PDF Attached

USDA

report day – US S&D’s attached

USDA

released their April supply and demand outlook

Reaction:

Neutral

to friendly feedgrains and neutral to slightly bearish soybeans. We tightened up our trading range for May soybeans & corn and raised our trading ranges for all three US wheat contracts.

USDA

OCE Secretary Briefing

https://www.usda.gov/sites/default/files/documents/april-2021-wasde-lockup-briefing.pdf

CBOT

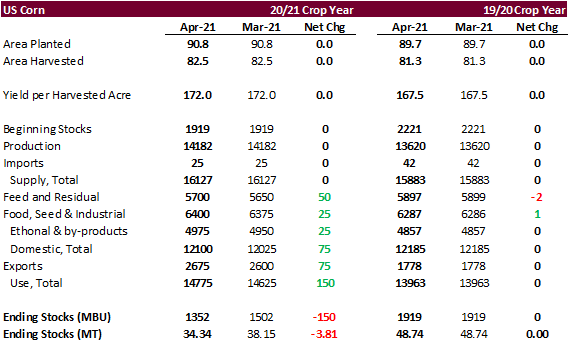

soybeans trended lower post USDA report and wheat trimmed gains. CBOT corn sold off post USDA report which created a buying opportunity for some longs. Prices dipped as USDA made a less than expected upward adjustment to US exports by only 75 million bushels

(trade was looking for 100-to-200-million-bushel increase). USDA’s outlook on 2020-21 corn exports indicated we could see some current crop year corn commitments rolled into new-crop at the end of the marketing season, or USDA acknowledging actual corn shipments

need to increase in order to convince the government US corn exports could reach commitment potential. US corn stocks dropped a more than expected 150 million bushels. Corn for feed was upward revised 50 and food use was down 25. They lifted corn for ethanol

by 25 million bushels, a surprise in our opinion. Corn exports were taken up only 75 as we mentioned. World corn stocks were lowered 3.8 million tons to 283.9 million, 19.1 million tons below 2019-20. Argentina corn production was lowered 0.5 million tons

to 47 million. Brazil was left unchanged at 109 million tons.

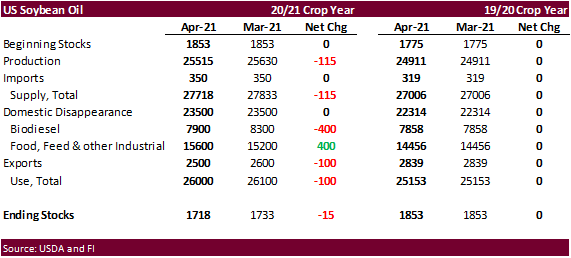

US

soybean stocks were unchanged but USDA did tinker with demand, by taking exports up 30 million bushels, offset by 10 million bushels lower crush, 2-million-bushel lower seed and 17 million downward revision in residual. US soybean oil food was up 400 million

pounds, and biodiesel use lowered 400 million. This could be a glimpse of what USDA is thinking for soybean oil for renewable biodiesel use. Next month USDA will add biofuel use, replacing soybean oil for biodiesel use. USDA made a bearish move by raising

Brazil exports by 1 million tons to 86 million tons of soybeans for 2020-21. Brazil soybean production was taken up 2 million tons to 136 million while Argentina was left unchanged at 47.5 million tons.

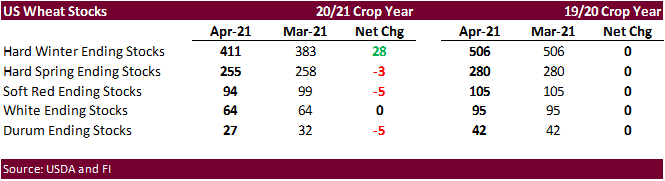

All-wheat

US stocks were raised 16 mil bu, 5 above trade expectations. Wheat imports were lowered 10 million bushels and feed was taken down 25 million to 100 million bushels. We think feed could be trimmed another 10 million in the next report. By class HRW wheat

stocks were upward revised 28 million bushels, and durum, HRS & SRW wheat stocks were each lowered 5 million bushels.

World

wheat production was lowered 300,000 tons and world stocks decreased a large 5.7 million tons to 295.5 million, 4.5 million below 2019-20. USDA noted “World 2020/21

consumption

is increased 5.1 million tons to 781.0 million, mainly on higher feed and residual use for China. Auction sales of China’s old-crop wheat stocks continue to be large and domestic corn prices in China remain at a premium to wheat. This is expected to further

increase China’s 2020/21 wheat feed and residual use, raised 5.0 million tons to a record 40.0 million.”

World

Weather Inc.

MOST

IMPORTANT WEATHER IN THE WORLD

-

Brazil’s

Safrinha corn areas are still drying down and little change will occur for ten days with the exception of central and northern Mato Grosso where a favorable mix of rain and sunshine is expected -

Crop

stress will slowly intensify over the forecast period -

Showers

that occur April 19-24 are unlikely to bring a soaking rain leaving soil moisture short to very short in some areas which is not good with monsoonal precipitation ending shortly thereafter

-

Fear

of dryness during reproduction is still running very high -

60%

of the corn crop was planted after the Feb. 20 optimum yield date and 15-20% of the crop was planted very late suggesting reproduction will not occur until the second half of May -

Limited

crop moisture will surely impact production this year -

Argentina’s

rain this week has been locally heavy and will continue into Saturday resulting in some areas of flooding -

Local

flooding has already occurred in a part of central Santa Fe reporting 2.00 to more than 6.00 inches of rain overnight -

Too

much rain could harm crop conditions and delay harvesting, but it is early enough in the season for conditions to improve enough without harming crops -

Drier

weather is needed over an extended period of time, though, to ensure crops do not suffer from too much moisture -

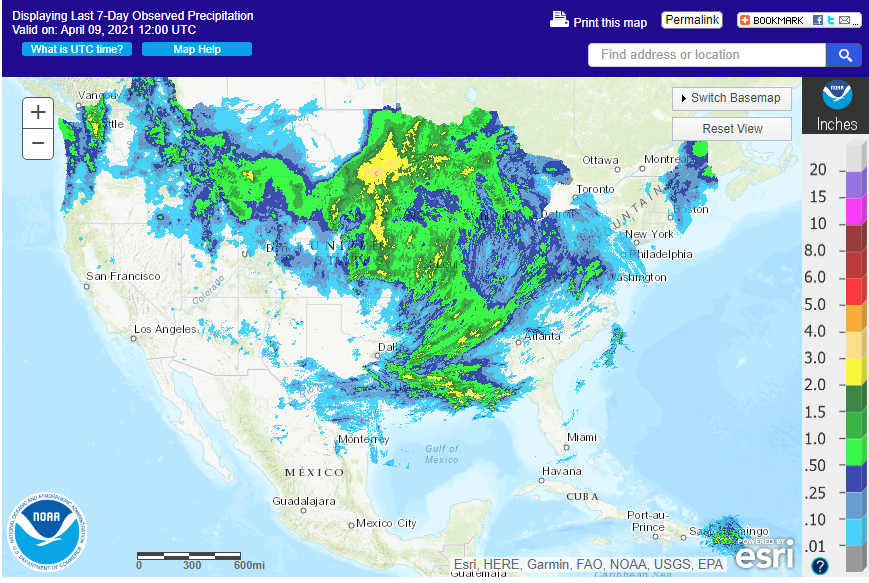

Central

U.S. temperatures will fall notably below average in the coming week to ten days with April 13-19 coldest in the Plains and western Midwest and April 16-20 coldest in the eastern Midwest -

Frost

and freezes will impact many areas in the central and northern Plains as well as the heart of the Midwest, although the heart of the Midwest will not see the coldest weather for at least a week -

No

permanent damage to wheat will occur in the Plains or Midwest -

Extreme

lows in hard red winter wheat areas will slip to the middle and upper 20s Saturday and again next week -

Eastern

Canada Prairies and a part of northern North Dakota and northwestern Minnesota will get some snow and rain late this weekend into early next week to help improve soil moisture for planting later this month -

Southwestern

Canada’s Prairies and the northwestern U.S. Plains will remain drought ridden for the next ten days, despite a few light showers -

U.S.

Pacific Northwest needs moisture too with central Washington through the heart of Oregon still much too dry for unirrigated winter crops -

Additional

rain in U.S. Delta this weekend will further delay field work, but drier weather at times in the following week will help get fieldwork back under way -

West

Texas may get some rain next week to briefly moisten the topsoil, but much more rain will still be needed to induce the best planting conditions in May and early June -

South

Texas drought continues and very little rain of significance is expected for a while, although a few showers will be possible periodically -

U.S.

southeastern states will continue to see a good mix of rain and sunshine over the next couple of weeks -

Recent

warm and dry weather in the U.S. eastern Midwest has accelerated net drying in the topsoil, but conditions are still very good for early season planting and germination -

Fieldwork

may be slowed with the prospects of colder weather coming after April 15 -

California

and the southwestern desert region will remain dry and in need of significant moisture, but irrigation is sufficient to carry on most agricultural needs -

No

relief is expected in the coming week, but some showers may occur in a part of the region After April 18 -

At

0900 GMT, Tropical Cyclone Seroja was located 306 miles west northwest of Learmonth, Western Australia at 19.95 south, 109.2 east moving southwesterly at 11 mph and producing maximum sustained wind speeds of 63 mph -

The

storm will move inland near Geraldton, Western Australia Sunday producing heavy rain and strong wind speeds along the coast -

Beneficial

moisture will fall in wheat, barley and canola production areas of Western Australia where planting will begin late this month -

Most

interior crop areas of Australia will not be bothered by significant rain this week -

Rain

in Western Australia late this weekend and early next week will be dependent upon the tropical cyclone noted above

-

Good

drying conditions are likely in key summer grain, oilseed and cotton areas in Eastern Australia this week favoring summer crop maturation and good harvest progress. -

Frost

and freezes in Europe are not permanently harming winter wheat, barley, rye or rapeseed, although new growth is being burned back -

Warming

is needed to stimulate new winter crop development and spring planting -

Rain

and snow across the continent will increase soil moisture for use by crops during the warmer days of late April and May -

Western

Europe will receive some needed rain this weekend -

The

precipitation will be erratic and somewhat light leaving need for more moisture -

Next

week trends drier once again and some warming is expected -

CIS

grain and oilseed areas will continue plenty moist except in Russia’s Southern Region and Kazakhstan where there is need for more moisture this spring and summer -

Winter

crops are still dormant or semi-dormant, although a little greening may be occurring in the far south -

Significant

warming is expected this weekend and early next week that will more significantly melt snow and warm soil temperatures

-

Some

improved planting conditions may evolve in parts of Ukraine and Russia’s Southern Region and winter crops will break dormancy a little more significantly because of the warmth -

Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas -

Some

beneficial rain fell across parts of this region recently, but southern areas are still dry -

Philippines

weather is good for most crops, but a boost in rainfall would be welcome -

Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain -

Flooding

in Timor and Flores is abating after serious crop and property damage occurred during the weekend from a developing tropical cyclone -

India

weather will continue good for this time of year with restricted rainfall and warm temperatures supporting winter crop maturation and harvest progress -

Rain

may fall heavily in Bangladesh and neighboring areas of India briefly next week -

China

weather remains mostly very good, although portions of the Yangtze River Basin are too wet and need to dry down -

Northern

crop areas in China are favorably moist and poised to support aggressive winter and spring crop development this year once additional warming takes place -

North

Africa will experience a favorable mix of weather over the next ten days, although resulting rainfall is not likely to be very great -

All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture -

Northwestern

Algeria and southwestern Morocco need rain -

Temperatures

will be near to above average -

West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well -

Rainfall

will be a little lighter and less frequent than usual over for a while longer, but improved rainfall should occur in the April 16-22 period -

Temperatures

have been and will continue to be very warm keeping evaporation rates very strong until greater rain evolves -

East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down -

South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops -

Net

drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress -

Temperatures

will be warmer than usual and that will dry out the soil relatively quickly -

New

Zealand weather has been drier than usual and precipitation will slowly improve during the next week to ten days in both North Island and western parts of South Island -

Temperatures

will be seasonable -

Southeastern

Canada will see below average precipitation and warmer than usual temperatures over the next ten days -

Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days -

Rain

is needed in many areas -

Drought

is prevailing across most of the nation -

Southern

Oscillation Index this morning was +0.93 and the index will move in a narrow range through next week with slight rise in the index.

Source:

World Weather inc.

Bloomberg

Ag Calendar

Friday,

April 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Monday,

April 12:

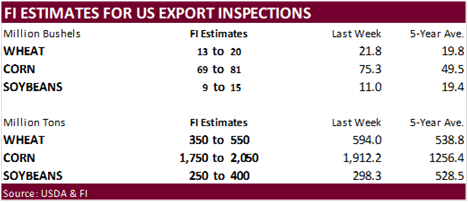

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Malaysian

Palm Oil Board data on March end-stocks, output, exports - Malaysia’s

April 1-10 palm oil export data from SGS - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 13:

- China

customs to publish trade data, including imports of soy, edible oils, meat and rubber - France’s

agriculture ministry updates on 2021 crop plantings - Malaysian

Cocoa Board releases 1Q 2021 cocoa grinding numbers - HOLIDAY:

Thailand

Wednesday,

April 14:

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

SUPPLEMENTAL

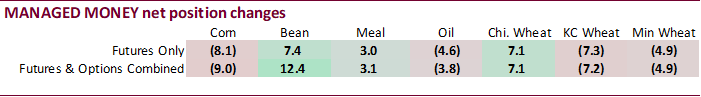

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

355,743 -6,381 414,436 -4,551 -739,333 6,783

Soybeans

114,491 15,791 172,068 7,204 -283,409 -34,011

Soyoil

46,636 -2,186 120,517 -621 -186,126 -1,289

CBOT

wheat -35,476 4,451 155,386 -1,993 -106,959 -1,767

KCBT

wheat -3,069 -4,724 61,062 -3,213 -56,790 6,748

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

386,619 -8,967 235,334 -13,448 -713,907 12,651

Soybeans

154,305 12,424 73,708 -17,889 -256,519 -19,665

Soymeal

61,345 3,110 70,247 -341 -180,000 -2,026

Soyoil

77,037 -3,803 100,373 2,632 -207,185 -1,859

CBOT

wheat -7,583 7,128 90,311 -8,196 -91,128 881

KCBT

wheat 14,510 -7,212 41,779 -331 -48,846 6,213

MGEX

wheat 5,483 -4,901 4,444 -836 -14,416 2,951

———- ———- ———- ———- ———- ———-

Total

wheat 12,410 -4,985 136,534 -9,363 -154,390 10,045

Live

cattle 91,884 8,648 85,636 990 -183,833 -9,207

Feeder

cattle 6,116 1,005 7,464 -106 -3,495 304

Lean

hogs 76,933 -1,179 59,024 569 -145,235 1,201

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

122,800 5,615 -30,845 4,149 2,364,959 44,848

Soybeans

31,655 14,113 -3,150 11,017 1,193,107 17,449

Soymeal

17,769 -2,872 30,640 2,128 476,527 5,933

Soyoil

10,803 -1,065 18,972 4,096 603,836 14,357

CBOT

wheat 21,352 878 -12,951 -690 500,331 -11,572

KCBT

wheat -6,241 142 -1,202 1,188 249,263 7,017

MGEX

wheat -1,040 -713 5,529 3,499 81,757 -3,515

———- ———- ———- ———- ———- ———-

Total

wheat 14,071 307 -8,624 3,997 831,351 -8,070

Live

cattle 20,718 597 -14,405 -1,027 384,783 -7,705

Feeder

cattle 4,214 -138 -14,298 -1,066 52,513 -844

Lean

hogs 15,673 -981 -6,394 390 363,049 7,168

=================================================================================

Source:

Reuters and FI

Macro

Canadian

Unemployment Rate Mar: 7.5% (est 8.0%; prev 8.2%)

US

PPI Final Demand (M/M) Mar: 1.0% (est 0.5%; prev 0.5%)

US

PPI Final Demand (Y/Y) Mar: 4.2% (est 3.8%; prev 2.8%)

US

PPI Ex-Food, Energy (M/M) Mar: 0.7% (est 0.2%; prev 0.2%)

US

PPI Ex-Food, Energy (Y/Y) Mar: 3.1% (est 2.7%; prev 2.5%)

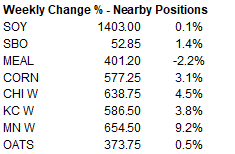

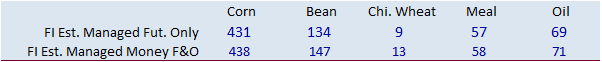

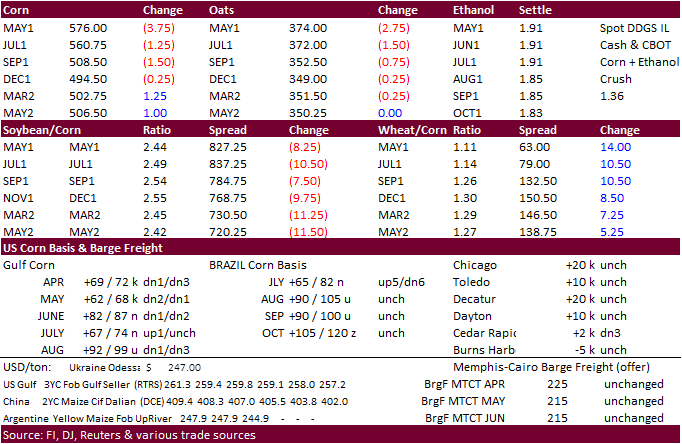

Corn

- May

corn traded to a new contract high today (rolling contracts near 8-year high) and selling into the closed pulled the contract 2.50 cents lower. For the week it was up 3.1%. CBOT corn

was

higher before the report on follow through buying. Selling commenced after the release of the report and again near the close. December finished up 1.75 cents from unwinding of bull spreads. News was very quiet. Some traders speculate the recent rally was

already worked in ahead of what people expect as a bullish report. One key change in today’s USDA report was USDA taking exports 75 million bushels higher, less than what the trade was looking for.

- US

corn stocks of 1.352 billion bushels are see tightest since the 2013-14 season.

- Today

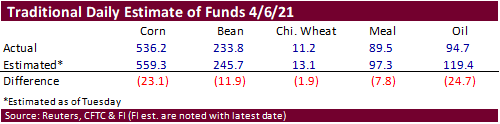

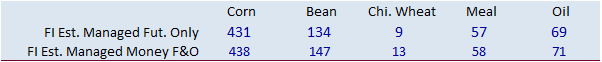

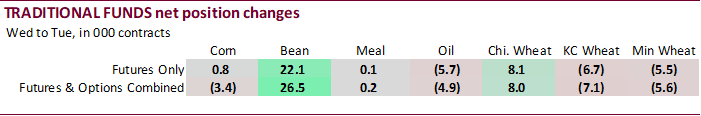

was day two of the “Goldman Roll.” - Funds

on Friday bought an estimated net 4,000 corn contracts. - China

in their CASDE report raised their corn import forecast for 2020-21 to 22 million tons from 10 million tons previous month. This was warranted and already penciled in balance sheets.

Export

developments.

- None

reported

Updated

4/9/21

May

corn is seen in a $5.55 and $6.00 range (up 15, unch)

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

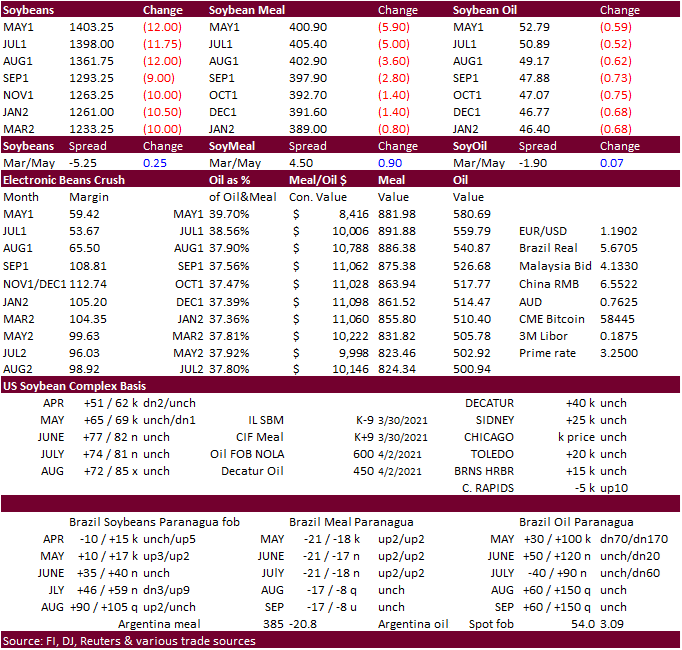

- CBOT

soybeans closed

lower after USDA upward revised the SA soybean crop and left US ending stocks unchanged (see text page one and tables after the text). USDA estimated global soybean stocks at 86.9 million tons, above an average trade guess of 83.5 million.

- May

soybeans ended 12.25 cents lower and for the week were up 0.1%. May soybean meal finished $5.60 lower and for the week was down 2.2%. May soybean oil was 53 points higher and for the week was up 1.4%.

- Funds

on Friday sold an estimated net 6,000 soybean contracts, sold 4,000 soybean meal and sold an estimated 3,000 soybean oil.

- Safras

& Mercado estimates Brazil soybean producers sold 14 percent of their upcoming 2022 crop. The crop will not be planted until later this year. For this year, a separate group, Datagro, estimates Brazil farmers sold 66.6% of their soybean crop through April

2, above a 57.1% five-year average. - China

cash crush margins on our analysis were 179 (161 previous) vs. 144 cents late last week and compares to 214 cents year earlier.

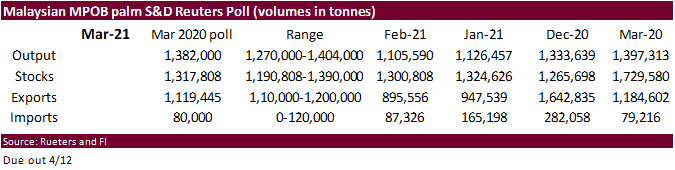

- APK-Inform

reported Ukrainian rapeseed export prices increased by $10-15 a ton over the past week to $525 to $533 per ton for delivery in July-August. - A

Reuters poll for Malaysia’s palm oil inventories shows March stocks expected to rise 1.3% from February to 1.32 million tons, production to slightly decline, and exports to be up 25% to 1.12 million tons. The Malaysian Palm Oil Board will release the official

data on April 12.

Export

Developments

None

reported

May

soybeans are seen in a $13.75 and $15.50 range (unch, down 25)

November $10.50-$14.50

May

soymeal is seen in a $395 and $415 range (unch, down $10)

December $325-$5.00

May

soybean oil is seen in a 51 and 55 cent range (up 100, unch)

December 40-60 cent wide range

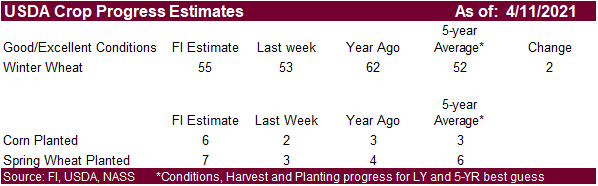

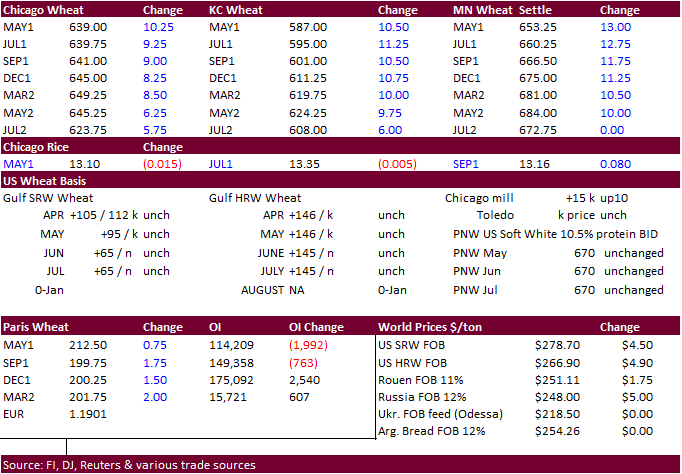

- Wheat

prices firmed on Friday on EU, US and Canada weather concerns and technical buying, led by high protein contracts. USDA trimmed global wheat stocks by 5.7 million tons in large part to a large increase in China consumption. US wheat stocks were taken up

16 million bushels. - May

Chicago wheat traded back above its 100-day MA and during the session was able to break above its 20-day but gains earlier were trimmed after corn futures sold off post USDA report. The Chicago May contract settled at $6.3875, below its 20-dayy but above the

100-day. - Chicago

wheat basis May was up 10 cents (4.5% higher for the week), KC May up 10 cents (3.8% higher for the week) and May MN up 13.75 cents (up 9.2% for the week).

- Funds

on Friday bought and estimated net 8,000 CBOT SRW wheat contracts. - May

milling wheat settled up 1.00 euro, or 0.5%, at 212.75 euros ($253.09) a ton. - EU

soft wheat conditions were unchanged from the previous week at 87% for the week ending April 5. Winter barley was up 1 point to 85 percent.

- SovEcon

pegged the Russian 2021 wheat crop at 80.7 million tons, 1.4 million tons higher than their previous estimate.

- Japan

in its weekly SGS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by September 30.

- Jordan

postponed their 120,000 ton import tender of animal feed barley from April 6 to April 13.

- Ethiopia

seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Iraq bought 60,000 tons of rice from Pakistan at $595/ton c&f.

·

South Korea’s Agro-Fisheries & Food Trade Corp bought 46,229 tons of rice for up to 208,217 tons sought in late March, sourced from Thailand, Vietnam and China.

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/9/21

May Chicago wheat is seen in a $6.20‐$6.75 range (up 20, up 15)

May KC wheat is seen in a $5.70‐$6.15 range

(up 20, up 15)

May MN wheat is seen in a $6.25‐$6.75 range

(up 50, up 25)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.