PDF Attached

Grains

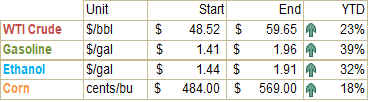

and oilseeds were higher again on fund buying amid weather and inflation concerns. WTI crude that was up around $2.75 as of 2:30 pm CT.

USD was down 18 points.

![]()

Next

7 days

6-10

& 11-14 temps

World

Weather Inc.

MOST

IMPORTANT WEATHER ISSUES OF THE DAY

- Tropical

Storm Surigae was located 55 miles southwest of Yap Island in the western Pacific Ocean - The

storm was expected to become a typhoon as moves over open water east of the Philippines in the coming week - The

system will become quite intense, but its predicted movement should keep the center of the system east of the Philippines - Some

outer bands of precipitation may impact the eastern islands this weekend into next week

- A

close watch on the storm is warranted since its path has been drifting a little more to the west in recent forecast model runs - Negative

Phase of Pacific Decadal Oscillation (PDO) continues to evolve in the eastern Pacific Ocean with cooling ocean surface water temperatures occurring most significantly in the eastern Gulf of Alaska most recently - Cooler

than usual water is becoming more common in the eastern North Pacific and could influence North America weather this late spring and summer - Interior

southern Brazil Safrinha corn production areas are still advertised to receive only light scattered showers and thunderstorms during the next ten days - Totally

dry weather is not likely and the precipitation that does occur will be welcome to the crop, but more moisture will be needed especially prior to the arrival of the dry season - 45%

of the Safrinha crop is produced in Mato Grosso do Sul, Parana and Sao Paulo and conditions are becoming a little dry in the region - Mato

Grosso, Goias, Tocantins, Maranhao and Piaui, Brazil will experience routinely occurring showers and thunderstorms intermixing with periods of sunshine and warm weather during the next ten days maintaining a very good outlook for late season crops - Argentina

harvest progress has slipped behind normal in nearly all of the nation - Net

drying is expected during the coming week to help firm the soil and support some resuming fieldwork - Rain

expected mid- to late-week next week will disrupt farming activity for a while and set back the drying trend - The

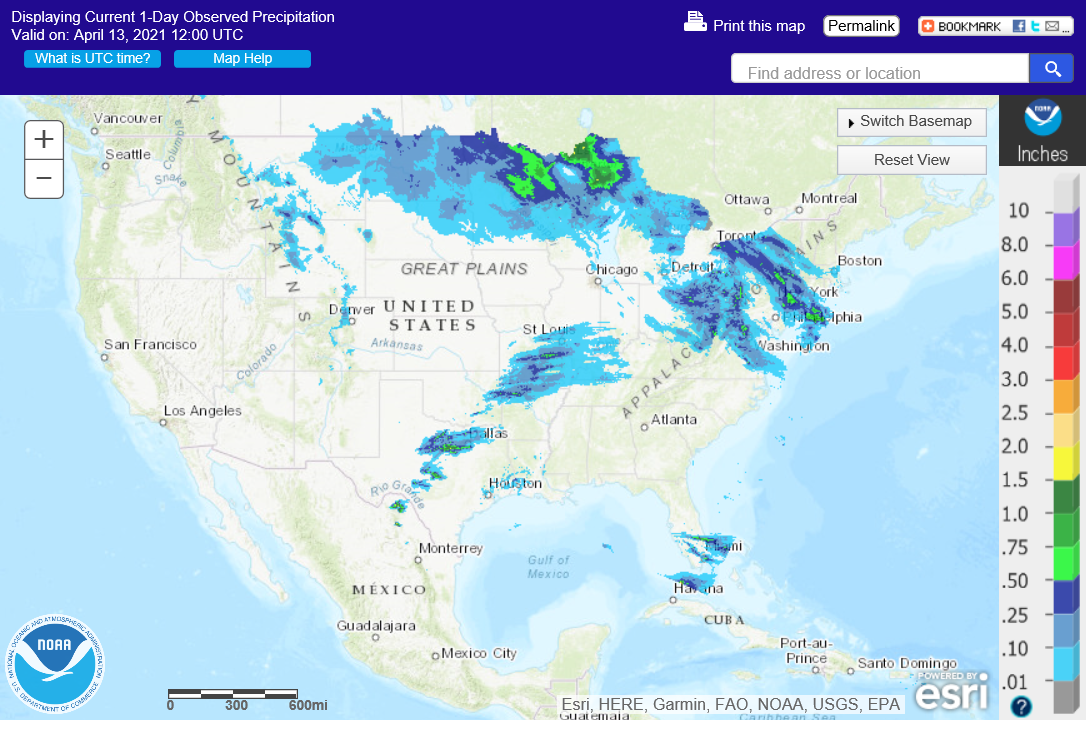

rain will only last a couple of days and net drying will then resume - Snowstorm

in eastern Canada’s Prairies and the far northern U.S. Plains is winding down

- Snowfall

of 4 to 12 inches was common in the southeastern half of Saskatchewan and Manitoba with local totals over 20 inches northwest of Yorkton, SK - Snowfall

in the northern Plains reached 9.5 inches in northwestern North Dakota, 7 inches in northeastern Montana and 6 inches in far northwestern Minnesota while 2 to 5 inches occurred elsewhere in North Dakota and norther and central Minnesota - Moisture

content in the storm will help lift topsoil moisture for spring planting and early season crop development later this month when warming returns - U.S.

Pacific Northwest unirrigated small grains still need significant moisture to improve soil conditions and early season crop development - Net

drying will continue over the coming seven days, but “some” rain may evolve in the April 22-28 period - U.S.

hard red winter wheat production areas will experience significant snow and rain tonight into Friday with a few lingering showers Saturday - Moisture

totals of 0.40 to 1.50 inches is expected from northeastern Colorado and southwestern Nebraska through the heart of Kansas with lighter rain in Texas and Oklahoma - Snow

accumulations will vary from 4 to 10 inches with northeastern Colorado and southwestern Nebraska getting 10-16 inches

- The

moisture will be ideal in raising topsoil moisture after recent drying conditions.

- U.S.

west-central high Plains livestock stress is expected because of heavy snow, cold rain and colder temperatures Thursday into Saturday morning - West

and South Texas have potential for a little rain over the next couple of weeks infrequently - The

moisture will be welcome, but not nearly enough for a lasting improvement in soil moisture in the areas that need it most - Today

and Thursday will bring 0.05 to 0.50 inch to both regions - Additional

rain showers are possible April 21-22 in West Texas with similar rainfall expected - U.S.

Midwest will experience brief periods of rain and longer periods of drier weather during the coming ten days - Temperatures

will be cool - Decreases

in soil moisture may occur gradually from the upper Midwest through Iowa to northern Illinois - Greater

precipitation will occur in the lower Midwest - Field

progress will be slow due to cool temperatures and some periodic precipitation - Drier

and warmer weather will be needed in the south while the north will need rain and some warmer weather - U.S.

Delta and southeastern states will experience a mix of rain and sunshine during the next two weeks favoring some fieldwork - Interior

parts of the southeast; including central and northern Georgia, interior South Carolina and parts of North Carolina will experience net drying for a while - Some

heavy rain will occur near the Gulf of Mexico coast from Louisiana into northern Florida and southern Georgia delaying farming activity - California

and the southwestern states will be left mostly dry for a while - China

crop weather will remain very good over the next two weeks, although net drying is expected in the North China Plain for a while - India’s

weather will be mostly good, although scattered showers will occur periodically to slow some of the winter harvest progress - Australia

will continue in a net drying mode for the next ten days supporting good harvest progress in the east while raising the need for moisture in most of the south for future winter wheat, barley and canola planting - Western

Europe will be drying down again for a while, but recent rain fell in France and Spain to induce a short term improvement in soil moisture - Additional

rain will be needed in the west and north parts of the continent when seasonal warming finally kicks in more significantly - Temperatures

will be cool for most of this coming week and April 21-27 will trend warmer - Warming

in the western CIS earlier this week helped to melt more snow in Russia and accelerated drying rates - A

change back to wetter and cooler conditions is expected over the coming week - Some

improved greening conditions have occurred in Ukraine and Russia’s Southern Region

- Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas - Some

beneficial rain fell across parts of this region recently, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - North

Africa will experience a favorable mix of weather over the next ten days - All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture in some areas - Northwestern

Algeria and southwestern Morocco need rain most - Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Rainfall

will be a little lighter and less frequent than usual over for a while longer, but improved rainfall should occur later this week and into the coming weekend

- Temperatures

have been and will continue to be warmer than usual keeping evaporation rates very strong until greater rain evolves - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops - Net

drying is expected for except in the southeast where some periodic showers will occur - Good

field progress is expected for early maturing crops - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand rainfall will be a little lighter than usual during the coming ten days, but still beneficial - Many

areas are still drier biased and need the increased rainfall - Temperatures

will be seasonable - Southeastern

Canada will see below average precipitation and warmer than usual temperatures over the next ten days

- Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days - Rain

is needed in many areas - Drought

is prevailing across most of the nation - Southern

Oscillation Index this morning was +0.22 and the index will move lower over the next several days

Source:

World Weather Inc. & FI

Wednesday,

April 14:

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

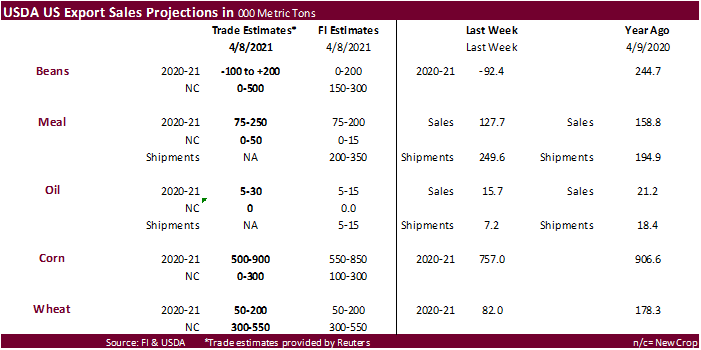

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Macro

US

Import Price Index (M/M) Mar: 1.2% (exp 0.9%; prev 1.3%)

–

Import Price Index (M/M) Mar: 0.9% (exp 0.5%; prev 0.5%)

–

Import Price Index (Y/Y) Mar: 6.9% (exp 6.4%; prev 3.0%)

–

Export Price Index (M/M) Mar: 2.1% (exp 1.0%; prev 1.6%)

–

Export Price Index (Y/Y) Mar: 9.1% (prev 5.2%)

U.S.

Crude Oil Futures Settle At $63.15/BBL, Up $2.97, 4.94 PCT

Brent

Crude Futures Settle At $66.58/BBL, Up $2.91, 4.57 PCT

US

DoE Crude Oil Inventories (W/W) 09-Apr: -5890K (est -2700K; prev -3522K)

–

Distillate Inventories: -2083K (est 1000K; prev 1452K)

–

Cushing OK Crude Inventories: 346K (prev -735K)

–

Gasoline Inventories: 309K (est 900K; prev 4044K)

–

Refinery Utilization: 1.00% (est 0.20%; prev 0.10%)

Fed’s

Williams: Inflation Is Going To Be Volatile But Expects It To Stay Relatively Subdued Near 2% Goal

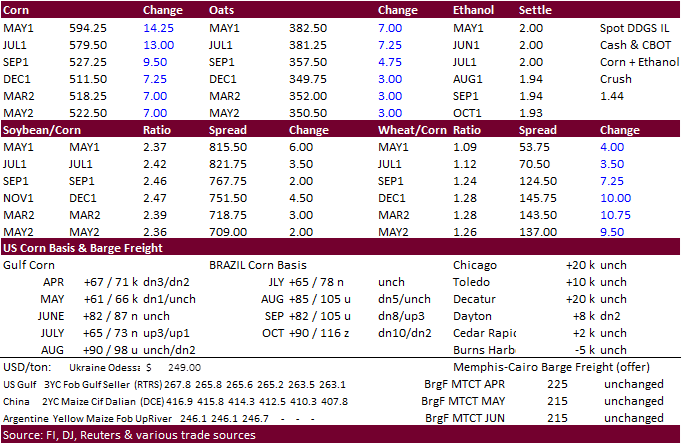

Corn

- CBOT

corn

ended sharply higher led by the front thee contract on weather concerns. Dryness is spreading in the Northern spring areas, western corn belt, and across Brazil’s Safrinha corn area and cold temps prevail in western Europe through the end of this week. Below

normal temps are also forecast for the Midwest over the next 15 days, but that may not slow plantings. Today was the last day of the Goldman Roll.

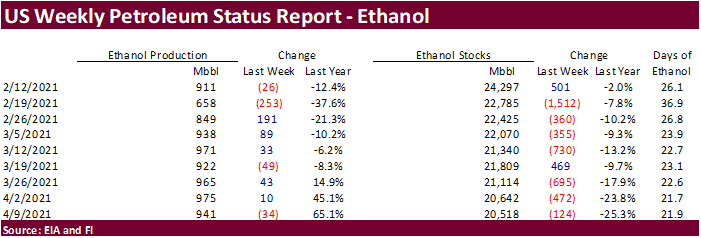

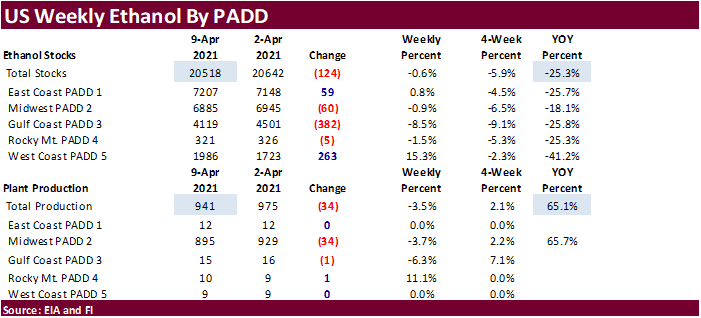

- US

ethanol production came in well below expectations (941,000 vs. 980,000 Bloomberg estimate). It is maintenance season for ethanol plants.

- Funds

on Wednesday bought an estimated net 17,000 corn contracts. - US

corn basis was steady to mixed from yesterday at river and terminal locations but firm at selected ethanol plants. Linden, IN was up 15 cents to 35 over the May.

- We

are hearing Delta corn plantings are off to a good start. Some areas are already done planting the crop, such as northeast Louisiana. Some commercials noted they have seen some of the best soil conditions in the past 10 to 15 years. With rain in the forecast

today, followed by a stretch of 7-8 days of mostly dry weather for the northern Delta, we think the Delta could be near complete by early May. We just need to see if the cold weather this week and next week will impact planting progress.

- The

USDA Broiler Report showed eggs set in the US up 7 percent and chicks placed up slightly. Cumulative placements from the week ending January 9, 2021 through April 10, 2021 for the United States were 2.61 billion. Cumulative placements were down 2 percent

from the same period a year earlier.

US

weekly ethanol production

declined an unexpected 34,000 barrels to 941,000 barrels and stocks declined 124,000 barrels to 20.518 million. Stocks are lowest since November 13, 2020. The production figure had little impact on US corn futures. We still believe USDA is overestimating

2020-21 US corn for ethanol usage by at least 30 million bushels.

Export

developments.

- None

reported

Brazil

corn prices

are firm in part to increasing use in the ethanol sector. High Brazilian corn prices have led some end users to source corn from Argentina and Paraguay.

Source:

Reuters and FI

Updated

4/13/21

May

corn is seen in a $5.60 and $5.95 range

July

is seen in a $5.25 and $5.90 range

December

corn is seen in a $3.85-$5.50 range.

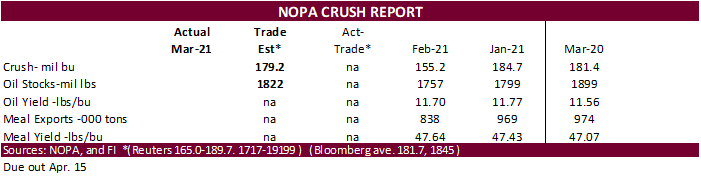

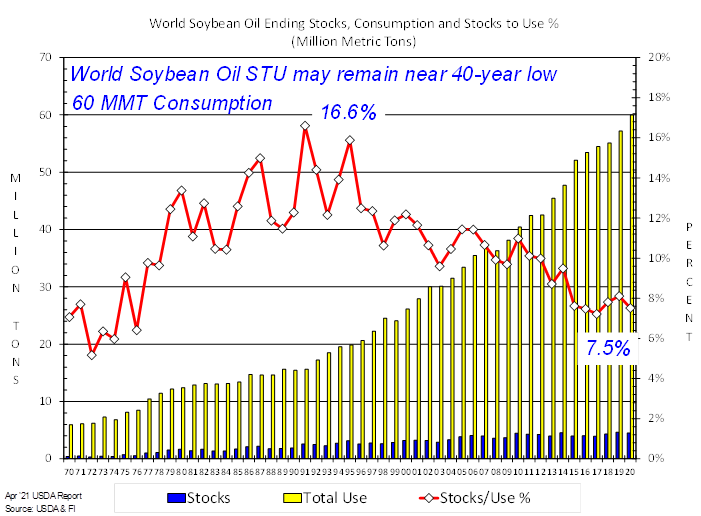

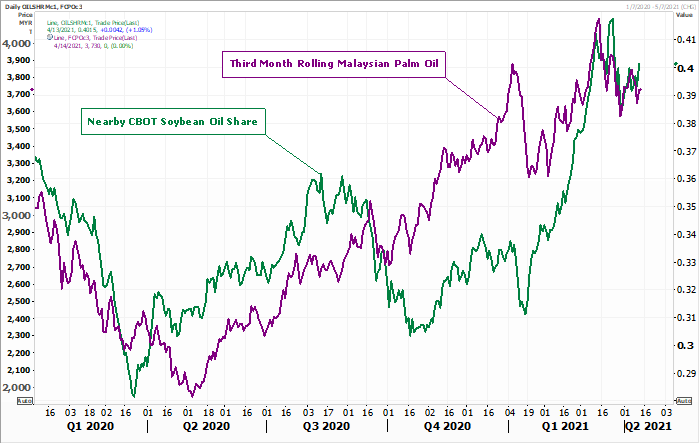

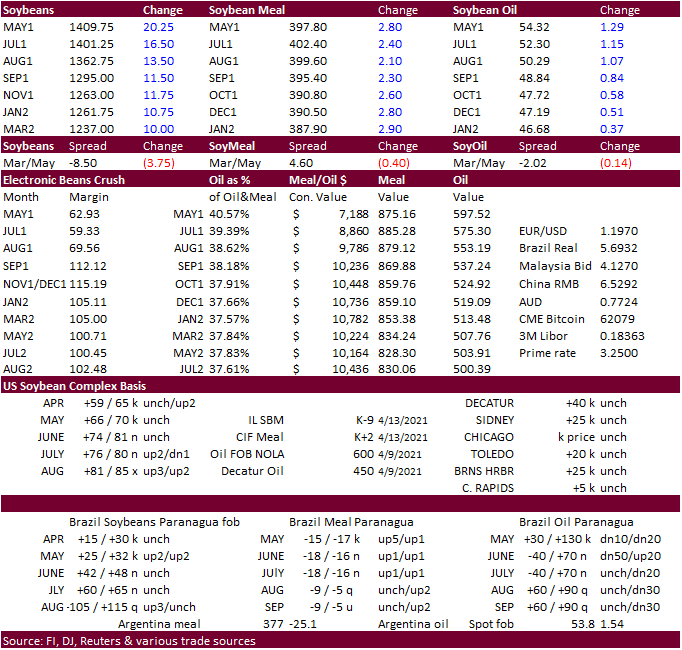

- CBOT

soybeans,

meal and nearby soybean oil contracts were sharply higher (not so much for meal) on weather issues, follow through buying amid US inflation fears and higher WTI crude (up more than $3.00 during the session).

Soybean oil has been the leader over the past couple of days. July soybeans are about 38 cents away from its contract high made on April 1. Thursday we will see a little guidance from the USDA export sales reported followed by NOPA

crush. The report is expected to show a crush of 179.2 for March with oil stocks of 1822, using Reuters estimates.

- Nearby

and July ICE canola posted a new contract high. - Funds

on Wednesday bought an estimated net 13,000 soybean contracts, bought 2,000 soybean meal and bought an estimated 6,000 soybean oil.

- US

soybean meal basis was up $1-$3 for selected IL & IN locations. Claypool, IN declined $7 to 8 over. - Ukraine

is considering to curb sunseed exports and adding export licenses to sunflower oil for the September through August season. Ukraine traders union UGA is concerned with the government’s plan. APK-Inform estimated the Ukraine 2021 sunseed crop at a record

16.4 million tons, in part to a 6% increase in the planted area. Ukraine produced 14.3 million tons in 2020.

- 150

soybean oil registrations were cancelled Tuesday evening out of Volga, SD. SBO registrations stand at 968.

- India

palm oil imports during March were 526,463 tons, a 57% increase from March 2000. Soybean oil imports were 284,200 tons, a 3 percent increase. Sunflower imports were 146,970 tons, about half of what was imported a year earlier.

- Today

the USDA seeks 35,000 tons of soybean meal for the Food for Progress export program of which 11,000 tons for Ivory Coast and 24,000 tons for Ghana.

- Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on April 15 for arrival June 1-20. Payment is for at sight and 180-day letter of credit.

USDA

Attaché – Paraguay: Oilseeds and Products Annual

2021/2022

Paraguayan soybean production is projected at 10.5 million tons as a return to normal climatic conditions allow for increased second-crop soybean planting. Exports are forecast at 6.5 million tons. 2020/2021 soybean production is lowered to 9.9 million tons

as a delayed harvest prevented farmers from planting second-crop soybeans. Crush is reduced to 3.3 million tons as plants received soybeans late and will have fewer operating days in the marketing year. Exports are forecast up at 6.75 million tons due to lowered

crush volume.

Source:

Reuters and FI

Updated

4/13/21

May

soybeans are seen in a $13.65 and $14.50 range

July $13.00-$14.60 November $10.50-$14.50

May

soymeal is seen in a $385 and $410 range

July $380-$4.40 December $325-$460

May

soybean oil is seen in a 50.25 and 55 cent range

July

47.00-56.00 December 42-53 cent wide range (depends on global biodiesel and renewable fuel expansion)

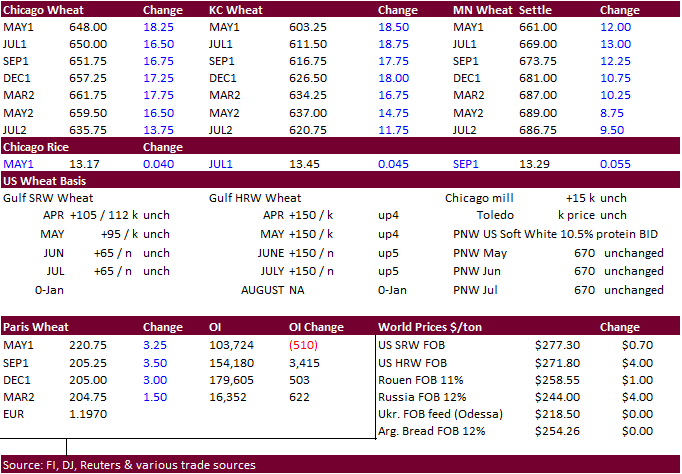

- US

wheat traded higher primarily on weather concerns. July SRW hit a one-month high, July KC near a one-month high and spring wheat a three-year high. Global importers continue to tender for wheat. Dry weather concerns for the US and Europe are in focus. Cold

temperatures are expected to dominate parts of Europe through the end of this week. Dry weather returns to the northern Great Plains for at least a week.

- Funds

on Wednesday bought an estimated net 12,000 CBOT SRW wheat contracts. - September

Paris wheat was up 3.00 euros to 204.75 euros. - FranceAgriMer

raised its monthly forecast of French soft wheat exports outside the European Union’s 27 countries this season to 7.55 million tons from 7.45 million tons last month, 44% below a record 13.54 million tons in 2019-20.

- Results

awaited: Algeria’s OAIC seeks 50,000 tons of durum wheat, valid until Thursday, April 15, for shipment between May 1-15 and May 15-31. - The

Philippines are in for 165,000 tons of feed wheat. - Jordan

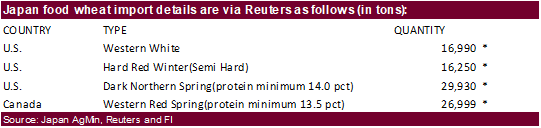

seeks 120,000 tons of feed barley on April 21. - Japan

seeks 90,169 tons of food wheat this week from US and Canada. *no

shipment period was provided.

- Japan

in its weekly SGS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by September 30.

- Ethiopia

seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/13/21

May Chicago wheat is seen in a $6.20‐$6.65 range

July $6.00-$6.80

May KC wheat is seen in a $5.60‐$6.10 range (US HRW wheat

conditions are improving)

July $5.40-$6.25

May MN wheat is seen in a $6.30‐$6.80 range

July $6.20-$7.00 (depends on EU crop damage

and US spring wheat seedings/development)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.