PDF Attached

Calls:

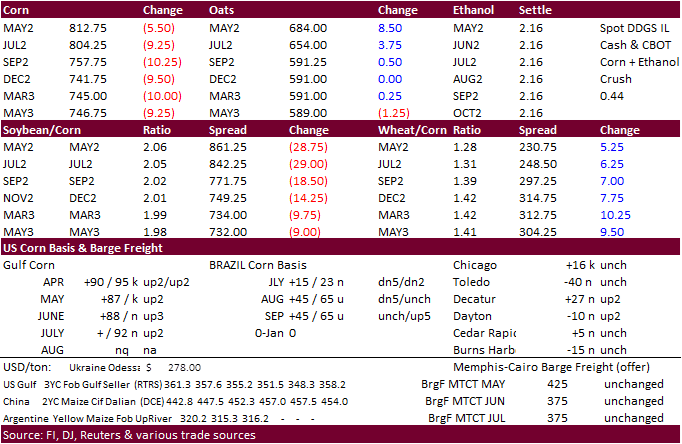

Soybeans up 3-6, corn up 1-3 and Chicago wheat up 2-5.

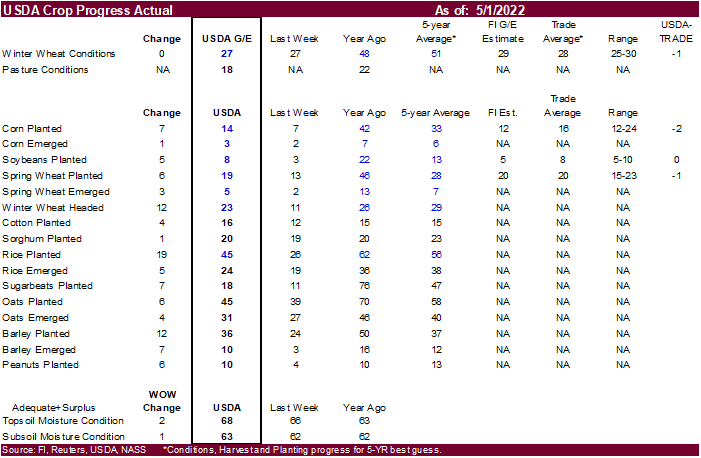

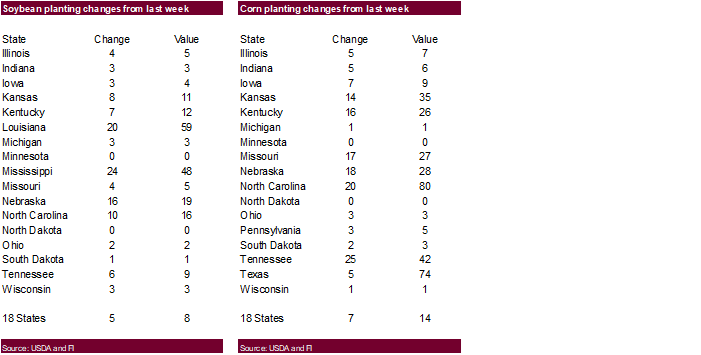

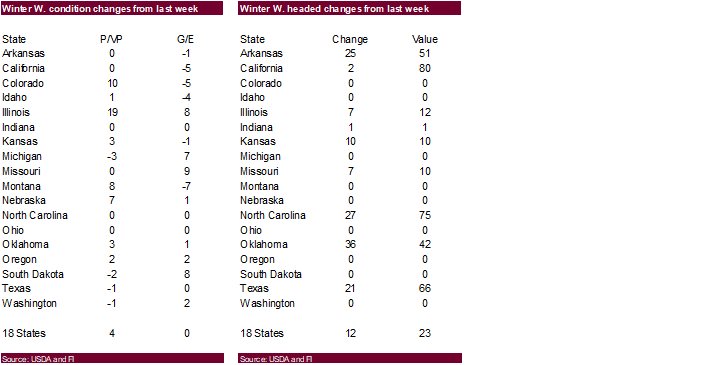

US

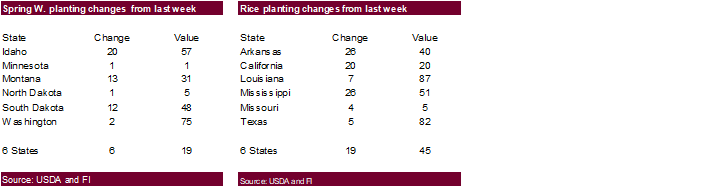

corn and spring wheat seeding progress fell short of expectations while soybeans were at an average trade guess, all behind their 5-year averages. US winter wheat ratings slipped one point. Many countries were on holiday today, and a thin market led to volatility.

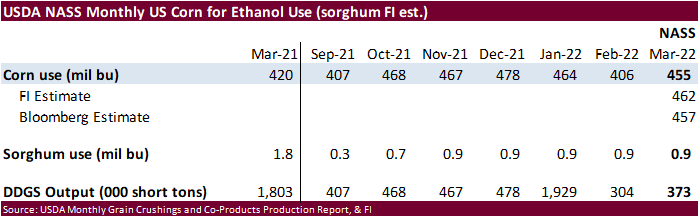

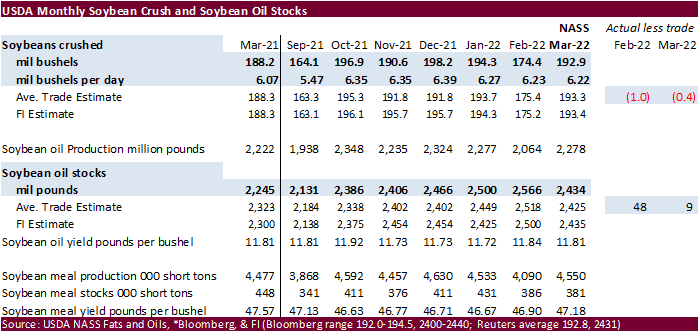

A strong USD and large swing in WTI crude oil sent mixed signals. Some people believe corn acres could be switched to soybeans. Adding to the negative undertone are ongoing China Covid-19 lockdown rules. The soybean complex traded lower led by soybean oil

and soybeans, corn was lower, and wheat mixed. The NASS crush and corn use for ethanol offered little surprises, but we did lower corn for ethanol use by 5 million bushels for the current season. New CBOT daily limits kicked in today –

https://www.cmegroup.com/trading/price-limits.html#agricultural?redirect=/trading/price-limit-update.html

NASS

crop progress https://release.nass.usda.gov/reports/prog1922.txt

Past

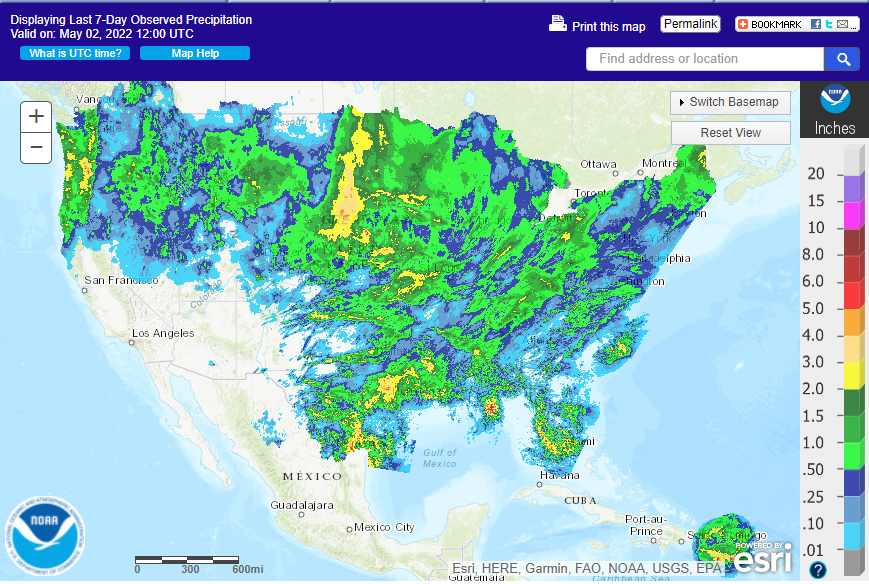

7-days

WEATHER

EVENTS AND FEATURES TO WATCH

- West

Texas thunderstorms erupted overnight, but the resulting rainfall was mostly disappointing

- Rainfall

reached 3.34 inches at Snyder, Texas, 1.78 inches near Midland, Texas and 1.68 inches at Stinnett, Texas while most other areas reported rainfall of less than 0.35 inch - The

precipitation will add some moisture to the atmosphere which could add to future thunderstorm development - West

Texas will have some risk of additional showers and thunderstorms Wednesday into Thursday of this week and again during early to mid-week next week

- Most

of these weather systems are unlikely to produce enough rain to seriously change soil moisture and drought status will be unchanged - The

Wednesday and Thursday event could generate some greater than expected rainfall - U.S.

southwestern hard red winter wheat production areas will get “some” rain this week, but resulting amounts will not be enough to counter evaporation for the entire ten day period resulting in the need for much more rain - No

serious change in drought status is expected from the Texas Panhandle to southwestern Kansas and southeastern Colorado, despite expected rainfall tonight and a few thunderstorms infrequently at other times in the coming ten days - Temperatures

will be warm enough to keep evaporation rates high when rain is not falling - Rain

is expected in northern and eastern hard red winter wheat production areas early to mid-week this week and then drier late this week into next week

- That

restricts opportunities for change in soil moisture to this week primarily, although eastern fringes of wheat country could receive additional rain late next week and into the following weekend - Rain

in hard red winter wheat areas during the weekend was most significant in Nebraska where central parts of the state received 0.60 to 1.43 inches with more than 2.00 inches in central and northern parts of the state’s minor production areas - Limited

rainfall occurred in the southwest half of wheat country Friday through Sunday afternoon - The

bottom line for hard red winter wheat areas remains one of drought in the southwestern Plains, but relief is expected from dryness in Nebraska, northeastern Colorado, northern and eastern Kansas and central Oklahoma because of frequent rainfall during the

next ten days in those areas - Rain

fell lightly across the U.S. Midwest during the weekend with most areas getting rain at one time or another, but not enough to seriously disrupt a drying trend from northwest to southeast across Illinois, in southern Indiana, across Ohio or in northern Kentucky - These

latter areas continued to dry down, albeit gradually - U.S.

Delta and southeastern states experienced restricted rainfall during the weekend resulting in net drying conditions for many, but not all areas - U.S.

Delta and southeastern states will see a good mix of rain and sunshine during the next ten days resulting in favorable crop development conditions, but some periodic field working delay due to rain - U.S.

Midwest will experience frequent rain through mid-week this week, take a little break late this week and into the weekend and then receive more rain next week - The

result will be slow field progress - Temperatures

will be mild which may keep drying rates a little slow - Some

planting is expected, but it should not be aggressive - The

weekend and next Monday will be best for planting, but some areas will still be too wet following early to mid-week rain this week - The

bottom line for U.S. Midwest, Delta and southeastern states will remain one of concern due to slow fieldwork. Drying time in the Midwest will be limited and planting is unlikely to move aggressively with the pace likely to slip further behind the normal pace.

A period of multiple days of dry and warm weather is needed, but not likely to come anytime in this next ten days. The Delta and may also be a little wet, but warmer temperatures will promote better planting potentials when rain is not falling. The best field

and crop conditions in these three areas will be in the southeastern states where timely rain will be mostly beneficial supporting good crop development potential and fieldwork will advance around periods of rain.

- U.S.

Northern Plains received significant rain in the eastern Dakotas and Minnesota with 0.50 to 2.00 inches resulting in many areas - The

rain maintained wet field conditions in many North Dakota and northern Minnesota locations while expanding the wet conditions southward into central and eastern South Dakota and central Nebraska - Western

Dakotas and Montana did not receive much rain from the weekend precipitation event - U.S.

Northern Plains weather will be dry biased early this week, but brief periods of rain will return to all of the region during the second half of this week and into the weekend slowing the region’s badly-needed drying trend in the eastern Dakotas and Minnesota,

but offering some timely rainfall to the western Dakotas and Montana - Fieldwork

will continue to advance very slowly in the central and eastern parts of North Dakota and northern Minnesota where it is much too wet - Fieldwork

delays will occur periodically in the western Dakotas, Montana and southern Minnesota, but the moisture will be good for future crop development once drier and warmer weather arrives - U.S.

Pacific Northwest weather will continue to generate precipitation most often and most significantly in the Cascade Mountains and the northern Rocky Mountains leaving the Yakima and Columbia River Valleys with limited precipitation

- The

environment will alright, but greater moisture must fall in dryland production areas of Oregon and Washington as well as southern Idaho to induce the best conditions - Far

southwestern U.S., including central and southern California, will stay dry over the next couple of weeks - Mato

Grosso and Mato Grosso do Sul will receive rain Tuesday night into Thursday - The

precipitation will be greatest in western Mato Grosso and Mato Grosso do Sul where 0.25 to 0.75 inch of rain is expected with a few rare amounts over 1.00 inch - Eastern

Mato Grosso and Goias will fail to get more than 0.50 inch and net drying is expected leaving Safrinha crops in need of significant rain

- Mato

Grosso and Mato Grosso do Sul and Goias, Brazil may receive another chance for rain early to mid-week next week with rainfall of 0.10 to 0.60 inch resulting - Confidence

is low, but if both rain events occur this week and next week there may be enough disruption to the drying trend to buy “some” crops a little time before serious crop stress occurs to accelerate damage to Safrinha production potential - The

bottom line, however, is still one of concern that yields for some of the Safrinha corn crop will slip lower especially that in eastern Mato Grosso and Goias. Confidence in rainfall for next week is too low to offer a reversal in the declining yield potentials,

but the situation will be closely monitored - Southern

Brazil was wetter biased during the weekend as it was late last week after heavy rain fell earlier in the week

- Additional

heavy rain will fall through mid-week this week resulting in some flooding and ongoing concern over crop and field conditions - Rain

totals of 2.00 to more than 7.00 inches are expected in southern Parana, northern Rio Grande do Sul and Santa Catarina as well as far northeastern Argentina and southern Paraguay - Some

flooding rain will occur along the coast where more than 10.00 inches might result.

- Drier

weather is expected late this week and during the first half of next week and that change will be welcome and good for crops and field conditions - Argentina

received little rain during the weekend and drier than usual conditions should dominate the next ten days

- The

environment will be good for summer crop maturation and harvest progress - The

environment will promote net drying which may reduce soil moisture for future wheat planting - A

boost in soil moisture must occur late this month and in June to support winter wheat planting and establishment especially in the west where the soil is driest - Some

rain will fall in the far northeast of the country - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Quebec

and Ontario, Canada weather outlook in early May will be appealing for early season crop development and planting, although the region is likely to be a little too wet initially.

- Canada’s

Prairies turned warmer and remained mostly dry during the weekend - Not

much precipitation is expected this workweek - Temperatures

will be quite warm during mid- to late week this week - Some

cooling will accompany a frontal system this weekend, but rain of significance is not likely in the southwestern Prairies – although a few showers are possible - Rain

may evolve in the drier areas of the Prairies after mid-month and that event will be extremely important for providing planting, germination and emergence moisture in the driest areas - Rain

in southeastern Manitoba, Canada early in the weekend varied from 0.50 to 2.28 inches

- The

moisture maintained excessive moisture in the southeast half of the province and flooding remains a problem - Drier

weather is expected this week, but some showers could evolve late this week and into the weekend

- The

precipitation may linger into the Monday of next week and then drier weather will resume - Temperatures

will be cool early this week and then begin to warm ahead of the next bout of rain during the second half of this week and early in the weekend - India’s

hot weather continued Friday through Sunday and it will prevail today - The

heat pushed temperatures up to 115 degrees Fahrenheit and similar conditions were likely today - Winter

crops were already maturing and being harvested leaving little new damage - Winter

crop yields have come downward because of late February and March heat and dryness, but little change has occurred recently - Livestock

stress has been high due to excessive heat and farming activity may have slowed due to some of the heat - Cooler

weather during mid-week may come with a few showers in the far northern cotton production area benefiting some of the region’s crops - A

tropical cyclone will form in the Bay of Bengal late this week and could move toward the central east coast with landfall possible during the early part of next week - Torrential

rain, flooding and excessive wind speeds may accompany the storm inland - Landfall

is possible along the middle or upper east coast of India - Europe

precipitation will occur periodically through the weekend and into next week supporting spring and summer crop planting and winter crop development - The

precipitation should favor the south half of the continent this week - Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be mild this week - Warming

is likely next week - Western

Commonwealth of Independent States weather will include periodic bouts of rain, drizzle and some wet snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Net

drying is possible in the eastern Russia New Lands and in northern Kazakhstan this week, but some rain will evolve next week

- Fieldwork

will advance a little slower than usual in some western areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - North

Africa rainfall over the next week rain totals will vary from 0.30 to 1.00 inch with many amounts of 1.00 to 2.50 inches - Wettest

in northeastern Algeria and northern Tunisia - Morocco

will be driest with only a few sporadic showers - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be infrequent and light over this coming week to ten days resulting in net drying conditions - Too

much moisture in recent weeks delayed harvesting and reduced cotton and some oilseed quality, but the situation has been and will continue improving - Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Some

much needed rain fell in western portions of the Yellow River Basin Wednesday offering some relief to dryness recently - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Australia

rainfall during the weekend was sufficient to disrupt harvest progress in New South Wales where cotton quality could have slipped lower because of wet weather earlier last week as well - Queensland

was left dry and harvest progress advanced well - Dry

weather also occurred elsewhere - Rain

in eastern Australia will diminish for a while this week, but it will return during the weekend and next week

- The

moisture will be good for future wheat, barley and canola planting this autumn while not quite so welcome in summer crop areas where harvest progress is under way - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Not

much rain will fall this week, but next week could trend a little wetter - Southern

portions of Russia’s Southern Region will get some needed rain varying from 1.00 to 3.00 inches in the next week to ten days - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

Iran, Turkmenistan and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - Eastern

Mexico will receive sporadic showers over the coming week - Western

areas will be dry biased - Recent

rain in the east has improved soil moisture to some crop areas - Central

America precipitation will slowly increase during the next couple of weeks

- the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +20.07 and it has likely peaked and will slowly decline over the coming week

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in the north next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

export inspections – corn, soybeans, wheat, 11am - Cotton

market outlook by International Cotton Advisory Committee - U.S.

crop progress and planting data for corn, soybeans and cotton; winter wheat condition, 4pm - USDA

soybean crush, corn for ethanol, DDGS output, 3pm - Honduras,

Costa Rica monthly coffee exports - Australia

commodity index - HOLIDAY:

China, Malaysia, Indonesia, Hong Kong, Singapore, Thailand, Vietnam, Pakistan, Bangladesh, U.K.

Tuesday,

May 3:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment - HOLIDAY:

China, India, Malaysia, Indonesia, Singapore, Japan, Vietnam, Pakistan, Bangladesh

Wednesday,

May 4:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand commodity prices - HOLIDAY:

China, Japan, Malaysia, Indonesia, Thailand, Bangladesh, Pakistan

Thursday,

May 5:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Japan, Indonesia, South Korea, Pakistan

Friday,

May 6:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Statistics

Canada releases stockpiles data for barley, canola and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

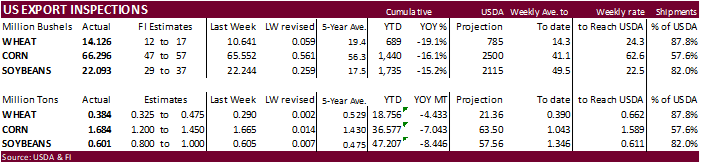

USDA

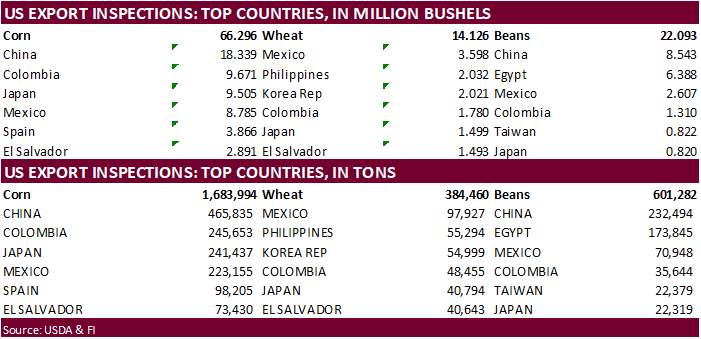

inspections versus Reuters trade range

Wheat

384,460 versus 225000-500000 range

Corn

1,683,994 versus 1000000-1775000 range

Soybeans

601,282 versus 500000-1000000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 28, 2022

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/28/2022 04/21/2022 04/29/2021 TO DATE TO DATE

BARLEY

73 0 499 10,156 33,143

CORN

1,683,994 1,665,105 2,211,277 36,577,009 43,620,219

FLAXSEED

0 0 0 324 509

MIXED

0 0 0 0 0

OATS

0 0 0 600 6,514

RYE

0 0 0 0 0

SORGHUM

217,881 169,144 235,496 5,306,921 5,620,367

SOYBEANS

601,282 605,385 155,374 47,206,500 55,652,995

SUNFLOWER

288 384 0 2,260 0

WHEAT

384,460 289,607 533,203 18,755,678 23,189,100

Total

2,887,978 2,729,625 3,135,849 107,859,448 128,122,847

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

84

Counterparties Take $1.796 Tln At Fed Reverse Repo Op (prev $1.907 Tln, 92 Bids)

US

10 Year Yield Rises To 3%, Highest Since December 2018

US

ISM Manufacturing Apr: 55.4 (est 57.6; prev 57.1)

–

Prices Paid: 84.6 (est 87.4; prev 87.1)

–

New Orders: 53.5 (est 54.1; prev 53.8)

–

Employment: 50.9 (est 55.0; prev 56.3)

US

Construction Spending (M/M) Mar: 0.1% (est 0.8%; prev 0.5%)

·

WTI was lower this morning by more than $3.00/barrel but rebounded to trade about 53 cents higher by 1:42 pm CT.

·

USDA US corn export inspections as of April 28, 2022 were 1,683,994 tons, within a range of trade expectations, above 1,665,105 tons previous week and compares to 2,211,277 tons year ago. Major countries included China for 465,835

tons, Colombia for 245,653 tons, and Japan for 241,437 tons.

·

The USD was sharply higher (up 77 points by 1:45 pm CT).

·

StoneX estimated the Brazil 2021-22 second corn crop at 88.14 million tons, down from 91.9 million from their previous estimate. Conab is at 88.536 million tons for the second crop. The StoneX estimate brings the total corn crop

to 116.45 million tons, above Conab’s 115.60 million tons.

·

Traders should continue to monitor bird flu disease outbreaks as that could result in feed demand destruction.

·

We are already hearing of some potential switching from corn to soybeans if farmers are not able to get corn in by mid-May. Its early, but a reality for some Delta states.

·

Turkey apparently cancelled their local and international tender for 480,000 tons of wheat due to high prices.

·

Thailand is looking into suspend corn and wheat exports over an animal feed shortage, and ease corn import rules.

·

The EPA sent the White House US biofuel blending mandates today. It is not known the volumes are but are likely unchanged from December. Back then, the EPA would retroactively set total renewable fuel volumes at 17.13 billion

gallons for 2020. That was down from a previously finalized rule for the year of 20.09 billion gallons, set before the onset of the pandemic. It set volumes at 18.52 billion gallons for 2021 and 20.77 billion gallons for 2022.

Impact

of Higher Corn Prices On Feeding Cost of Gain and Net Returns for Cattle Finishing

Langemeier,

M. “Impact of Higher Corn Prices On Feeding Cost of Gain and Net Returns for Cattle Finishing.”

farmdoc

daily

(12):60, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 29, 2022.

Export

developments.

None

reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range

·

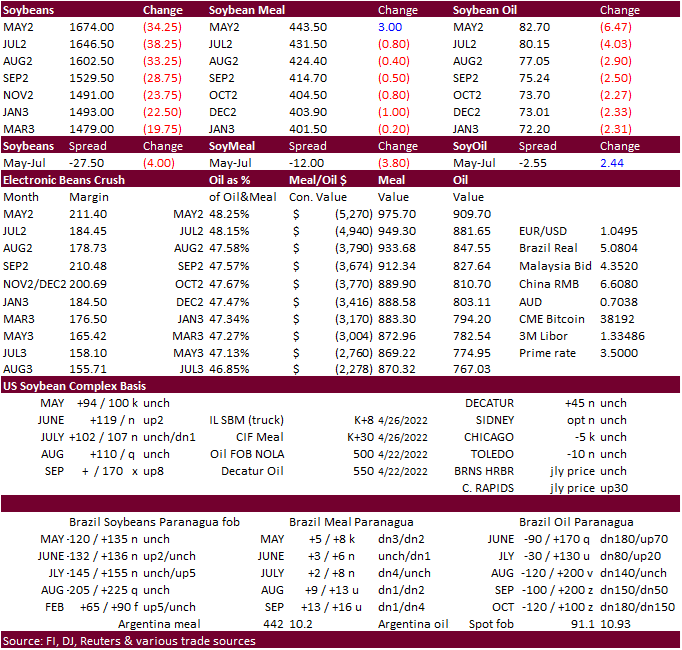

Soybeans, meal and soybean oil traded sharply lower in the non-expiring contracts in a risk off session, significant increase in the USD and lack of fresh news. Soybean oil and soybeans were down sharply while meal saw limited

losses. Traders were unwinding oil/meal spreads. US planting delays are leading some to think some corn acres will be switched to soybeans. China continues to implement strict Covid-19 lockdowns, hampering trade. WTI was lower this morning by more than $3.00/barrel

but rebounded to trade about 53 cents higher by 1:42 pm CT.

·

Funds sold an estimated net 21,000 soybeans, 2,000 soybean meal and 9,000 soybean oil.

·

The tank in soybean oil was thought to be from rumors Indonesia lifting their palm export ban later this month.

·

Malaysia and China were on holiday.

·

USDA US soybean export inspections as of April 28, 2022 were 601,282 tons, within a range of trade expectations, below 605,385 tons previous week and compares to 155,374 tons year ago. Major countries included China for 232,494

tons, Egypt for 173,845 tons, and Mexico for 70,948 tons.

·

StoneX estimated the Brazil 2021-22 soybean crop at 123.4 million tons, above 122 million for their previous estimate. Conab is at 122.431 million tons, down from 138.153 million for 2020-21.

·

Gulf soybean oil basis fell 150 points to 350 over the July as of Friday, April 27, from the previous week.

·

With nearby soybean oil (July) down more than 400 points and basis around 350 at the Gulf, I would not discount export announcements this week.

·

AmSpec reported April Malaysian palm oil exports at 1.113 million tons, down from 1.292 million tons for March. ITS reported 1.136 million tons, down from 1.353 million during March.

·

Strategie Grains increased its forecast for EU’s sunflower crop to 10.7 million tons from 10.2 million tons last month due to governments allowing producers to sow on fallow land. If realized, that would be up 2.9% from 2021.

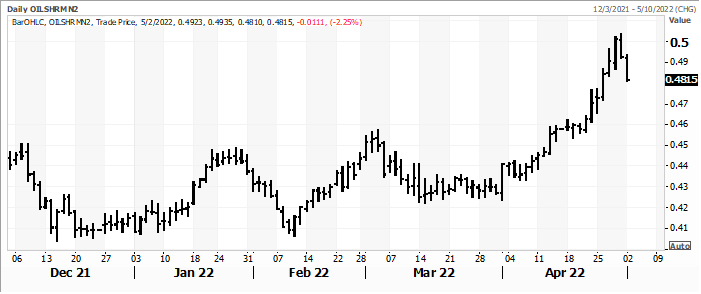

July

CBOT oil share

Source:

Reuters and FI

·

China looks to sell another 500,000 tons of soybeans from reserves on May 6.

Updated

4/22/22

Soybeans

– July $16.00-$18.50

Soybeans

– November is seen in a wide $12.75-$16.50 range (unchanged, up $1.00 high end)

Soybean

meal – July $420-$5.20

Soybean

oil – July 75-90

·

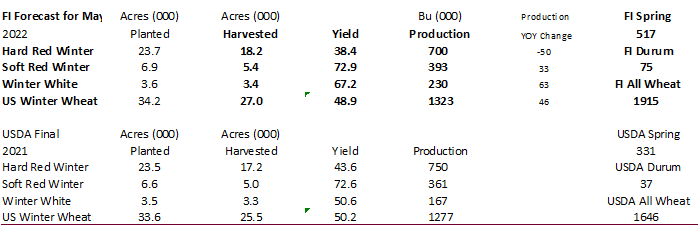

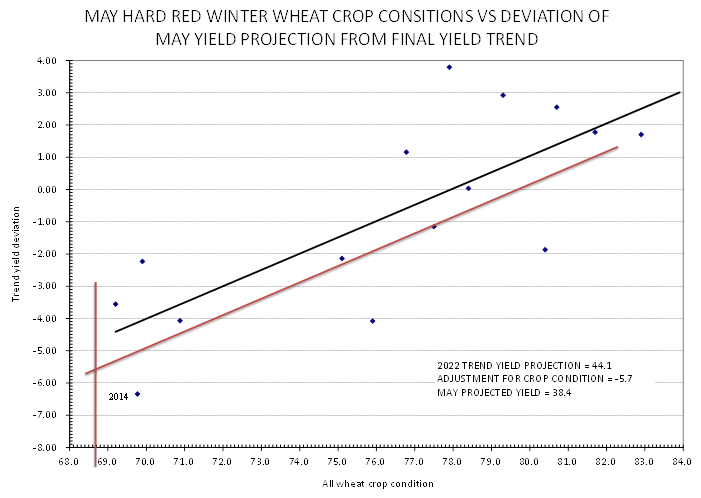

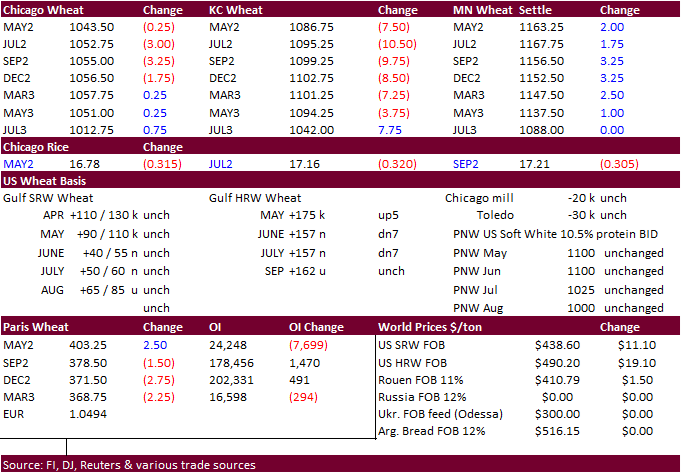

US wheat futures started lower from macro influences, lower USD and rain expected for parts of the Great Plains this week but turned higher for some markets to end mixed for Chicago, lower for KC and higher for Minneapolis. There

was likely spreading between soybeans (selling) and wheat. There are three more rain events possible over the next ten days that could improve winter wheat conditions. The next two weeks will be very important for wheat production ahead of the upcoming harvest.

·

Funds sold an estimated net 2,000 Chicago wheat contracts.

·

USDA US all-wheat export inspections as of April 28, 2022 were 384,460 tons, within a range of trade expectations, above 289,607 tons previous week and compares to 533,203 tons year ago. Major countries included Mexico for 97,927

tons, Philippines for 55,294 tons, and Korea Rep for 54,999 tons.

·

The euro was lower, but September Paris wheat futures settled down 1.50 euros to 377.50 .

·

Ukraine’s president Volodymyr Zelenskiy warned Ukraine could lose tens of millions of tons off grain (exports) due to the blockade. There are reports of Russian targets on Ukraine grain infrastructure.

·

India’s weather is threatening wheat production. March was the hottest in 122 years. The government warned production could be down 6 percent from their initial estimate.

·

India has yet to update their estimates for grain production but in mid-February the government pegged a record high 111.32 million tons of wheat, up from the previous year’s 109.59 million tons. Now some think the production

could be much lower than that, and exports could be eventually capped. India exported a record 7.85 million tons in the fiscal year to March, up 275% from the previous year. Before the hot spell India could have potentially exported 12 million tons of wheat

for the 2022-23 fiscal year.

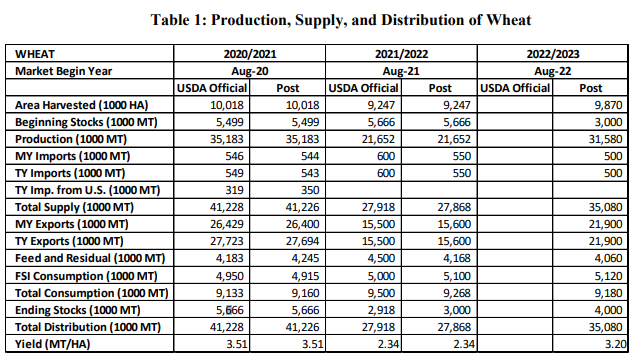

USDA

Attaché: Canada – Grain and Feed Annual

·

Turkey apparently cancelled their local and international tender for 480,000 tons of wheat due to high prices.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Jordan seeks 120,000 tons of wheat on May 11 for Jun/Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago

– July $10.50 to $12.50 range, December $8.50-$12.50

KC

– July $10.25 to $12.50 range, December $8.75-$13.50

MN

– July $10.75‐$13.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.