PDF Attached

USDA

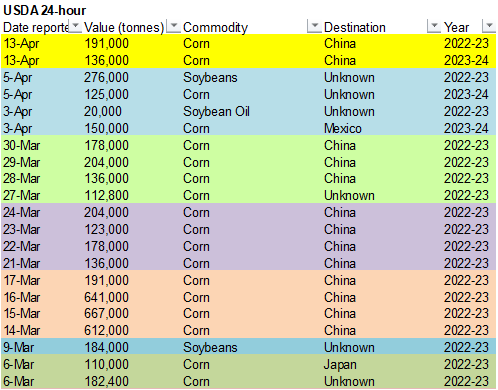

24-H: Private exporters reported sales of 327,000 metric tons of corn for delivery to China. Of the total, 191,000 metric tons is for delivery during the 2022/2023 marketing year and 136,000 metric tons is for delivery during the 2023/2024 marketing year.

Grains

and soybean oil traded lower. The USD was sharply lower and may have limited losses. Soybeans ended higher from a cut in Argentina’s soybean production by a local exchange and strength in soybean meal. The front four months for soybean meal found strength

from slow Argentina producer sales under the new soybean dollar program. Soybean oil was lower following weaker palm oil and other related vegetable oil markets.

CPC:

ENSO-neutral conditions are expected to continue through the Northern Hemisphere spring, followed by a 62% chance of El Niño developing during May-July 2023.

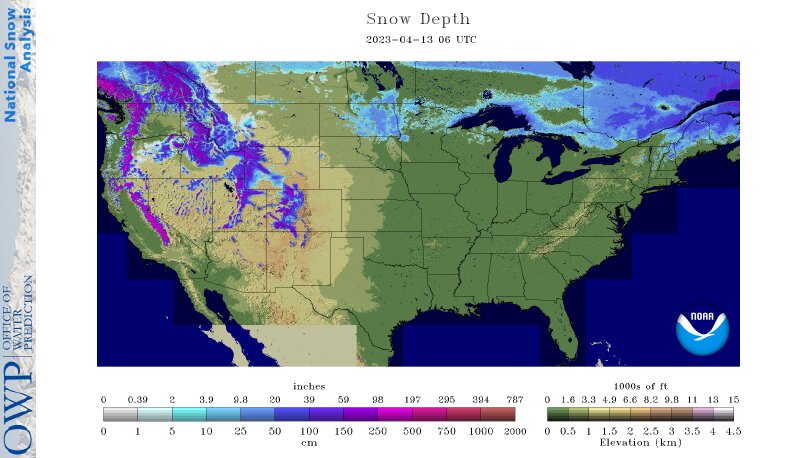

The

US area covered with snow was 13.2%, down from 14.8% as of the 12th and 17.5% April 11th.

WEATHER

TO WATCH

-

Today’s

06z GFS operational model run and the 00z ECMWF model run both introduced more significant cold weather to the central and eastern United States during the second weekend of the two-week outlook -

Both

model Ensembles, however, do not carry the colder weather which leaves room for much debate over these colder outlooks -

The

only reason for watching closely is the 62-day cold cycle that World Weather, Inc. has been monitoring

-

This

cycle, if it still exits, is due to repeat sometime from April 18-23 period -

The

last cold surge assumed to be a part of this cycle occurred Feb. 20 and 62 days later is April 22 -

Previous

cold surges began Oct. 14 and Dec. 15 and lasted a few days thereafter which is why April 18 has always been the leading date, but the cycle in the past has lasted a few days and its repeating may not be exactly 62 days -

Negative

PDO should work hard against the colder weather going as far to the south as it has in the past and because the two patterns will fight each other confidence is still low whether or not there is reason to be concerned about the advertised cold if the pattern

actually evolves which is still questionable -

Until

the Ensembles start carrying the cold confidence will be low -

World

Weather, Inc. anticipates more volatility in coming model runs and will not be surprised to see them restoring a warmer scenario later today -

Fort

Lauderdale, Florida experienced torrential rainfall Wednesday as a super cell thunderstorm became stationary over the city -

The

storm produced 25.60 inches of rain Wednesday with 22.60 of that occurring in seven hours -

This

shattered the old record 24-hour rainfall at Fort Lauderdale set April 25, 1979, when 14.59 inches resulted -

Flooding

was quite serious, but the event was highly localized -

Damage

in the area has been substantial -

Category

Four Tropical Cyclone Ilsa was moving into northwestern parts of Western Australia 80 miles east of Port Hedland today.

-

The

storm was producing torrential rain a huge storm surge and wind speeds gusting between 150 and 184 mph.

-

The

storm will miss the major port facility enough to minimize damage potentials, but the town of Pardoo may be destroyed and so will some of the areas beaches -

There

is very little agriculture in the impacted region -

U.S.

southeastern states will receive additional rain today and Friday with some follow up moisture during the weekend -

The

region is already too wet and needs dry and warm conditions to get farming activity back on track -

U.S.

Delta weather will see less rainfall over the next ten days, although totally dry weather is not likely -

The

region will slowly experience some net drying -

U.S.

west-central and southwestern Plains will continue drier than usual over the next week to ten days, although completely dry conditions not expected in all of the region -

Some

increase in rainfall may occur in the central U.S. Plains during the April 20-26 period -

California

and the southwestern desert areas will remain drier biased during the next ten days -

Snow

melt in the Sierra Nevada will eventually push water reservoir levels in California higher and some release of water from dams will be necessary to accommodate the influx of moisture expected this year.

-

This

may lead to flooding of farm land near the rivers and streams impacted by the water release -

U.S.

Pacific Northwest precipitation recently and that forthcoming has and will continue to increase runoff potentials from the mountains -

Rain

is needed in parts of the Yakima Valley and the middle Snake River Valley -

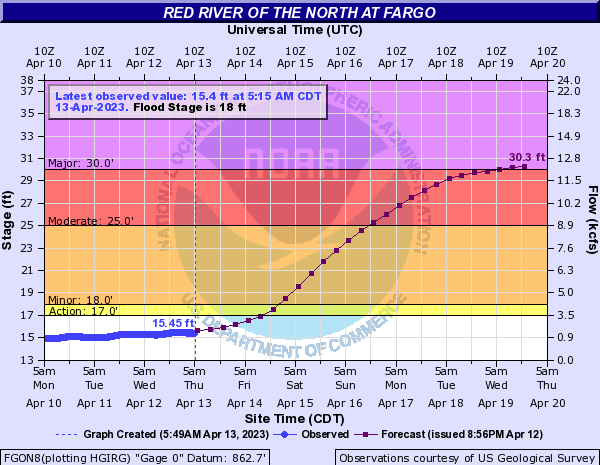

Snowmelt

is continuing across the U.S. Red River Basin of the North where significant runoff and flooding has begun -

The

snowmelt rate may slow after today, but rain expected Friday into Saturday will add to the runoff and aggravate the developing flood situation -

U.S.

Midwest weather will include warm temperatures for the next few days followed by a more seasonable range of temperatures and some periodic precipitation -

Moisture

totals in the lower Midwest should be lighter than usual, but sufficient to support planting and early season crop development between periods of rain -

North

Africa, Spain and Portugal will continue to experience limited precipitation and warm temperatures over the next ten days resulting in rising crop stress in unirrigated areas -

Most

other areas in Europe are experiencing good early spring weather with little change likely over the next ten days -

-

Southeastern

half of Saskatchewan and southern Manitoba will receive snow and rain late this week that will add to runoff from melting snow and complicate the anticipated flood coming to the Red River Basin -

Snow

accumulations of 2 to 6 cines will be common with local totals over 12 inches possible, but it will be a heavy, wet, snow and will melt quickly in some areas -

A

moisture boost is expected from south-central through east-central Saskatchewan and in much of Manitoba -

Interior

southern Alberta through west-central Saskatchewan will receive very little precipitation in the next ten days -

Drought

will prevail in this region -

Rain

from Belarus and Ukraine into Russia’s Southern Region and farther east into northern Kazakhstan through the weekend will be ideal for promoting winter crop development -

Spring

planting is expected to advance slowly because of rain, but immediate improvement is expected next week with drier weather -

Western

Russia crop conditions are improving with drier weather after too much precipitation fell earlier this season while snow was melting aggressively.

-

Safrinha

corn and cotton in Brazil are rated favorably and the outlook through much of this month is favorable -

Mato

Grosso rainfall is expected periodically, but it will be light supporting crop development -

A

boost in precipitation intensity, coverage and frequency might prove beneficial for crops prior to the end of the monsoon season later this month -

Center

south Brazil will receive abundant rainfall in the next week to ten days resulting in ongoing saturated field conditions which will prove beneficial to Safrinha corn development after the rainy season ends later this month -

Argentina’s

central and southern crop areas will not receive much significant precipitation for a while supporting good summer crop maturation and harvest progress -

India

crop weather should be mostly good during the next ten days -

Warm

temperatures and restricted rainfall will promote winter crop maturation and some early harvesting -

Showers

in Maharashtra will be welcome, but not likely to change sugarcane conditions much -

China

weather is nearly ideal for winter crop development (wheat and rapeseed) and the outlook remains mostly favorable -

Spring

planting should be advancing well with little change likely. -

Some

rapeseed areas may trend a little too wet again in the coming week -

Heavy

rain is expected next week and some flooding will be possible -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Southern

Australia pre-planting weather is mostly good for wheat, barley and canola -

Additional

rain is expected in South Australia, Victoria and southwestern New South Wales during the coming week -

Eastern

Australia summer crop maturation and harvest weather has been and will continue to be favorable -

South

Africa late season summer crop maturation and harvest weather is very good with little change likely -

Middle

East rainfall has been greatest from eastern Turkey into Iraq and western Iran -

The

moisture has been good for cotton and rice planting as well as other crops -

Some

wheat will still benefit from the moisture, but it is getting a little late for a big improvement -

Less

rain is expected this weekend and especially next week -

Mainland

areas of Southeast Asia are still in need of greater rain, although the situation is not critical

-

Poor

pre-monsoonal shower and thunderstorm activity has been occurring in many areas and improved rainfall will soon be needed -

This

is impacting some early season sugarcane, rice and coffee development as well as other crops -

West-central

Africa rainfall has been very good this season in coffee and cocoa production areas as well as some rice and sugarcane areas -

There

is need for greater rain in cotton areas from Mali to Burkina Faso and northern Ivory Coast where planting normally occurs from now through June -

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Mexico

remains in a drought, though eastern and far southern parts of the nation will get some periodic rain -

A

tropical disturbance will impact the northern Philippines over the next few days, but not much negative impact is expected -

Portions

of Luzon Island have been drier than usual in recent weeks and the moisture boost should prove beneficial for rice, sugarcane and other crops -

Indonesia

and Malaysia rain intensity is becoming lighter and this trend will continue for a while due to the passing negative phase of Madden Julian Oscillation (MJO) -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.27 and it should move erratically over the next several days

Source:

World Weather, INC.

Bloomberg

Ag calendar

Friday,

April 14:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

India, Thailand

Source:

Bloomberg and FI

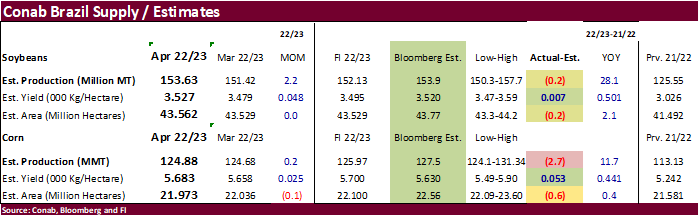

Brazil’s

Conab

reported an upward revision to soybean production by 2.2 million tons to 153.63 million tons, near trade expectations. For comparison, USDA is at 154.0 MMT versus 130.5 MMT year earlier. The Conab Brazil corn production was disappointing as output increased

only 200,000 tons from the previous month to 124.88 million tons, 2.7 million tons below a Bloomberg trade guess. For comparison, USDA is at 125.0 MMT versus 116.0 MMT year earlier.

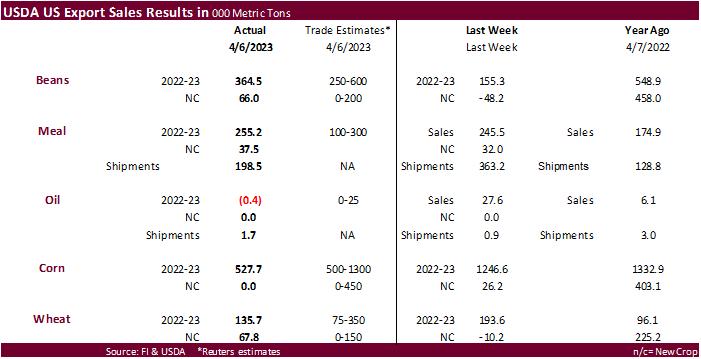

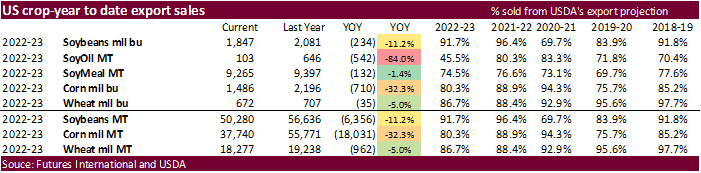

USDA

export sales

Soybean

and soybean meal export

sales were within expectations but soybean oil for 2022-23 were negative 4,000 tons. Shipments were just below 200,000 tons for meal and only 1,700 tons were shipped for soybean oil. The soybean sales included many countries switching from unknown destinations.

New-crop soybean sales of 66,000 tons were for China.

USDA

export sales for corn of 527,700 tons were near the lower end of a range of expectations. Mexico and Japan were the primary buyers, China sales of 140,800 tons included 136,000 tons switched from unknown.

Pork

sales were good at 27,100 tons. Sorghum sales of 65,000 tons were for China.

USDA

export sales for all wheat of 135,700 tons old crop and 67,800 tons new-crop were near the lower end of a range of trade expectations.

Macros

US

PPI Final Demand (M/M) Mar: -0.5% (est 0.0%; prev -0.1%)

US

PPI Ex Food And Energy (M/M) Mar: -0.1% (est 0.2%; prev 0.0%)

US

PPI Final Demand (Y/Y) Mar: 2.7% (est 3.0%; prev 4.6%)

US

PPI Ex Food And Energy (Y/Y) Mar: 3.4% (est 3.4%; prev 4.4%)

US

Initial Jobless Claims Apr 8: 239K (est 235K; prev 228K)

US

Continuing Claims Apr 1: 1810K (est 1835K; prev 1823K)

US

EIA NatGas Storage Change (BCF) 07-Apr: +25 (est +27; prev -23)

–

Salt Dome Cavern NatGas Stocks Change (BCF): -2 (prev +1)

101

Counterparties Take $2.322 Tln At Fed Reverse Repo Op. (prev $2.304 Tln, 106 Bids)

·

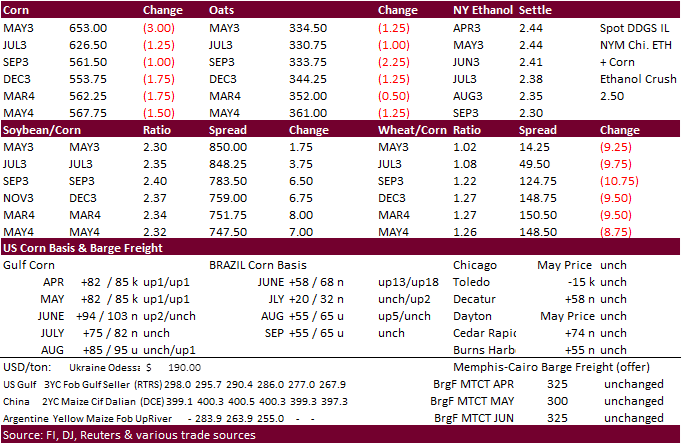

Corn futures traded two-sided for the front month contracts before all 2023 positions ended lower on the day. A sharply lower USD limited losses. There was some profit taking from the bull spreading that occurred yesterday.

·

US new-crop corn plantings are moving along nicely across the central US. A note from Dale Gustafson on a drive between St. Louis to Topeka, KS, mentioned a lot of planters in the fields and creeks mostly dry or with very little

water in them.

·

Argentina’s Rosario grains exchange estimated the Argentina corn production at 32 million tons, down from 35 million tons previously estimated.

Their

2022 forecast was 55 million tons.

·

Today was day 4 of the Goldman Roll.

Export

developments.

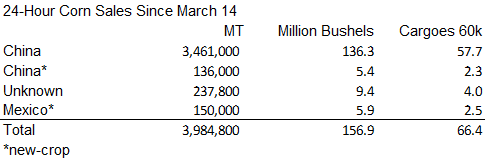

·

USDA 24-H: Private exporters reported sales of 327,000 metric tons of corn for delivery to China. Of the total, 191,000 metric tons is for delivery during the 2022/2023 marketing year and 136,000 metric tons is for delivery during

the 2023/2024 marketing year.

·

Russia sent 2,800 tons of corn to North Korea so far this year.

Updated

04/11/23

May

corn $6.10-$7.00

July

corn $5.75-$7.00

·

With exception of the May position, soybeans rose from a cut in the Argentina soybean production estimate by the Rosario exchange and higher soybean meal. Argentina soybean sales by producers under the new soybean dollar amounted

to around only 300,000 tons over the past three days. Argentina sales today were light. Like corn, there was light profit taking from the bull spreading that occurred on Wednesday.

·

Weakness in outside related vegetable oil markets weighted on soybean oil. Rapeseed oil prices in the EU were down sharply yesterday and Black Sea sunflower oil prices have been under pressure for a few weeks.

·

SA soybean meal prices in Rotterdam were sharply higher from yesterday morning.

·

USDA export sales were within to below expectations for the complex.

·

Argentina’s Rosario grains exchange estimated the Argentina soybean production at 23 million tons, down from 27 million tons previously estimated. Their 2022 forecast was 47 million tons.

·

China March soybean imports were 6.85 million tons, down from February but up 7.9% from a year earlier. Jan-Mar imports totaled 23 million tons, up 13.5% from a year earlier. Imports could slow after May from weaker demand for

meal amid poor hog margins.

·

Ukraine’s food producers’ union (UAC) estimated Ukraine sunflower area for 2023 at 6.0 million hectares from 5.2 million in 2022. This is below the AgMin projection of 5.6 million.

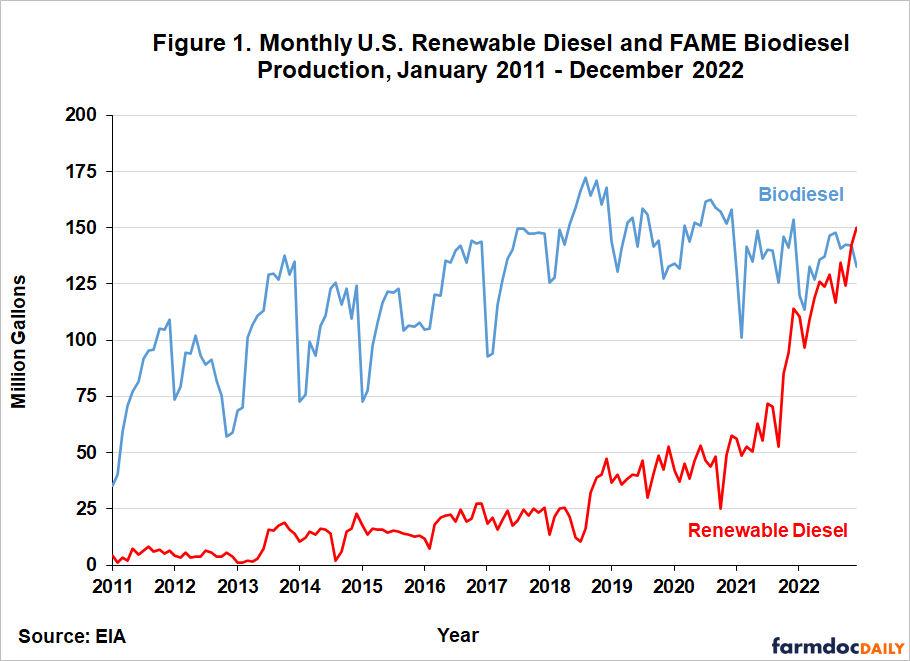

U

of I: Renewable Diesel and Biodiesel Supply Trends over 2011-2022

Gerveni,

M., T. Hubbs and S. Irwin. “Renewable Diesel and Biodiesel Supply Trends over 2011-2022.”

farmdoc daily (13):68, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 12, 2023.

Export

Developments

-

None

reported

Updated

04/11/23

Soybeans

– May $14.50-$15.25, November $12.25-$15.00

Soybean

meal – May $420-$480, December $325-$500

Soybean

oil – May 53.00-57.00,

December 49-58

·

US wheat futures

trended lower today in part to profit taking after prices gained over the past three days. News was light. Algeria bought 400,000 to 450,000 tons of Canadian and Mexico durum wheat. That result limited losses for the Minneapolis contracts. Russia again stressed

that the grain deal could come to an end if western sanctions don’t ease for Russian exports of grain and fertilizer, and reinstatement of the SWIFT payment system with the Russian Agriculture Bank.

·

FranceAgriMer lowered its forecast for French soft wheat exports outside the EU for the current season to 10.40 million tons from 10.45 million projected in March, still 18.5% above year ago. Within the EU, they are at 6.43 million

tons, down from 6.51 million previously and 19.7% below 2021-22.

·

Strategie Grains raised their 2023-24 EU soft wheat exports by 400,000 tons to 30.7 million and lowered 2022-23 soft wheat exports by 600,000 tons to 29.4 million.

·

Ukraine’s UGA estimates grain exports could be another 10 million tons from now until June 30, including 1.5 million tons of wheat and 7.5 million tons of corn.

·

Warm temperatures continue to melt the snowpack across the northern Great Plains that should result in flooding.

Export

Developments.

·

Algeria bought 400,000 to 450,000 tons of durum wheat, for May-June shipment. Reuters noted Mexico and Canadian origin, about half each. Mexico prices were $412 to $413/ton c&f for panamax and $422 to $423 a ton handy. Canadian

prices were $423 to $424/ton c&f for panamax and $430 for handy.

·

China will auction off 40,000 tons of wheat on April 19.

·

Taiwan Flour Millers Association bought 52,850 tons of million wheat from the US for May 31-June 14 shipment via PNW.

-34,500

tons of dark northern spring wheat with a minimum 14.5% protein content bought at an estimated $352.00 a ton FOB

-11,100

tons of hard red winter wheat of a minimum 12.5% protein content bought at $364.38 a ton FOB

-7,250

tons of soft/white wheat of a minimum 8.5% and maximum 10% protein bought at $283.63 a ton

·

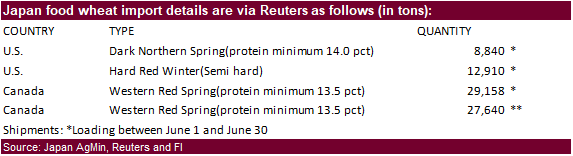

Japan bought 78,548 tons of food wheat from the US and Canada for June shipment.

·

The Philippines seek 150,000 tons of feed wheat on April 14 for arrival between June 15 and July 30.

·

Jordan seeks 120,000 tons of feed barley on April 19 for October through November 15 shipment.

·

Jordan seeks 120,000 tons of wheat on April 18 for Oct-FH Nov shipment.

Rice/Other

·

Reuters: ZHENGZHOU COMMODITY EXCHANGE: WILL ADJUST MARGIN REQUIREMENT OF SUGAR FUTURES CONTRACTS FOR JULY AND SEPTEMBER DELIVERY TO 9%, TRADING LIMITS TO 8% FROM SETTLEMENT ON APRIL 19

Updated

04/11/23

KC

– May $8.25-9.00

MN

– May

$8.40-$9.00

U.S. EXPORT SALES FOR WEEK ENDING 4/6/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

46.2 |

595.7 |

1,334.1 |

65.8 |

4,374.2 |

6,214.4 |

12.4 |

122.0 |

|

SRW |

-5.3 |

454.5 |

487.1 |

28.1 |

2,364.9 |

2,347.8 |

40.0 |

451.8 |

|

HRS |

56.1 |

882.9 |

816.9 |

62.0 |

4,658.7 |

4,504.1 |

15.5 |

110.4 |

|

WHITE |

35.1 |

603.3 |

438.6 |

95.9 |

3,970.6 |

2,905.7 |

0.0 |

43.2 |

|

DURUM |

3.5 |

52.1 |

15.5 |

28.5 |

319.6 |

174.1 |

0.0 |

36.9 |

|

TOTAL |

135.7 |

2,588.5 |

3,092.2 |

280.2 |

15,688.0 |

16,146.1 |

67.8 |

764.2 |

|

BARLEY |

0.0 |

3.3 |

5.8 |

0.0 |

8.2 |

14.7 |

0.0 |

6.0 |

|

CORN |

527.7 |

16,442.9 |

20,395.9 |

917.0 |

21,296.6 |

35,373.5 |

0.0 |

2,000.4 |

|

SORGHUM |

65.0 |

692.9 |

2,538.3 |

52.4 |

871.7 |

4,219.8 |

0.0 |

63.0 |

|

SOYBEANS |

364.5 |

4,530.5 |

11,507.4 |

684.0 |

45,750.3 |

45,128.2 |

66.0 |

1,766.9 |

|

SOY MEAL |

255.2 |

2,742.5 |

2,961.7 |

198.5 |

6,522.5 |

6,435.0 |

37.5 |

343.5 |

|

SOY OIL |

-0.4 |

67.4 |

145.2 |

1.7 |

35.7 |

500.4 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

16.8 |

114.4 |

179.3 |

22.3 |

501.4 |

1,002.7 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

32.3 |

2.7 |

0.0 |

20.6 |

11.4 |

0.0 |

5.0 |

|

L G BRN |

0.4 |

4.9 |

6.1 |

0.2 |

15.7 |

44.2 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

35.7 |

23.9 |

0.0 |

9.0 |

62.6 |

0.0 |

0.0 |

|

L G MLD |

17.5 |

182.5 |

83.7 |

8.3 |

480.1 |

604.4 |

0.0 |

0.0 |

|

M S MLD |

1.0 |

127.6 |

237.0 |

2.6 |

198.7 |

265.8 |

0.0 |

13.0 |

|

TOTAL |

35.7 |

497.4 |

532.8 |

33.5 |

1,225.5 |

1,991.0 |

0.0 |

18.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

143.2 |

4,617.6 |

6,906.6 |

334.6 |

7,146.5 |

7,412.8 |

11.1 |

1,399.4 |

|

PIMA |

32.3 |

89.8 |

134.5 |

8.9 |

126.2 |

312.9 |

0.0 |

4.7 |

Export Sales Highlights

This summary is based on reports from exporters for the period March 31 – April 6, 2023.

Wheat: Net sales of 135,700 metric tons (MT) for 2022/2023 were down 30 percent from the previous week and 27 percent from the prior 4-week average. Increases primarily

for the Philippines (43,000 MT), Mexico (32,000 MT, including decreases of 100 MT), Ecuador (30,300 MT, including decreases of 400 MT), Tunisia (28,500 MT, including 25,000 MT switched from unknown destinations), and Singapore (22,000 MT), were offset by reductions

for Peru (40,000 MT), unknown destinations (17,000 MT), Venezuela (5,000 MT), and Nigeria (600 MT). Net sales of 67,800 MT for 2023/2024 were reported for Peru (40,000 MT) and Japan (27,800 MT). Exports of 280,200 MT were up 42 percent from the previous week

and unchanged from the prior 4-week average. The destinations were primarily to Japan (66,600 MT), Thailand (57,900 MT), Vietnam (37,200 MT), Tunisia (28,500 MT), and Mexico (28,400 MT).

Corn: Net sales of 527,700 MT for 2022/2023 were down 58 percent from the previous week and 68 percent from the prior 4-week average. Increases primarily for Mexico (291,000

MT, including decreases of 500 MT), Japan (166,800 MT, including 111,300 MT switched from unknown destinations), China (140,800 MT, including 136,000 MT switched from unknown destinations and decreases of 1,100 MT), Colombia (45,100 MT, including 34,000 MT

switched from Panama, 5,000 MT switched from Honduras, and decreases of 113,100 MT), and unknown destinations (24,300 MT), were offset by reductions for South Korea (130,000 MT), Panama (34,000 MT), El Salvador (13,500 MT), Qatar (8,100 MT), and the Dominican

Republic (3,800 MT). Exports of 917,000 MT were down 19 percent from the previous week and 15 percent from the prior 4-week average. The destinations were primarily to Mexico (279,700 MT), China (208,800 MT), Japan (161,800 MT), Colombia (159,200 MT), and

the Dominican Republic (57,200 MT).

Optional Origin Sales: For 2022/2023, decreases of 50,000 MT were reported for South Korea.

Barley: No net sales or exports were reported for the week.

Sorghum: Total net sales of 65,000 MT for 2022/2023 were unchanged from the previous week, but down 11 percent from the prior 4-week average. The destination was China,

including decreases of 1,000 MT. Exports of 52,400 MT were up noticeably from the previous week, but down 30 percent from the prior 4-week average. The destinations were to China (52,000 MT) and Mexico (400 MT).

Rice: Net sales of 35,700 MT for 2022/2023 were down 65 percent from the previous week and 11 percent from the prior 4-week average. Increases were primarily for Haiti (16,700 MT, including decreases of 300 MT), Honduras (12,000

MT), Venezuela (4,500 MT), Canada (1,500 MT), and Guatemala (300 MT). Exports of 33,500 MT were down 41 percent from the previous week, but up 7 percent from the prior 4-week average. The destinations were primarily to Honduras (22,000 MT), Haiti (6,700 MT),

Canada (1,900 MT), South Korea (1,000 MT), and Mexico (700 MT).

Export Adjustments: Accumulated exports of long grain, milled rice to Malta were adjusted down 15 MT for week ending March 30th. This shipment was reported in error.

Soybeans: Net sales of 364,500 MT for 2022/2023 were up noticeably from the previous week and up 17 percent from the prior 4-week average. Increases primarily for the Netherlands

(150,100 MT, including 145,000 MT switched from unknown destinations), unknown destinations (122,500 MT), Japan (32,300 MT, including 28,900 MT switched from unknown destinations), Spain (21,200 MT, including decreases of 300 MT and 21,500 MT – late), and

Indonesia (19,100 MT), were offset by reductions for Mexico (1,700 MT). Total net sales of 66,000 MT for 2023/2024 were for China. Exports of 684,000 MT were up 22 percent from the previous week, but down 9 percent from the prior 4-week average. The destinations

were primarily to China (365,600 MT), the Netherlands (150,100 MT), Mexico (75,700 MT), Japan (35,200 MT), and Spain (21,200 MT – late).

Optional Origin Sales: For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export for Own Account: For 2022/2023, the current exports for own account outstanding balance of 1,600 MT are for Canada (1,400 MT) and Taiwan (200 MT).

Late Reporting: For 2022/2023, net sales totaling 21,500 MT of soybeans were reported late for Spain. Exports of 21,157 MT were late to Spain.

Soybean Cake and Meal: Net sales of 255,200 MT for 2022/2023 were up 4 percent from the previous week and 6 percent from the prior 4-week average. Increases primarily for the Philippines (95,300 MT, including decreases of 100 MT),

Vietnam (52,000 MT), Mexico (21,500 MT, including decreases of 100 MT), Costa Rica (17,400 MT, including decreases of 7,200 MT), and Nicaragua (13,200 MT, including decreases of 100 MT), were offset by reductions for Belgium (2,500 MT), Ecuador (2,000 MT),

and Japan (500 MT). Total net sales of 37,500 MT for 2023/2024 were for Indonesia. Exports of 198,500 MT were down 45 percent from the previous week and 34 percent from the prior 4-week average. The destinations were primarily to the Philippines (52,300 MT),

Colombia (45,700 MT, including 200 MT – late), Honduras (26,400 MT), Canada (22,200 MT), and Mexico (21,200 MT).

Late Reporting: For 2022/2023, exports of 200 MT were late to Colombia.

Soybean Oil: Total net sales reductions of 400 MT for 2022/2023 were down noticeably from the previous week and from the prior 4-week average. Decreases were for Canada. Exports of 1,700 MT were up 79 percent from the previous week

and up noticeably from the prior 4-week average. The destinations were to Mexico (1,400 MT) and Canada (300 MT).

Cotton: Net sales of 143,200 RB for 2022/2023 were down 11 percent from the previous week and 41 percent from the prior 4-week average. Increases primarily for China (22,300 RB, including 1,500 RB switched from Indonesia and 100

RB switched from Singapore), Turkey (18,700 RB), India (17,700 RB), El Salvador (15,100 RB), and Bangladesh (13,700 RB), were offset by reductions for Singapore (200 RB). Net sales of 11,100 RB for 2023/2024 were reported for Turkey (8,800 RB) and Pakistan

(2,300 RB). Exports of 334,600 RB were up 34 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to Vietnam (77,600 RB), China (68,100 RB), Pakistan (51,000 RB), Turkey (47,600 RB), and Indonesia (20,600

RB). Net sales of Pima totaling 32,300 RB for 2022/2023–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for China (20,400 RB), India (6,000 RB, including decreases of 300 RB), Pakistan

(3,900 RB), Vietnam (1,000 RB), and Turkey (400 RB). Exports of 8,900 RB–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily to China (6,200 RB), Pakistan (1,200 RB), India (500

RB), Thailand (400 RB), and Indonesia (300 RB).

Optional Origin Sales: For 2022/2023, options were exercised to export 1,000 RB to Malaysia from the United States. The current outstanding balance of 5,800 RB, all Malaysia.

Export for Own Account: For 2022/2023, new exports for own account totaling 18,500 RB were to China (10,600 RB) and Vietnam (7,900 RB). Exports for own account totaling

5,200 RB primarily to Vietnam (4,100 RB) were applied to new or outstanding sales. The current exports for own account outstanding balance of 135,400 RB are for China (114,200 RB), Vietnam (11,100 RB), Pakistan (5,000 RB), South Korea (2,400 RB), India (1,500

RB), and Turkey (1,200 RB).

Hides and Skins: Net sales of 492,400 pieces for 2023 were up 73 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for China

(315,600 whole cattle hides, including decreases of 11,200 pieces), Mexico (50,400 whole cattle hides, including decreases of 1,400 pieces), Brazil (44,500 whole cattle hides), South Korea (38,000 whole cattle hides, including decreases of 400 pieces), and

Thailand (25,600 whole cattle hides, including decreases of 500 pieces), were offset by reductions for Vietnam (100 pieces) and Indonesia (100 pieces). In addition, total net sales of 800 kip skins were for Canada. Exports of 405,200 pieces were down 9 percent

from the previous week and 6 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (260,000 pieces), Mexico (49,900 pieces), South Korea (46,600 pieces), Turkey (12,700 pieces), and Thailand (11,200 pieces).

Net sales of 48,300 wet blues for 2023 were down 63 percent from the previous week and 59 percent from the prior 4-week average. Increases primarily for Vietnam (29,800 unsplit),

China (7,700 unsplit, including decreases of 1,900 unsplit), Italy (7,100 unsplit, including decreases of 100 unsplit), and South Korea (3,600 grain splits), were offset by reductions for Brazil (100 grain splits). Exports of 116,000 wet blues were down 11

percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to China (38,200 unsplit), Vietnam (36,100 unsplit), Italy (20,300 unsplit), Mexico (3,600 grain splits and 1,700 unsplit), and Thailand (5,200 unsplit).

Net sales of 1,800 splits were reported for Vietnam (1,300 pounds) and Hong Kong (500 pounds). No exports of splits were reported for the week.

Beef: Net sales of 8,700 MT for 2023 were down 36 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for South Korea (3,400 MT, including decreases of 400 MT), Japan (2,900 MT, including

decreases of 400 MT), Mexico (1,200 MT, including decreases of 200 MT), Taiwan (500 MT, including decreases of 200 MT), and Chile (400 MT), were offset by reductions for Indonesia (700 MT), China (400 MT), and Brazil (100 MT). Exports of 15,900 MT were down

8 percent from the previous week, but up 1 percent from the prior 4-week average. The destinations were primarily to South Korea (4,900 MT), Japan (3,700 MT), China (2,600 MT), Mexico (1,200 MT), and Taiwan (1,200 MT).

Pork: Net sales of 27,100 MT for 2023 were down 49 percent from the previous week and 31 percent from the prior 4-week average. Increases were primarily for Japan (5,400 MT, including decreases of 100 MT), Mexico (5,300 MT, including

decreases of 200 MT), China (3,900 MT, including decreases of 200 MT), South Korea (3,800 MT, including decreases of 500 MT), and Canada (2,100 MT, including decreases of 400 MT). Exports of 37,000 MT–a marketing-year high–were up 17 percent from the previous

week and 19 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), China (8,200 MT), Japan (4,300 MT), South Korea (3,400 MT), and Canada (1,700 MT).

#non-promo