PDF Attached

Follow-thru buying from yesterday derived from US planting delays, South American weather, and US Corn Belt wintery weather. Option activity was heavy, many call spreads traded which are thought to be new longs for the buyers and roll ups for the sellers. Both sides of the flow can be construed as bullish. Tight cash supplies coupled with global demand for US grain has got the US ag markets all bulled up.

Next 7 days precipitation – QPC

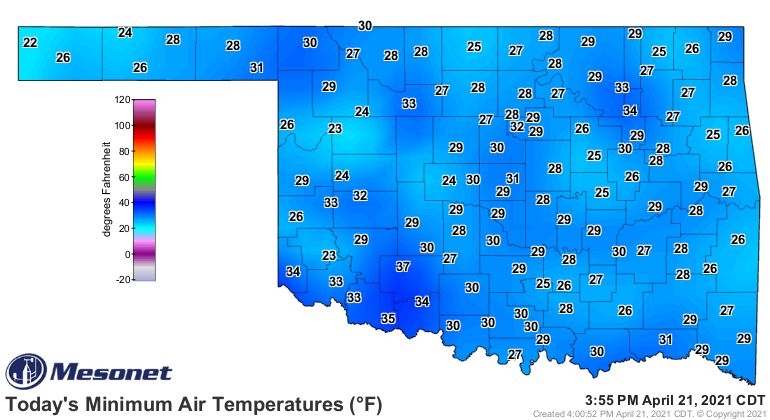

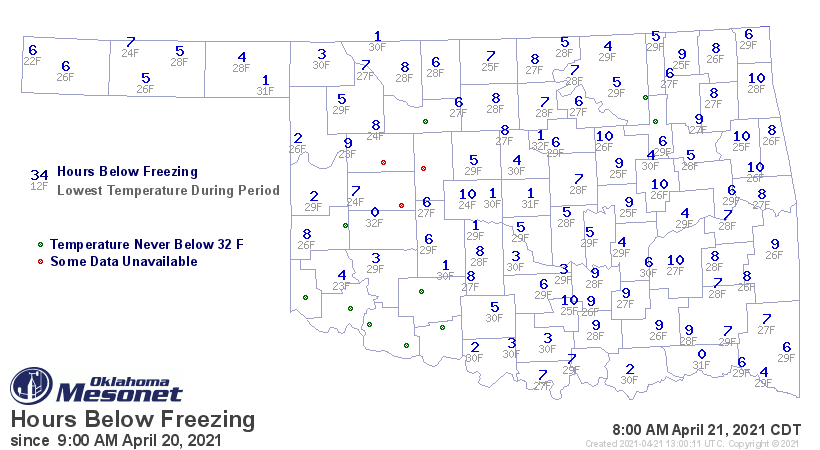

Oklahoma Mesonet

Minimum Air Temperature Hours Below Freezing

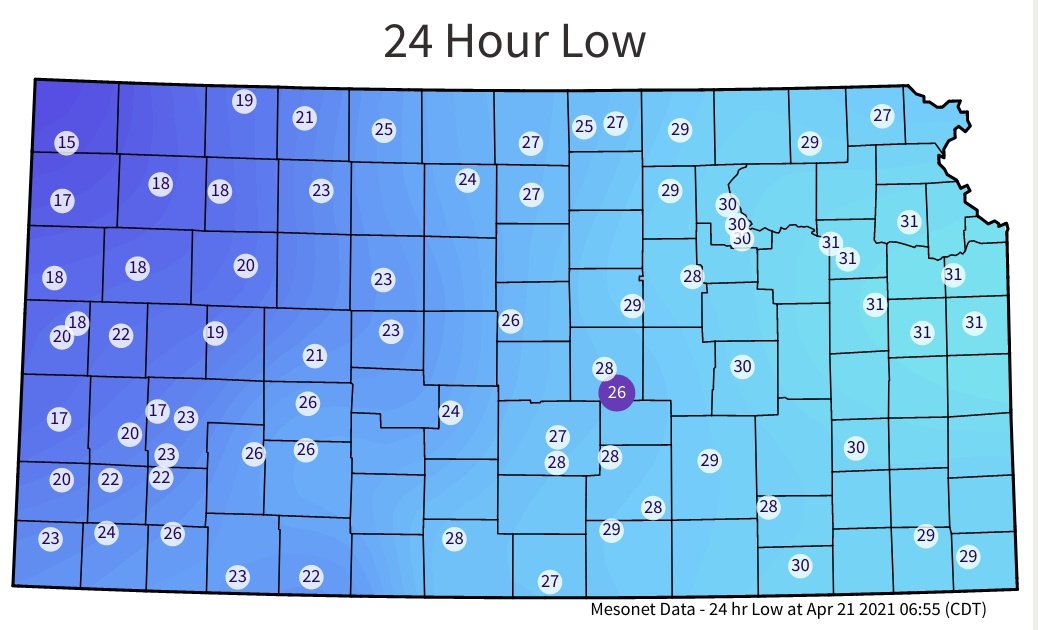

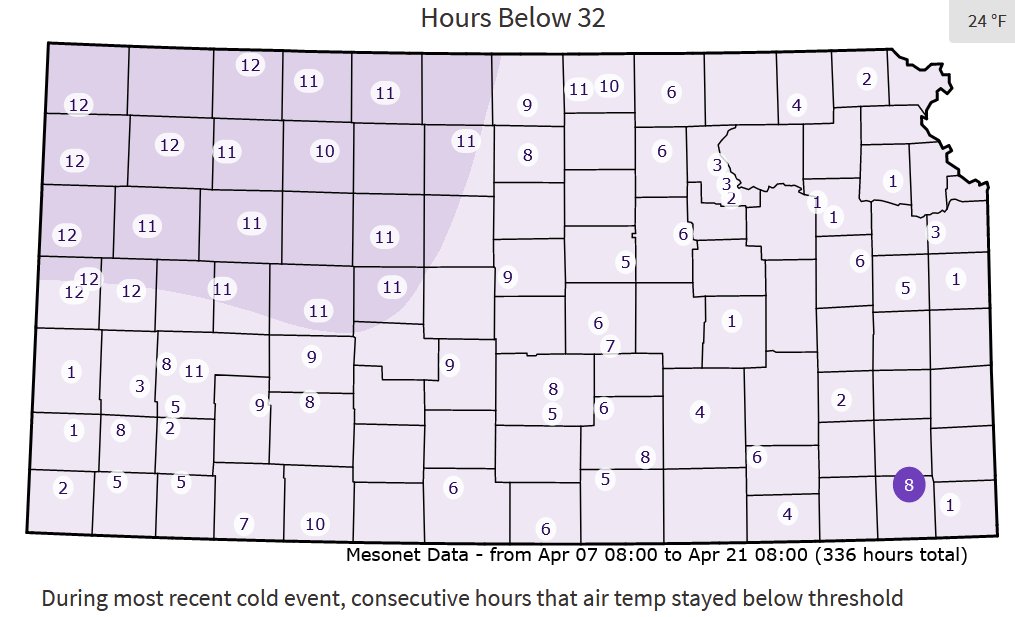

Kansas Mesonet

Minimum Air Temperature Hours Below Freezing

World Weather Inc.

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Safrinha corn remains the crop of concern in Brazil. Showers are expected infrequently and it still looks like the monsoon will end before the end of this month arrives. Rain advertised for Mato Grosso and Mato Grosso do Sul, Brazil is most likely late this weekend into early next week will maintain good crop conditions in those areas. Parana will only receive a brief bout of light showers and then trend drier. Most other Safrinha crop areas will not likely get much rain over the next ten days leading to net drying and rising stress for the driest areas.

Argentina soybeans, corn, sorghum, and peanuts will receive rain today into Saturday. The ground will become saturated once again delaying early season harvest progress while slowing crop development in some areas. Cooling next week will keep the ground wet and could slow crop development rates.

Cool weather in the U.S. Midwest this week may be a concern, but corn planting should accelerate late this week into next week on the prospects for at least some warming and a boost in precipitation for some areas. Seed germination and planting emergence will be slow until improved soil temperatures return.

Weather in China, India and South Africa will remain good for coarse grain and oilseeds. Europe will slowly begin to warm, but soil temperatures are well below optimum levels for aggressive crop development and that is true for southern Russia and Ukraine too even though some warming occurred recently.

Overall, weather today will not provide any reason to turn market mentality around.

MARKET WEATHER MENTALITY FOR WHEAT: Damaging cold temperatures today in Oklahoma and a few areas in Texas and “possibly” far southern Kansas will resulting in some production cuts for hard red winter wheat.

Worry over spring wheat planting and development conditions will continue in the northern U.S. Plains and Canada’s Prairies, although it is not too late for those crop areas to get warmer, moisture and planted. A close monitoring of the region is warranted. Rain is imperative in early May and there is some advertised for the first week of the month that will prove timely if it verifies.

Dryness in Australia is not much of a concern for this time of year and the prospects for planting in May and June remains mostly good. However, the situation will continue be closely monitored because of the tight grain stocks around the world and damage to U.S. crops and ongoing concern about Canada moisture.

Europe’s colder biased weather is abating, but there is still some chatter about dryness in parts of Europe later this season and there is now more concern over too much moisture in Russia and Ukraine possibly delaying farming activity.

Overall, concern over small grains and the connection with corn and soybeans leaves little reason for weather to stop the bullish bias.

Source: World Weather Inc. & FI

Wednesday, April 21:

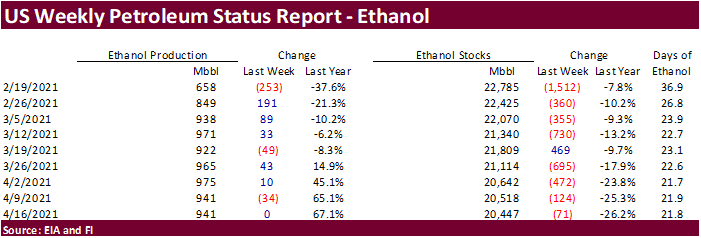

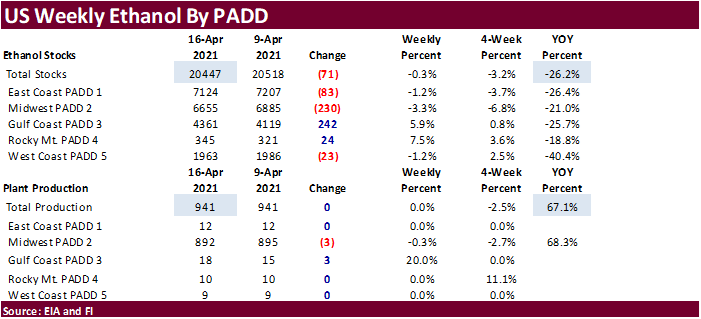

- EIA weekly U.S. ethanol inventories, production

- China farm ministry’s CASDE outlook conference, day 2

- Platts Agriculture Week conference, day 2

- Boao Forum in Hainan, China, day 4

- USDA Milk Production, 3pm

- HOLIDAY: Brazil, India

Thursday, April 22:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- Platts Agriculture Week conference, day 3

- USDA red meat production

- EARNINGS: Suedzucker, Barry Callebaut

Friday, April 23:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- U.S. Cattle on Feed, Poultry Slaughter 3pm

- U.S. cold storage – pork, beef, poultry

Source: Bloomberg and FI

Macro

MBA Mortgage Applications up 8.6% ending April 16, from last week.

USDA Cattle on Feed Report – Friday 2:00pm CDT/19:00 GMT

All figures, except headcount, for feedlots with 1,000-plus head of cattle shown as percentage vs year ago:

Range Average Mln head

On feed April 1 105.0-107.5 106.1 11.986

Placements in March 128.0-143.4 133.7 2.082

Marketings in March 100.5-101.6 101.1 2.032

Cattle On Feed March March

as of April 1 Placements Marketings

Allegiant Commodity Group 106.1 133.9 101.3

Allendale 105.3 128.0 101.1

Hedgersedge 106.1 135.0 101.6

KIS Futures, Justin Lewis 105.0 130.0 101.0

Linn Group 106.8 137.4 100.5

Livestock Mktg Info Center 106.5 136.0 101.1

MBS Research, Mike Sands 106.0 133.0 101.0

New Frontier Capital Markets 106.0 133.3 101.2

Steiner Consulting 105.7 130.7 101.0

Texas A&M AgriLife Extension 107.5 143.4 101.1

U.S. Commodities 105.6 130.0 101.0

(Source: Reuters)

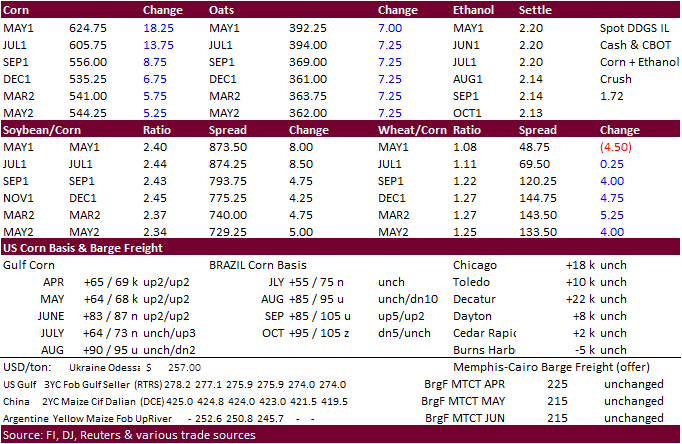

Corn

- CBOT corn again was firm today, touching the highest levels seen since June 2013. Hopes of Chinese buying kept corn bid all session.

- Also supporting corn prices also is the delay of planting as the US Corn Belt saw wintry weather this week, but in our opinion, it is too early to get concerned about planting delays.

- US ethanol production was unchanged from the previous week and stocks declined 71,000. Traders were looking for higher production and slightly lower stocks.

- Funds on Wednesday bought an estimated net 28,000 corn contracts.

- Reuters estimates are calling for a 33.7% increase in cattle placed on feed in March compared to a year ago.

Export developments.

- None Reported

Updated 4/15/21

May corn is seen in a $5.70 and $6.10 range

July is seen in a $5.25 and $5.90 range

December corn is seen in a $3.85-$5.50 range.

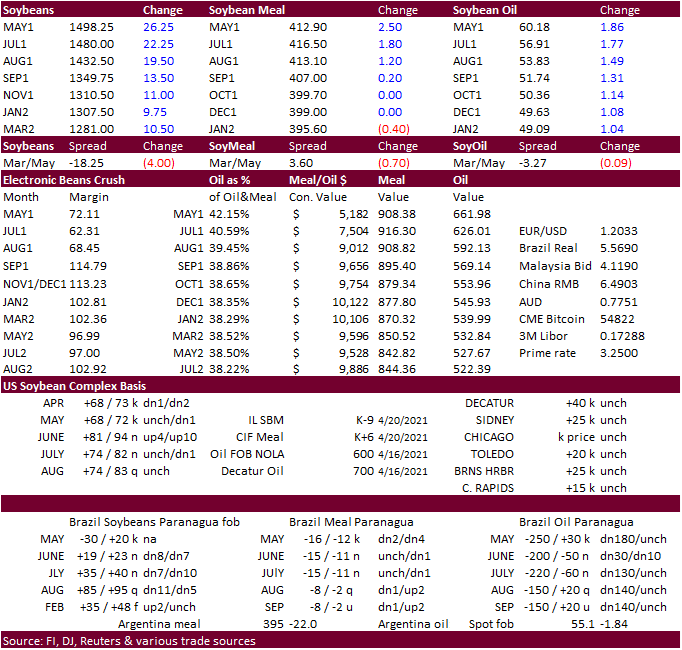

- CBOT soybeans rose to the highest levels since June 2014 on firm soybean cash market bids and strong vegoil markets.

- ICE canola was up for the 7th consecutive day and hitting a record price for the second day in a row on tight supplies.

- Funds on Wednesday bought an estimated net 12,000 soybean contracts, bought 1,000 soybean meal and bought an estimated 9,000 soybean oil.

- USDA Attaché Argentina Oilseeds update sees crop at 45MMT in 2020/21 compared to USDA’s 47.5MMT. Low precipitation during the February to early March period ids the driver for the reduction.

Updated 4/21/21

May soybeans are seen in a $14.30-$15.10 range; July $14-$15.30; November $12.75-$13.75

May soymeal is seen in a $400-$430 range; July $400-$440; December $380-$420

May soybean oil is seen in a 57 and 62 cent range; July 53-62; December 46-52 cent range

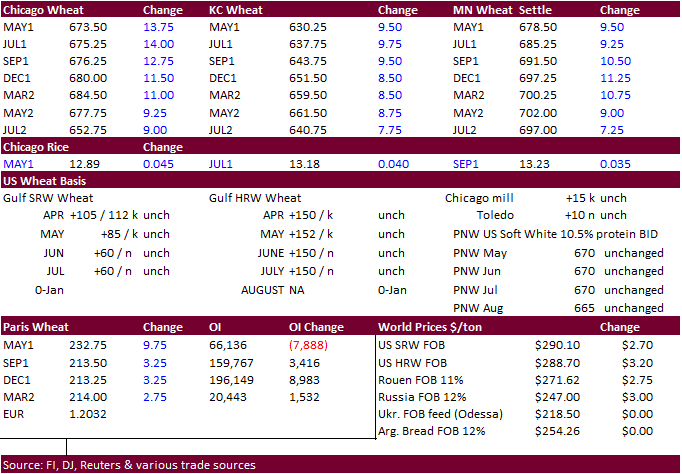

- US wheat traded up on cold weather seen in the southern US Great Plains overnight and the possible damage stemming from it.

- Funds on Wednesday bought an estimated net 9,000 CBOT SRW wheat contracts.

- September Paris wheat was up 3.00 at 213.25 euros.

- Jordan seeking 120,000 tons of feed barley today makes no purchase after receiving one offer.

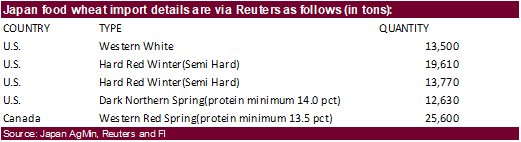

- Japan seeks 85,110 tons of food wheat from the US and Canada.

- Results awaited: Ethiopia seeks 30,000 tons of wheat on April 16.

- Results awaited: Ethiopia seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

- Jordan seeks 120,000 tons of feed barley on April 21.

Rice/Other

· Results awaited: Ethiopia seeks 170,000 tons of parboiled rice on April 20.

· Results awaited: Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

· Results awaited: Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

· Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

· Bangladesh seeks 50,000 tons of rice on May 2.

Updated 4/21/21

May Chicago wheat is seen in a $6.35‐$6.80 range; July $6.30-$7.00

May KC wheat is seen in a $5.70‐$6.50 range; July $5.60-$6.60

May MN wheat is seen in a $6.30‐$6.80 range; July $6.40-$7.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.