PDF Attached

USDA:

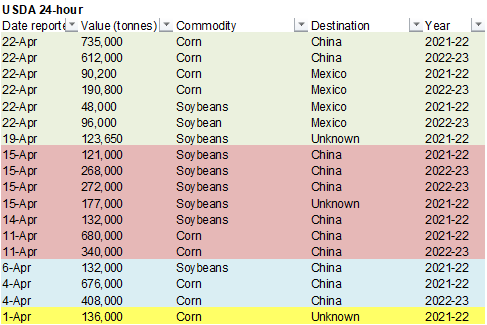

Private exporters reported the following activity:

-1,347,000

metric tons of corn for delivery to China.

Of the total, 735,000 metric tons is for delivery during the 2021/2022 marketing year and 612,000 metric tons is for delivery during the 2022/2023 marketing year

-281,000

metric tons of corn for delivery to Mexico.

Of the total, 90,200 metric tons is for delivery during the 2021/2022 marketing year and 190,800 metric tons is for delivery during the 2022/2023 marketing year

-144,000

metric tons of soybeans for delivery to Mexico.

Of the total, 48,000 metric tons is for delivery during the 2021/2022 marketing year and 96,000 metric tons is for delivery during the 2022/2023 marketing year

Wild

trading session today with wide ranges. Soybeans, meal and corn ended lower. SBO was higher bias the nearby. Wheat ended mixed. Indonesia’s president announced they plan to ban exports of cooking oil and its raw material from April 28. Soybean oil rallied.

WEATHER

EVENTS AND FEATURES TO WATCH

- Windy

conditions and excessive heat occurred Thursday in the central and southern U.S. Plains - Wind

speeds were not more than 40 mph in the southern Plains, but reached over 50 mph in western Nebraska and western South Dakota - Temperatures

were in the 80s and 90s in the southern Plains with extremes over 100 in the southeastern Texas Panhandle - Excessive

wind and more heat will impact the central and southern U.S. Plains today - Temperatures

over 90 Fahrenheit will occur as far north as the Nebraska/South Dakota border with several areas to breach 100 again in the southwestern Plains - U.S.

High Plains region from southwestern Nebraska to western Texas will see a line of thunderstorms this evening and overnight tonight producing some rain - The

precipitation in the southwestern Plains will not be well organized and will be quite limited leaving drought unaffected - A

few counties and parts of counties in west-central and northwestern Kansas into southwestern Nebraska will receive thunderstorms of significance with 0.25 to 0.75 inch of rain and locally more possible briefly overnight tonight - No

change in drought status is expected because of the moisture - Additional

waves of excessive heat, strong wind and low humidity are expected in the central and southern U.S. Plains over the next two weeks - The

first round of extremes will began Thursday and will continue today - Another

wave of hot and windy weather is expected during mid- to late-week next week

- A

third wave of heat and dryness will occur in the first week of May - The

waves of heat will be separated by brief bouts of more seasonable temperatures and a few showers, but the resulting precipitation will fail to change drought status in the high Plains region - Temperature

extremes in each period of heat will reach the 80s and 90s Fahrenheit in the central and southern Plains - U.S.

southeastern states will experience a return of dryness in the next two weeks with daily temperatures rising into the 80s and infrequent rainfall that will be well below average is expected - Good

planting weather will occur for a while, but the region will become too dry by the start of May - Spring

planting delays are likely In North Dakota and Manitoba Canada as well as a few immediate bordering areas due to significant snow on the ground and the potential for flooding when the snow melts - This

weekend’s storm will produce 0.50 to 2.50 inches of moisture from eastern Montana and the western Dakotas to Manitoba, Canada - A

brief break in the active weather pattern is expected during the week next week and then more rain is expected at the end of next week and into the following weekend - Montana

and western North Dakota will experience additional drought relief with significant snow and rain falling tonight into Sunday - Travel

delays are likely due to snowfall during the weekend of 8 to 16 inches with a few amounts of 20-30 inches - The

heavy snow will also impact southeastern Saskatchewan and Manitoba - Livestock

stress and travel delays are also expected - One

more storm may impact this region late next week, although confidence is low - Southwestern

Canada Prairies are still much too dry and significant relief is not likely for a while - Spring

planting will begin in this coming week, but significant precipitation is needed to fix long term dryness and to recharge subsoil moisture - Early

season crop emergence will occur normally, but without rain some crops may wither in the absence of supportive subsoil moisture especially if it turns too warm prior to the arrival of rain - Some

moisture will be possible in the second week of the forecast, but confidence is low - Eastern

U.S. Midwest and Tennessee River Basin areas will see faster drying rates into the weekend as temperatures turn warmer while rainfall is restricted - Some

planting of corn and other early season crops will result - Rain

frequency in the Midwest will be greatest from Missouri, Kansas and the northwestern Delta into Illinois and immediate bordering states through the weekend and then drier weather is expected next week favoring “some” possible field progress - Precipitation

in the U.S. high Plains from western Nebraska and eastern Colorado through western Texas will be restricted over the next two weeks, although a few showers cannot be ruled out - As

noted above (third bullet), some rain is expected tonight - West

Texas cotton, corn and sorghum production areas will remain too dry during the next two weeks, despite a few showers infrequently - South

Texas dryness will also prevail for a while, although some rain will fall in the Rio Grande Valley next week - Coastal

Bend crop areas will not see much usable precipitation for the next week to ten days - U.S.

southeastern states will experience net drying over the next ten days - Warm

temperatures and limited rainfall will allow aggressive spring planting to take place - Greater

rainfall will be needed late this month and in May to ensure the best establishment, although World Weather, Inc. anticipates additional drying and an eventual concern over the lack of moisture - U.S.

Pacific Northwest continues to get less than usual precipitation, although the lower Columbia River Valley did receive above normal precipitation in the most recent 30 days - Some

improvement in soil moisture also occurred in southern Idaho and in a few Wyoming sugarbeet and potato production areas - More

moisture is needed - California

snow water equivalents are now running 19-32% of normal for this date - Brief

bouts of precipitation are expected in the next ten days, but resulting precipitation is expected to be less than usual - All

of the moisture will be welcome, but water restrictions and concern over long term water supply are expected to continue rising - Mato

Grosso and Mato Grosso do Sul through Bahia, Minas Gerais and Sao Paulo, Brazil will experience net drying over the next two weeks - Dryness

is already an issue in northern Minas Gerais and parts of central Bahia and is becoming an issue in Mato Grosso - Mato

Grosso topsoil moisture is rated short to very short while its subsoil moisture is rated marginally adequate to short - Rising

crop stress is predicted over the next two weeks and if there is no relief some yield potentials in corn fields will begin slipping lower - Some

rain will fall tonight and Saturday in Mato Grosso and Mato Grosso do Sul, but resulting rainfall will not be enough to seriously counter evaporation in Mato Grosso for the next few days – let alone the next two weeks - Mato

Grosso do Sul, however, will receive 0.30 to 1.00 inch of moisture with a few amounts to 1.50 inches tonight and early Saturday - Concern

is greatest for Mato Grosso - Southern

Brazil crops will stay favorably moist with alternating periods of rain and sunshine expected - Most

of Argentina will also continue to see a good mix of weather along with favorable soil moisture - There

is need for rain in northwestern through west-central parts of the nation - North

Africa weather will remain mostly good for developing wheat and barley - Production

cuts are permanent in southwestern Morocco since some of the crop was not planted due to drought - Other

areas in northern Morocco and areas east to Tunisia should see a favorable production year, despite some winter dryness - India’s

lost winter crop yields came from late February and March dryness, but the losses are not likely to be very great and the winter crops were already poised to produce quite well which should reduce the significance of the decline recently reported - Weather

in India, Europe, the Commonwealth of Independent States and China is expected to remain mostly good over the next ten days - Southwestern

through east-central Europe will experience frequent precipitation over the next ten days and temperatures may be mild to a little cool at times - The

environment may slow some spring fieldwork, but progress is expected - Early

season winter and spring crop development will advance, albeit slowly due to milder than usual conditions - North-central

and northwestern Europe weather is expected to be driest - Waves

of rain and some snow in the western CIS will maintain moist field conditions in most of the crop areas west of the Ural Mountains and for some areas to the east as well - Spring

fieldwork will be slower advancing than usual because of the precipitation, wet fields and milder than usual temperatures in many areas - Topsoil

moisture is rated adequate to excessive west of the Ural Mountains and subsoil moisture is rated adequate - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - China’s

Yangtze River Basin will see rain develop again late this week and into next week

- The

moisture abundance will be good for long term crop development, but fieldwork could be delayed at times

- Net

drying is expected in China’s Yellow River Basin and North China Plain - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Some

rain and snow may impact the far northeast of Xinjiang briefly this weekend through most of next week - India’s

rainfall will be greatest in the far Eastern States this week, although some pre-monsoonal showers and thunderstorms are expected briefly in the south - Good

harvest weather will continue in winter crop areas - Temperatures

will remain warm - Turkey,

Iran and Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas - Overall,

crop conditions will remain favorable - A

developing tropical cyclone is expected over the Philippines during the middle and latter part of next week that will evolve into a tropical storm later next week in the South China Sea

- Some

heavy rainfall is likely in the Philippines - The

storm should turn toward Taiwan in the following weekend - Eastern

Australia cotton and sorghum areas will experience dry weather through the weekend improving field progress after recent rain delays in New South Wales.

- Cotton

and sorghum harvest conditions in Queensland, Australia remain nearly ideal

- Rain

delay is expected again during the middle to latter part of next week - South

Africa continues in need of drier weather to protect summer crop conditions and to promote faster crop maturation and harvest progress - Too

much moisture this month has already raised concern over crop quality in many areas and fieldwork has been delayed.

- Cotton

quality has already been compromised and soybean harvesting has been a little slow at times - Central

Africa showers and thunderstorms will occur periodically during the next two weeks to support fieldwork and crop development - North

Africa precipitation over the next two weeks will be a little more sporadic and light leading to some net drying - Crop

conditions have remained favorable and are not likely to change much in the next ten days, despite some drying - Mexico’s

winter dryness and drought have been expanding due to poor precipitation resulting from persistent La Nina - Northern

parts of the nation will continue lacking precipitation for an extended period of time - Eastern

and southern Mexico will experience some periodic rainfall over the next two weeks and some soil moisture boosting is expected in eastern parts of the nation - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +15.82 and it should drift higher before leveling off in the coming week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - First

quarter cocoa grinding data from Cocoa Association of Asia - Brazil’s

Unica may release cane crush and sugar output data (tentative) - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - FranceAgriMer

weekly update on crop conditions

Monday,

April 25:

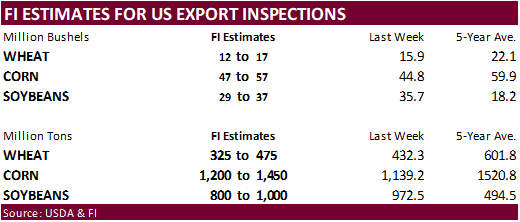

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop progress and planting data for corn and cotton; spring wheat progress, 4pm - Malaysia’s

April 1-25 palm oil export data - U.S.

poultry slaughter, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

Australia, New Zealand, Egypt

Tuesday,

April 26:

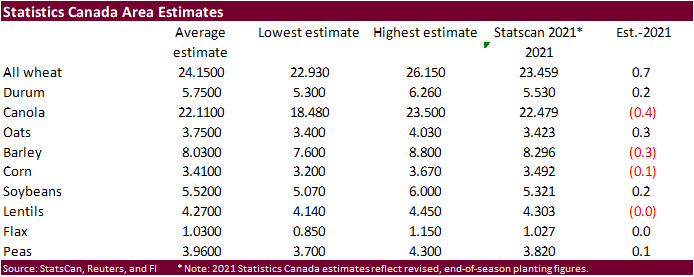

- Statistics

Canada publishes report on seeded area for wheat, barley and canola - MARS

monthly report on EU crop conditions - Geneva

Sugar Conference, day 1 - EU

weekly grain, oilseed import and export data - EARNINGS:

ADM

Wednesday,

April 27:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Geneva

Sugar Conference, day 2 - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

April 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab releases production numbers for sugar, cane and ethanol (tentative)

Friday,

April 29:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Source:

Bloomberg and FI

Due

out April 26

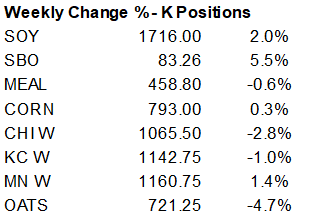

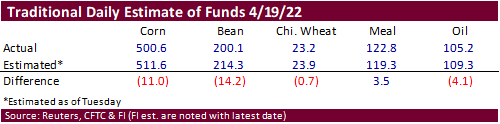

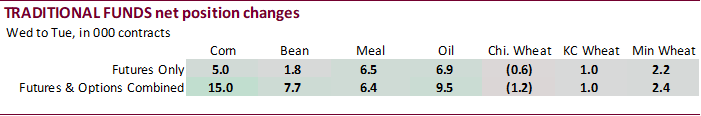

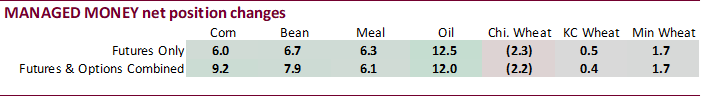

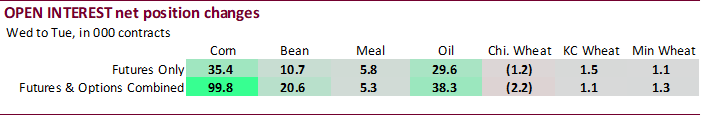

CFTC

Commitment of Traders

Funds

were less long than estimated for corn, soybeans and soybean oil. There were no major surprises for the week ending April 19. Keep an eye on Chicago wheat as funds are near flat. At the end of March, they were net long 43,100 contracts.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

285,977 14,893 486,281 -5,414 -741,241 -15,082

Soybeans

103,552 5,656 211,720 2,806 -290,134 -10,518

Soyoil

64,470 9,314 117,361 -584 -204,499 -10,115

CBOT

wheat -38,046 -1,072 160,776 -382 -120,063 1,584

KCBT

wheat 16,030 334 63,076 215 -81,471 -716

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

379,110 9,157 285,998 -78 -735,187 -20,506

Soybeans

179,723 7,852 111,505 -1,350 -280,092 -8,384

Soymeal

99,542 6,131 89,889 -456 -241,081 -6,092

Soyoil

96,088 12,026 84,252 -1,304 -208,219 -9,580

CBOT

wheat 14,470 -2,170 68,179 -510 -93,574 1,789

KCBT

wheat 49,841 449 25,420 1,432 -73,470 -2,620

MGEX

wheat 19,867 1,747 627 -15 -30,314 -2,800

———- ———- ———- ———- ———- ———-

Total

wheat 84,178 26 94,226 907 -197,358 -3,631

Live

cattle 46,807 7,309 74,096 241 -132,822 -4,043

Feeder

cattle -4,410 390 5,361 147 2,529 -1,113

Lean

hogs 56,507 1,833 54,473 58 -110,663 -3,366

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

101,096 5,823 -31,017 5,604 2,363,241 99,846

Soybeans

14,004 -173 -25,139 2,056 1,005,019 20,608

Soymeal

15,846 314 35,803 104 466,468 5,332

Soyoil

5,213 -2,528 22,666 1,386 471,333 38,336

CBOT

wheat 13,591 1,020 -2,666 -129 484,604 -2,217

KCBT

wheat -4,156 573 2,366 167 211,504 1,065

MGEX

wheat 5,184 631 4,636 436 77,613 1,284

———- ———- ———- ———- ———- ———-

Total

wheat 14,619 2,224 4,336 474 773,721 132

Live

cattle 25,347 -3,239 -13,428 -269 360,036 1,344

Feeder

cattle 449 -3 -3,929 579 58,224 -1,664

Lean

hogs 5,607 802 -5,924 672 298,882 -20,880

Source:

Reuters, CFTC, and FI

US

S&P Global Manufacturing PMI Apr P: 59.7 (est 58.0; prev 58.8)

–

Services PMI: 54.7 (est 58.0; prev 58.0)

–

Composite PMI: 55.1 (est 57.9; prev 57.7)

Canadian

Retail Sales (M/M) Feb: 0.1% (est -0.5%; prev 3.2%; prevR 3.3%)

Canadian

Retail Sales Ex Auto (M/M) Feb: 2.1% (est 0.4%; prev 2.5%; prevR 2.9%)

Canadian

PPI (M/M) Mar: 4.0% (prev 3.1%; prevR 2.6%)

Canadian

PPI (Y/Y) Mar: 18.5% (prev 16.4%; prevR 15.8%)

Canadian

Industrial Product Price (M/M) Mar: 4.0% (est 2.1%; prev 3.1%; prevR 2.6%)

81

Counterparties Take $1.765 Tln At Fed Reverse Repo Op (prev $1.855 Tln, 80 Bids)

·

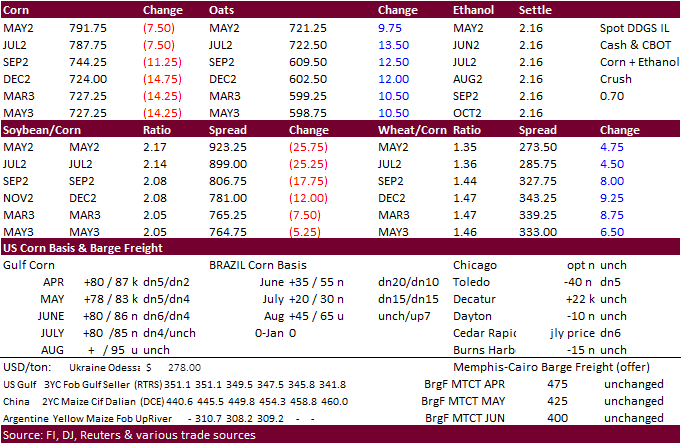

CBOT corn traded lower throughout the day session despite the USDA flash sales to Mexico and China. Technical selling, profit taking and a sharply higher USD weighed on prices.

·

WTI crude oil (China lockdown concerns) was down $1.75 as of 1:35 pm CT.

·

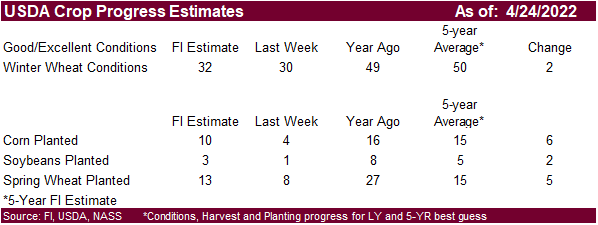

US corn planting progress should start to improve this weekend and significantly increase early May.

·

The Buenos Aires Grain Exchange reported 18% of the Argentina corn crop was rated good or excellent, down from 20% last week.

·

Bulgaria reported an outbreak of bird flu on a laying hens farm in the southern part of the country.

·

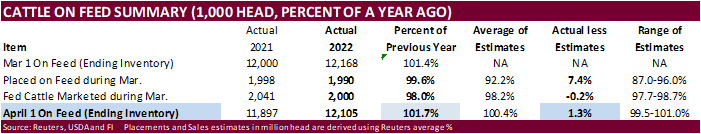

USDA Cattle on Feed showed placements well above expectations. On feed as of April 1 was 1.3 points above expectations and fed cattle slightly below. The report is slightly supportive for feed demand and bearish for cattle futures,

in our opinion.

What

Do We Know About How Long It Takes to Plant the U.S. Corn Crop?

Irwin,

S. “What Do We Know About How Long It Takes to Plant the U.S. Corn Crop?.”

farmdoc

daily

(12):54, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 21, 2022.

Export

developments.

·

USDA: Private exporters reported the following activity:

-1,347,000

metric tons of corn for delivery to China. Of the total, 735,000 metric tons is for delivery during the 2021/2022 marketing year and 612,000 metric tons is for delivery during the 2022/2023 marketing year

-281,000

metric tons of corn for delivery to Mexico. Of the total, 90,200 metric tons is for delivery during the 2021/2022 marketing year and 190,800 metric tons is for delivery during the 2022/2023 marketing year

-144,000

metric tons of soybeans for delivery to Mexico. Of the total, 48,000 metric tons is for delivery during the 2021/2022 marketing year and 96,000 metric tons is for delivery during the 2022/2023 marketing year

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

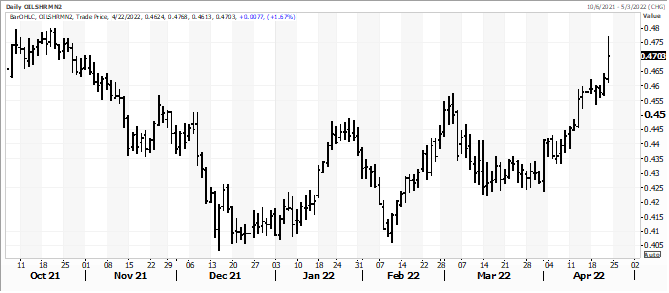

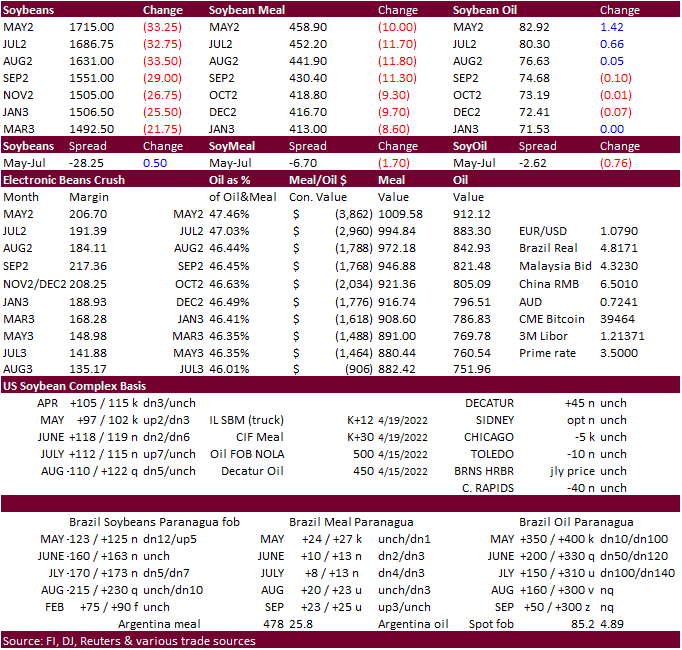

Soybean oil contracts high fresh record highs on Friday after Indonesia announced they plan will temporality ban palm oil exports. The market paired gains and by early afternoon with back months trading lower. In the end May was

up 176 points, July up 87 and December down 7 points.

·

Soybeans traded two-sided and ended lower on end of week profit taking and a sharply higher USD. Sell stops were hit in soybeans around 12:41 pm CT. Someone sold 1,300 contracts. July soybeans settled 211.50 cents lower.

·

Soybean meal was lower throughout the day session on soybean oil/meal spreading, sharply lower corn and higher USD. July finished down $11.80.

·

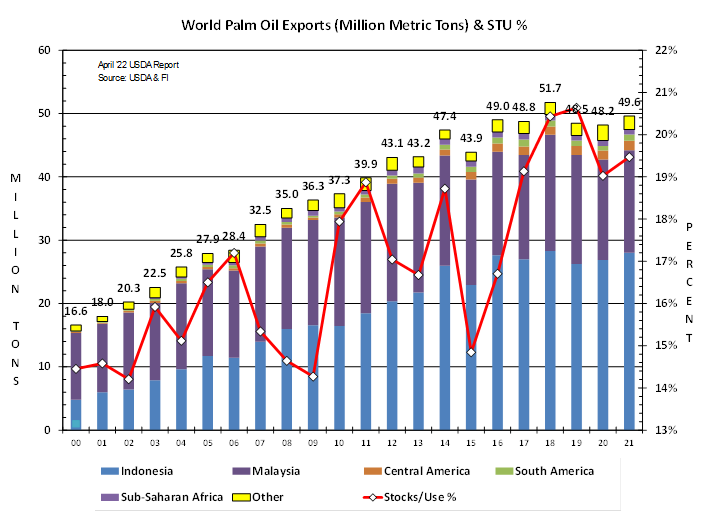

Around 5:30 am CT, Reuters released a headline that Indonesia’s president announced they plan to ban exports of cooking oil and its raw material from April 28. Indonesia aims to fight domestic food inflation. This is the second

time this year Indonesia has announced a plan to curb exports. In January Indonesia set a domestic price cap and restricted export volumes, then relaxed it in March. This latest announcement comes a day after Indonesia set its May crude palm oil export reference

price at $1,657.39 a ton, below April’s $1,787.5 per ton.

·

If realized, it’s a blow to major palm oil importers. Major trade bodies, including India’s SEA and Indonesia’s GAPKI have voiced concerns. Even the USDA called for cooperation.

·

The palm oil ban adds to a short list of major developments that have pushed up global vegetable oil prices. A drought in South America followed by the evaporation of Ukraine sunflower oil shipments had already underpinned prices.

·

May crush was up 29 cents to $2.90.

·

July soybean oil share rallied but paired some of the gains by noon.

·

August Paris rapeseed closed 27.00 euros higher at a record 881.25.

·

APK-Inform mentioned Ukraine could export 745,000 tons of sunflower oil to Europe for the rest of the 2021-22 season (Sep-Aug), delivered by train.

·

On Friday Malaysia set its May crude palm oil export tax at 8%, unchanged from April, based on a reference price at 6,759.22 ringgit ($1,564.63) a ton, up from 5,925.33 ringgit a ton for April.

·

Malaysia palm futures trended higher by 78MYR and cash was up $15.00/ton at $1,605/ton.

·

China looks to auction off another 500,000 tons of soybeans April 29. This week they may have sold about 80 percent of the 500,000 tons offered. For some reason, the government has not been releasing official soybean auction data.

More

graphs can be found after the text

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

Wheat

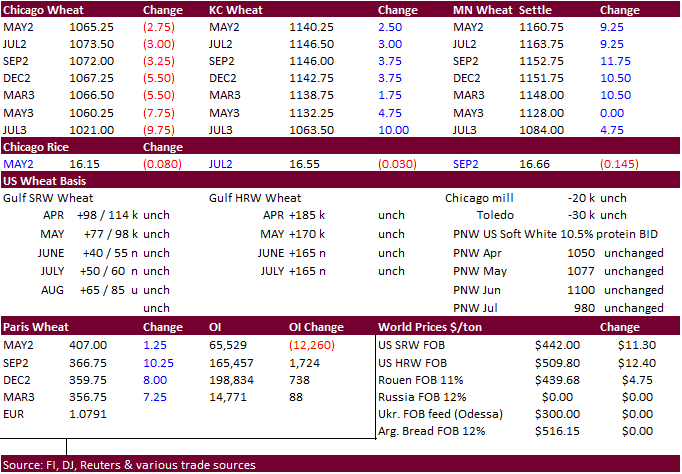

·

Wide trading range today. US wheat paired

losses during early electronic trading from a rally in soybeans and corn. Then it turned down hard during the morning day session only to rally again in afternoon trading. Chicago lagged KC and MN in part to fund selling. Russia will increase its wheat export

duty by $8.50/ton for the April 25-May 5 period (table attached after the text).

·

Chicago July settled 1.25 cents lower, KC July 6.0 cents higher, and MN July 8.25 cents higher.

·

September Paris wheat closed 10.25 euros higher at 366.75.

·

The French AgMin estimated 91 percent of the soft wheat crop was in good or excellent condition for the week ending April 18, down one point from the previous week and compares to 85 percent year ago.

·

The Rosario grains exchange warned Argentina wheat production could drop 25 percent for the 2022-23 season for the central growing region due to dry weather and increasing input/labor costs. La Nina was cited.

·

IKAR estimates Russia’s 2022 wheat crop at 83.5 million tons from 83 million previously. This compares to a SovEcon estimate of a record 2022 Russian wheat crop of 87.4 million tons. Russia harvested 76.0 million tons of wheat

in 2021.

·

Russia set the April 24-May 5 wheat export tax at $119.10 per ton, up from $110.70 per ton previous week.

·

Morocco recently bought 136,260 tons of soft wheat for storage.

·

Russia delivered nearly 20,000 tons of wheat to Cuba.

·

Jordan seeks 120,000 tons of feed barley on April 26 for Aug and/or Sep shipment.

·

Jordan seeks 120,000 tons of wheat. on April 27 for Jun and/or Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago – July $10.50 to $12.50 range, December $8.50-$12.50

KC – July $10.25 to $12.50 range, December $8.75-$13.50

MN – July $10.75‐$13.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.