PDF Attached

Private

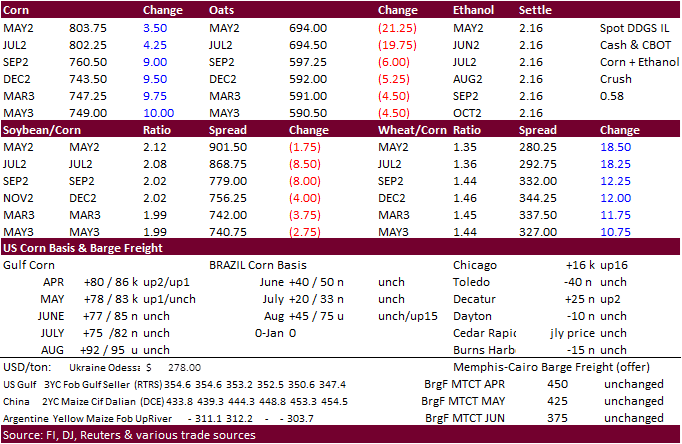

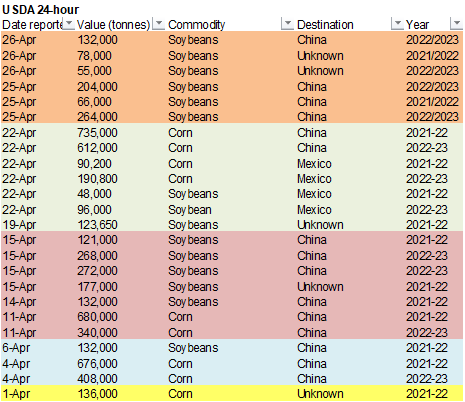

exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-133,000

metric tons of soybeans for delivery to unknown destinations. Of the total, 78,000 metric tons is for delivery during the 2021/2022 marketing year and 55,000 metric tons is for delivery during the 2022/2023 marketing year

The

USDA crop progress report initially lent support for US agriculture futures. Higher energy prices added to the firm undertone. The USD was sharply higher and US equities lower. July soybean meal was down for the 4th consecutive day. Soybeans were

mixed. July soybean oil nearly reached a contract high. July corn also trading near its contract high. Chicago and KC wheat traded higher. July MN hit a contract high. September rice also reached a contract high, in part to very slow plantings for Arkansas,

US’s largest producing state.

StatsCan

prospective plantings suggested producers are looking to expand wheat and oats plantings, and plant less canola and barley. The corn area was reported above trade expectations.

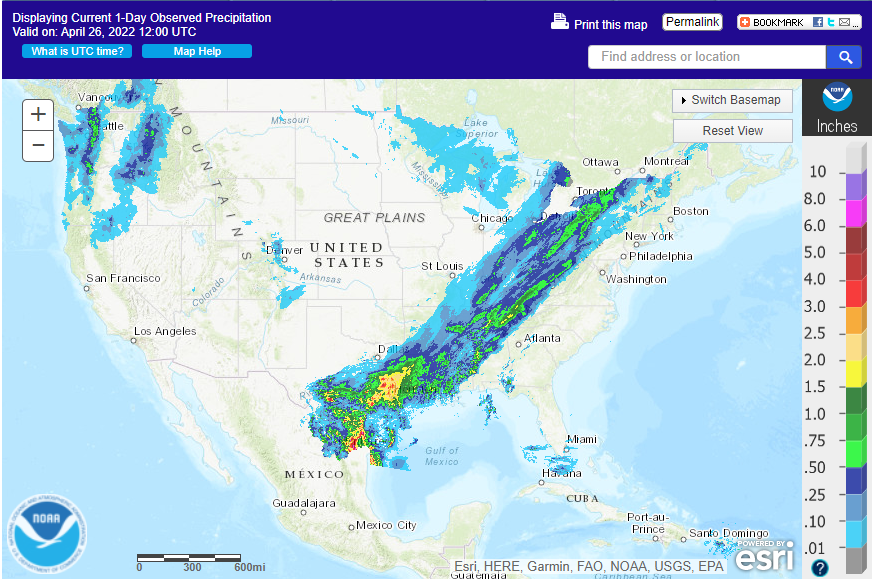

WEATHER

EVENTS AND FEATURES TO WATCH

- Frost

and freeze conditions this morning in the central Plains and western soft wheat areas of the Midwest had little to no impact on production potentials for 2022 - Temperatures

were not low enough to permanently damage any crop - Soil

moisture is still rated adequate to excessive across most of the U.S. Midwest and the northern U.S. Plains and this has delayed fieldwork so far this spring in many areas - Weather

conditions will be drier biased through the end of this week in the majority of these areas, but cool temperatures will limit drying rates and raise some worry for corn planted in cool and wet soil never performs well - That

fact and the high expense for inputs this year will likely keep farmers out of the fields for a while longer - Weather

this weekend and especially next week will be wetter biased again across the Midwest and temperatures will be mild to cool perpetuating the poor environment for fieldwork keeping progress sluggish if it advances much at all - North

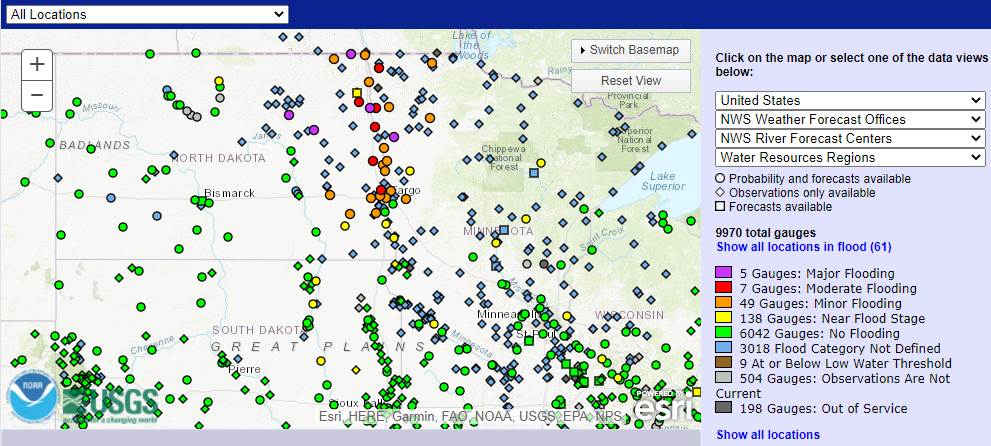

Dakota, Manitoba, northern Minnesota and a few areas in far southeastern Saskatchewan Canada are much too wet - Snow

remains on the ground in parts of this region, the soil is saturated, and some river and stream flooding is under way resulting in no opportunity for fieldwork

- Another

storm system will impact these areas Friday into the weekend with 0.50 to 1.50 inches of moisture resulting and local totals over 2.00 inches - The

additional moisture and melting snow will worsen flood conditions and ensure an extended period of delay to fieldwork - One

more storm system “may” impact the northern U.S. Plains during mid-week next week maintaining these excessively wet conditions and possibly delaying fieldwork until mid-May for some areas - Eastern

Montana, the western U.S. Dakotas, and other areas in southern South Dakota and southwestern Minnesota have a more favorable moisture profile and it the region is a little wet today it will dry down quickly between weather systems since subsoil moisture is

not excessively wet like it is farther to the north - Southwestern

U.S. hard red winter wheat areas are unlikely to get significant rainfall during the next two weeks, although a few showers will be possible - The

environment will continue to be stressful for unirrigated crops and yield potentials will remain low - Other

wheat areas in the central U.S. Plains will get some timely rainfall to support a fair crop development, but more routinely occurring rainfall is needed with temperatures in a seasonable range to support the best conditions - West

Texas cotton areas are unlikely to get more than a few sporadic showers during the next ten days to two weeks and worry over planting moisture in dryland fields will remain high - South

Texas will receive some welcome rain today that might improve dryland field conditions briefly, but more rain will be needed, and little is expected.

- Texas

Coastal Bend areas are unlikely to get much rain during the next two weeks, although a few showers are possible infrequently

- U.S.

southeastern states will experience net drying over the next two weeks - Crop

moisture stress is expected to evolve during May, but excellent planting conditions are likely until then - Lower

U.S. Delta crop areas will experience net drying conditions for a while favoring fieldwork of all kinds - U.S.

far west will continue dry from central and southern California through the southwestern desert region where cotton and other crops are grown - U.S.

Pacific Northwest precipitation will occur more routinely in the next couple of weeks which may improve dryland crop development potential in Oregon and improve the outlook for unirrigated winter wheat throughout the region from Idaho to Washington - Southwestern

Canada’s Prairies will continue too dry for ideal planting and establishment conditions; although planting is under way - Timely

rainfall is needed to support improved emergence and establishment - Manitoba,

Canada will experience the greatest delay to spring planting this season, but conditions could improve greatly with some drier and warmer weather - Ontario

and Quebec soil moisture is abundant, and some drying will be needed next month to support spring planting, but there is sufficient time for improvement - Concern

about Mato Grosso, Brazil Safrinha corn and cotton will continue over the next ten days - Some

showers are advertised in the second week of the outlook, but early indications suggest only a limited amount of moisture will occur - Crop

moisture stress will rise until that precipitation evolves and once the showers begin they may need to prevail for a while to raise soil moisture for the second half of the reproductive and filling season for cotton and corn - Western

Argentina is still drying down, but summer crops are not being harmed by the pattern - Rain

will be needed in the second half of May and June to support winter wheat and other winter crops that get planted at that time; until then, there is not much reason for concern over dryness - Waves

of rain will impact southern Paraguay, eastern Argentina, Uruguay and far southern Brazil during the next ten days maintaining wet field conditions in those areas - The

region to be impacted will include the south half of Parana and southern Paraguay into Chaco, Santa Fe and eastern Buenos Aires, Argentina

- Fieldwork

will be slowed in these areas and some crop quality concerns will arise over time - Frequent

rain from the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Europe

precipitation will occur most often from Spain, Portugal and parts of southern France into southern Belarus, central and western Ukraine and parts of western Russia over the next ten days to two weeks

No

heavy rain is expected, but enough will occur to support winter and spring crop development

- Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be near to below normal during the next ten days while the eastern CIS New Lands and Kazakhstan are warmer than usual - Parts

of Central Asia will also be quite warm - Western

Commonwealth of Independent States weather will include frequent bouts of rain, drizzle and some snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Fieldwork

will advance a little slower than usual in some areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - India

weather will remain normal for this time of year - Bouts

of rain will occur from West Bengal through Bangladesh to the far Eastern States

- Some

showers will also occur in far southern India, but they should be brief and very light

- Harvest

progress should advance well - North

Africa rainfall over the next ten days will be greatest in northern Algeria and northern Tunisia where some areas will received 2.00 to 4.00 inches of rain while others receive 0.50 to 1.50 inches - Morocco

will be driest with only a few sporadic showers - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be a little less frequent and less significant in this coming week to ten days relative to that of last week - The

nation needs net drying to support better summer crop maturation and harvest conditions - Too

much moisture in recent weeks has delayed harvesting and reduced cotton and some oilseed quality - Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- Recent

soil assessments show the Yellow River Basin and North China Plain becoming a little too dry, but much of the winter crop is irrigated and there will be some timely rainfall in the next ten days that should maintain a good outlook for winter crop and spring

crops - Planting

is advancing swiftly after recent warm and dry biased conditions - China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Central

Queensland, Australia received some heavy rainfall Monday - The

impact was low, but harvest delays resulted - The

region is a minor production area - Rain

in eastern Australia will overspread most of New South Wales in the next couple of days inducing some delay to summer crop harvesting, but bolstering soil moisture for future winter crop planting - Some

Central New South Wales locations will receive 1.00 to 2.50 inches of rain today and some additional amounts over 1.00 inch Friday

- Cotton

quality might be briefly compromised - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

northern Iran and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - A

developing tropical cyclone is expected over the southern Philippines the next few days that will evolve into a tropical storm later in the week over the South China Sea

- Some

moderate to locally heavy rainfall is likely in the central and southern Philippines over the next couple of days as the disturbance pushes through central areas - The

tropical cyclone could move across Luzon island or Taiwan early during the middle part of next week after becoming better organized in the South China Sea this weekend - Eastern

Mexico will receive rain today and Wednesday increasing soil moisture in many areas - Western

areas will be dry biased - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +17.79 and it will continue rising for a while longer.

- New

Zealand weather has been mostly good recently, but central parts of the nation have been drier than usual and precipitation in the next ten days will be very limited

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- Statistics

Canada publishes report on seeded area for wheat, barley and canola - MARS

monthly report on EU crop conditions - Geneva

Sugar Conference, day 1 - EU

weekly grain, oilseed import and export data - EARNINGS:

ADM

Wednesday,

April 27:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Geneva

Sugar Conference, day 2 - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

April 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab releases production numbers for sugar, cane and ethanol (tentative)

Friday,

April 29:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Source:

Bloomberg and FI

Full

table

US

Philadelphia Fed Non- Manufacturing Regional Business Activity Index Apr: 29.3 (prev 32.4)

US

Durable Goods Orders Mar P: 0.8% (est 1.0%; prev -2.1%; prevR -1.7%)

US

Durables Ex Transportation Mar P: 1.1% (est 0.6%; prev -0.6%; prevR -0.5%)

US

Cap Goods Orders Nondef Ex Air Mar P: 1.0% (est 0.5%; prev -0.2%; prevR -0.3%)

US

Cap Goods Ship Nondef Ex Air Mar P: 0.2% (est 0.5%; prev 0.3%; prevR 0.2%)

US

CB Consumer Confidence Apr: 107.3 (est 108.2; prev R 107.6)

–

Present Situation: 152.6 (prev R 153.8)

–

Expectations: 77.2 (prev R 76.7)

US

New Home Sales Change Mar: 763K (est 768K; prev 772K)

–

New Home Sales (M/M): -8.6% (est -0.6%; prev -2.0%)

–

Median Sale Price (USD): 436.7K or +21.4% (prev 400.6K)

84

Counterparties Take $1.819 Tln At Fed Reverse Repo Op (prev $1.784 Tln, 82 Bids)

·

July corn traded back above the psychological $8.00 level. Traders faded the nearby contracts on concerns over slowing US ethanol plant production. Slow US corn planting progress and higher outside energy markets supported the

back months. WTI crude oil was higher in part to China rolling out a plan to stimulate its economy against lockdowns.

·

Funds bought an estimated net 2,000 corn contracts.

·

StatsCan prospective plantings reported Canada corn plantings at 3.715 million acres, 300,000 above an average trade guess and up 200,000 from a year ago.

·

After unfavorable weather (hail and thunderstorms) rolled across the safrinha corn areas of western Parana and southern Mato Grosso do Sul over the weekend, Soybean and Corn Advisory warned about 1 million tons of corn could be

lost.

·

South Africa’s CEC in their second estimate for the 2021-22 corn crop season estimated production at 14.723 million tons (14.684 million tons previous), down from 16.315 million tons last season. That includes 7.553 million tons

of white corn and 7.170 million tons of yellow.

·

OPIS via a RFA newsletter warned issues with US rail traffic congestion created “major disruptions” for ethanol movement. That could force some planta to slow production ,or even take downtime.

·

A Bloomberg poll looks for weekly US ethanol production to be up 5,000 barrels to 952 thousand (938-965 range) from the previous week and stocks down 78,000 barrels to 24.264 million.

Trends

in General Inflation and Farm Input Prices

Langemeier,

M. “Trends in General Inflation and Farm Input Prices.” farmdoc daily (12):56, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 25, 2022.

https://farmdocdaily.illinois.edu/2022/04/trends-in-general-inflation-and-farm-input-prices.html

Export

developments.

·

None reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

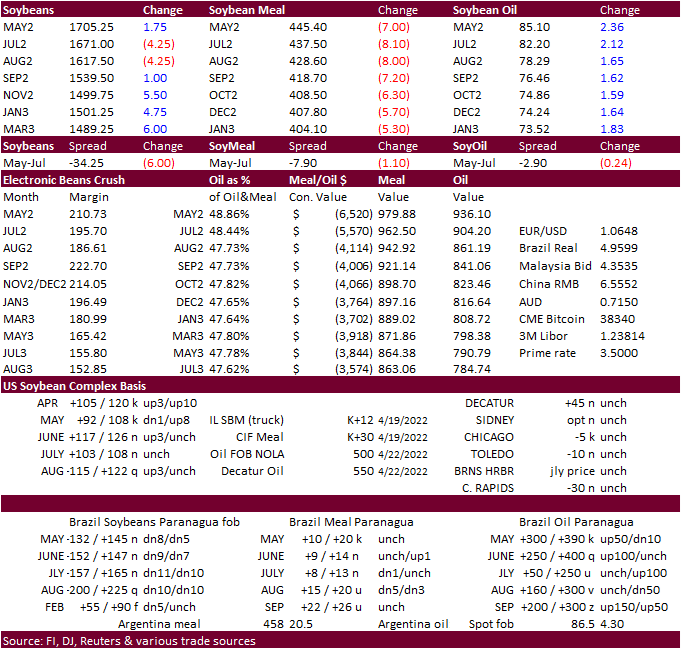

The soybean complex started higher over uncertainty from the impact of Indonesia banning RBD palm exports will have on the market. WTI crude also lent support. Soybeans settled mixed. July soybean oil traded near its contract

high, settling 236 points higher. Soybean oil/meal spreading pressured soybean meal (July down last four consecutive sessions). July meal traded $8.60 lower. Note July soybean oil share hit a record 48.65 (settled 48.44%).

·

Funds bought an estimated net 2,000 soybeans, sold 5,000 meal and bought 5,000 soybean oil.

·

StatsCan prospective plantings reported Canada soybean plantings at 5.358 million acres, 200,000 below expectations and near unchanged from 2021. Canola plantings are expected to decline 7 percent from year ago to 20.897 million

acres, 1.2 million below expectations.

·

July ICE canola rallied 27.70 today, a new contract high.

·

Indonesia late yesterday said they are willing to widen their ban on cooking oil exports. Current measures apply to refined palm olein. Then earlier today a senior minister said Indonesia will ban exports of RBD palm olein from

midnight on April 28 until prices of bulk cooking oil drop to 14,000 rupiah per liter. Domestic shortages of selected refined palm olein have sent prices higher. RBD accounts for 40 percent of Indonesia’s total shipments of palm oil products, according to

Reuters. China, India, the Philippines and South Korea, source between 46% and 58% of their total palm oil imports from Indonesia. The ban might be short lived, IMO. On Reuters story cited an industry participant that thinks it will not last more than a month.

·

There has already been a large backlash at the export ban. Bangladesh will lower its import taxes on canola, sunflower oil and olive oil to 10% from 32% following the global supply shortages of vegetable oils. The Malaysian Palm

Oil Board (MPOB) recommended Malaysia should slow biodiesel production to ensure supply for use in food.

·

India May palm oil imports are still on track to exceed 600,000 tons despite the Indonesia ban but look for June imports to drop below that amount.

·

Cargo surveyor SGS reported month to date April 25 Malaysian palm exports at 897,683 tons, 133,260 tons below the same period a month ago or down 12.9%, and 219,236 tons below the same period a year ago or down 19.6%.

·

Malaysian palm oil finished 178 points higher (2.7%), and cash was unchanged at $1,590/ton.

·

The European Union’s crop monitoring service MARS lowered its estimate for the EU’s rapeseed yield in 2022, to 3.19 t/ha from an initial forecast of 3.22 t/ha in March, near unchanged from last year.

·

August Paris rapeseed was up 2.6% or 22.50 euros to 882.50 euros.

·

Anec: Brazil April soybean exports 12.09 million tons, up from 11.98 million tons previously.

USDA

Attaché: Argentina Oilseeds and Products Annual

·

Private exporters reported the following activity:

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

-133,000

metric tons of soybeans for delivery to unknown destinations. Of the total, 78,000 metric tons is for delivery during the 2021/2022 marketing year and 55,000 metric tons is for delivery during the 2022/2023 marketing year

·

Egypt’s GASC seeks vegetable oils for June and/or July arrival on Thursday, April 28. A minimum of 30,000 tons of soybean oil and 10,000 tons of sunflower oil, in the international market, is for arrival between June 10 and 30.

Locally they seek 3,000 tons of soybean oil and 2,000 tons of sunflower oil with delivery from June 10 to 30.

·

Turkey seeks 18,000 tons of sunflower oil on April 28 for shipment between May 16 and June 16.

·

China looks to auction off another 500,000 tons of soybeans April 29.

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

·

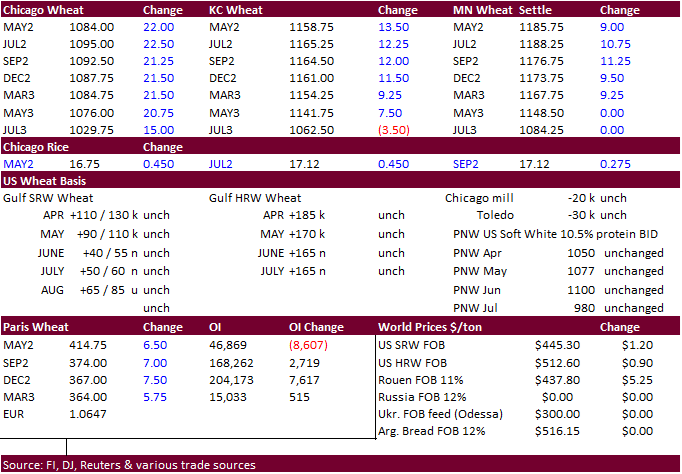

US wheat ended

higher after USDA surprised the trade with a 3 point decline in US winter wheat ratings. Fund buying in Chicago lifted that market over KC and MN. Yesterday, on our weighted basis, SRW type wheat conditions declined from the previous week while HRW improved.

·

Funds bought an estimated net 10,000 SRW wheat contracts.

·

Canada looks for high protein wheat acres to expand a good amount from 2021.

·

StatsCan prospective plantings reported Canada all-wheat acres at 25.031 million acres, 900,000 above an average trade guess and 7.2% above the previous year. The durum crop was expected to expand 12.5% from 2021. Spring wheat

was projected to expand 7 percent.

·

September EU wheat futures were 7.00 euros higher at 374.00 euros.

·

The European Union’s crop monitoring service MARS lowered its forecast of the EU’s average soft wheat yield this year to 5.95 tons per hectare (t/ha), down from 6.02 t/ha projected last month, and 1.5% below the 2021 level.

·

EU soft wheat exports so far for the 2021-22 season reached 21.61 million tons by April 24, compared with 22.41 million tons by the same week in 2020-21.

·

Ukraine has sent via rail about 80,000 tons of grain to Romania’s Black Sea port of Constanta since the start of the Ukraine/Russia situation.

·

See rice section regarding US plantings.

USDA

Attaché: Argentina Grain and Feed Annual

USDA

Attaché: Australia Grain and Feed Annual

·

Today Algeria is in for 50,000 tons of wheat for second half of May and June shipment.

·

Turkey seeks 210,000 tons of international red milling wheat on Friday and another 210,000 tons of wheat already in warehouses for delivery between May 17 and August 10.

·

Jordan passed on 120,000 tons of feed barley for Aug and/or Sep shipment.

·

Jordan seeks 120,000 tons of wheat. on April 27 for Jun and/or Aug shipment.

Rice/Other

·

September rice futures hit a contract high. US rice planting progress is running well below average. As of Sunday, it was reported at 26 percent complete compared to 47 percent average. Every day rice does not get planted; we

think acres could be lost. Arkansas, US’s largest rice producing state (49 percent of US total planted acres), was only 14 percent complete compared to 48 percent average.

Updated

4/22/22

Chicago – July $10.50 to

$12.50 range, December $8.50-$12.50

KC – July $10.25 to $12.50

range, December $8.75-$13.50

MN – July $10.75‐$13.00,

December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.