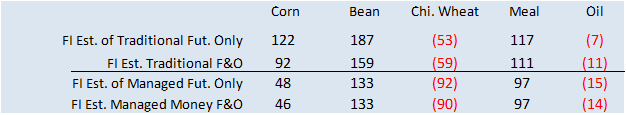

PDF Attached includes FI estimates for USDA export sales

Choppy

trade with soybeans ending higher led by slow Argentina producer selling and higher soybean oil. Wide two-sided trade in meal with a lower close on demand destruction. Corn ended moderately higher, Chicago wheat higher and high protein wheat lower.

World

Weather Inc.

-

Freezes

will occur this weekend in the Great Plains, Midwest and northern Delta -

Most

winter crops in the central Plains should not be harmed -

Concern

is moderate over crops in Oklahoma and southeastern parts of the Texas Panhandle where frost and some freezes are possible

-

Wheat

is booting and heading in some of these areas, although mostly south of where the more significant freezes are expected -

Oats

and rye are also heading in these warmer areas and canola is flowering; all of these crops are vulnerable to damage, but since the more advanced crops are in the south there is potential the only a few will be seriously impacted by the cold -

Northern

fringes of the Delta in Arkansas, southeastern Missouri as well as southernmost Illinois and Kentucky will be monitored for some damage, too -

Early

emerged corn will be negatively impacted by the cold, although the growing point should be below the surface of the soil keeping the potential for permanent damage low -

Rain

may return to the central and southern U.S. Plains next week as warmer air returns the Plains after weekend frost and freezes -

The

southwestern Plains are least likely to get a soaking of rain, but some showers are expected -

The

heart of Texas into central Kansas, parts of Nebraska, Iowa and Missouri could receive rain as warm, moist, air flows northward -

The

west-central Plains may get some moisture, too, but a general soaking seems unlikely -

U.S.

Delta will experience rain prior to the cold surge late this week and then receive more rain when the warm air returns next week keeping the region plenty wet if not a little too wet -

Some

U.S. southeastern states crop areas will dry down for a while, but rain may return next week

-

Red

River Basin of the North flooding in eastern North Dakota and northwestern Minnesota will continue to evolve, but the situation does not seem to be as extreme as that of 2009 and 1997 -

Canada’s

eastern Prairies will be inundated with heavy snow tonight through Thursday -

Snowfall

of 6 to 15 inches is expected from east-central and southeastern Saskatchewan through west-central and southwestern Manitoba -

Local

accumulations of more than 20 inches is quite likely in interior southeastern Saskatchewan

-

Moisture

totals of 0.50 to 1.50 inches and local totals over 2.00 inches will be possible -

Breezy

conditions are likely as well which may result in a notable amount of blowing and drifting of snow even though it will be a s wet snow -

Livestock

stress, travel delays and perhaps a few power outages will be possible as well -

Snowfall

of 2 to 6 inches will also impact central Saskatchewan while 1 to 3 inches accumulates in west-central Saskatchewan and into east-central and southern Alberta -

Drought

will continue in the

southwestern Canadian Prairies, although the snow noted above will provide a little topsoil moisture for a brief period of time -

Temperatures

will be colder than usual across much of the Canada central and eastern Prairies and the northern U.S. Plains through the next ten days and some areas in the U.S. Pacific Northwest will also be cooler biased for a while -

California

and the southwestern desert region will be dry biased for the next ten days -

Ontario

and Quebec, Canada soil temperatures have warmed in favor or new wheat development, but cooling is expected in the coming week

-

U.S.

temperatures will turn much warmer in the central and southern states during mid-week this week and in the eastern states late this week ahead of much colder air late this week and during the weekend in the central states and in the eastern states during the

late weekend and early part of next week. -

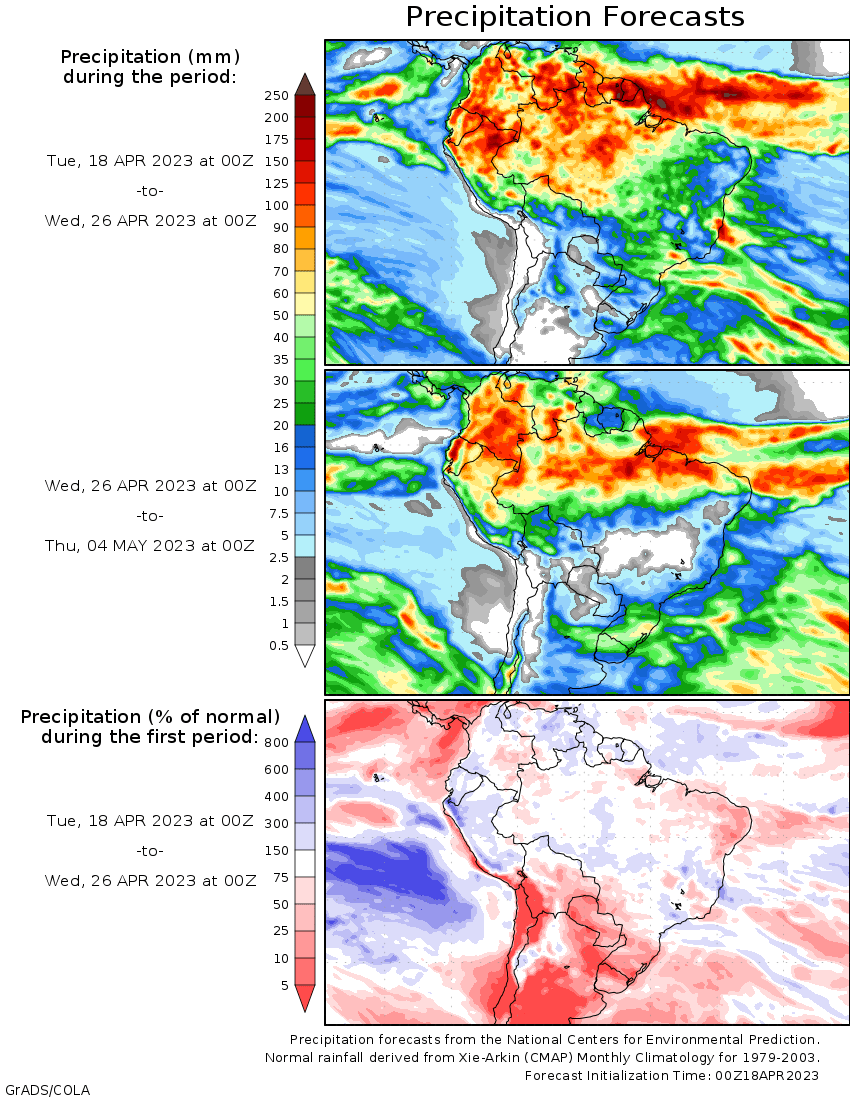

Argentina

precipitation during the seven days will continue restricted which will be great for summer crop maturation and harvesting, but a boost in rain will be needed prior autumn wheat and barley planting in June -

Some

rain is expected next week, but the impact on harvesting will be low -

Weekend

precipitation was minimal, and temperatures were mild -

Brazil’s

summer monsoon is ending, but some rainfall is expected erratically over the next two weeks some of which will be from mid-latitude frontal systems and not due to the withdrawing monsoon -

Rainfall

will be greatest from Mato Grosso do Sul to Parana and Sao Paulo today and Wednesday in association with a cool front -

Net

drying is expected after that for a while -

Southwestern

Europe is still not likely to get much precipitation during the next ten days -

A

few showers will occur, but resulting precipitation will not be enough to counter evaporation -

Rain

is expected in most other areas periodically -

Europe

temperatures will continue near to above normal through the next ten days with southwestern areas driest and warmest -

CIS

precipitation in the coming week to ten days will be greatest from Belarus and the Baltic States through Ukraine to Russia’s Southern Region maintaining moisture abundance -

Temperatures

will be seasonable -

Spring

planting may be delayed at times, but winter crop development should be normal -

Western

and northern Russia precipitation will be light during the next ten days, but soil moisture will remain favorable -

India

precipitation over the next two weeks is expected to be typical of this time of year with periodic, pre-monsoonal, precipitation expected in the central, west, south and east while some unusually great rain falls from Uttarakhand to Jammu and Kashmir -

China

weather over the next two weeks will include; -

Frequent

rain in the Yangtze River Basin and areas south to the coast -

Some

rapeseed areas may become a little too wet -

Erratic

precipitation in the North China Plain, eastern Yellow River Basin and northeastern provinces through mid-week and then rain will develop in the Yellow River Basin late this week

-

Winter

wheat and early spring planting will benefit from northern China rainfall -

Xinjiang,

China will experience brief periods of light rain and cool air in the northeast through the next two weeks -

Cotton

and corn planting has begun, but mostly in western production areas where it has been warmest -

Northeastern

Xinjiang continues to experience bouts of cold and some additional frost and freezes are expected this week -

Western

Xinjiang will experience the best planting conditions, but temperatures will still be milder than usual -

Yunnan,

China is too dry and needs moisture for early season corn and rice as well as other crops -

The

province and neighboring areas are considered to be in a drought -

Dryness

will continue in the province cutting into rice and corn planting and production potential as well as some other crops -

Middle

East rainfall is expected from Turkey to Iran this week and will be great for winter and spring crops -

Cotton

and rice planting will benefit after the rain passes -

Winter

crops will fill favorably, but drier weather may soon be needed to protect grain quality -

Australia

precipitation will be minimal over the next week allowing some early season planting of canola, wheat and barley to begin -

Favorable

summer crop maturation and harvest progress is expected -

Rain

will develop in Victoria and neighboring areas late next week -

South

Africa precipitation should be restricted for a while favoring summer crop maturation and harvest progress -

North

Africa will continue too mostly dry along with Spain and Portugal over the next ten days -

Temperatures

will be warmer than usual -

Crop

stress will be expanding raising more concern over wheat and barley production as well as unirrigated spring and summer crops in Spain -

Mainland

areas of Southeast Asia are still in need of greater rain, although the situation is not critical

-

Poor

pre-monsoonal shower and thunderstorm activity has been occurring in many areas and improved rainfall will soon be needed -

This

is impacting some early season sugarcane, rice and coffee development as well as other crops -

Indonesia

and Malaysia weather has been lighter than usual due to the negative phase of Madden Julian Oscillation and this will continue through the coming week and possibly ten days -

Totally

dry weather is not expected, but rainfall may be lighter and more sporadic than usual -

Cotton

areas from Mali to Burkina Faso have not seen a normal start to the rainy season this year; rain is needed to support planting -

Other

west-central Africa coffee and cocoa production areas will receive routinely occurring showers and thunderstorms

-

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Mexico

remains in a drought, though eastern and far southern parts of the nation will get some periodic rain -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was -0.32 and it should move lower over the next several days.

Source:

World Weather, INC.

Bloomberg

Ag calendar

Tuesday,

April 18:

- China’s

2nd batch of March trade data, including agricultural imports - China’s

first quarter pork output and inventory levels - New

Zealand global dairy trade auction

Wednesday,

April 19:

- EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Conab releases cane, sugar and ethanol output data - USDA

total milk production, 3pm - HOLIDAY:

Indonesia, Bangladesh

Thursday,

April 20:

- China’s

3rd batch of March trade data, including country breakdowns for commodities - Malaysia’s

April 1-20 palm oil export data - Cocoa

Association of Asia grinding data for first quarter - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm - HOLIDAY:

Indonesia

Friday,

April 21:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

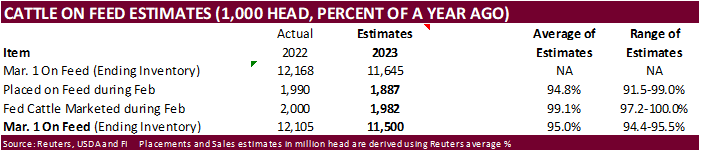

weekly crop condition report - US

cattle on feed, 3pm - HOLIDAY:

Brazil, Indonesia

Source:

Bloomberg and FI

Soybean

and Corn Advisory

2022/23

Brazil Soybean Estimate Unchanged at 153.0 Million Tons

2022/23

Brazil Corn Estimate Unchanged at 123.0 Million Tons

2022/23

Argentina Soybean Estimate Lowered 2.0 mt to 24.0 Million

2022/23

Argentina Corn Estimate Lowered 1.0 mt to 35.0 Million

Chinese

GDP (Y/Y) Q1: 4.5% (exp 4.0%; prev 2.9%)

–

GDP SA (Q/Q) Q1: 2.2% (exp 2.0%; prev 0.0%) – GDP YTD (Y/Y) Q1: 4.5% (exp 4.0%; prev 3.0%)

Chinese

Industrial Production (Y/Y) Mar: 3.9% (exp 4.4%; prev 2.4%)

–

Industrial Production YTD (Y/Y) Mar: 3.0% (exp 3.5%; prev 2.4%)

Chinese

Retail Sales (Y/Y) Mar: 10.6% (exp 7.5%; prev 3.5%)

–

Retail Sales YTD (Y/Y) Mar: 5.8% (exp 3.7%; prev 3.5%)

Chinese

Fixed Assets Ex-Rural YTD (Y/Y) Mar: 5.1% (exp 5.7%; prev 5.5%)

Chinese

Property Sales YTD (Y/Y) Mar: -5.8% (exp -4.7%; prev -5.7%)

–

Residential Property Sales YTD (Y/Y) Mar: 7.1% (prev 3.5%)

Chinese

Surveyed Jobless Rate Mar: 5.3% (exp 5.5%; prev 5.6%)

US

Housing Starts Mar: 1420K (exp 1400K; prev 1450K)

Building

Permits Mar: 1413K (exp 1450K; prevR 1550K)

Housing

Starts (M/M) Mar: -0.8% (exp -3.5%; prev 9.8%)

Building

Permits (M/M) Mar: -8.8% (exp -6.5%; prevR 15.8%)

Canadian

CPI (Y/Y) Mar: 4.3% (exp 4.3%; prev 5.2%)

CPI

NSA (M/M) Mar: 0.5% (exp 0.5%; prev 0.4%)

CPI

BoC Core (Y/Y) Mar: 4.3% (exp 4.4%; prev 4.7%)

CPI

Core- Trim (Y/Y) Mar: 4.4% (exp 4.4%; prev 4.8%)

CPI

Core- Median (Y/Y) Mar: 4.6% (exp 4.5%; prev 4.9%)

106

Counterparties Take $2.239 Tln At Fed Reverse Repo Op. (prev $2.257 Tln, 102 Bids)

·

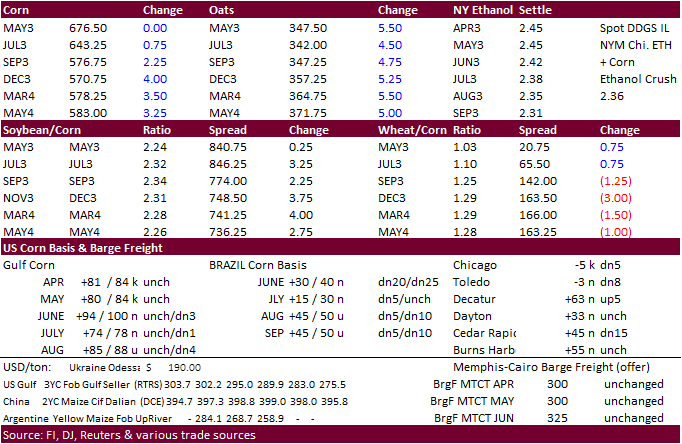

US corn futures ended higher after trading two-sided. Recall corn was strong Monday. A lower soybean meal market limited losses. Positive China economic data and ongoing Black Sea shipping concerns underpinned prices.

·

Funds bought 1,000 corn contracts.

·

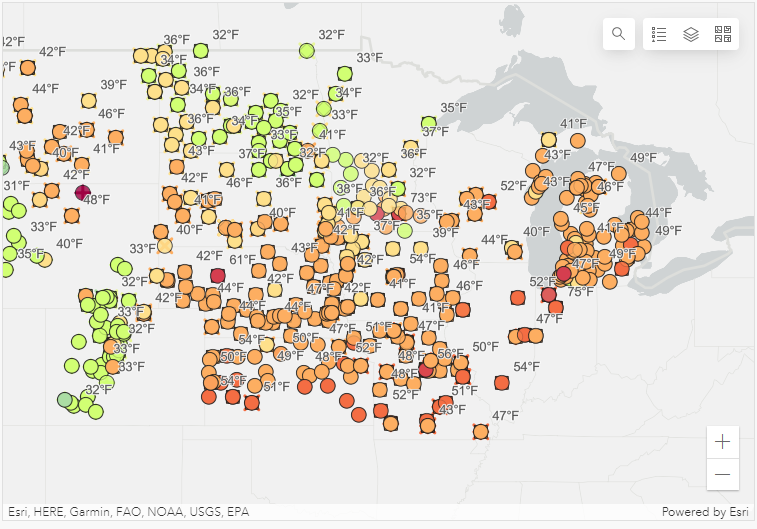

Ideal conditions to plant corn and soybeans is when soil temperatures (3 inches) reach around 50 degrees Fahrenheit.

https://www.weather.gov/ncrfc/LMI_SoilTemperatureDepthMaps

·

China’s GDP was better than expected at 4.5 percent (4.0% expected).

·

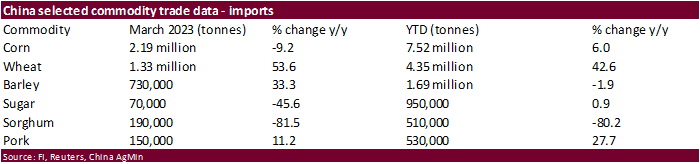

China imported 2.19 million tons of corn during the month of March, 6 percent above the same period year ago. YTD corn imports stand at 7.52 million tons, down 9.2% from year earlier.

·

China’s Q1 pork production increased 1.9% to 15.9 million tons. For Jan-Mar, that’s the highest since at lease 2018. Total meat output including pork, beef, mutton and poultry increased by 2.5% during the first quarter to 24.56

million tons. (Bloomberg)

·

The US Midwest will see precipitation this week, slowing fieldwork progress.

·

Anec sees Brazil corn exports reaching 186,552 tons in April, down from 207,000 tons seen previous week.

·

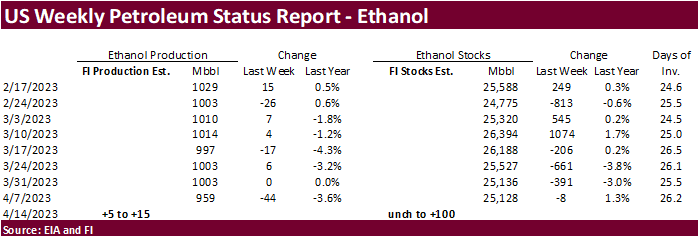

A Bloomberg poll looks for weekly US ethanol production to be up 9,000 thousand barrels to 968k (937-1003 range) from the previous week and stocks down 98,000 barrels to 25.030 million.

Export

developments.

·

None reported

Due

out Friday after the close

Updated

04/11/23

May

corn $6.10-$7.00

July

corn $5.75-$7.00

·

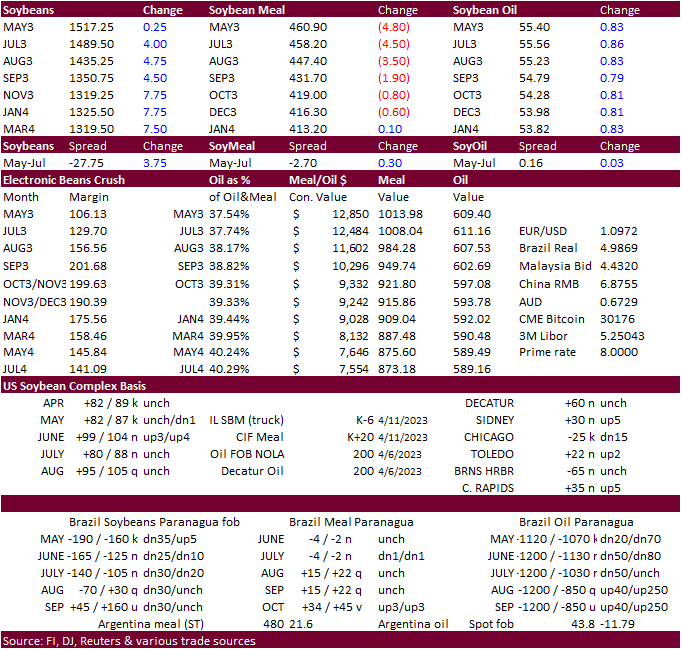

Funds bought 3,000 soybeans, sold 2,000 soybean oil and bought 2,000 soybean oil.

·

Despite higher cash oilmeal prices in Europe and China soybean meal futures appreciating 3.3%, CBOT soybean meal futures fell on demand destruction. Cash movement within Europe was slow. Some traders cited prices are too high.

US soybean meal basis was mostly unchanged across the Midwest.

·

Soybean oil increased on strong global cash prices and spreading against soybean meal. July Malaysian palm oil surged little more than 4 percent, largest one day gain since December, over Indonesia supply concerns and Black Sea

shipping concerns. Indonesia palm stocks at the end of February fell 15 percent from January, reported by GAPKI last week.

·

Egypt seeks vegetable oils on Wednesday.

·

Anec sees Brazil soybean exports are seen reaching 15.15 million tons in April, up from 13.736 million estimated week earlier. Soybean meal exports are seen reaching 2.04 million tons in April, slightly below 2.09 million tons

seen previous week.

·

EU soybean imports so far this season reached 9.79 million tons by April 16 against 11.25 million previous season. EU rapeseed imports reached 6.37 million tons vs. 4.22 million year earlier. Soymeal imports were 12.54 million

tons, down from 13.08 million tons prior season.

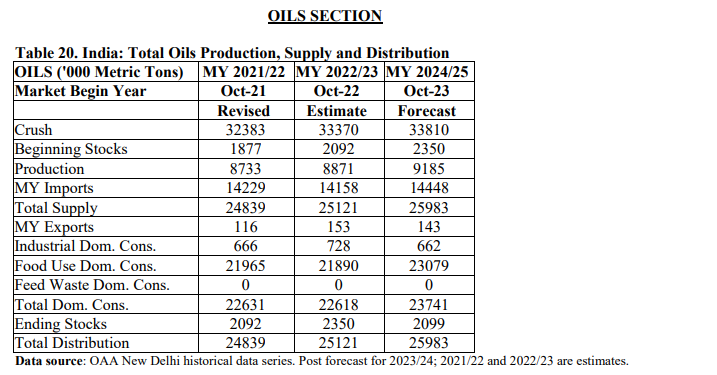

USDA

Attaché: India – Oilseeds Annual

Export

Developments

-

Egypt’s

GASC seeks an unspecified amount of international vegetable oils and small amount of domestic supplies of soybean oil and sunflower oil on April 19 for delivery between May 20 and June 15.

July

Malaysian palm oil

Updated

04/11/23

Soybeans

– May $14.50-$15.25, November $12.25-$15.00

Soybean

meal – May $420-$480, December $325-$500

Soybean

oil – May 53.00-57.00,

December 49-58

·

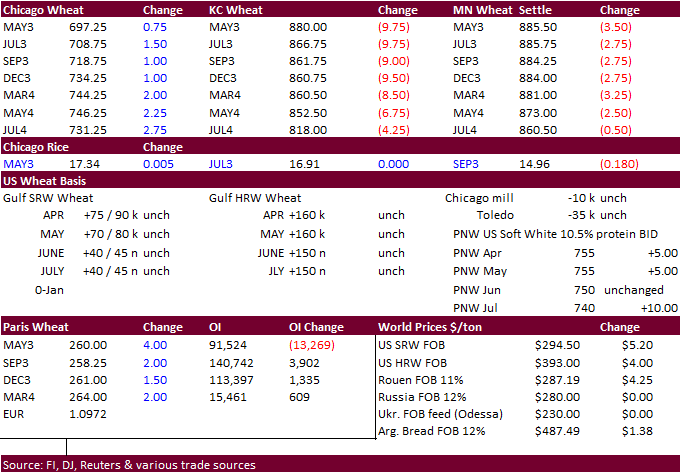

Black Sea uncertainty sent US wheat futures higher earlier, but prices eased on profit taking and prospects for large 2023 supplies. Chicago managed to rebound by afternoon trading and end higher. KC fell 6.50-8.50 cents. MN

was 2.50-3.50 cents lower. The USD was down 37 points as of 2:30 PM CT.

·

Poland reached an agreement with Ukraine over grain transit.

·

SovEcon upward revised their estimate of the Russian wheat crop for 2023 to 86.8 million tons from 85.3 million tons. The AgMin has an 80-85 million ton range. SovEcon lifted their Russian 2022-23 wheat export forecast by 0.4

million tons to 44.5 million tons.

·

Funds bought 1,000 Chicago wheat contracts.

·

May KC wheat hit sell stops after it traded through its 200-day moving average.

·

President Putin visited command posts in Ukraine (annex) as Russia increased assaults on Bakhmut.

·

Ukraine said grain shipments under the grain deal were delayed for a second day, but news agency RIA overnight reported ship inspections resumed. Then later in the morning a Ukraine official denied inspections have restarted.

·

Poland, Hungary and Slovakia recently banned imports of Ukrainian grain. Poland and Ukraine are in talks. Romania’s Social Democrat party supports a ban on Ukraine grain imports.

·

Ukrainian First Deputy Prime Minister said on Tuesday that the Black Sea grain deal is under threat of being halted.

·

The US weather forecast is wetter next week for the US wheat areas. Wet and cold conditions should slow spring wheat planting progress. Light snow will fall across the northern growing areas this week. Eastern KS and eastern NE

will see precipitation one time or another Wednesday through Friday.

·

China imported 1.33 million tons of wheat during the month of March, 43 percent above the same period year ago. YTD wheat imports stand at 4.35 million tons, up 53.6% from year earlier.

·

China sold 18,552 tons of wheat or 47 percent of what was offered back on April 12, at an average price of 2,578 yuan per ton.

·

EU soft wheat exports so far this season that started in July reached 24.37 million tons by April 16, versus 22.47 million a year earlier. EU barley exports were 5.05 million tons against 6.59 million a year ago.

Export

Developments.

·

Jordan bought 50,000 tons of wheat for LH Oct shipment at $303/ton c&f.

·

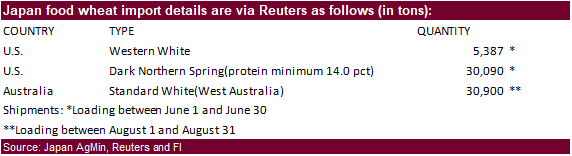

Japan seeks 66,377 tons of food wheat later this week.

·

Jordan seeks 120,000 tons of feed barley on April 19 for October through November 15 shipment.

·

China will auction off 40,000 tons of wheat on April 19.

Rice/Other

·

South Korea seeks 43,500 tons of rice on April 25 for July 1 and September 30 arrival.

Updated

04/11/23

KC

– May $8.25-9.00

MN

– May

$8.40-$9.00

#non-promo