PDF Attached

Funds were not available at the time this was sent

Private

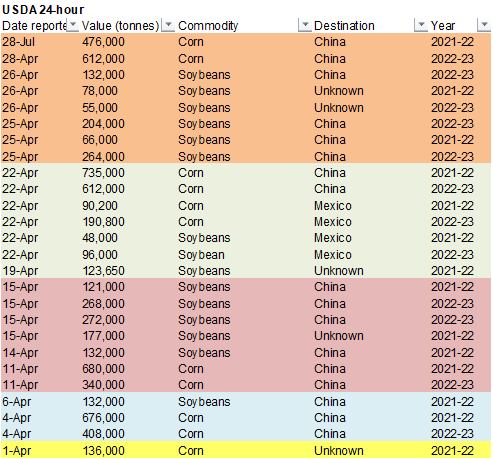

exporters reported sales of 1,088,000 metric tons of corn for delivery to China. Of the total, 476,000 metric tons is for delivery during the 2021/2022 marketing year and 612,000 metric tons is for delivery during the 2022/2023 marketing year.

The

Midwest will remain wet over the next week. The southwestern Plains winter wheat areas will continue to see drought conditions. Flooding across the far northern Great Plains remains an issue this spring as heavy rains are forecast for north Dakota this weekend.

On a positive note, beneficial rains will fall across Nebraska and South Dakota.

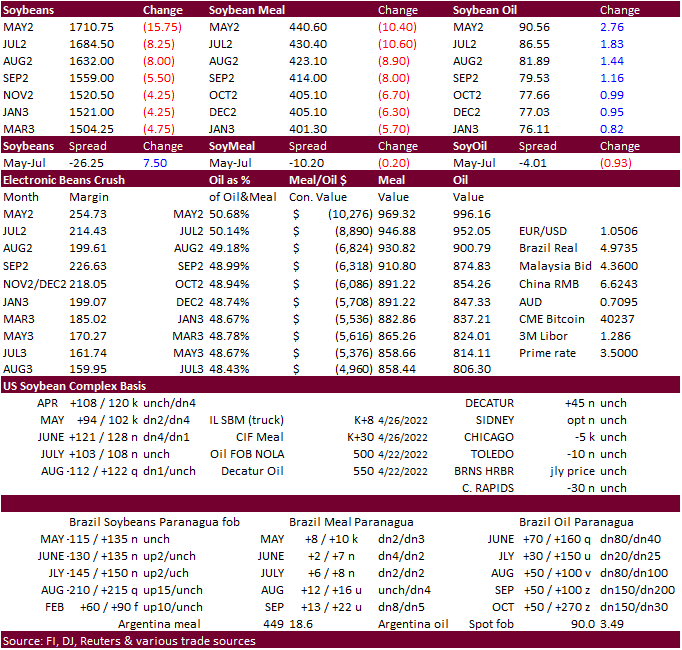

July

SBO

Source:

Reuters and FI

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- India’s

hot weather peaked out setting a few record highs Wednesday - The

heat pushed temperatures up to 115 degrees Fahrenheit - Winter

crops were already maturing and being harvested leaving little new damage - Winter

crop yields have come downward because of late February and March heat and dryness - More

recent weeks of the same weather have had a more minor influence on the bottom line - Livestock

stress has been high due to excessive heat and farming activity may have slowed due to some of the heat - U.S.

southwestern Plains weather changes advertised overnight made sense - The

GFS model run backed off of its excessive rain event in the southwestern Plains – this was a necessary change - The

model is still predicting scattered showers and thunderstorms in the region - The

ECMWF model increased its rainfall coverage in West Texas for Saturday night into Monday - This

change was also needed as the previous European model run was too dry - U.S.

hard red winter wheat areas will get scattered showers and thunderstorms more often in the next ten days supporting better reproductive conditions

- Crop

stress last autumn and winter will see to it that a full recovery in production does not occur, but the coming moisture will help improve yields in at least portions of the production region - Drier

and hotter weather will evolve later in May - West

Texas showers and thunderstorms expected late this weekend will bring some welcome moisture to a few corn, sorghum, cotton, peanut and wheat production areas - The

precipitation will be quite erratic with locally heavy rain possible, but most areas will not likely get enough rain to seriously change the moisture profile - Showers

will continue to come and go into the first half of May and that will offer some temporary improvements to topsoil moisture - Periods

of warm temperature and wind will make it very difficult for a lasting boost in soil moisture to take place - The

second half of May should turn drier and warmer as ridge building takes place - U.S.

Midwest weather will become wet this weekend through the end of next week and possible a few days longer - The

precipitation will slow or stall spring planting and there is still potential for the pattern to last deeper into May

- Temperatures

should be a little warmer in the second and third weeks of the forecast helping to stimulate better drying between rain events, but the situation will still not be ideal - U.S

Delta and southeastern states will also get periodic rainfall during the next ten days supporting early season crop development and only briefly disrupting fieldwork - The

northern Delta will be much wetter than the lower Delta and field working delays in the north will last longer and those in the south - Southern

Georgia, parts of Florida, southeastern Alabama and portions of South Carolina will be driest and yet will receive at least some precipitation periodically - South

Texas and the Texas Coastal Bend precipitation over the next ten days will continue restricted with less than 0.60 inch of total moisture expected - The

region has been too dry this spring and some dryland crops have failed to develop normally and may be written off by insurance companies - Drier

and warmer weather has been suggested for Canada’s Prairies in the first half of May - For

southern Manitoba and the snow covered areas in the eastern and far northern Prairies this is good news - Snow

cover will melt and with limited precipitation expected there will flooding in southern Manitoba will not get worse

- For

the drought stricken areas of the southwestern Prairies, Canada is facing some grave concerns about future crop development because of the anticipated dry and warmer biased weather in the first half of May - Some

early planted crops in marginally adequate moisture may become too dry for germination and more likely too dry to sustain development after emergence which could lead to withering if there is no significant precipitation in the second half of May. Early season

planting will advance quickly in the drier and warmer environment for areas with favorable soil moisture - Market

and farmer concerns about dryness in Alberta and western Saskatchewan will likely rise during the first half of May because of little to no rain and warmer temperatures - Quebec

and Ontario, Canada weather outlook in early May will be appealing for early season crop development and planting, although the region is likely to be a little too wet initially.

- Northern

U.S. Plains will stay wet from the Dakotas into Minnesota during the coming week to ten days further delaying fieldwork in some areas and raising the potential for flooding in other areas - Concern

about Mato Grosso, Brazil Safrinha corn and cotton will continue over the next ten days - Some

showers are advertised during mid-week next week, but early indications suggest rainfall will be mostly too light for a lasting impact on soil o crop conditions - Crop

moisture stress will rise until that precipitation evolves and once the showers begin they may prove to be a little too light for a serious change in crop or field conditions - Drier

weather will resume late next week limiting the amount of benefit that will come

- A

few other showers may occur near mid-month - Western

Argentina is still drying down, but summer crops are not being harmed by the pattern - Rain

will be needed in the second half of May and June to support winter wheat and other winter crops that get planted at that time; until then, there is not much reason for concern over dryness - Waves

of rain will impact southern Paraguay, eastern Argentina, Uruguay and far southern Brazil during the next ten days maintaining wet field conditions in those areas - The

region to be impacted will include the south half of Parana and southern Paraguay into Chaco, Santa Fe and eastern Buenos Aires, Argentina

- Fieldwork

will be slowed in these areas and some crop quality concerns will arise over time - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Europe

precipitation will occur most often from Spain, Portugal and parts of southern France into southern Belarus, central and western Ukraine and parts of western Russia over the next ten days to two weeks

No

heavy rain is expected, but enough will fall to support winter and spring crop development

- Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be near to below normal during the next ten days while the eastern CIS New Lands and Kazakhstan are warmer than usual - Parts

of Central Asia will also be quite warm - Western

Commonwealth of Independent States weather will include periodic bouts of rain, drizzle and some snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Net

drying is possible in the eastern Russia New Lands and in northern Kazakhstan for a while - Fieldwork

will advance a little slower than usual in some western areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - India

weather will remain hot with below average precipitation in the south - Bouts

of rain will occur from West Bengal through Bangladesh to the far Eastern States

- Some

showers will also occur in far southern India, but they should be brief and very light

- Temperatures

will remain hot - Harvest

progress should advance well - North

Africa rainfall over the next ten days will be greatest in north-central Algeria where some areas will receive 1.00 to 3.00 inches and local totals to 5.00 inches while others receive 0.20 to 0.75 inch - Morocco

and interior Tunisia will be driest with only a few sporadic showers - North

central Algeria will be wettest - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be infrequent and light over this coming week to ten days relative to that of last week - The

nation needs net drying to support better summer crop maturation and harvest conditions - Too

much moisture in recent weeks has delayed harvesting and reduced cotton and some oilseed quality, but the situation is improving

- Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Some

much needed rain fell in western portions of the Yellow River Basin Wednesday offering some relief to dryness recently - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Australia

rainfall Wednesday was greatest in central and eastern New South Wales where 0.15 to 0.60 inch resulted with local totals of 1.00 to 2.00 inches along the front range of the Great Dividing Range

- The

impact was low, but harvest delays resulted - Rain

in eastern Australia will return Friday into the weekend after dry weather occurs today

- The

moisture will be good for future wheat, barley and canola planting this autumn while not quite so welcome in summer crop areas where harvest progress is under way - Some

Central New South Wales locations will receive 0.50 to 1.50 inches of rain Friday into Saturday - Cotton

quality might be briefly compromised - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Southern

portions of Russia’s Southern Region will get some needed rain varying from 1.00 to 2.00 inches in the next five or six days - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

Iran, Turkmenistan and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - The

developing tropical cyclone in the South China Sea has been removed from today’s forecast

- There

is no longer a concern over flooding rain in the northern Philippines or Taiwan for next week

- Eastern

Mexico will receive sporadic showers over the coming week - Western

areas will be dry biased - Recent

rain in the east has improved soil moisture to some crop areas - Central

America precipitation will slowly expand northward in the next few weeks - the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +19.51 and it will continue rising for a while longer.

- New

Zealand weather has been mostly good recently, but central parts of the nation have been drier than usual and precipitation in the next ten days will be limited

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Brazil’s

Conab releases production numbers for sugar, cane and ethanol (tentative)

Friday,

April 29:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Source:

Bloomberg and FI

USDA

Export Sales

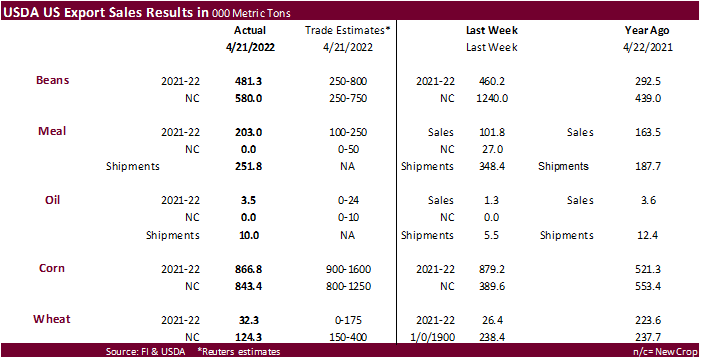

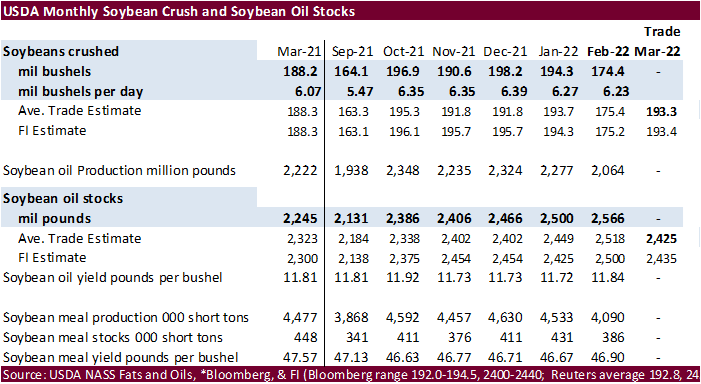

USDA

export sales were within expectations for the soybean complex, corn and wheat. Grains and soybean oil did come in near the lower end of a range of estimates. 2021-22 corn sales included 729,200 tons for China and 2022-23 sales included 612,000 tons for China.

For soybeans, 2021-22 China sales were 164,100 tons (including 121,000 MT switched from unknown destinations and decreases of 33,300 MT), and 2022-23 China sales were 580,000 tons. Sorghum sales were only 12,500 tons and pork sales were good at 31,500 tons.

US

Initial Jobless Claims Apr 23: 180K (est 180K; prev 184K)

US

Continuing Claims Apr 16: 1408K (est 1399K; prev 1417K)

US

GDP Annualized (Q/Q) Q1 A: -1.4% (est 1.0%; prev 6.9%)

US

Personal Consumption Q1 A: 2.7% (est 3.5%; prev 2.5%)

US

GDP Price Index Q1 A: 8.0% (est 7.2%; prev 7.1%)

US

Core PCE (Q/Q) Q1 A: 5.2% (est 5.5%; prev 5.0%)

Canadian

SEPH Payroll Employment Change Feb: 142.9K (prev 5.5K)

83

Counterparties Take $1.818 Tln At Fed Reverse Repo Op (prev $1.803 Tln, 82 Bids)

·

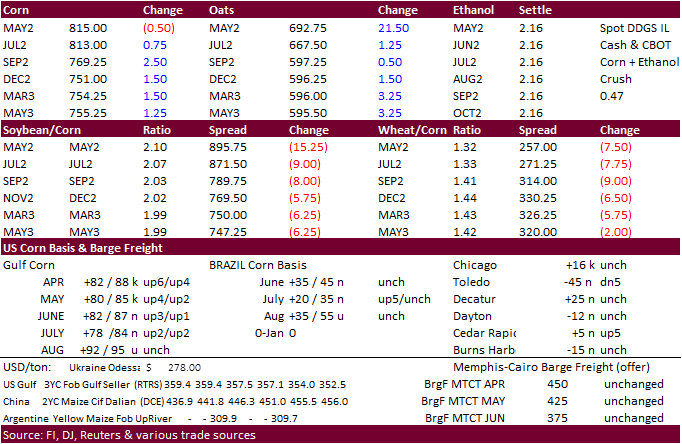

July corn hit a fresh contract high during the session. The market traded two-sided, in part to another rally in the USD. This is the sixth consecutive session the USD has been higher. Corn futures found some support from the

flash USDA sale to China and increasing concerns over slow US plantings.

·

Parts of Brazil are dry and that is raising concern of yield declines, especially for Mato Grosso. April rainfall for that state for the month of April is on track to end up 70 percent below a 10-year average.

·

China plans to buy another 40,000 tons of pork for state reserves on April 29, sixth such purchase this year.

Export

developments.

·

USDA: Private exporters reported sales of 1,088,000 metric tons of corn for delivery to China. Of the total, 476,000 metric tons is for delivery during the 2021/2022 marketing year and 612,000 metric tons is for delivery during

the 2022/2023 marketing year.

Updated

4/22/22

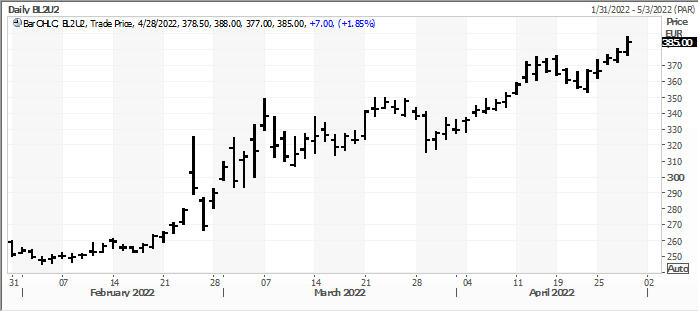

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

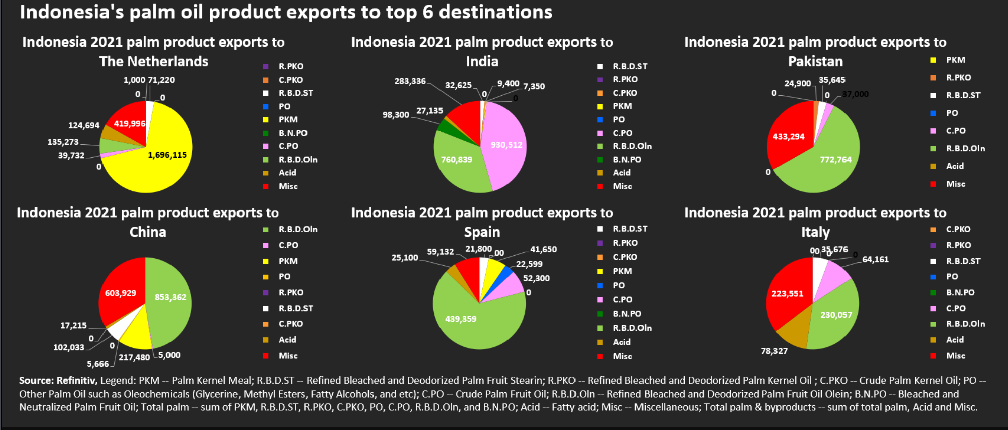

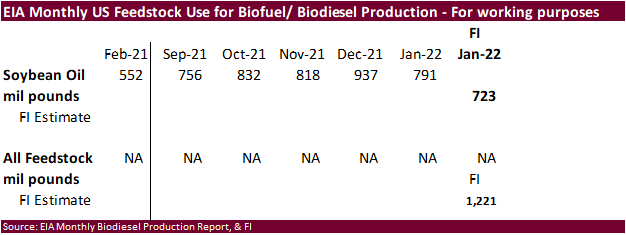

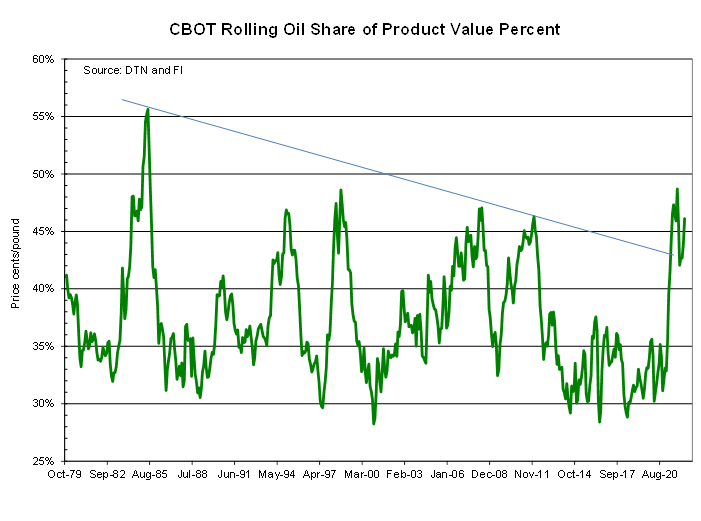

The soybean complex traded two-sided today. Soybean oil traded lower earlier after palm futures ended lower but rallied from bottom picking by the funds and commercial end users. With no end in sight for Indonesia’s export ban

of palm oil, some traders are nervous that prices will continue to trend higher. The rally in soybean oil added renewed pressure for the soybean meal market. Soybeans turned lower, in part to ideas some US corn acres could be switched to soybeans if the corn

planting pace remains slow. The May/July spread collapsed ahead of First Notice Day Deliveries. We don’t look for soybean, soybean oil deliveries on Friday, but some meal could circulate.

·

Indonesia’s ban on most palm oil exports started today. Reuters noted the Indonesia Navy already seized two tankers for “paperwork discrepancies” and blocked at least 290,000 tons of palm oil destined for India. India buys on

average about 350,000 tons of vegetable oil from India every month, and now faces a short-term shortage as most of the Malaysian palm oil available for prompt shipment are spoken for. Meanwhile Indonesia’s Palm Oil Board predicts the ban could be lifted sometime

in May.

·

Egypt’s GASC passed on international vegetable oils due to high prices for soybean oil and lack of offers for sunflower oil. But they bought local soybean oil.

GASC

purchased 56,500 tons of soyoil in a separate local production tender, a supply ministry statement said on Thursday. The purchase was made at a price of 35,500 Egyptian pounds ($1,924.12) a ton.

A

minimum of 30,000 tons of soybean oil and 10,000 tons of sunflower oil was sought in the international market and is for arrival between June 10 and 30.

·

Turkey bought 18,000 tons of sunflower oil for shipment between May 16 and June 16.

It

included 12,000

tons for shipment to the port of Mersin at an estimated $1,997 a ton c&f, and 6,000 tons for shipment to the port of Tekirdag at an estimated $2,007 a ton c&f.

·

China looks to auction off another 500,000 tons of soybeans April 29.

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

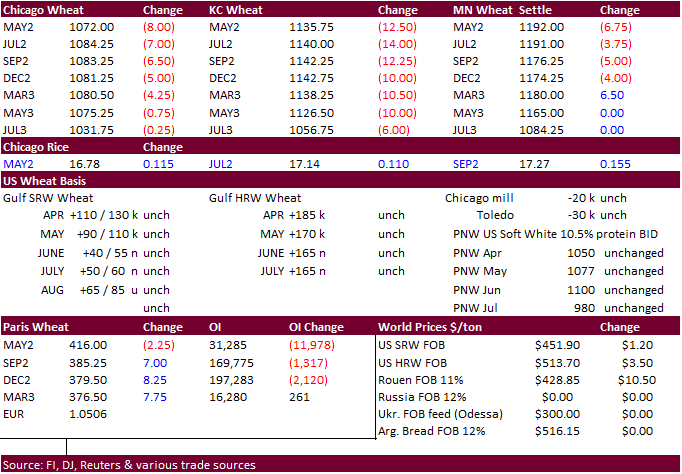

·

US wheat futures traded two-sided, ending lower. It rallied earlier on US weather and Black Sea concerns, but traded lower late afternoon as the USD was up around 66 points as of 1:30 pm CT. The southwestern Plains winter wheat

areas will continue to see drought conditions. Flooding across the far northern Great Plains remains an issue this spring as heavy rains are forecast for north Dakota this weekend. On a positive note, beneficial rains will fall across Nebraska and South Dakota.

·

There are no major developments with the Ukraine/Russia situation.

·

The CME Group will launch a Canadian Wheat Platts futures on June 13. It will reflect Vancouver Canadian western red spring wheat.

·

The pressure in the euro supported Paris wheat futures, up 7.00 euros to a new record high of 385.

September

Paris wheat

Source:

Reuters and FI

·

4/28. Jordan seeks 120,000 tons of wheat on May 11 for Jun/Aug shipment.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Turkey seeks 210,000 tons of international red milling wheat on Friday and another 210,000 tons of wheat already in warehouses for delivery between May 17 and August 10.

Rice/Other

·

September rice futures rallied and are back near its contract high.

Updated

4/22/22

Chicago – July $10.50 to

$12.50 range, December $8.50-$12.50

KC – July $10.25 to $12.50

range, December $8.75-$13.50

MN – July $10.75‐$13.00,

December $9.00-$14.00

USDA Export Sales

U.S. EXPORT SALES FOR WEEK ENDING 4/21/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

-2.8 |

1,017.8 |

1,097.9 |

56.7 |

6,472.2 |

7,626.7 |

-10.8 |

573.9 |

|

SRW |

1.8 |

369.9 |

254.6 |

46.5 |

2,484.2 |

1,555.2 |

4.5 |

591.5 |

|

HRS |

22.2 |

700.1 |

1,187.7 |

75.9 |

4,721.2 |

6,553.1 |

67.5 |

635.4 |

|

WHITE |

5.4 |

312.5 |

1,083.5 |

46.2 |

3,023.4 |

5,567.5 |

63.2 |

400.3 |

|

DURUM |

5.7 |

0.5 |

72.1 |

20.7 |

195.2 |

594.9 |

0.0 |

64.4 |

|

TOTAL |

32.3 |

2,400.8 |

3,695.8 |

246.0 |

16,896.1 |

21,897.4 |

124.3 |

2,265.5 |

|

BARLEY |

-0.1 |

5.7 |

4.4 |

0.0 |

14.7 |

25.1 |

0.0 |

8.6 |

|

CORN |

866.8 |

19,383.4 |

26,411.4 |

1,562.1 |

38,132.0 |

41,308.2 |

843.4 |

4,206.8 |

|

SORGHUM |

12.5 |

2,048.4 |

1,809.7 |

168.0 |

4,668.5 |

5,348.2 |

0.0 |

0.0 |

|

SOYBEANS |

481.3 |

10,849.1 |

5,054.6 |

710.9 |

46,728.1 |

56,064.8 |

580.0 |

10,741.3 |

|

SOY MEAL |

203.0 |

2,666.2 |

2,118.6 |

251.8 |

6,987.9 |

7,304.9 |

0.0 |

370.4 |

|

SOY OIL |

3.5 |

134.5 |

93.2 |

10.0 |

515.9 |

569.6 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

1.0 |

137.8 |

311.3 |

65.2 |

1,077.9 |

1,215.9 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

9.2 |

5.3 |

0.0 |

11.8 |

23.5 |

0.0 |

0.0 |

|

L G BRN |

0.3 |

6.0 |

2.9 |

0.4 |

44.9 |

35.4 |

0.0 |

0.0 |

|

M&S BR |

0.5 |

24.1 |

45.6 |

0.4 |

63.1 |

109.2 |

0.0 |

0.0 |

|

L G MLD |

1.6 |

86.3 |

37.4 |

9.1 |

623.6 |

502.2 |

0.0 |

0.0 |

|

M S MLD |

13.1 |

223.7 |

244.3 |

13.8 |

296.6 |

409.8 |

0.0 |

0.0 |

|

TOTAL |

16.4 |

487.0 |

646.7 |

88.8 |

2,117.9 |

2,296.0 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

121.1 |

6,325.1 |

4,322.0 |

386.0 |

8,165.9 |

10,827.4 |

49.5 |

2,846.1 |

|

PIMA |

13.0 |

132.3 |

197.6 |

4.4 |

331.9 |

563.9 |

0.5 |

40.6 |

This

summary is based on reports from exporters for the period April 15-21, 2022.

Wheat: Net

sales of 32,300 metric tons (MT) for 2021/2022 were up 23 percent from the previous week, but down 65 percent from the prior 4-week average. Increases primarily for Mexico (42,400 MT, including decreases of 2,200 MT), Taiwan (33,000 MT), the Dominican Republic

(23,400 MT, including 22,200 MT switched from Guatemala and decreases of 200 MT), Costa Rica (14,700 MT, including 15,000 MT switched from Colombia and decreases of 400 MT), and Chile (7,000 MT), were offset by reductions for Nigeria (37,500 MT), unknown destinations

(31,900 MT), Guatemala (22,200 MT), Colombia (12,900 MT), and Italy (400 MT). Net sales of 124,300 MT for 2022/2023 primarily for the Philippines (60,000 MT), Japan (33,700 MT), Chile (23,000 MT), Italy (20,000 MT), and unknown destinations (14,500 MT), were

offset by reductions for Nigeria (41,000 MT). Exports of 246,000 MT were down 51 percent from the previous week and 35 percent from the prior 4-week average. The destinations were primarily to Italy (54,600 MT), the Philippines (44,600 MT), Mexico (38,600

MT), Japan (30,900 MT), and Colombia (27,300 MT).

Corn:

Net sales of 866,800 MT for 2021/2022 were down 1 percent from the previous week and 5 percent from the prior 4-week average. Increases primarily for China (729,200 MT, including decreases of 5,800 MT), Mexico (144,900 MT, including 52,000 MT switched from

unknown destinations and decreases of 59,300 MT), South Korea (125,100 MT, including 66,000 MT switched from unknown destinations and decreases of 6,000 MT), Spain (55,000 MT, including 50,000 MT switched from unknown destinations), and Japan (53,100 MT, including

205,000 MT switched from unknown destinations and decreases of 92,200 MT), were offset by reductions primarily for unknown destinations (376,700 MT). Net sales of 843,400 MT for 2022/2023 were reported for China (612,000 MT), Mexico (190,800 MT), and Japan

(40,600 MT). Exports of 1,562,100 MT were up 31 percent from the previous week, but unchanged from the prior 4-week average. The destinations were primarily to Japan (385,600 MT), Mexico (337,800 MT), China (266,200 MT), Colombia (73,900 MT), and South Korea

(60,100 MT).

Optional

Origin Sales:

For 2021/2022, new optional origin sales of 200 MT were reported for Morocco. Options were exercised to export 90,200 MT to unknown destinations (60,000 MT) and Morocco (30,200 MT) from the United States. Decreases totaling 65,000

MT were reported for unknown destinations. The current outstanding balance of 378,300 MT is for unknown destinations (240,000 MT), South Korea (65,000 MT), Italy (34,300 MT), Morocco (30,000 MT), and Saudi Arabia (9,000 MT). For 2022/2023, decreases totaling

23,000 MT were reported for Italy. The current outstanding balance of 35,400 MT is for Italy.

Barley:

Total net sales reductions of 100 MT for 2021/2022 were unchanged from the previous week, but down 95 percent from the prior 4-week average. The destination was South Korea. No exports were reported for the week.

Sorghum:

Net sales of 12,500 MT for 2021/2022 were down noticeably from the previous week and from the prior 4-week average. Increases reported for China (41,600 MT, including 30,000 MT switched from unknown destinations), Mexico (800 MT), and South Korea (200 MT),

were offset by reductions for unknown destinations (30,000 MT) and Haiti (100 MT). Exports of 168,000 MT were down 40 percent from the previous week and 33 percent from the prior 4-week average. The destinations were to China (167,800 MT) and Haiti (200

MT).

Rice:

Net sales of 16,400 MT for 2021/2022 were down 75 percent from the previous week and 53 percent from the prior 4-week average. Increases were primarily for Japan (12,000 MT), Canada (1,400 MT), Costa Rica (1,000 MT), Mexico (900 MT), and Argentina (300 MT).

Exports of 88,800 MT were up noticeably from the previous week and up 84 percent from the prior 4-week average. The destinations were primarily to Mexico (31,400 MT), Colombia (30,800 MT), Japan (12,000 MT), Costa Rica (11,000 MT), and Canada (2,300 MT).

Exports

for Own Account:

For 2021/2022, new exports for own account totaling 100 MT were to Canada. Exports of 100 MT to Canada were applied to new or outstanding sales.

Soybeans:

Net sales of 481,300 MT for 2021/2022 were up 5 percent from the previous week, but down 37 percent from the prior 4-week average. Increases were primarily for China (165,100 MT, including 121,000 MT switched from unknown destinations and decreases of 33,300

MT), Mexico (88,100 MT, including decreases of 3,000 MT), Bangladesh (56,100 MT, including 55,000 MT switched from unknown destinations), Japan (48,100 MT, including 3,600 MT switched from unknown destinations and decreases of 500 MT), and Taiwan (33,900 MT,

including 20,000 MT switched from unknown destinations and decreases of 100 MT). Net sales of 580,000 MT for 2022/2023 were reported for China (468,000 MT) and Mexico (112,000 MT). Exports of 710,900 MT were down 20 percent from the previous week and 10

percent from the prior 4-week average. The destinations were primarily to China (279,900 MT), Egypt (158,800 MT), Mexico (81,400 MT), Bangladesh (56,100 MT), and Taiwan (40,300 MT).

Export

for Own Account:

For 2021/2022, new exports for own account totaling 29,700 MT were to Canada. The current exports for own account outstanding balance is 32,800 MT, all Canada.

Late

Reporting:

For 2021/2022, net sales and exports totaling 18,000 MT of soybeans were reported late for Belgium (9,900 MT) and Ireland (8,100 MT).

Soybean

Cake and Meal:

Net sales of 203,000 MT for 2021/2022 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Colombia (49,400 MT, including decreases of 3,100 MT), the Philippines (45,500 MT, including decreases of 2,300 MT),

Mexico (36,600 MT), Japan (26,400 MT), and unknown destinations (20,000 MT), were offset by reductions primarily for Costa Rica (7,300 MT), Guatemala (3,000 MT), Israel (3,000 MT), and Belgium (2,300 MT). Exports of 251,800 MT were down 16 percent from the

previous week, but up 11 percent from the prior 4-week average. The destinations were primarily to Colombia (65,600 MT), Mexico (46,700 MT), Israel (27,000 MT), Morocco (26,400 MT), and Canada (21,100 MT).

Soybean

Oil:

Net sales of 3,500 MT for 2021/2022 were up noticeably from the previous week, but down 69 percent from the prior 4-week average. Increases were reported for Costa Rica (2,300 MT), Canada (1,100 MT), and Venezuela (100 MT). Exports of 10,000 MT were up 82

percent from the previous week, but down 44 percent from the prior 4-week average. The destinations were primarily to Venezuela (6,600 MT) and Mexico (2,800 MT).

Cotton:

Net sales of 121,100 RB for 2021/2022 were up noticeably from the previous week and up 19 percent from the prior 4-week average. Increases primarily for China (61,400 RB, including decreases of 7,600 RB), Vietnam (25,300 RB, including 1,700 RB switched from

China, 700 RB switched from South Korea, and 500 RB switched from Japan), India (12,700 RB, including decreases of 5,500 RB), Pakistan (11,600 RB), and Turkey (4,700 RB), were offset by reductions for Ecuador (600 RB), South Korea (400 RB), Japan (300 RB),

and Colombia (100 RB). Net sales of 49,500 RB for 2022/2023 primarily for El Salvador (28,800 RB), Honduras (11,400 RB), Peru (5,100 RB), Guatemala (4,500 RB), and Vietnam (4,400 RB), were offset by reductions for China (11,200 RB). Exports of 386,000 RB

were up 5 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to China (117,900 RB), Vietnam (67,400 RB), Pakistan (57,600 RB), Turkey (43,300 RB), and Mexico (17,500 RB). Net sales of Pima totaling

13,000 RB were up noticeably from the previous week and from the prior 4-week average. Increases were reported for China (10,300 RB), Vietnam (1,700 RB), India (700 RB), Colombia (200 RB), and Malaysia (100 RB). Net sales of 500 RB for 2022/2023 were reported

for Japan (300 RB) and Peru (200 RB). Exports of 4,400 RB were down 70 percent from the previous week and 69 percent from the prior 4-week average. The destinations were primarily to Peru (2,000 RB), China (1,600 RB), Vietnam (400 RB), Turkey (200 RB), and

Bangladesh (100 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 57,200 RB is for Vietnam (52,800 RB) and Pakistan (4,400 RB).

Exports

for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 383,800 pieces for 2022 were down 19 percent from the previous week and 8 percent from the prior 4-week average. Increases primarily for China (161,800 whole cattle hides, including decreases of 12,400 pieces), South Korea (66,200 whole cattle

hides, including decreases of 400 pieces), Mexico (54,600 whole cattle hides, including decreases of 700 pieces), Thailand (39,700 whole cattle hides, including decreases of 1,600 pieces), and Taiwan (20,400 whole cattle hides, including decreases of 4,500

pieces), were offset by reductions for Indonesia (300 pieces). In addition, total net sales reductions of 300 kip skins were reported for Italy. Exports of 417,000 pieces were up 10 percent from the previous week, but down 14 percent from the prior 4-week

average. Whole cattle hides exports were primarily to China (251,200 pieces), Mexico (44,600 pieces), Thailand (35,200 pieces), South Korea (27,700 pieces), and Italy (15,800 pieces). In addition, total exports of 3,500 kip skins were to Italy.

Net

sales of 61,400 wet blues for 2022 were down 77 percent from the previous week and 52 percent from the prior 4-week average. Increases reported for Vietnam (31,000 unsplit, including decreases of 900 unsplit), China (21,700 unsplit), India (7,800 unsplit,

including decreases of 5,500 grain splits), and Italy (6,800 unsplit, including decreases of 200 unsplit and 100 grain splits), were offset by reductions for Brazil (100 unsplit), Thailand (100 unsplit), the Dominican Republic (100 unsplit), and Portugal (100

unsplit). Exports of 128,100 wet blues were down 25 percent from the previous week and 29 percent from the prior 4-week average. The destinations were primarily to Italy (33,100 unsplit and 8,100 grain splits), Vietnam (37,700 unsplit), Thailand (19,300

unsplit), China (14,000 unsplit), and Brazil (6,800 unsplit). Net sales of 123,200 splits were down 88 percent from the previous week and 84 percent from the prior 4-week average. Increases were reported for China (43,000 pounds), Taiwan (41,000 pounds),

Vietnam (36,200 pounds, including decreases of 12,300 pounds), and South Korea (3,000 pounds, including decreases of 600 pounds). Exports of 476,200 pounds were down 31 percent from the previous week and 30 percent from the prior 4-week average. The destination

was primarily to Vietnam (396,200 pounds).

Beef:

Net sales of 11,400 MT for 2022 were down 24 percent from the previous week and 34 percent from the prior 4-week average. Increases primarily for Japan (4,100 MT, including decreases of 500 MT), China (1,500 MT, including decreases of 100 MT), South Korea

(1,300 MT, including decreases of 600 MT), Mexico (1,000 MT), and Taiwan (1,000 MT, including decreases of 300 MT), were offset by reductions for the United Arab Emirates (100 MT). Total net sales of 100 MT for 2023 were reported for Japan. Exports of 17,600

MT were down 16 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to South Korea (4,400 MT), Japan (4,300 MT), China (3,200 MT), Taiwan (1,300 MT), and Mexico (1,300 MT).

Pork:

Net sales of 31,500 MT for 2022 were up noticeably from the previous week and up 19 percent from the prior 4-week average. Increases were primarily for Mexico (21,600 MT, including decreases of 300 MT), Japan (3,600 MT, including decreases of 100 MT), Canada

(2,100 MT, including decreases of 400 MT), South Korea (1,500 MT, including decreases of 200 MT), and Colombia (1,100 MT, including decreases of 200 MT). Exports of 29,900 MT were up 6 percent from the previous week, but unchanged from the prior 4-week average.

The destinations were primarily to Mexico (13,200 MT), China (3,800 MT), Japan (3,200 MT), South Korea (2,900 MT), and Colombia (2,000 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.