PDF Attached

Agriculture

prices sold off in part to disappointing USDA export sales. Soybeans caught a bid from higher soybean oil led by higher WTI crude oil (at the time market closed). Brazil was on holiday today.

Weather

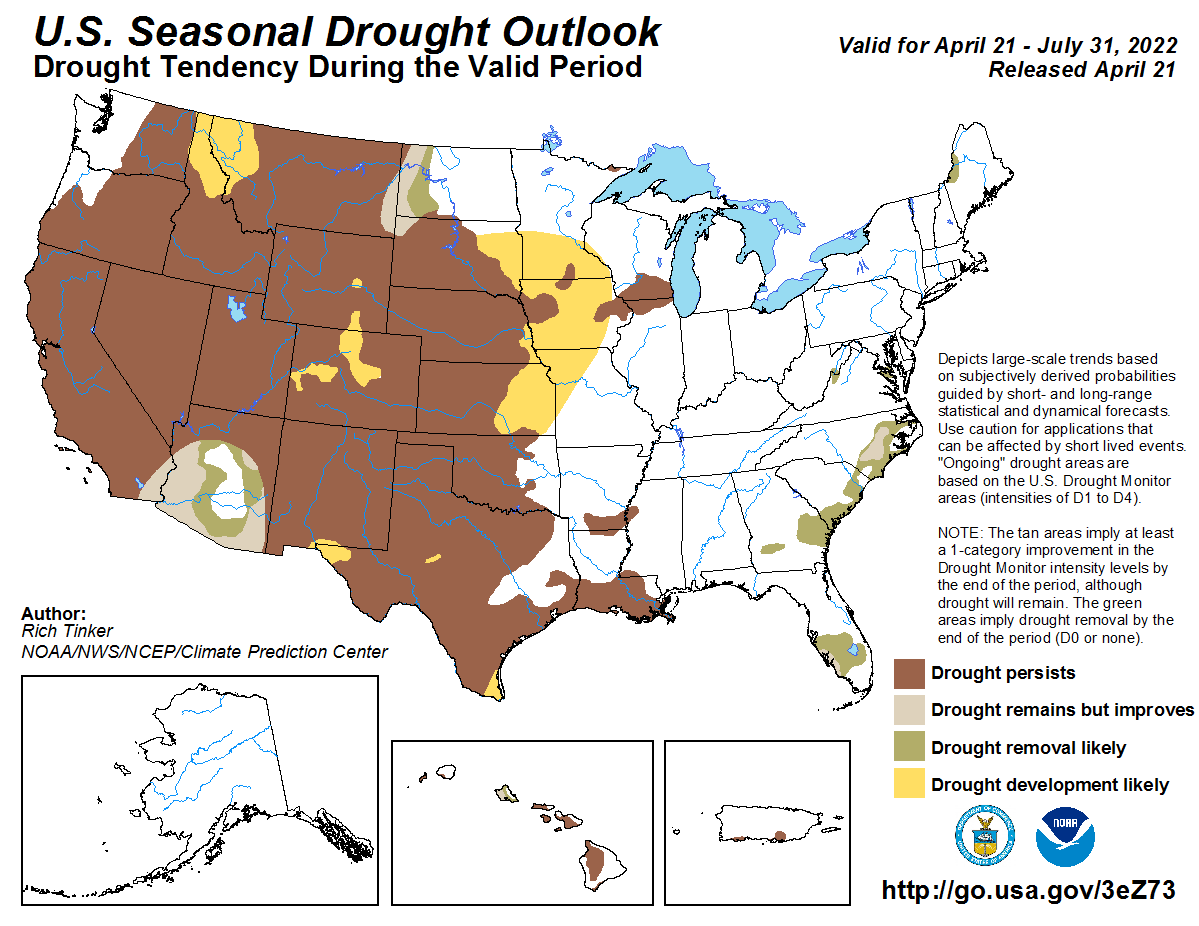

CPC’s

updated Seasonal Drought Outlook. Drought conditions to persist. https://www.cpc.ncep.noaa.gov/products/expert_assessment/season_drought.png

WEATHER

EVENTS AND FEATURES TO WATCH

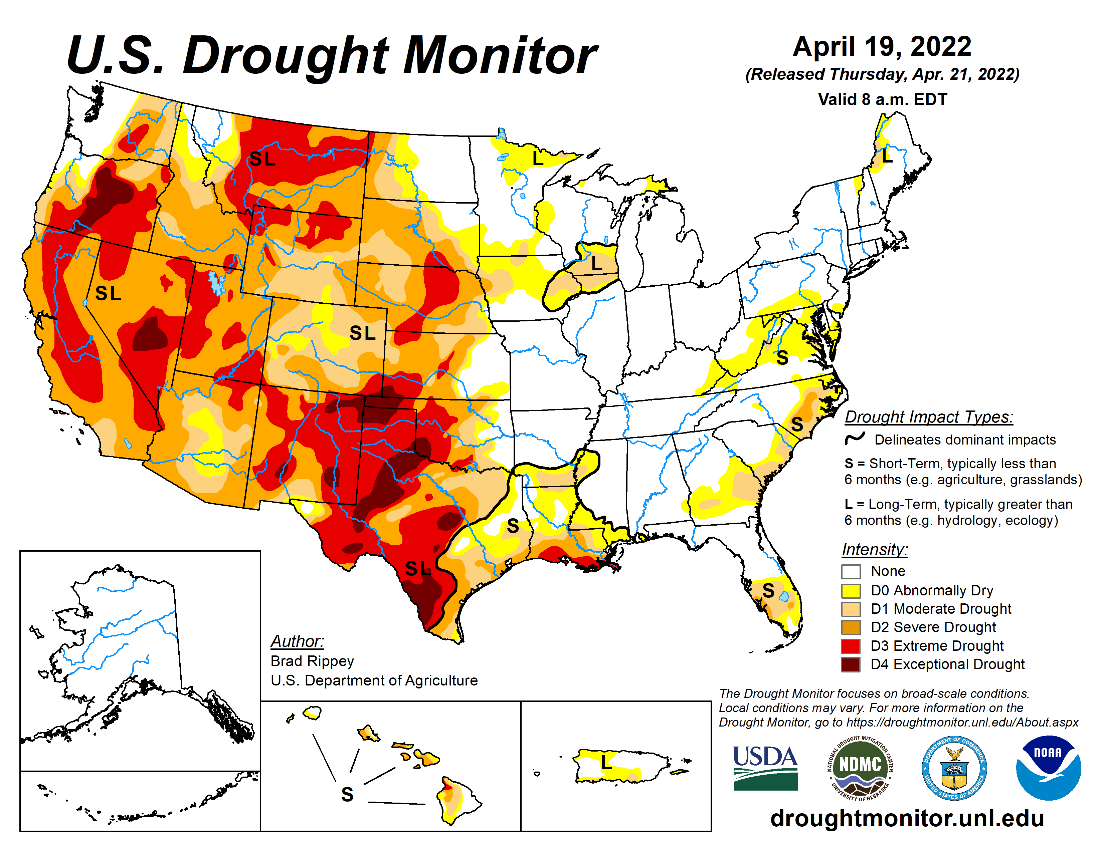

- Waves

of excessive heat, strong wind and low humidity are expected in the central and southern U.S. Plains over the next two weeks - The

first round of extremes will occur today and especially Friday - High

temperatures in the 90s Fahrenheit are likely Friday afternoon from the South Dakota/Nebraska border to southern Texas with a few extremes near 100 - Another

wave of hot and windy weather is expected during mid-week next week - A

third wave of heat and dryness will occur in the first days of May - The

waves of heat will be separated by brief bouts of more seasonable temperatures and a few showers, but the resulting precipitation will fail to change drought status in the high Plains region - U.S.

Southeastern states will experience a return of dryness in the next two weeks with daily temperatures rising into the 80s and infrequent rainfall that will be well below average is expected - Good

planting weather will occur for a while, but the region will become too dry by the start of May - Spring

planting delays are likely In North Dakota and Manitoba Canada as well as a few immediate bordering areas due to significant snow on the ground and the potential for flooding when the snow melts - Southwestern

Canada Prairies are still much too dry and significant relief is not likely for a while - Spring

planting will begin in this coming week, but significant precipitation is needed to fix long term dryness and to recharge subsoil moisture - Early

season crop emergence will occur normally, but without rain some crops may wither in the absence of supportive subsoil moisture especially if it turns too warm prior to the arrival of rain - Eastern

U.S. Midwest and Tennessee River Basin areas will see faster drying rates later this week and into the weekend as temperatures turn warmer while rainfall is restricted - Some

planting of corn and other early season crops will result - Rain

frequency in the Midwest will be greatest from Missouri and the northwestern Delta into Illinois and immediate bordering states through the weekend and then drier weather is expected next week favoring “some” possible field progress - Precipitation

in the U.S. high Plains from western Nebraska and eastern Colorado through western Texas will be restricted over the next two weeks, although a few showers cannot be ruled out - West

Texas cotton, corn and sorghum production areas will remain too dry during the next two weeks, despite a few showers infrequently - South

Texas dryness will also prevail for a while - U.S.

southeastern states will experience net drying over the next ten days - Warm

temperatures and limited rainfall will allow aggressive spring planting to take place - Greater

rainfall will be needed late this month and in May to ensure the best establishment, although World Weather, Inc. anticipates additional drying and an eventual concern over the lack of moisture - U.S.

northern Plains and Canada’s eastern Prairies will be subjected to bouts of snow and rain Friday into Sunday and possibly again at the end of next week

- Parts

of the region are expected to become too wet when the deep snow cover finally melts - Flooding

is already an issue along the Red River in Manitoba and there is much snow to melt and more coming

- Planting

in Manitoba could be delayed through May 15 - Some

delays to planting in North Dakota and northern Minnesota are also expected - Montana

and western North Dakota will experience additional drought relief with significant snow and rain falling Friday into Saturday - Travel

delays are likely due to snowfall during the weekend of 8 to 16 inches with a few amounts of 20-30 inches - The

heavy snow will also impact southeastern Saskatchewan and Manitoba - Livestock

stress and travel delays are also expected - One

more storm may impact this region late next week, although confidence is low - U.S.

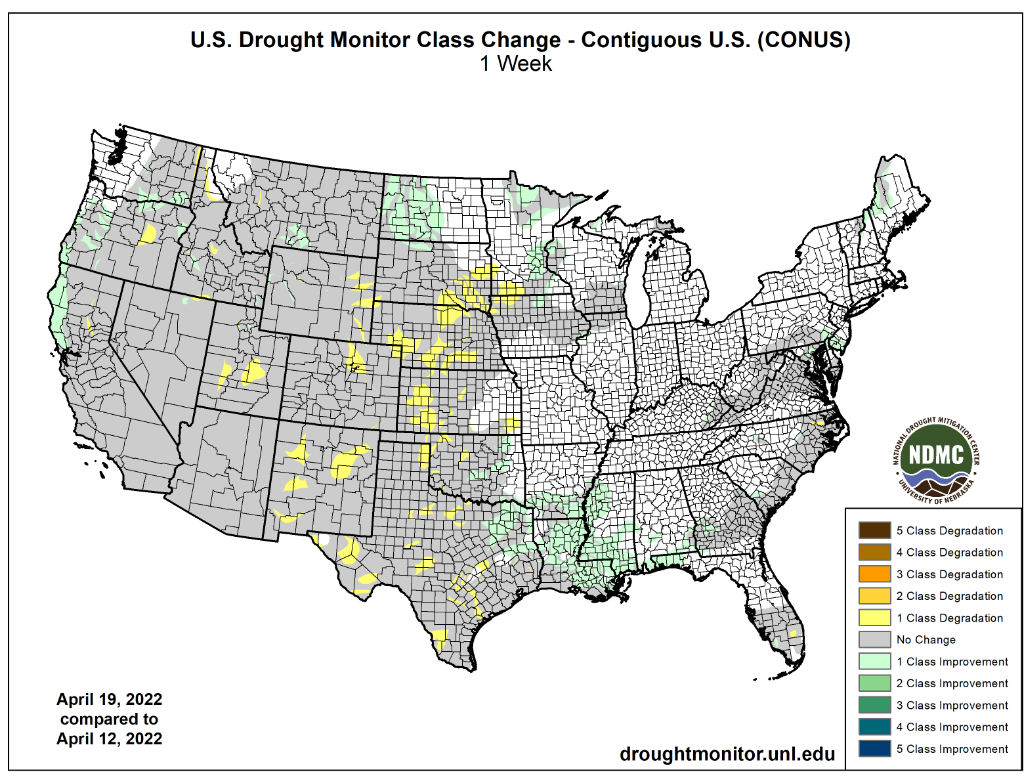

Pacific Northwest continues to get less than usual precipitation, although the lower Columbia River Valley did receive above normal precipitation in the most recent 30 days - Some

improvement in soil moisture also occurred in southern Idaho and in a few Wyoming sugarbeet and potato production areas - More

moisture is needed - California

snow water equivalents are now running 21-31% of normal for this date - Waves

of rain and mountain snow are expected over the next week to ten days, but a recovery in the low snowpack is not likely - All

of the moisture will be welcome, but water restrictions and concern over long term water supply are expected to continue rising - Mato

Grosso and Mato Grosso do Sul through Bahia, Minas Gerais and Sao Paulo, Brazil will experience net drying over the next two weeks - Dryness

is already an issue in northern Minas Gerais and parts of central Bahia and is becoming an issue in Mato Grosso - Mato

Grosso topsoil moisture is rated short to very short while its subsoil moisture is rated marginally adequate to short - Rising

crop stress is predicted over the next two weeks and if there is no relief some yield potentials in corn fields will begin slipping lower - A

few showers will occur Saturday in Mato Grosso and Mato Grosso do Sul, but resulting rainfall will not be enough to seriously counter evaporation for the next few days – let alone the next two weeks - Concern

is greatest for Mato Grosso - Southern

Brazil crops will stay favorably moist with alternating periods of rain and sunshine expected - Most

of Argentina will also continue to see a good mix of weather along with favorable soil moisture - There

is need for rain in northwestern through west-central parts of the nation - North

Africa weather will remain mostly good for developing wheat and barley - Production

cuts are permanent in southwestern Morocco since some of the crop was not planted due to drought - Other

areas in northern Morocco and areas east to Tunisia should see a favorable production year, despite some winter dryness - India’s

lost winter crop yields came from late February and March dryness, but the losses are not likely to be very great and the winter crops were already poised to produce quite well which should reduce the significance of the decline recently reported - Weather

in India, Europe, the Commonwealth of Independent States and China is expected to remain mostly good over the next ten days - Southwestern

through east-central Europe will experience frequent precipitation over the next ten days and temperatures may be mild to a little cool at times - The

environment may slow some spring fieldwork, but progress is expected - Early

season winter and spring crop development will advance, albeit slowly due to milder than usual conditions - North-central

and northwestern Europe weather is expected to be driest - Waves

of rain and some snow in the western CIS will maintain moist field conditions in most of the crop areas west of the Ural Mountains and for some areas to the east as well - Spring

fieldwork will be slower advancing than usual because of the precipitation, wet fields and milder than usual temperatures in many areas - Topsoil

moisture is rated adequate to excessive west of the Ural Mountains and subsoil moisture is rated adequate - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - China’s

Yangtze River Basin will see rain develop again late this week and into next week

- The

moisture abundance will be good for long term crop development, but fieldwork could be delayed at times

- Net

drying is expected in China’s Yellow River Basin and North China Plain - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Some

rain and snow may impact the far northeast of Xinjiang briefly this weekend through most of next week - India’s

rainfall will be greatest in the far Eastern States this week, although some pre-monsoonal showers and thunderstorms are expected briefly in the south - Good

harvest weather will continue in winter crop areas - Temperatures

will remain warm - Turkey,

Iran and Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas - Overall,

crop conditions will remain favorable - A

tropical cyclone is possible near or over the Philippines during the middle and latter part of next week

- Some

heavy rainfall is possible - Confidence

is low - Eastern

Australia cotton and sorghum areas will experience dry weather through the weekend improving field progress after recent rain delays in New South Wales.

- Cotton

and sorghum harvest conditions in Queensland, Australia remain nearly ideal

- Rain

delay is expected again during the middle to latter part of next week - South

Africa continues in need of drier weather to protect summer crop conditions and to promote faster crop maturation and harvest progress - Topo

much moisture could harm crop quality - Cotton

quality has already been compromised and soybean harvesting has been a little slow at times - Central

Africa showers and thunderstorms will occur periodically during the next two weeks to support fieldwork and crop development - North

Africa precipitation over the next two weeks will be a little more sporadic and light leading to some net drying - Crop

conditions have remained favorable and are not likely to change much in the next ten days, despite some drying - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will experience some periodic rainfall over the next two weeks and some soil moisture boosting is expected in eastern parts of the nation - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +15.64 and it should drift higher before leveling off in the next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - USDA

red meat production, 3pm - HOLIDAY:

Brazil

Friday,

April 22:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - First

quarter cocoa grinding data from Cocoa Association of Asia - Brazil’s

Unica may release cane crush and sugar output data (tentative) - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

Export Sales

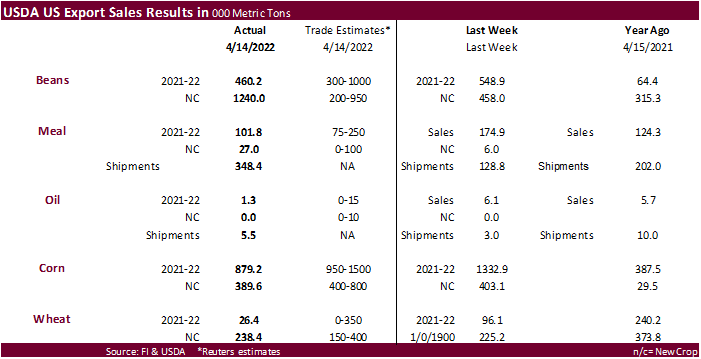

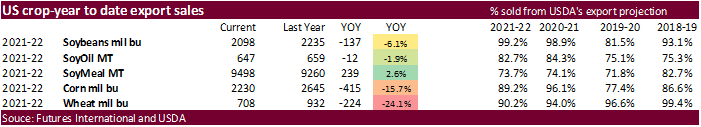

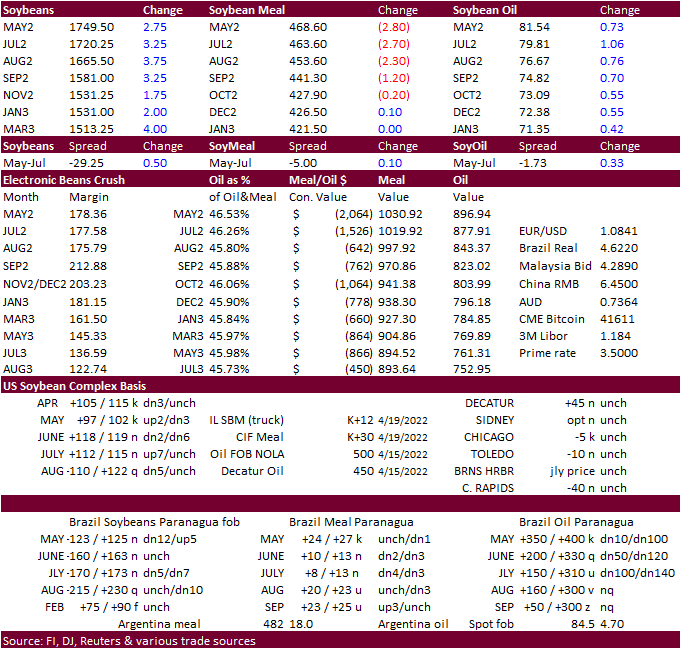

While

USDA soybean 2021-22 sales came in at a low 460,200 tons, new-crop was above expectations at 1.240 million tons. Old crop soybean sales included increases for China (496,400 MT, including 66,000 MT switched from unknown destinations and decreases of 5,000

MT), Indonesia (81,000 MT, including 55,000 MT switched from unknown destinations and decreases of 100 MT), Bangladesh (57,000 MT, including 55,000 MT switched from unknown destinations), and Egypt (53,700 MT, including decreases of 1,300MT). 2022-23 soybean

sales included China (669,000 MT), unknown destinations (351,000 MT), and Spain (131,000 MT).

Soybean

meal sales were near the lower end of expectations but shipments were ok at 348,400 tons. Soybean oil sales were poor at 1,300 tons and shipments were 5,500 tons.

USDA

corn export sales were 879,200 tons old crop and 389,600 tons new crop. 2021-22 included China (675,200 MT, including decreases of5,600 MT), South Korea (126,200 MT, including 68,000 MT switched from unknown destinations and decreases of 6,800 MT), and Mexico

(75,500 MT, including decreases of 34,600 MT). 340,000 tons of new crop were booked by China. USDA sorghum export sales were a net reduction of 53,600 tons for 2021-22. Increases reported for China (11,400 MT, including decreases of 2,100MT), were more than

offset by reductions for unknown destinations (65,000MT). Pork sales were 12,900 tons and didn’t include China.

All-wheat

export sales were a low 26,400 tons old crop. New-crop were 238,400 tons, low for this time of year.

(Reuters)

– A half-point interest rate increase will be “on the table” when the Fed meets on May 3-4 to approve the next in what are expected to be a series of rate increases this year, Fed chair Jerome Powell said Thursday.

US

Initial Jobless Claims Apr 16: 184K (est 180K; prev 185K; prevR 186K)

US

EIA Natural Gas Storage Change (BCF) 15-Apr: +53 (est +40; prev +15)

–

Salt Dome Cavern NatGas Stocks (BCF): +15 (prev +13)

U.S.

GENERATED 490 MLN BIODIESEL (D4) BLENDING CREDITS IN MARCH, VS 396 MLN IN FEBRUARY -EPA

U.S.

GENERATED 1.27 BLN ETHANOL (D6) BLENDING CREDITS IN MARCH, VS 1.07 BLN IN FEBRUARY -EPA

Year

ago D4 biodiesel 406 and D6 ethanol 1.19 billion

·

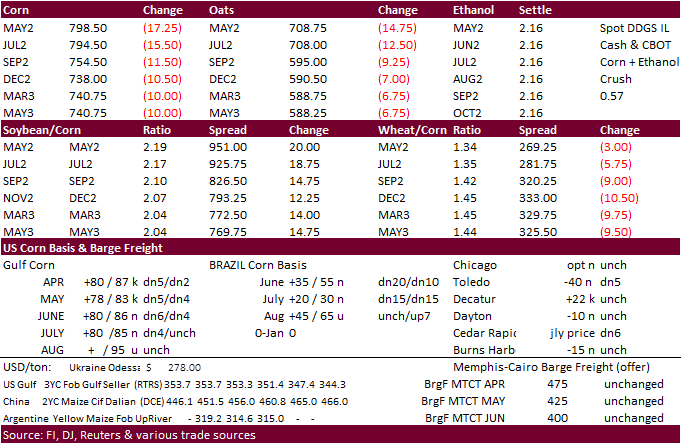

CBOT corn was sharply lower led by the nearby contracts following weakness in wheat, lower than expected USDA export sales and profit taking after contract highs were established on Wednesday.

·

The IGC in its initial estimate projected 2022-23 global corn production at 1.197 billion tons, 13 million below the current year, due to smaller crops for the US and Ukraine.

·

Ukraine is about 20 percent complete for summer grain planting progress, or 2.5 million hectares of the intended total. The area was expected by the AgMin to drop about 20 percent from the previous season.

Export

developments.

·

None reported

Updated

4/18/22

May

corn is seen in a $7.75 and $8.55 range

December

corn is seen in a wide $5.50-$8.00 range

·

Soybeans ended higher led by strength in soybean oil, which was led by higher WTI crude oil and product spreading. Soybean meal finished lower. Brazil was on holiday, and news was light. Export sales were ok for soybeans (combined)

but poor for the products. July soybean oil topped 80 cents for the first time.

·

The Argentina AgMin reported the March crush at 2.9 million tons, well below 3.4 million year ago but up from 2.6 million crushed during February 2022. Jan-Mar crush ended up at 8.1 million tons, down 15 percent from year earlier

(15% less product production).

·

The one day port strike in Argentina has little impact on shipping.

·

Argentina’s Rosario grains exchange raised its 2021-22 soybean production estimate to 41.2 million tons from previous 40 million tons.

·

China remains a potential buyer of 2021-22 US soybeans. Earlier we heard Sinograin was in for soybeans but saw no confirmation.

·

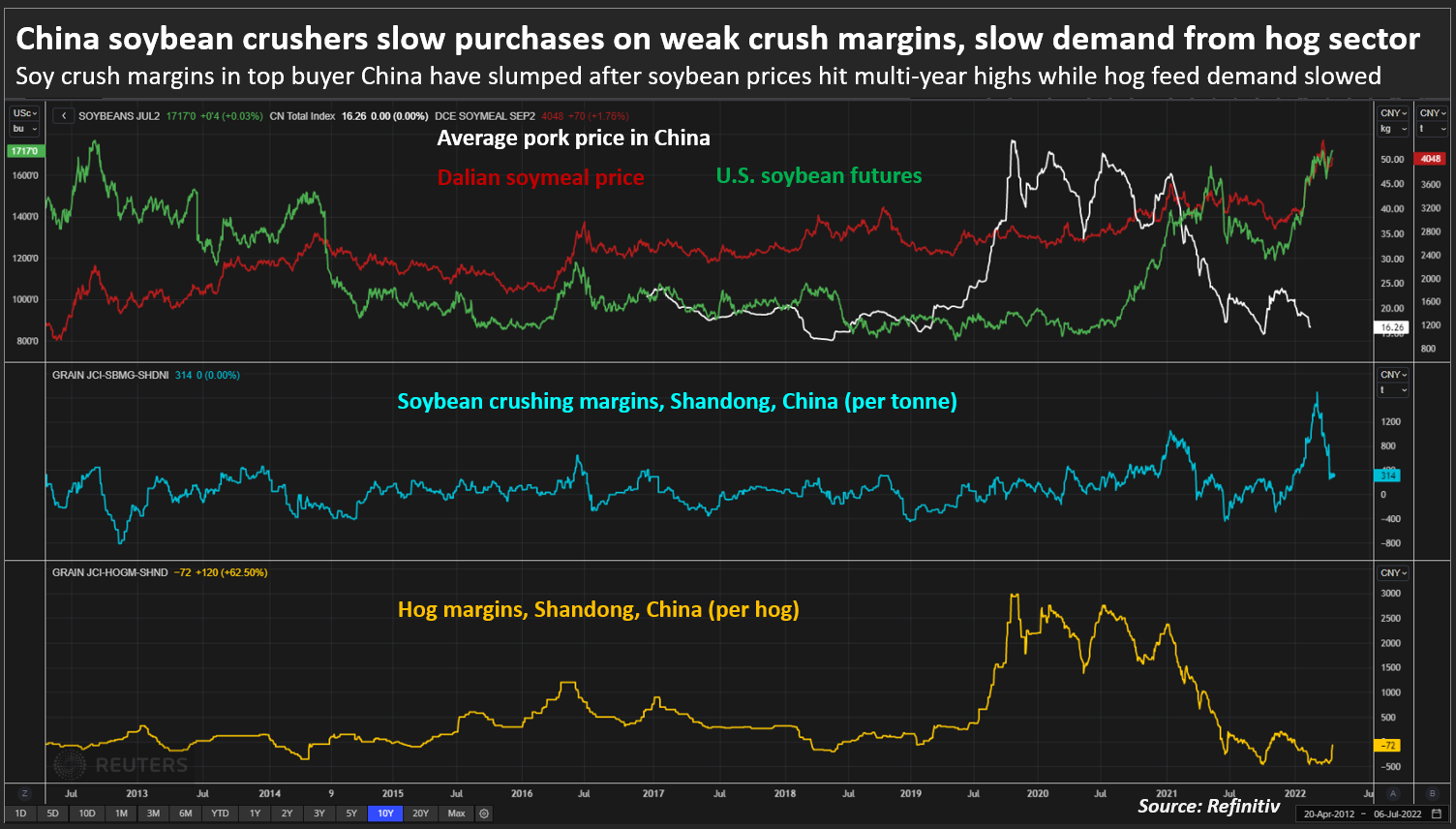

In a China crush margin article by Reuters, they noted China has secured only about 20 percent of 7-8 million tons of soybean imports needed each month between June-August. Currently US soybeans Gulf FOB are priced cheaper than

Brazil from June through August period. Reuters also noted “Crush margins for Brazilian and U.S. soybeans for delivery in June and July are currently around -20 yuan ($3.11) to -5 yuan per ton, while margins for August U.S. Gulf cargoes were slightly positive.”

·

CNGOIC reported China soybean stocks for the week ending April 17 at 3.2 million tons, about 350,000 tons higher than the previous week but still down 1.2 million tons from this time a year ago. Soybean meal stocks were off 30,000

tons to only 310,000 tons, more than half of what they held in inventories a year ago. Soybean oil inventories were 790,000 tons, up 10,000 from the previous week and 200,000 higher than a year ago. The weekly crush increased 190,000 tons to 1.4 million tons,

about 200,000 tons below a year ago.

·

A Sioux City IA soybean crushing plant will be down until nearly mid-May.

·

Indonesia set its May crude palm oil reference price at $1,657.39 a ton, below April’s $1,787.5 per ton. The May reference price pegs the May export levy and export tax at maximum at $375 per ton and $200 per ton, respectively.

·

Cargo surveyor SGS reported month to date April 20 Malaysian palm exports at 632,588 tons, 91,409 tons below the same period a month ago or down 12.6%, and 194,320 tons below the same period a year ago or down 23.5%.

·

China looks for sell another 500,000 tons of soybeans this week.

Updated

4/13/22

Soybeans

– May $16.00-$17.75

Soybeans

– November is seen in a wide $12.75-$15.50 range

Soybean

meal – May $440-$490

Soybean

oil – May 77-82

Wheat

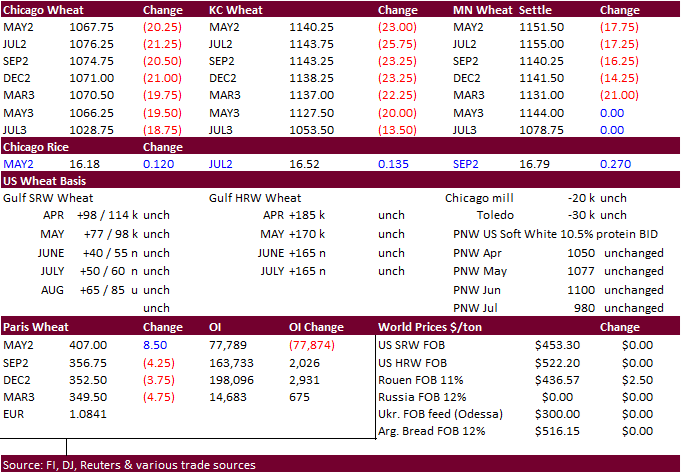

·

US wheat ended

sharply lower on technical selling and improving weather for the upper Great Plains. Based on historical early US winter wheat crop conditions and initial USDA May crop production yields, we tentatively estimate the May USDA winter wheat production at 1.335

billion bushels, up 58 million from 2021.

·

The IGC in its initial estimate projected 2022-23 global wheat production at 780 million tons, only 1 million below the current year, with a smaller crop for Ukraine offset by larger crops elsewhere.

·

SovEcon estimated a record 2022 Russian wheat crop of 87.4 million tons, up from a previous forecast of 86.5 million tons. Russia harvested 76.0 million tons of wheat in 2021. They pegged Russia wheat exports in for 2022-23 (Jun-Jul)

at 41.0 million tons compared to 33.9 million tons in the current season.

·

USDA export sales were reported near the lower end of expectations, on a combined crop-year basis.

·

Egypt said they have enough wheat reserves, after securing local wheat, to last until the end of January 2023.

·

BA Grains Exchange: Argentina wheat planted are projected at 6.5 million hectares, down from 6.5 million last season. 2021-22 production was 21.8 million tons.

·

September EU wheat futures were 4.25 euros lower at 356.50 euros.

·

Taiwan bought 47,120 tons of US wheat for June 2 through June 21 if shipped off the PNW. It included 32,950 tons of 14.5% protein dark northern spring wheat at $475.80 a ton. 12.5% hard red winter wheat was bought at $511.56 a

ton FOB, and 10.5% soft white wheat at $424.57 a ton.

·

Japan bought 27,320 tons of wheat on Thursday. Original details as follows.

·

Jordan seeks 120,000 tons of feed barley on April 26 for Aug and/or Sep shipment.

·

Jordan seeks 120,000 tons of wheat. on April 27 for Jun and/or Aug shipment.

Rice/Other

·

None reported

Updated

4/13/22

Chicago May $9.75 to $12.00 range, December $8.50-$12.00

KC May $10.50 to $12.00 range, December $8.75-$13.50

MN May $10.75‐$12.00, December $9.00-$14.00

U.S. EXPORT SALES FOR WEEK ENDING 4/14/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

-55.8 |

1,077.2 |

1,102.1 |

201.1 |

6,415.5 |

7,518.7 |

81.0 |

584.7 |

|

SRW |

17.4 |

414.6 |

245.6 |

89.9 |

2,437.8 |

1,528.9 |

78.0 |

587.0 |

|

HRS |

78.1 |

753.8 |

1,271.0 |

141.2 |

4,645.3 |

6,409.1 |

28.5 |

567.9 |

|

WHITE |

-13.7 |

353.4 |

1,332.7 |

71.4 |

2,977.1 |

5,296.9 |

50.9 |

337.2 |

|

DURUM |

0.4 |

15.5 |

69.7 |

0.4 |

174.4 |

594.9 |

0.0 |

64.4 |

|

TOTAL |

26.3 |

2,614.5 |

4,021.0 |

504.0 |

16,650.1 |

21,348.6 |

238.4 |

2,141.2 |

|

BARLEY |

0.0 |

5.8 |

4.5 |

0.0 |

14.7 |

24.7 |

0.0 |

8.6 |

|

CORN |

879.2 |

20,078.7 |

27,805.3 |

1,196.4 |

36,570.0 |

39,393.0 |

389.6 |

3,363.4 |

|

SORGHUM |

-53.6 |

2,203.9 |

1,943.8 |

280.8 |

4,500.6 |

5,107.0 |

0.0 |

0.0 |

|

SOYBEANS |

460.2 |

11,078.6 |

5,102.5 |

889.0 |

46,017.2 |

55,724.4 |

1,240.0 |

10,161.3 |

|

SOY MEAL |

101.8 |

2,715.0 |

2,142.7 |

348.4 |

6,783.4 |

7,117.2 |

27.0 |

370.4 |

|

SOY OIL |

1.2 |

141.0 |

101.9 |

5.5 |

505.9 |

557.2 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

32.7 |

202.0 |

319.9 |

10.0 |

1,012.7 |

1,183.3 |

0.0 |

0.0 |

|

M S RGH |

6.8 |

9.2 |

5.3 |

0.4 |

11.8 |

23.5 |

0.0 |

0.0 |

|

L G BRN |

0.3 |

6.1 |

3.0 |

0.3 |

44.5 |

35.2 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

23.9 |

68.5 |

0.1 |

62.7 |

86.1 |

0.0 |

0.0 |

|

L G MLD |

20.3 |

93.9 |

52.7 |

10.2 |

614.5 |

483.7 |

0.0 |

0.0 |

|

M S MLD |

4.5 |

224.4 |

247.2 |

17.1 |

282.9 |

402.1 |

0.0 |

0.0 |

|

TOTAL |

64.7 |

559.4 |

696.5 |

38.1 |

2,029.1 |

2,214.0 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

50.5 |

6,589.9 |

4,586.8 |

367.1 |

7,779.9 |

10,485.4 |

136.1 |

2,796.6 |

|

PIMA |

3.8 |

123.7 |

207.2 |

14.7 |

327.6 |

549.4 |

5.5 |

40.1 |

This

summary is based on reports from exporters for the period April 8-14, 2022.

Wheat: Net

sales of 26,300 metric tons (MT) for 2021/2022–a marketing-year low–were down 73 percent from the previous week and 79 percent from the prior 4-week average. Increases primarily for Mexico (90,500 MT, including decreases of 1,000 MT), Haiti (27,000 MT switched

from unknown destinations), Ghana (26,000 MT switched from Nigeria), Cameroon (23,000 MT, including 20,000 MT switched from Nigeria), and Italy (15,000 MT), were offset by reductions primarily for Nigeria (131,000 MT). Net sales of 238,400 MT for 2022/2023

were primarily for Nigeria (86,000 MT), unknown destinations (75,000 MT), Japan (45,900 MT), Mexico (13,000 MT), and South Korea (9,500 MT). Exports of 504,000 MT were up 48 percent from the previous week and from the prior 4-week average. The destinations

were primarily to Mexico (77,300 MT), Thailand (60,200 MT), Taiwan (57,100 MT), Guatemala (39,400 MT), and South Korea (38,500 MT).

Corn:

Net sales of 879,200 MT for 2021/2022 were down 34 percent from the previous week and 6 percent from the prior 4-week average. Increases primarily for China (675,200 MT, including decreases of 5,600 MT), South Korea (126,200 MT, including 68,000 MT switched

from unknown destinations and decreases of 6,800 MT), Mexico (75,500 MT, including decreases of 34,600 MT), Indonesia (67,200 MT, including 68,000 MT switched from unknown destinations and decreases of 800 MT), and Saudi Arabia (42,800 MT, including 40,000

MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (234,000 MT). Net sales of 389,600 MT for 2022/2023 were reported for China (340,000 MT), Colombia (40,000 MT), Mexico (5,100 MT), and Canada (4,500 MT).

Exports of 1,196,400 MT were down 23 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to China (402,400 MT), Mexico (275,900 MT), Japan (104,300 MT), Indonesia (67,200 MT), and South Korea (61,900

MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 533,300 MT is for unknown destinations (365,000 MT), South Korea (65,000 MT), Morocco (60,000 MT), Italy (34,300 MT), and Saudi Arabia (9,000 MT). For 2022/2023, new optional origin

sales of 52,000 MT were reported for Italy. The current outstanding balance of 58,400 MT is for Italy.

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales reductions of 53,600 MT for 2021/2022–a marketing-year low–were down noticeably from the previous week, but up noticeably from the prior 4-week average. Increases reported for China (11,400 MT, including decreases of 2,100 MT), were more than

offset by reductions for unknown destinations (65,000 MT). Exports of 280,800 MT were up 98 percent from the previous week and 15 percent from the prior 4-week average. The destinations was China.

Rice:

Net sales of 64,700 MT for 2021/2022 were up 29 percent from the previous week and 63 percent from the prior 4-week average. Increases were primarily for Mexico (40,100 MT), Haiti (15,200 MT, including decreases of 100 MT), Canada (3,300 MT), Saudi Arabia

(1,900 MT), and Jordan (1,800 MT). Exports of 38,100 MT were down 19 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to Japan (12,100 MT), Honduras (9,100 MT), Haiti (7,100 MT), Canada (3,700 MT),

and Mexico (2,100 MT).

Soybeans:

Net sales of 460,200 MT for 2021/2022 were down 16 percent from the previous week and 39 percent from the prior 4-week average. Increases primarily for China (496,400 MT, including 66,000 MT switched from unknown destinations and decreases of 5,000 MT), Indonesia

(81,000 MT, including 55,000 MT switched from unknown destinations and decreases of 100 MT), Bangladesh (57,000 MT, including 55,000 MT switched from unknown destinations), Egypt (53,700 MT, including decreases of 1,300 MT), and Japan (51,600 MT, including

45,500 MT switched from unknown destinations and decreases of 2,600 MT), were offset by reductions for unknown destinations (326,300 MT) and Spain (66,000 MT). Net sales of 1,240,000 MT for 2022/2023 were primarily for China (669,000 MT), unknown destinations

(351,000 MT), Spain (131,000 MT), the Netherlands (66,000 MT), and Mexico (20,000 MT). Exports of 889,000 MT were up 10 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to China (294,000 MT), Indonesia

(109,700 MT), Mexico (102,300 MT), the Netherlands (84,200 MT), and Japan (67,600 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 3,000 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 101,800 MT for 2021/2022 were down 42 percent from the previous week and 33 percent from the prior 4-week average. Increases primarily for the Philippines (47,200 MT), Colombia (25,500 MT, including decreases of 1,100 MT), Mexico (21,600 MT),

Canada (15,200 MT, including decreases of 1,100 MT), and El Salvador (6,400 MT switched from Guatemala), were offset by reductions primarily for Ireland (12,000 MT), unknown destinations (4,500 MT), Guatemala (4,100 MT), and Morocco (2,200 MT). Net sales

of 27,000 MT for 2022/2023 were reported for Colombia (15,000 MT) and Ireland (12,000 MT). Exports of 348,400 MT were down noticeably from the previous week and down 88 percent from the prior 4-week average. The destinations were primarily to the Philippines

(49,400 MT), Ecuador (47,000 MT), Mexico (44,600 MT), Vietnam (43,900 MT), and Colombia (25,500 MT).

Soybean

Oil:

Net sales of 1,200 MT for 2021/2022 were down 81 percent from the previous week and 88 percent from the prior 4-week average. Increases primarily for Guatemala (800 MT), were offset by reductions for Mexico (300 MT). Exports of 5,500 were up 84 percent from

the previous week, but down 74 percent from the prior 4-week average. The destinations were primarily to Jamaica (3,500 MT) and Mexico (1,400 MT).

Cotton:

Net sales of 50,500 RB for 2021/2022–a marketing-year low–were down 15 percent from the previous week and 70 percent from the prior 4-week average. Increases primarily for India (19,500 RB, including decreases of 13,500 RB), Peru (10,300 RB), Guatemala

(6,200 RB), China (4,700 RB), and Turkey (2,400 RB, including decreases of 9,600 RB), were offset by reductions for Indonesia (900 RB), Honduras (500 RB), and South Korea (400 RB). Net sales of 136,100 RB for 2022/2023 were primarily for Turkey (48,400 RB),

Mexico (30,100 RB), Honduras (17,400 RB), Peru (11,900 RB), and Indonesia (9,700 RB). Exports of 367,100 RB were up 10 percent from the previous week, but down 6 percent from the prior 4-week average. The destinations were primarily to China (146,800 RB),

Pakistan (57,000 RB), Turkey (55,400 RB), Vietnam (42,300 RB), and Mexico (10,800 RB). Net sales of Pima totaling 3,800 RB were up 79 percent from the previous week, but down 20 percent from the prior 4-week average. Increases were primarily for Pakistan

(1,500 RB), Vietnam (900 RB), Bangladesh (700 RB), Turkey (400 RB), and India (200 RB). Net sales of 5,500 RB for 2022/2023 were reported for Peru (4,300 RB), India (700 RB), Germany (400 RB), and Japan (100 RB). Exports of 14,700 RB were down 19 percent

from the previous week, but up 22 percent from the prior 4-week average. The destinations were primarily to India (5,700 RB), China (5,200 RB), Turkey (1,200 RB), Peru (1,100 RB), and Taiwan (400 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 57,200 RB is for Vietnam (52,800 RB) and Pakistan (4,400 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 473,700 pieces for 2022 were up 15 percent from the previous week and 18 percent from the prior 4-week average. Increases primarily for China (271,100 whole cattle hides, including decreases of 17,100 pieces), Thailand (125,700 whole cattle hides,

including decreases of 1,300 pieces), Mexico (27,800 whole cattle hides, including decreases of 600 pieces), South Korea (20,300 whole cattle hides, including decreases of 700 pieces), and Indonesia (13,100 whole cattle hides, including decreases of 700 pieces),

were offset by reductions for Argentina (600 pieces), Brazil (400 pieces), and Taiwan (300 pieces). Exports of 377,900 pieces were down 36 percent from the previous week and 26 percent from the prior 4-week average. Whole cattle hides exports were primarily

to China (206,500 pieces), South Korea (45,400 pieces), Mexico (34,300 pieces), Thailand (34,000 pieces), and Taiwan (25,300 pieces).

Net

sales of 270,800 wet blues for 2022 were up noticeably from the previous week and up 89 percent from the prior 4-week average. Increases primarily for Italy (86,200 unsplit and 9,000 grain splits, including decreases of 100 unsplit), China (58,000 unsplit,

including decreases of 200 unsplit), Vietnam (53,600 unsplit), Thailand (31,800 unsplit), and Portugal (16,000 grain splits), were offset by reductions for Hong Kong (100 unsplit). Exports of 171,300 wet blues were up 3 percent from the previous week, but

down 8 percent from the prior 4-week average. The destinations were primarily to Italy (41,400 unsplit and 16,200 grain splits), China (31,400 unsplit), Vietnam (30,400 unsplit), Thailand (25,700 unsplit), and Hong Kong (10,900 unsplit). Net sales of 999,000

splits were down noticeably from the previous week, but up 96 percent from the prior 4-week average. Increases were reported for Vietnam (623,400 pounds, including decreases of 17,100 pounds), South Korea (249,600 pounds, including decreases of 2,900 pounds),

and China (126,000 pounds). Exports of 686,900 pounds were down 11 percent from the previous week, but up 16 percent from the prior 4-week average. The destinations were primarily to Vietnam (557,700 pounds) and South Korea (85,300 pounds).

Beef:

Net sales of 15,000 MT for 2022 were down 13 percent from the previous week and 27 percent from the prior 4-week average. Increases were primarily for Japan (4,600 MT, including decreases of 700 MT), South Korea (4,100 MT, including decreases of 700 MT),

China (2,500 MT, including decreases of 700 MT), Canada (1,000 MT, including decreases of 100 MT), and Taiwan (600 MT, including decreases of 100 MT). Exports of 21,000 MT were up 13 percent from the previous week, but down 16 percent from the prior 4-week

average. The destinations were primarily to South Korea (6,800 MT), Japan (5,200 MT), China (3,600 MT), Taiwan (1,200 MT), and Mexico (1,000 MT).

Pork:

Net sales of 12,900 MT for 2022–a marketing-year low–were down 46 percent from the previous week and 55 percent from the prior 4-week average. Increases primarily for Mexico (4,700 MT, including decreases of 600 MT), South Korea (2,800 MT, including decreases

of 1,300 MT), the Philippines (1,300 MT), Canada (800 MT, including decreases of 500 MT), and the Dominican Republic (700 MT), were offset by reductions for China (100 MT). Exports of 28,200 MT were down 11 percent from the previous week and 6 percent from

the prior 4-week average. The destinations were primarily to Mexico (11,600 MT), Japan (4,600 MT), China (3,800 MT), South Korea (2,700 MT), and Canada (1,300 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.