PDF Attached

Indonesia

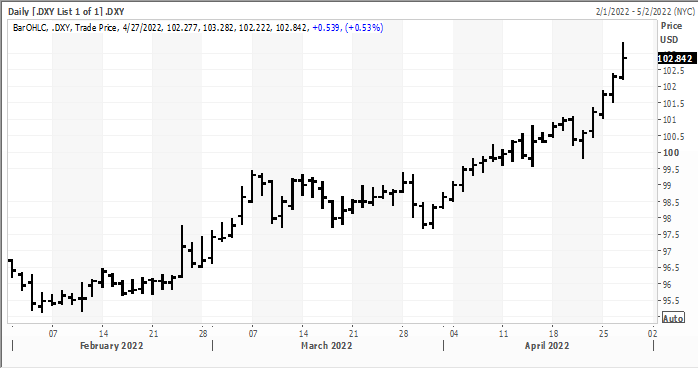

reversed their decision again, widening their ban on selected palm oil products. USD rallied. CBOT soybean complex ended higher. Corn reversed to settle higher and wheat was lower in the front months for Chicago wheat, lower for KC and higher for MN. South

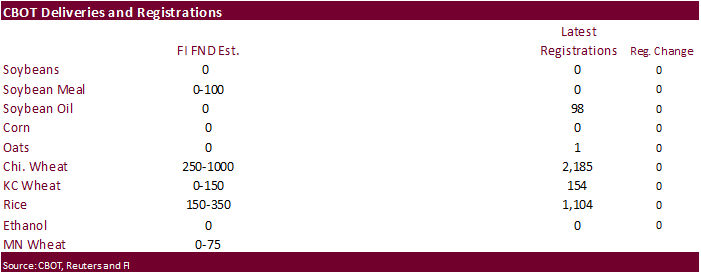

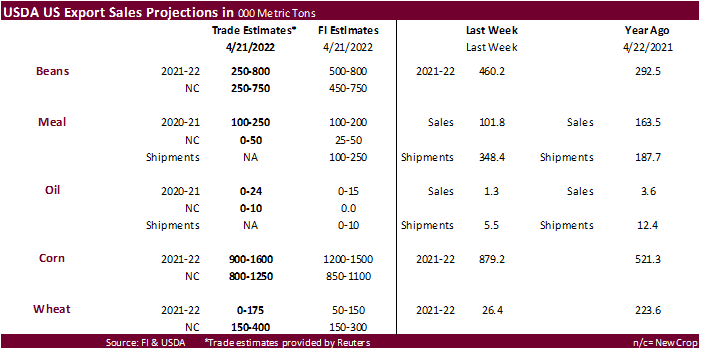

Korea bought a combined 119,000 tons of soybean meal, SA and optional origin for September arrival. On Thursday Egypt and Turkey are in for vegetable oils. Algeria bought durum wheat. USDA export sales are due out Thursday morning and traders are looking for

a slowdown in commitments.

![]()

USD

as of 1:14 pm CT

Source:

Reuters and FI

WEATHER

EVENTS AND FEATURES TO WATCH

- Spring

planting delays will remain the greatest issue of the day today in the U.S. northern Plains and Midwest with some disruption possible in parts of the Delta and southeastern states as well - Moisture

that falls in the lower Delta and southeastern states will be good for developing crops especially since precipitation in those areas is expected to be infrequent, brief and light - Southwestern

U.S. Plains will get some rain this weekend offering a little reprieve from dryness - Moisture

totals of 0.25 to 0.75 inch and local totals over 1.00 inch will be possible in the Texas Panhandle, western Oklahoma and southern Kansas while some greater rain occurs in central Oklahoma - Some

follow up precipitation may occur briefly next week - The

bottom line will be some short-term crop improvement for winter wheat, oats and canola produced in the region - West

Texas cotton, corn, sorghum and peanut country will only see precipitation in the Low Plains and Rolling Plains in this coming week - Southwestern

dryland areas will not likely get significant precipitation - Showers

and thunderstorms will be most likely from the Abilene and Wichita Falls, Texas region into the Texas Panhandle and western Oklahoma clipping only a few of the northeastern most counties of West Texas proper - Western

Oklahoma and the Rolling Plains of Texas should be wettest - South

Texas showers and thunderstorms Tuesday and early this morning produced highly varying amounts of rain with some heavy amounts near the Rio Grande and from the southern Blacklands to the upper Texas Coast where Doppler Radar suggested rainfall of 1.00 to more

than 3.00 inches resulted - The

Texas Coastal Bend area, through reported less than 0.20 inch. - Very

little follow up precipitation is expected for a while - U.S.

southeastern states will receive below normal precipitation during the next two weeks especially in southern Georgia, Florida, South Carolina and southeastern Alabama - U.S.

Midwest rainfall will become frequent this weekend and last for about ten days resulting in a lengthy period of restricted field progress - Temperatures

will be cooler than usual keeping drying rates between rain events slow - Frequent

precipitation in the northern U.S. Plains will perpetuate flood conditions in North Dakota and neighboring areas of Manitoba, Canada - Additional

moisture in Montana and the western Dakotas will be great for use during the spring growing season, but some delay in fieldwork is likely until then - Precipitation

in the U.S. Pacific Northwest will be a little more restricted over the next ten days, but mountainous areas will get moisture while the Yakima and Colombia River Basins see more limited precipitation potential - U.S.

far west will continue dry from central and southern California through the southwestern desert region where cotton and other crops are grown - Southwestern

Canada’s Prairies will continue to see restricted rainfall over the next ten days maintaining concern over crop development and production potentials this year - Relief

from dryness is still expected late this spring and into the summer - Ontario

and Quebec, Canada will see a frequent occurrence of precipitation that should support planting and early season crop development from the middle of May through June - Concern

about Mato Grosso, Brazil Safrinha corn and cotton will continue over the next ten days - Some

showers are advertised early next week, but early indications suggest rainfall of 0.20 to 0.75 inch with a few local totals to 1.00 inch - Crop

moisture stress will rise until that precipitation evolves and once the showers begin, they may prove to be a little too light for a serious change in crop or field conditions - Drier

weather will resume during the second half of next week limiting the amount of benefit that will come

- Western

Argentina is still drying down, but summer crops are not being harmed by the pattern - Rain

will be needed in the second half of May and June to support winter wheat and other winter crops that get planted at that time; until then, there is not much reason for concern over dryness - Waves

of rain will impact southern Paraguay, eastern Argentina, Uruguay and far southern Brazil during the next ten days maintaining wet field conditions in those areas - The

region to be impacted will include the south half of Parana and southern Paraguay into Chaco, Santa Fe and eastern Buenos Aires, Argentina

- Fieldwork

will be slowed in these areas and some crop quality concerns will arise over time - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Europe

precipitation will occur most often from Spain, Portugal and parts of southern France into southern Belarus, central and western Ukraine and parts of western Russia over the next ten days to two weeks

No

heavy rain is expected, but enough will fall to support winter and spring crop development

- Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be near to below normal during the next ten days while the eastern CIS New Lands and Kazakhstan are warmer than usual - Parts

of Central Asia will also be quite warm - Western

Commonwealth of Independent States weather will include frequent bouts of rain, drizzle and some snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Fieldwork

will advance a little slower than usual in some areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - India

weather will remain normal for this time of year - Bouts

of rain will occur from West Bengal through Bangladesh to the far Eastern States

- Some

showers will also occur in far southern India, but they should be brief and very light

- Harvest

progress should advance well - North

Africa rainfall over the next ten days will be greatest in northern Algeria and northern Tunisia where some areas will receive 1.00 to 3.00 inches while others receive 0.25 to 0.75 inches - Morocco

and Tunisia will be driest with only a few sporadic showers - North

central Algeria will be wettest - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be a little less frequent and less significant in this coming week to ten days relative to that of last week - The

nation needs net drying to support better summer crop maturation and harvest conditions - Too

much moisture in recent weeks has delayed harvesting and reduced cotton and some oilseed quality - Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - A

brief bout of rain is expected in the coming week to offer a short-term break from the recent drying trend, but more rain will be needed

- Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- Recent

soil assessments show the Yellow River Basin and North China Plain becoming a little too dry, but much of the winter crop is irrigated and there will be some timely rainfall in the next ten days that should maintain a good outlook for winter crop and spring

crops - Planting

is advancing swiftly after recent warm and dry biased conditions - China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Australia

rainfall Tuesday was greatest in northern New south Wales where 0.60 to 1.30 inches resulted through dawn today - The

impact was low, but harvest delays resulted - Rain

in eastern Australia will linger in New South Wales today, but Thursday will be dry before another bout of moisture arrives Friday into the weekend.

- The

moisture will be good for future wheat, barley and canola planting this autumn while not quite so welcome in summer crop areas where harvest progress is under way - Some

Central New South Wales locations will receive 1.00 to 2.50 inches of rain between today’s rain event and that of this weekend

- Cotton

quality might be briefly compromised - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

Iran and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - A

developing tropical cyclone is expected over the southern Philippines the next few days that will evolve into a tropical storm later in the week over the South China Sea

- Some

moderate to locally heavy rainfall is likely in the central and southern Philippines over the next couple of days as the disturbance pushes through central areas - The

tropical cyclone could move across Luzon island or Taiwan early during the middle part of next week after becoming better organized in the South China Sea this weekend - Confidence

is low - Eastern

Mexico will receive sporadic showers over the coming week - Western

areas will be dry biased - Recent

rain in the east has improved soil moisture to some crop areas - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +18.61 and it will continue rising for a while longer.

- New

Zealand weather has been mostly good recently, but central parts of the nation have been drier than usual and precipitation in the next ten days will be very limited

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Geneva

Sugar Conference, day 2 - EARNINGS:

Bunge, Pilgrim’s Pride

Thursday,

April 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab releases production numbers for sugar, cane and ethanol (tentative)

Friday,

April 29:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Source:

Bloomberg and FI

US

Wholesale Inventories (M/M) Mar P: 2.3% (est 1.5%; prev 2.5%)

US

Advance Goods Trade Balance Mar: -$125.3Bln (est -$105.0Bln; prev -$106.6Bln; prevR -$106.3Bln)

US

Retail Inventories (M/M) Mar: 2.0% (est 1.4%; prev 1.1%)

US

DoE Crude Oil Inventories (W/W) 22-Apr: +691K (est 0K; prev -8020K)

–

Distillate Inventories: -1449K (est -1000K; prev -2664K)

–

Cushing OK Crude Inventories: +1298K (prev -185K)

–

Gasoline Inventories: -1573K (est 1000K; prev -761K)

–

Refinery Utilization: -0.70% (est 0.00%; prev 1.00%)

EIA:

US Distillate Inventories Fell To Lowest Since May 2008 In Latest Week

84

Counterparties Take $1.803 Tln At Fed Reverse Repo Op (prev $1.819 Tln, 84 Bids)

·

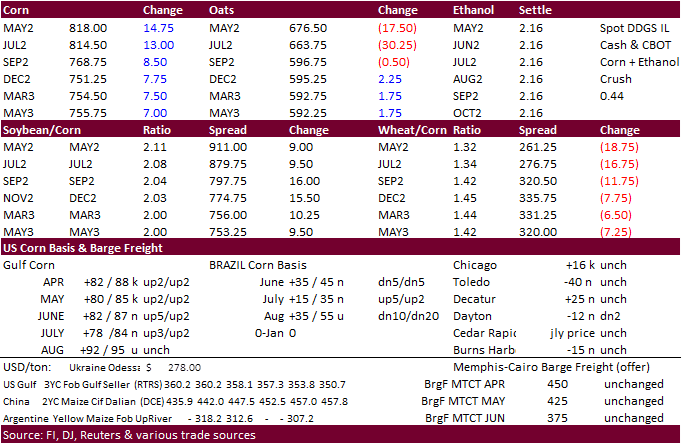

July corn traded in a wide two-sided range, ending on a strong note led by nearby contracts. Funds bought an estimated net 9,000 contracts. The rally in the USD initially pressured corn but that fizzled away after wheat started

to pair losses and soybeans rallied.

·

News was light and global corn export developments are slowing.

·

Argentina producers sold 880,000 tons of corn for the week ending April 20, bringing 2021-22 sales to 22.6 million tons, near the same about at this time last year.

·

China plans to buy another 40,000 tons of pork for state reserves on April 29, sixth such purchase this year.

·

The USDA Broiler Report showed eggs set in the US up slightly and chicks placed up slightly from a year ago. Cumulative placements from the week ending January 8, 2022, through April 23, 2022 for the United States were 2.98 billion.

Cumulative placements were down slightly from the same period a year earlier.

·

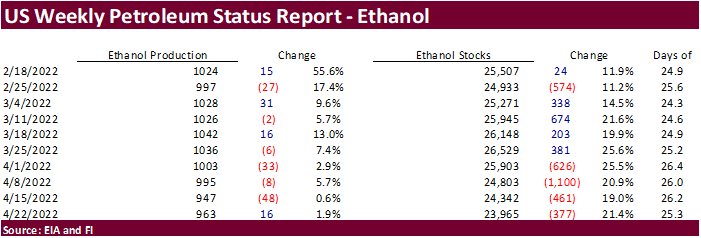

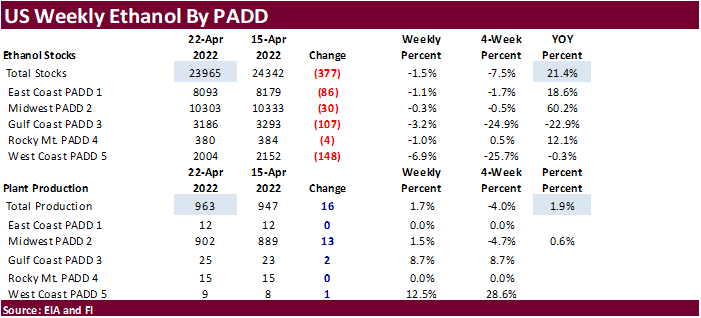

We lowered our 2021-22 US corn for ethanol use from 5.400 billion bushels to 5.380 billion, 5 million above USDA.

Iowa

lawmakers OK bill mandating sale of E15 at gas stations

https://apnews.com/article/business-iowa-kim-reynolds-cc6bd64ce6e80a2b9e55d85066b92c6d

Potential

Disruptions in Nitrogen Fertilizer Trade

Schnitkey,

G., C. Zulauf, K. Swanson, N. Paulson and J. Baltz. “Potential Disruptions in Nitrogen Fertilizer Trade.”

farmdoc

daily

(12):57, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 26, 2022.

https://farmdocdaily.illinois.edu/2022/04/potential-disruptions-in-nitrogen-fertilizer-trade.html

Export

developments.

·

None reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

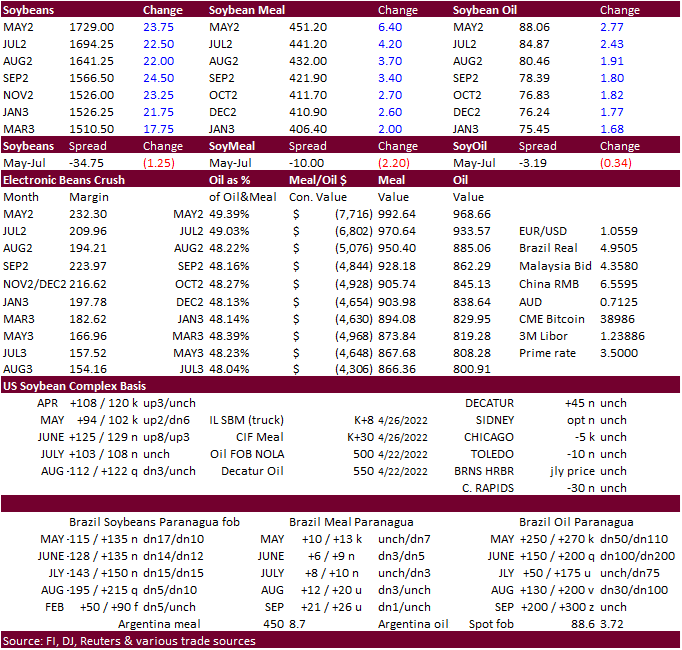

Soybean oil traded sharply higher on Indonesia palm oil export ban concerns and a large rally in the palm oil market. Malaysian palm oil hit a 7-week high. July CBOT oil share hit a record contract high, settling near 49.03%.

Soybeans and meal settled higher after seeing a two-sided trade. The Indonesia palm oil export ban starts Thursday. Today Indonesia widened their list of products, including crude palm oil, to the export ban. Selected RBD and cooking oils were already considered.

·

Funds bought an estimated net 11,000 soybeans, 4,000 soybean meal and 9,000 soybean oil.

·

July soybean meal tested its 100-day MA and bounced off of it, then rallied to trade higher. Much of this was technical buying after CBOT soybean meal futures prices broke earlier this week. Adding to the positive undertone was

South Korea taking advantage of the price drop by buying a combined 119,000 tons of soybean meal, at about $20/ton cheaper than what NOFI paid earlier this week.

·

The CBOT nearby crush firmed with the rally in soybean oil, with July up 14 cents to $2.1050.

·

(Reuters) – Indonesia’s planned export ban on cooking oil’s raw material will cover crude palm oil, refined palm oil and used cooking oil, among other palm oil products, its chief economic minister said on Wednesday. The announcement

was a reversal of the minister’s statement a day earlier, in which he had said the export ban would only cover refined, bleached, and deodorized palm olein. The ban comes into force at midnight (1700 GMT Wednesday).

·

Argentina producers sold 13.6 million tons so far for the 2021-22 crop-year, compared to 15.5 million tons year earlier.

·

Malaysia is on holiday May 2-4, returning May 5.

·

South Korean groups FLC and MFG bought 59,000 tons and 60,000 tons of soybean meal, respectively, at $571.95/ton C&F and $569.30/ton, for September arrival. Earlier this week NOFI paid $591.80.

·

Egypt’s GASC seeks vegetable oils for June and/or July arrival on Thursday, April 28. A minimum of 30,000 tons of soybean oil and 10,000 tons of sunflower oil, in the international market, is for arrival between June 10 and 30.

Locally they seek 3,000 tons of soybean oil and 2,000 tons of sunflower oil with delivery from June 10 to 30.

·

Turkey seeks 18,000 tons of sunflower oil on April 28 for shipment between May 16 and June 16.

·

China looks to auction off another 500,000 tons of soybeans April 29.

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

·

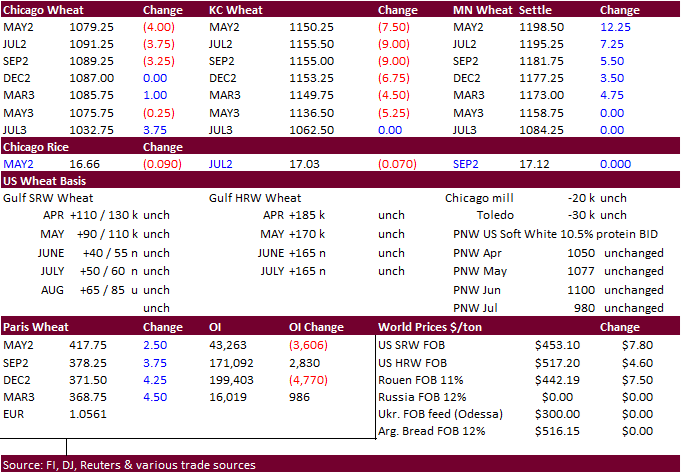

US wheat traded

two-sided, ending lower in the nearby contracts for Chicago, lower for KC, and higher for Minneapolis. The USD was up again, by 63 points by 1:25 pm CT. Chicago and KC were under pressure from profit taking and technical selling. MN found strength on slow

seeding progress for US and Canadian spring wheat and Algeria picking up at least 230,000 tons of durum wheat. Taiwan passed on feed wheat. A weaker euro supported Paris wheat futures.

·

Funds sold an estimated net 2,000 soft red winter wheat contracts.

·

September EU wheat futures were 3.75 euros higher at 378.25 euros.

·

Russia announced they are ready to increase wheat shipments to Africa.

·

Algeria bought at least 230,000 tons of Mexican durum wheat for second half of May and June shipment at around $570 a ton c&f for shipment in large panama bulk carriers and about $590 a ton for shipment in smaller handysized vessels.

·

Thailand passed on feed wheat for June-October shipment. Lowest offer was around $380/ton c&f.

·

Jordan passed on 120,000 tons of wheat for Jun and/or Aug shipment.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Turkey seeks 210,000 tons of international red milling wheat on Friday and another 210,000 tons of wheat already in warehouses for delivery between May 17 and August 10.

Rice/Other

·

None reported

Updated

4/22/22

Chicago – July $10.50 to

$12.50 range, December $8.50-$12.50

KC – July $10.25 to $12.50

range, December $8.75-$13.50

MN – July $10.75‐$13.00,

December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.