questionable since World Weather, Inc. believes the Gulf of Mexico low pressure center is likely overdone on today’s forecast model runs.

- California precipitation is expected in the north this weekend and along the upper U.S. Pacific Coast and perhaps a little farther to the south during mid-month

- Canada’s Prairies are expected to be drier biased this weekend while warming up

- Snow will melt in many areas and soil temperatures will rise in areas of snow free conditions

- Some precipitation will develop as the warm weather begins to abate temporarily during the latter part of next week and into early next week.

- West Texas cotton areas will continue dry for another five to six days and then the chances for some periodic shower activity should begin to improve

- Rain chances may improve for the Rolling Plains in the second week of the outlook and there is a “chance” for some shower activity to reach into the low Plains

- U.S. Delta weather will trend drier late this weekend, but abundant rain in the central and south over the next few days will induce some delay to farming activity

- A favorable mix of rain and sunshine should occur in the second week of the forecast

- Southern parts of the Tennessee River Basin will get waves of rain into the weekend before drying down

- Some areas in the region are already too wet

- Drying is expected for a while late this weekend through much of next week resulting in better field conditions eventually

- Aggressive planting progress should result after a few days of drying

- Southeastern Manitoba, Canada received significant snowfall Wednesday and the precipitation will melt with warmer temperatures

- The Red River in Canada is expected to move into flood stage in the second half of this month due to U.S. snowmelt in the upper Midwest

- Other Canada Prairies crop areas will get some periodic precipitation during weeks 2 and 3, but a general soaking of rain is not very likely outside of a few pockets

- Concern about ongoing dryness will be very high for a while this spring because of drought that is prevailing in the southwestern Prairies

- Some relief is certainly expected, but confidence in the significance of that relief is low until the weather patterns change late this spring and more likely in the summer

- China’s Yellow River Basin, central parts of Inner Mongolia and the North China Plain reported 1.00 to 3.00 inches of rainfall earlier this week

- The moisture has bolstered topsoil moisture for more aggressive winter wheat development and has improved spring planting potentials

- Soil temperatures are warm enough to plant corn and a host of other spring crops in east-central and southeastern China where fieldwork will advance around additional bouts of rain

- China’s Yangtze River Basin will receive waves of rain during the next ten days

- Rain totals of 2.00 to 6.00 inches will with locally more

- Yunnan, China is too dry and needs moisture for early season corn and rice as well as other crops

- The province and neighboring areas are considered to be in a drought

- Dryness will continue in the province cutting into rice and corn planting and production potential as well as some other crops

- India and Pakistan will restricted rainfall over the next two weeks

- A few showers will occur, but the potential impact on winter crops will be low

- Recent rain will support aggressive early season cotton planting

- Wheat will benefit greatly from the change

- Central and southern Argentina, Uruguay and southern Rio Grande do Sul, Brazil are unlikely to receive much precipitation in the week to ten days

- The drier bias will support crop maturation and harvest progress

- Scattered showers and thunderstorms will develop in the following weekend

- Northern Argentina precipitation during the next ten days will be sufficient to maintain favorable late season crop development, but it may also interfere with early season summer crop maturation and harvest progress

- Center south Brazil will experience increasing rainfall later this week into next week

- The moisture will help to saturate the topsoil once again in support of Safrinha and other late season crops

- A part of the region has been drying out recently and this will help to reverse the trend and saturate the soil again before seasonal rains end later this month

- A tropical cyclone may form east southeast of the Philippines this weekend and it will be closely monitored for possible influence on the archipelago next week

- The latest computer forecast model runs have come into strong agreement bringing the system to the northern Philippines in the second half of next week

- Another tropical cyclone is expected to form north of Australia this weekend and the disturbance is east southeast of Timor, Indonesia today

- The system will become better defined and intensify early next week before moving inland over the central North coast of Western Australia during the second half of next week

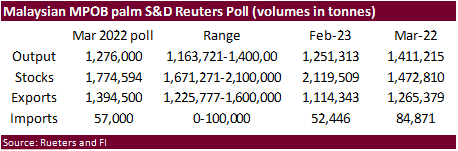

- Southeast Asia rainfall will continue favorably distributed for the next ten days to two weeks; this is true for Indonesia, Philippines and Malaysia as well as the maintain crop areas

- Mainland areas will not receive as much rain as usual

- March was notably drier biased

- Eastern Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops

- Turkey will be the wettest Middle East nation in the coming week while net drying occurs in most other areas through early next week

- Recent precipitation has been good for wheat development and rice and cotton planting

- Western Europe will be drier biased over the coming week while Eastern Europe is sufficiently wet to bolster topsoil moisture

- Southeastern Europe rain during mid-week this week has improved soil moisture for the southern Balkan Countries and areas east northeast into central and western Ukraine

- Relief from drought is occurring in the lower Danube River Basin and parts of Romania

- Additional rain is possible during the coming week to ten days

- Western CIS weather will be wettest in Ukraine, southern Belarus and western parts of Russia’s Southern Region over the coming week to ten days

- Sufficient moisture is expected throughout the western CIS to maintain a good prospect for winter and spring crops throughout the region

- Drying in western Russia will be great for improving topsoil moisture for spring fieldwork – many areas are too dry

- West-central Africa rainfall is expected periodically in the next two weeks to support ongoing coffee, cocoa, rice and sugarcane development

- A boost in rainfall is needed in cotton production areas to support the best planting environment

- Central Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected

- Limited rainfall in eastern Australia will be great for summer crop maturation and harvesting

- A boost in precipitation will be needed in southern Australia in the next few weeks to support wheat, barley and canola planting

- Scattered showers are advertised for the coming week, but most of the resulting rain should be light

- The outlook is favorable

- South Africa weather will be mostly good over the next two weeks with a mix of rain and sun supporting corn, sorghum, sunseed, soybeans, rice, cotton, citrus sugarcane and other crops

- Rainfall will be limited in this first week of the outlook and then increase this weekend and next week

- Production potentials are high and late summer weather is mostly very good

- Mexico drought will continue this month, although there will be some periodic opportunity for rain in eastern parts of the nation through much of the next ten days

- Central America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days

- Net drying is likely in portions of Honduras and Nicaragua

- Southeastern Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away

- Today’s Southern Oscillation Index was -3.90 and it was expected to move erratically over the next few days

Source: World Weather, INC.

Bloomberg Ag calendar

Friday, April 7:

- FAO World Food Price Index, grains report

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

- Good Friday holiday in several countries

Monday, April 10:

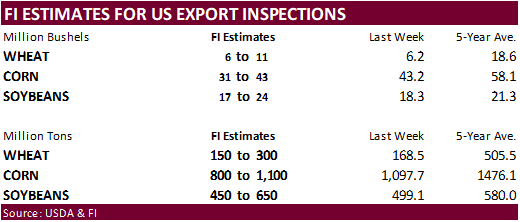

- USDA export inspections – corn, soybeans, wheat, 11am

- Malaysia’s April 1-10 palm oil export data

- Brazil’s Unica to release cane crush, sugar production data (tentative)

- US planting data for corn, cotton, spring wheat and soybeans, 4pm

- US winter wheat condition, 4pm

- HOLIDAY: Easter Monday holiday in several countries, including the UK, Australia, France, Germany and Hong Kong

Tuesday, April 11:

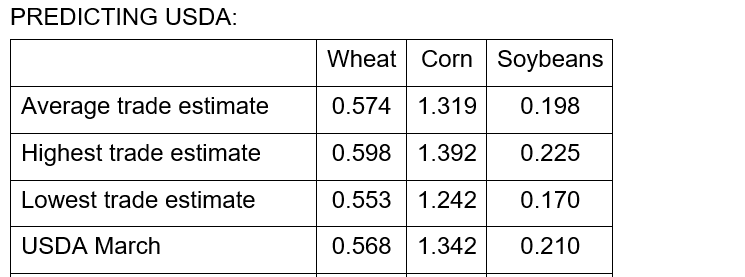

- USDA’s World Agricultural Supply & Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly supply and demand report

Wednesday, April 12:

- EIA weekly US ethanol inventories, production, 10:30am

- France agriculture ministry’s 2023 planting estimates

Thursday, April 13:

- China’s 1st batch of March trade data, including soybean, edible oil, rubber and meat & offal imports

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Brazil’s CONAB publishes production, area and yield data for corn and soybeans

- FranceAgriMer monthly grains balance sheet

- Port of Rouen data on French grain exports

- HOLIDAY: Thailand

Friday, April 14:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop condition report

- HOLIDAY: India, Thailand

Source: Bloomberg and FI

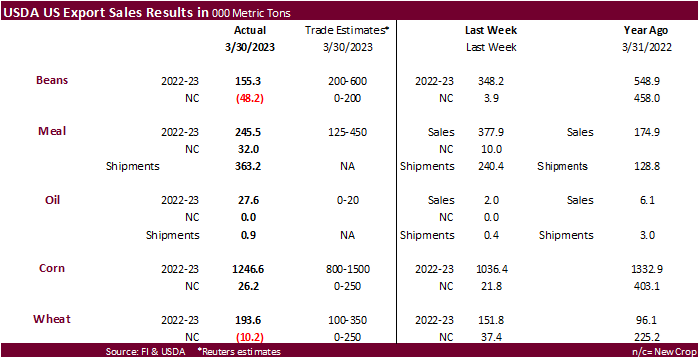

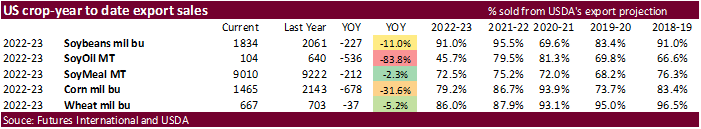

USDA export sales

Soybean sales were disappointing with only 155,300 tons posted for old crop and a net reduction of 48,200 tons for new-crop, which is unusual. Old crop soybean sales included China (162,000 of which one cargo switched) and Germany (69,100). China cancelled a new-crop soybean cargo. Soybean meal sales were within expectations while soybean oil sales of 27,600 tons were above a range of expectations. Shipments of meal were very good at 363,200 tons, a marketing year high. USDA reported 1.247 million tons of corn was sold for 2022-23, within expectations. China corn sales totaled 586,100 tons and unknown 164,500 tons. Pork sales were large at 53,200 tons, a marketing year high. China took 20,200 tons of pork and Mexico 14,300 tons. All-wheat sales of 193,600 tons for old crop were ok but new-crop showed net reductions of 10,200 tons. For 2022-23, China switched from unknown destinations and there was a cargo also switched from unknown by Egypt. No sorghum sales were reported.

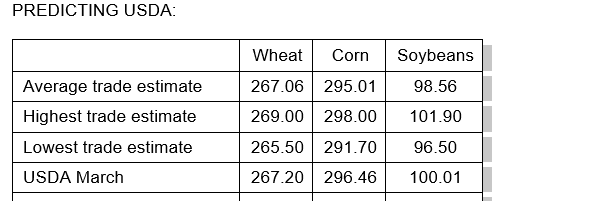

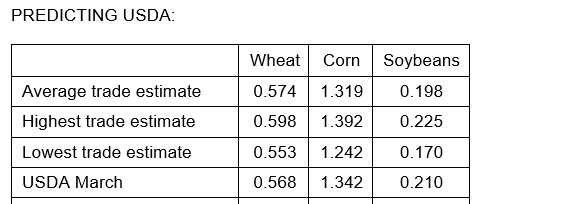

Reuters trade estimates

US stocks

World stocks

SA Production

US Initial Jobless Claims Apr 1: 228K (est 200K; prev 198K)

US Continuing Claims Mar 25: 1823K (est 1700K; prev 1689K)

Canada Gains 34,700 Jobs In March, Jobless Rate Holds At 5.0% – RTRS

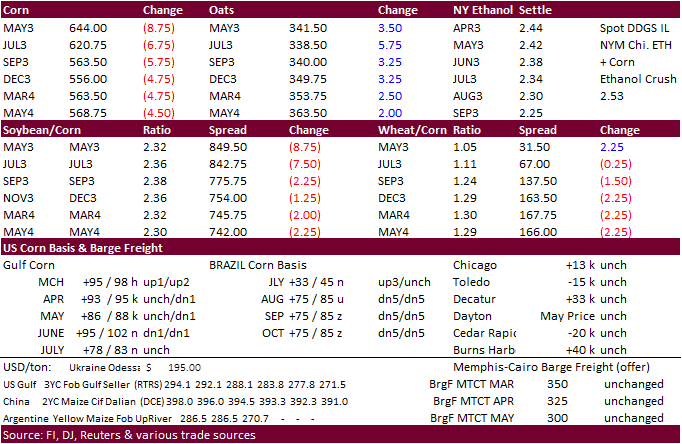

· Corn ended lower with CK3 down over 9 cents and new crop December corn down 4 cents.

· May corn led pricese lower as some started rolling ahead of the Goldman Roll which starts Monday.

· US weather improves next week for the central and lower half of the US for summer fieldwork progresswhich weighed on the new crop.

· Some countries are on holiday starting today through Sunday. Many European countries will be on holiday Monday.

· Note USDA offices are open Friday and CFTC COT report will be released tomorrow afternoon.

Export developments.

Updated 03/31/23

May corn $6.00-$7.15

July corn $5.75-$7.00

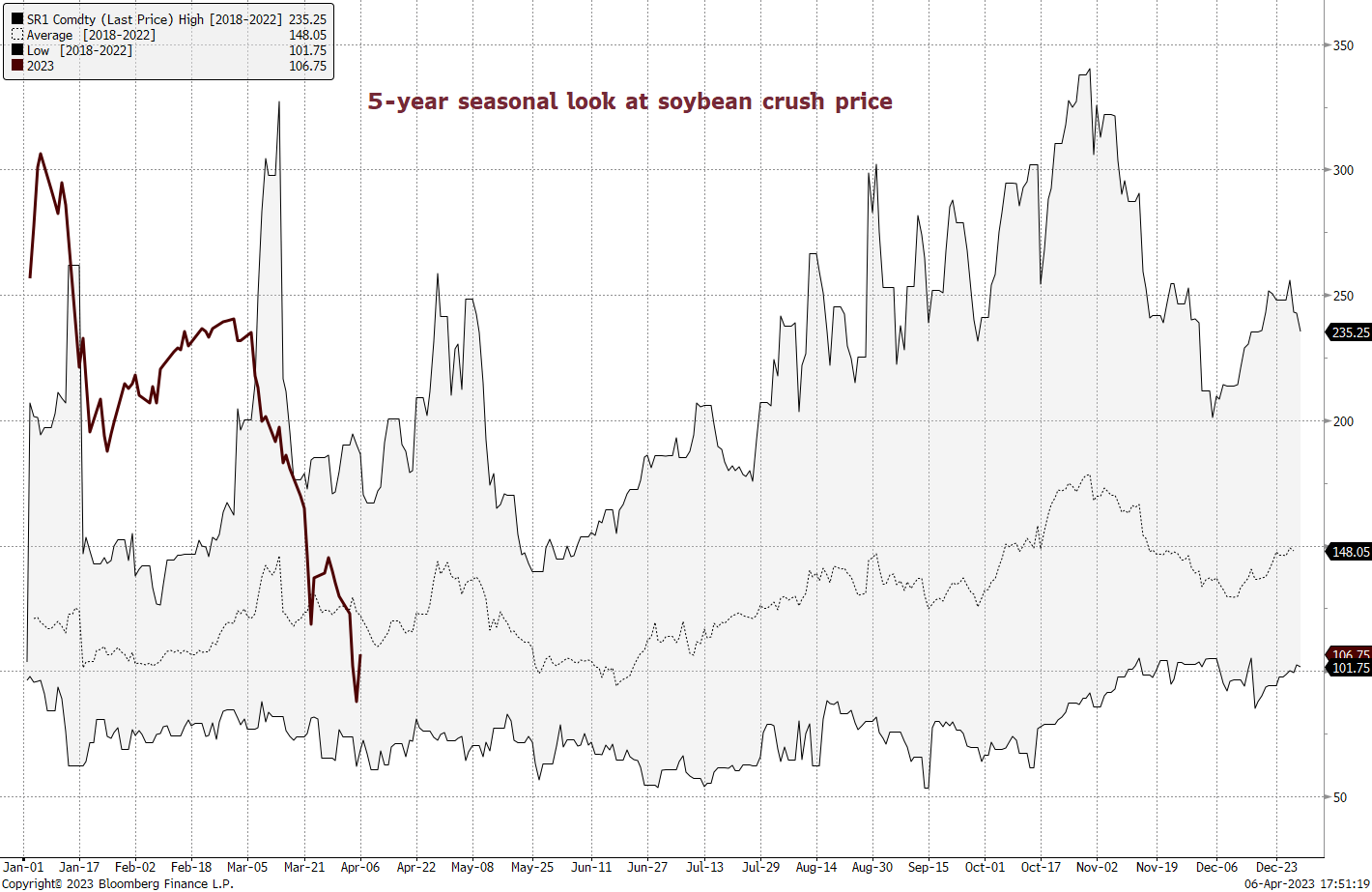

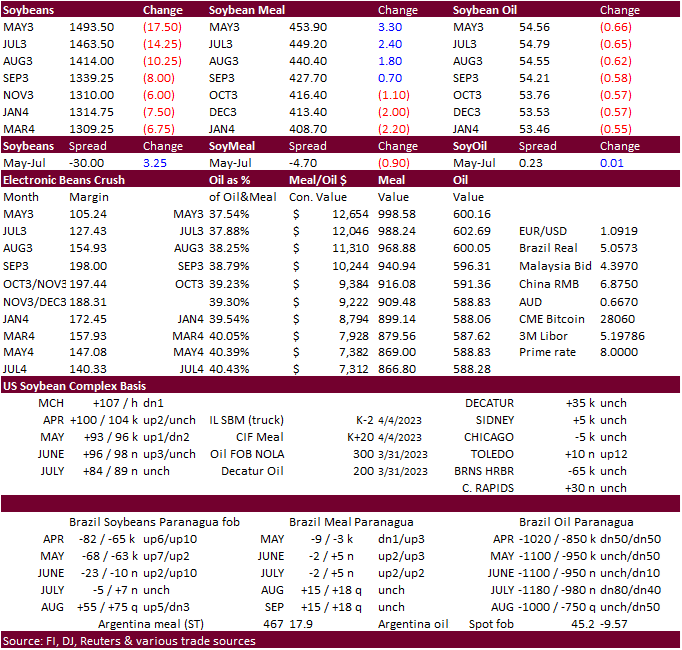

· Soybeans fell on continued liquidation and lower-than-expected export sales.

· Following a weak bean complex the last two sessions, soybean meal rose midsession on thoughts that Argentine farmers are not impressed with the soydollar incentives. The Argentine crusher may not get ahold beans as originally thought.

· Argentina and many other countries will be on holiday through Monday.

· Argentina’s 300 peso to the USD FX rate incentive, effective April 8 through May 31, may attract 5-10 million tons of sales, per industry estimates.

Due out 4/10

Export Developments

- No 24-H USDA sales

Updated 03/31/23

Soybeans – May $14.25-$15.50, November $12.25-$15.00

Soybean meal – May $410-$500, December $325-$500

Soybean oil – May 52.00-58.00, December 49-58

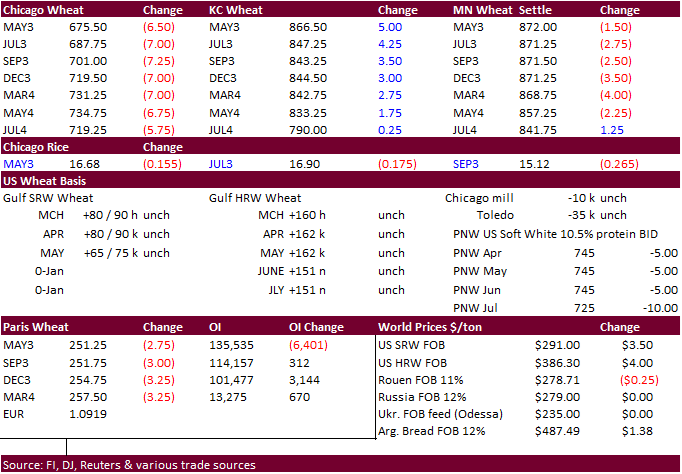

· US wheat futures were mixed with a weaker SRW and spring wheat lower and KC wheat firmer.

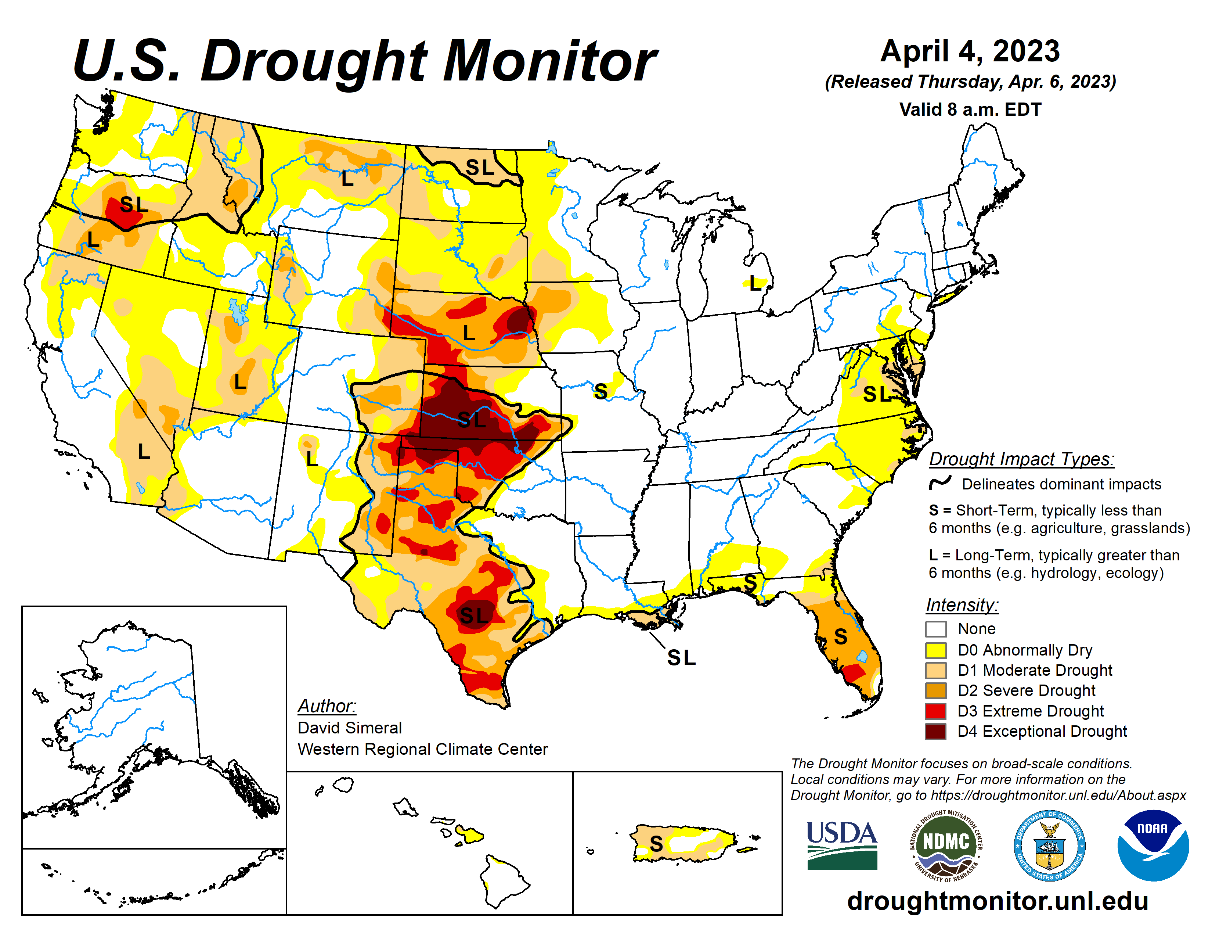

· The cold weather with no snow cover and current drought conditions for the Southern Great Plains doesn’t help the HRW crop just out of dormacy.

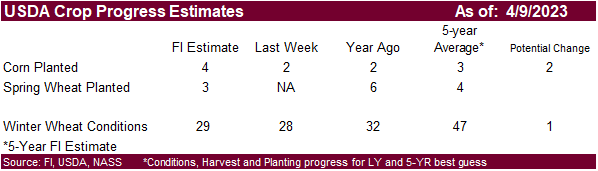

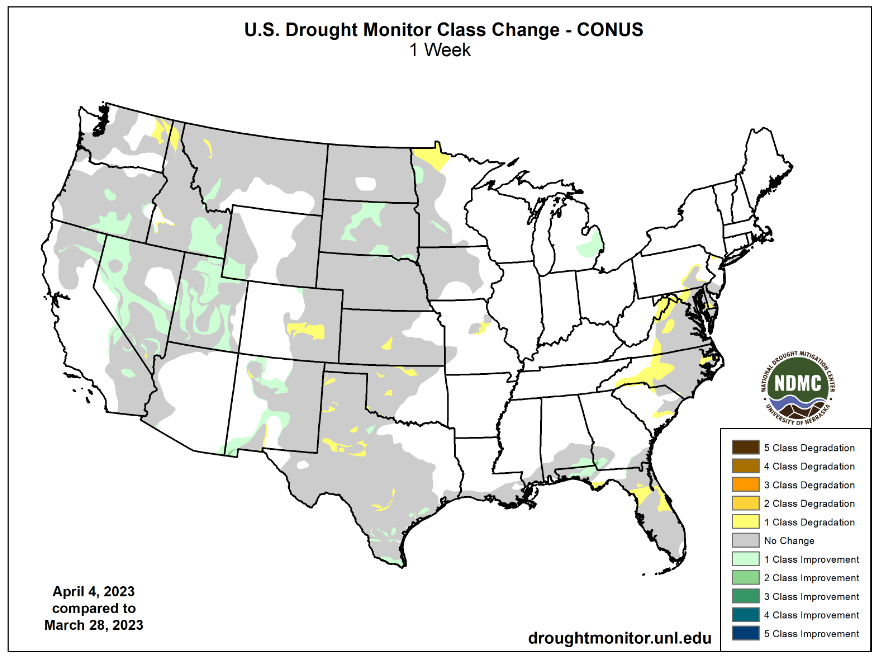

· The US Drought Monitor showed little change from the previous week in conditions, leading some to think US winter wheat conditions will remain 28 percent G/E when updated on Monday.

· Paris May wheat was down 2.75 euro at 251.25 per ton.

Export Developments.

· Egypt bought 600,000 tons of Russian wheat for May 10-20 AND May 21-31 shipment. Prices were $275 fob, and $293-$294 C&F.

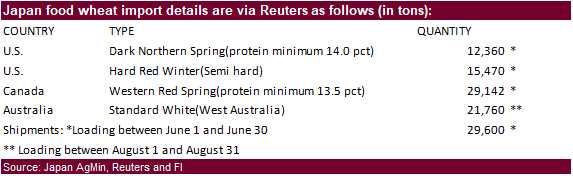

· Japan in its weekly import tender bought 78,732 tons of food wheat later this week from the US, Canada and Australia.

· Japan’s AgMin seeks 60,000 tons of feed wheat and 20,000 tons of feed barley on April 12 for arrival in Japan by September 28.

Rice/Other

Updated 03/31/23

KC – May $8.00-9.25

MN – May $8.50-$9.50

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |