PDF Attached

Grains

and oilseeds are seeing another bull session from fund buying amid weather and inflation concerns. WTI crude that was up little more than $1.00 as of 8:00 am CT.

Next

7 days

6-10

& 11-14 temps

World

Weather Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Brazil’s

Safrinha corn crop remains a concern, but showers expected in the next couple of weeks will offer some partial relief. If any of the advertised rain is missed crop moisture stress is going to get very high and production will be cut. Mato Grosso crops will

get most of the rain and be in the best shape. Areas to the south are expected to remain limited on soil moisture and crop stress will continue in areas that fail to get much moisture.

Argentina weather is improving for crop maturation and harvesting, although the wettest areas will need more time to dry out before conditions become ideal again.

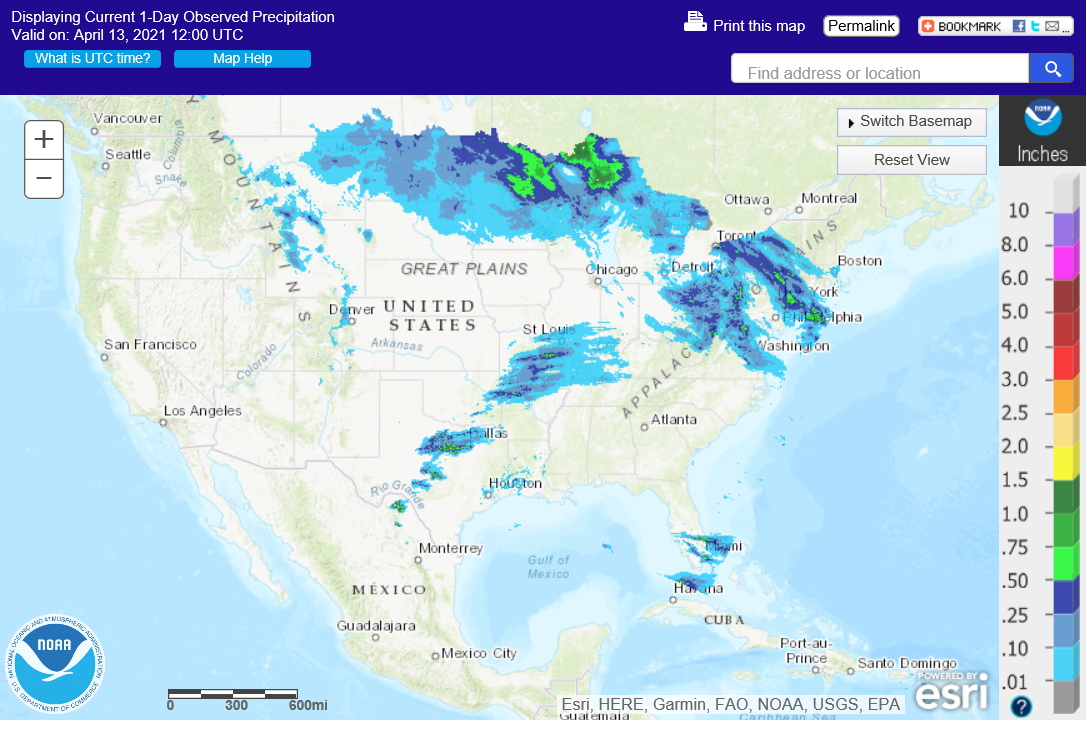

U.S.

planting moisture still looks good, although cool temperatures during the next couple of weeks may slow fieldwork and germination as well as emergence. Warmer temperatures with periodic rain are needed for the best scenario. Central and northern Iowa and southern

Minnesota as well as southwestern Wisconsin will be closely monitored for developing dryness, although it is not too dry today.

Recent

moisture in the upper Midwest and southeastern Canada’s Prairies will improve the planting outlook for late this month and especially in May if there is follow up rain. Temperatures will be cool this week limiting any thought of fieldwork for a while.

Southeast

Asia Palm Oil conditions will remain good during the next ten days as will be winter rapeseed in Western Europe, China and India. South Africa summer crops will remain in good condition as well.

Overall,

weather today will likely produce a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT: Portions of North Dakota, Saskatchewan and Manitoba have received welcome precipitation this week easing long term dryness concerns, although more moisture will be needed. Areas in the southwestern Canada Prairies and the northwestern

U.S. Plains will continue too dry and are waiting for significant rain.

Dryness

remains a concern for unirrigated winter crops from central Washington through Oregon and no relief is expected for the coming ten days.

U.S.

hard red winter wheat areas will receive significant rain and snow Thursday into Saturday morning, although the far southwest may not get a large amount of moisture. The precipitation will bring some needed relief after recent net drying and crop conditions

will respond positively reinforcing good yield potentials. Additional timely rain must continue through the spring, however.

China

winter wheat conditions remain very good with a positive outlook, despite net drying over the next ten days. India’s wheat is being harvesting with little reason for lasting disruptions because of rain. North Africa still has need for greater rain in southwestern

Morocco and northwestern Algeria and parts of Tunisia are starting to dry down as well, but these areas will get some rain in the next ten days.

Europe soil moisture is mostly rated well, but there will be a gradual dry down in the north for a while. Cool temperatures are keeping spring crop development and planting advancing slower than usual.

Warming

in the western CIS this week has brought on some greening in the south and recent moisture has most areas plenty moist. Cooler weather in the coming week will restrict new crop development, but the longer range outlook is good.

Australia’s

winter crop planting outlook is favorable, although there is need for widespread precipitation in the south before much fieldwork will begin.

Overall,

weather today may have a bearish bias to market mentality.

Source:

World Weather Inc. & FI

Wednesday,

April 14:

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

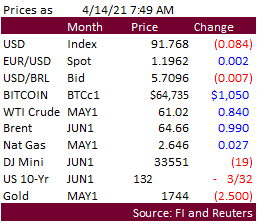

Macro

US

Import Price Index (M/M) Mar: 1.2% (exp 0.9%; prev 1.3%)

–

Import Price Index (M/M) Mar: 0.9% (exp 0.5%; prev 0.5%)

–

Import Price Index (Y/Y) Mar: 6.9% (exp 6.4%; prev 3.0%)

–

Export Price Index (M/M) Mar: 2.1% (exp 1.0%; prev 1.6%)

–

Export Price Index (Y/Y) Mar: 9.1% (prev 5.2%)

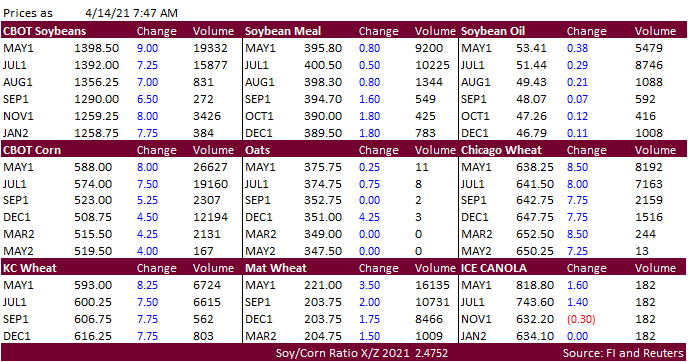

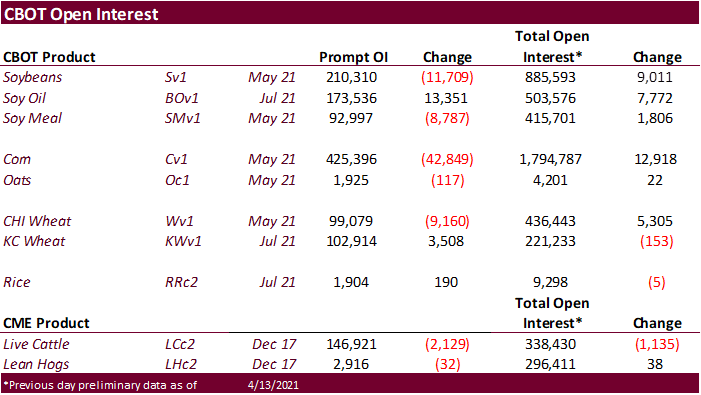

- CBOT

corn

is higher on weather concerns for the North American summer growing season. Dryness is spreading in the Northern spring areas, western corn belt, and across Brazil’s Safrinha corn area and cold temps prevail in western Europe through the end of this week.

Below normal temps are also forecast for the Midwest over the next 15 days. Today is the last day of the Goldman Roll.

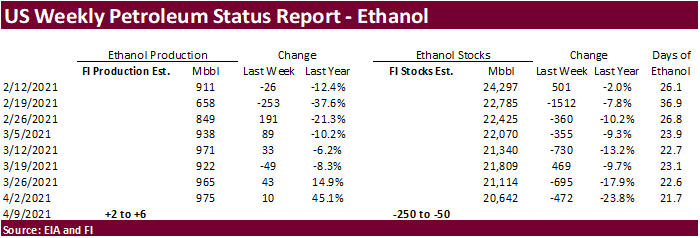

- Funds

on Tuesday bought an estimated net 15,000 corn contracts. - Estimates

US ethanol data is calling for higher production and stocks.

Survey

Results EIA

Avg Low High Prev. Week

Production (k bpd) 980 970 989 975

Stockpiles (m bbl) 20.719 20.460 21.100 20.642

SOURCE: Bloomberg News

Export

developments.

-

None

reported

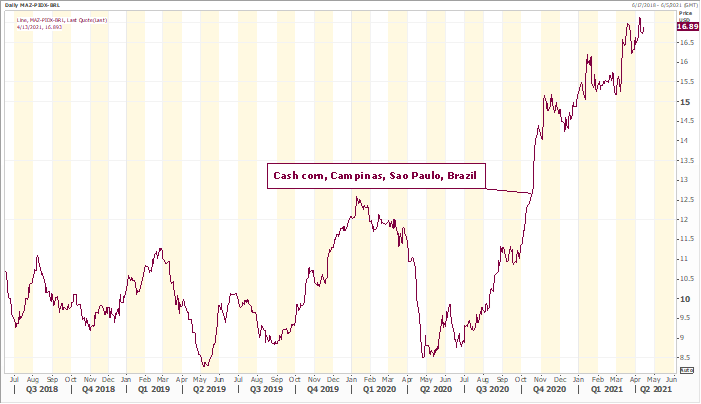

Brazil’s

corn prices are firm in part to increasing use in the ethanol sector. High Brazilian corn prices have led some end users to source corn from Argentina and Paraguay.

Source:

Reuters and FI

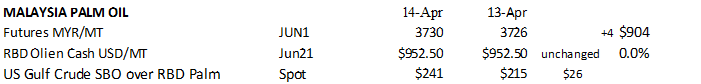

- CBOT

soybeans,

meal and nearby soybean oil contracts are higher on weather issues, follow through buying amid US inflation fears and higher WTI crude. June palm oil settled 4 lower and cash was unchanged at $952.50. China veg oils were up 1.1% to 1.7% - Ukraine

is considering to curb sunseed exports and adding export licenses to sunflower oil for the September through August season. Ukraine traders union UGA is concerned with the government’s plan.

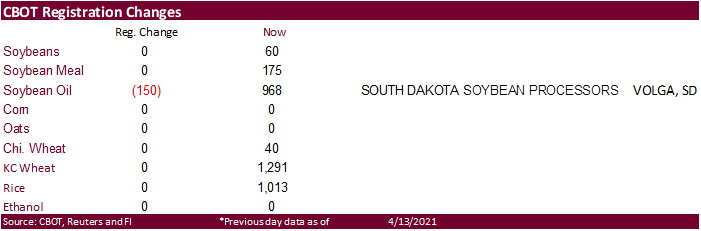

- 150

soybean oil registrations were cancelled out of Volga, SD. SBO registrations stand at 968.

- India

palm oil imports during March were 526,463 tons, a 57% increase from March 2000. Soybean oil imports were 284,200 tons, a 3 percent increase. Sunflower imports were 146,970 tons, about half of what was imported a year earlier.

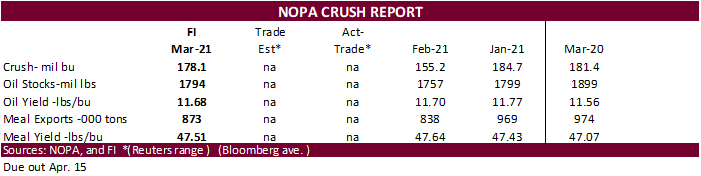

- Tomorrow’s

NOPA crush report is expected to show a crush of 178.1 for March with oil stocks of 1794 and an oil yield of 11.68.

- Offshore

values were leading CBOT SBO 83 points lower and meal $2.70 short ton higher.

- Rotterdam

vegetable oil values were 10-15 eros higher from this time previous session and Rotterdam meal 3-7 euros lower.

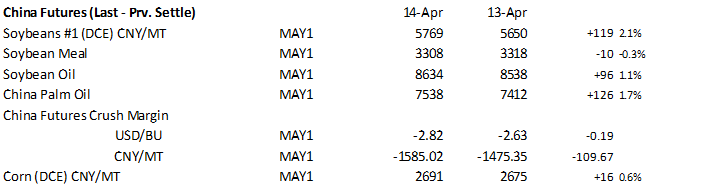

- China

cash crush margins on our analysis were 170 (158 previous) vs. 179 cents late last week and compares to 197 cents year earlier.

- China:

- Funds

on Tuesday bought an estimated net 5,000 soybean contracts, sold 4,000 soybean meal and bought an estimated 5,000 soybean oil.

-

Today

the USDA seeks 35,000 tons of soybean meal for the Food for Progress export program of which 11,000 tons for Ivory Coast and 24,000 tons for Ghana.

-

Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on April 15 for arrival June 1-20. Payment is for at sight and 180-day letter of credit.

- US

wheat was higher again this morning primarily on weather concerns, but also global importers continue to tender for wheat, and follow through strength from yesterday’s CPI driven bull market. Dry weather concerns for the US and Europe are in focus. Cold temperatures

are expected to dominate parts of Europe through the end of this week. Dry weather returns to the northern Great Plains for at least a week.

- FranceAgriMer

raised its monthly forecast of French soft wheat exports outside the European Union’s 27 countries this season to 7.55 million tons from 7.45 million tons last month, 44% below a record 13.54 million tons in 2019-20. - Funds

on Tuesday bought an estimated net 3,000 CBOT SRW wheat contracts. - September

Paris wheat was up 1.50 euros to 203.25 euros.

- Today

Algeria’s OAIC seeks 50,000 tons of durum wheat, valid until Thursday, April 15, for shipment between May 1-15 and May 15-31. - The

Philippines are in for 165,000 tons of feed wheat. - Jordan

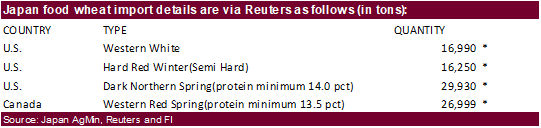

seeks 120,000 tons of feed barley on April 21. - Japan

seeks 90,169 tons of food wheat this week from US and Canada. *no

shipment period was provided.

- Japan in its weekly SGS

import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by September 30.

- Ethiopia seeks 30,000 tons

of wheat on April 16. - Ethiopia seeks 400,000 tons

of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.