PDF Attached

Impressive

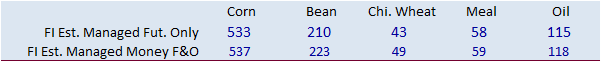

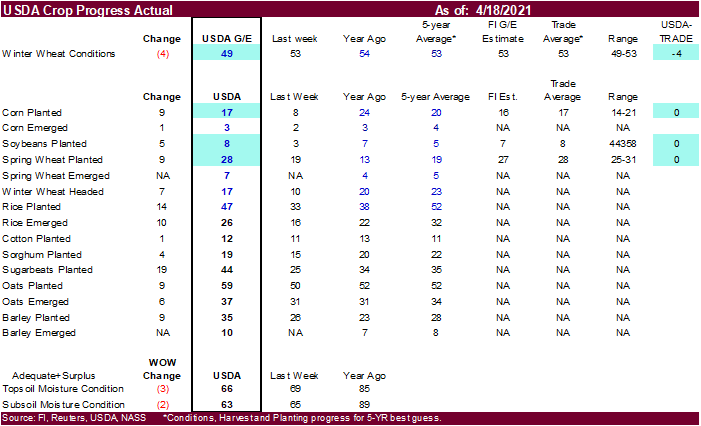

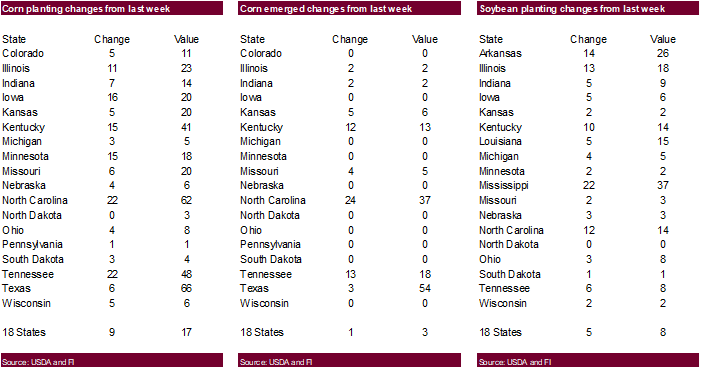

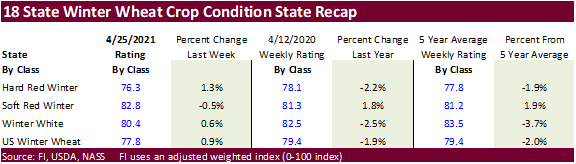

upside again today in CBOT agricultural futures. Inflation story, weather and supply concerns supported markets. US corn and soybean plantings were as expected at 17 and 8 percent, respectively, but corn is lagging its respected 5-year averages by 3 points.

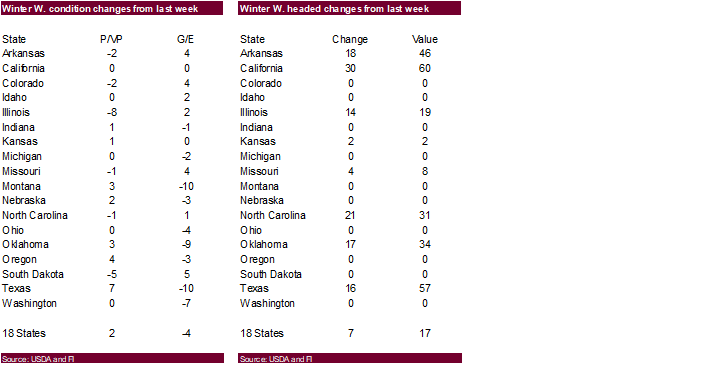

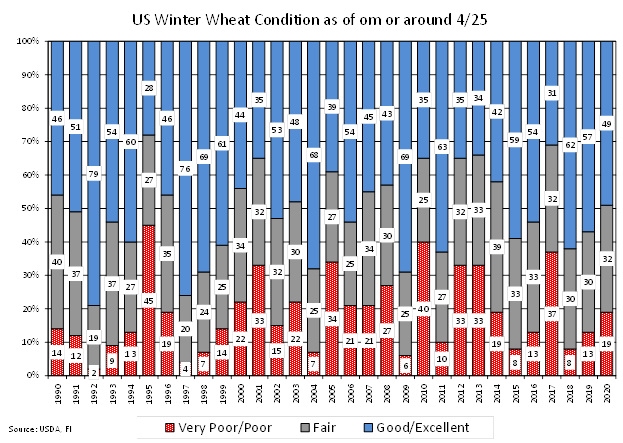

Soybeans are running 3 points above average. US spring wheat plantings were reported at 28 percent, as expected and 9 points above average. US winter wheat ratings declined a more than expected 4 points to 49 percent good/excellent, 4 points below trade

expectations and below its 53 percent average. But by class HRW wheat increased 1.3% from the previous week, and white was up slightly. SRW declined 0.6% (see wheat section).

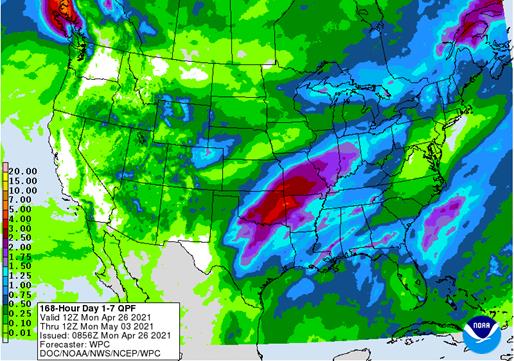

Parts

of the US Delta saw flooding over the weekend from a large storm, from Central Louisiana through portions of southern Mississippi to southeastern Alabama and southern Georgia (3-6 inches). The US central Plains will be hot over the next few days deleting

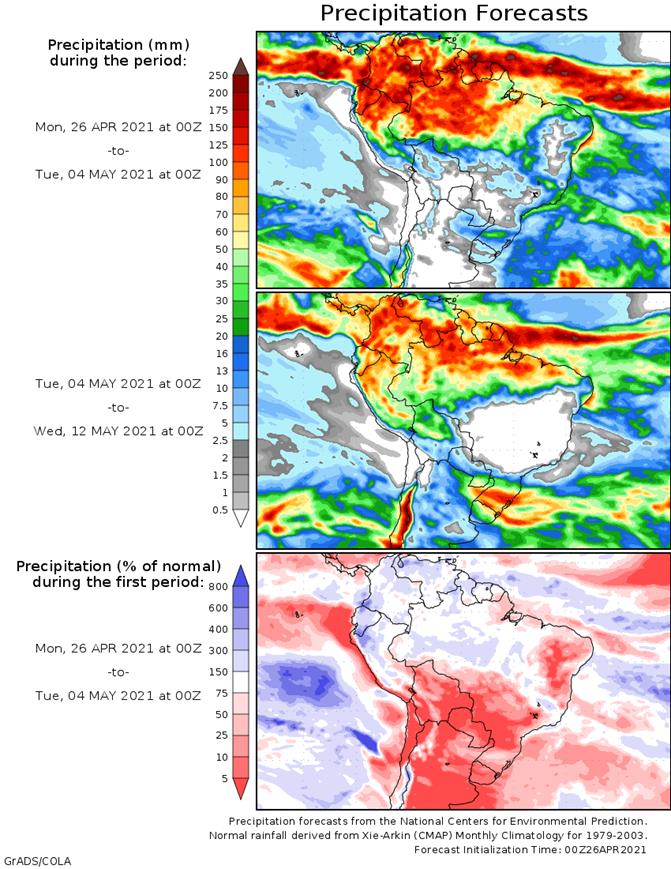

soil moisture levels. No threatening cold temperatures are expected over the next two weeks for the US corn belt. Brazil weekend rain was expected, and this workweek rain is expected across northern Mato Grosso, Tocantins, western Bahia, as well as Rio Grande

do Sul, Brazil, while net drying occurs elsewhere, according to World Weather Inc. Mexico is seeing drought conditions that will last for at least another 2 weeks. Frost and freezes continued in northeastern parts of the European continent during the weekend,

but the outlook looks like weather improves.

Next

7 days

TODAY’S

MOST IMPORTANT WEATHER

- Brazil’s

outlook is still dry biased for the next ten days and some forecast models keep the majority of Safrinha corn country mostly dry through the next two weeks - Argentina’s

weather still looks good with net drying this week and then some rain next week - Western

Russia, Belarus and central and western Ukraine are still advertised wet and cool biased over the coming week with a gradual trend toward less precipitation and some warming next week

- Europe

will be cool and moist this week, although the North Sea region will be dry for a while this workweek - North

Africa will receive erratic rainfall and experience net drying in most areas except possible the far northernmost part of Morocco where rain is likely - West-central

Africa rainfall will be favorably mixed - Indonesia/Malaysia,

Mainland areas of Southeast Asia get periods of rain next two weeks

- Western

Australia gets a little rain in the southwest late this week and more early next week over a larger part of the state that bolsters planting moisture, although more will be needed - Some

of the increase next week may be overdone - U.S.

outlook is still wet and stormy from late Tuesday into Thursday from eastern Oklahoma and central Texas to southern Illinois and southern Indiana; including the northern Delta where some excessive rain is expected and a little flooding - Damaging

wind, hail and some tornadoes will be possible, as well - Virginia

and the Carolinas are dry and need rain – some showers will occur briefly Friday

- West

Texas rainfall potentials remain poor in the high Plains for at least ten days - South

Texas rainfall potential is also poor for next ten days - Northern

U.S. Plains and Canada’s Prairies will be drier biased in the coming week with some potential for at least a little rain in the following week

Source:

World Weather Inc. & FI

Monday,

April 26:

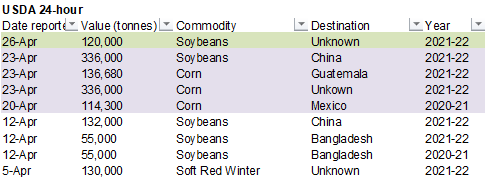

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - Monthly

MARS bulletin on crop conditions in Europe - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

April 1-25 palm oil export data from AmSpec, SGS - HOLIDAY:

New Zealand

Tuesday,

April 27:

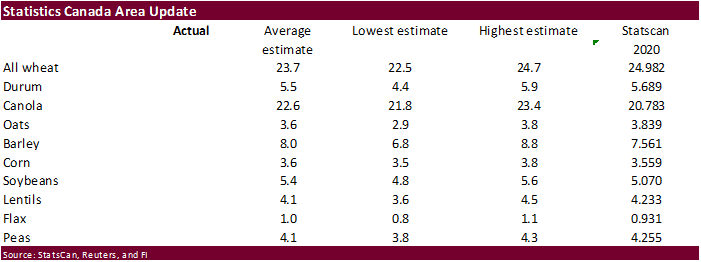

- Canada’s

StatsCan releases data on seeded area for soybeans, barley, canola, wheat and durum

Wednesday,

April 28:

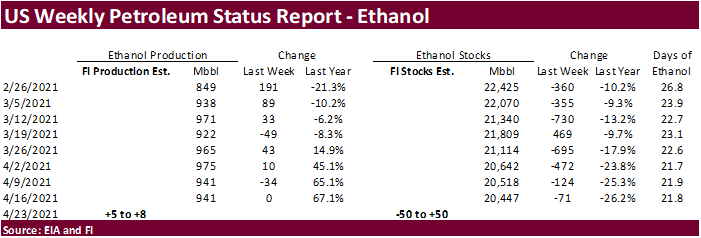

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica publishes data on cane crush and sugar output (tentative)

Thursday,

April 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - HOLIDAY:

Japan, Malaysia

Friday,

April 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received - Malaysia’s

April 1-30 palm oil export data - FranceAgriMer

weekly update on crop conditions - Holiday:

Vietnam

Source:

Bloomberg and FI

Due

out Tuesday April 27

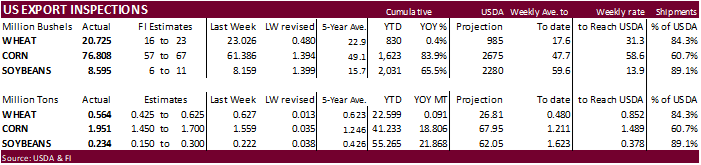

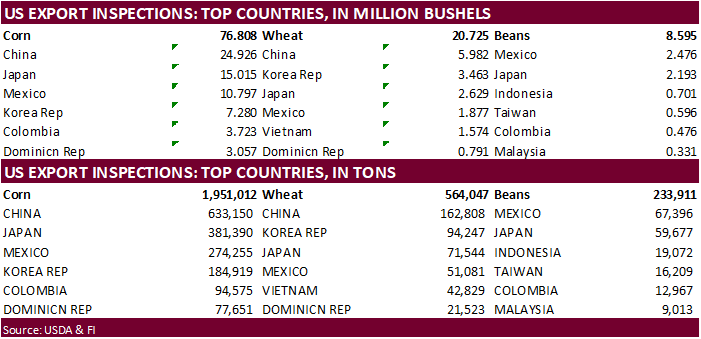

USDA

inspections versus Reuters trade range

Wheat

564,047 versus 400000-625000

Corn

1,951,012 versus 1100000-1700000

Soybeans

233,911 versus 150000-300000

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 22, 2021

— METRIC TONS —

————————————————————————-

CURRENT

PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/22/2021 04/15/2021 04/23/2020 TO DATE TO DATE

BARLEY

24 0 49 32,644 30,548

CORN

1,951,012 1,559,267 1,078,788 41,232,631 22,426,554

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

0 599 0 4,290 3,343

RYE

0 0 0 0 0

SORGHUM

182,614 314,699 285,813 5,382,520 2,449,179

SOYBEANS

233,911 222,065 561,063 55,265,233 33,397,666

SUNFLOWER

0 0 0 0 0

WHEAT

564,047 626,670 506,700 22,599,479 22,508,623

Total

2,931,608 2,723,300 2,432,413 124,517,306 80,816,433

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

March Retail Sales Revised To +9.7% (Prev +9.8%)

EPA

Reconsiders Previous Administration’s Withdrawal Of California’s Waiver To Enforce Greenhouse Gas Standards For Cars And Light Trucks

US

Durable Goods Orders Mar P: 0.5% (est 2.5%; prevR -0.9%; prev -1.2%)

US

Durables Ex-Transportation Mar P: 1.6% (est 1.6%; prevR -0.3%; prev -0.9%)

US

Cap Goods Orders Nondef Ex-Air Mar P: 0.9% (est 1.8%; prevR -0.8%; prev -0.9%)

US

Cap Goods Ship Nondef Ex-Air Mar P: 1.3% (est 1.5%; prev -1.1%)

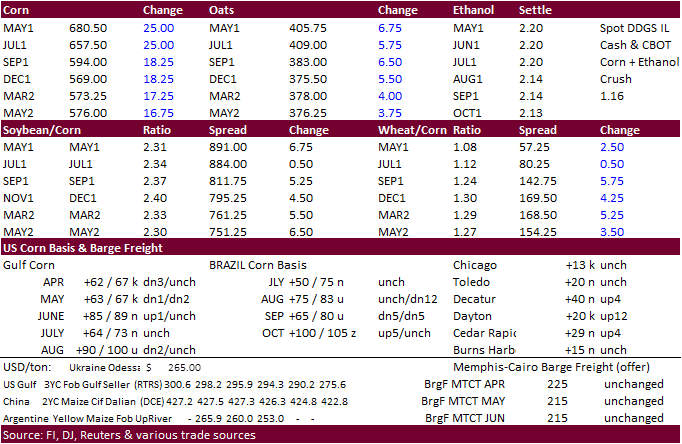

- Another

limit up day in corn with May and July both up 25 cents. CK synthetically on the close was $6.8550. CBOT

corn

was higher today on ongoing fund buying amid Brazil second crop production concerns and heavy rain flooding local fields across the Delta over the weekend. Brazil’s second corn crop is approaching the critical pollination stage. We see Brazil corn production

around 103 million tons (76.64 million ton second corn crop). USDA is at 109 million tons. There was chatter over Argentina looking at raising grain export taxes. Argentina’s inflation remains out of control and this is seen supportive for corn and soybean

meal. Argentina currently has a 33% tax on soybean exports, 31% on soymeal & soyoil, and 12% on corn and wheat. US producer selling ticked up today.

- On

Monday funds bought an estimated net 60,000 corn contracts. - Price

increases in Chicago could stall this week with warmer weather expected across the US Midwest that could boost planting progress. However, $7.00 corn is not out of reach.

- US

corn and soybean plantings were as expected at 17 and 8 percent, respectively, but corn is lagging its respected 5-year averages by 3 points.

- Corn

basis at Decatur, IL, was up 4 cents to 40 over the July and corn at Cedar Rapids, IA, was up 4 cents to 29 over the July.

- The

USD was slightly lower as of 2:45 pm CT. - There

were rumors Friday that China bought about 1 million tons of Q1 2021-22 US corn.

- Bulgaria

reported a fifth bird flu outbreak at an industrial farm affecting 40,000 laying hens.

- Brazil’s

meat lobby group said meatpackers are looking at using more wheat for feed as grain prices are getting very expensive.

- The

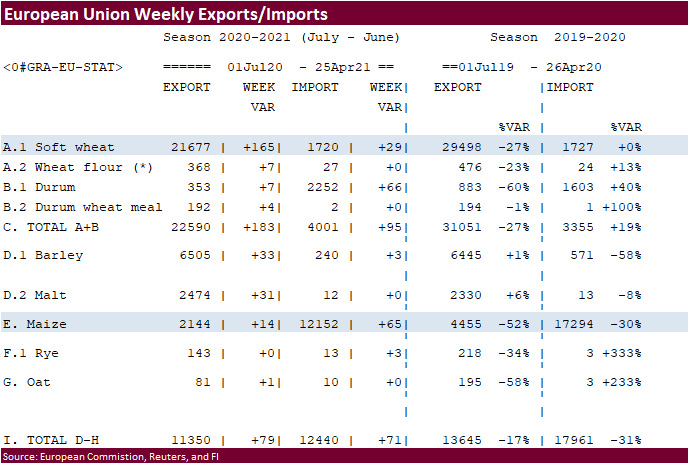

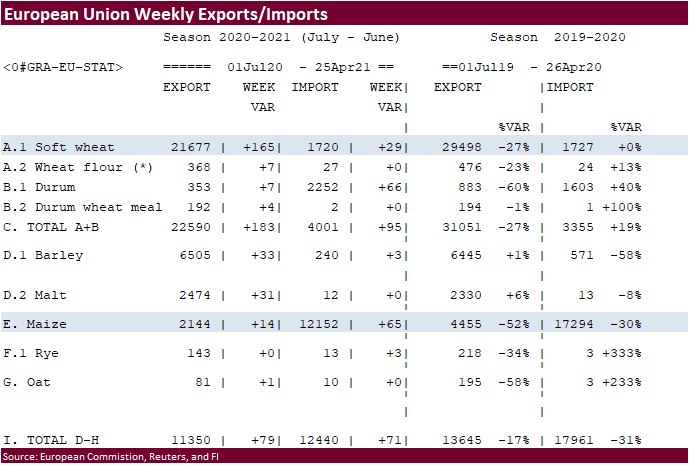

European Union granted imports licenses for 65,000 tons of corn imports, bringing cumulative 2020-21 imports to 12.152 MMT, 30 percent below same period year ago

Export

developments.

- South

Korea’s FLC bought 65,000 tons of corn, likely from South America, at $305.99/ton c&f, for arrival around August 25.

Updated

4/26/21

May

corn is seen in a $6.50 and $7.25 range

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

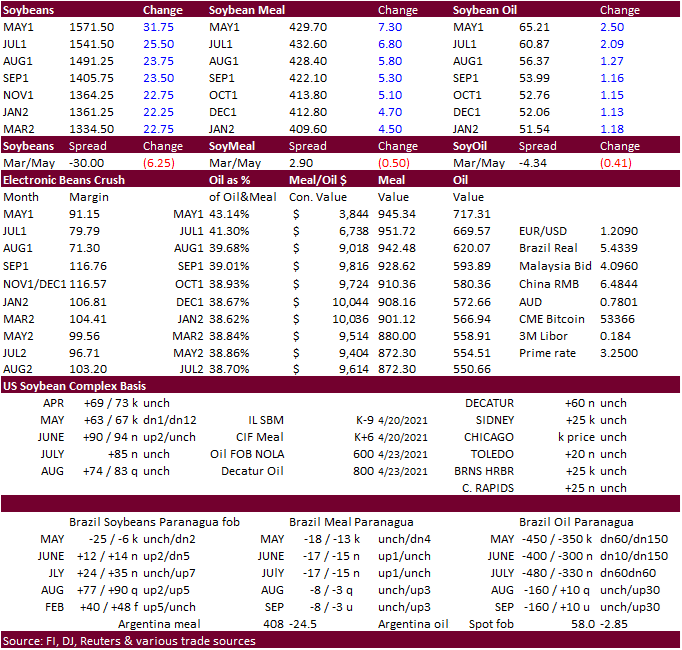

- CBOT

soybeans,

meal and oil were higher on supply concerns and strong US interior soybean basis. Slow plantings of the US corn and soybean crops across the US last week from cold temperatures were noted. An Indiana location hit $16/bu for soybeans late last week. We are

hearing Brazil’s FOB soybean price for May hit a new high of around $560/ton Friday. Council Bluffs IA soybean basis was up 15 cents from Friday. Soybean meal basis across selected US main locations was unchanged from Friday. Many dealers were already rolling

from the May to July futures. July soybeans were up 23.25 cents, July meal up $5.70 and July SBO up 211 points. The May position for SBO was up 250 points and May meal & soybeans were little stronger than July. Increasing Covid-19 cases across India may

slow vegetable oil imports over the short term as parts of the country go back into lockdown. Egypt is in for vegetable oils.

- US

corn and soybean plantings were as expected at 17 and 8 percent, respectively, but corn is lagging its respected 5-year averages by 3 points. Soybeans are running 3 points above average.

- Cargo

surveyor SGS reported month to date April 25 Malaysian palm exports at 1,116,919 tons, 102,757 tons above the same period a month ago or up 10.1%, and 157,831 tons above the same period a year ago or up 16.5%. ITS reported April 1-25 Malaysian palm exports

at 1.103 million tons, a 9 percent increase from the same period last month. AmSpec reported 1.104MMT, up 8.5%.

- Funds

on Monday bought an estimated net 16,000 soybean contracts, 5,000 soybean meal and 9,000 soybean oil. - ICE

canola futures were sharply higher today with the May topping $900. July was up $15.80 or 1.9% to $840.

- Viterra

announced they plan to build a 2.5 million ton canola crushing plant in Regina, Saskatchewan, set to open sometime in late 2024. This would be the largest canola crushing plant in the world.

- MARS

revised down the 2021 EU rapeseed yield to 3.19 tons per hectare 3.26 in March. - The

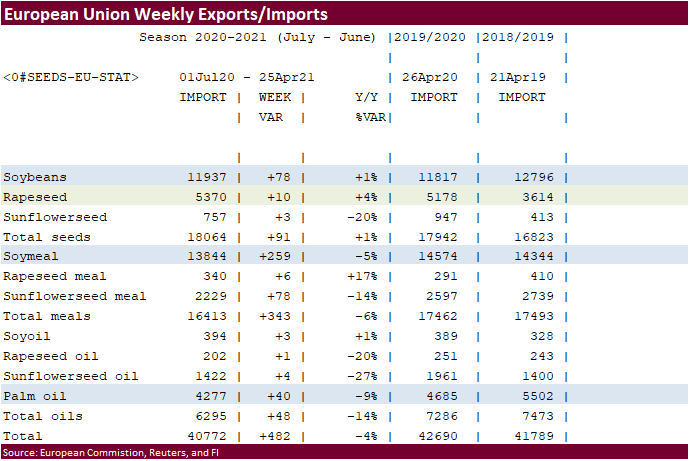

European Union reported soybean import licenses since July 1 at 11.937 million tons, above 11.817 million tons a year ago. European Union soybean meal import licenses are running at 13.844 million tons so far for 2020-21, below 14.574 million tons a year ago.

EU palm oil import licenses are running at 4.277 million tons for 2020-21, below 4.685 million tons a year ago, or down 9 percent. - European

Union rapeseed import licenses since July 1 were 5.370 million tons, above 5.178 million tons from the same period a year ago.

Top

US and Brazil soybean export prices, bottom China soybean and meal stocks at ports

- Egypt’s

GASC seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on April 28 for June 26-July 10 arrival. They are also in for local vegetable oils, 3,000 soybean oil and 1,000 sunflower oil for June26-July 15 arrival.

- The

USDA under the food export program seeks 420 tons of vegetable oils for June 1-30 shipment.

- The

USDA bought 10,610 tons of bulk crude, degummed soybean oil last Thursday on behalf of the CCC program at $1,549/ton for 8,000 tons and rest at $1,658/ton.

Updated

4/26/21

May

soybeans are seen in a $15.30-$16.10 range; July $14.75-$16.50; November $12.75-$15.00

May

soymeal is seen in a $415-$440 range; July $400-$460; December $380-$460

May

soybean oil is seen in a 63.50 and 67 cent range; July 56-70; December 48-60 cent range

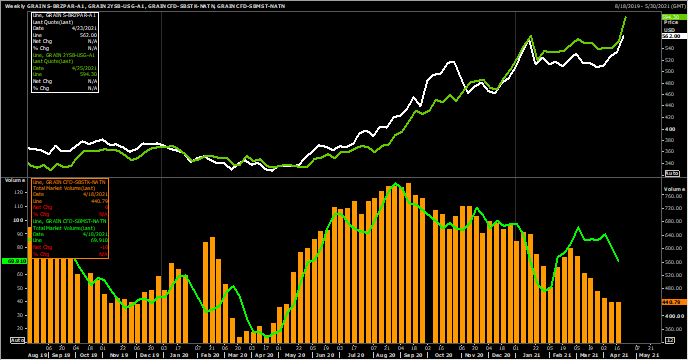

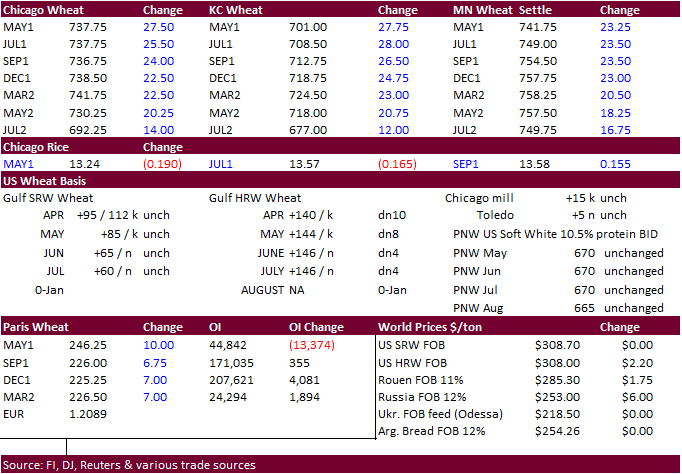

- Chicago

wheat hit its highest level since February 2013. Contracts in Chicago and KC ended nearly 30 cents higher. MN was up 18-23.50 cents. Global wheat

futures

were higher on supply concerns and US drought conditions for the western crop areas and parts of West Texas along with cold temperatures over the weekend for northern Europe. Rain this week for the southern Great Plains could stall the futures wheat rally,

but the northern Great Plains could use rain, keeping MN futures gaining over Chicago type wheat.

Egypt

and Algeria are in for wheat. - Funds

on Monday bought an estimated net 18,000 CBOT SRW wheat contracts. - US

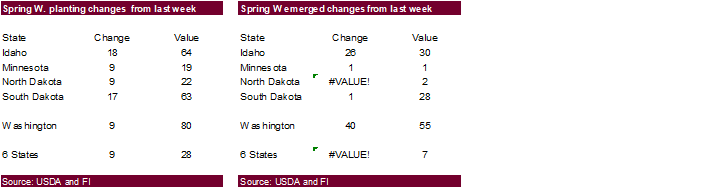

spring wheat plantings were reported at 28 percent, as expected and 9 points above average.

- US

winter wheat ratings declined a more than expected 4 points to 49 percent good/excellent, 4 points below trade expectations and below its 53 percent average.

- September

Paris wheat closed 7 euros higher at 226 euros. - China

sold 311,837 tons of wheat, or only 7.75% of the total offered, at an auction of state reserves last week.

- The

EU crop monitor MARS group lowered the average soft wheat yield for the EU crop to 5.86 tons per hectare from an initial projection of 5.89 in March, and 3 percent above a five-year average. MARS revised down the 2021 EU winter barley yield to 5.83 tons per

hectare from 5.88 previous. - The

European Union granted export licenses for 165,000 tons of soft wheat exports, bringing cumulative 2020-21 soft wheat export commitments to 21.677 MMT, well down from 29.498 million tons committed at this time last year, a 27 percent decrease. Imports are

near unchanged from year ago at 1.717 million tons.

- Algeria’s

state grains agency OAIC seeks 50,000 tons of wheat on Wednesday, April 28, with offers remaining valid up to Thursday, April 29. - Bangladesh

seeks 50,000 tons of milling wheat on May 6. - Egypt

seeks wheat for August 11-20 shipment, on April 27. - Jordan

seeks 120,000 tons of feed barley on April 28 for Oct-Nov shipment.

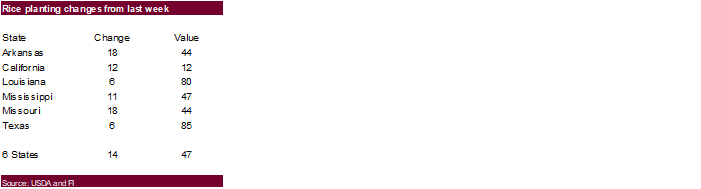

Rice/Other

·

Egypt cancelled their import tender for 100,000 tons of raw sugar cane.

·

Results awaited: Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

·

Bangladesh seeks 50,000 tons of rice on May 2.

Updated

4/26/21

May

Chicago wheat is seen in a $6.90‐$7.75 range; July $6.75-$8.00

May

KC wheat is seen in a $6.70‐$7.50 range; July $6.60-$7.50

May

MN wheat is seen in a $7.10‐$7.75 range; July $7.15-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.