PDF Attached

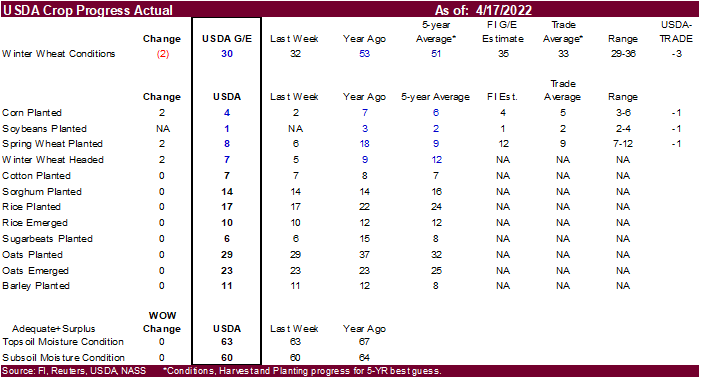

Winter

wheat conditions declining was a surprise after the precipitation

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- West

Texas rain potentials may slowly improve over the next ten days to two weeks.

- Multiple

frontal passages are expected and some of them will be over the region long enough to stimulate a few showers and a couple of thunderstorms eventually - Initial

rainfall cannot be very great because of low humidity and dry air, but over time the potential for rain might improve - No

general soaking is presently anticipated - South

Texas rainfall will be restricted as well, but 0.20 to 0.75 inch of moisture will be possible in the coming ten days which is not enough to adequately moisten the soil in dryland areas - U.S.

High Plains region from Nebraska to Western Texas will not be absolutely dry during the next ten days, but resulting rainfall is unlikely to counter evaporation and net drying is still expected - The

showers that are anticipated will briefly moisten the topsoil during mid-week this week, during the weekend and again during mid-week next week - Each

of these weather systems will be closely monitored for possible change, but as of today the greatest rainfall from each of these systems will be in eastern hard red winter wheat areas where crop conditions are expected to be more favorably rated than those

in the high Plains - U.S.

far northern Plains received additional snow during the weekend from northeastern Montana into northern Minnesota, southern Saskatchewan and Manitoba - Another

12 inches of snow accumulated at Minot, N.D. after 30 inches fell last week - Snowfall

of 2 to 7 inches were common in other areas - U.S.

Northern Plains and eastern Canada’s Prairies will be facing additional storm systems maintaining a wet bias and further raising the potential for planting delays - Snow

and rain will return briefly Tuesday night and Wednesday in the eastern Dakotas to Minnesota as well as in Manitoba, Canada - Moisture

totals will vary from 0.05 to 0.35 inch with local amounts over 0.60 inch in Minnesota and Manitoba - Several

inches of snow will fall in Manitoba - Other

areas in Canada’s Prairies will get precipitation tonight into Wednesday favoring the central and northern areas with accumulations of 3 to 10 inches - A

much larger storm system is expected in the northern Plains and eastern parts of the Canadian Prairies April 21-23 producing 0.20 to 0.75 inch with local totals of 1.00 to 1.50 inches

- Interior

eastern South Dakota will be an exception with less than 0.20 inch of moisture likely - Some

very heavy snow is expected in North Dakota and Manitoba once again with accumulations of 5 to 15 inches possible - There

is plenty of time for change on this event and it will be closely monitored - More

rain than snow may result - There

may be one more storm system in the northern Plains at the end of this month - If

all of these disturbances occur in the northern Plains and southeastern Canada’s Prairies will result in some serious delays to farming activity. The flood potential for North Dakota, northern Minnesota and Manitoba Canada will be high as well. A drier and

warmer weather pattern must develop soon. The Red River in Manitoba is already in flood.

- U.S.

Midwest drying conditions will be poor between storm systems through mid-week this week because of mild to cool temperatures; however, rainfall from most systems is expected to be light - Some

field progress is expected, but warmer weather is needed to induce the best possible field progress - Some

warming is expected in the U.S. Midwest during the second half of this week - Temperatures

will rise into the upper 60s and 70s Fahrenheit Thursday and Friday - Some

extreme highs near and above 80 will be possible in the south Friday - Highs

in the 70s and lower 80s may occur Saturday and Sunday with the eastern Midwest warmest Sunday - The

best planting conditions in the U.S. Midwest will likely occur in the latter part of this week into the weekend before rain evolves again early to md-week next week

- U.S.

Midwest weather late next week will be a little wetter and cooler once again - U.S.

Delta and southeastern states will experience some improved weather this week and next week with less frequent precipitation and warmer temperatures

- Planting

progress is expected to slowly improve - Southwestern

U.S. weather will remain dry biased through the next two weeks - Texas

Blacklands precipitation will vary from 0.75 to 2.00 inches and locally more during the next ten days - Southwestern

Canada’s Prairies will not receive much “significant” precipitation during the next ten days, but a few bouts of very light moisture will occur - Ontario

and Quebec, Canada will see alternating periods of rain and sunshine over the next two weeks supporting abundant soil moisture. - Net

drying is advertised in much of Mato Grosso, northern Mato Grosso do Sul and areas east to southern Bahia, Minas Gerais and Sao Paulo - Topsoil

moisture is already rated short in Mato Grosso and central Bahia wile short to very short in northern Minas Gerais.

- Subsoil

moisture is rated marginally adequate in Mato Grosso and short to very short from northeastern Goias to southern Bahia and northern Minas Gerais - Ten

days of drying will result in crop moisture stress for Mato Grosso and a few neighboring areas and that could harm production potentials for Safrinha corn and cotton - Some

negative impact is also possible for minor grain and oilseed production areas in Bahia and northern Minas Gerais - Rain

must develop soon to prevent dryness during reproduction from cutting into yield potentials.

- Southern

Brazil will get periods of rain from late this week through the first half of next week - Resulting

precipitation will be sufficient to maintain moisture abundance in the region which may slow some farming activity at times - Argentina

experienced net drying during the weekend and similar conditions are expected through Tuesday - Argentina

will get rain Wednesday into Saturday of this week, but its significance has been reduced from that advertised Friday

- Alternating

periods of rain and sunshine are expected next week and that should provide a relatively good environment for late season crops and for future planting moisture for winter wheat - Western

most crop areas will be driest - Frequent

rain will fall from the Amazon River Basin through Ecuador, Colombia and western Venezuela maintaining moisture abundance in those areas - Some

heavy rain and flooding will be possible - Central

and southern Europe will experience wetter than usual conditions over the next ten days and temperatures may be a little cooler than usual as well - The

environment may slow some spring fieldwork, but some progress is expected - Early

season winter and spring crop development will advance, albeit slowly due to milder than usual conditions - Waves

of rain and some snow in the western CIS will maintain moist field conditions in most of the crop areas west of the Ural Mountains and for some areas to the east as well - Spring

fieldwork will be slower advancing than usual because of the precipitation, wet fields and milder than usual temperatures in many areas - China

rainfall was widespread in the middle and upper Yangtze River Basin during the weekend with some heavy rain in the Yangtze Basin

- Rainfall

of 3.00 to more than 7.00 inches occurred in a part of the Yangtze Basin while lighter amounts occurred elsewhere.

- Temperatures

were mild in the south and warm in the north - China’s

Yangtze River Basin will take a break from precipitation early this week - Rain

will develop again during the second half of this week and continuing frequently into next week maintaining favorable moisture - Net

drying is expected in China’s Yellow River Basin and North China Plain - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - India’s

rainfall will be greatest in the far Eastern States this week, although some pre-monsoonal showers and thunderstorms are expected briefly in the south - Good

harvest weather will continue in winter crop areas - Temperatures

will remain warm - Turkey,

Iran and Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas - Overall,

crop conditions will remain favorable - Southern

New South Wales cotton and sorghum areas will be bothered by some early-week rainfall this week; otherwise good crop maturation and harvest weather is expected in summer crop areas - Next

week’s weather may trend wetter in a larger part of southeastern Australia - South

Africa continues in need of drier weather to protect summer crop conditions and to promote faster crop maturation and harvest progress - The

moisture will be good for winter crop planting - Central

Africa showers and thunderstorms will occur periodically during the next two weeks to support fieldwork and crop development - North

Africa precipitation over the next two weeks will be a little more sporadic and light leading to some net drying - Crop

conditions have remained favorable and are not likely to change much in the next ten days, despite some drying - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will experience some periodic rainfall over the next two weeks and some soil moisture boosting is expected in eastern parts of the nation - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +14.40 and it should drift a little higher early this week before leveling off

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Malaysia

Wednesday,

April 20:

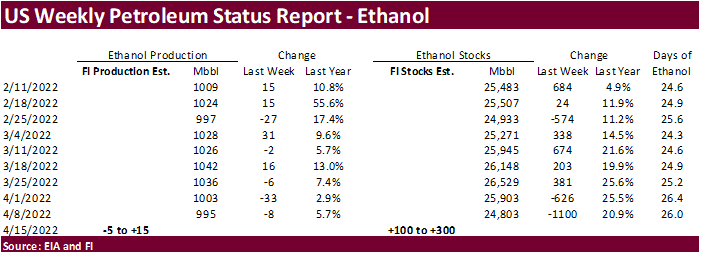

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

third batch of March trade data, including soy, corn and pork imports by country - China

Agricultural Outlook Conference, Beijing - USDA

monthly milk production, 3pm - Malaysia’s

April 1-20 palm oil export data

Thursday,

April 21:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - USDA

red meat production, 3pm - HOLIDAY:

Brazil

Friday,

April 22:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - First

quarter cocoa grinding data from Cocoa Association of Asia - Brazil’s

Unica may release cane crush and sugar output data (tentative) - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

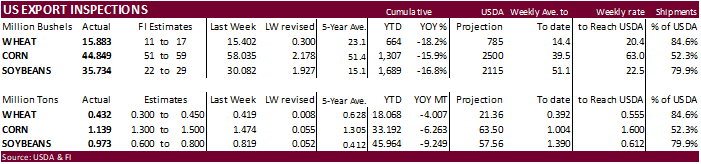

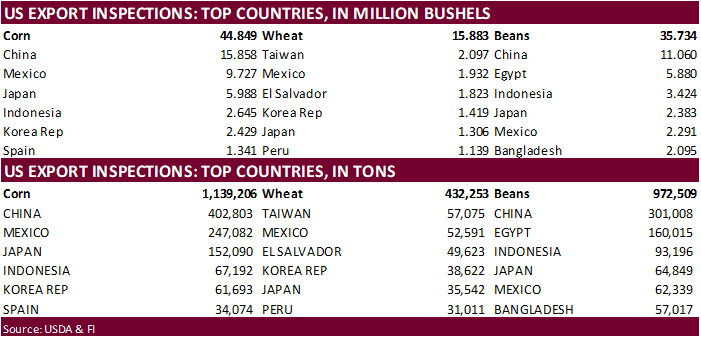

USDA

inspections versus Reuters trade range

Wheat

432,253 versus 300000-500000 range within

Corn

1,139,206 versus 1050000-1800000 range within

Soybeans

972,509 versus 500000-1150000 range within

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 14, 2022

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/14/2022 04/07/2022 04/15/2021 TO DATE TO DATE

BARLEY

0 0 0 10,010 32,620

CORN

1,139,206 1,474,156 1,559,267 33,191,718 39,454,930

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

100 0 1,099 600 6,514

RYE

0 0 0 0 0

SORGHUM

316,467 143,839 314,699 4,912,896 5,202,257

SOYBEANS

972,509 818,689 222,065 45,964,092 55,213,057

SUNFLOWER

336 528 0 1,588 0

WHEAT

432,253 419,185 629,065 18,067,567 22,074,810

Total

2,860,871 2,856,397 2,726,195 102,148,795 121,984,697

—————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

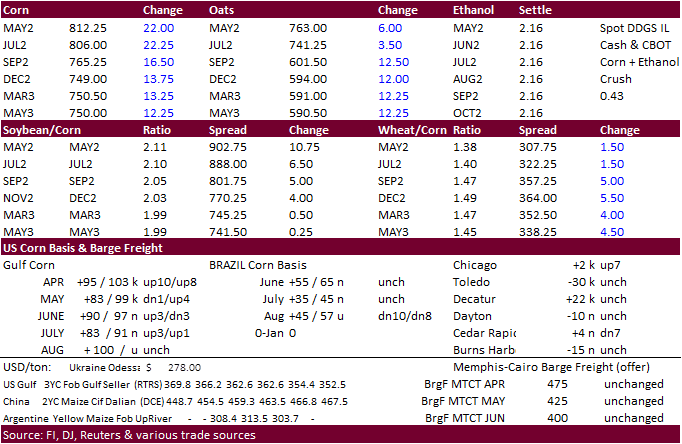

Corn

·

May corn

was higher (well above $8.00) on higher wheat amid Black Sea concerns. WTI crude gained today, adding support. Higher energy prices, including natural gas, are sending thoughts to traders that they will not see acreage increase in June from March intentions.

·

Ongoing Black Sea shipping concerns should underpin corn this week. The slow start to US plantings and cold US weather could also be supportive.

·

USDA US corn export inspections as of April 14, 2022 were 1,139,206 tons, within a range of trade expectations, below 1,474,156 tons previous week and compares to 1,559,267 tons year ago. Major countries included China for 402,803

tons, Mexico for 247,082 tons, and Japan for 152,090 tons.

·

China imported 2.41 million tons of corn last month, a 25 percent increase from a year ago.

·

Ukraine’s AgMin updated their 2022 summer grain planting intentions to 14 million hectares, up from previous 13.4 million, and well down from 16.9 million planted in 2021. This estimate is well above private forecasts. The AgMin

said producers have planted 146,400 hectares of spring wheat, 742,900 hectares of spring barley, 100,500 hectares of peas, 122,600 hectares of corn, 433,700 hectares of sunflower, 110,300 hectares of sugar beet and some other crops. (Rueters)

·

APK-Inform estimates Ukraine could harvest 38.9 million tons of grain in 2022, almost 55% less than in 2021.

·

FranceAgriMer reported 8% of the corn crop had been planted, compared with 4% a week earlier and 16% year ago.

·

Bulgaria reported an outbreak of bird flu at an industrial farm in the village of Bogdanitsa, southern part of the country.

Export

developments.

·

None reported

Cost

to Produce Corn and Soybeans in Illinois—2021

Zwilling,

B. “Cost to Produce Corn and Soybeans in Illinois—2021.” farmdoc daily (12):52, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 15, 2022.

https://farmdocdaily.illinois.edu/2022/04/cost-to-produce-corn-and-soybeans-in-illinois-2021.html

Updated

4/18/22

May

corn is seen in a $7.75 and $8.55 range

December

corn is seen in a wide $5.50-$8.00 range

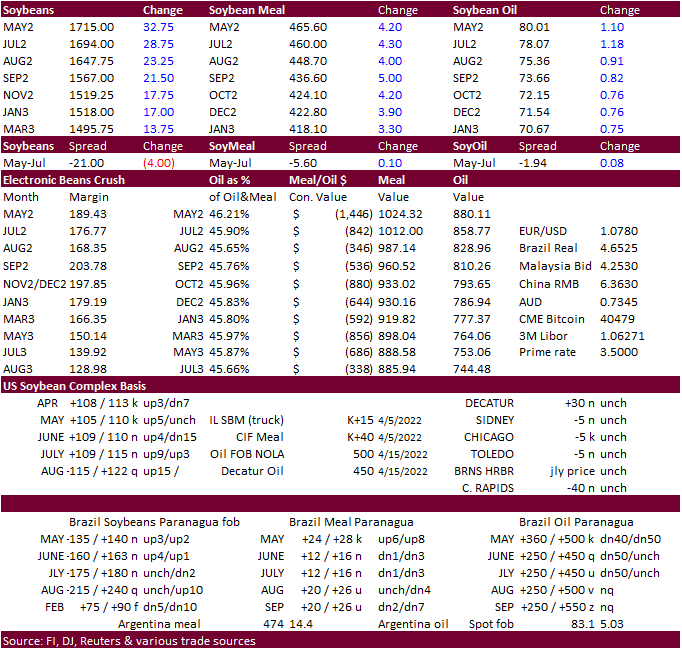

Soybeans

·

Soybeans were higher from strength in outside markets, USDA sales reported on Friday and higher soybean oil. Soybean oil and meal ended higher.

·

USDA US soybean export inspections as of April 14, 2022 were 972,509 tons, within a range of trade expectations, above 818,689 tons previous week and compares to 222,065 tons year ago. Major countries included China for 301,008

tons, Egypt for 160,015 tons, and Indonesia for 93,196 tons.

·

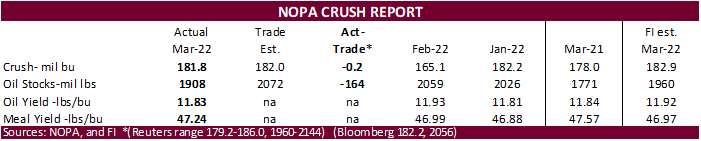

NOPA reported a 181.8-million-bushel US March soybean crush, 0.2 million below expectations. Soybean oil stocks fell 164 million pounds below expectations at 1.908 billion pounds. Daily adjusted, the crush rate fell to 5.86 million

bu/day from 5.89 million/day during February. The lower than anticipated stocks reflected a steep monthly drop in the soybean oil yield to 11.83 pounds per bushel versus 11.93 pounds reported for the month of February. Soybean oil stocks at the end of March

for all the major regions are up from end of March 2021, with exceptions of the far northwestern Corn Belt/upper Great Plains (MN, ND, SD, MT). The March soybean meal yield was 47.24, up from 46.99 previous month. Soybean meal production during March was the

fifth largest, for any month, in our recorded history.

·

Europe was on holiday today.

·

Cargo surveyor SGS reported month to date April 15 Malaysian palm exports at 495,096 tons, 79,797 tons below the same period a month ago or down 13.9%, and 88,779 tons below the same period a year ago or down 15.2%.

·

AmSpec reported Malaysian April 1-15 palm oil exports at 436,548 tons, down 23 percent from 567,637 tons during the March 1-15 period. ITS reported 472,181 tons from 585,277 tons, down 19.3 percent.

·

Russia’s sunflower oil export duty for the month of May will increase 19% or $58.90/ton to a maximum of $372.20/ton, highest since September 2021.

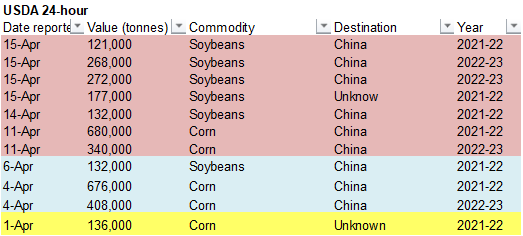

-389,000

metric tons of soybeans for delivery to China. Of the total, 121,000 metric tons is for delivery during the 2021/2022 marketing year and 268,000 metric tons is for delivery during the 2022/2023 marketing year.

-272,000

metric tons of soybeans received during the reporting period for delivery to China during the 2022/2023 marketing year.

-177,000

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

Soybeans

– May $16.00-$17.75

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 77-82

·

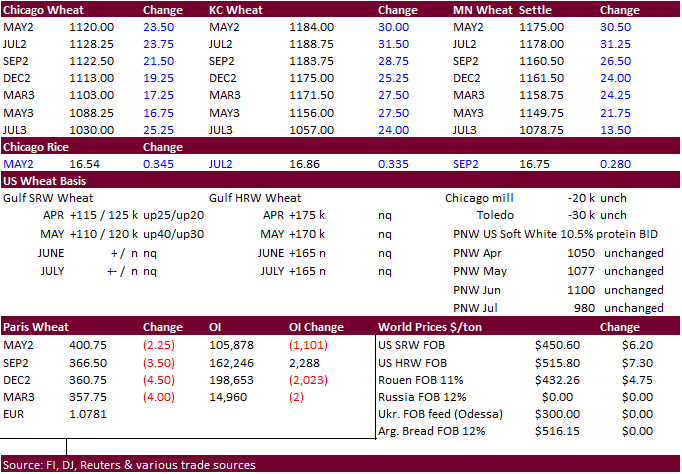

US wheat was higher on ongoing Black Sea concerns and dry weather for parts of US winter wheat country.

·

USDA US all-wheat export inspections as of April 14, 2022 were 432,253 tons, within a range of trade expectations, above 419,185 tons previous week and compares to 629,065 tons year ago. Major countries included Taiwan for 57,075

tons, Mexico for 52,591 tons, and El Salvador for 49,623 tons.

·

Kazakhstan decided to go ahead with restricting flour and wheat exports until June 2022. 1 million tons of wheat and 300,000 tons of wheat flour will be allowed to be exported during that time period.

·

China sold 531,469 tons of wheat from reserves at an average price of 2,841 yuan per ton. That represents 96.43 percent of what was offered.

·

FranceAgriMer reported 92% of French soft wheat crop was in good or excellent condition for the week ending April 11, unchanged from the previous week and above 86 percent year ago.

·

Jordan seeks 120,000 tons of feed barley on April 19.

·

Jordan seeks 120,000 tons of feed wheat on April 20.

·

Japan seeks 70,000 tons of feed wheat and 40,000 tons of feed barley on April 20 for arrival by September 29.

·

Taiwan seeks 47,120 tons of US wheat on April 21 for June 2 through June 21 if shipped off the PNW.

Rice/Other

·

None reported

Updated

4/13/22

Chicago May $9.75 to $12.00 range, December $8.50-$12.00

KC May $10.50 to $12.00 range, December $8.75-$13.50

MN May $10.75‐$12.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.