PDF Attached

Choppy

trade today. Soybean oil was down sharply after Germany announced they are looking at cutting back on feedstock for biofuels in order to cool food prices. Soybeans were mixed and meal was higher in the front months. Corn ended mixed from late session selling.

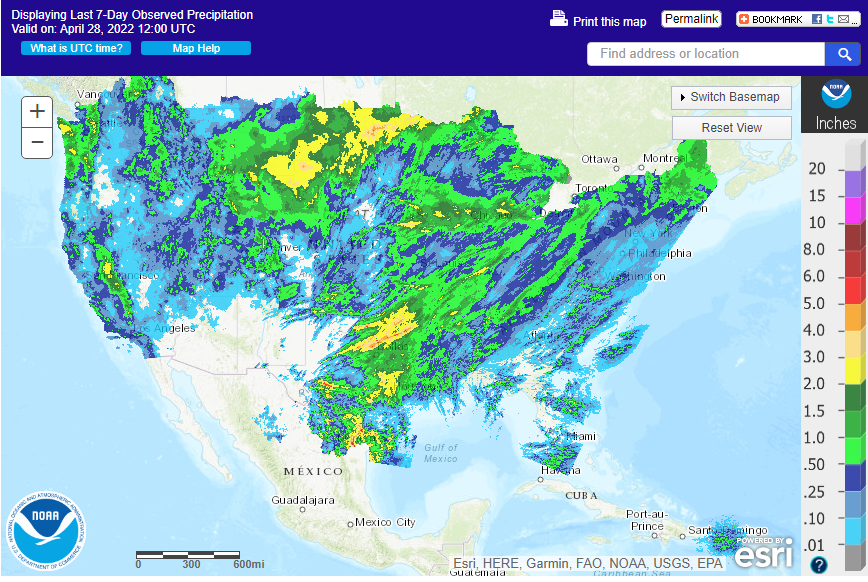

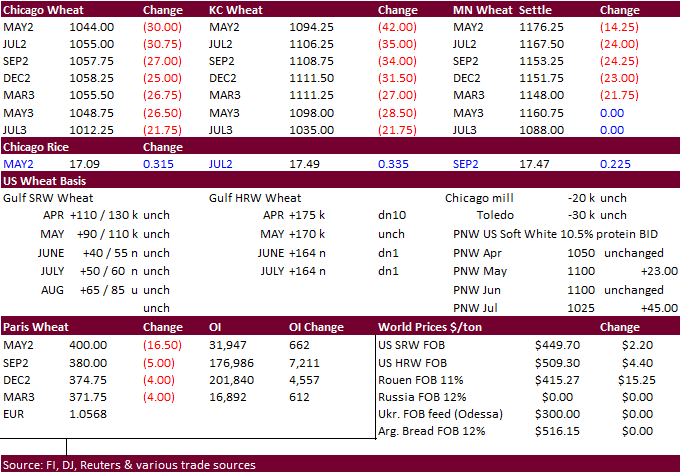

Wheat was sharply lower on US weather forecasts calling for precipitation across the dry areas of the central and parts of the southern Great Plains. The USD was lower today.

Past

7-days

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

spring planting is expected this weekend in the lower eastern Midwest, a part of the Delta and southeastern states where precipitation will be most limited, although not completely absent - U.S.

Midwest is expecting too much rain too frequently during the ten day period beginning this weekend - The

frequency of rain events will be too high for any meaningful drying to occur between storms - Temperatures

will also be mild to cool during much of the period limiting evaporation rates and keeping many fields too wet until near mid-month - High

temperatures in the 40s and 50s will occur in the far northern parts of the Midwest while 50s and 60s occur elsewhere with a few 70-degree readings in the south briefly early in the rainy period - U.S.

hard red winter wheat areas will get rain during this wetter biased period in the central and eastern parts of the nation - The

moisture will help improve crop and field conditions ahead of reproduction - Central

Oklahoma, northern and eastern Kansas and Nebraska will be wettest - Southwestern

hard red winter wheat areas will get some rain, but not enough to carry normal crop development to the end of the growing season, but a temporary reprieve from drying is expected - West

Texas cotton, corn and sorghum areas will get some needed rain Sunday into Monday and again Wednesday into Thursday with some follow up rain in the following weekend - Moisture

totals will be quite erratic with a few counties or parts of counties getting 0.50 inch upwards to more than 1.00 inch of rain, but such instances should be rare - The

greatest rainfall will likely occur Wednesday into Thursday after the first storm system primes the atmosphere with moisture

- West

Texas cotton areas will not get enough moisture to change subsoil conditions and any improvement in topsoil moisture will disappear relatively quickly due to warm temperatures and returning dry weather between rain events - South

Texas and the Texas Coastal Bend region will not get much precipitation during the next two weeks and net drying and crop stress will continue for unirrigated areas - Lower

U.S. Delta and southeastern states will get some beneficial rainfall between storm systems that impact the Midwest. - The

moisture will help support planting, emergence and establishment - Central

and Southern California will remain drier biased during the next two weeks - U.S.

Pacific Northwest will experience waves of precipitation during the next ten days that will prove beneficial to dryland crops in the region - Rainfall

in the Yakima Valley will continue quite limited - Quebec

and Ontario, Canada weather outlook in early May will be appealing for early season crop development and planting, although the region is likely to be a little too wet initially.

- Canada’s

Prairies will turn very warm and dry next week especially late in the week and during the following weekend with highs in the 70s and some lower 80s Fahrenheit - Rain

may evolve in the drier areas of the Prairies near mid-month and that event will be extremely important for providing planting, germination and emergence moisture in the driest areas - Rain

will impact Manitoba, Canada today and Friday with 0.50 to 1.50 inches and a few totals to 2.00 inches aggravating flood conditions across the region - Drier

weather is expected next week and it should last for about ten days - Temperatures

will be cool for a while and then begin to warm ahead of the next bout of rain near mid-month - India’s

hot weather continued Thursday and will prevail through the weekend - The

heat pushed temperatures up to 115 degrees Fahrenheit both Wednesday and Thursday with similar or slightly warmer readings this weekend - Winter

crops were already maturing and being harvested leaving little new damage - Winter

crop yields have come downward because of late February and March heat and dryness - More

recent weeks of the same weather have had a more minor influence on the bottom line - Livestock

stress has been high due to excessive heat and farming activity may have slowed due to some of the heat - Concern

about Mato Grosso, Brazil Safrinha corn and cotton will continue over the next ten days - Some

showers are advertised during mid-week next week, but early indications suggest rainfall will be mostly too light for a lasting impact on soil o crop conditions - Western

Mato Grosso will be more beneficially impacted than any other area - The

precipitation event should dissipate while moving into eastern parts of Mato Grosso and Goias

- Crop

moisture stress will rise until that precipitation evolves and once the showers begin they may prove to be a little too light for a serious change in crop or field conditions - Drier

weather will resume late next week limiting the amount of benefit that will come

- A

few other showers may occur near mid-month - Western

Argentina is still drying down, but summer crops are not being harmed by the pattern - Rain

will be needed in the second half of May and June to support winter wheat and other winter crops that get planted at that time; until then, there is not much reason for concern over dryness - Waves

of rain will impact southern Paraguay, northeastern Argentina, Uruguay and interior southern Brazil during the next ten days maintaining wet field conditions in those areas - The

region to be impacted will include the south half of Parana and southern Paraguay into Chaco, Santa Fe and eastern Buenos Aires, Argentina

- Fieldwork

will be slowed in these areas and some crop quality concerns will arise over time - Flooding

remains serious in southern Rio Grande do Sul where multiple inches of rain have fallen in the past week - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Europe

precipitation will occur most often from Spain, Portugal and parts of southern France into southern Belarus, central and western Ukraine and parts of western Russia over the next ten days to two weeks

No

heavy rain is expected, but enough will fall to support winter and spring crop development

- Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be near to below normal during the next ten days while the eastern CIS New Lands and Kazakhstan are warmer than usual - Parts

of Central Asia will also be quite warm - Western

Commonwealth of Independent States weather will include periodic bouts of rain, drizzle and some snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Net

drying is possible in the eastern Russia New Lands and in northern Kazakhstan for a while - Fieldwork

will advance a little slower than usual in some western areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - North

Africa rainfall over the next ten days will be greatest in north-central Algeria where some areas will receive 1.00 to 3.00 inches and local totals to 5.00 inches while others receive 0.20 to 0.75 inch - Morocco

and interior Tunisia will be driest with only a few sporadic showers - North

central Algeria will be wettest - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be infrequent and light over this coming week to ten days relative to that of last week - The

nation needs net drying to support better summer crop maturation and harvest conditions - Too

much moisture in recent weeks has delayed harvesting and reduced cotton and some oilseed quality, but the situation is improving

- Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Some

much needed rain fell in western portions of the Yellow River Basin Wednesday offering some relief to dryness recently - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Australia

rainfall Thursday more limited once again after recent significant rain in the southeast - Rain

in eastern Australia will return today into Saturday setting back fieldwork once again - The

moisture will be good for future wheat, barley and canola planting this autumn while not quite so welcome in summer crop areas where harvest progress is under way - Some

Central New South Wales locations will receive 0.50 to 1.25 inches of rain

- Cotton

quality might be briefly compromised - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Southern

portions of Russia’s Southern Region will get some needed rain varying from 1.00 to 2.00 inches in the next five or six days - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

Iran, Turkmenistan and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - A

tropical cyclone may evolve in the Bay of Bengal next week that might eventually threaten India or Myanmar - Eastern

Mexico will receive sporadic showers over the coming week - Western

areas will be dry biased - Recent

rain in the east has improved soil moisture to some crop areas - Central

America precipitation will slowly increase during the next couple of weeks

- the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +20.00 and it may begin to level out this weekend and next week before starting to weaken. - New

Zealand weather will be drier than usual over much of South Island while normal precipitation occurs in the north

Source:

World Weather Inc.

Source:

World Weather Inc.

Northern

China saw welcome rain over the past few days

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Vietnam’s

General Statistics Office releases coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received, 3pm - HOLIDAY:

Japan, Indonesia

Monday,

May 2:

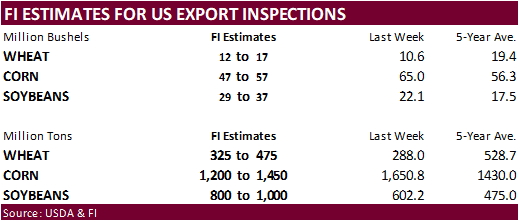

- USDA

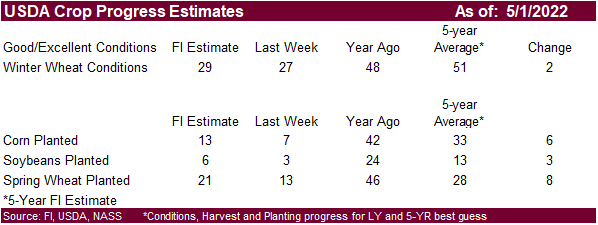

export inspections – corn, soybeans, wheat, 11am - Cotton

market outlook by International Cotton Advisory Committee - U.S.

crop progress and planting data for corn, soybeans and cotton; winter wheat condition, 4pm - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - Honduras,

Costa Rica monthly coffee exports - Australia

commodity index - HOLIDAY:

China, Malaysia, Indonesia, Hong Kong, Singapore, Thailand, Vietnam, Pakistan, Bangladesh, U.K.

Tuesday,

May 3:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment - HOLIDAY:

China, India, Malaysia, Indonesia, Singapore, Japan, Vietnam, Pakistan, Bangladesh

Wednesday,

May 4:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand commodity prices - HOLIDAY:

China, Japan, Malaysia, Indonesia, Thailand, Bangladesh, Pakistan

Thursday,

May 5:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Japan, Indonesia, South Korea, Pakistan

Friday,

May 6:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Statistics

Canada releases stockpiles data for barley, canola and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

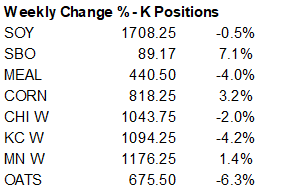

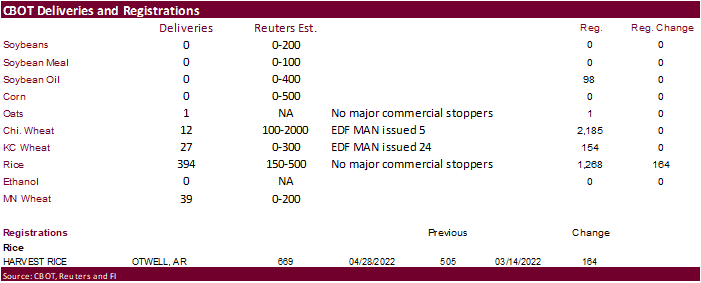

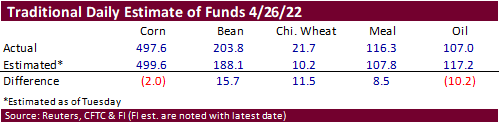

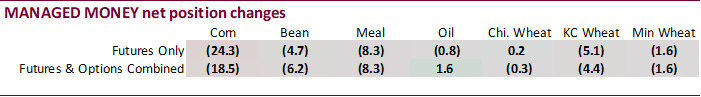

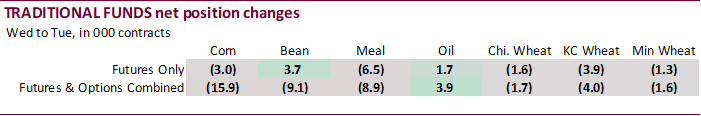

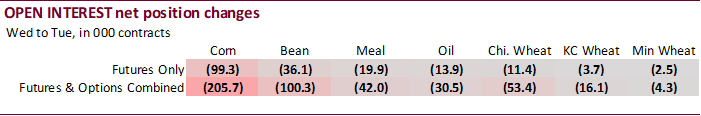

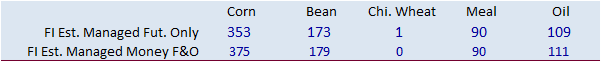

No

major surprises for the week ending April 26. During that period, we did see selling by money managers and that is reflected in the major contracts with exception of soybean oil (futures and options). Futures and options corn open interest was down a large

205,700 contracts.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

272,242 -13,736 485,653 -628 -720,214 21,028

Soybeans

97,798 -5,754 199,474 -12,246 -270,456 19,678

Soyoil

69,164 4,692 116,914 -448 -203,250 1,249

CBOT

wheat -37,501 545 158,269 -2,507 -116,760 3,303

KCBT

wheat 11,913 -4,117 65,403 2,326 -80,820 651

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

360,655 -18,455 285,264 -734 -711,917 23,270

Soybeans

173,477 -6,248 111,086 -419 -268,934 11,159

Soymeal

91,291 -8,251 90,902 1,013 -226,576 14,505

Soyoil

97,683 1,595 82,848 -1,402 -205,214 3,005

CBOT

wheat 14,180 -289 68,565 386 -90,872 2,701

KCBT

wheat 45,407 -4,434 27,732 2,313 -72,945 525

MGEX

wheat 18,268 -1,599 1,267 640 -29,936 377

———- ———- ———- ———- ———- ———-

Total

wheat 77,855 -6,322 97,564 3,339 -193,753 3,603

Live

cattle 55,284 8,476 74,147 51 -141,183 -8,360

Feeder

cattle -3,269 1,141 5,410 49 2,716 187

Lean

hogs 44,086 -12,421 54,968 495 -96,577 14,086

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

103,680 2,583 -37,681 -6,664 2,157,559 -205,682

Soybeans

11,188 -2,816 -26,816 -1,677 904,744 -100,274

Soymeal

15,217 -630 29,168 -6,637 424,438 -42,030

Soyoil

7,509 2,296 17,173 -5,494 440,799 -30,534

CBOT

wheat 12,135 -1,456 -4,007 -1,342 431,253 -53,351

KCBT

wheat -3,699 458 3,505 1,140 195,409 -16,096

MGEX

wheat 5,148 -36 5,253 619 73,326 -4,287

———- ———- ———- ———- ———- ———-

Total

wheat 13,584 -1,034 4,751 417 699,988 -73,734

Live

cattle 25,941 594 -14,188 -760 365,662 5,626

Feeder

cattle 471 24 -5,329 -1,400 56,780 -1,444

Lean

hogs 4,347 -1,261 -6,824 -900 291,155 -7,726

92

Counterparties Take $1.907 Tln At Fed Reverse Repo Op (prev $1.818 Tln, 83 Bids)

US

Employment Cost Index Q1: 1.4% (exp 1.1%; prev 1.0%)

US

Personal Income Mar: 0.5% (exp 0.4%; prev 0.5%)

–

Personal Spending Mar: 1.1% (exp 0.6%; prev 0.2%)

–

PCE Core Deflator (M/M) Mar: 0.3% (exp 0.3%; prev 0.4%)

–

PCE Core Deflator (Y/Y) Mar: 5.2% (exp 5.3%; prev 5.4%)

–

PCE Deflator (M/M) Mar: 0.9% (exp 0.9%; prev 0.6%)

–

PCE Deflator (Y/Y) Mar: 6.6% (exp 6.7%; prev 6.4%)

–

Real Personal Spending Mar: 0.2% (exp -0.1%; prev -0.4%)

Canadian

GDP (M/M) Feb: 1.1% (exp 0.8%; prev 0.2%)

–

GDP (Y/Y) Feb: 4.5% (exp 4.1%; prev 3.5%)

US

Univ. Of Michigan Sentiment Apr F: 65.2 (est 65.7; prev 65.7)

–

Current Conditions: 69.4 (est 68.0; prev 68.1)

–

Expectations: 62.5 (est 64.1; prev 64.1)

–

1-Year inflation: 5.4% (est 5.4%; prev 5.4%)

–

5-10 Year inflation: 3.0% (prev 3.0%)

EIA:

US Crude Oil Exports Fell To 3.309M Bpd In Feb (Prev 3.347M Bpd In Jan)

–

Total Refined Oil Product Exports Rose To 2.868M Bpd In Feb (Prev 2.576M Bpd)

–

Distillates Fuel Exports Rose To 1.036M Bpd In Feb (Prev 965K Bpd)

–

Gasoline Exports Fell To 799K Bpd In Feb (Prev 806K Bpd)

–

Liquefied Petroleum Gas Exports Fall To 2.076M Bpd In Feb (Prev 2.094M Bpd)

·

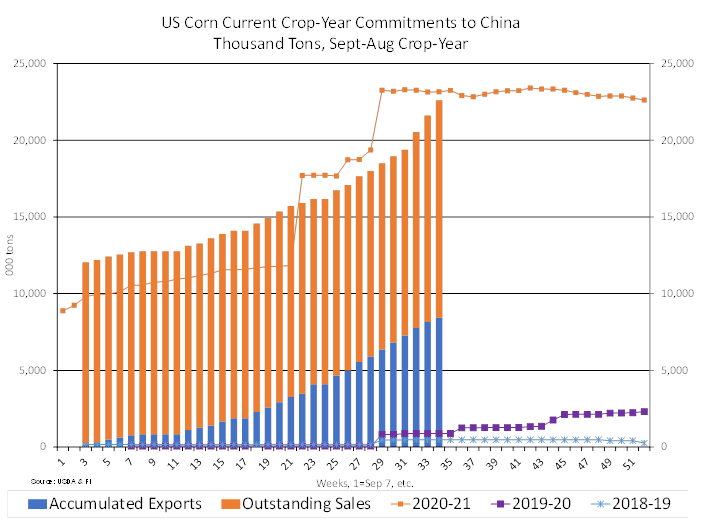

Before selling off into the close and settling mixed, corn futures traded to their highest level since August 2012, helped by a lower USD and higher WTI crude oil. Weakness in wheat limited gains.

Cool

and wet weather for the US may continue to hinder plantings through the first week of May. Funds bought an estimated net 2,000 corn.

·

The USD eased after hitting a 20-year high.

·

WTI crude oil turned lower early afternoon before the ag market closed.

·

China’s end of March sow herd contracted 3.3 percent from February and is down 3.1 percent from year ago, in part to negative margins from rising feed costs. China had 422.53 million head of pigs at the end of March, down 5.9

percent from February.

·

22 US states have reported bird flu cases so far this year.

·

Colorado man tests positive for highly contagious avian flu

https://www.msn.com/en-us/health/medical/colorado-man-tests-positive-for-highly-contagious-avian-flu/vi-AAWJvMG?ocid=msedgntp&cvid=d79ae5bc1a7d473b87f00c841342f8a9

·

Bulgaria reported a case resulting in the culling of 160,000 birds.

·

China approved more GMO corn varieties produced by domestic companies.

·

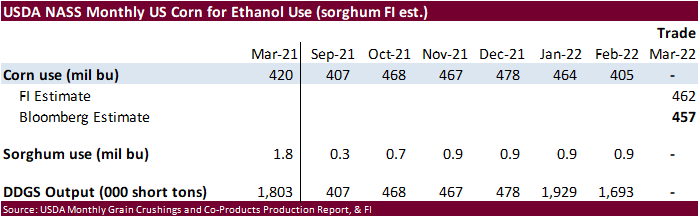

The EPA issued an emergency waiver for a higher-ethanol gasoline blend, from May 1-May 20 (only 20 days), allowing summertime sales of the fuel in an attempt to help lower gasoline prices at the pump. The move represents a temporary

win for the biofuels industry and corn farmers, as it will likely expand sales of corn-based ethanol, and a setback for oil refiners, which view ethanol as competition. (Reuters)

·

A higher blend will make a small difference for ethanol use as about 2,500 gas stations are equipped to sell E15, or only 2.5% of the roughly 100,000 gas stations nationwide.

·

The EPA is expected to send biofuel blending mandates for 2020, 2021 and 2022 to the White House for final review by early next week. The White House said it could save a family 10 cents per gallon. Some analysts argue that the

price of filling up could cost more.

·

(Reuters) – U.S. governors from eight Midwest states, many of which are major corn producers, asked the Biden administration on Thursday to apply rules that would allow gasoline blended with a higher level of ethanol to be sold

year-round in their states. Governors from Iowa, Illinois and Minnesota said in a letter to the Environmental Protection Agency that allowing the blend, known as E15, year-round would help lower gasoline prices, which have risen to over $4 per gallon after

Russia’s invasion of Ukraine.

·

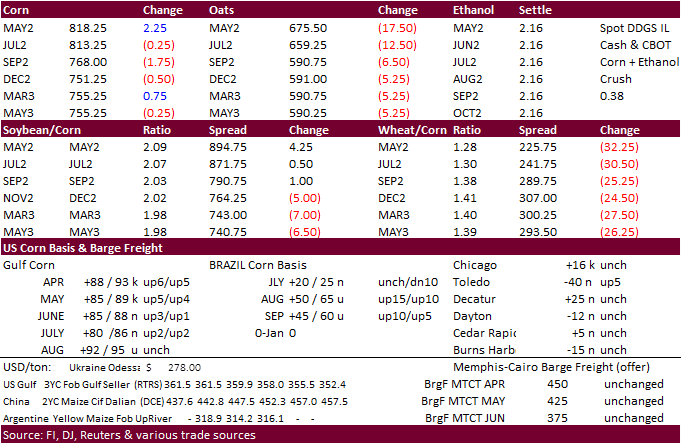

EIA February US ethanol production was as expected.

What

Do We Know About the Impact of Late Planting on the U.S. Average Corn Yield?

Irwin,

S. “What Do We Know About the Impact of Late Planting on the U.S. Average Corn Yield?.”

farmdoc

daily

(12):59, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 28, 2022.

Export

developments.

·

None reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range (unchanged, up 50 cents high end)

·

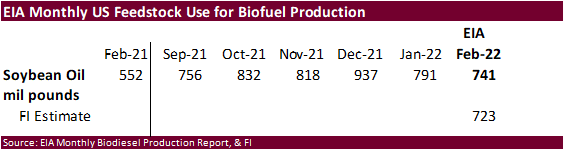

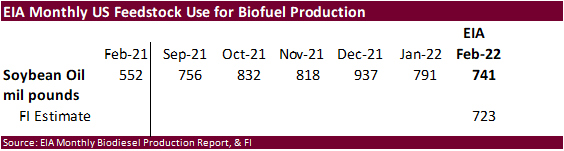

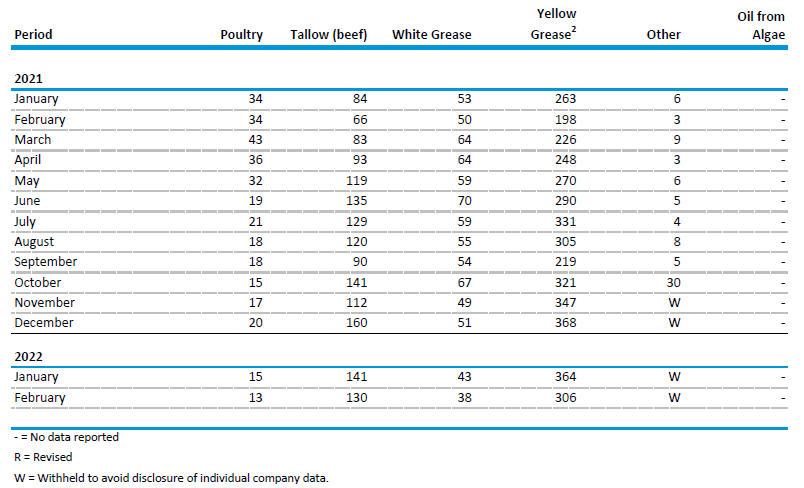

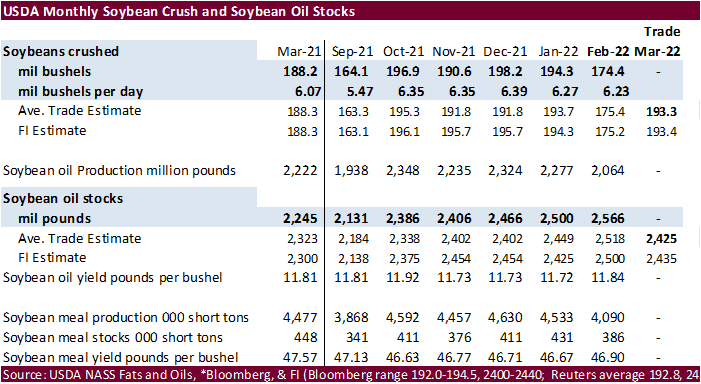

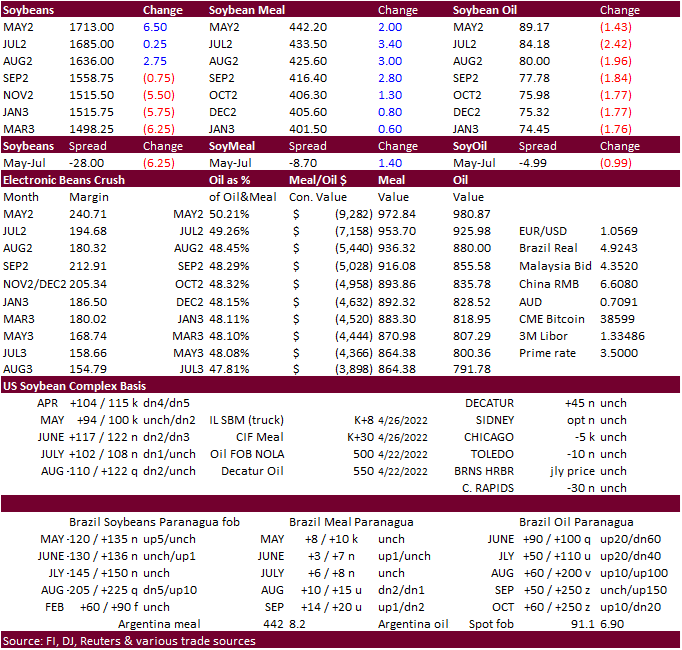

Soybeans settled mixed with light bull spreading during the close. Crude oil lent support. Soybean meal ended higher on technical buying. Soybean oil sold off (down 143-242 points) after seeing higher prices earlier this week.

Some countries are starting to cut back on biodiesel (vegetable oil feedstock) mandates to cool rising prices for food end users. Germany, the largest EU biofuel market, is the latest country looking at cutting back on feedstock to ensure food security.

·

Funds bought an estimated net 2,000 soybeans, bought 1,000 meal and sold 4,000 soybean oil.

·

Many countries will be on holiday Monday and with month end, there was some positioning in today’s trade.

·

ICE canola finished $18.90 lower basis the July contract. The inverted July-November canola spread firmed.

·

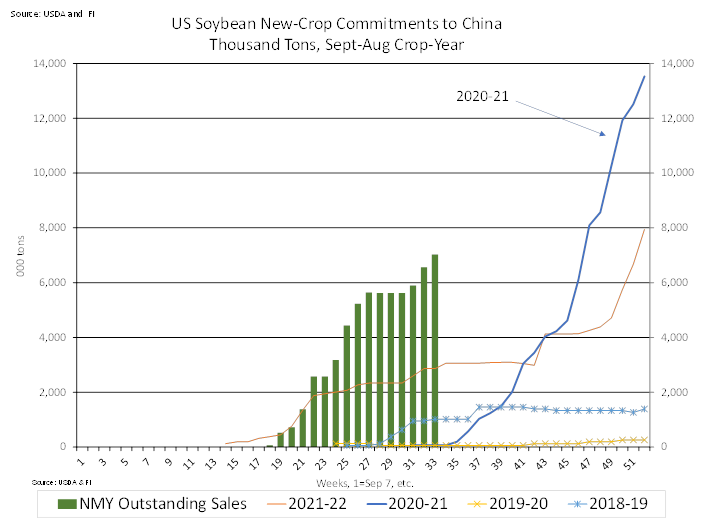

We heard China bought at least 20 cargoes of soybeans from Brazil this week, mostly for June and July shipment, and 5-6 US new-crop cargoes from the US Thursday into Friday.

·

Malaysian palm futures were up 24.5 percent for the month of April.

·

India will allow imports of an extra 550,000 tons of GMO soybean meal to help the poultry industry. The shipments will have to be by September 30. In August 2021 relaxed import rules to allow shipments of 1.2 million tons of GMO

soybean meal.

·

China looks to sell another 500,000 tons of soybeans from reserves on May 6.

·

We heard they sold nearly 75% today out of the nearly 510,000 tons offered,

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

·

US wheat futures settled sharply lower on technical selling and US weather forecasts. The North American weather forecast has not improved for this weekend with flooding potentials running high for the far northern Great Plains

and southern Manitoba, Canada. But next week offers some relief for the hard red winter wheat crop. A good part of the US hard red winter wheat areas will get rain in the central and eastern parts of the nation, with central Oklahoma, northern and eastern

Kansas and Nebraska – wettest. The southwestern hard red winter wheat areas will get some rain.

·

Funds sold an estimated net 9,000 SRW wheat contracts.

·

Winter wheat futures are near a 3-week low.

·

The euro was higher.

·

Wheat ratings in France were stable from the previous week at 91 percent G/E condition.

·

September Paris wheat futures were down 5.00 euros, off from a record high, to 380.00 at the time this was written.

·

Russia’s wheat export tax will increase to $120.10/ton from $119.10 for the May 6-12 period. Corn increased to $58.30 from $54.90.

·

Ukraine exported 763,000 tons of grain so far during the month of April and reached 45.709 million tons since July 2021. Ukraine exported only 300,000 tons of grain during March.

·

Ukraine completed plantings for 6 out of the 24 growing regions.

The

ministry said farmers had sown 175,800 hectares of spring wheat, 838,500 hectares of spring barley, 116,300 hectares of peas, 144,400 hectares of oats, 774,800 hectares of corn and some acreage of other commodities. (Reuters)

·

The Philippines were in for wheat.

·

Turkey bought 210,000 tons of wheat at around $409 a ton ex warehouse.

·

Turkey also bought 270,000 tons of international red milling wheat for delivery between May 17 and August 10. Lowest price was thought to be $404.80/ton.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Jordan seeks 120,000 tons of wheat on May 11 for Jun/Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago

– July $10.50 to $12.50 range, December $8.50-$12.50

KC

– July $10.25 to $12.50 range, December $8.75-$13.50

MN

– July $10.75‐$13.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.