PDF Attached

US

CPI (M/M) Mar: 0.1% (est 0.2%; prev 0.4%).

Two-sided

trade for most of the US agriculture markets. The USD was down 68 points by 1:30 PM CT. Bull spreading was a feature for soybeans, corn and Chicago wheat. Some suggested improved US weather for plantings pressuring back months, a tightening US old crop cash

market for soybeans and corn, and Black Sea shipping concerns. Nearby Chicago wheat likely followed (nearby fund buying) the other two May contracts.

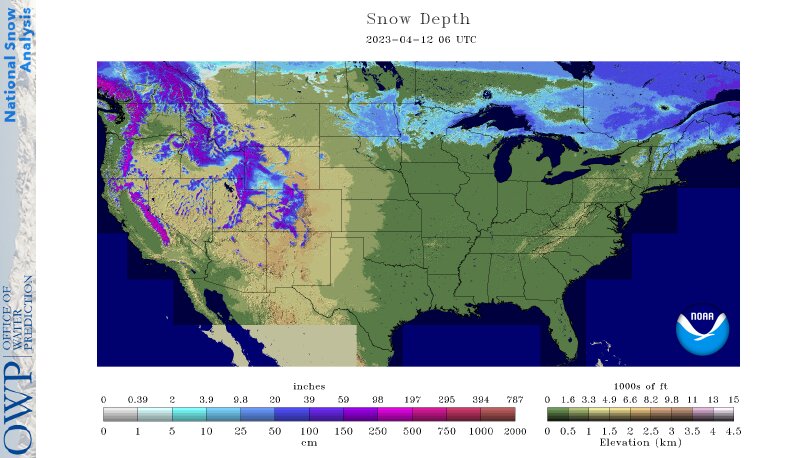

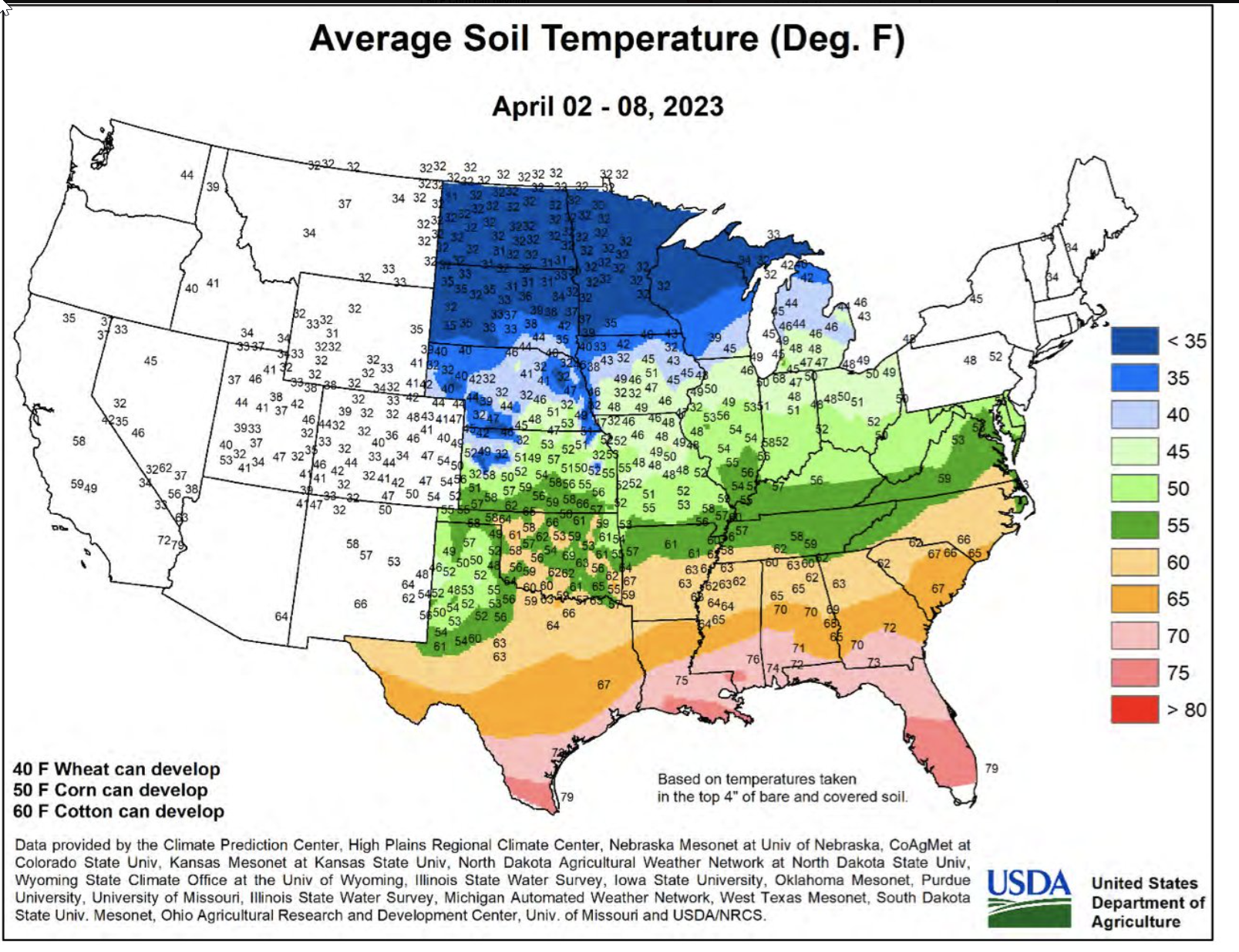

The

US area covered with snow was 14.8% as of the 12th, down from 17.5% previous day. Many areas of the US will see near or record high temperatures through Friday, from a large warm corn ridge. This should result in rapid melting of the deep snowpack

across the upper Great Plains.

World

Weather Inc.

-

Not

many changes occurred overnight -

Aggressive

snowmelt is impacting the upper U.S. Midwest and northeastern Plains today with a notable reduction in snowpack already noted -

Portions

of Minnesota are already snow free and much of the remaining areas will get that way today -

Eastern

North Dakota snow melt has been significant, and more is likely overt the next few days, although the snow melt rate will slow greatly late this week as temperatures turn colder once again

-

Rain

and snow will impact portions of the region Friday into Saturday with 0.10 to 0.75

-

U.S.

west-central and southwestern Plains; including key wheat producing areas as well as some important corn, sorghum and cotton production areas need significant rain -

Spain,

Portugal and North Africa remain drier biased with little opportunity for change in the next ten days -

California

and the southwestern desert region cotton areas will be left dry for the next ten days -

Interior

southern Alberta through west-central Saskatchewan will receive very little precipitation in the next ten days -

Drought

will prevail in this region -

Snow

and rain fell in western and northern Alberta, Canada Tuesday and the region will return to a drier bias today -

The

moisture added to the runoff from recent melting snow to keep the ground wet -

Drying

will occur for the next few days -

Southeastern

half of Saskatchewan and southern Manitoba will receive snow and rain late this week that will add to runoff from melting snow and complicate the anticipated flood coming to the Red River Basin -

Snow

accumulations of 2 to 6 cines will be common with local totals over 12 inches possible, but it will be a heavy, wet, snow and will melt quickly in some areas -

A

moisture boost is expected from south-central through east-central Saskatchewan and in much of Manitoba -

U.S.

Delta weather is improving after rain fell abundant in the south last weekend -

Drying

is expected, but it will be slow -

U.S.

southeastern states will receive rain again late this week and again during the weekend to maintain slow field progress because of wet conditions -

Argentina’s

central and southern crop areas will not receive much significant precipitation for a while supporting good summer crop maturation and harvest progress -

Recent

rain in Brazil has been improving topsoil moisture after drying down earlier this month and in late March -

Greater

rain is forthcoming in the next ten days and that may saturate the soil in many areas of center south crop country -

Safrinha

corn and cotton in Brazil are rated favorably and the outlook through much of this month is favorable -

Some

sugarcane and coffee areas in Brazil are expected to be a little too wet in the next ten days and some drying might be welcome -

Europe

soil moisture and crop conditions outside of the southwest will remain favorable over the next couple of weeks -

Rain

from Belarus and Ukraine into Russia’s Southern Region during the next ten days will be ideal for promoting winter crop development -

Spring

planting is expected to advance slowly because of rain -

Western

Russia crop conditions are improving with drier weather after too much precipitation fell earlier this season while snow was melting aggressively.

-

India

crop weather should be mostly good during the next ten days -

Warm

temperatures and restricted rainfall will promote winter crop maturation and some early harvesting -

Showers

in Maharashtra will be welcome, but not likely to change sugarcane conditions much -

China

weather is nearly ideal for winter crop development (wheat and rapeseed) and the outlook remains favorable -

Spring

planting should be advancing well with little change likely. -

Some

rapeseed areas may trend a little too wet again in the coming week, but the situation should not be too bad -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Southern

Australia pre-planting weather is mostly good for wheat, barley and canola -

Additional

rain is expected in South Australia, Victoria and southwestern New South Wales during the coming week -

Eastern

Australia summer crop maturation and harvest weather has been and will continue to be favorable -

South

Africa late season summer crop maturation and harvest weather is very good with little change likely -

Middle

East rainfall will be greatest from eastern Turkey into Iraq and western Iran -

The

moisture will be good for cotton and rice planting as well as other crops -

Some

wheat will still benefit from the moisture, but it is getting a little late for a big improvement -

Mainland

areas of Southeast Asia are still in need of greater rain, although the situation is not critical

-

Poor

pre-monsoonal shower and thunderstorm activity has been occurring in many areas and improved rainfall will soon be needed -

West-central

Africa rainfall has been very good this season in coffee and cocoa production areas as well as some rice and sugarcane areas -

There

is need for greater rain in cotton areas where planting normally occurs from now through June -

Eastern

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Mexico

remains in a drought, though eastern and far southern parts of the nation will get some periodic rain -

A

tropical disturbance will impact the northern Philippines over the next three days, but the impact will be low -

Tropical

cyclone 18S (Isa) was 205 miles west northwest of Broome, Western Australia at 1300 GMT today -

The

storm was producing 115 mph sustained wind speeds and additional intensification was expected prior to landfall which is expected to be 133 miles east of Port Hedland.

-

The

storm will become quite intense with wind speeds sustained at over 150 mph prior to landfall with landfall expected well east of Port Hedland Wednesday Night or during the day Thursday -

The

system needs to be closely monitored for possible impact on Port Hedland, but is expected to occur in a low populated part of northern Western Australia where the impact should be low.

-

Indonesia

and Malaysia rain intensity is becoming lighter and this trend will continue for a while -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.51 and it should move erratically over the next several days

Source:

World Weather, INC.

Bloomberg

Ag calendar

Thursday,

April 13:

- China’s

1st batch of March trade data, including soybean, edible oil, rubber and meat & offal imports - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

CONAB publishes production, area and yield data for corn and soybeans - FranceAgriMer

monthly grains balance sheet - Port

of Rouen data on French grain exports - HOLIDAY:

Thailand

Friday,

April 14:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

India, Thailand

Source:

Bloomberg and FI

Macros

U.S.

Mar Cpi +0.1% , Exfood/Energy +0.4% (est 0.2%; prev 0.4%)

U.S.

Mar Real Earnings All Private Workers -0.1% Vs Feb -0.4% (Prev -0.4%)

U.S.

Mar Cpi Year-Over-Year +5.0%, Exfood/Energy +5.6%

U.S.

Short-Term Interest Rate Futures Price In Less Chance Of 25-Bps Fed Hike In May After Inflation Data

106

Counterparties Take $2.304 Tln At Fed Reverse Repo Op. (prev $2.297 Tln, 109 Bids)

US

MBA Mortgage Applications Apr 7: 5.3% (prev -4.1%)

US

30-Yr Mortgage Rate Apr 7: 6.3% (prev 6.4%)

US

DoE Crude Oil Inventories (W/W) 07-Apr: +597K (est -1.050M; prev -3.739M)

–

Distillate Inventories: -606K (est -200K; prev -3.632M)

–

Cushing OK Crude Inventories: -409K (prev -970K)

–

Gasoline Inventories: -330K (est -1.900M; prev -4.119M)

–

Refinery Utilization: -0.30% (est 0.55%; prev -0.70%)

EIA:

US Crude Inventories In SPR Off 1.6 Mln Bbls To 369.58 Mln

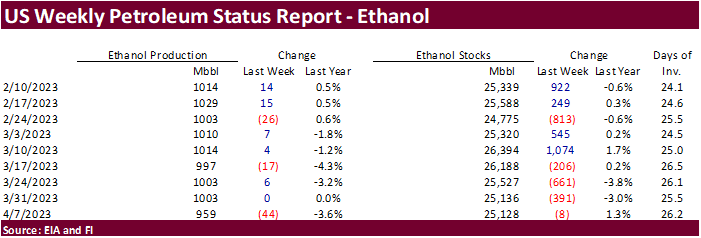

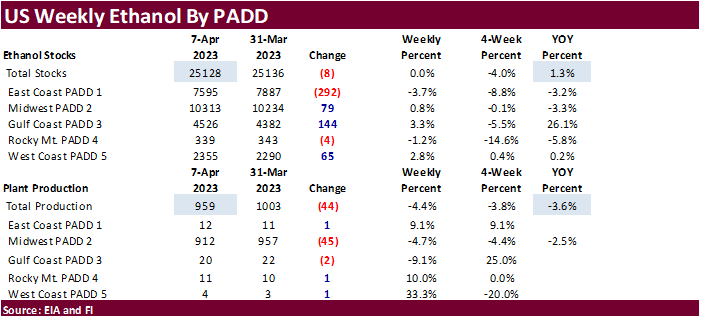

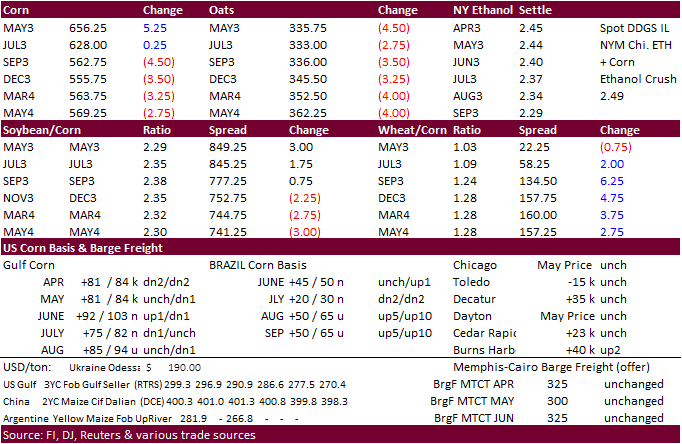

Corn

·

Bull spreading in US corn futures sent May corn 5 cents higher. July ended unchanged and back months lower. There was again talk of ethanol plants sourcing corn, but EIA did report a large drop in weekly US ethanol production.

Improving US weather pressured back months. Same could be said for soybeans. Index rolling and spec spreading trading could be noted.

·

Today was day 3 of the Goldman Roll.

·

The USDA Broiler Report showed eggs set up slightly and chicks placed down 1 percent. Cumulative placements were up slightly from the same period a year earlier.

·

US corn plantings are expected to rapidly advance this week with warmer and drier conditions for the Corn Belt.

US

DoE Crude Oil Inventories (W/W) 07-Apr: +597K (est -1.050M; prev -3.739M)

–

Distillate Inventories: -606K (est -200K; prev -3.632M)

–

Cushing OK Crude Inventories: -409K (prev -970K)

–

Gasoline Inventories: -330K (est -1.900M; prev -4.119M)

–

Refinery Utilization: -0.30% (est 0.55%; prev -0.70%)

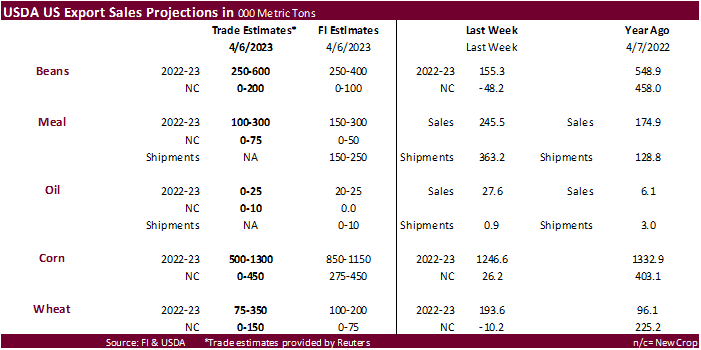

Export

developments.

-

Taiwan’s

MFIG bought about 65,000 tons of corn, optional origin, for May 26-June 14 shipment, later if sourced from the US PNW and/or South Africa. The corn was purchased at an estimated premium of 179.50 cents a bushel c&f over the July contract.

Updated

04/11/23

May

corn $6.10-$7.00

July

corn $5.75-$7.00

·

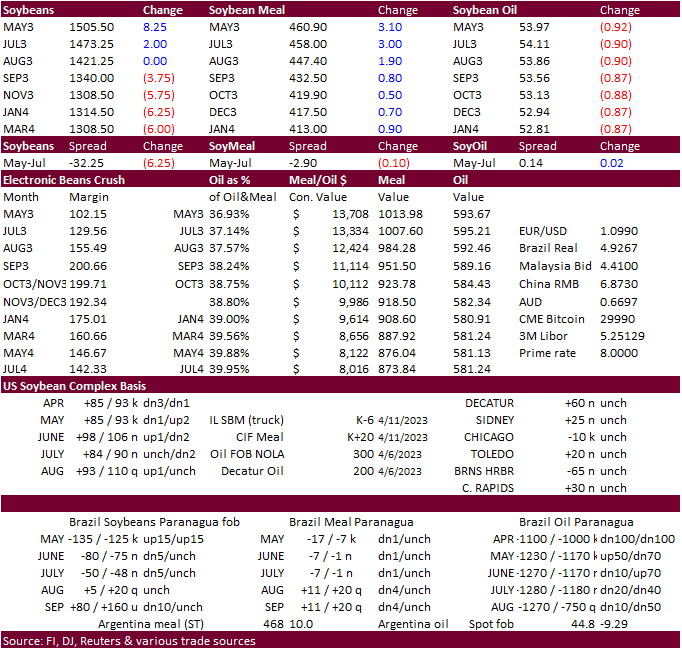

Soybeans ended mixed on bull spreading. Soybean oil fell from lower rival vegetable oil markets. Soybean meal was higher from product spreading and slow Argentina producer sales under the new FX program. Malaysian palm oil futures

were down sharply overnight (113 ringgit), settling at a 12-day low, on concerns over the slowing export pace.

·

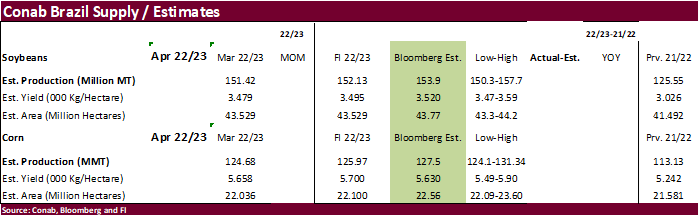

Brazil’s soybean basis was up about 15 to 25 cents today.

·

Abiove raised their estimate of Brazil’s soybean exports for 2023 by 1.4 million tons to 93.7 million tons. They also took meal exports up by 300,000 tons to 21 million. Soybean production was left unchanged at 153.6 million tons.

Stocks were lowered to 9.6 million from 11 million.

·

US ECB soybean basis has firmed from the previous week for selected locations, pressuring cash crush margins.

·

European Union soybean imports so far for the 2022-23 season at 9.47 million tons by April 9, down 13% from 10.86 million a year earlier. EU rapeseed imports reached 6.36 million tons, up 59%. Soybean meal imports were 12.17

million tons, down nearly 5%.

·

France’s AgMin estimated the 2022-23 rapeseed area at 1.34 million hectares, up 9.3% versus 2022, and 11.1% above a 5-year average.

·

(Bloomberg) — Indonesia, the world’s biggest palm oil supplier, is reviewing its export policy as it seeks to regulate domestic supplies after the peak demand season of Ramadan, according to a senior government official.

Export

Developments

-

None

reported

Updated

04/11/23

Soybeans

– May $14.50-$15.25, November $12.25-$15.00

Soybean

meal – May $420-$480, December $325-$500

Soybean

oil – May 53.00-57.00,

December 49-58

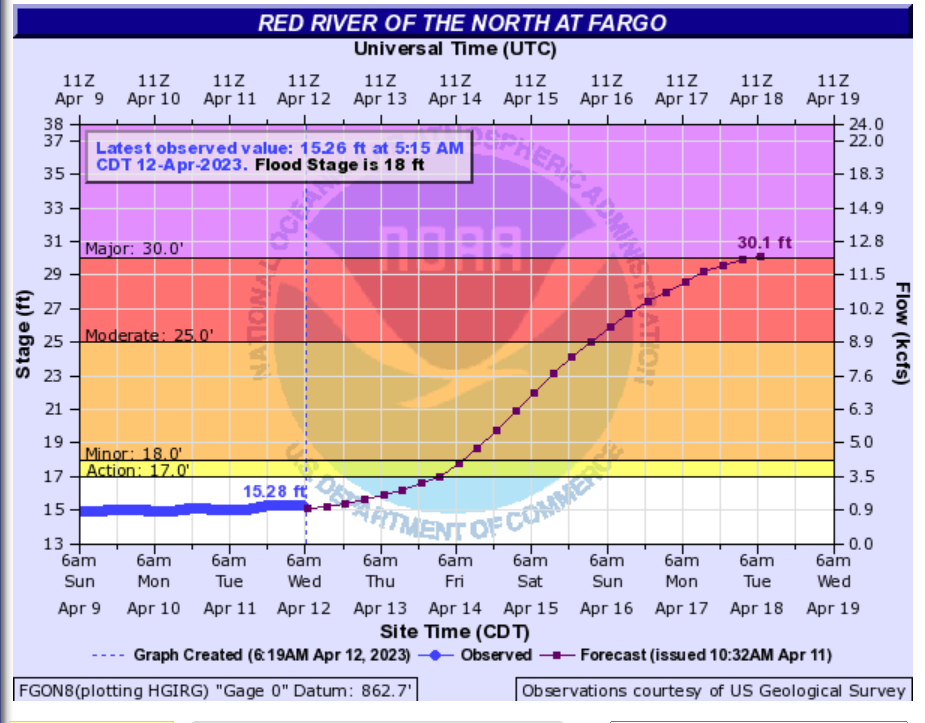

·

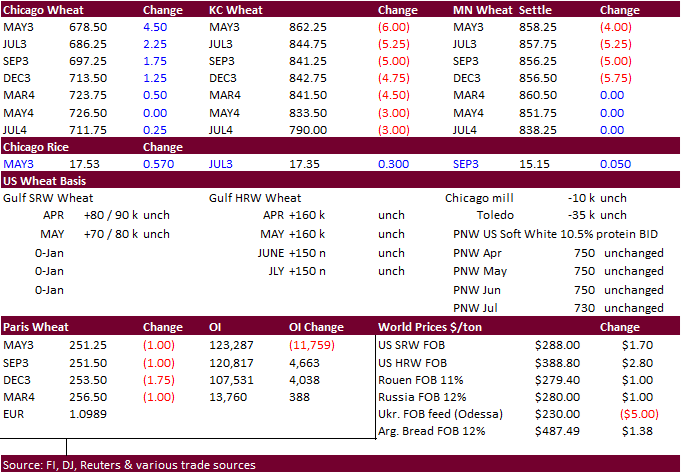

Chicago wheat futures

traded higher led by the nearby contracts. KC and MN were lower, in part to profit taking against Chicago futures. All three markets were higher earlier after Russia made additional negative comments of the grain export deal. They mentioned the deal is ‘not

so great.’ Russia would like to a see some sanctions eased. Russia

has said it may end their term if issues are not resolved in 60 days.

·

Algeria’s durum wheat import tender is still open.

·

Unseasonable warm temperatures are expected to melt the snowpack across the upper US, resulting in flooding bias Red River Basin.

·

The eastern US wheat areas will see some rain. CO will see some rain later this week (day 3-4). Other western areas will be mostly dry.

·

European Union soft wheat exports since July 1, 2022, reached 23.83 million tons by April 9, up from 22.08 million tons a year earlier.

·

France’s AgMin estimated the 2022-23 soft wheat area and spring wheat at 4.77 million hectares, up 1.7% versus 2022 but down from a previous estimate of 4.75 million.

·

Romanian producers are seeking a ban on Ukraine grain imports due to the influx of arrivals.

·

(Reuters) – Egypt’s cabinet has raised the local wheat procurement price for the 2023 season to 1,500 pounds ($48.59) per ardeb (150 kilograms), it said in a statement on Wednesday. The new price is a 50% increase of the initial

price the cabinet had set in August of 1,000 Egyptian pounds.

Export

Developments.

·

Algeria seeks at least 50,000 tons of durum wheat, for May-June shipment. The tender is still open as of early afternoon.

·

South Korea millers bought 45,000 tons of US wheat for June shipment at $270-$350/ton, depending on variety.

-soft

white wheat 10% to 11% protein content high $270s a ton

-soft

white wheat of 8.5% protein bought in the low $280s a ton

-hard

red winter wheat of 11.5% protein bought in the mid $360s per ton

-northern

spring/dark northern spring wheat of 14% protein bought in the mid $350s a ton (Reuters)

·

South Korea’s NOFI group bought around 60,000 tons of feed wheat, optional origin, at $305.86/ton c&f for arrival in SK around September 24. Russia, Argentina, Pakistan, Denmark and China were excluded.

·

Japan’s AgMin passed on feed wheat and bought 380 tons of feed barley for arrival in Japan by September 28.

·

Jordan passed 120,000 tons of feed barley for October through November 15 shipment.

·

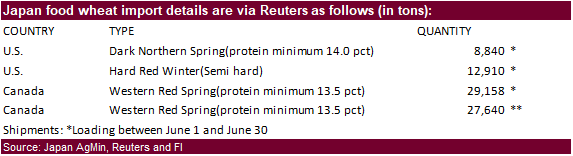

Taiwan Flour Millers Association seeks 52,850 tons of million wheat from the US on April 13 for May 31-June 14 shipment via PNW.

·

Japan seeks 78,548 tons of food wheat from the US and Canada later this week for June shipment.

·

Jordan seeks 120,000 tons of wheat on April 18 for Oct-FH Nov shipment.

Rice/Other

·

(Bloomberg) — Sugar climbed again in New York, hitting the highest in a decade on persistent worries about tight global supplies. Meanwhile, corn extended declines toward a one-month low as Brazilian production is set to rise,

heating up the competition with US supplies.

Updated

04/11/23

KC

– May $8.25-9.00

MN

– May

$8.40-$9.00

#non-promo