PDF Attached

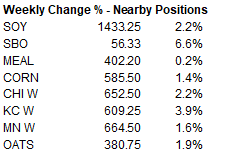

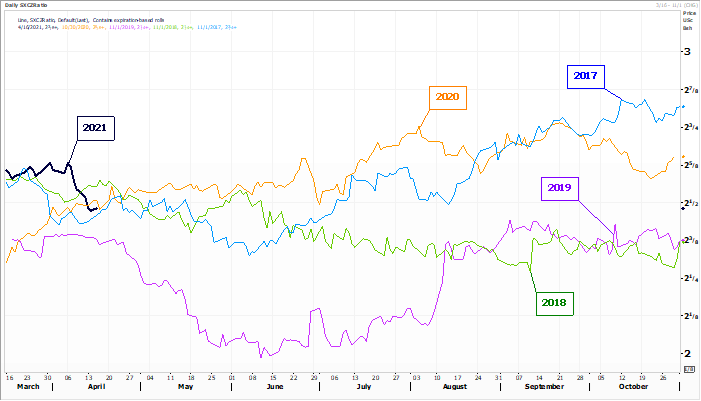

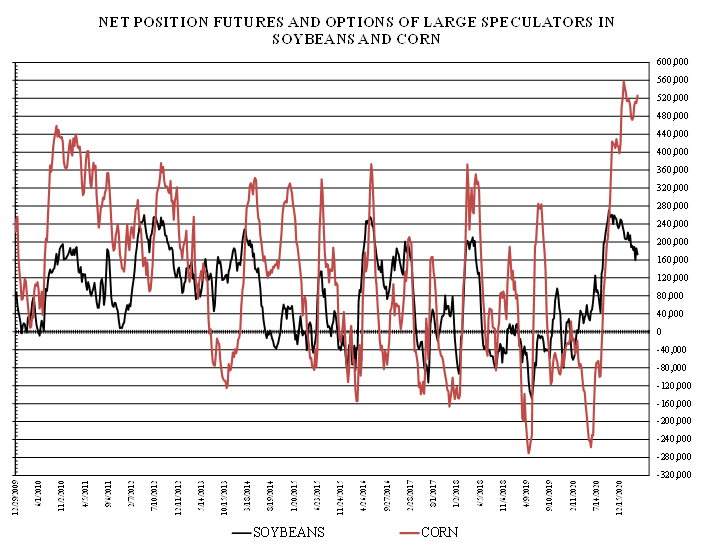

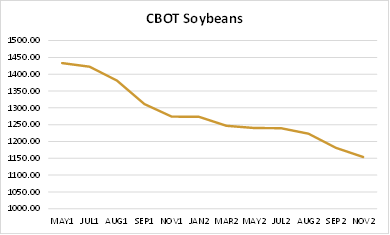

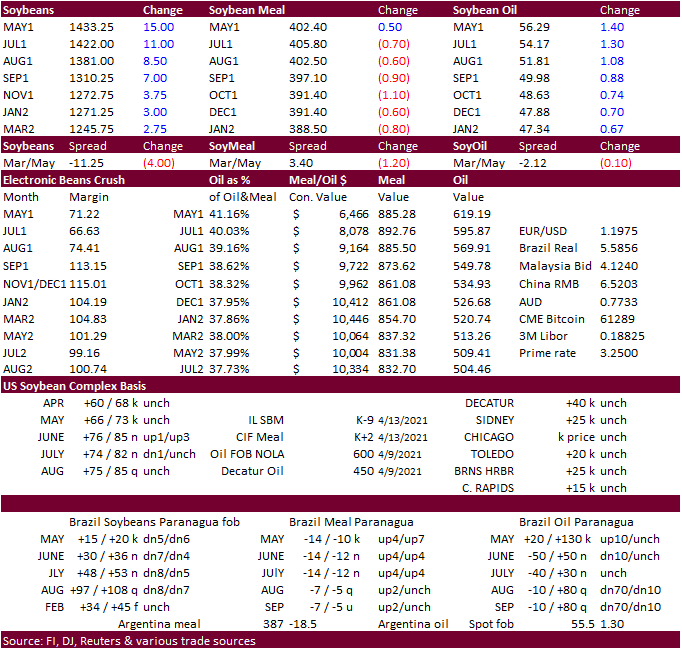

Soybean/corn

and soybean/Chicago wheat spreading along with higher soybean oil underpinned the soybean market bias the nearby contracts to the upside.

November

soybean/December corn ratio

Source:

Reuters and FI

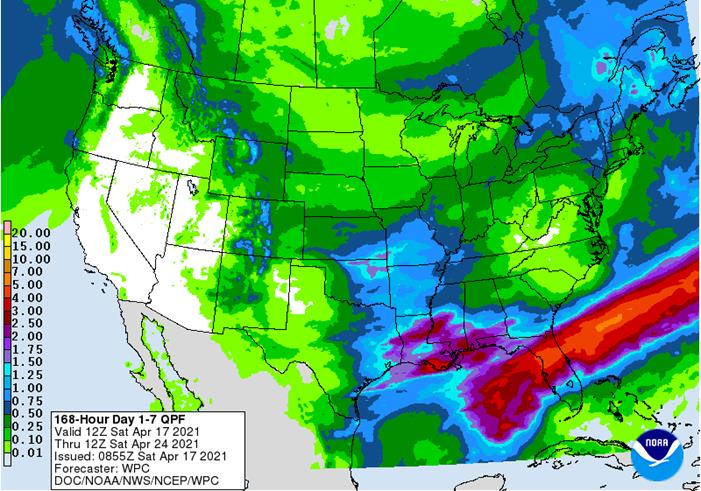

Next

7 days

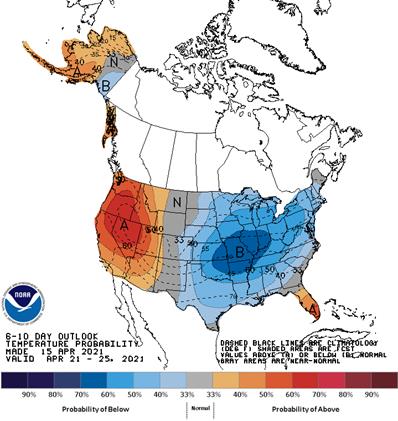

6-10

temps

World

Weather Inc.

MOST

IMPORTANT WEATHER ISSUES OF THE DAY

- Typhoon

Surigae was located 89 miles northwest of Palau Island well to the southeast of the Philippines at 0900 GMT today - The

storm was producing maximum wind speeds of 92 mph near its center with tropical storm force wind occurring out 140 miles from the storm center - Wind

speeds greater than 74 mph were occurring out 40 miles - Surigae

was moving west northwesterly at 11 mph - The

storm will intensify greatly this weekend and will move close enough to influence the Philippines early to mid-week next week - The

storm is expected to produce high wind speeds, heavy rain and rough seas in the northeastern Visayan Islands and along the east coast of Luzon Island - The

European forecast model suggest the storm will move across Luzon island during mid-week next week, but the best forecast track will likely take the storm very near to if not over the northeastern corner of Luzon before curving back out to see - Some

damage to rice, sugarcane, infrastructure and personal property is possible, but mostly if the storm moves directly over land and confidence of that is still not high - Brazil’s

key agricultural areas will experience three waves of scattered showers and thunderstorms during the next two weeks, but big soaking rain will likely be localized - Many

Safrinha crop areas will get rain and crop conditions will improve - The

best precipitation most often will be in Mato Grosso and Goias - Late

April/early May is expected to trend drier as the monsoon withdraws to the north - Late

season crop conditions should stay favorably rated through the end of the month, but low subsoil moisture in some areas could lead to crop stress in May - Argentina’s

outlook is still mostly very good for the next two weeks - Sufficient

soil moisture is present to support late season crops - Buenos

Aires will see the least amount of rain for the next ten days, but has favorable subsoil moisture - Rain

is expected in many western, central and northern crop areas of Argentina next week disrupting the drying trend under way and limiting early season harvest progress - U.S.

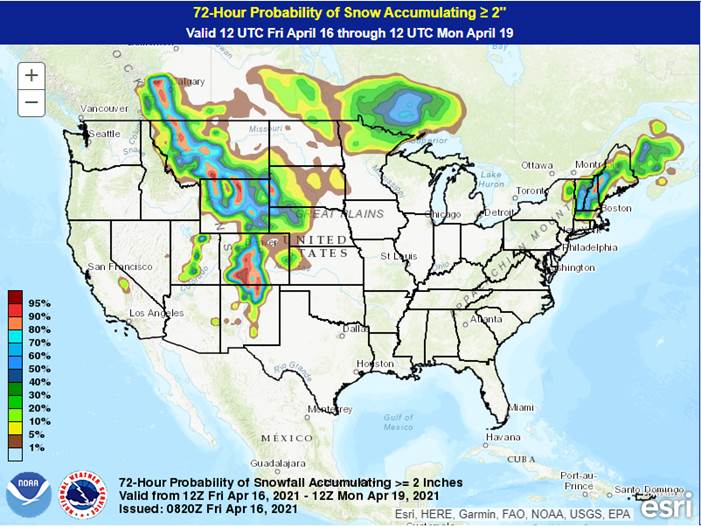

cool weather next week should not harm winter wheat in a permanent manner, but frequent freezes from the northern Texas Panhandle to South Dakota and Montana will keep crop development in check - The

coldest weather is expected Tuesday and Wednesday mornings and temperatures may get low enough in southern Kansas and northern Oklahoma to warrant a close watch, but today’s forecasts do not offer much reason for concern over potential damaging conditions - Cool

weather in U.S. Midwest crop areas next week will slow corn germination, emergence and establishment, but planting will likely advance especially in areas where soil conditions are favorable for such activity now - Recent

lighter than usual precipitation in central and northern Iowa, southern Minnesota and southwestern Wisconsin will need to be closely monitored for needed rain when warming returns late this month - Dryness

is not an issue in any part of the Midwest today - Restricted

precipitation in the coming week to ten days will be great for fieldwork - Warming

will soon be needed to get soil temperatures high enough for corn germination, emergence and establishment - U.S.

hard red winter wheat areas will receive welcome rain and snow today with areas from western Nebraska and northeastern Colorado through the heart of Kansas getting 0.20 to 0.75 inch of moisture with local totals of up to 1.50 inches - Wettest

in south-central Kansas, southern Oklahoma and northern Texas - Poor

rainfall is expected in the southwestern Plains, including the Texas Panhandle - Follow

up precipitation next week will be lighter, but still welcome and beneficial, although not very significant in the southwestern Plains - Wheat

will respond well to the moisture - Rain

will soon be needed in the U.S. southwestern U.S. Plains - West

Texas and far South Texas are not likely to see much meaningful rain for a while - Good

rainfall and periods of sunshine will occur in the Texas Blacklands, upper Coast and in the interior southeastern states - U.S.

lower Delta to northern Florida and southern Georgia will continue too wet for a while, but improving weather is expected next week - California

and the southwestern states will be left mostly dry for a while - Some

beneficial rain and snow will impact southern Alberta and southwestern Saskatchewan briefly late this weekend into Monday, but much more precipitation will be needed to end drought - Northern

U.S. Plains and most of the Canada Prairies still are in the midst of drought and need significant precipitation this spring to support planting and establishment - U.S.

Pacific Northwest precipitation will remain restricted for the next week, but some precipitation may impact a part of the region in the last week of this month - Western

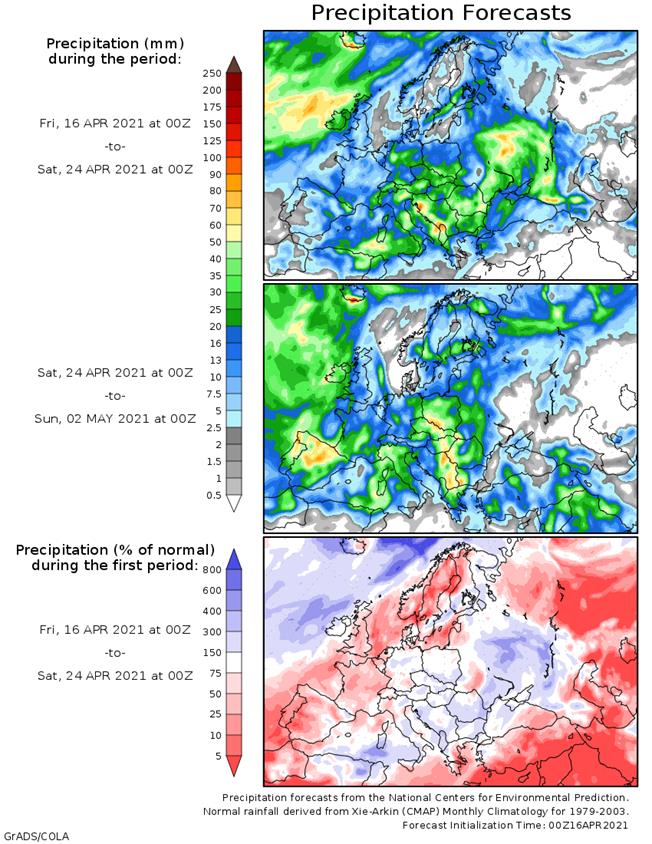

Europe may get some needed precipitation after April 26, but net drying is likely until then in France, the United Kingdom and neighboring areas - Recent

frost and freezes in western and southern Europe have induced more damage to fruits and vegetables than to small grains or rapeseed, but these latter crops have been impacted as well - France

and Italy crops have most impacted by this month’s cold - Eastern

Europe will experience mild temperatures and experience some periodic precipitation to maintain mostly favorable field conditions for a while - Western

CIS soil moisture is adequate to abundant and will increase with anticipated rain expected during the coming week to ten days - Western

and southern Russia as well as Ukraine will be favorably moist during the next ten days with a few areas getting a little too wet possibly this weekend into early next week

- The

exception will be near the Caspian Sea where some dryness will linger - China

crop weather will remain very good over the next two weeks, although net drying is expected in the North China Plain for a while - India’s

weather will be mostly good, although scattered showers will occur periodically to slow some of the winter harvest progress - Australia

will continue in a net drying mode for the next ten days supporting good harvest progress in the east while raising the need for moisture in most of the south for future winter wheat, barley and canola planting - Rain

in Queensland sugarcane areas will be welcome and beneficial to late season crop development

- Mainland

areas of Southeast Asia will experience a net boost in precipitation over the next few weeks that will improve corn planting conditions and maintain an improving trend in sugarcane, rice and coffee production areas - Some

beneficial rain fell across parts of this region recently, but southern areas are still dry - Philippines

weather is good for most crops, but a boost in rainfall would be welcome - Typhoon

Surigae may negatively impact coastal areas of Luzon Island next week, but the moisture that spreads inland will be welcome - Indonesia

and Malaysia crop weather is expected to be mostly good for the next ten days to two weeks with most areas getting rain - North

Africa will experience a favorable mix of weather over the next ten days - All

of the moisture will be welcome, but resulting amounts may be a little erratic and light leaving need for more moisture in some areas - Northwestern

Algeria and southwestern Morocco need rain most - Temperatures

will be near to above average - West-central

Africa coffee and cocoa weather has been very good recently and that is not likely to change much for a while; some rice and sugarcane has benefited from the pattern as well - Rainfall

will be a little lighter and less frequent than usual over for a while longer, but improved rainfall should occur later this week and into the coming weekend

- Temperatures

have been and will continue to be warmer than usual keeping evaporation rates very strong until greater rain evolves - East-central

Africa rainfall has been erratic recently and a boost in precipitation should come to Ethiopia this month while Tanzania slowly begins to dry down - South

Africa weather will continue favorably for early maturing summer crops and the development of late season crops - Net

drying is expected for except in the southeast where some periodic showers will occur - Good

field progress is expected for early maturing crops - Temperatures

will be warmer than usual and that will dry out the soil relatively quickly - New

Zealand rainfall will be a little lighter than usual during the coming ten days, but still beneficial - Many

areas are still drier biased and need the increased rainfall - Temperatures

will be seasonable - Southeastern

Canada will see a boost in precipitation and some cooling during the coming week - Mexico

precipitation will continue limited to a few eastern and far southern locations during the next week to ten days - Rain

is needed in many areas - Drought

is prevailing across most of the nation - Southern

Oscillation Index this morning was +0.48 and the index will move in a narrow range for a while

Source:

World Weather Inc. & FI

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Sunday,

April 18:

- China

customs to publish trade data, including imports of corn, wheat, sugar and pork - Boao

Forum in Hainan, China, day 1

Monday,

April 19:

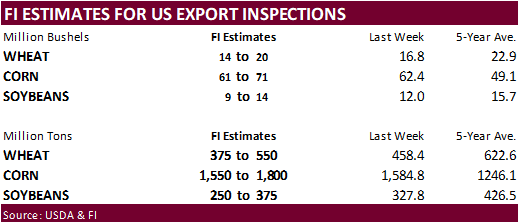

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Boao

Forum in Hainan, China, day 2 - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 20:

- China

customs to release trade data, including country breakdowns for commodities such as soybeans - China

farm ministry’s CASDE outlook conference, day 1 - New

Zealand global dairy trade auction - Boao

Forum in Hainan, China, day 3 - Malaysia’s

April 1-20 palm oil export data from SGS - Platts

Agriculture Week conference, day 1 - Brazil’s

Conab releases cane, sugar and ethanol production data (tentative) - AB

Sugar interim results

Wednesday,

April 21:

- EIA

weekly U.S. ethanol inventories, production - China

farm ministry’s CASDE outlook conference, day 2 - Platts

Agriculture Week conference, day 2 - Boao

Forum in Hainan, China, day 4 - USDA

Milk Production, 3pm - HOLIDAY:

Brazil, India

Thursday,

April 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - Platts

Agriculture Week conference, day 3 - USDA

red meat production - EARNINGS:

Suedzucker, Barry Callebaut

Friday,

April 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

Cattle on Feed, Poultry Slaughter 3pm - U.S.

cold storage – pork, beef, poultry

Source:

Bloomberg and FI

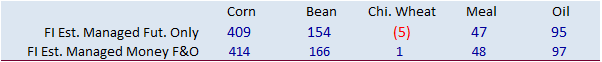

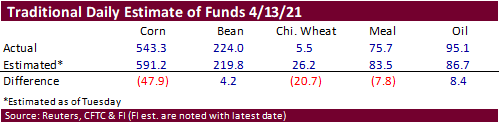

-

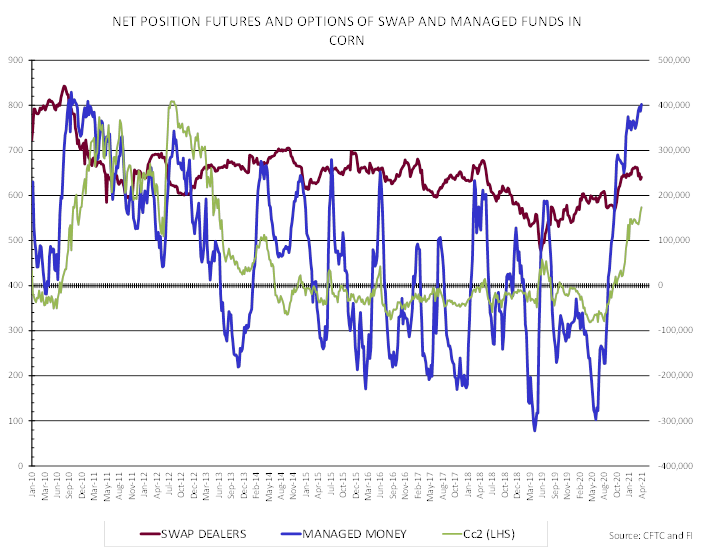

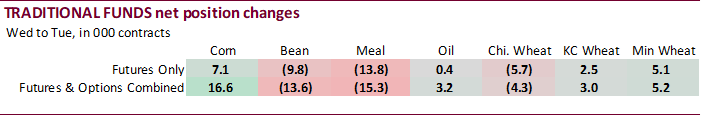

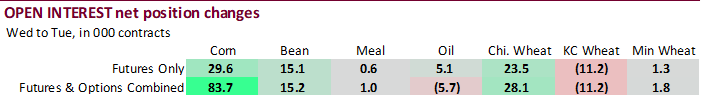

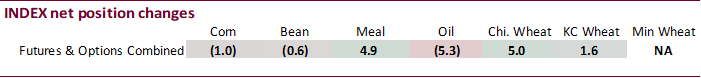

Traditional

funds futures only net long for corn was not a record for the week ending 4/13 as the net long position fell short of estimates by a large 47,900 contracts. Traditional funds for corn futures only were net long 543,286 contracts, short of its record net long

of 547,677 contracts established 1/26/2021. -

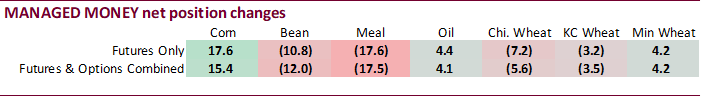

Managed

money futures and options combined in corn was not a record net long but close to it. At 401,993 net long contracts, it did take out the short-term net long position of 395,584 established two weeks earlier and has not been above 400,000 since January 21,

2011. Record net long position was 429,189 net long contracts as of 10/1/2010. -

Traditional

funds futures and options combined for corn was net long 526,059 just short of its record 557,581 net long position established 1/12/21.

-

The

funds futures only net long position for Chicago wheat and soybean meal fell short of expectations and soybeans and soybean oil were little more long than expected.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

375,789 20,046 413,405 -1,031 -758,138 -18,805

Soybeans

102,025 -12,466 171,422 -645 -270,214 13,196

Soyoil

53,275 6,640 115,253 -5,264 -186,200 -74

CBOT

wheat -40,459 -4,984 160,376 4,991 -107,696 -738

KCBT

wheat -369 2,701 62,700 1,639 -62,471 -5,681

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

401,993 15,374 240,603 5,269 -735,606 -21,700

Soybeans

142,258 -12,048 71,142 -2,566 -240,245 16,274

Soymeal

43,830 -17,514 74,845 4,598 -167,463 12,536

Soyoil

81,165 4,128 102,844 2,471 -211,533 -4,348

CBOT

wheat -13,217 -5,634 92,307 1,997 -89,525 1,602

KCBT

wheat 11,028 -3,482 45,267 3,488 -56,627 -7,781

MGEX

wheat 9,680 4,197 4,233 -211 -19,991 -5,575

———- ———- ———- ———- ———- ———-

Total

wheat 7,491 -4,919 141,807 5,274 -166,143 -11,754

Live

cattle 87,231 -4,654 85,639 3 -180,855 2,978

Feeder

cattle 5,781 -334 7,567 102 -3,294 202

Lean

hogs 77,960 1,027 58,678 -346 -146,133 -897

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

124,067 1,267 -31,056 -210 2,448,675 83,716

Soybeans

30,080 -1,575 -3,233 -84 1,208,328 15,222

Soymeal

19,994 2,225 28,794 -1,845 477,525 998

Soyoil

9,851 -952 17,672 -1,300 598,089 -5,747

CBOT

wheat 22,656 1,304 -12,221 731 528,463 28,132

KCBT

wheat 192 6,434 140 1,342 238,080 -11,183

MGEX

wheat -12 1,027 6,090 561 83,605 1,848

———- ———- ———- ———- ———- ———-

Total

wheat 22,836 8,765 -5,991 2,634 850,148 18,797

Live

cattle 22,560 1,842 -14,574 -168 381,970 -2,813

Feeder

cattle 3,519 -694 -13,574 724 52,020 -493

Lean

hogs 15,255 -419 -5,759 635 366,677 3,628

Source:

CFTC, Reuters and CFTC

Macro

JPMorgan

Cuts Brent, WTI 2022 Forecasts By $4 To $70/Bbl, $66/Bbl

US

Housing Starts Mar: 1739K (exp 1613K; prev 1421K)

–

Housing Starts (M/M) Mar: 19.4% (exp 12.5%; prev -10.3%)

–

Building Permits Mar: 1766K (exp 1750K; R prev 1720K)

–

Building Permits (M/M) Mar: 2.7% (exp 1.7%; R prev -8.8%)

Canadian

International Securities Transactions (CAD) Feb: 8.52B (prev 1.27B)

Canadian

Wholesale Trade Sales (M/M) Feb: -0.7% (exp -0.4%; prev 4.0)

US

Univ. Of Michigan Sentiment Apr P: 86.5 (est 89.0; prev 84.9)

–

Conditions: 97.2 (est 96.0; prev 93.0)

–

Expectations: 79.7 (est 85.0; prev 79.7)

–

1-Year Inflation: 3.7% (est 3.3%; prev 3.1%)

–

5-10 Year Inflation: 2.7% (prev 2.8%)

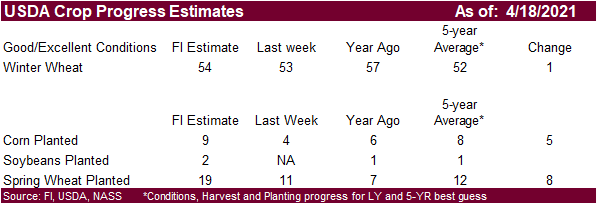

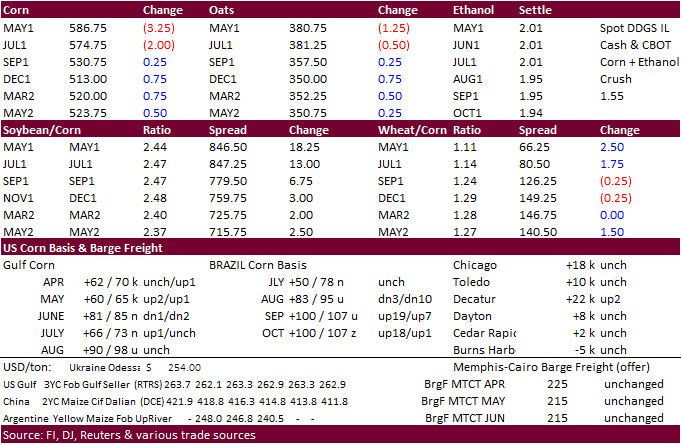

Corn

- CBOT

corn

started higher but turned lower on soybean/corn spreading and profit taking after prices traded above the $6.00 level earlier this week. US weather concerns limited losses for new crop. May ended 4.50 cents lower and December unchanged ($5.8550 & $5.1225,

respectively). Manage money long position has been very large and funds may wanted to liquidate ahead of the weekend to avoid a potential change, in a favorable manor, in the US weather forecast. Brazil will see three waves of scattered showers during the

next two weeks, but amounts will not be soaking. World Weather noted the best precipitation most often will be in Mato Grosso and Goias - Snow

and freezing rain are projected to track across the central Great Plains and far WCB this weekend, delaying fieldwork activity.

- Funds

on Friday sold an estimated net 3,000 corn contracts.

Export

developments.

- South

Korea’s KOCOPIA bought 55,000 tons of US corn at $293.79/ton c&f for March 20-April 30 loading for arrival around July 20.

Updated

4/15/21

May

corn is seen in a $5.70 and $6.10 range

July

is seen in a $5.25 and $5.90 range

December

corn is seen in a $3.85-$5.50 range.

Soybeans

- Funds

on Friday bought an estimated net 6,000 soybean contracts, were flat in soybean meal and bought an estimated 6,000 soybean oil.

- Mato

Grosso, Brazil, producers completed their soybean harvest season. - Argentina

oilseed workers called for a 24 hour strike but apparently that was called off after mediation was agreed upon.

- China’s

first-quarter pork production rose 31.9% from a year earlier to 13.69 million tons. China’s pig herd increased to 415.95 million head at the end of March, a 29.5% rise on the year, and up from 406.5 million at the end of December, via National Bureau of Statistics.

(Reuters). Pork prices via Reuters fell more than 40% since the start of the year. - Ukraine

sunflower oil export prices rose about $45 a ton to $1,570-$1,580 a ton FOB Black Sea over the past several days, according to APK-Inform, over possible government intervention of new-crop exports. Ukraine is considering imposing curbs on sunflower seed exports

and establishing a license requirement for sunflower oil exports. Ukraine is expected to export most of the sunflower oil that was produced in 2020-21.

- Indonesia

Palm Oil Association (GAPKI) reported Indonesia exported 1.99 million tons of palm oil during February, down from 2.54 million tons year ago. Indonesia produced 3.38 million tons of palm oil and kernel oils in February, down from a month earlier. Stocks were

4.04 million tons. (Reuters) - China

cash crush margins on our analysis were 175 (179 previous) vs. 179 cents late last week and compares to 197 cents year earlier.

- APK-Inform

estimated 2021 Ukraine sunflower production at 16.4 million tons, up 15% from last year.

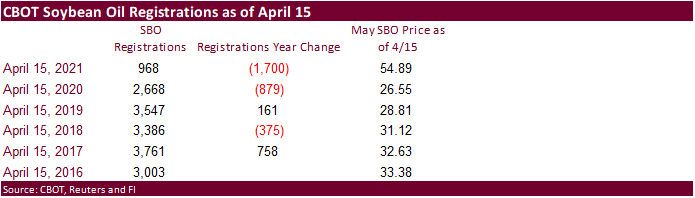

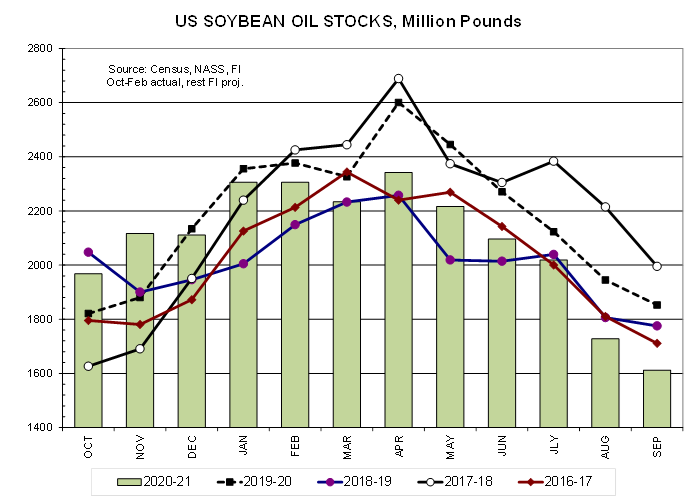

Earlier

in the week 150 soybean oil registrations were canceled out of the Dakota’s, lowering the total amount to 968 receipts. A year ago, the US was flush with soybean oil due to restaurant closures from state lockdowns due to the pandemic. This year soybean oil

is very hard to find across parts of the western US. The western Corn Belt recently has seen a shortage in part to a renewable biodiesel plant planning to open this summer in Oklahoma that will have an annual capacity of around 100 million gallons per year.

The shortage of soybean oil has driven up WCB SBO basis to around indicative 1000 over May futures earlier this month. With US crush downtime scheduled this month for some plants, US SBO supplies are expected to tighten up by the end of next month. We know

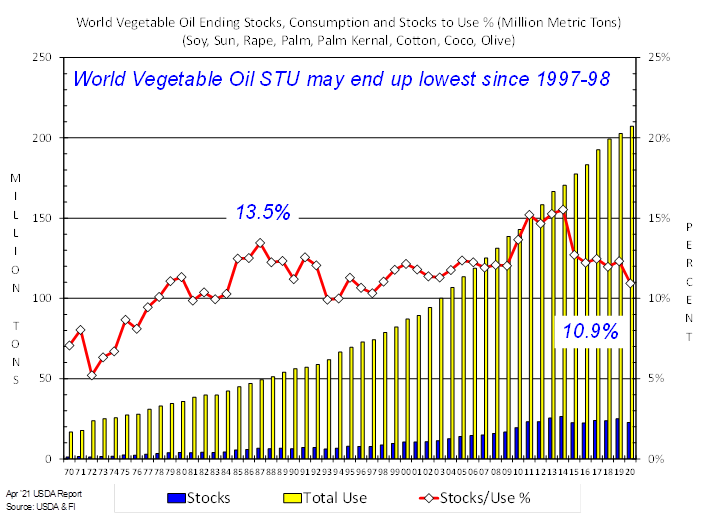

of at least two plants that are currently offline for annual maintenance. Long term SBO demand is expected to remain firm if US biofuel makers remain profitable in producing biodiesel, and global vegetable oils stocks-to-use remain at a 30-year low. Back

in January, Biodiesel Magazine noted about 5 renewable plants were operating across the US, with 6 plants under construction. A total of at least 14 could be up and running within 3 years, representing about 5.5 billion gallons per year of potential capacity.

http://www.biodieselmagazine.com/articles/2517318/renewable-diesels-rising-tide

Below

is a snapshot of April 15 CBOT soybean oil registrations versus SBO May futures on or around April 15.

Export

Developments

- None

reported

Updated

4/16/21

May

soybeans are seen in a $13.65 and $14.50 range

July $13.00-$14.60 November $10.50-$14.50

May

soymeal is seen in a $385 and $410 range

July $380-$4.40 December $325-$460

May

soybean oil is seen in a 53 and 57.50 cent range (up 150)

July

47.00-56.00 December 42-53 cent wide range (depends on global biodiesel and renewable fuel expansion)

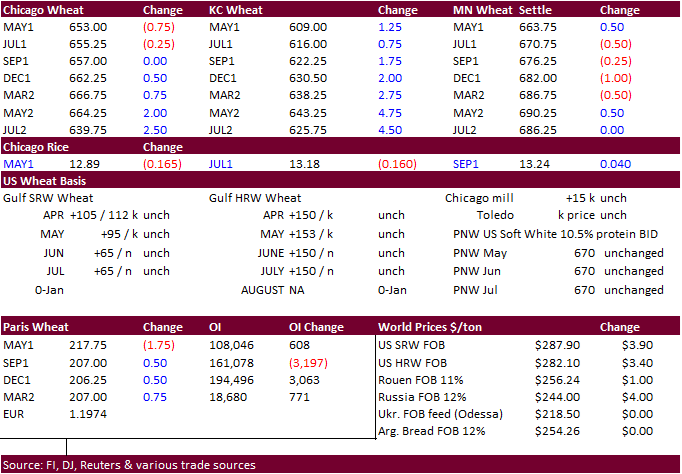

- US

wheat started the day session higher but profit taking dragged Chicago lower followed by MN type wheat. EU wheat paired gains. Bear spreading in Chicago was a feature. Cold weather projected over the next several days for HRW wheat country allowed for that

market to close higher. French crop ratings did not decline that much as of April 12 from the previous week. It may take some time to access the damage form recent cold weather.

- Funds

on Friday sold an estimated net 2,000 CBOT SRW wheat contracts. - There

were 30 CBOT Chicago wheat receipts canceled out of Chicago and Maumee, OH.

- As

of April 12, French soft wheat crop conditions fell one point for the combined good and excellent categories to 86 percent. French winter barley was down 2 and spring barley down 4. Durum wheat declined one point to 88.

- September

Paris wheat was unchanged at 206.25 euros. It was higher this morning but fell after a break in CBOT prices.

- France’s

main agriculture areas may not see much rain until early May. - APK-Inform

sees Ukraine’s 2021 grain harvest up 13% to 73.6 million tons, including 27.6 million tons of wheat, 7.97 million tons of barley and 35.71 million tons of corn. Grain exports could reach 54.2 million tons in 2021-22 season from 45.6 million tons in 2020/21.

- The

Philippines passed on 240,000 tons of wheat and 140,000 tons of animal feed barley for June through September shipment.

- Indonesia

bought around 120,000 tons of Black Sea wheat this week for June shipment.

- Japan

bought a

small amount (380 tons) of feed wheat this week under its SBS import system.

- Results

awaited: Ethiopia seeks 30,000 tons of wheat on April 16. - Ethiopia

seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

- Jordan

seeks 120,000 tons of feed barley on April 21.

Rice/Other

·

Results awaited:

Mauritius

seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Updated

4/13/21

May Chicago wheat is seen in a $6.20‐$6.65 range

July $6.00-$6.80

May KC wheat is seen in a $5.60‐$6.10 range (US HRW wheat

conditions are improving)

July $5.40-$6.25

May MN wheat is seen in a $6.30‐$6.80 range

July $6.20-$7.00 (depends on EU crop damage

and US spring wheat seedings/development)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.