PDF Attached

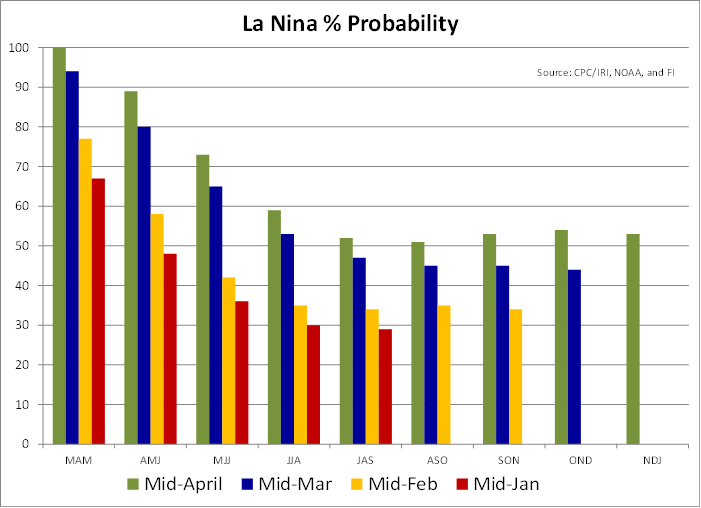

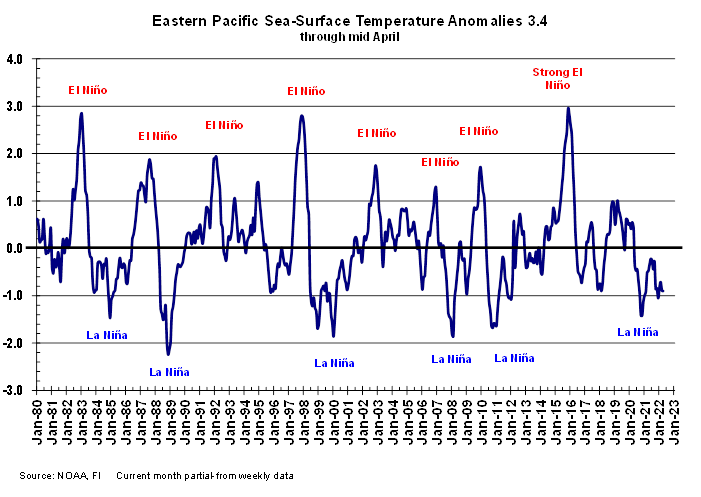

Chance

of La Nina hanging around worsened

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat areas will experience a mini heatwave Thursday and Friday with afternoon temperatures rising to the 80s and 90s Fahrenheit - The

heat will shift east through the Midwest Friday and Saturday with highs in the 70s and 80s - The

heat will stimulate a few days of faster drying between rain events, but the outlook suggests showers and thunderstorms will occur during the warm period limiting the advancement of spring planting - Cooling

is expected late this weekend and throughout next week especially in the Midwest where a cooler bias to temperatures is eventually expected - Spring

planting progress in U.S. corn and soybean production areas from the Delta and Tennessee River Basin into the lower Midwest are behind the usual pace and weather in the next ten days may not help the situation much - Frequent

rain in this first week will limit field progress, despite some warming - Cooling

next week will slow drying rates between storm systems - Planting

is expected, but some areas from the northern Delta and Missouri to the Great Lakes region will experience a little too much moisture for aggressive progress - Not

much precipitation will fall in the high Plains region from West Texas to western Nebraska or eastern Colorado in the next two weeks, although complete dryness is not likely - Most

of the precipitation that falls will not counter evaporation very well and there will be no change in drought status - West

Texas cotton, corn and sorghum production areas will remain too dry during the next two weeks, despite a few showers infrequently - South

Texas dryness will also prevail for a while - U.S.

southeastern states will experience net drying over the next ten days - Warm

temperatures and limited rainfall will allow aggressive spring planting to take place - Greater

rainfall will be needed late this month and in May to ensure the best establishment, although World Weather, Inc. anticipates additional drying and an eventual concern over the lack of moisture - U.S.

northern Plains and Canada’s eastern Prairies will continue subjected to frequent bouts of snow and rain during the next ten days - Parts

of the region are expected to become too wet when the deep snow cover finally melts - Flooding

is already an issue along the Red River in Manitoba and there is much snow to melt and more coming

- Planting

in Manitoba could be delayed through May 15 - Some

delays to planting in North Dakota and northern Minnesota are also expected - Montana

and western North Dakota will experience additional drought relief with significant snow and rain falling Friday into Sunday

- Travel

delays are likely due to snowfall during the weekend of 8 to 15 inches with a few amounts possibly approaching 20 inches - The

heavy snow will also impact southeastern Saskatchewan and Manitoba - Canada’s

southwestern Prairies are not likely to see much “heavy” precipitation for a while and concern over planting moisture and especially subsoil moisture will continue for an extended period of time.

- U.S.

Pacific Northwest continues to get less than usual precipitation, although the lower Columbia River Valley die receive above normal precipitation in the most recent 30 days - Some

improvement in soil moisture also occurred in southern Idaho and in a few Wyoming sugarbeet and potato production areas - More

moisture is needed - California

snow water equivalents are now running 21-31% of normal for this date - Waves

of rain and mountain snow are expected over the next week to ten days, but a recovery in the low snowpack is not likely - All

of the moisture will be welcome, but water restrictions and concern over long term water supply are expected to continue rising - Mato

Grosso and Mato Grosso do Sul through Bahia, Minas Gerais and Sao Paulo, Brazil will experience net drying over the next two weeks - Dryness

is already an issue in northern Minas Gerais and parts of central Bahia and is becoming an issue in Mato Grosso - Mato

Grosso topsoil moisture is rated short to very short while its subsoil moisture is rated marginally adequate to short - Rising

crop stress is predicted over the next two weeks and if there is no relief some yield potentials in corn fields will begin slipping lower - Southern

Brazil crops will stay favorably moist with alternating periods of rain and sunshine expected - Most

of Argentina will also continue to see a good mix of weather along with favorable soil moisture - There

is need for rain in northwestern through west-central parts of the nation - North

Africa weather will remain mostly good for developing wheat and barley - Production

cuts are permanent in southwestern Morocco since some of the crop was not planted due to drought - Other

areas in northern Morocco and areas east to Tunisia should see a favorable production year, despite some winter dryness - India’s

lost winter crop yields came from late February and March dryness, but the losses are not likely to be very great and the winter crops were already poised to produce quite well which should reduce the significance of the delay recently reported - Weather

in India, Europe, the Commonwealth of Independent States and China is expected to remain mostly good over the next ten days - Southwestern

through east-central Europe will experience frequent precipitation over the next ten days and temperatures may be mild to a little cool at times - The

environment may slow some spring fieldwork, but progress is expected - Early

season winter and spring crop development will advance, albeit slowly due to milder than usual conditions - North-central

and northwestern Europe weather is expected to be driest - Waves

of rain and some snow in the western CIS will maintain moist field conditions in most of the crop areas west of the Ural Mountains and for some areas to the east as well - Spring

fieldwork will be slower advancing than usual because of the precipitation, wet fields and milder than usual temperatures in many areas - Topsoil

moisture is rated adequate to excessive west of the Ural Mountains and subsoil moisture is rated adequate - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - China’s

Yangtze River Basin will see rain develop again late this week and into next week

- The

moisture abundance will be good for long term crop development, but fieldwork could be delayed at times

- Net

drying is expected in China’s Yellow River Basin and North China Plain - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Some

rain and snow may impact the far northeast of Xinjiang briefly this weekend through most of next week - India’s

rainfall will be greatest in the far Eastern States this week, although some pre-monsoonal showers and thunderstorms are expected briefly in the south - Good

harvest weather will continue in winter crop areas - Temperatures

will remain warm - Turkey,

Iran and Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas - Overall,

crop conditions will remain favorable - A

tropical cyclone is possible near or east of the Philippines during the middle part of next week that might also impact Japan in the following weekend - Confidence

is low - Southern

New South Wales, Australia cotton and sorghum areas received rain Monday and Tuesday slowing cotton and sorghum maturation and harvest progress - Drying

is expected now through the weekend and crop and field conditions should quickly resume - Cotton

and sorghum harvest conditions in Queensland, Australia remains nearly ideal

- South

Africa continues in need of drier weather to protect summer crop conditions and to promote faster crop maturation and harvest progress - Topo

much moisture could harm crop quality - Cotton

quality has already been compromised and soybean harvesting has been a little slow at times - Central

Africa showers and thunderstorms will occur periodically during the next two weeks to support fieldwork and crop development - North

Africa precipitation over the next two weeks will be a little more sporadic and light leading to some net drying - Crop

conditions have remained favorable and are not likely to change much in the next ten days, despite some drying - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will experience some periodic rainfall over the next two weeks and some soil moisture boosting is expected in eastern parts of the nation - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +15.03 and it should drift higher before leveling off in the next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

third batch of March trade data, including soy, corn and pork imports by country - China

Agricultural Outlook Conference, Beijing - USDA

monthly milk production, 3pm - Malaysia’s

April 1-20 palm oil export data

Thursday,

April 21:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - USDA

red meat production, 3pm - HOLIDAY:

Brazil

Friday,

April 22:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - First

quarter cocoa grinding data from Cocoa Association of Asia - Brazil’s

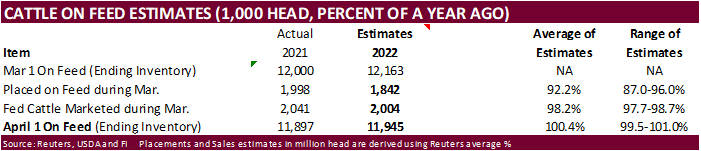

Unica may release cane crush and sugar output data (tentative) - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Canadian

CPI NSA (M/M) Mar: 1.4% (est 0.9%; prev 1.0%)

Canadian

CPI (Y/Y) Mar: 6.7% (est 6.1%; prev 5.7%)

Canadian

CPI BoC Core (M/M) Mar: 1.0% (est 0.5%; prev 0.8%)

Canadian

CPI BoC Core (Y/Y) Mar: 5.5% (est 4.2%; prev 4.8%)

US

Existing Home Sales Change Mar: 5.77M (est 5.77M; prev R 5.93M)

–

Existing Home Sales (M/M): -2.7% (est -4.1%; prev R -8.6%)

US

Median Home Price (USD): 375.3K Or +15.0%

US

DoE Crude Oil Inventories (W/W) 15-Apr: -8020K (est 3000K; prev 9382K)

–

Distillate Inventories: -2664K (est -800K; prev -2902K)

–

Cushing OK Crude Inventories: -185K (prev 450K)

–

Gasoline Inventories: -761K (est -1100K; prev -3648K)

–

Refinery Utilization: 1.00% (est 0.50%; prev -2.50%)

EIA:

US Net Imports Of Crude Oil Fell Last Week To Lowest Since April 2021

·

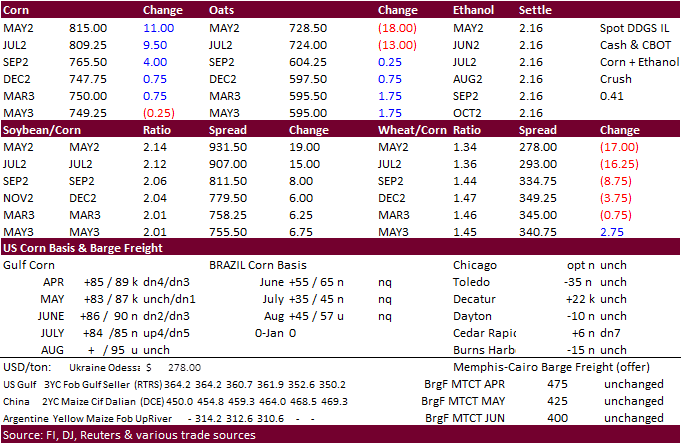

CBOT July corn closed 10.25 cents higher, near its contract high, led by strength in soybeans and talk of strong US demand. The USD was sharply lower. WTI crude was moderately higher by early afternoon. Slow US plantings and Ukraine

planting concerns continue to support corn. On the US domestic demand side, the weekly US ethanol numbers were bearish.

·

The US Midwest will warm up through the weekend, allowing for fieldwork activity before rain returns early next week to the heart of the Midwest, western Delta, parts of TX and OK. The best planting conditions may occur during

the second week of the forecast.

·

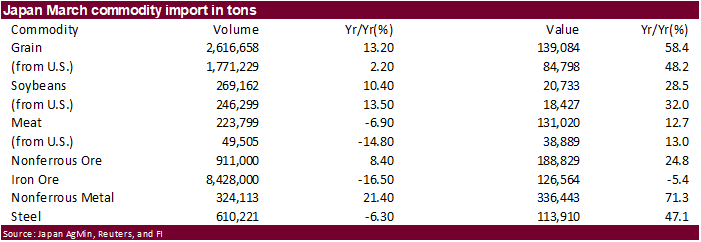

China Jan-March corn imports were 6.73 million tons. March corn imports from the US were 1.04 million tons, near year ago levels. They took in 1.36 million tons of Ukraine corn (sailed before the conflict), up 64 percent from

year earlier.

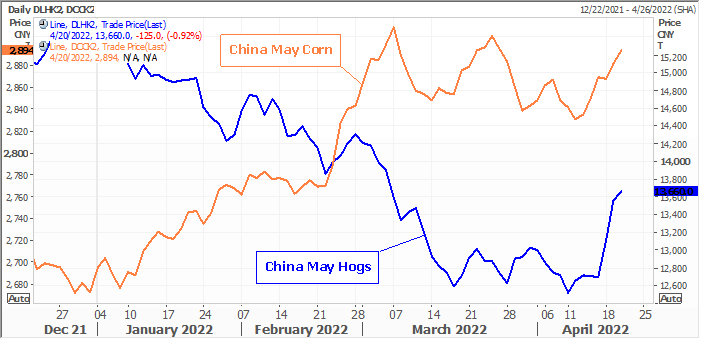

·

China’s Ministry of Agriculture and Rural Affairs sees producer hog margins returning to a profit during the third quarter. Margins have been under pressure since last summer. Hog futures have been on the rise since April 15.

·

The USDA Broiler Report showed eggs set in the US down slightly and chicks placed up slightly from a year ago.

Cumulative

placements from the week ending January 8, 2022 through April 16, 2022 for the United States were 2.79 billion. Cumulative placements were down slightly from the same period a year earlier.

- The

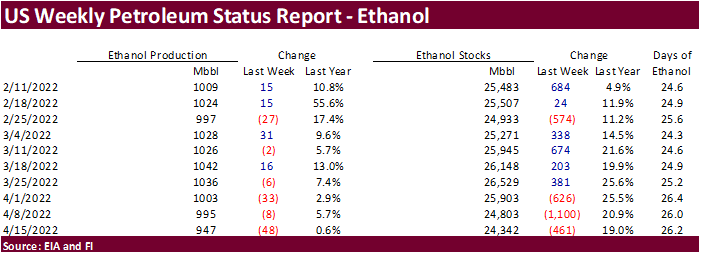

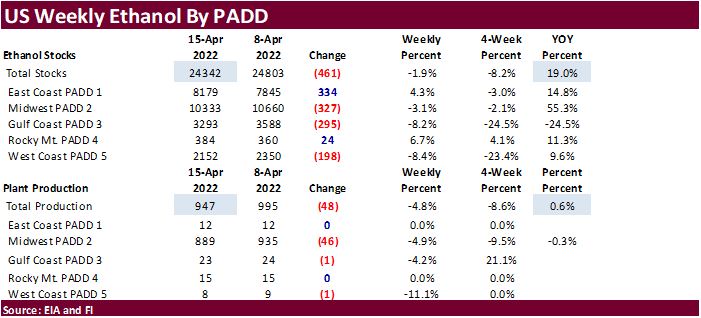

US weekly EIA ethanol data was viewed bearish for US corn futures and friendly for US ethanol futures. - Weekly

US ethanol production decreased 48,000 barrels from the previous week to 947 thousand barrels per day (bbl), lowest level since September 24, 2021.

- Ethanol

stocks decreased 461,000 barrels to 24.342 million, third consecutive weekly decline and stocks are down 2.187 million barrels over the past three weeks.

- For

comparison, A Bloomberg poll looked for weekly US ethanol production to decrease 6,000 barrels from the previous week and stocks to decrease 77,000 barrels.

- US

ethanol production of 947 thousand barrels per day is up 0.6% below from about the same time a year ago but down 8.2% from a month ago.

- Early

September 2021 date (33 weeks) US ethanol production is running 9.8% above the same period a year ago.

- There

were no ethanol imports reported this week. Last reported was late January.

- The

net blender input of fuel ethanol was down 1,000 from the previous week at 886,000 bpd, above its 4-week average of 864,000 bpd.

- Net

production of finished reformulated and conventional motor gasoline with ethanol, increased 13,000 to 8.749 million barrels, or 93.0 percent of the net production of all finished motor gasoline, up from 92.1 percent for the previous week.

- For

2021-22, we are using 5.400 billion bushels corn for ethanol production, compared to 5.375 billion by USDA.

Corn

Projected More Profitable than Soybeans Well into June

Schnitkey,

G., R. Batts, C. Zulauf, K. Swanson and N. Paulson. “Corn Projected More Profitable than Soybeans Well into June.”

farmdoc

daily

(12):53, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 19, 2022.

Export

developments.

·

None reported

Source:

Reuters and FI

Updated

4/18/22

May

corn is seen in a $7.75 and $8.55 range

December

corn is seen in a wide $5.50-$8.00 range

·

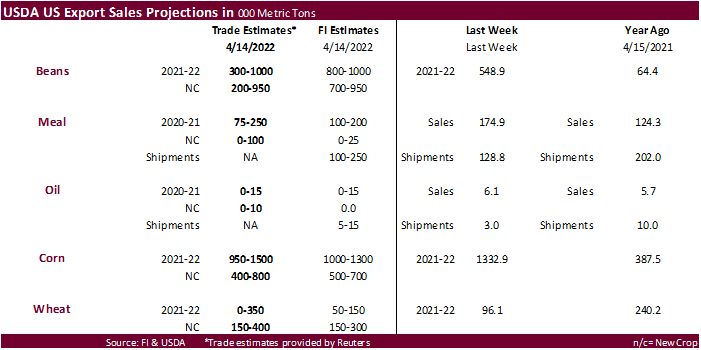

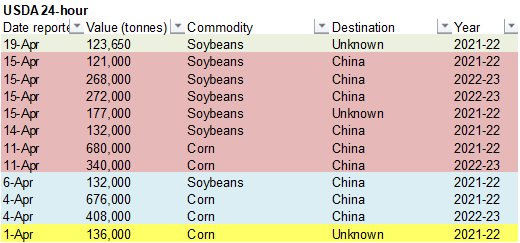

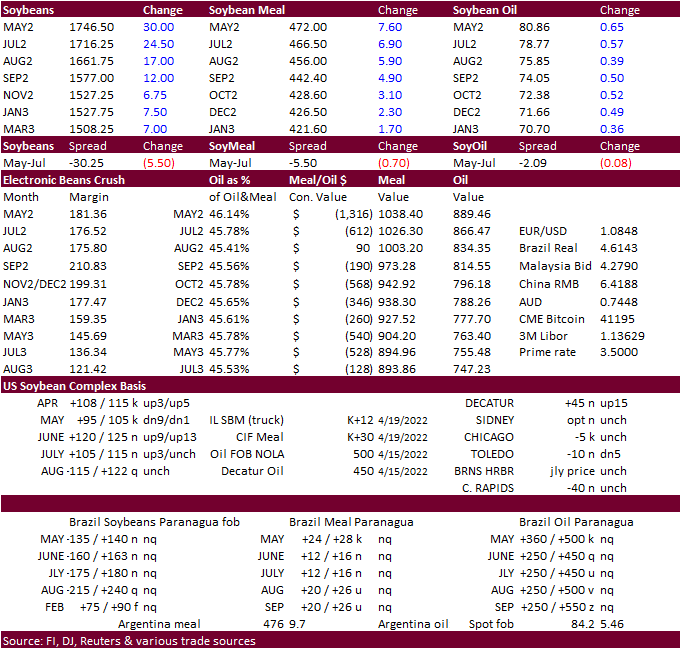

Soybeans ended on a very strong note led by the May contract. July settled 25.25 cents higher. July meal was up $6.70 and July soybean oil was up 55 points, after trading in a wide range. May soybean oil hit a fresh record high.

Talk of strong US soybean demand was noted. 24-hour sales have been good over the past week, especially for old crop soybeans. US FOB Gulf soybean prices are cheaper than Brazil for the summer months through early fall, according to latest cash indications.

Any more snap old crop sales announcements could put some light pressure on nearby crush margins, as that can drive up the values of soybeans over the products.

·

Earlier we heard China was pricing US soybeans. There were no 24-hour sales this morning but something to monitor on Thursday.

·

Oil World noted Russian sunflower oil shipments to India are picking up as current price favors imports over SA soybean oil.

·

Abiove:

Brazil

2022 soybean crop seen at 125.3MMT, unchanged from March

Brazil

2022 soybean exports seen at 77.2MMT, down 500,000 tons from previous estimate

Brazil

2022 soybean crushing seen at a record 48MMT, unchanged from previous

Brazil

2022 soymeal exports seen at a record 18.3MMT, unchanged from previous

Brazil

2022 soybean ending stocks seen at 2.42MMT, up from 1.9 million tons in March estimate

·

China Jan-March soybean imports were 6.73 million tons. During the month of March, China imported 3.37 million tons of US soybeans, down from 7.18 million tons a year earlier. US January-March soybean imports are down 30 percent

from a year ago to 13.4 million tons. March Brazil soybean imports were 2.87 million tons, up from 315,334 tons a year ago.

·

Paris May rapeseed, soon to be expiring, hit a new contract high.

·

The European Commission is studying if the European Union could achieve a target of a 45% share of renewable energy by 2030, instead of its previously proposed 40%, to become less dependent on energy imports.

·

Malaysia is back from holiday and futures trended lower by 99MYR and cash was off $20/ton to $1,590/ton.

·

Cargo surveyor AmSpec reported Malaysian palm oil products for the April 1-20 period fell 18% to 610,728 tons from 744,841 tons previous period month earlier. ITS reported a 14.5 percent decrease to 646,341 tons from 755,977 tons

during March 1-20, cargo surveyor.

·

China looks for sell another 500,000 tons of soybeans during the April 18-23 workweek.

Soybeans

– May $16.00-$17.75

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 77-82

·

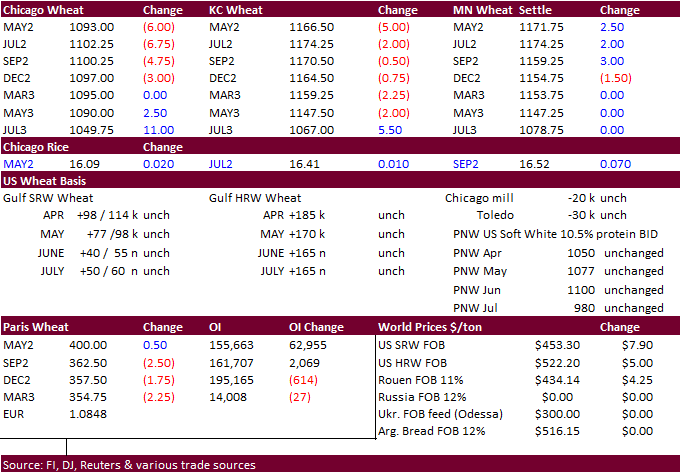

US wheat were

higher in the font months at the electronic break but rolled over after the day session started on follow through fund/technical selling. The contracts paired losses to close 11.50 cents lower basis the July Chicago, 6.75 cents lower for July KC, and remarkably

unchanged for July MN.

·

The July KC/July Chicago wheat spread widened to 72 cents, KC premium, highest for the contract, from negative 20 cents March 22. US drought conditions and strong global demand for high protein wheat has supported this move.

·

Some are doubting if Egypt will buy a large amount of Indian wheat as freight costs are around $70/ton but at $300 to $3355/ton fob, India is still cheaper than EU and US supplies.

·

September EU wheat futures were 4.00 euros lower at 361.00 euros.

·

BA Grains Exchange: Argentina wheat planted are projected at 6.5 million hectares, down from 6.5 million last season. 2021-22 production was 21.8 million tons.

·

Jordan passed on 120,000 tons of wheat.

·

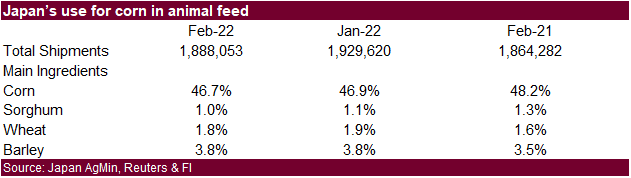

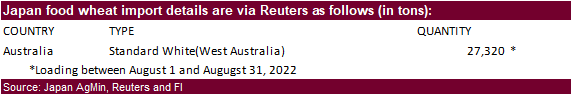

Japan bought only 380 tons of feed barley in their weekly feed wheat & barley import tender.

·

Japan seeks 27,320 tons of wheat on Thursday.

·

Taiwan seeks 47,120 tons of US wheat on April 21 for June 2 through June 21 if shipped off the PNW.

Rice/Other

·

None reported

Updated

4/13/22

Chicago May $9.75 to $12.00 range, December $8.50-$12.00

KC May $10.50 to $12.00 range, December $8.75-$13.50

MN May $10.75‐$12.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.