PDF Attached

![]()

USDA

S&D is this Friday

USDA

S&D May Report Changes

Reuters

– WASHINGTON, April 8, 2021 – Starting with the May 12, 2021 release (issue No. 612), the following changes will be made to the World Agricultural Supply and Demand Estimates (WASDE) report:

-

U.S.

Soybeans and Products Supply and Use (page 15): ‘Biofuel’ will replace ‘Biodiesel’ in the soybean oil section, reflecting recent changes to the monthly biofuels data reported by the U.S. Energy Information Administration. The WASDE will follow soybean oil

used for biofuel as reported in the Monthly Biofuels Capacity and Feedstocks Update -Table 2C (PDF, 287 KB).

-

World

Soybean Meal Supply and Use (page 29): Soybean meal supply and use for China will be presented separately.

-

The

U.S. Rice Supply and Use table (page 14): The table will include separate categories for U.S. imports of long-grain and combined medium and short-grain rice. The addition is made due to the significant rise in U.S. imports of long-grain and medium- and short-grain

rice over the past decade -

The

May WASDE template will be available on the WASDE report page by April 30.

World

Weather Inc.

MOST

IMPORTANT WEATHER IN THE WORLD

- At

0900 GMT, Tropical Cyclone Seroja was located 346 miles north northeast of Learmonth, Western Australia at 17.35 south, 111.4 east moving southwesterly at 10 mph and producing maximum sustained wind speeds of 63 mph - The

storm will move inland near Geraldton, Western Australia Sunday producing heavy rain and strong wind speeds along the coast - Beneficial

moisture will fall in wheat, barley and canola production areas of Western Australia where planting will begin late this month - Frost

and freezes in Europe are not permanently harming winter wheat, barley, rye or rapeseed, although new growth is being burned back - Warming

is needed to stimulate new winter crop development and spring planting - Rain

and snow across the continent will increase soil moisture for use by crops during the warmer days of late April and May - Western

Europe will continue to dry down today raising the need for rain - Rain

is expected Friday into the weekend to partially ease recent drying - Precipitation

will be erratic and somewhat light leaving need for more moisture - Next

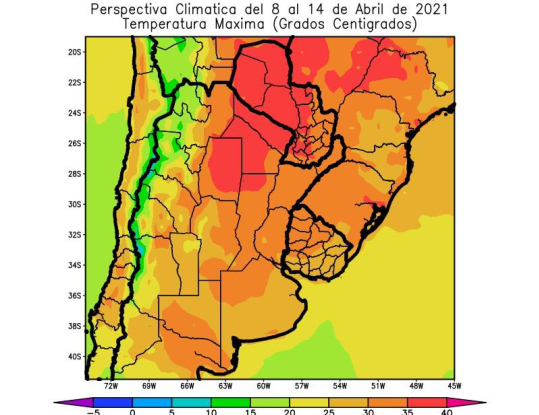

week trends drier once again and some warming is expected - Brazil’s

Mato Grosso and Goias will experience well-timed rainfall and seasonable temperatures to support Safrinha corn and cotton during the next two weeks - Some

increase in rain may be needed soon in southern Mato Grosso - Brazil’s

interior south and center south will dry down for another week to ten days - Many

areas have short to very short topsoil moisture, but subsoil moisture will carry on normal crop developing for a while longer, although it is rated marginally adequate to slightly short - A

boost in precipitation will be very important during the second week of the outlook and into the second half of this month - Some

of that moisture boost is expected, but a close watch is warranted for fear that the rain fails to develop or is too light to seriously bolster soil moisture for lasting support to Safrinha crops after the monsoon season ends - Argentina

began receiving significant rain overnight from southwestern Buenos Aires into Cordoba and the remainder of the nation will get generalized rainfall over the next few days as well.

- Topsoil

moisture will be bolstered supporting great late season corn, sorghum, peanut and soybean development - CIS

grain and oilseed areas will continue plenty moist except in Russia’s Southern Region and Kazakhstan where there is need for more moisture this spring and summer - Winter

crops are still dormant or semi-dormant, although a little greening may be occurring in the far south - Northwestern

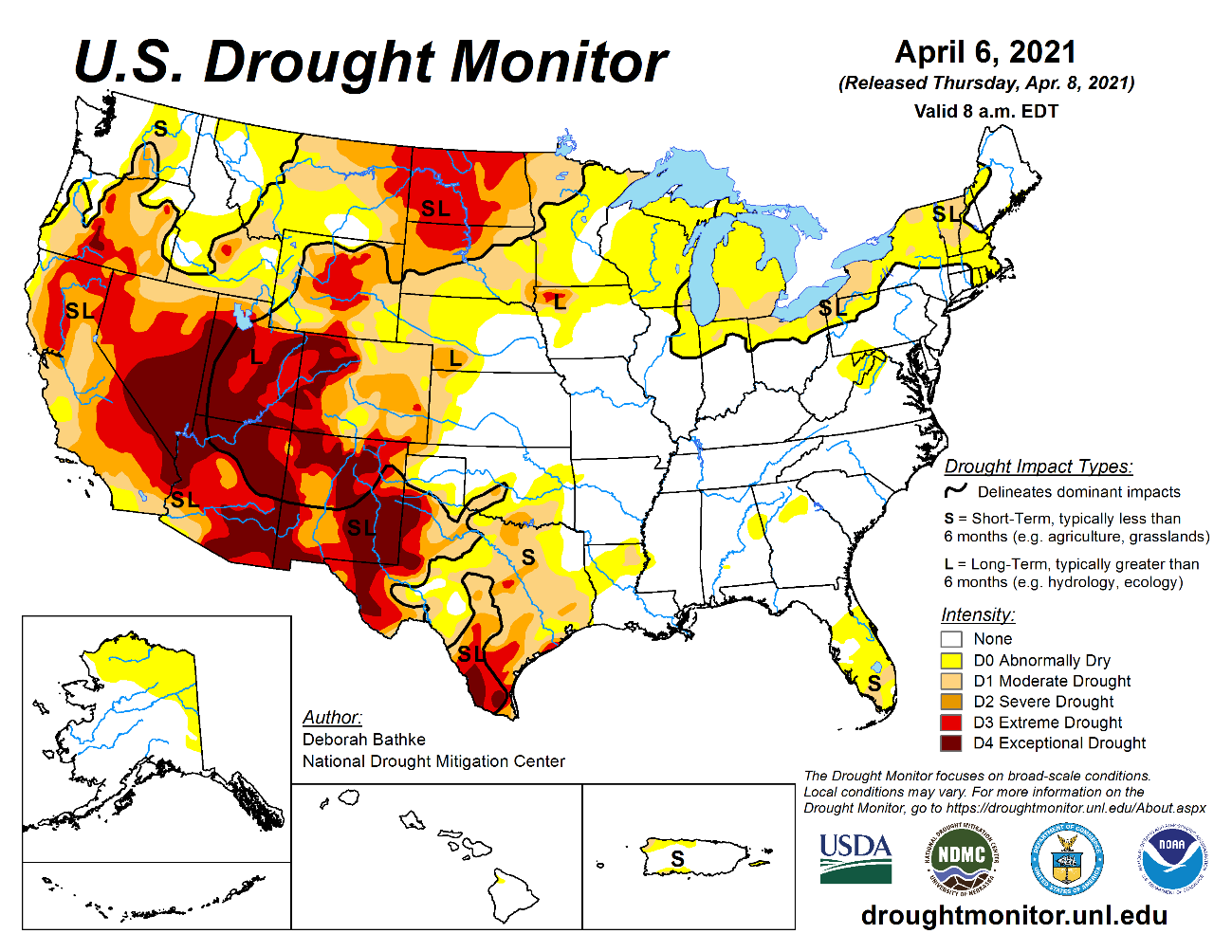

U.S. Plains and Canada’s Prairies will continue dry biased and in need of significant moisture; not much relief is expected for a while, but possibly after April 20 for some areas - Light

rain and snow will impact Manitoba and eastern Saskatchewan briefly this weekend into early next week - U.S.

Delta will be too wet for cotton, corn and early soybean planting today into Saturday, but there will be time for improvement after that before the next storm system arrives April 18 - Some

flooding is expected from rain Friday - U.S.

Southeastern States will experience a good mix of weather over the next two weeks supporting early-planted crop development and future planting as well - U.S.

west-central and southwestern Plains are drying down and this process will continue until mid- to late-week next week when some computer forecast model runs have been suggesting improved rain potential - Rain

in the southwestern Plains should evolve late next week and continue into the following weekend, but it is questionable how significant the event will be - Central

Washington into Central Oregon is too dry and needs rain for unirrigated crops - California

and the southwestern desert region will remain dry and in need of significant moisture, but irrigation is sufficient to carry on most agricultural needs - No

relief is expected in the coming week, but some showers may occur in a part of the region After April 18 - Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas - Some

beneficial rain fell across parts of this region recently, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - Flooding

in Timor and Flores is abating after serious crop and property damage occurred during the weekend from a developing tropical cyclone - India

weather will continue good for this time of year with restricted rainfall and warm temperatures supporting winter crop maturation and harvest progress - Rain

may fall heavily in Bangladesh and neighboring areas of India briefly next week - China

weather remains mostly very good, although portions of the Yangtze River Basin are too wet and need to dry down - Northern

crop areas in China are favorably moist and poised to support aggressive winter and spring crop development this year once additional warming takes place - CIS

precipitation over the next two weeks will be frequent - Sufficient

amounts will occur while snow is melting in northern and central Russia to maintain muddy fields in snow free areas and high river and stream flows - Drier

and warmer weather is needed for most winter crops and for advancing early spring planting - Greening

winter crops is occurring mostly in southern Ukraine and southern parts of Russia’s Southern Region - Most

interior crop areas of Australia will not be bothered by significant rain this week - Rain

in Western Australia late this weekend and early next week will be dependent upon the tropical cyclone noted above

- Good

drying conditions are likely in key summer grain, oilseed and cotton areas in Eastern Australia this week favoring summer crop maturation and good harvest progress. - North

Africa will experience a favorable mix of weather over the next ten days, although resulting rainfall is not likely to be very great - All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture - Northwestern

Algeria and southwestern Morocco need rain - Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Rainfall

will be a little lighter and less frequent than usual over for a while longer, but improved rainfall should occur in the April 16-22 period - Temperatures

have been and will continue to be very warm keeping evaporation rates very strong until greater rain evolves - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops - Net

drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand weather has been drier than usual and precipitation will slowly improve during the next week to ten days in both North Island and western parts of South Island - Temperatures

will be seasonable - Canada’s

Prairies will receive restricted amounts of precipitation for the next ten days - Some

organized rain and snow will be possible this weekend into early next week in Manitoba and eastern Saskatchewan

- Temperatures

will trend cooler than usual for a while this weekend and early next week.

- Southeastern

Canada will see below average precipitation and warmer than usual temperatures over the next ten days - Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days - Rain

is needed in many areas - Drought

is prevailing across most of the nation - Southern

Oscillation Index this morning was +0.75 and the index is expected to move in a narrow range the rest of this week

Source:

World Weather inc.

Bloomberg

Ag Calendar

Thursday,

April 8:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

CNGOIC to publish soybean and corn reports - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Port

of Rouen data on French grain exports

Friday,

April 9:

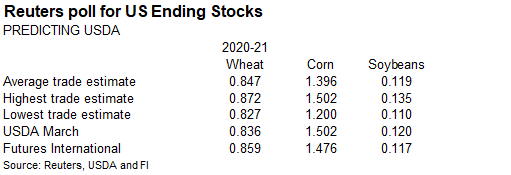

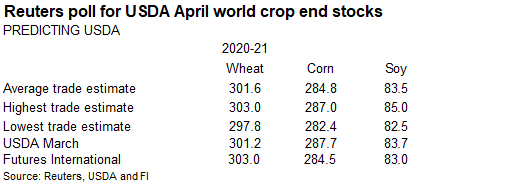

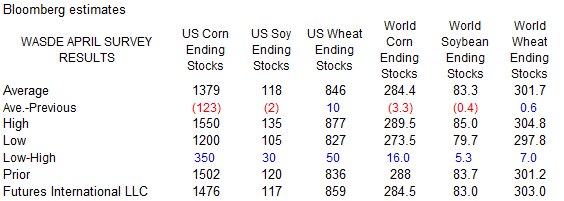

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

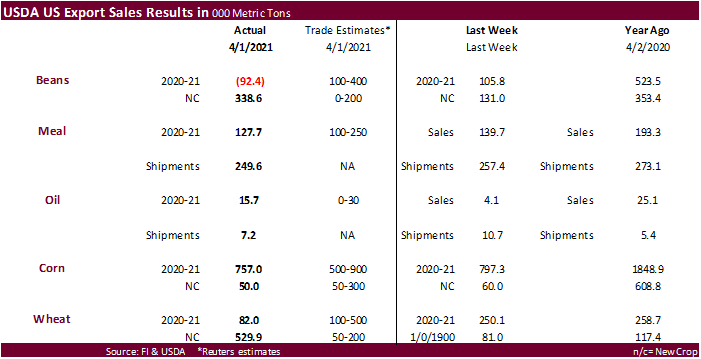

Export Sales

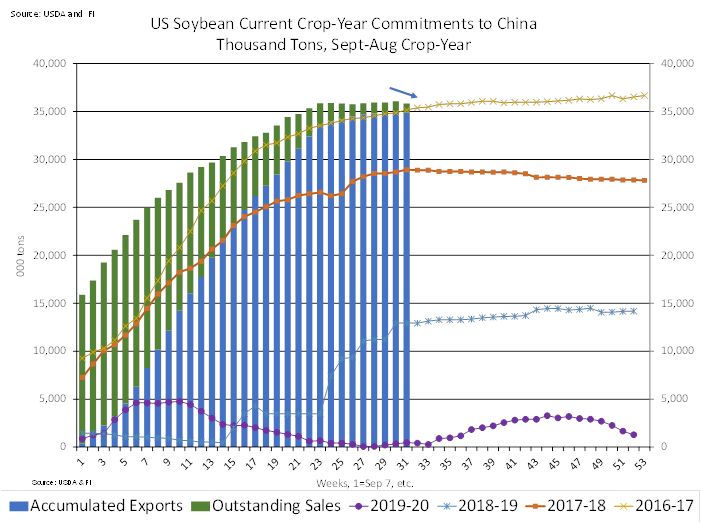

USDA

export sales showed China interest for new-crop US soybeans picking up while there were old crop cancelations. Don’t discount additional old-crop US soybean cancellations, given the availability of Brazilian soybeans and discount of new-crop US soybeans.

Macro

US

Initial Jobless Claims Apr 3: 744K (est 680K; prevR 728K; prev 719K)

US

Continuing Claims Mar 27: 3734K (est 3638K; prevR 3750K; prev 3794K)

Fed’s

Bullard: Inflation Seen At 2.5% By End-2021

Fed’s

Kashkari: Real Unemployment Rate Is 9.1% ***

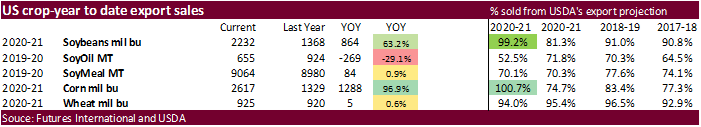

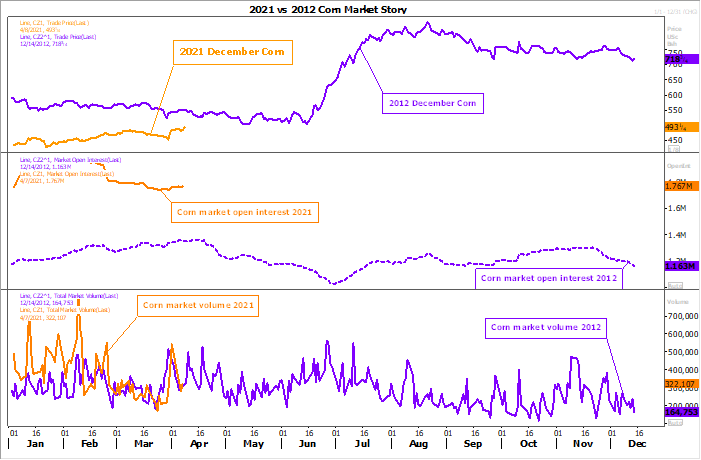

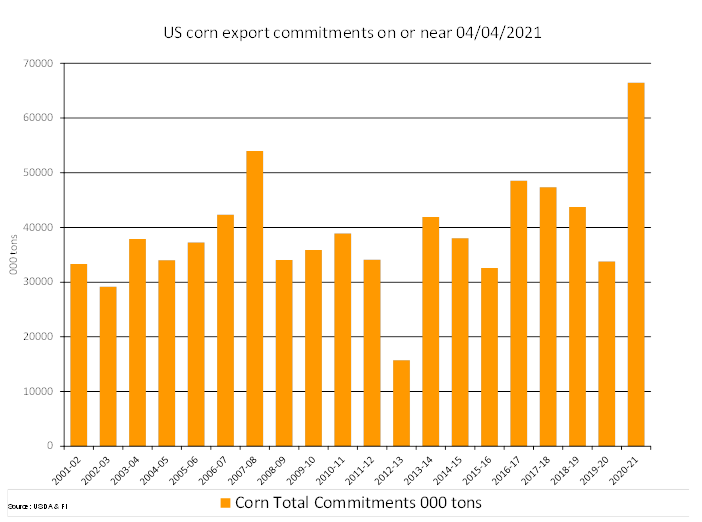

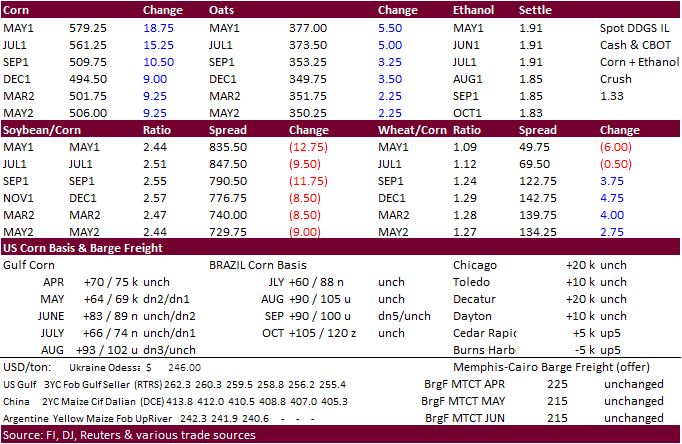

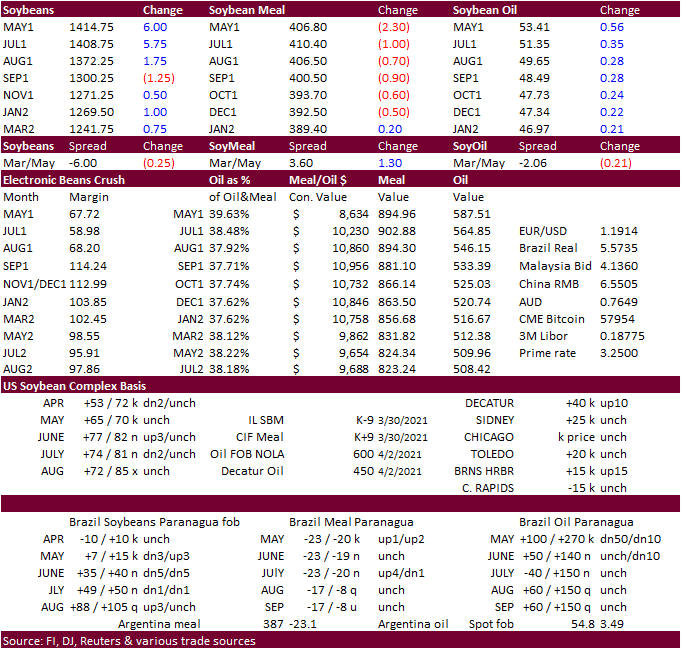

Corn

- CBOT

corn futures

were up sharply following wheat and decent USDA export sales. May corn failed to test its absolute contract high made on March 31 report day of $5.85/bu but closed at a record high of $5.7975/bu, up 19.25 cents. Some traders are also trying to get ahead

of weather concerns for Brazil and potentially the US. Brazil’s second corn crop areas will be dry over the next 10-15 days. Meanwhile the Brazil dry season normally starts in May. Some people speculate a hot US Midwest summer will occur after Chicago hit

five consecutive 70-degree days in early April. This has happened only a few times in decades, and during those years there were at least two years summer temperatures were hotter than normal. Chicago hit 80 degrees earlier this week. The average first

date for an 80-degree temp in Chicago over the past 150 years has been on or about April 27, according to WGN news.

- Later

in session we heard US ethanol producers were buying corn and another rumor China was looking to add to their large US corn export commitment pool, for late summer delivery.

- Funds

on Thursday bought an estimated net 35,000 corn contracts. - Although

US soybeans supplies are generally tighter than corn, Midwest corn supplies are expected to also get tight during the summer months. US corn basis was up at some locations yesterday. Cedar Rapids and Burns Harbor were up 5 cents.

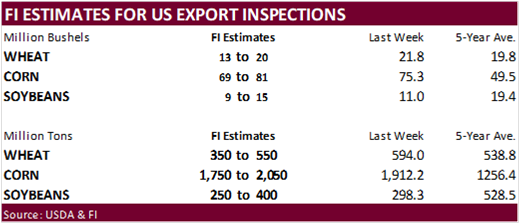

- USDA

corn export sales were 757,000 tons, within expectations, with 285,300 tons for Japan and 247,600 tons for South Korea (a good chink switched from unknown). Corn sales also included 99,000 tons for China, including 70,000 tons switched from unknown.

- Sorghum

export sales were a net reduction of 500 tons. - Pork

sales were 33,400 tons and included 1,900 tons for China. South Korea was the largest pork buyer.

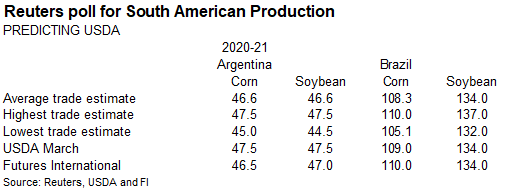

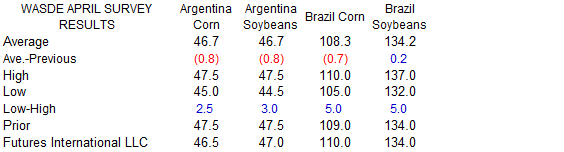

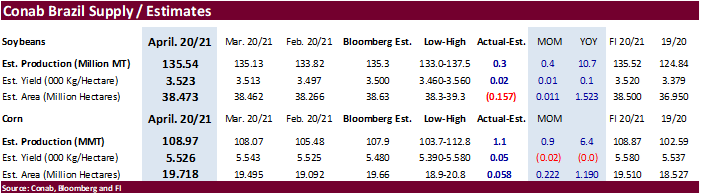

- Conab

reported a higher-than-expected Brazil corn and soybean crop. Corn production was 0.9 million tons above their March estimate at 109 million tons, 1.1 million above an average trade guess. Brazil soybean output was pegged at 135.5 million tons, up 0.4 million

from March and 300,000 tons above an average trade guess. - CNGOIC

estimated China corn imports a record 28 million tons of corn in 2020-21, triple previous year, and up 20 million tons from their previous projection. Imports of grains used for animal feed were seen at a record 43.2 million tons for 2020-21. Previous record

was 12.05 million tons in 2014-15. - The

Philippines this week lowered import tariffs on pork imports because of a domestic shortage. The import duty will drop to 5% from 30% for the first three months and then rise to 10% for month four through month twelve, effective immediately.

Export

developments.

- None

reported

University

of IL:

Irwin, S. “Just How Surprising Was the Prospective Plantings Report for Corn and Soybeans?.”

farmdoc daily (11):55, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 7, 2021.

Source:

Reuters and FI

Updated

3/31/21

May

corn is seen in a $5.40 and $6.00 range

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

- CBOT

soybeans sold off post USDA export sales report but rallied after the day session open on technical buying and higher wheat & corn. The USD was off 38 points around 1:45 pm CT and WTI down slightly. Brazil soybean output was pegged by Conab at 135.5 million

tons, up 0.4 million from March and 300,000 tons above an average trade guess. Argentina’s BA Grains Exchange lowered their Argentina soybean crop estimate by 1 million tons to 43 million tons. They left corn unchanged at 45 million tons. Argentina’s soybean

harvest is 3.5 percent complete.

- Soybean

meal ended lower led by bear spreading and soybean oil rallied to close 53 points higher in the May position.

- Funds

on Thursday bought an estimated net 4,000 soybean contracts, sold 1,000 soybean meal and bought an estimated 2,000 soybean oil.

- Rumors

were circulating again this week of bids being sought to bring beans into the US. Later we heard 1-3 Brazilian soybean cargoes were bought by an animal unit end user off the southeast coast.

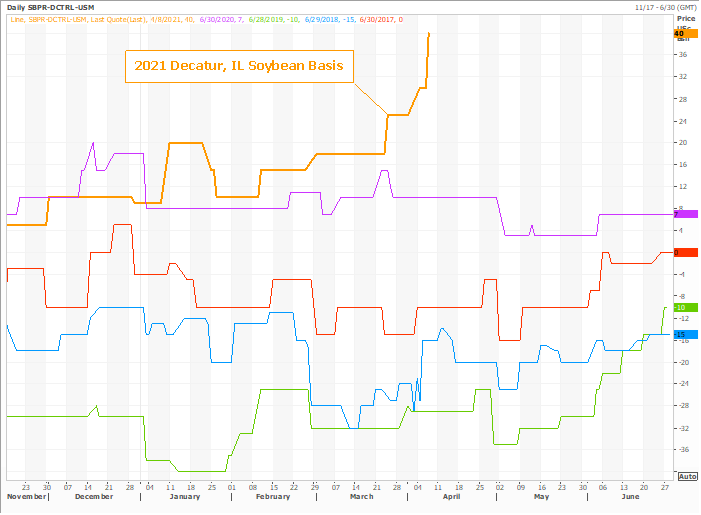

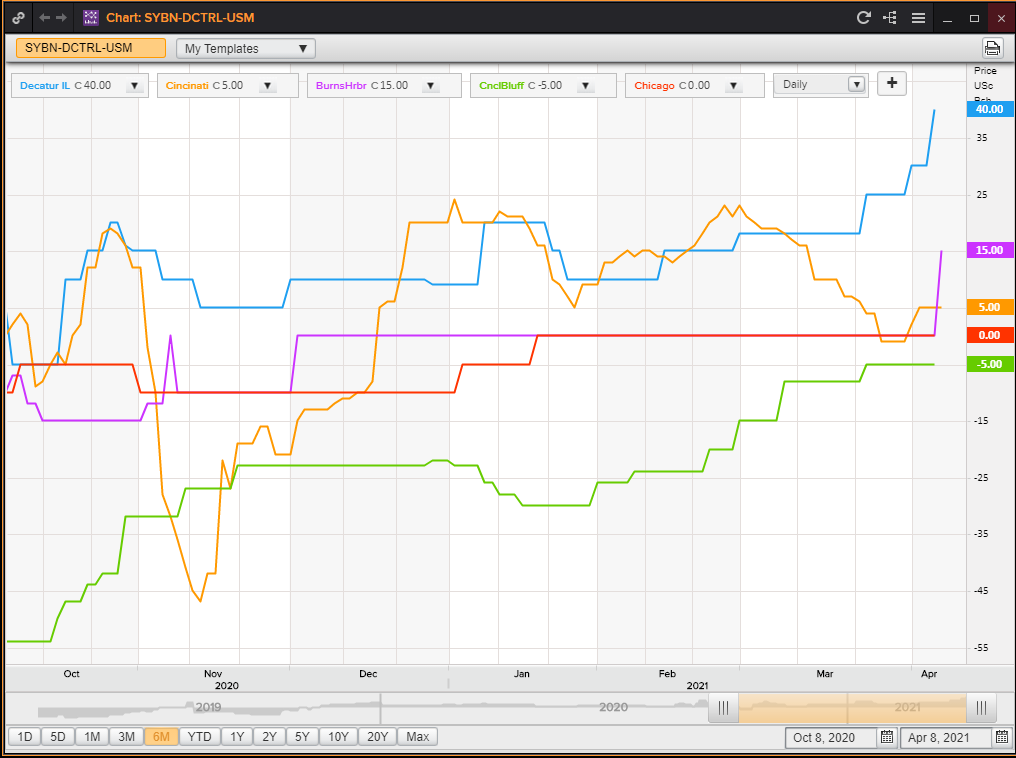

- US

soybean basis is firming and a reminder it’s getting harder to source soybeans for the summer crushing period. Soybean basis at processor/elevator locations Decatur, IL was up 10 cents to 40 over, and Burns Harbor up 15 cents, from yesterday. Claypool is

50 over. - We

are hearing Ontario, Canada, soybean basis was around 50 to 60 over.

2021

Decatur, IL soybean basis versus previous 4 years

Source:

Reuters and FI

- USDA

soybean export sales for 2020-21 showed a net reduction of 92,500 tons. China cancelled 216,100 tons. For 2021-22, net sales of 338,600 tons were reported for China (264,000 MT), Taiwan (65,000 MT), and Mexico (10,000 MT). Soybean meal sales fell from the

previous week to 127,700 tons, low end of expectations, and shipments were 249,600 tons, slightly below the previous week. Soybean oil sales of 15,700 tons were more than three times than that of last week and included SK and Mexico. SBO shipments were 7,200

tons. - China

should start seeing an increase for Brazil soybean arrivals of this week into next week. Meanwhile China soybean stocks at ports are running at their lowest level in 10 months.

- US

new crop soybean export premiums are nearing levels China will want to see to start securing new crop soybeans, but Chinese margins may need to improve before they start a round of buying from the US.

- The

US CPC sees a transition from La Niña to neutral conditions next month, with an 80% chance of neutral conditions during May-July 2021 period.

- Soybean

meal basis for Decatur, IN, was up $2 to 16 over.

- Egypt’s

GASC seeks at least 3,000 tons of soybean oil and 2,000 tons of sunflower oil for May 15-Jun 5 shipment on Sunday (AgriCensus).

Basis

at selected US elevator locations have been rising since the third week of March

Source:

Reuters and FI

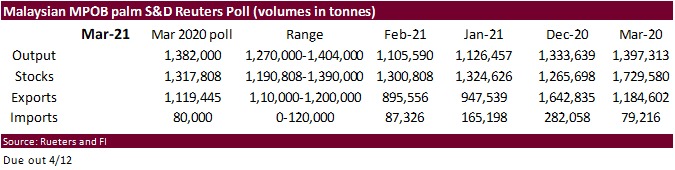

A

Reuters poll for Malaysia’s palm oil inventories shows March stocks expected to rise 1.3% from February to 1.32 million tons, production to slightly decline, and exports to be up 25% to 1.12 million tons. The Malaysian Palm Oil Board will release the official

data on April 12.

May

soybeans are seen in a $13.75 and $15.75 range.

November $10.50-$14.50

May

soymeal is seen in a $395 and $425 range.

December $325-$5.00

May

soybean oil is seen in a 50 and 55 cent range

December 40-60 cent wide range

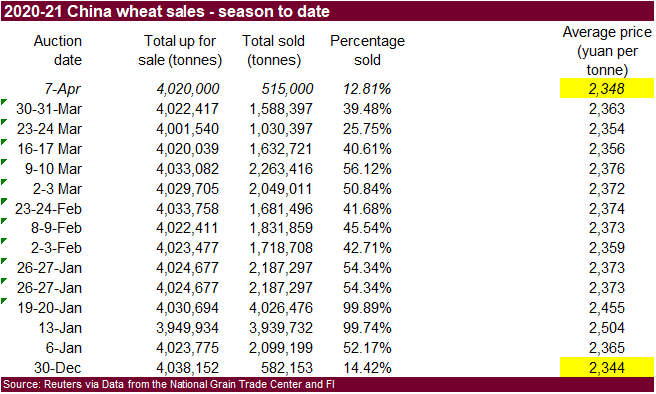

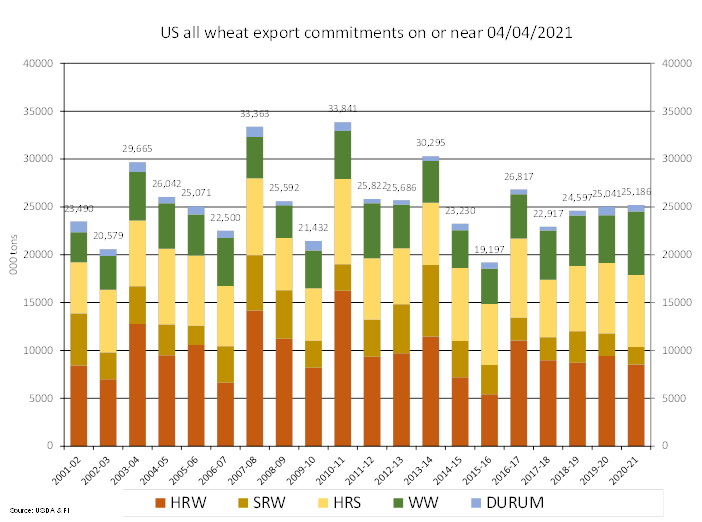

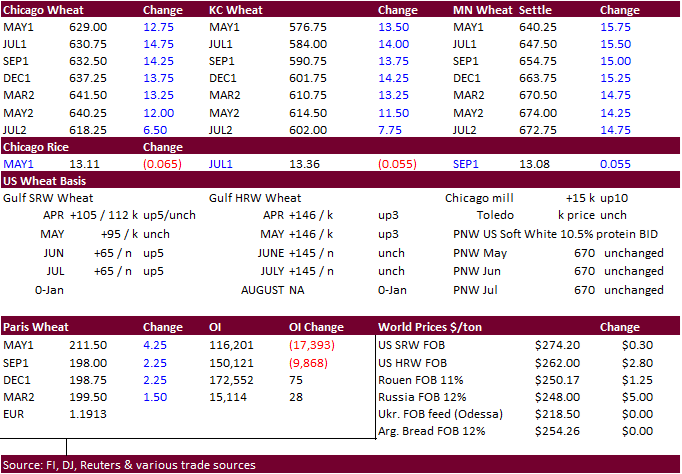

- Chicago

wheat

was higher again but this time on rumors China bought US wheat on top of follow through concerns over US and Canadian spring wheat seedings that are expected to slow over the next 14 days. Global export developments for wheat are also supporting prices. Chicago

wheat saw resistance at just under its 100-day MA of 632.25 and May KC saw resistance at its 20-day MA of $5.7975. MN May is breaking to the upside and has a chance to rally into the $6.55-6.60 area.

- Funds

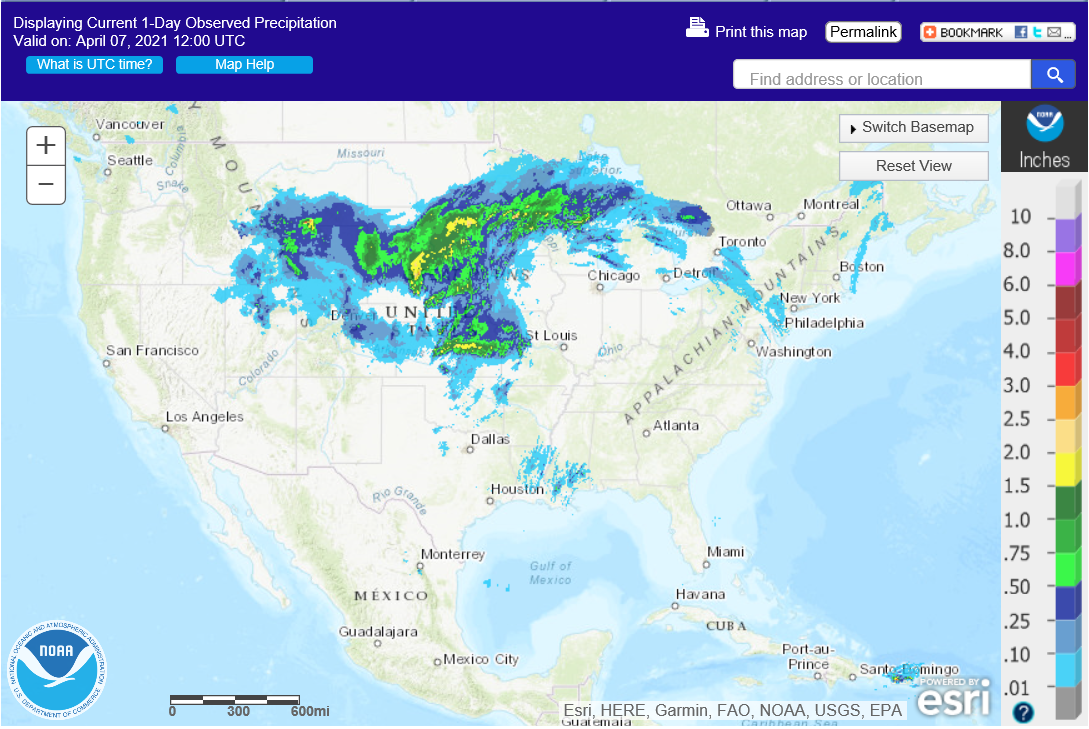

on Thursday bought and estimated net 2,000 CBOT SRW wheat contracts. - Reuters

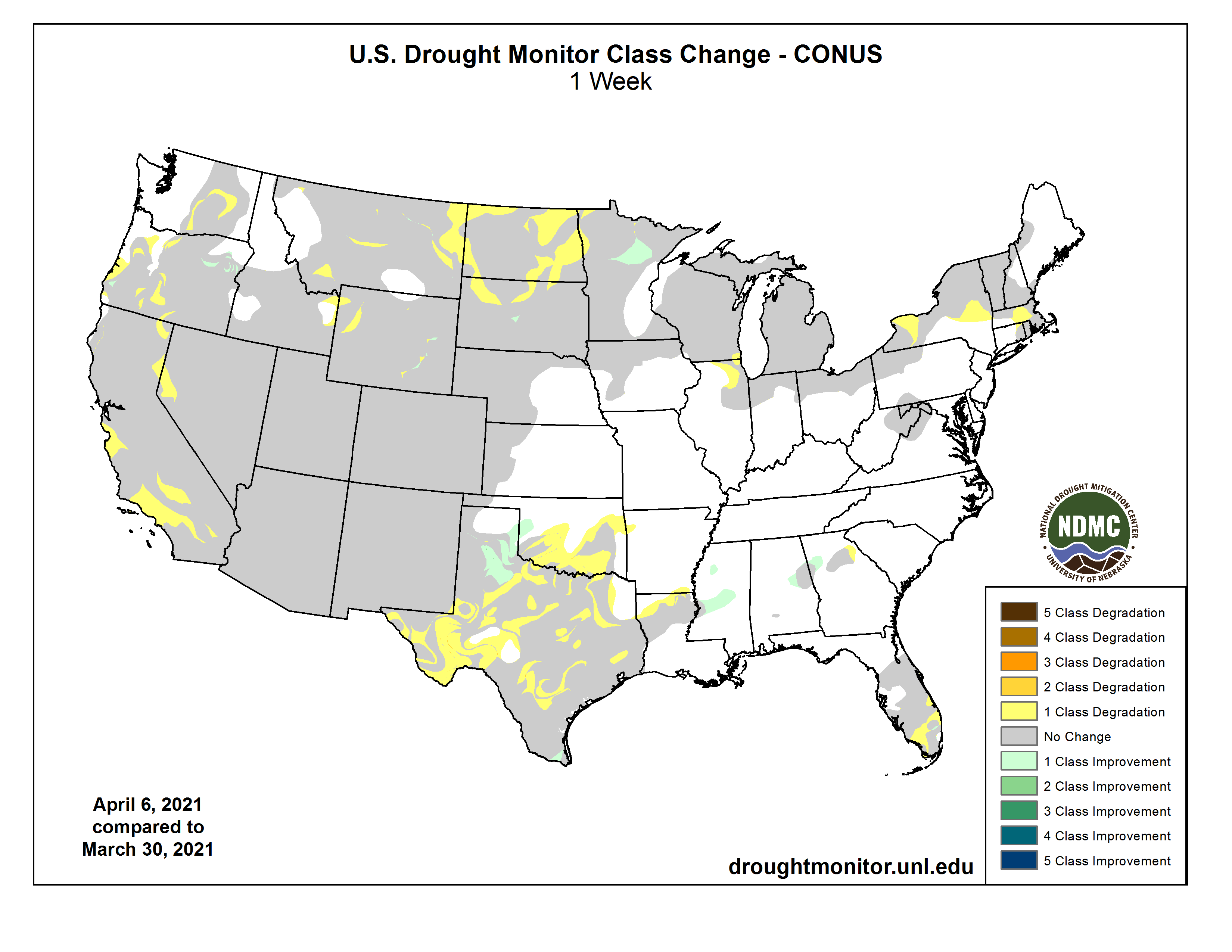

noted the weekly U.S. Drought Monitor showed 70% of North Dakota in “extreme drought,” up from 47% last week. - USDA

all-wheat sales were a marketing year low but the season is winding down for commitments. New-crop wheat export commitments were 529,900 tons, well above expectations and included a large 260,000 tons for China. Export commitments of winter wheat for the

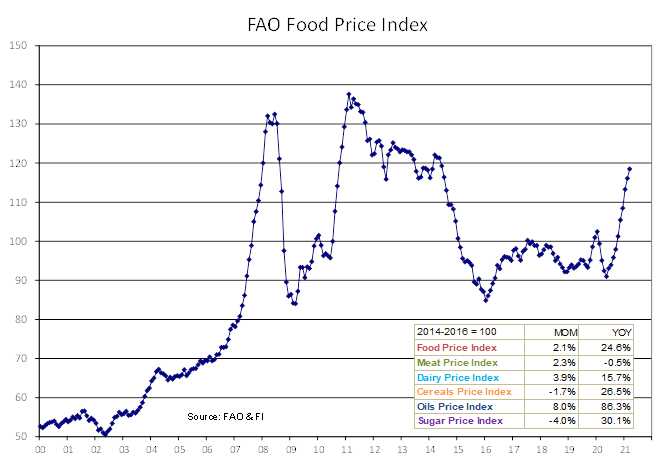

current crop year are running strong. - The

World Price Index increased to 118.5 points from 116.1 for February, highest since June 2014. The vegetable oil index was up 8%, highest since June 2011.

- May

Paris milling wheat settled up 4.50 euros, or 2.2%, at 211.75 euros ($252.49) a ton. - Cold

weather across Europe is now thought to limit crop growth. Earlier this week it was suggested there would be no impact. There are reports development stalled mid-week and the cold air will prevail through mid-next week.

- Two

thirds of the northern U.S. Plains spring wheat area will trend drier over the next week.

Cold

weather forecast in the 6-10 day and 8–14-day weather maps indicate conditions will hinder seeding progress over the next two weeks.

- The

World Price Index increased to 118.5 points from 116.1 for February, highest since June 2014. The vegetable oil index was up 8%, highest since June 2011.

- We

heard China was auctioning off wheat yesterday and about 13 percent of what was offered so far was sold.

- Tunisia

bought 75,000 tons of optional origin soft wheat at an estimated $259.82, $262.42 and $259.89 a ton c&f for May 15 and June 25 shipment.

- Thailand

buyers bought 58,000 tons of feed wheat at around $275/ton c&f for June shipment. TFMA passed on a half million tons earlier this week.

- Taiwan

flour mills bought 96,485 tons of US wheat for May and June shipment off the PNW.

- 25,270

tons of 14.5% protein U.S. dark northern spring wheat at $285.04 a ton FOB - 15,390

tons of 12.5% protein hard red winter wheat at $262.81 a ton - 5,005

tons of soft white wheat of 9% protein bought at $260.79 a ton FOB. - 27,990

tons of dark northern spring wheat of 14.5% protein content bought at $285.04 a ton

- 16,500

tons of hard red winter wheat of 12.5% protein content bought at $262.81 - 6,490

ton of soft white wheat of 9% protein bought at $260.79 a ton FOB.

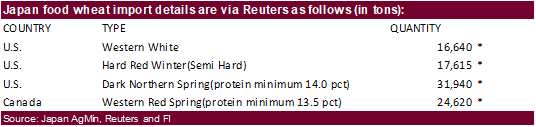

- Japan

in its weekly SGS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by September 30.

- Japan

bought 90,815 tons of food wheat this week from the US and Canada for June loading. Original details as follows:

- Ethiopia

seeks 30,000 tons of wheat on April 16. - Jordan

postponed their 120,000 ton import tender of animal feed barley from April 6 to April 13.

- Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Ukraine seeks to import 110,000 tons of sugar in 2020-21.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/7/21

May Chicago wheat is seen in a $6.00‐$6.65 range

May KC wheat is seen in a $5.50‐$6.00 range

May MN wheat is seen in a $6.00‐$6.50 range

U.S. EXPORT SALES FOR WEEK ENDING 4/1/2021

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

34.1 |

1,271.8 |

1,702.9 |

189.0 |

7,276.1 |

7,715.0 |

90.7 |

387.2 |

|

SRW |

11.9 |

301.3 |

288.4 |

42.0 |

1,493.6 |

2,070.9 |

154.3 |

471.6 |

|

HRS |

71.3 |

1,408.1 |

1,566.6 |

213.9 |

6,140.9 |

5,785.0 |

53.5 |

422.1 |

|

WHITE |

-37.2 |

1,804.2 |

1,112.2 |

189.3 |

4,817.8 |

3,898.8 |

231.4 |

420.2 |

|

DURUM |

1.8 |

80.1 |

216.3 |

0.0 |

592.1 |

685.3 |

0.0 |

5.0 |

|

TOTAL |

82.0 |

4,865.5 |

4,886.3 |

634.2 |

20,320.5 |

20,155.1 |

529.9 |

1,706.0 |

|

BARLEY |

0.2 |

5.5 |

10.8 |

0.5 |

23.7 |

38.8 |

0.0 |

20.2 |

|

CORN |

757.0 |

30,512.1 |

14,159.5 |

2,053.4 |

35,971.0 |

19,596.9 |

50.0 |

2,049.5 |

|

SORGHUM |

-0.5 |

2,396.7 |

1,621.3 |

165.7 |

3,990.3 |

1,425.3 |

0.0 |

819.0 |

|

SOYBEANS |

-92.5 |

5,587.3 |

5,263.4 |

345.2 |

55,161.9 |

31,969.2 |

338.6 |

5,610.8 |

|

SOY MEAL |

127.7 |

2,354.9 |

2,771.8 |

249.6 |

6,709.2 |

6,208.4 |

4.8 |

254.8 |

|

SOY OIL |

15.7 |

115.9 |

306.0 |

7.2 |

539.0 |

618.0 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

14.7 |

317.2 |

300.8 |

13.7 |

1,106.3 |

1,031.5 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

5.3 |

43.7 |

0.0 |

23.5 |

25.6 |

0.0 |

0.0 |

|

L G BRN |

14.6 |

17.8 |

16.4 |

0.5 |

34.4 |

41.1 |

0.0 |

0.0 |

|

M&S BR |

0.7 |

69.0 |

61.5 |

0.7 |

85.1 |

46.9 |

0.0 |

0.0 |

|

L G MLD |

3.9 |

49.8 |

70.6 |

3.5 |

457.0 |

673.8 |

0.0 |

0.0 |

|

M S MLD |

10.1 |

258.7 |

267.3 |

12.4 |

382.0 |

409.9 |

0.0 |

0.0 |

|

TOTAL |

44.0 |

718.0 |

760.2 |

30.7 |

2,088.4 |

2,228.8 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

269.9 |

5,003.7 |

6,173.3 |

371.7 |

9,843.3 |

9,113.9 |

49.0 |

1,591.9 |

|

PIMA |

7.5 |

233.4 |

179.8 |

21.6 |

513.4 |

361.6 |

0.0 |

1.1 |

This

summary is based on reports from exporters for the period March 26-April 1, 2021.

Wheat: Net

sales of 82,000 metric tons (MT) for 2020/2021–a marketing-year low–were down 67 percent from the previous week and 75 percent from the prior 4-week average. Increases primarily for South Korea (49,300 MT, including 45,000 MT switched from unknown destinations

and decreases of 3,900 MT), the Philippines (29,300 MT), Japan (28,900 MT), Mexico (23,500 MT, including decreases of 3,900 MT), and Panama (19,300 MT), were offset by reductions primarily for China (56,700 MT), unknown destinations (50,000 MT), and El Salvador

(7,500 MT). For 2021/2022, net sales of 529,900 MT were primarily for China (260,000 MT), unknown destinations (154,600 MT), South Korea (83,000 MT), Honduras (15,000 MT), and the Dominican Republic (12,500 MT). Exports of 634,200 MT were up noticeably from

the previous week and up 23 percent from the prior 4-week average. The destinations were primarily to China (200,300 MT), Mexico (129,100 MT), South Korea (123,400 MT), the Philippines (57,200 MT), and Ecuador (29,500 MT).

Optional

Origin Sales:

For 2020/2021, new optional origin sales of 29,000 MT were reported for Spain. The current outstanding balance of 29,000 MT is for Spain.

Corn:

Net sales of 757,000 MT for 2020/2021 were down 5 percent from the previous week and 54 percent from the prior 4-week average. Increases primarily for Japan (285,300 MT, including 135,300 MT switched from unknown destinations and decreases of 2,900 MT), South

Korea (247,600 MT, including decreases of 20,200 MT), Colombia (122,200 MT, including 50,000 MT switched from unknown destinations and decreases of 8,700 MT), China (99,000 MT, including 70,000 MT switched from unknown destinations), and Mexico (67,700 MT,

including decreases of 10,000 MT), were offset by reductions primarily for unknown destinations (164,800 MT). For 2021/2022, net sales of 50,000 MT reported for Mexico (90,000 MT) and Guatemala (10,000 MT), were offset by reductions for unknown destinations

(50,000 MT). Exports of 2,053,400 MT were up 4 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to China (578,500 MT), Mexico (473,600 MT), Japan (366,100 MT), South Korea (242,500 MT), and Colombia

(120,400 MT).

Optional

Origin Sales:

For 2020/2021, options were exercised to export 202,000 MT to South Korea from the United States. Options were exercised to export 56,100 MT to China from other than the United States. Decreases totaling 4,800 MT were reported for China. The current outstanding

balance of 567,800 MT is for South Korea (282,000 MT), unknown destinations (244,500 MT), the Ukraine (32,400 MT), and China (8,900 MT).

Barley:

Net sales of 200 MT for 2020/2021 were up 97 percent from the previous week, but down noticeably from the prior 4-week average. Increases were for Taiwan (200 MT). Exports of 500 MT were up 24 percent from the previous

week and 52 percent from the prior 4-week average. The destinations were primarily to Canada (300 MT) and Taiwan (200 MT).

Sorghum:

Net sales reductions of 500 MT for 2020/2021 were down noticeably from the previous week and from the prior 4-week average. Increases for China (54,500 MT, including decreases of 3,300 MT), were offset by reductions for

unknown destinations (55,000 MT). Exports of 165,700 MT were down 46 percent from the previous week and 16 percent from the prior 4-week average. The destination was primarily to China (165,600 MT).

Rice:

Net sales of 44,000 MT for 2020/2021 were down 21 percent from the previous week and 30 percent from the prior 4-week average. Increases were primarily for Haiti (14,500 MT), Panama (9,700 MT), Mexico (6,800 MT), Canada (3,200 MT), and Jordan (3,100 MT).

Exports of 30,700 MT were down 51 percent from the previous week and 45 percent from the prior 4-week average. The destinations were primarily to Mexico (15,300 MT), Saudi Arabia (3,300 MT), Canada (2,700 MT), Jordan (1,800 MT), and South Korea (1,600 MT).

Soybeans:

Net sales reductions 92,500 MT for 2020/2021–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Egypt (66,200 MT, including 65,000 MT switched from unknown destinations and decreases

of 2,500 MT), Japan (40,700 MT, including 8,800 MT switched from unknown destinations), Indonesia (21,100 MT, including decreases of 200 MT), Mexico (13,200 MT, including decreases of 900 MT), and Saudi Arabia (10,400 MT, including 9,500 MT switched from unknown

destinations), were offset by reductions primarily for China (216,100 MT). For 2021/2022, net sales of 338,600 MT were reported for China (264,000 MT), Taiwan (65,000 MT), Mexico (10,000 MT), and Thailand (300 MT), were offset by reductions for Japan (700

MT). Exports of 345,200 MT–a marketing-year low–were down 25 percent from the previous week and 37 percent from the prior 4-week average. The destinations were primarily to Egypt (119,200 MT), Mexico (76,500 MT), Costa Rica (27,100 MT), Indonesia (26,100

MT), and Taiwan (18,500 MT).

Exports

for Own Account:

For 2020/2021, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 127,700 MT for 2020/2021 were down 9 percent from the previous week and 36 percent from the prior 4-week average. Increases primarily for Mexico (40,900 MT), Canada (39,300 MT, including decreases of 700 MT), Colombia (16,800 MT, including decreases

of 2,700 MT), Japan (8,500 MT), and Belgium (5,900 MT), were offset by reductions for El Salvador (5,100 MT) and Jamaica (4,400 MT). For 2021/2022, net sales of 4,800 MT were primarily for Mexico. Exports of 249,600 MT were down 3 percent from the previous

week and 1 percent from the prior 4-week average. The destinations were primarily to the Philippines (43,100 MT), Mexico (35,100 MT), Canada (34,000 MT), the Dominican Republic (32,000 MT), and Colombia (27,600 MT).

Soybean

Oil:

Net sales of 15,700 MT for 2020/2021 were up noticeably from the previous week and up 53 percent from the prior 4-week average. Increases primarily for South Korea (15,000 MT), Mexico (700 MT), and the Dominican Republic (500 MT), were offset by reductions

for Colombia (500 MT). Exports of 7,200 MT were down 32 percent from the previous week and 69 percent from the prior 4-week average. The destinations were primarily to South Korea (5,300 MT), Mexico (1,200 MT), and Canada (700 MT).

Cotton:

Net sales of 269,900 RB for 2020/2021 were up noticeably from the previous week and up 8 percent from the prior 4-week average. Increases primarily for Vietnam (136,200 RB, including 4,400 RB switched from China and 2,200 RB switched from Hong Kong), Pakistan

(49,900 RB, including decreases of 200 RB), China (31,200 RB, including decreases of 8,300 RB), Turkey (21,800 RB), and South Korea (7,900 RB), were offset by reductions primarily for Hong Kong (2,200 RB) and Malaysia (300 RB). For 2021/2022, net sales of

49,000 RB were primarily for Indonesia (13,200 RB), China (13,200 RB), Turkey (11,800 RB), Pakistan (5,700 RB), and Mexico (2,600 RB). Exports of 371,700 RB were up 15 percent from the previous week and 11 percent from the prior 4-week average. Exports were

primarily to Vietnam (121,200 RB), Pakistan (53,000 RB), Turkey (51,300 RB), China (45,800 RB), and Mexico (16,700 RB). Net sales of Pima totaling 7,500 RB were up 73 percent from the previous week, but down 2 percent from the prior 4-week average. Increases

primarily for China (4,400 RB), Pakistan (1,500 RB, including 1,100 RB switched from the United Arab Emirates), India (700 RB, including decreases of 100 RB), Greece (400 RB), and Turkey (400 RB), were offset by reductions primarily for the United Arab Emirates

(1,100 RB) and Japan (200 RB). Exports of 21,600 RB were up 51 percent from the previous week and 50 percent from the prior 4-week average. The destinations were primarily to India (7,200 RB), China (4,800 RB), Peru (3,200 RB), Pakistan (2,400 RB), and Austria

(900 RB).

Exports

for Own Account:

For 2020/2021, new exports for own account totaling 2,400 RB were primarily to Vietnam (1,300 RB) and China (1,000 RB). Exports for own account totaling 1,100 RB to Vietnam were applied to new or outstanding sales. The current exports for own account outstanding

balance of 31,500 RB is for China (24,600 RB), Vietnam (6,300 RB), and Bangladesh (600 RB).

Hides

and Skins:

Net sales of 399,900 pieces for 2021 were up 12 percent from the previous week, but down 20 percent from the prior 4-week average. Increases primarily for China (276,000 whole cattle hides, including decreases of 14,200 pieces), South Korea (52,400 whole

cattle hides, including decreases of 200 pieces), Thailand (45,700 whole cattle hides, including decreases of 100 pieces), Brazil (14,000 whole cattle hides, including decreases of 700 pieces), and Taiwan (8,900 whole cattle hides, including decreases of 1,300

pieces), were offset by reductions for Italy (200 pieces), Indonesia (200 pieces), and India (100 pieces). Exports of 367,900 pieces for 2021 were down 11 percent from the previous week and 5 percent from the prior 4-week average. Whole cattle hides exports

were primarily to China (242,300 pieces), South Korea (44,700 pieces), Mexico (22,000 pieces), Thailand (17,400 pieces), and Taiwan (15,800 pieces).

Net

sales of 64,100 wet blues for 2021 were down 71 percent from the previous week and 62 percent from the prior 4-week average. Increases reported for China (25,500 unsplit, including decreases of 100 grain splits), Mexico (20,000 grain splits and 4,300 unsplit),

Vietnam (12,300 unsplit, including decreases of 200 pieces), and Brazil (2,600 unsplit), were offset by reductions primarily for Thailand (200 unsplit) and Italy (200 unsplit). Exports of 119,800 wet blues for 2021 were down 28 percent from the previous week,

but up 1 percent from the prior 4-week average. The destinations were primarily to Vietnam (41,000 unsplit), Italy (23,000 unsplit and 1,600 grain splits), China (24,500 unsplit), Brazil (10,300 unsplit), and Mexico (6,500 grain splits and 2,800 unsplit).

Net sales of 927,400 splits were for Vietnam (600,000 pounds) and China (327,400 pounds, including decreases of 18,600 pounds). Exports of 364,600 pounds were to Vietnam (280,000 pounds) and China (84,600 pounds).

Beef:

Net

sales of 18,200 MT reported for 2021 were down 3 percent from the previous week and 14 percent from the prior 4-week average. Increases primarily for South Korea (9,100 MT, including decreases of 700 MT), Japan (4,200 MT, including decreases of 400 MT), China

(1,900 MT, including decreases of 100 MT), Mexico (1,300 MT, including decreases of 100 MT), and Taiwan (700 MT, including decreases of 100 MT),

were

offset by reductions primarily for the Philippines (300 MT) and Vietnam (100 MT).

Exports of 18,800 MT were up 1 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to South Korea (6,500 MT), Japan (4,700 MT), China (3,200 MT), Mexico (1,100 MT),

and Taiwan (1,000 MT).

Pork:

Net

sales of 33,400 MT reported for 2021 were down 45 percent from the previous week and 22 percent from the prior 4-week average. Increases were primarily for Mexico (23,000 MT, including decreases of 500 MT), Japan (3,400 MT, including decreases of 300 MT),

Australia (1,600 MT, including decreases of 100 MT), China (1,200 MT, including decreases of 1,000 MT), and South Korea (1,200 MT, including decreases of 400 MT). Exports of 38,400 MT were down 5 percent from the previous week and 3 percent from the prior

4-week average. The destinations were primarily to China (13,400 MT), Mexico (7,800 MT), Japan (5,400 MT), South Korea (3,300 MT), and the Philippines (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.