PDF Attached

US

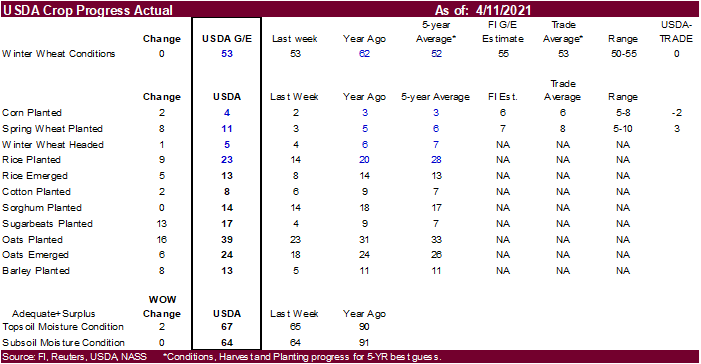

WINTER WHEAT – 53 PCT CONDITION GOOD/EXCELLENT VS 53 PCT WK AGO (62 PCT YR AGO) -USDA

US

WINTER WHEAT – 5 PCT HEADED VS 4 PCT WK AGO (7 PCT 5-YR AVG) -USDA

US

CORN – 4 PCT PLANTED VS 2 PCT WK AGO (3 PCT 5-YR AVG) -USDA

US

SPRING WHEAT – 11 PCT PLANTED VS 3 PCT WK AGO (6 PCT 5-YR AVG) -USDA

US

RICE – 23 PCT PLANTED VS 14 PCT WK AGO (28 PCT 5-YR AVG) -USDA

US

RICE – 13 PCT EMERGED VS 8 PCT WK AGO (13 PCT 5-YR AVG) -USDA

US

COTTON – 8 PCT PLANTED VS 6 PCT WK AGO (7 PCT 5-YR AVG) -USDA

World

Weather Inc.

- Tropical

Cyclone Seroja failed to bring as much rain to Western Australia as desired and winter crop areas in the state need more moisture - Wind

speeds reached 105 mph in ports from Shark Bay to Geraldton, Western Australia - Strong

winds also occurred farther inland, but the impact on agriculture was suspected of being low - Brazil’s

outlook is a little wetter starting this weekend and continuing into the end of this month with scattered showers and thunderstorms likely - The

moisture will not bring general soakings of rain to Safrinha corn country, but it will support crop development - Greater

rain will be needed to fix long term soil moisture so that dryness does not become a greater issue later this season - Argentina

is not as wet this weekend into next week as it was advertised to be Sunday - The

change was expected and needed - Cold

air advertised for next week was reduced and that helped reduce rainfall as well - The

outlook is better for summer crop maturation and harvest progress, although some rain is still expected - U.S.

outlook has not changed much - Hard

red winter wheat areas are still expecting some rain Wednesday into Friday that will improve crop and field conditions - Beneficial

rain is falling now and will continue into Tuesday into eastern Canada’s Prairies, northern and eastern North Dakota and northern Minnesota

- The

moisture will improve topsoil conditions for future planting and crop development - Limited

rainfall in the Pacific Northwest and far U.S. northern Plains will continue along with southwestern Canada’s Prairies - U.S.

southeastern states will dry down over the next ten days - Additional

rain is expected from Louisiana into southern Alabama later this week and into the weekend

- Some

of this region received excessive rain during the weekend - France

and Spain received needed moisture during the weekend bolstering topsoil conditions with moisture and improving short term outlooks for winter crop development and spring planting when it warms up

- Snow

cover in Russia continues to recede - Warming

in the western CIS for a little while this week will accelerate the snow melt and raise soil temperatures for more wheat greening in the south - The

warm up will be disrupted by cooling late this week that will last into next week - No

significant changes were noted in India, China, South Africa or North Africa - Although

North Africa will receive a little more rain over the next ten days than advertised Sunday - A

tropical cyclone developing east of the Philippines is expected to stay east of the Philippines and not be a threat to land

MOST

IMPORTANT WEATHER IN THE WORLD

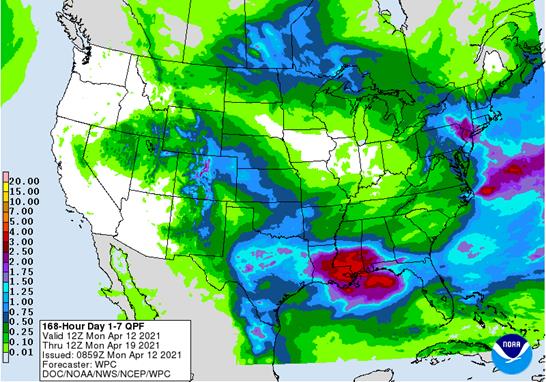

- U.S.

Midwest soil conditions are still rated favorably along with that in the Delta - Portions

of the U.S. Delta and central Gulf of Mexico coast states are a little too wet - Some

net drying will occur in the northern Delta for a while - Portions

of the southeastern states have been drying down recently and that trend will continue for the next ten days with the exception of areas from southern Alabama into northern Florida and southern Georgia where a few showers and thunderstorms Wednesday into Thursday

and again Friday into Saturday of this week will produce 0.05 to 0.75 inch of moisture in each event with a few totals over 1.00 inch - Portions

of Iowa, southeastern Minnesota and southwestern Wisconsin have missed out on precipitation in the past two weeks and will not receive much for the next ten days - Soil

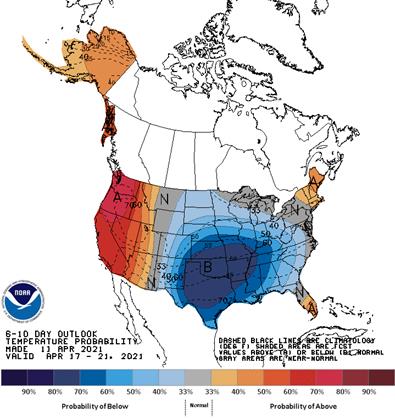

moisture is still rated favorably in the region now, but ten days from now there will be a growing need for rain - Mild

to cool weather expected during the period will protect the region from a more serious decline in soil moisture, but greater rain will be needed in late April and May to replenish topsoil moisture before warm temperatures evolve and soil moisture becomes more

seriously depleted - Greater

rain is advertised for April 24-25 by GFS model, but confidence is a little low

- Recent

rainfall (past two weeks) has also been restricted in the eastern U.S. Midwest with parts of southern Indiana and immediate neighboring areas of Illinois, Kentucky and Ohio receiving 50-75% of normal precipitation in the past 30 days - Soil

moisture is still rated adequately because of seasonably mild temperatures, but net drying is expected - Temperatures

will continue seasonably mild to cool for the next ten days - Some

rain will fall in these areas, but amounts will be light and erratic leaving need for more rain over the next ten days - Cool

temperatures will keep additional drying moving along slowly - Greater

rain is advertised April 25-26 by the GFS model run, but confidence is a little low today - Drought

continues in the Pacific Northwest impacting unirrigated areas from Washington’s Yakima Valley into Oregon - Not

much change to the drought is advertised for the next ten days and perhaps longer - California

will continue dry along with the Great Basin and southwestern desert region over the next two weeks with the exception of a few brief periods of rain Tuesday and Wednesday of this week when rain and mountain snow will fall in the Great Basin with a few lingering

showers Thursday. - The

bottom line to the U.S. is still one of concern for the Pacific Northwest, the northwestern Great Plains, southwestern Canada’s Prairies and western and southern Texas. A guarded watch on Iowa and immediate areas will be needed since recent precipitation has

been notably lighter biased and it may not be noticed now, but it will become an issue when warmer temperatures evolves later this month and in May without improved rainfall. Portions of the Delta will see improved weather, but Alabama, parts of Mississippi

and northwestern Florida along with parts of Louisiana will need to dry down soon.

- U.S.

weekend weather was wet in parts of the Midwest, Delta and central Gulf of Mexico coast states - Much

of Iowa was dry during the weekend, although the southeastern one-fourth of the state received 0.60 to 2.64 inches

- Eastern

Nebraska, the eastern Dakotas and far western Minnesota were also dry, but they received rain late last week - Rain

fell abundantly in Missouri and northwestern Illinois with 1.00 to 2.24 inches resulted with local totals to 2.90 inches - Most

other areas to the east in the Midwest received 0.25 to 0.70 inch with local totals of 1.00 to 1.30 inches in interior southern Michigan, northern Ohio and central Indiana, although central Indiana received 1.72 inches

- Rain

from Louisiana through most of Mississippi to Alabama, northwestern Florida and far southwestern Georgia ranged from 1.00 to 3.86 inches, although up to 5.19 inches occurred near the coast - Some

flooding resulted in a part of this region - Lighter

and more sporadic rain fell during the weekend from Florida through the remainder of Georgia and the Carolinas to Kentucky and Virginia - Amounts

ranged from less than 0.20 inch in parts of Georgia, South Carolina and southern Florida to amounts of 0.50 1.53 inches from North Carolina to Virginia - Very

little rain or snow fell across the Great Plains during the weekend, although some rain and drizzle fell from central Nebraska into north-central Oklahoma where moisture totals varied up to 0.65 inch and some light rain and snow evolved in the northern Plains

Sunday night into this morning - Temperatures

turned cooler in the northwestern half of the nation during the weekend with lowest morning temperatures slipping to the teens and 20s, but no permanent damage occurred in any wheat production area - Extreme

lows slipped to the teens in western Nebraska and parts of the Dakotas - Hot

weather occurred Friday in central and southern Texas with middle and upper 90s Fahrenheit noted with a few extremes over 100 occurring in the far southern parts of Texas - An

extreme of 104 occurred at Cotulla, Texas - Friday

afternoon temperatures in the lower Midwest reached into the upper 70s and lower 80s and the same occurred in farther to the south from the Tennessee River Basin into the southeastern states - Canada

Prairies received erratic precipitation through Sunday morning with Alberta receiving the most generalized rain and snow with moisture totals to 0.39 inch with most areas getting up to 0.12 inch - Erratic

rain occurred farther to the east, but the precipitation was intensifying and becoming better organized Sunday and early today in eastern Saskatchewan and Manitoba - Rain

and snow was most significant from eastern Saskatchewan into central North Dakota Sunday evening and this morning with moisture totals to 0.62 inch occurring through 0100 CDT

- Temperatures

trended cooler during the weekend with highs falling from the 50s and 60s Friday down to the 30s and lower 40s Sunday except in Manitoba where 50s and 60s were still noted Sunday and Monday - Waves

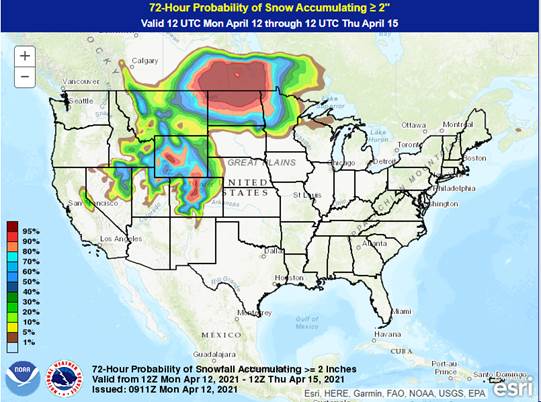

of snow and rain in eastern Canada’s Prairies will change to mostly snow and will prevail through Tuesday with a few insignificant showers or snow and a little rain Wednesday and Thursday - Moisture

totals will vary from 0.25 to 0.80 inch with a few areas to get as much as 1.75 inches by Wednesday from east-central through southeastern Saskatchewan and north-central North Dakota (this includes what fell overnight) - Snow

accumulations will range from 4 to 10 inches with local amounts of 10 to 16 inches - Eastern

Saskatchewan and Manitoba will be most impacted - This

precipitation event will be a huge boon to the eastern Prairies lifting topsoil moisture after prolonged drought. There will be need for additional precipitation, but this event will change the planting outlook for some of the driest areas and provide relief

to producers over planting and early season crop development potential. The western half of Saskatchewan, east-central and southern Alberta will still have a big need for moisture, but that will be harder to come by for a while - Argentina

weather this week will be wettest in the north during mid-week - Rainfall

of 0.30 to 0.80 inch will result with a few amounts of 1.00 to 2.00 inches - Salta

and northern Santiago del Estero to Corrientes and southern Paraguay will be wettest - Net

drying elsewhere - Other

showers and thunderstorms are expected in the west late this week through early next week with net drying elsewhere - Argentina

rainfall April 18-24 weather is advertised drier than that of Sunday improving the summer crop maturation and harvest outlook, despite a few showers - Argentina

temperatures will be near to above average this week and cooler in many areas next week - Frost

and a few freezes may occur in the far south after April 22, but confidence is low - Argentina

rainfall during the weekend was excessively great Friday in east-central Santa Fe where more than 6.00 inches resulted. Similar amounts occurred Thursday into Friday morning in west-central Santa Fe making that region too wet - Rain

surrounding this heavy rainfall region ranged from 1.00 to 2.63 inches with a couple of amounts over 3.00 inches - Rain

also fell from eastern La Pampa to central Buenos Aires with 1.00 to 2.28 inches and local amounts over 3.50 inches - Mostly

dry weather occurred in the far north of Argentina including some important cotton areas while rainfall elsewhere was mostly under 1.20 inches with many areas less than 0.60 inch - Argentina’s

bottom line is still viewed as being mostly good, although there may be a little more rain falling a little more often than desired in the far north for a little while this week. Net drying in central Argentina this week will be very important for firming

the soil after recent excessive rain. Fieldwork will be slow resuming in the wettest areas. Returning wet weather April 18-23 in the heart of summer crop production areas may slow down crop maturation and harvest progress once again, but good field work is

expected until then outside the areas that received 6.00 inches of rain recently. Some of the advertised precipitation for next week may be a little overdone. The cold air advertised for mid- to late-week next week is likely overdone as well and as that airmass

moderates so might the rain intensity for next week. Frost and freeze potentials in the far south after April 22 will be closely monitored, but confidence is low for now.

- Brazil

was mostly dry during the weekend with temperatures warm in much of the nation, but not excessively warm; quick drying occurred in many areas - Brazil

rainfall will be limited through Thursday from Mato Grosso do Sul and northwestern Parana into Bahia resulting in additional net drying - Some

showers will occur briefly Friday into Saturday, but resulting rainfall will not change topsoil moisture in a significant manner - Alternating

periods of rain and sunshine will occur from Friday into next week, but, resulting rain amounts will be light at times.

- Rain

will occur continue more frequently in Mato Grosso and areas east into parts of northern Goias and Tocantins where 0.50 to 1.50 inches of rain will result through Saturday and another 0.25 to 0.75 inch and local totals to 1.25 inches next week

- A

full restoration of soil moisture is not likely in interior southern and center south Brazil next week, although relief from dryness is expected. Low subsoil moisture is expected to continue, despite some increase in topsoil moisture. World Weather, Inc.

believes additional showers and thunderstorms will occur in Brazil into the last days of this month, but the intensity and coverage of rain will not be much better than that noted for next week leaving a need for greater rain as May approaches. Safrinha corn

conditions will be most stressed through Friday and then some relief is expected thereafter into late month, but the improvement will still be erratic. All corn needs is timely rainfall during reproduction and its yields can still be favorable, but a bigger

soaking of rain would be preferred. - Tropical

Cyclone Seroja moved through Western Australia Sunday - The

storm brought some beneficial moisture inland, although official amounts were notably lighter than expected

- Wheat,

barley and canola production areas of Western Australia did not benefit nearly as much as expected from this storm - Some

wind damage occurred on the coast from Shark Bay to Geraldton; peak wind gusts reached 105 mph near the coast - Power

outages occurred in many areas and reports of tree and property damage occurred in these coastal areas and a short distance inland - No

winter crop has been planted yet and the largest concern was over agricultural property damage due to strong wind speeds - All

of southern Australia will still need generalized rain in the next few weeks to bolster soil moisture for future wheat, barley and canola planting, but Western Australia will benefit from Seroja’s moisture - Western

Europe received some needed moisture during the weekend - France

reported 0.30 to 1.58 inches of rain during the weekend and central through northwestern Spain and Portugal received 0.20 to 1.57 inches

- The

improved topsoil moisture will be helpful to winter crops that are breaking dormancy and had been drying down recently - Europe

weather this week and out ten days will be wettest from southern Spain into Italy, southern France and a part of the eastern Adriatic Sea nations - The

precipitation will further improve soil moisture in parts of southern France, Spain and parts of Italy

- Most

other areas in Europe will either experience status quo soil moisture or net drying conditions - Winter

crops will continue to slow in developing because of ongoing cooler biased weather this week, but next week will trend warmer - CIS

grain and oilseed areas will continue plenty moist except in Russia’s Southern Region and Kazakhstan where there is need for more moisture this spring and summer - Winter

crops are still dormant or semi-dormant especially in the central and north where snow is still melting - Greening

is expected in southern areas this week as a notable warming trend occurs - Significant

warming is expected this week that will more significantly melt snow and warm soil temperatures

- Some

improved planting conditions may evolve in parts of Ukraine and Russia’s Southern Region and winter crops will break dormancy a little more significantly because of the coming warmth - However,

cooling will return during the weekend and into next week limiting the amount of new crop development at evolves

- Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas - Some

beneficial rain fell across parts of this region recently, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - India

weather will continue good for this time of year with restricted rainfall and warm temperatures supporting winter crop maturation and harvest progress - Rain

may fall heavily in Bangladesh and neighboring areas of eastern India briefly this week and again next week - China

weather remains mostly very good, although portions of the Yangtze River Basin are too wet and need to dry down - Northern

crop areas in China are favorably moist and poised to support aggressive winter and spring crop development this year once additional warming takes place - Net

drying will occur in east-central parts of China including much of the North China Plain over the next two weeks

- North

Africa will experience a favorable mix of weather over the next ten days, although resulting rainfall is not likely to be very great in some areas - All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture - Northwestern

Algeria and southwestern Morocco need rain most - Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Rainfall

will be a little lighter and less frequent than usual over for a while longer, but improved rainfall should occur later this week and into the coming weekend

- Temperatures

have been and will continue to be warmer than usual keeping evaporation rates very strong until greater rain evolves - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops - Net

drying is expected for a while which will support faster crop maturation and will eventually support early season harvest progress - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand weather will be a little lighter than usual during the coming ten days, but recent rain in western parts of South Island and a few areas in western North Island was welcome and good for moistening the soil - Many

areas are still drier biased and need the increased rainfall - Temperatures

will be seasonable - Southeastern

Canada will see below average precipitation and warmer than usual temperatures over the next ten days except in southwestern Ontario where there will be some increase in rainfall this week - Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days - Rain

is needed in many areas - Drought

is prevailing across most of the nation - Southern

Oscillation Index this morning was +1.60 and the index will move in a narrow range through next week.

Source:

World Weather inc.

Monday,

April 12:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Malaysian

Palm Oil Board data on March end-stocks, output, exports - Malaysia’s

April 1-10 palm oil export data from SGS - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 13:

- China

customs to publish trade data, including imports of soy, edible oils, meat and rubber - France’s

agriculture ministry updates on 2021 crop plantings - Malaysian

Cocoa Board releases 1Q 2021 cocoa grinding numbers - HOLIDAY:

Thailand

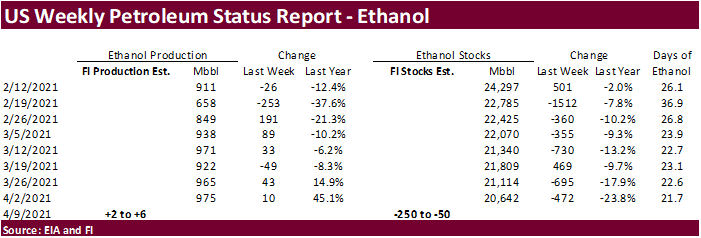

Wednesday,

April 14:

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

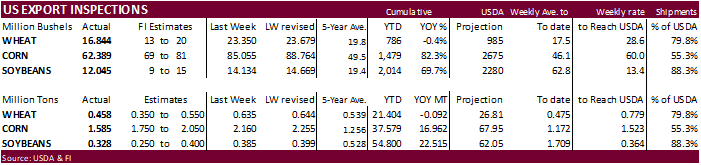

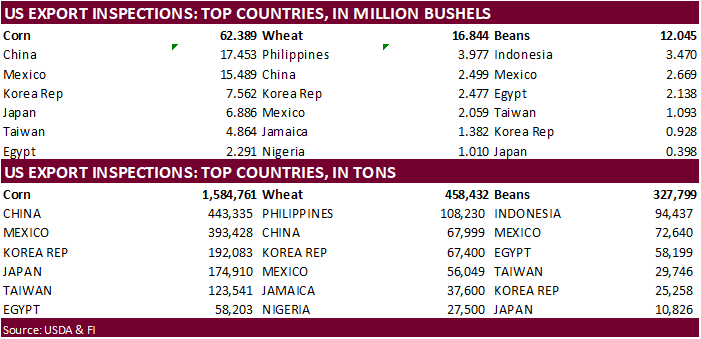

USDA

inspections versus Reuters trade range

Wheat

458,432 versus 300000-550000 range

Corn

1,584,761 versus 1200000-2100000 range

Soybeans

327,799 versus 100000-400000 range

China

took 443,000 tons of corn and 68,000 wheat.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 01, 2021

— METRIC TONS —

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/01/2021 03/25/2021 04/02/2020 TO DATE TO DATE

BARLEY

100 1,497 0 32,620 30,499

CORN

1,912,211 1,720,251 1,279,364 35,676,394 19,439,980

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

100 399 0 3,691 3,243

RYE

0 0 0 0 0

SORGHUM

165,647 244,739 9,160 4,612,580 1,787,116

SOYBEANS

298,252 439,930 301,111 54,385,688 31,809,227

SUNFLOWER

0 0 0 0 0

WHEAT

594,032 306,579 350,190 20,902,559 20,833,533

Total

2,970,342 2,713,395 1,939,825 115,614,041 73,904,118

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macro

Canada

Adjusted Inflation At 1.5% In February (prev 1.1% Non-Adjusted) – StatsCan

Corn

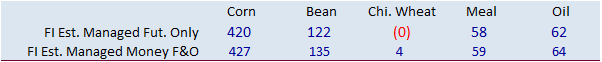

- CBOT

2020-21 corn was

lower on fund selling. New crop was unchanged to moderately lower on talk of dry weather in the US weather forecast (renewing drought fears) for US corn areas and bear spreading. May corn fell 8.25 cents and December was unchanged. US planting delay concerns

for the Delta and lower Midwest after weekend rains stalled fieldwork progress lifted corn higher this morning but the longer term forecast really caught traders attention. Note additional rains and cool temperatures this week are expected to continue to

slow fieldwork progress. - Today

was day three of the “Goldman Roll.” - Funds

on Monday sold an estimated net 11,000 corn contracts. - USDA

US corn export inspections as of April 08, 2021 were 1,584,761 tons, within a range of trade expectations, below 2,160,490 tons previous week and compares to 1,176,514 tons year ago. Major countries included China for 443,335 tons, Mexico for 393,428 tons,

and Korea Rep for 192,083 tons. - AgRural

warned Brazil producers who planted second corn outside the ideal climate window are bracing for potential yield losses across the Center-South. - Rains

will occur across Brazil’s northern Mato Grosso this week. Central Parana and western RGDS will see light rain.

- The

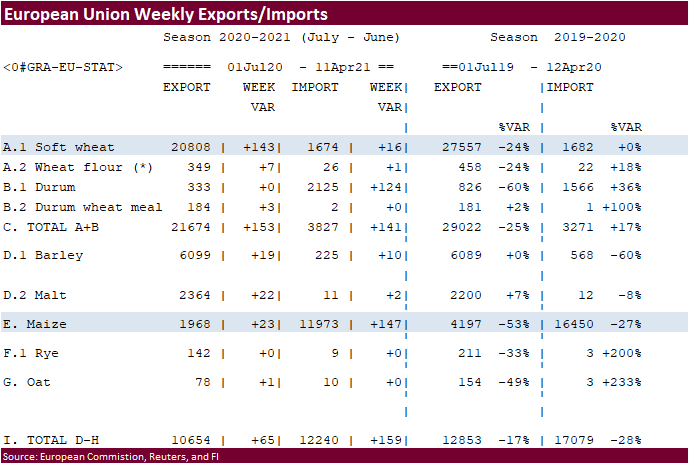

European Union granted imports licenses for 147,000 tons of corn imports, bringing cumulative 2020-21 imports to 11.973 MMT, 27 percent below same period year ago

Export

developments.

- None

reported

Updated

4/9/21

May

corn is seen in a $5.55 and $6.00 range (up 15, unch)

July

is seen in a $5.25 and $6.00 range

December

corn is seen in a $3.85-$5.50 range.

- CBOT

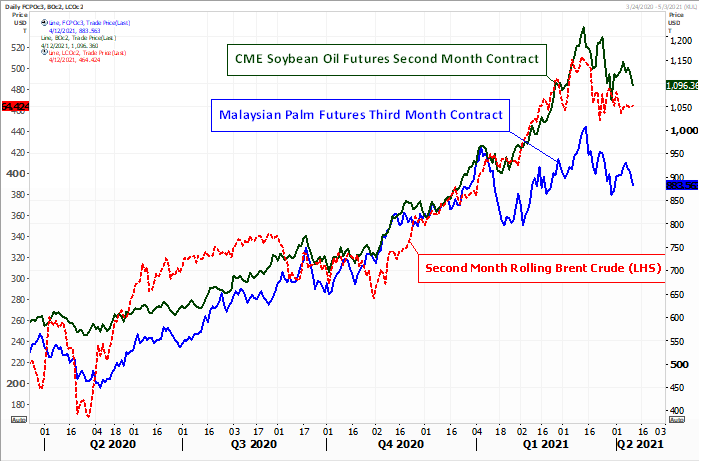

soybean oil led soybeans to the downside, at least initially. CBOT May soybean futures contract fell 21 cents to settle at $13.82 a bushel, May soyoil settled 1.40 cents lower at 51.45 cents and CBOT May soymeal futures rose 70 cents to $401.90 per ton. CBOT

soybeans are

sharply lower with the May contract breaking below its 50-day MA of $14.11/bu. Soybean oil is lower on weakness in palm oil and talk of Brazil cutting back on biodiesel blending. We think this will be short lived until Brazil crushers get more access to soybeans,

but domestic prices need to ease. Malaysian June palm oil ended up falling 3 percent to a one week low after MPOB reported higher than expected end of March palm oil stocks. Cash fell around 2.7% to $940/ton. Soybean meal is on the defensive, but losses are

limited on product spreading.

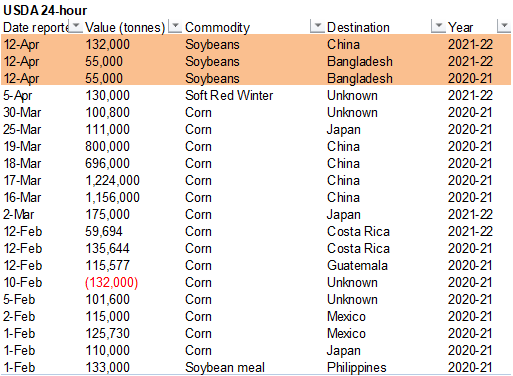

- Under

the 24-hour announcement system, private exporters reported export sales of 132,000 tons of soybeans for delivery to China during the 2021-22 marketing year and export sales of 110,000 tons of soybeans for delivery to Bangladesh. The last USDA 24-hour soybean

sale was back on January 29 for 132,000 tons of 2021-22 soybeans to China, and last 2020-21 sales was 126,500 tons for unknown.

- Chicago

soybean meal basis was up $1.00 to 2 under while KC (MO) and Fostoria (OH) fell $4.00 to 10 and 2 under, respectively.

- AgRural

reported the Brazil soybean harvest at 85% complete as of April 8 compared to 78% a week earlier and 89% a year earlier. Soybean production is seen at 133 million tons.

- Brazil

will temporarily reduce biodiesel blending requirements for diesel fuel to 10% from 13%. About 70% of Brazil’s biodiesel is produced from soybean oil. Biodiesel prices are up sharply in part to rising domestic soybean prices that are available for crushers.

The government may restore the 13 percent mandate as soon as more soybeans become available to crushers.

- USDA

US soybean export inspections as of April 08, 2021 were 327,799 tons, within a range of trade expectations, below 384,662 tons previous week and compares to 475,597 tons year ago. Major countries included Indonesia for 94,437 tons, Mexico for 72,640 tons,

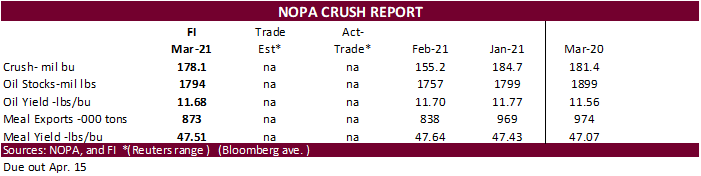

and Egypt for 58,199 tons. On Thursday we will get a March US NOPA crush estimate and we look for the daily rate to rebound from the weather impacted February figure.

- Safras

& Mercado estimates Brazil soybean producers sold 14 percent of their upcoming 2022 crop. The crop will not be planted until later this year. For this year, a separate group, Datagro, estimates Brazil farmers sold 66.6% of their soybean crop through April

2, above a 57.1% five-year average. - Funds

on Monday sold an estimated net 12,000 soybean contracts, bought 1,000 soybean meal and sold an estimated 7,000 soybean oil.

- ITS

reported April 1-10 Malaysian palm oil exports at 345,010 tons, up 11.3% from the previous month. AmSpec reported 343,356 tons, up 10.3%.

- Malaysia’s

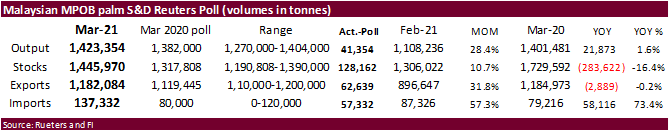

palm oil inventories showed March stocks rising 10.7% to 1.446 million tons, higher than expected, from the month of February, but still 283,622 tons below a year ago. March production was up 41,354 tons. Palm exports increased 25% to 1.12 million tons.

- Malaysian

palm oil: (uses settle price).

Malaysian June palm oil ended up falling 3 percent to a one week low. - The

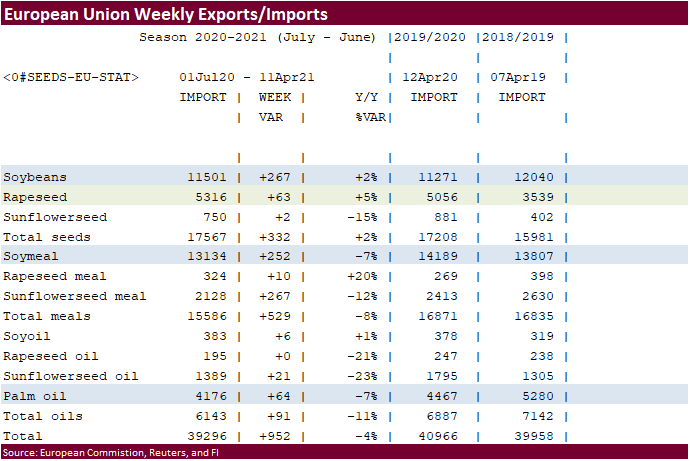

European Union reported soybean import licenses since July 1 at 11.601 million tons, above 11.271 million tons a year ago. European Union soybean meal import licenses are running at 13.134 million tons so far for 2020-21, below 14.189 million tons a year ago.

EU palm oil import licenses are running at 4.176 million tons for 2020-21, below 4.467 million tons a year ago, or down 7 percent. - European

Union rapeseed import licenses since July 1 were 5.316 million tons, above 5.056 million tons from the same period a year ago.

- Under

the 24-hour announcement system, private exporters reported export sales of 132,000 tons of soybeans for delivery to China during the 2021-22 marketing year and export sales of 110,000 tons of soybeans for delivery to Bangladesh. Of the total, 55,000 tons

is for 2020-21 and 55,000 tons is for delivery during the 2021-22 marketing year. - USDA

seeks 35,000 tons of soybean meal for the Food for Progress export program on April 14, of which 11,000 tons for Ivory Coast and 24,000 tons for Ghana.

- Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on April 15 for arrival June 1-20. Payment is for at sight and 180-day letter of credit.

- Egypt’s

GASC bought 20,000 tons of refined bottled vegetable oils for May and June shipment. Last week we picked up they were in for at least 3,000 tons of soybean oil and 2,000 tons of sunflower oil for May 15‐Jun 5 shipment on Sunday (AgriCensus).

-

8,000

tons of soyoil at 19,850 (equating $1,262.72) -

5,000

tons of soyoil at 19,860 (equating to $1,263.35) -

10,000

tons of soyoil at 19,800 (equating to $1,259.54) -

3,000

tons of soyoil at 20,100 (equating to $1,278.62) - 3,000

tons of soyoil at 20,000 (equating to $1,272.26)

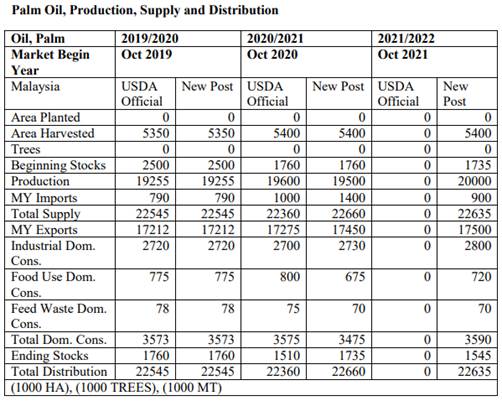

USDA

Attaché for Malaysian palm oil

Source:

Reuters and FI

Updated

4/9/21

May

soybeans are seen in a $13.75 and $15.50 range (unch, down 25)

November $10.50-$14.50

May

soymeal is seen in a $395 and $415 range (unch, down $10)

December $325-$5.00

May

soybean oil is seen in a 51 and 55 cent range (up 100, unch)

December 40-60 cent wide range

- US

wheat markets were lower on a less threatening Black Sea weather forecast and lower CBOT soybeans. Cold temperatures remain a concern for the US western and central Great Plains, however, some analysts noted to newswires that lack of US export demand threatened

high priced US wheat futures. We do not disagree with this notion but its too early to tell if new crop US supplies will soon be snapped up by major importing countries, that now include the mix of grain feed hungry China, given weather woes across rival

Canadian and European export competitors. Crop condition and weather updates by France and other EU countries this week should be monitored. Stories today on EU sugarbeats taking a weather hit from the recent cold is something to keep in mind. US winter

wheat crop conditions today came in at expectations. Meanwhile, Black Sea wheat prices started to fall after rising five consecutive weeks, a sign new crop supplies will undermine America (SA and NA) competition. Heathy shipments of US wheat in months ahead

should not be ignored if China runs into a summer grain production crop problem.

- USDA

US all-wheat export inspections as of April 08, 2021 were 458,432 tons, within a range of trade expectations, below 635,487 tons previous week and compares to 662,173 tons year ago. Major countries included Philippines for 108,230 tons, China for 67,999 tons,

and Korea Rep for 67,400 tons. - September

Paris wheat fell 0.75 euro to 198.75 euros. - Black

Sea region crop areas of Belarus, Ukraine, southwest Central Region, and southwest North Caucasus should see rain this week. Weekend rains across the US central/southeastern NE, eastern KS, eastern OK, and eastern TX saw rain. Additional rain will fall today

through Wednesday across eastern OK, east central TX. But with that front will be cold temperatures. Western NE and northern CO will see snow Thursday into Friday. Other southern Great Plains areas will see rain late workweek. The Canadian Prairies will

dry down after snow occurs today through Tuesday favoring southern and eastern Saskatchewan and Manitoba. - FranceAgriMer

sees the French wheat rating declining after recent cold weather impacted Europe.

- Funds

on Monday sold and estimated net 9,000 CBOT SRW wheat contracts. - Last

week China did end up selling 515,209 tons of wheat out of auction, 13 percent of what was offered, smallest weekly percent sold since December 23.

- IKAR

reported Russian wheat export prices were higher last week, snapping a five-week decline. Back Sea 12.5% protein was at $247 a ton FOB at the end of last week, up $2 from the previous week. Barley prices fell by $2 to $233 a ton.

- ProZerno

sees Russian 2021 wheat crop at 78 million tons. - SovEcon

on Friday raised their ‘21 Russian wheat production projection by 1.4 million tons to 80.7.

- APK-Inform

reported Ukrainian wheat export prices decreased $7 a ton over the past week.

- The

European Union granted export licenses for 143,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 20.806 MMT, well down from 27.557 million tons committed at this time last year, a 24 percent decrease. Imports are

near unchanged from year ago at 1.682 million tons.

- Algeria’s

OAIC seeks 50,000 tons of durum wheat on Wednesday, April 14, valid until Thursday, April 15, for shipment between May 1-15 and May 15-31.

- Jordan

postponed their 120,000 ton import tender of animal feed barley from April 6 to April 13.

- Japan

in its weekly SGS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by September 30.

- Ethiopia

seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/9/21

May Chicago wheat is seen in a $6.20‐$6.75 range (up 20, up 15)

May KC wheat is seen in a $5.70‐$6.15 range (up 20, up

15)

May MN wheat is seen in a $6.25‐$6.75 range (up 50, up

25)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.