PDF Attached

Friday

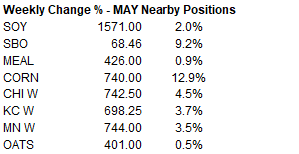

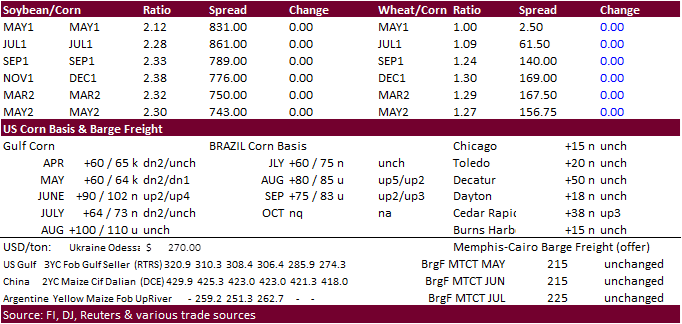

most ag futures appreciated on ongoing concerns over shrinking supplies. CFTC showed the managed fund positions less long than expected. Next week we will start to see new crop analyst estimates for the upcoming May USDA report.

Reminder:

CME is resetting price limits for grain, soybean complex and lumber futures on May 2. For example, corn to 40 cents, soybeans to 1.00, wheat to 45.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2021/04/SER-8761.pdf

CME

Margin changes:

CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 7.9% TO $2,050 PER CONTRACT FROM $1,900 FOR MAY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON MAY 3, 2021

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 7.2% TO $4,100 PER CONTRACT FROM $3,825 FOR MAY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 30, 2021

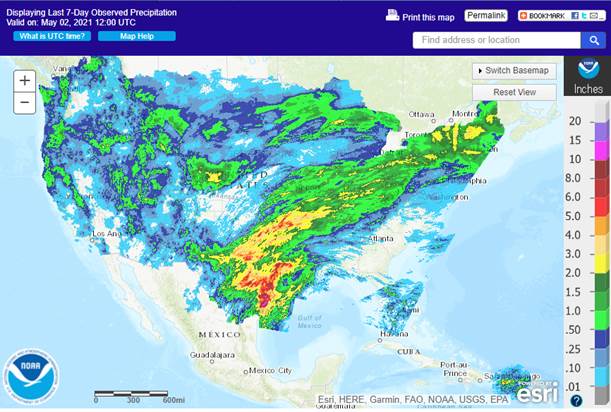

Past

7-days

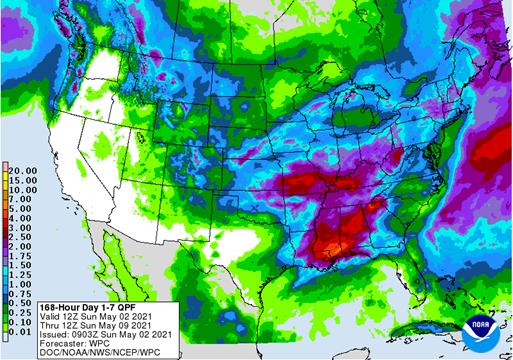

Next

7 days

World

Weather, Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

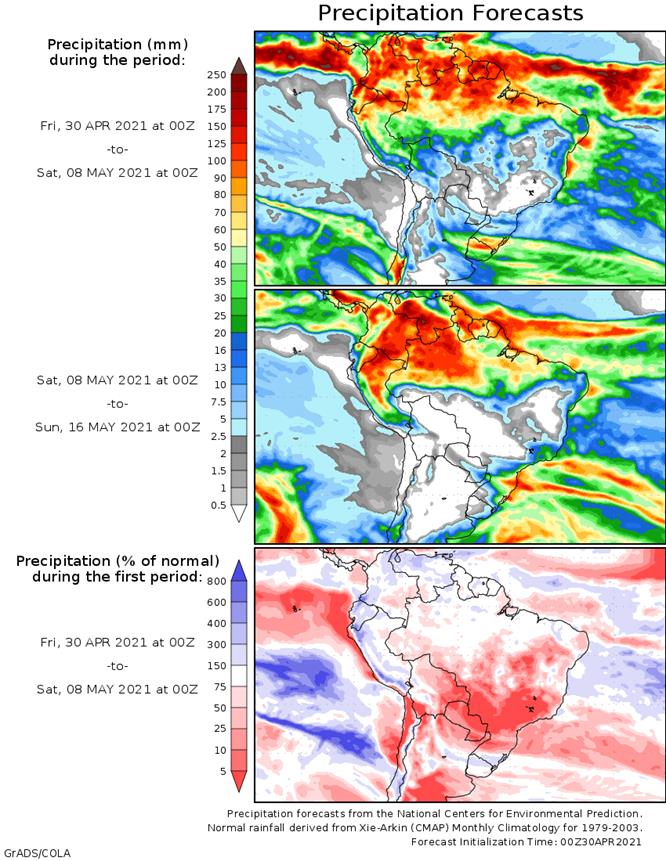

Alternating

periods of rain and sunshine in the U.S. Midwest during the next two weeks will prove beneficial for spring planting and early crop development. Too much rain in the Delta might induce some flooding and some crop damage.

In

South America, Argentina’s weather is still favorable for late season summer crop development and drier weather through the coming weekend will improve maturation and harvest conditions after recent rain. Brazil weather will be dry keeping a great amount of

concern over long term Safrinha corn production potentials.

Rapeseed

in Western Europe will see improved weather and some warming this week will help support better corn, sunseed and other spring and summer crop planting in southwestern Europe. Western Ukraine weather will remain inclement for planting of summer crops and the

same is true for parts of Eastern Europe.

China’s

rapeseed will experience better weather over the coming week with less frequent rain and some warmer weather, but too much moisture during much of the spring likely reduced production and quality. Spring planting of other coarse grain and oilseeds in the south

will improve with warmer temperatures and less rain for a while. China’s outlook may not be ideal, but it should improve for spring planting. Northern China planting weather is good.

India’s

harvest of winter coarse grain and oilseeds will advance well during the next two weeks. Australia’s canola planting will begin soon, but some rain is needed first – at least in some areas. Dry conditions in Australia will prevail for a while longer, but some

showers will develop in the southwest late this week and throughout Western Australia early next week.

Southeast

Asia oil palm production areas are experiencing a mostly good environment for crop development and little change is expected, despite some drier biased weather for a while.

Canada

canola planting should begin soon, but dryness and cold temperatures will be a concern for a while along with the potential for some cool weather in May.

Overall,

weather today will likely maintain support for the marketplace, but improving U.S. weather conditions may take some of the bullishness down a bit. Brazil is still the biggest potential problem area, though.

MARKET

WEATHER MENTALITY FOR WHEAT: Concern over dryness in the southwestern U.S. Plains will continue over the next week to ten days, although some showers are expected in this coming week. Rain is needed to support crops as they move toward reproduction. Dryness

is also an ongoing concern for Canada’s Prairies and the northern U.S. Plains where some increase in rainfall is expected during May. Poor seed germination and plant emergence will occur in spring wheat areas of Canada and the northern Plains without improving

rainfall.

Today’s

forecast in Australia is advertised to bring showers to many wheat and barley production areas during the coming ten days. Any precipitation would be welcome and good for moistening topsoil moisture ahead of planting, but greater amounts will still be needed.

Wheat

conditions in Europe and the western CIS are fair to good, although recent cold weather in Europe caused some concern over a few crops. Rainy weather in western Russia and parts of Ukraine has been raising concern over winter crop conditions and early season

planting delays.

India’s

harvest is moving along well while China’s wheat is rated favorably. Some spring planting is under way in northern China and it should advance well.

North

Africa wheat is in mostly good shape, but rain is needed in northwestern Algeria and southwestern Morocco. The best crops are in northern Morocco and that will not change for a while.

Overall,

weather today is likely to have a mixed influence on market mentality.

Source:

World Weather, Inc.

Monday,

May 3:

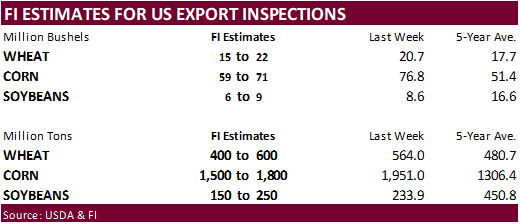

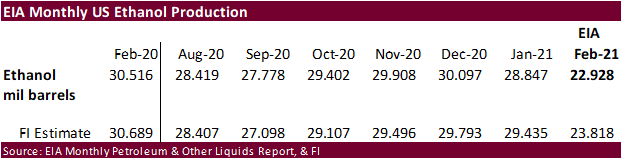

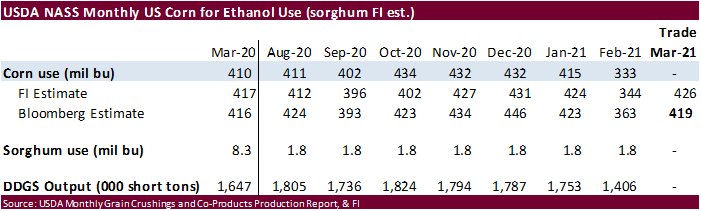

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - EU

weekly grain, oilseed import and export data - U.S.

corn for ethanol, soybean crush, DDGS production, 3pm - Honduras,

Costa Rica monthly coffee exports - International

Cotton Advisory Committee updates world supply and demand outlook - Australia

Commodity Index - Ivory

Coast cocoa arrivals - HOLIDAY:

U.K., Japan, China, Vietnam, Thailand

Tuesday,

May 4:

- Purdue

Agriculture Sentiment - New

Zealand global dairy trade auction - EARNINGS:

Bunge, Andersons, Minerva - HOLIDAY:

Japan, China, Thailand

Wednesday,

May 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia

May 1-5 palm oil export data - New

Zealand Commodity Price - HOLIDAY:

Japan, China

Thursday,

May 6:

- FAO

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

May 7:

- China

customs publishes trade data, including imports of soy, edible oils, meat and rubber - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC

monthly report on Chinese grains & oilseeds - Canada’s

Statcan to issue wheat, canola, barley and durum stockpile data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Changes

to WASDE starting May

Starting

with the May 12, 2021 release (issue No. 612), the following changes will be made to the World Agricultural Supply and Demand Estimates (WASDE) report:

-

U.S.

Soybeans and Products Supply and Use (page 15): “Biofuel” will replace “Biodiesel” in the soybean oil section, reflecting recent changes to the monthly biofuels data reported by the U.S. Energy Information Administration. The WASDE will follow soybean oil

used for biofuel as reported in the Monthly Biofuels Capacity and Feedstocks Update – Table 2C (PDF, 287 KB). -

World

Soybean Meal Supply and Use (page 29): Soybean meal supply and use for China will be presented separately. -

The

U.S. Rice Supply and Use table (page 14): The table will include separate categories for U.S. imports of long-grain and combined medium and short-grain rice. The addition is made due to the significant rise in U.S. imports of long-grain and medium- and short-grain

rice over the past decade. -

The

United Kingdom officially left the European Union on January 1, 2021; the trade bloc now has 27 member states instead of 28. Beginning with the January 2021 WASDE report, the heading for the EU-28 region will change from “European Union” to “EU-27+UK”. Starting

May 2021, (when projections for the new Marketing Year are released), the UK data will be disaggregated from the regional total and presented separately in the report, where applicable.

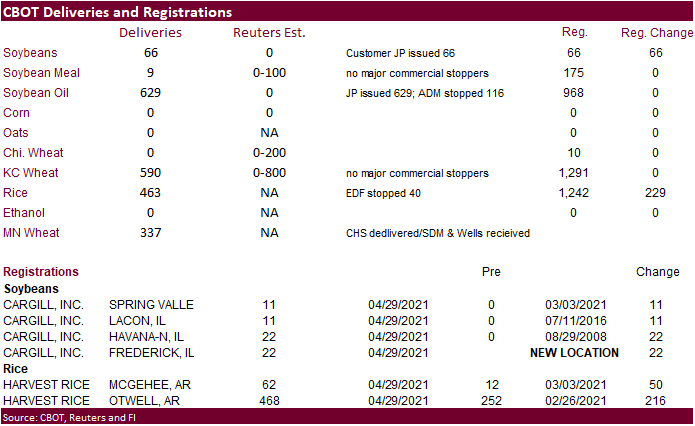

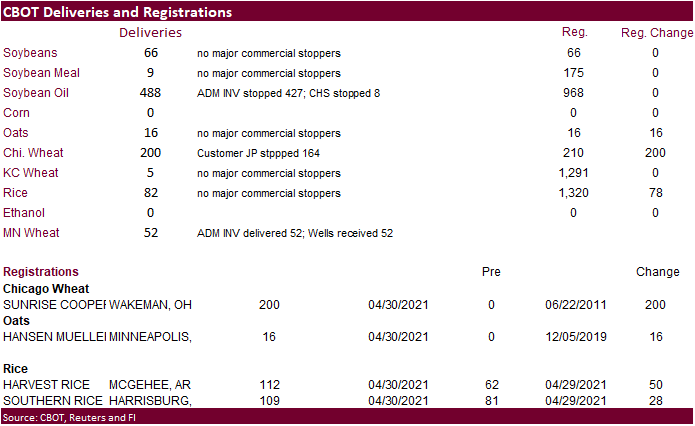

FRIDAY

FND (released Thursday night)

SUNDAY

DELIVERIES

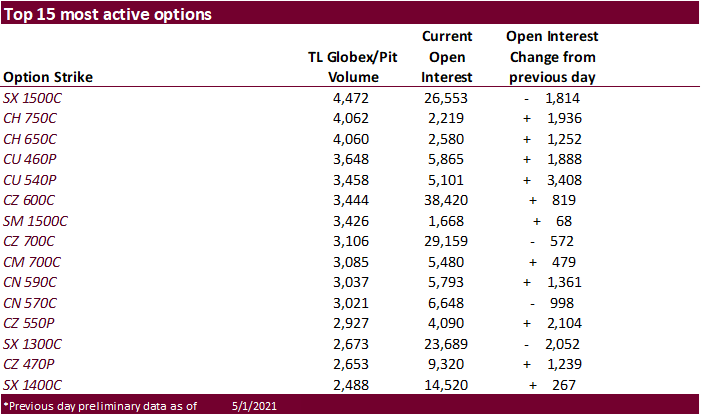

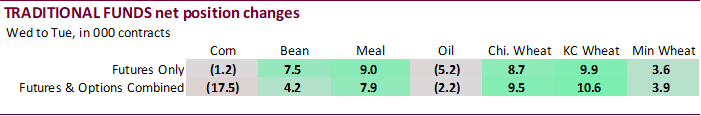

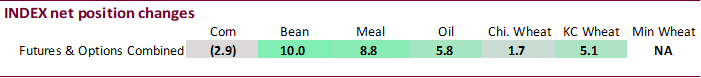

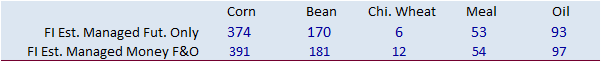

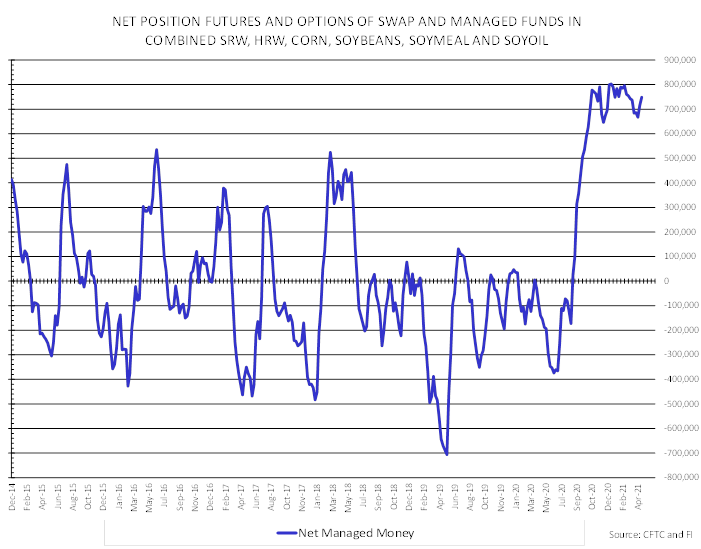

CFTC

Commitment of Traders

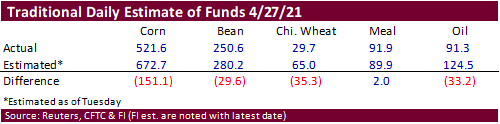

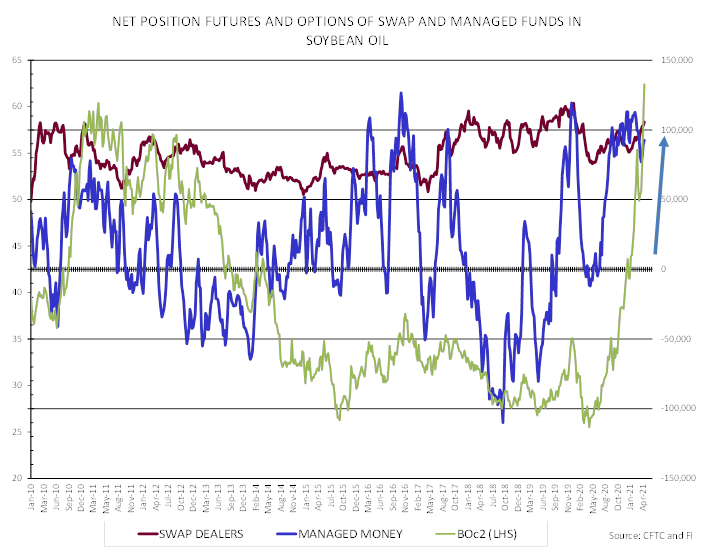

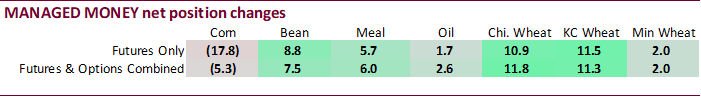

There

were no notable record positions this week. SBO prices have managed to climb substantially despite the net fun position unable to test its record long position established 2016. Managed money for corn is near a recent record. Managed money for Chicago wheat

ticked higher with nearby prices at highs not seen since 2012. As we said in the past, we caution taking the daily estimate of funds literally, rather look at the momentum of buying. Funds estimates missed the corn position by most for the week ending April

27 in our recorded history dating back to 2012.

Speculators

cut corn net long position-CFTC – Reuters News

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

335,631 -19,286 413,831 -2,948 -733,660 21,448

Soybeans

133,912 924 183,053 9,994 -320,269 -11,244

Soyoil

57,308 -3,850 120,794 5,846 -197,028 -1,566

CBOT

wheat -18,508 6,831 160,331 1,671 -131,321 -10,531

KCBT

wheat 13,528 6,699 68,666 5,058 -81,151 -9,838

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

378,663 -5,336 239,774 -1,299 -710,596 18,036

Soybeans

180,014 7,470 71,146 2,279 -283,625 -6,847

Soymeal

54,086 6,039 74,657 -532 -188,549 -7,517

Soyoil

92,587 2,595 105,756 2,752 -218,831 -146

CBOT

wheat 13,399 11,816 80,823 -5,530 -105,929 -6,036

KCBT

wheat 30,038 11,292 45,405 649 -74,720 -9,374

MGEX

wheat 14,079 1,962 3,480 -189 -28,435 -2,995

———- ———- ———- ———- ———- ———-

Total

wheat 57,516 25,070 129,708 -5,070 -209,084 -18,405

Live

cattle 54,895 -16,424 85,543 -171 -157,997 10,079

Feeder

cattle 679 -1,569 7,763 67 -2,574 230

Lean

hogs 71,117 -2,129 59,136 -551 -136,454 3,188

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

107,963 -12,188 -15,803 785 2,399,229 -148,475

Soybeans

29,160 -3,229 3,303 327 1,167,102 -82,399

Soymeal

26,423 1,867 33,383 141 459,296 -17,824

Soyoil

1,562 -4,770 18,925 -431 572,191 -49,898

CBOT

wheat 22,209 -2,280 -10,502 2,030 548,366 -196

KCBT

wheat 321 -647 -1,044 -1,919 237,214 3,537

MGEX

wheat 3,302 1,955 7,574 -733 84,487 2,877

———- ———- ———- ———- ———- ———-

Total

wheat 25,832 -972 -3,972 -622 870,067 6,218

Live

cattle 24,563 2,323 -7,004 4,193 377,095 -399

Feeder

cattle 3,934 109 -9,802 1,162 55,554 2,643

Lean

hogs 13,846 -74 -7,644 -433 343,649 2,684

US

Personal Income Mar: 21.1% (est 20.2%; prevR -7.0%; prev -7.1%)

US

Personal Spending Mar: 4.2% (est 4.1%; prev -1.0%)

US

Real Personal Spending Mar: 3.6% (est 3.7%; prev -1.2%)

US

PCE Core Deflator (Y/Y) Mar: 1.8% (est 1.8%; prev 1.4%)

US

PCE Core Deflator (M/M) Mar: 0.4% (est 0.3%; prev 0.1%)

US

PCE Deflator (Y/Y) Mar: 2.3% (est 2.3%; prev 1.6%)

US

PCE Deflator (M/M) Mar: 0.5% (est 0.5%; prev 0.2%)

Canadian

GDP (M/M) Feb: 0.4% (est 0.5%; prev 0.7%)

Canadian

GDP (Y/Y) Feb: -2.2% (est -2.3%; prev -2.3%)

Canadian

Industrial Product Price (M/M) Mar: 1.6% (est 1.6%; prev 2.6%)

Canadian

Raw Materials Price Index (M/M) Mar: 2.3% (est 2.0%; prev 6.6%)

US

Employment Cost Index Q1: 0.9% (est 0.7%; prev 0.7%)

US

Q1 Employment Cost Index Report – BLS

- CBOT

corn

started lower only to settle limit higher in July (+25 @ 6.7325). Synthetic settle in July was $6.8475. Improving US weather conditions for plantings did little to slow fund buying. Nearby expiring May corn was up 38 cents to $7.40 per bushel. For the

week July corn was up 40.75 cents or 6.4% and up 5 consecutive weeks. The USD was up 65 points as of 1:20 pm CT.

- There

were no fresh import tenders reported overnight but we are hearing China bought new crop corn this past week that went unreported.

- Safras

& Mercado estimated the Brazil corn crop at 104.1 million tons, 8% below their previous forecast. Second crop corn was pegged at 70.7 million tons.

- The

BA Grains Exchange pegged Argentina corn harvesting at 19%, below a 5-year average of 30%. They left their Argentina corn production unchanged 46MMT (USDA @ 47).

- US

ethanol biofuel RIN’s closed at $1.53 Thursday, highest on record. Today they were down slightly for both ethanol and biodiesel.

- On

Friday, the funds bought an estimated net 55,000 corn contracts. - China

will exempt some imported seeds from value-added tax until the end of 2025 – Ministry of Finance via Reuters.

- Latest

China PMI data suggested the economy is slowing. 51.1 was reported for April, down from 51.9 in March.

- France

planted 74 percent of the expected corn crop, up from 41 previous week and ahead of a five-year average of 68 percent.

- Ukraine

spring grain plantings are 39 percent complete as of April 29.

USDA

attaché reports – note on China ASF

Export

developments.

- None

reported

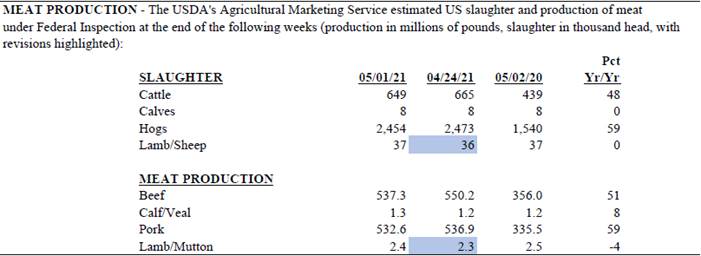

Trade

News Service meat data

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

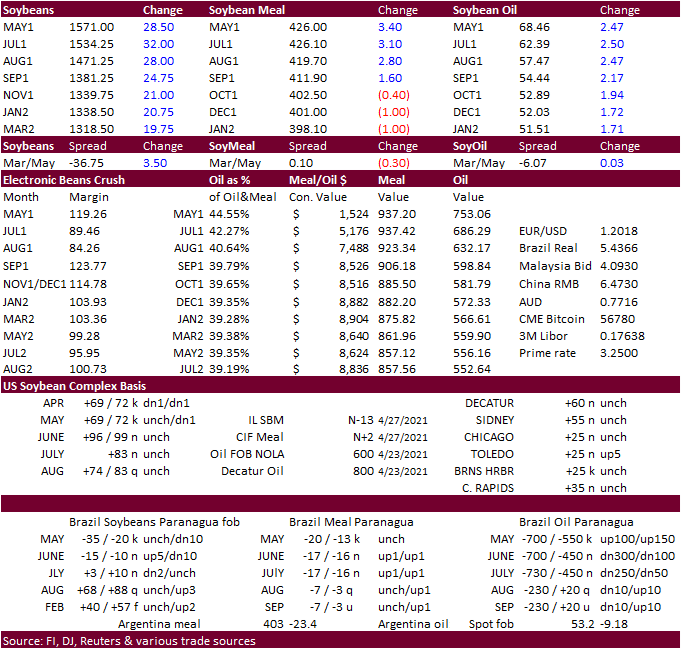

- CBOT

soybeans

set their best monthly winning stretch during the month of April. Tight US supplies, adverse weather and delays in the Brazil soybean harvest propelled prices higher, along with rising corn futures. Look for traders to shift their focus to US weather next

month. Spreads

are also red hot. For the week July soybeans were up 18.25 cents or 1.2% and up 5 consecutive weeks. - For

the day, soybeans started out lower early this morning but fund buying lifted soybeans sharply higher, after a very volatile week of trading. There were rumors China was back in today buying new crop soybeans. July soybeans finished 32 cents higher, July

meal $3.10 higher, and July soybean oil 250 points high, also limit. - Soybean

meal basis for the US interior rail markets were unchanged to down $1.00 on Friday. Decatur, IL, was at 4 under the July.

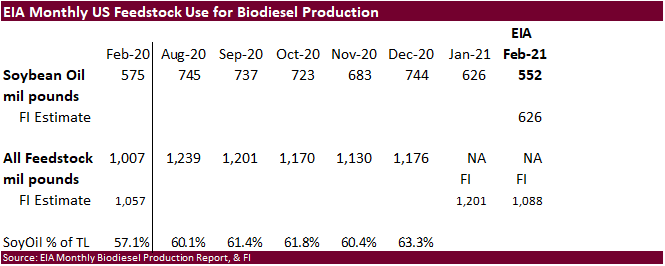

- Note

US soybean oil for biofuel for the month of February came in well below our expectations at 552 million pounds (626 by FI(, below 626 million for January and 575 million for February 2020. With US soybean oil stocks last month near last year levels, we question

the actual end of September carryout we are currently penciling in. This will be addressed Monday afternoon with USDA NASS updating US crush and stocks.

- There

were 629 soybean oil deliveries (JPM/Cargill) while the trade was looking for zero, but it appears some of them is retendering receipts that probably will get cancelled. The oil spread broke by 350 pts from top to bottom yesterday and that may be why today’s

reaction is muted. 66 soybean deliveries were posted, also a surprise. 22 of the soybean deliveries were at a new location.

- China

will be on holiday through Wednesday for Labor Day. Drier weather forecast for Argentina should boost harvest progress.

- Argentina

soybean harvest is now one third complete. - AmSpec

reported April Malaysian palm exports increased 9.7% to 1.4 million tons. - After

a one day holiday, palm futures fell 68 points to 3868MYR, and cash was down $10/ton to $985/ton.

- Russia

plans to reduce its export tax on soybeans to 20% from current 30% with a minimum level of $100 per ton (from min 165 euros or $200/ton), starting from July 1, according to the economy ministry. The new tax will be in place until September 2022. Russia grew

4.3MMT of soybeans last year, nearly four times higher than a decade ago. 2020-21 exports are projected by USDA at 1.45MMT, up from virtually zero ten years ago.

- APK-Inform

noted Ukraine rapeseed prices added $100/ton over the past 20 days to around $620 to $640/ton for July-August delivery.

- EU

MARS noted rapeseed projection this year was impacted by frost that had a direct impact on fields. Oilseed growers group FOP has estimated that France’s rapeseed crop area could shrink to 900,000 hectares by harvest time. The French farm ministry estimates

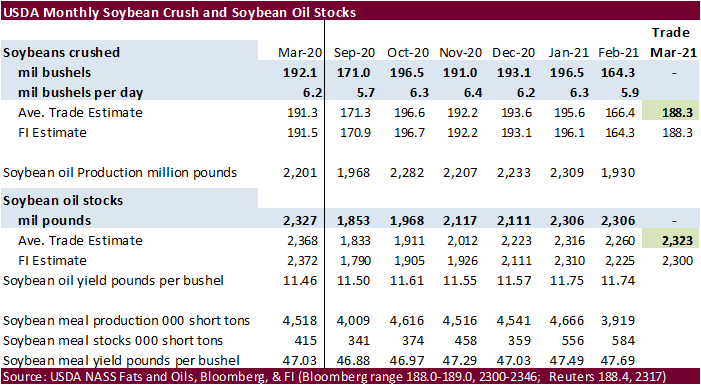

the area at 990,000 hectares. - A

Reuters poll calls for the March crush to be reported near 188.4 million bushels (5.94 mil bu per day), up from 164.3 million in February (5.87 mil/d) and below 192.1 million in March 2020 (5.85 million/day). Soybean oil stocks were estimated at 2.317 billion

pounds, up from 2.306 million in February and below 2.327 billion at the end of March 2020.

- Funds

on Friday bought an estimated net 18,000 soybean contracts, bought 3,000 soybean meal and bought 11,000 soybean oil.

- China

cash crush margins on our analysis were 178 cents (194 previous) vs. 141 cents late last week and compares to 132 cents year earlier.

- Algeria

seeks 30,000 tons of soybean meal on April 29 for shipment by June 15. - Results

awaited: Tunisia seeks 27,000 tons of soybean oil and/or rapeseed oil for late June / early July shipment.

- Results

awaited: USDA under the food export program seeks 420 tons of vegetable oils for June 1-30 shipment.

Updated

4/26/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 56-70; December 48-60 cent range

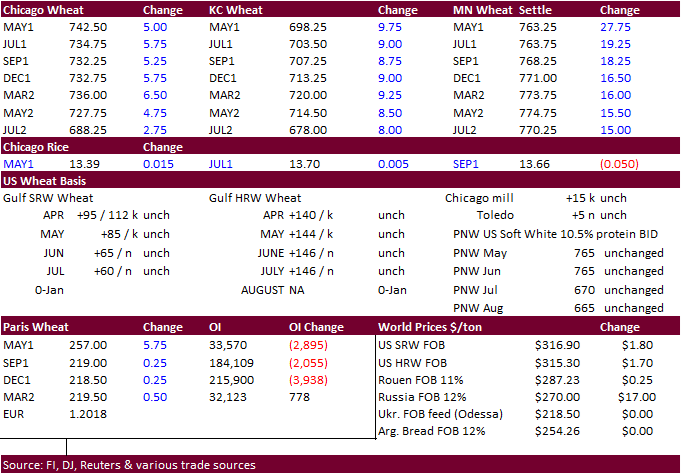

- Most

US wheat futures contracts started Friday mostly lower despite a decline in French crop conditions from the previous week, but then turned higher after corn rallied. Talk of a slowdown in US exports due to high prices was noted, but US basis is very strong.

July Chicago settled 5.0 higher, KC 9 higher and July MN a very impressive 19.25 cents higher.

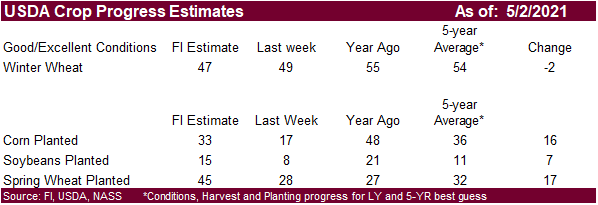

- We

may see a 2 point decline in US winter wheat ratings when reported on Monday and a slowdown in spring wheat planting progress due to dry conditions across the northern Great Plains.

- French

soft wheat crop conditions declined 4 points to 81% good or excellent for the week ending April 26 against 85%, above 57% score at the same point last season. Durum wheat fell 8 points to 69%, up from 65% year ago. The winter barley rating dropped 4 points

to 77% while spring barley dropped 5 points to 82%. - Funds

on Friday bought an estimated net 5,000 CBOT SRW wheat contracts. - September

Paris wheat was up 0.50 at 219.25 euros.

USDA

attaché report – Australia:

- The

Philippines seeks up to 185,000 tons of wheat on May 4 for shipment in June, July and August depending on origin.

- Bangladesh

seeks 50,000 tons of milling wheat on May 6.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on May 2.

Updated

4/26/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.15-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.