PDF Attached

May

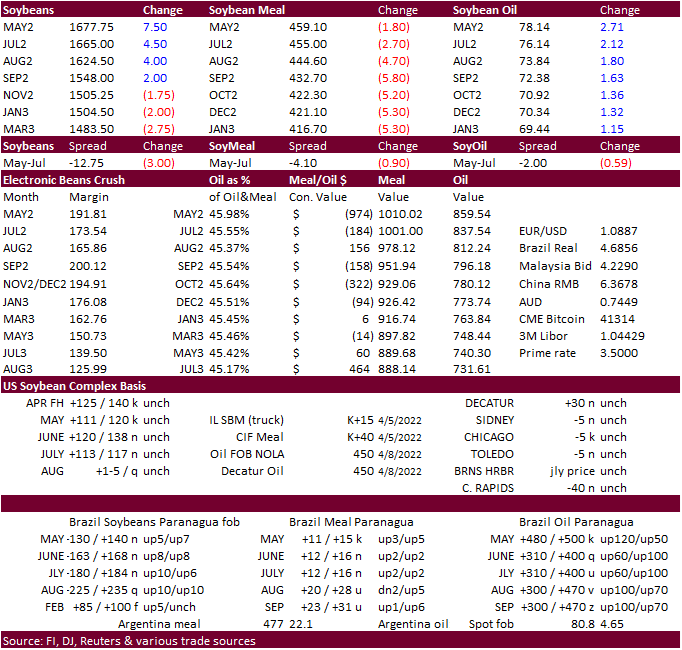

corn and May soybean oil hit a contract high today. Soybean oil was supported by US supply concerns after a major railroad company told some customers to trim their privately owned cars on their network so they can free up congestion in selected parts of the

country. There is a concern the US crush rate will slow. Meal ended lower and soybeans rallied. The strong soybean oil prices sent May crush to $1.92. Wheat opened lower but rebounded on strong global demand and lower USD.

![]()

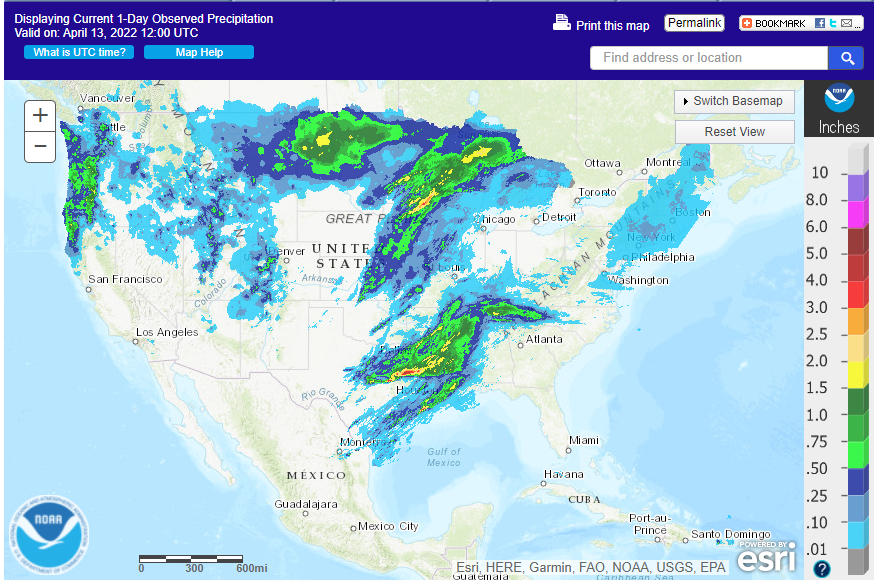

24-H

as of early Wed afternoon

WEATHER

EVENTS AND FEATURES TO WATCH

- La

Nina’s intensification continues with the Southern Oscillation Index at +13.80 and still rising - The

index should be marching toward another peak of intensity expected later this month before some weakening evolves for a little while

- The

March PDO Index was -1.0 from the Joint Institute for the Study of the Atmosphere and Ocean – this is the original Index, not the same as NOAA’s index, but similar

- The

Index shows a weakening trend in negative PDO since the fourth quarter of 2021, but be very cautious of how you interpret this change because in all of the years when strongly negative PDO was present in the fourth quarter it always weakened during the winter

and spring, but the following summer was still drier biased especially in the Plains and western Corn Belt - The

weakening in this trend should not be misunderstood to mean the chances of dryness in the central U.S. for the summer are diminishing

- World

Weather, Inc. still believes both the La Nina and negative PDO will be with us through spring and probably the summer as well with La Nina weakening more significantly than PDO during the summer - Blizzard

and near-blizzard conditions continue to occur and evolve across the far northern U.S. Plains and they will advance into southeastern Canada’s Prairies today and Thursday - Additional

snowfall of 6-12 inches are expected in northern North Dakota, 4 to 10 inches in southeastern Saskatchewan and 8 to 20 inches in southern Manitoba - Snowfall

as of dawn today was greatest near Dickenson, North Dakota where 17 inches had been reported many areas from southeastern Montana through the heart of North Dakota reported 6-15 inches and more snow is expected

- Today’s

greatest snow will shift a little more to the north as noted above - Cold

temperatures in Canada and the north-central United States will prevail into the weekend preventing much snow melt and lowering soil temperatures so that spring planting is stopped in the few areas that had actually begun to process - Snow

reported in southeastern Montana Tuesday and early today will be beneficial for future planting of spring crops - Temperatures

in the northern U.S. Plains and Canada’s Prairies will get back closer to normal next week - Significant

relief from drought is still not likely in the southwestern Canada Prairies during the next week to ten days, despite some limited precipitation next week - Western

U.S. hard red winter wheat areas will remain dry or mostly dry through the next ten days - Some

computer forecast models have suggested a rising precipitation potential might occur after April 22, but World Weather, Inc. has its doubts that significant precipitation will impact the high Plains portion of the southwestern Plains - West

and South Texas will be dry for ten days - A

few showers of limited significance are expected in April 23-28, but confidence is low - California’s

Sierra Nevada will receive brief bouts of precipitation over the next week to ten days, but resulting moisture will not be great enough to seriously bolster snowpack or change spring runoff potentials - Most

of the southwestern United States will continue dry over the next two weeks - U.S.

Midwest, Delta and Tennessee River Basin are not expecting excessive rainfall to occur over the next ten days to two weeks, but mild to cool temperatures at times along with saturated soil conditions and brief periods of additional rainfall will maintain poor

planting conditions. - U.S.

southeastern states will be drying down over the next couple of weeks, although some showers and thunderstorms will occur infrequently to temporarily slow the drying process - Canada’s

western Prairies are not expected to get much precipitation in the coming week, although there is some potential for light precipitation in the April 20-26 period.

- Ontario

and Quebec will experience routinely occurring precipitation this week maintaining moisture abundance. - Excessive

rainfall ended in southern Natal, South Africa Tuesday. - Additional

rain totals were over 6.00 inches after 11 inches were noted Sunday night into Monday morning - Flood

damage was suspected of being greatest in urban areas, but some agricultural areas nearly also suffered from the excessive rain event - Argentina

is moving into a full week of dry biased weather - Temperatures

will be seasonable - Late

next week’s weather will trend a little wetter and cooler - Rain

is expected in the second half of the week and it may disfavor the northwest - Late

season crops will benefit most from the moisture, but very little is needed at this point in the growing season - Temperatures

will be a little frosty again early next week, but early indications suggest damage potentials would not be any greater than that which occurred in last week’s frost event - Some

frost was noted in pockets today - Rain

fell significantly Tuesday and early today from central and western Mato Grosso do Sul into northern Parana and the southwest half of Sao Paulo with rainfall of 0.60 to nearly 3.91 inches resulting - Relief

has occurred to some of the dryness in Mato Grosso do Sul - Brazil’s

rain from Tuesday will shift northward today and Thursday passing briefly through the drier areas of northern Mato Grosso do Sul, Mato Grosso and southern Goias offering temporary relief.

- Rainfall

of 0.25 to 0.75 inch and a few amounts over 1.00 inch are expected - The

moisture will be welcome after recent drying, but more will be needed to protect subsoil moisture reserve for use during the dry season which is beginning to evolve - Late

season crops reproduce in late April and May making the next few weeks very important to Safrinha corn and cotton - Additional

timely rain will be needed - Brazil’s

center west, center south and interior far south will be dry after today and Thursday’s rain event for at least a week and maybe a little longer. - Some

partial relief to dryness is expected in Mato Grosso do Sul, northern Mato Grosso, Bahia and northern Minas Gerais, but moisture deficits will remain - Typhoon

Malakas, the season’s first typhoon in the western Pacific Ocean poses no threat to major land masses - Malakas

may pass very near to the island Iwo To late this week, but it will stay southeast of Japan’s main islands - Central

Europe will experience less precipitation over the next ten days and a seasonable range of temperatures - Totally

dry weather is not likely, but precipitation should be light and relatively infrequent - The

environment will be very good for fieldwork in time as soil temperatures rise - France,

Spain, Portugal and neighboring areas of Northwestern Africa will get most of the significant rain maintaining a favorable outlook for winter and spring crops - Western

Russia, Ukraine, Belarus and the Baltic States will experience brief periods of rain and snowfall during the next two weeks and temperatures should average relatively near normal with a slight cooler bias west of the Ural Mountains at times - snow

cover will continue to retreat from western and northern Russia - runoff

from melting snow will continue to keep some areas wet this week, despite more limited precipitation

- North

Africa will experience a favorable mix of rain and sunshine during the next ten days while temperatures are seasonable - India’s

weather will continue mostly dry in the bulk of the nation, but some occasional rain will occur in Kerala, and a few areas in both southern Karnataka and Tamil Nadu with minimal impacts on the region away from the coast - Rain

will also continue frequently from eastern Bangladesh through the Eastern States - West-central

Africa precipitation is expected to be more frequent and more significant over the next ten days to two weeks improving soil moisture for coffee, cocoa, sugarcane, rice and cotton

- East-central

Africa rainfall is expected to slowly increase in Ethiopia, Uganda and southwestern Kenya during the next ten days with next week wettest - The

change will be most welcome in Ethiopia where the dry season is coming to an end - Turkey

will experience a good mix of rain while areas to the southeast from Syria through Iraq are dry and only limited rain is expected in Iran - These

drier areas could experience some hot and dry weather in the next few weeks - China

weather is expected to see typical spring weather over the next two weeks - Rainfall

will be greatest near and south of the Yangtze River - Precipitation

will be sporadic and mostly light in the North China Plain, Yellow River Basin and interior portions of the northeast - Xinjiang,

China precipitation will be mostly confined to the mountains over the next couple of weeks - The

moisture will be great for improving spring runoff potential due to the fact it will occur largely as snow in the higher elevated areas - Temperatures

will be warmer than usual - Australia

precipitation is expected to be mostly limited to coastal areas over the next ten days - The

exception will be in Western Australia where some rain will fall periodically improving topsoil moisture for autumn planting that begins late this month - The

dry-biased environment in eastern Australia will be good for maturing cotton and sorghum as well as their harvests - South

Africa rainfall over the next couple of weeks may be a little too frequent for some early season summer crop maturation and harvest progress - Heavy

rain in Natal should is now over - Late

season crops will benefit alternating periods of rain and sunshine, but there is need drying to accelerate maturation and support harvest progress - Cotton

quality could be compromised - Rain

will fall frequently and abundantly near and north of the Amazon River into Colombia, Venezuela and Ecuador during the next ten days - Rain

will also fall frequently in Peru - Some

flooding could impact a part of the Amazon River System and Colombia in time - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will be seasonably dry this week and will receive sporadic rainfall of limited significance next week - Central

America precipitation will be greatest in both Panama and Costa Rica - Guatemala

and western Honduras will also get some showers periodically - Rain

elsewhere will be mostly along the Caribbean Sea coast - Southeast

Asia rainfall will continue frequent and abundant - No

area in the mainland areas, Philippines, Indonesia or Malaysia are expected to be too dry - Too

much rain may impact east-central Philippines and a part of the northern Malay Peninsula this week

Source:

World Weather Inc.

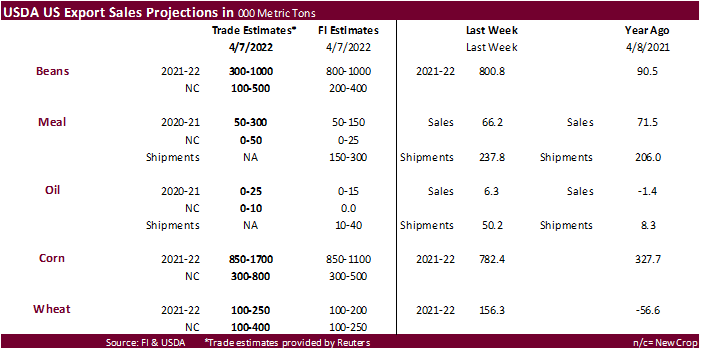

USDA

Scheduled Release Dates for Agency Reports and Summaries

https://www.usda.gov/media/agency-reports

2022

CME Globex Trading Schedule

https://www.cmegroup.com/tools-information/holiday-calendar.html

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

first batch of March trade data, incl. soybean, edible oil, rubber and meat imports - FranceAgriMer

report; monthly French grains outlook - New

Zealand food prices - Holiday:

Thailand

Thursday,

April 14:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - May

ICE white sugar contract expiry - HOLIDAY:

Argentina, India, Thailand

Friday,

April 15:

- ICE

Futures Europe weekly commitments of traders report - U.S.

green coffee stockpiles data released by New York-based National Coffee Association - FranceAgriMer

weekly update on crop conditions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Major markets closed due to Good Friday holiday

Source:

Bloomberg and FI

US

MBA Mortgage Applications Apr 8: -1.3% (prev -6.3%)

US

MBA Mortgage 30 Year Rate Apr 8: 5.13% (prev 4.90%)

US

PPI Final Demand (M/M) Mar: 1.4% (est 1.1%; prev 0.8%)

US

PPI Ex Food And Energy (M/M) Mar: 1.0% (est 0.5%; prev 0.2%)

US

PPI Ex Food And Energy (Y/Y) Mar: 9.2% (est 8.4%; prev 8.4%)

US

PPI Final Demand (Y/Y) Mar: 11.2% (est 10.6%; prev 10.0%)

·

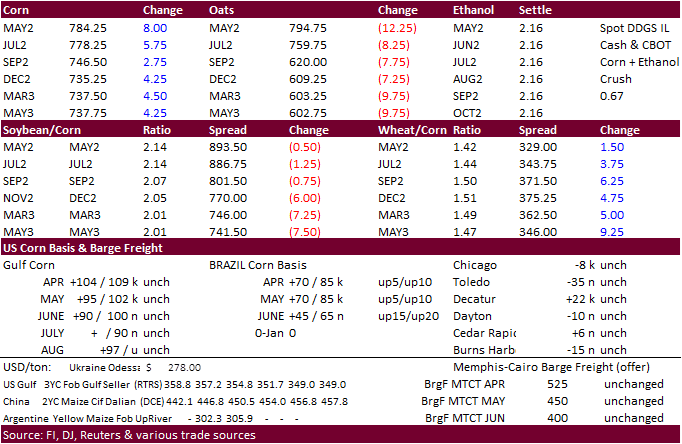

May corn hit a contract high, settling 7.25 cents higher at $$7.8350/bu. July settled up 5.50 cents and December up 4.75 cents.

·

Some of the buying was related to higher energy prices, lower USD and the White House Administration announcement that will grant E15 ethanol blending during the summer driving months, June 1 through September 15.

·

But be cautious with the E15 news. Many industry leaders warned E15 is hard to achieve. A news outlet mentioned only 1.5% of US gas stations carry E15. Some analysts see little or no impact from the summer E15 blend program.

·

With no end in sight to the war, and Ukraine’s corn crop expected to shrink by about 40 percent from year ago, the trade is looking for new-crop global export demand to shift to the US and South America, and other countries.

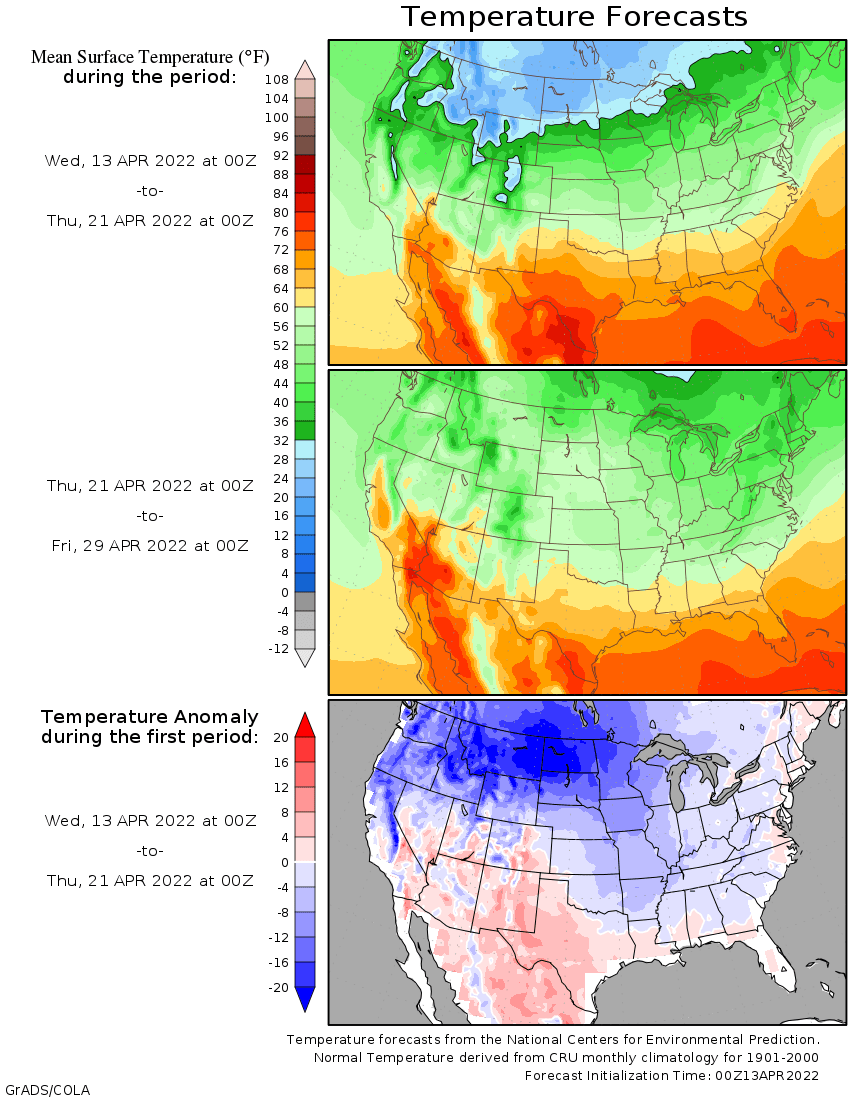

·

US temperatures are trending colder than normal and will last for several days. Plantings in the southern US are not expected to slow but fieldwork progress across the Midwest and Plains could be hindered.

·

Anec: Brazil April corn exports seen at 850,000 tons, up from 60,000 previous estimate.

·

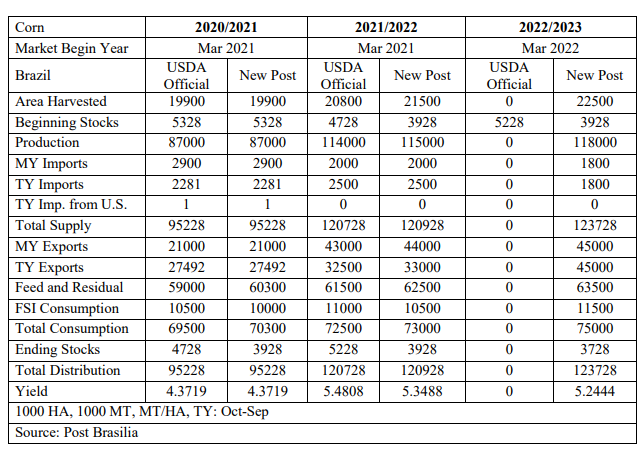

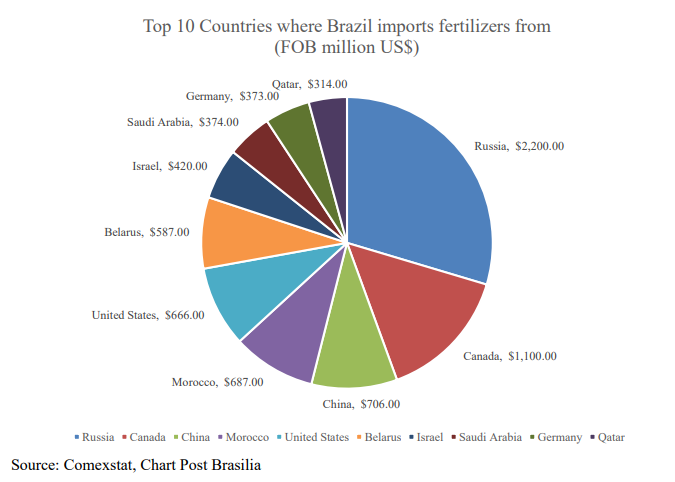

The USDA Attaché looks for new-crop Brazil corn production to reach 118 million tons, up from 115 million tons for this year as they have plantings expanding to 22.5 million hectares from 21.5 million for 2021-22. Conab is at

115.6 million tons for 2021-22. USDA official is at 114 million tons. The report (link below) is a good read, especially for a brush up on Brazil fertilizer information.

·

Germany’s association of farm cooperatives estimated the Germany 2022 corn crop at 4.31 million tons, down 2.8 percent from 2021.

·

The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed up slightly from a year ago. Cumulative placements from the week ending January 8, 2022 through April 9, 2022 for the United States were 2.60 billion.

Cumulative placements were down slightly from the same period a year earlier.

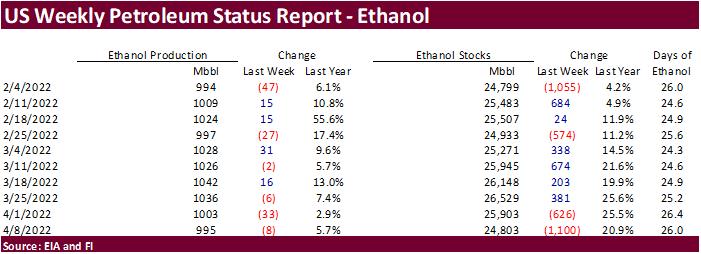

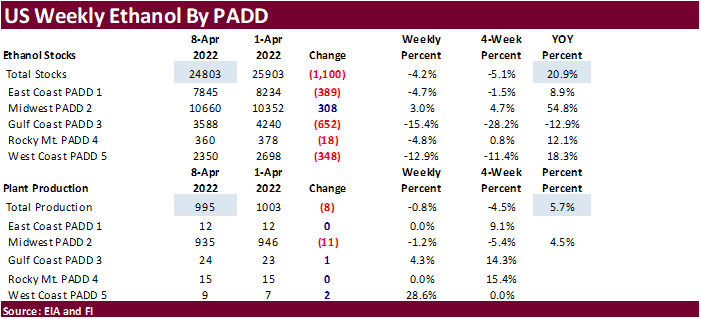

EIA

weekly ethanol update

·

The US weekly EIA ethanol data was viewed neutral to slightly bullish for US corn futures and neutral for US ethanol futures.

·

Weekly US ethanol production decreased 8,000 barrels from the previous week to 995 thousand barrels per day (bbl).

·

Ethanol stocks decreased a large 1.1 million barrels to 24.803 million.

·

For comparison, A Bloomberg poll looked for weekly US ethanol production to decrease 1,000 barrels from the previous week and stocks to decrease 203,000 barrels.

US

DoE Crude Oil Inventories (W/W) 08-Apr: 9382K (est 1000K; prev 2421K)

–

Distillate Inventories: -2902K (est -416K; prev 771K)

–

Cushing OK Crude Inventories: 450K (prev 1654K)

–

Gasoline Inventories: -3648K (est -600K; prev -2041K)

–

Refinery Utilization: -2.50% (est 0.30%; prev 0.40%)

Export

developments.

·

None reported

April

Update to 2022 Crop Budgets: Projected Profits Even with Record Costs

Schnitkey,

G., K. Swanson, C. Zulauf, N. Paulson and J. Baltz. “April Update to 2022 Crop Budgets: Projected Profits Even with Record Costs.”

farmdoc daily (12):49, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 12, 2022.

May

corn is seen in a $7.25 and $8.10 range

December

corn is seen in a wide $5.50-$8.00 range

·

May soybean oil took out its previous contract high of 78.58 cents. Soybeans ended higher after a lower start in part to sharply higher soybean oil that settled up 268 points basis the May contract at 78.11 cents. Potential US

supply concerns and higher crude oil underpinned soybean oil. Soybean meal ended $2.70-$6.00 short ton lower in a risk off session bias bear spreading. May soybean oil gained 55 points over the July contract. May soybeans settled 5.75 cents higher and July

up 4.50 cents.

·

Bloomberg yesterday put out a rail story regarding a major rail operator freeing up some congested areas by taking some privately owned cars off the network. Having a major rail operator contact customers to reduce rail car billings

could affect the food chain. Bad timing when several agriculture commodity markets are at or near multi year highs and energy prices are soaring. One trader noted this could slow the soybean crush if there is a short term shortage of rail cars to move the

byproducts.

·

May soybean crush ripped higher from the strength in soybean oil, ending an impressive 18.50 cents higher at $1.92.

·

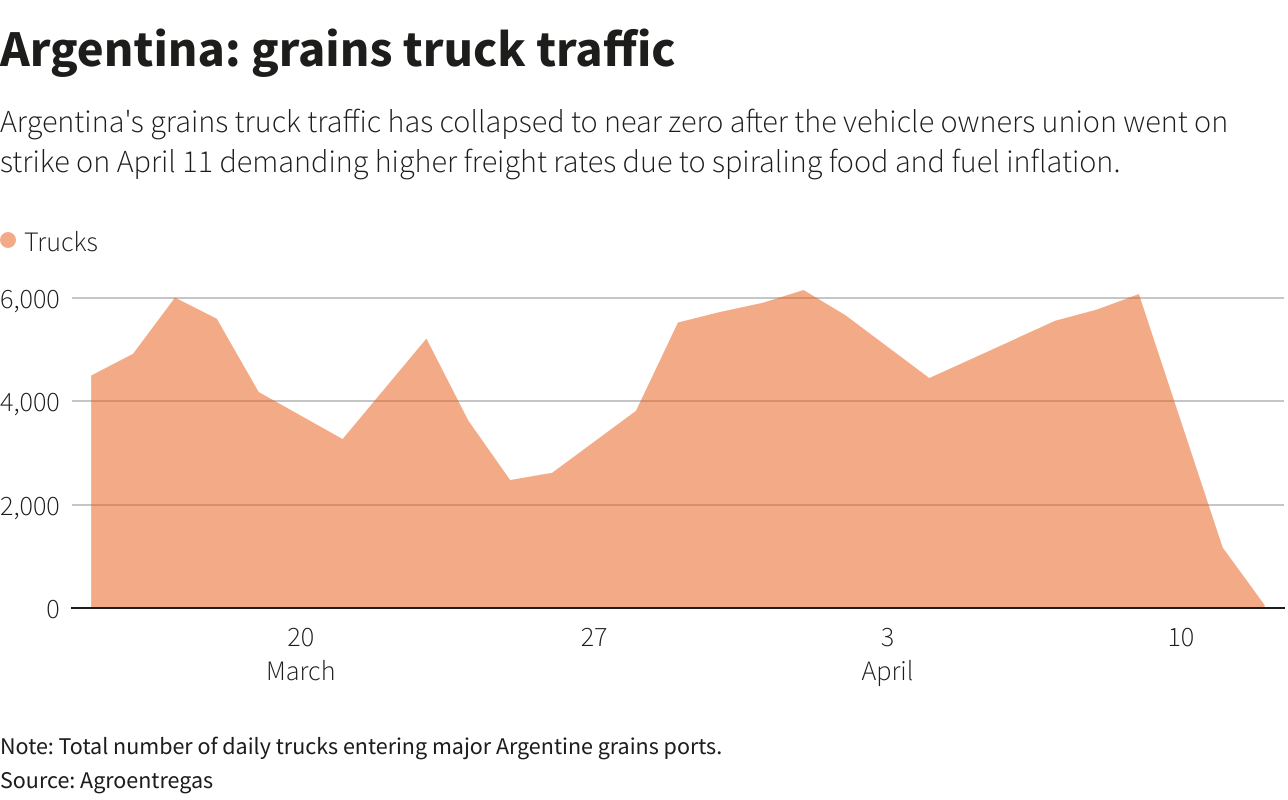

It appears the Argentina truck drivers’ strike will continue after both parties failed to reach an agreement. About 85% of Argentina’s grain is transported around the country by truck. Talks are underway. Some speculate ports/plants

may not see a resumption in deliveries until early next week.

·

China March soybean imports were 6.35 million tons, down 18 percent from 7.77 million tons year ago. January through March imports total 20.28 million tons, down 4.2$ from same period last year. March supplies were tight, but

meal demand was down from a year ago. Poor hog margins and negative crush margins slowed crushing. In addition, China started selling soybeans out of reserves.

·

China’s vegetable oil imports during March were only 307,000 tons, down 61 percent from a year ago and January through March vegetable oil imports were 1.047 million tons, off 63 percent from same period last year.

·

Anec: Brazil April soybean exports seen at 12.023 million tons, up from 11.117 previous estimate.

·

Anec: Brazil April soybean meal exports seen at 2.070 million tons, up from 1.900 previous estimate.

·

Brazil 2021-22 producer soybean sales reached 57 percent 8 points above the previous month and down from about 67% year ago.

·

Germany’s association of farm cooperatives estimated the Germany 2022 rapeseed crop at 3.88 million tons (3.90 estimated in March), up 11.1 percent from 2021.

·

India palm oil imports during the month of March reached 539,793 tons, up 19 percent from February. Soybean oil imports were 299,421 tons, down from 376,594 tons in February. Sunflower oil imports were 212,484 tons, up from 152,220

tons previous month.

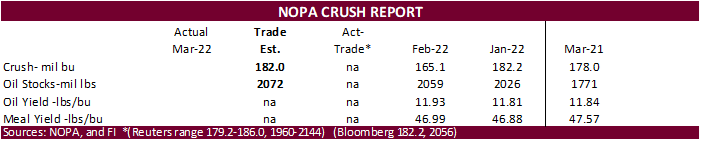

NOPA

will release its March crush report this Friday.

Reuters

published the following graph

·

Three South Korean groups bought a combined 121,000 tons of soybean meal, likely sourced from South America for shipment between May 20 to June 20 with arrival around July 30. MFG bought 60,000 tons at an estimated $595.50 a ton

c&f. KFA and FLC jointly bought 61,000 tons at an estimated $596.99 a ton c&f.

·

China plans to auction off another 500,000 tons of soybeans later this week.

Updated

4/13/22

Soybeans

– May $16.00-$17.75

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 77-82

·

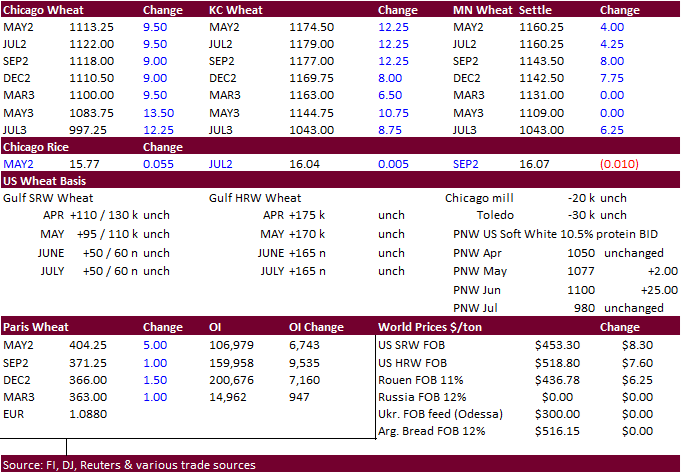

US wheat traded higher after a lower start on ongoing Black Sea concerns, strong global import demand and lower USD. May Chicago wheat hit a three week high. May MN wheat is back to its highest level since March 8. KC May is at

a March 99 high.

·

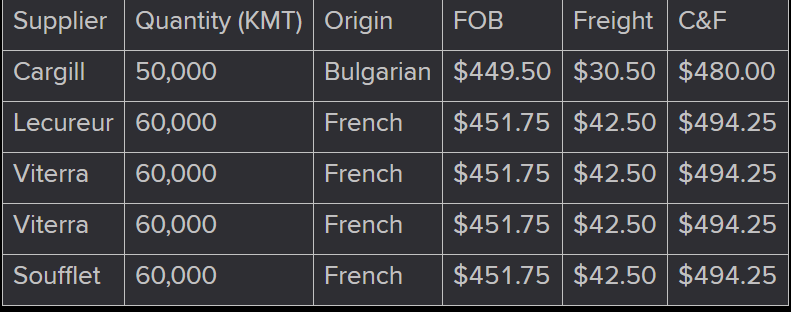

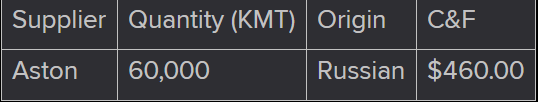

Egypt bought 350,000 tons wheat, 240,000 tons of French wheat, 50,000 tons of Bulgarian wheat and 60,000 tons of Russian wheat.

·

Ukraine’s AgMin said Ukraine could export 2 million tons of wheat by the end of the current season.

·

China’s AgMin said they saw an improvement in the winter wheat conditions. “The percentage of first and second grade grain was on par with normal levels.” Labor shortages and tight fertilizer supplies remain a problem for the

northeastern growing areas.

·

Germany’s association of farm cooperatives estimated the Germany 2022 wheat crop at 22.70 million tons (22.61 million estimated in March), up 6.2 percent from 2021.

·

May Paris wheat futures were up 5.00 euros at 403.00 euros, highest since March 7. December was up 1.50 at 365.25.

·

FranceAgriMer lowered its non-EU soft wheat export forecast to 9.5 million tons from 9.7 million estimated in March. Within the EU the AgMin looks for wheat exports to reach 8.1 million tons, up from 7.8 million previous. Stocks

were left unchanged at 3 million tons.

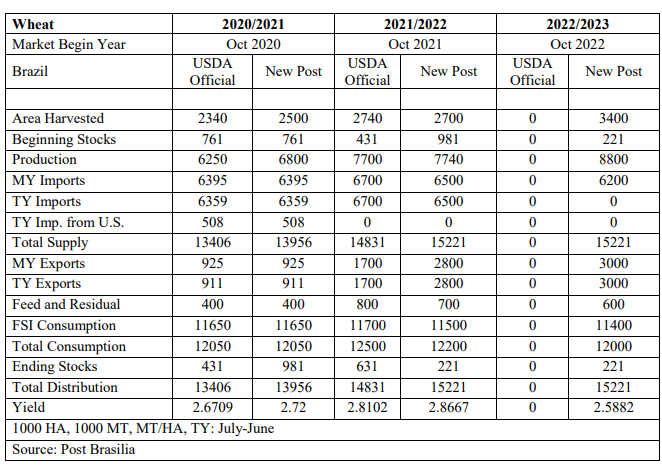

Brazil

looks to be less dependent on wheat imports by increasing plantings.

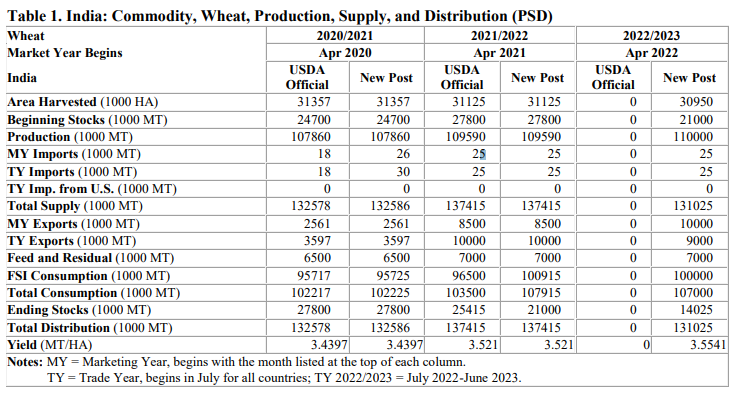

India

is expected to see a sixth consecutive bumper wheat production

·

Updated 4/13. Algeria bought 120,000 tons of wheat at around $460/ton c&f. The wheat is sought for shipment in several periods from the main supply regions including Europe: May 1-10, May 11-20, May 21-31, June 1-10, June 11-20

and June 21-30.

·

Egypt bought 350,000 tons wheat, 240,000 tons of French wheat, 50,000 tons of Bulgarian wheat and 60,000 tons of Russian wheat. Prices ranged from $480.00 to $494.25 per ton, C&F. They last bought 180,000 tons of wheat on February

17, all Romanian, at $338.55/ton C&F, up about $141.45 to $155.70/ton. Shipping was sought during May 20-31 for FOB, and C&F arrival offers will be from June 1-15.

Source:

Reuters

·

Jordan passed 120,000 tons of milling wheat for LH May and/or through July shipment.

·

Jordan seeks 120,000 tons of feed barley on April 19.

·

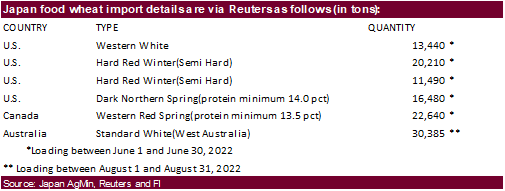

Japan seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on April 20 for arrival by September 29.

·

Japan seeks 114,645 tons of food wheat later this week.

Rice/Other

·

None reported

Updated

4/13/22

Chicago May $9.75 to $12.00 range, December $8.50-$12.00

KC May $10.50 to $12.00 range, December $8.75-$13.50

MN May $10.75‐$12.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.