PDF Attached

USDA

updated their S&D’s and traders thought it was friendly for soybeans and soybean oil. Wheat looked neutral while corn slightly bearish, IMO. Prices ended the week higher. We didn’t see any major import developments. China plans to auction off another 500,000

tons of soybeans next week, on April 15, third auction of the season. The UN reported the FOA Food Price Index hit a record during the month of March to 159.3 points versus a revised 141.4 for February. The Biden administration on Friday broadened its export

curbs against Russia and Belarus, restricting access to imports of items such as fertilizer and pipe valves. (Reuters)

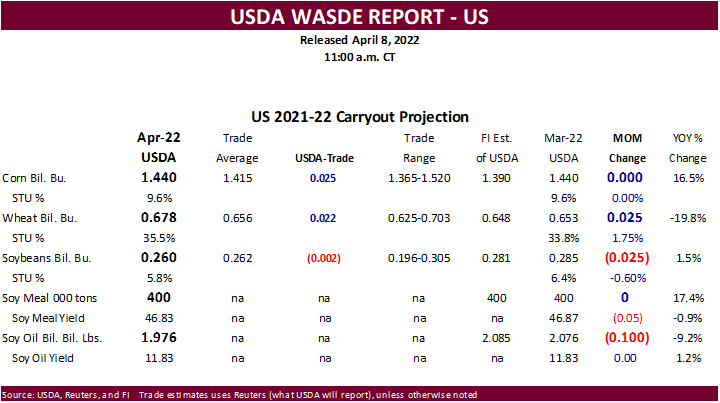

USDA

released their April supply and demand estimates

Reaction:

Slightly bearish corn, supportive soybeans & SBO, neutral wheat. Gains were added in some agriculture markets post-USDA report. We revised May price outlooks.

USDA

NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/2022/03-31-2022.pdf

USDA

OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

US

soybean stocks 260 vs. 285 last month (-25), -2 million vs. trade

US

corn stocks 1440 vs. 1440 last month (0), 25 million vs. trade

US

wheat stocks 678 vs. 653 last month (25), 22 million vs. trade

WLD

soy stocks 89.6 vs. 90.0 last month (-0.4), 0.8 million vs. trade

WLD

corn stocks 305.5 vs. 301.0 last month (4.5), 4.6 million vs. trade

WLD

wheat stocks 278.4 vs. 281.5 last month (-3.1), -3.0 million vs. trade

Brazil

Soy 125.0 vs. 127.0 last month (-2), -0.1 million vs. trade

Arg.

Soy 43.5 vs. 43.5 last month (0), 0.7 million vs. trade

Brazil

Corn 116.0 vs. 114.0 last month (2), 0.9 million vs. trade

Arg.

Corn 53.0 vs. 53.0 last month (0), 1.0 million vs. trade

Higher

prices post report. US corn and wheat stocks were above expectations and near an average trade guess for soybeans. We thought the report was slightly bearish for corn. World corn stocks increased 4.5 million tons from the previous month. CBOT crush margins

slipped after USDA increased their US soybean export forecast by 25 million bushels. They lowered the meal yield, increased imports (50) & domestic use (200) and lowered exports (200). Soybean oil exports were taken higher by 100 million pounds, a surprise.

We are now 200 million pounds below USDA. Argentina corn production was unchanged, and Brazil was taken up 2.0 million tons. Argentina soybeans were left unchanged and Brazil soybeans were lowered 2 million. Ukraine corn prod was unchanged from last month

at 41.9 million tons and corn exports were lowered 4.5 million from last month to 23.00. US corn for ethanol was lifted 25 million bushels. Corn for feed was lowered 25 million bushels to 5.625 billion, up from 5.598 billion year ago. As a result, US corn

ending stocks did not change. US all-wheat exports were lowered 15 million and feed 10 million bushels. Per March 1 stocks, the feed adjustment was justified. Slow USDA export sales likely prompted USDA to lower exports. Projected 2021-22 ending stocks were

raised 25 million bushels to 678 million but are still 20 percent lower than last year. Russian wheat exports were raised 1 million tons to 33 million and Ukraine wheat exports were lowered 1 million to 19 million. Some of the trade was looking for a larger

downward revision for Ukraine wheat exports. World wheat stocks were down 3.1 million tons and world soybean stocks decreased by 400,000 tons.

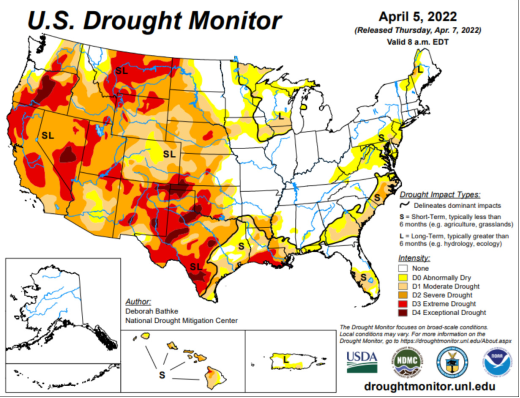

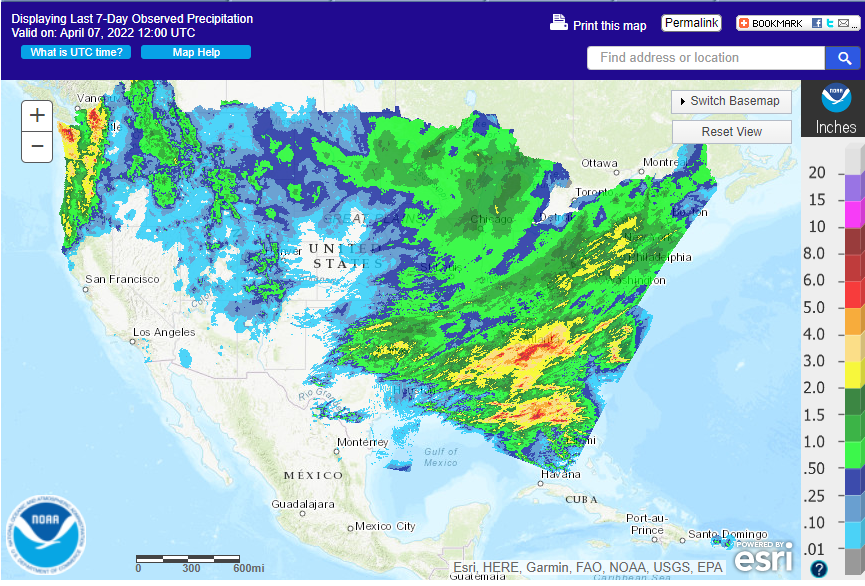

WEATHER

EVENTS AND FEATURES TO WATCH

-

Montana,

the northern U.S. Plains and southeastern Canada’s Prairies may get some significant moisture next week as a new snowstorm impacts a part of that region -

The

southwestern Canada Prairies will not be included in the event -

Southwestern

and west-central U.S. Plains are expected to remain drier than usual through the next two weeks -

The

GFS model has suggested a little rain might reach West Texas during the latter half of next week, but the ECMWF model does not agree -

World

Weather, Inc. sees opportunity for some showers to evolve, but resulting rainfall would not be great enough to change the bottom line for future planting of spring crops. -

Concern

over U.S. spring planting progress will remain for the lower eastern Midwest, Delta and Tennessee River Basin due to bouts of rain and mild to cool temperatures -

Some

welcome and significant warming is expected during the late weekend into early next week that will offer a small window for “some” planting -

Rain

returns a little too quickly for good field progress -

GFS

Ensemble forecast temperatures for the next two weeks suggests another bout or two of colder than usual conditions are likely in the central U.S. in the second week of the outlook -

Returning

cooler air will slow down drying rates once again -

Far

southeastern U.S. rainfall is expected to diminish greatly from where it has been recently once the cold shots of air cease -

Florida,

southern Georgia, southeastern Alabama and South Carolina will see less frequent and less significant rainfall once the cold shots of air cease to occur, but there will be a couple of frontal systems in the next two weeks that will bring additional, timely,

rainfall to the region. -

Fieldwork

will advance swiftly especially after recent rainfall -

Western

and southern Texas will received very little rain of significance in the next two weeks, but a few showers cannot be ruled out -

Some

rain showers may occur briefly in the Low and Rolling Plains of western Texas next week, but resulting rainfall should not be great enough for a lasting increase in soil moisture

-

Southern

Texas (i.e. Coastal Bend and interior southern parts of the state) will have a chance for rain in the second half of next week and continuing into the following weekend -

No

general soaking is likely, but there will may be a few localized areas of benefit -

Western

portions of U.S. hard red winter wheat production areas will continue with little to no rainfall over the next two weeks -

The

longer range outlook keeps this region in a direr than usual mode for a while longer -

U.S.

Pacific Northwest will experience some increasing precipitation in the next two weeks and that could translate into better spring planting and dryland planting potentials -

California’s

Sierra Nevada will get some snow and rain Monday into Tuesday of next week and gain April 15-16. -

The

precipitation should prove to be helpful for spring runoff, but mountain snowpack and snow water equivalency will remain well below average -

Brazil

weather will continue too wet in the interior far south into early next week, but rainfall after that should be more limited and sufficient warming should occur to induce better crop and field working conditions -

Mato

Grosso and Mato Grosso do Sul will experience net drying into early next week

-

Timely

rainfall during mid- to late-week next week should increase topsoil moisture for a short bout of time in a few areas, but no general soaking rain is expected -

Net

drying will resume in the second weekend of the two week outlook -

Brazil’s

monsoon moisture will be withdrawing from the central and southern crop areas of the nation next week

-

The

occurrence is considered to be normal -

Safrinha

and late season summer crops will rely on subsoil moisture for continued summer crop development -

The

outlook for Safrinha crops remains very good through mid-April and probably in late month as well, despite seasonal drying over time -

Argentina

will experience a good mix of weather during the next two weeks. -

Late

season crops will continue to have favorable soil moisture to support crops throughout the next two weeks -

Europe

is expected to turn briefly drier and a little warmer next week which may help reverse the recent trend of wet and cool biased conditions -

The

change should help get soil temperatures to rise again after this week’s recent bouts of frost and freezes

-

Fieldwork

and early season crop development may be a little behind normal after this recent bout of cool and wet weather -

A

new bout of cooler than usual temperatures and rainfall may evolve after mid-month -

Russia

weather is likely to remain quite active with frequent bouts of rain and snow in the west and north while the Southern Region is a little drier biased for a while -

Melting

snow and frequent bouts of new rain and snow have many northwestern crop areas in the nation very wet -

Flood

potentials are high and drier weather is needed to avoid a more serious bout of flooding -

Russia’s

southern region will get some welcome precipitation during mid-week next week -

Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days -

Rain

will also fall frequently in Peru -

Some

flooding could impact a part of the Amazon River System and Colombia in time -

Temperatures

in South America will be near to above normal over the coming week and then cooler in central and southern Argentina and southern Brazil next week -

Two

tropical cyclones are predicted in the Eastern Hemisphere this weekend and one will bring the risk of flooding and high wind speeds to the Philippines -

One

storm in the South China Sea -

Another

storm in the southwestern Pacific Ocean east of the Philippines -

The

South China Sea and Pacific Ocean storms will reach maturity at about the same time late in this coming weekend and early next week -

The

largest storm will be over open water in the Pacific Ocean and should not threaten land -

There

may actually be two storms in the Pacific Ocean, but both events are expected to move away from the Philippines and Asia without having influence on land -

The

storm in the South China sea may impact the central or northern Philippines during the middle to later part of next week resulting in some flooding rain, but confidence on when and where landfall occurs is not high -

The

disturbance in the Bay of Bengal is not advertised to threaten land, but it should be closely monitored -

Quebec

and Ontario, Canada weather will be active over the next ten days producing frequent rain and keeping temperatures mild to cool -

Northwestern

Africa and southwestern parts of Europe have turned drier, but more rain is expected during the middle to latter part of next week -

The

moisture will be greatest in northern Morocco, northeastern Algeria and northern Tunisia.

-

India’s

harvest weather will be very good over the next couple of weeks -

Precipitation

will be limited to sporadic showers in the far south and more generalized rain in the far Eastern States

-

Southeastern

China will be dry biased through the weekend -

The

break from rainy weather has already been great and the continued trend will further improve rapeseed development and early season corn and rice planting conditions throughout the south -

Improvements

to many crops and field working conditions are likely -

Temperatures

will trend warmer, as well -

Alternating

periods of rain and sunshine are expected next week through April 20. -

Northern

wheat areas of China will experience some warmer weather this week that may stimulate some greater crop development potential -

Rain

is expected early next week briefly to help stimulate greater winter crop development -

Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina -

The

region will continue lacking precipitation for an expected period of time -

Eastern

and southern Mexico will be seasonably dry this week and will only receive sporadic rainfall of limited significance this weekend and next week -

Southeast

Asia rainfall will continue frequent and abundant -

No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry -

Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week -

East-central

Africa rainfall will continue greatest in Tanzania, although parts of Uganda and Kenya will get rain periodically as well.

-

Ethiopia

rainfall should be most sporadic and light until next week when some increase is expected -

West-central

Africa rainfall will continue periodically and sufficient to support coffee and cocoa development -

Rainfall

so far this month has been a little sporadic, but no area has been seriously dry biased -

Pockets

in Ivory Coast and western Ghana have received less than usual rain, but crop development has advanced well

-

Rain

frequency and intensity should increase in many areas this weekend through all of next week -

Western

Australia is trending drier this week after abundant rain last week -

Winter

crop planting is still a few weeks away and some rain will be needed again before planting begins -

Eastern

Australia precipitation developed Thursday and will linger into Saturday with New South Wales wetter than Queensland

-

Irrigated

late season sorghum and other crops will continue to develop favorably -

Some

of the dryland crop that is still immature still needs greater moisture -

Rain

should not seriously harm fiber quality in open boll cotton, although any rain is not welcome at this time of year -

Drier

weather is expected next week and it should prevail for a week -

South

Africa rainfall over the next couple of weeks will be periodic and sufficient enough to support late season crop development while the impact on mature crops should be to slow harvest progress and raise a little crop quality concern for cotton -

Today’s

Southern Oscillation Index is +11.91 -

The

index will continue moving higher for the next few days -

Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days and in both Panama and Costa Rica -

Guatemala

will also get some showers periodically

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- FAO

World Food Price Index - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

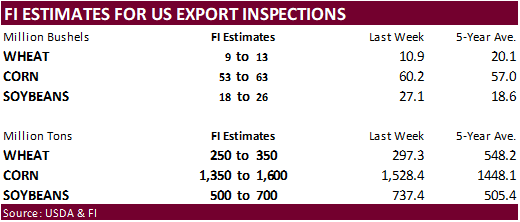

Monday,

April 11:

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysian

Palm Oil Board’s data for March output, exports and stockpiles - Malaysia’s

April 1-10 palm oil export data - Brazil’s

Unica may release sugar output and cane crush data (tentative) - U.S.

crop progress and planting data for corn and cotton; spring wheat progress, 4pm - Ivory

Coast cocoa arrivals

Tuesday,

April 12:

- France

Agriculture Ministry report; 2022 crop plantings - EU

weekly grain, oilseed import and export data - U.S.

winter wheat condition, 4pm

Wednesday,

April 13:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

first batch of March trade data, incl. soybean, edible oil, rubber and meat imports - FranceAgriMer

report; monthly French grains outlook - New

Zealand food prices - Holiday:

Thailand

Thursday,

April 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - May

ICE white sugar contract expiry - HOLIDAY:

Argentina, India, Thailand

Friday,

April 15:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

green coffee stockpiles data released by New York-based National Coffee Association - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Major markets closed due to Good Friday holiday

Source:

Bloomberg and FI

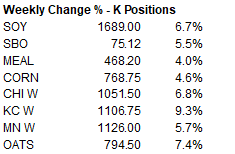

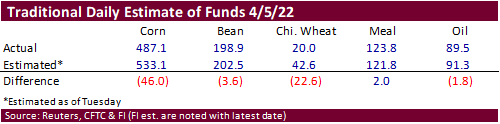

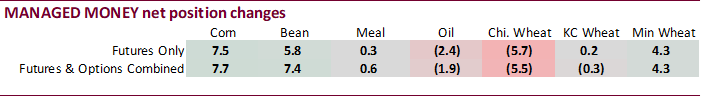

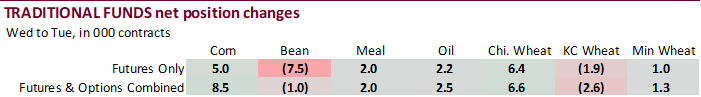

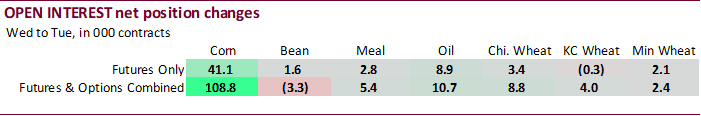

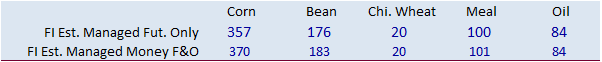

CFTC

Commitment of Traders

Traders

again missed the Chicago wheat let long position estimate and were way off for the corn position. Note open interest was up more than 108,000 contracts for corn combined futures and options.

84

Counterparties Take $1.750 Tln At Fed Reverse Repo Op (prev $1.734 Tln, 85 Bids)

Canadian

Net Change In Employment Mar: 72.5K (est 79.9K; prev 336.6K)

Canadian

Unemployment Rate Mar: 5.3% (est 5.4%; prev 5.5%)

Canadian

Hourly Wage Rate Permanent Employees (Y/Y) Mar: 3.7% (est 3.7%; prev 3.3%)

Canadian

Participation Rate Mar: 65.4% (est 65.4%; prev 65.4%)

Canadian

Full Times Employment Change Mar: 92.7K (est 41.7K; prev 121.5K)

Canadian

Part Time Employment Change Mar: -20.3K (est 38.2K; prev 215.1K)

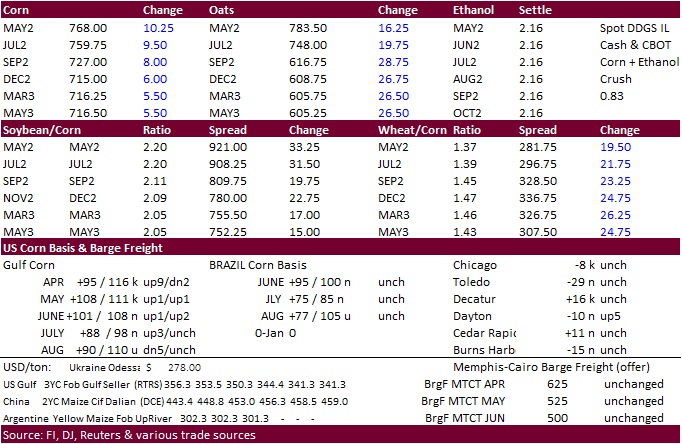

Corn

·

US corn futures traded higher before and after the USDA report. Gains were limited after USDA reported an unchanged US corn carryout at 1.440 billion. World corn stocks were revised up 4.5 million tons after production expected

4.3 million. Brazil corn was taken up 2 million and Argentina was left unchanged. USDA took EU corn production up 700,000 tons.

·

We hear one consultancy has their final US corn carryout around 1.125 billion bushels and soybeans at 175, both very tight. We are near 225 million bushels for soybeans and 1.460 billion for corn. Brazil has a good second corn

crop and will be competitive with exports. Brazil soybean exports may wind down during Q3.

·

There were no fresh US export developments.

·

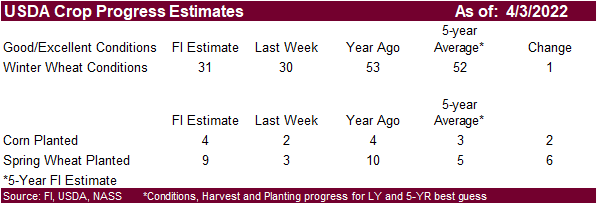

On Monday we look for USDA to report US corn plantings at 4 percent complete, up from 2 percent as of last Sunday.

·

Yesterday the US EPA announced decisions on refineries that were seeking exemptions to biofuel blending mandates. 36 petitions were denied for the 2018 compliance year. The EPA will provide 31 of those refineries with another

avenue to seek relief, without purchasing credits to show compliance with the law. Before this announcement, about 69 requests were pending. The refineries will still need to file compliance reports even though they won’t be forced to also submit biofuel

credits, according to a Bloomberg story.

Export

developments.

None

reported

May

corn is seen in a $7.25 and $8.10 range (up 15, unchanged)

December

corn is seen in a wide $5.50-$8.00 range

·

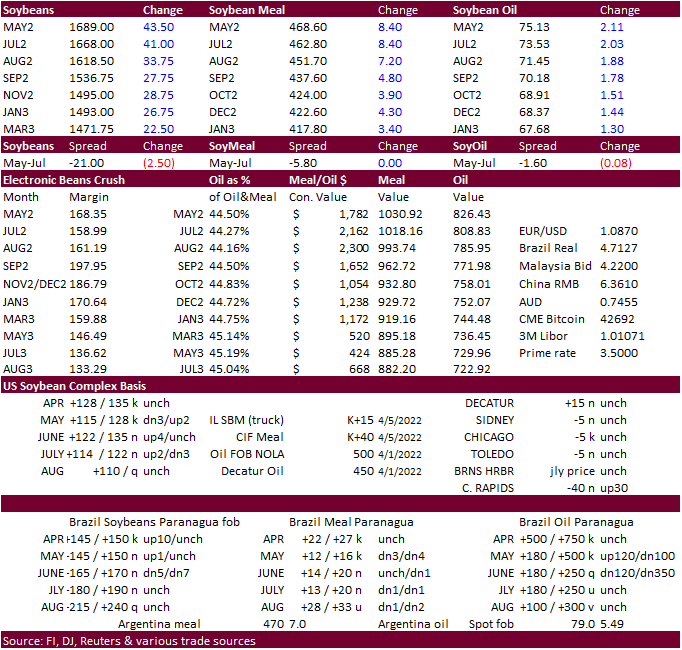

The CBOT soybean complex was higher in part to USDA lowering the total South American crop production, increasing US soybean exports and follow through buying. Meal and soybean oil were higher. FOA reported a 23.2 percent increase

in the global vegetable oils index for the Monday of March from February.

June

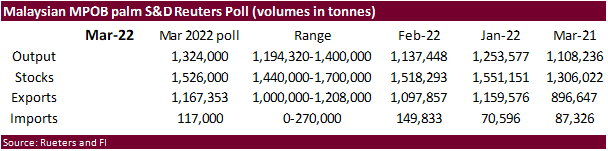

Malaysian palm futures were up 6 percent for the week.

·

USDA lowered US soybean stocks by 25 million bushels to 260 million. World soybean stocks were lowered only 400,000 tons after USDA decreased world production 3.1 million tons. Brazil soybean production was taken down 2 million

tons to 125 million, near other trade expectations. Brazil soybean exports were lowered 2.8 million tons in part to strong domestic crush demand, slowing demand from China and higher US exports. China soybean imports were lowered 3 million tons to 91 million.

Six months ago, the trade was thinking around 100 million tons. Then you have China’s estimate, currently at 102 million tons! (see CASDE attached). Paraguay production was lowered 1.1 million tons by USDA to 4.2 million.

·

China plans to auction off another 500,000 tons of soybeans next week, on April 15, third auction of the season.

·

Results awaited: China was to auction off 500,000 tons of imported soybeans this week. Another 500,000 tons will be auctioned off next week.

USDA:

Canada oilseeds products and annual

Due

out April 11

Updated

4/8/22

Soybeans

– May $16.00-$17.65 (up 50, up 15)

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490 (up $10, down $10)

Soybean

oil – May 70.00-76.50 (up 10, up 200)

·

US wheat traded higher from ongoing concerns across the Black Sea region. USDA lowered US feed demand and exports by 10 and 15 million bushels, respectively, lifting the carryout to 678 million. Ukraine is about done exporting

wheat for the current crop year ending June 30. Next month USDA will release their initial 2022-23 global supply and demand estimates and it will be interesting to see what they will pencil in for Ukraine and Russia for production and stocks.

·

We can’t get too bullish wheat at these levels. India prices are at a large discount to US wheat and USDA export sales have been underperforming, in our opinion.

·

Next week the US will see a large storm bring heavy snow to the upper Great Plains and risk for threatening weather for the upper Midwest.

·

The French soft wheat crop was rated 92% as of April 4, unchanged from the previous week and above a year-earlier score of 87%.4 percent of the corn crop had been planted, below 8 percent year ago.

·

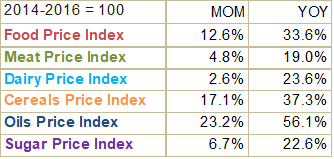

The UN reported the FOA Food Price Index hit a record during the month of March to 159.3 points versus a revised 141.4 for February.

·

In USDA’s crop progress report next week, we look for a one point improvement in the combined good and excellent condition to 31 percent, bias an increase in Midwestern states and Texas.

·

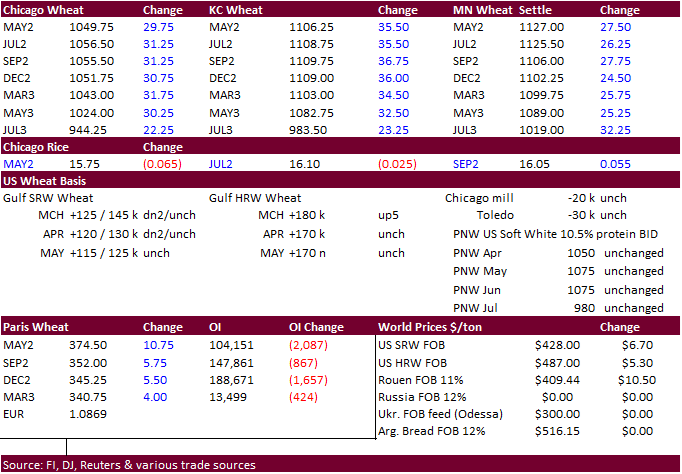

May Paris wheat futures were up 10.75 euros at 372.75 euros.

·

Russia set their export tax for wheat at $101.40 for the April 13-19 period, up from $96.10 previous.

Last

7-days

·

Bangladesh seeks 50,000 tons of wheat on April 11 for shipment within 40 days after contract signing.

·

Jordan seeks 120,000 tons of feed barley on April 12.

·

Jordan seeks 120,000 tons of milling wheat for LH May and/or through July shipment on April 13.

Rice/Other

·

(Reuters) – India could export a record 9 million tons of sugar in 2021/22 marketing year as production is likely to jump to a record 35 million tons, nearly 5% more than the previous estimate, according to IMSA.

Updated

4/8/22

Chicago May $9.50 to $12.00 range (up 50, unch), December $8.50-$11.00

KC May $10.00 to $12.00 range (up 75, unch), December $8.75-$11.50

MN May $10.50‐$12.00 (up 50, unch), December $9.00-$11.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.