PDF Attached

Outside

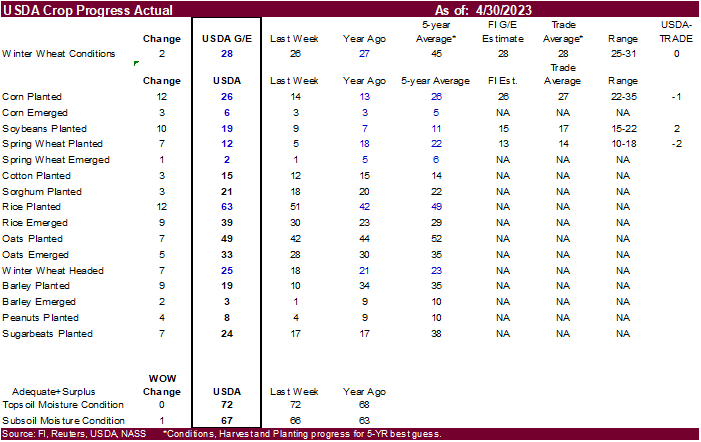

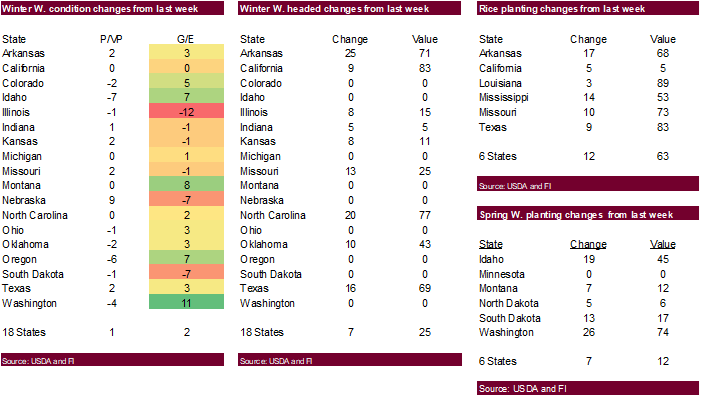

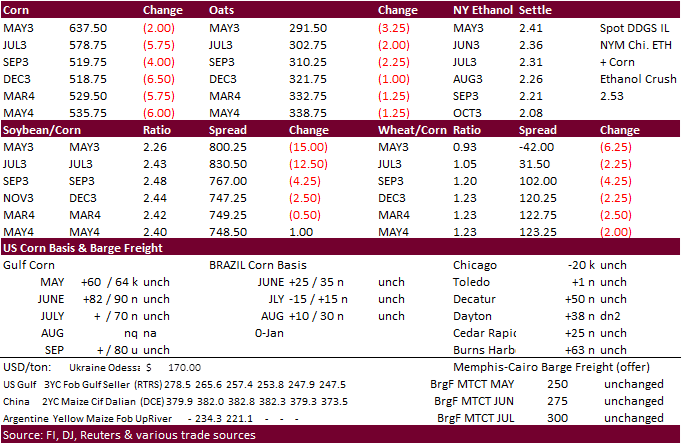

commodity influence sent most contracts lower for soybeans, corn and wheat. Bear spreading was a feature for soybeans while new crop corn saw selling after USDA reported a good increase in US corn plantings as of Sunday. US wheat traded two-sided and were

mostly lower for the day after USDA reported the combined G/E categories up two points to 28 percent from the previous week. US corn plantings were 26 percent, one point below expectations. With a quarter of the corn crop in the ground, look for the trade

to focus more on germination and development over the next couple of weeks. Soybean plantings were 19 percent, 2 points above expectations.

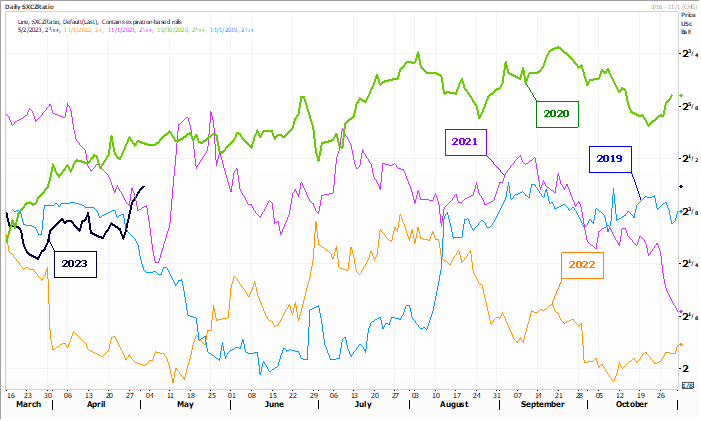

New-crop

soybean/corn ratio

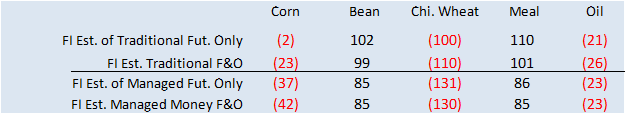

Fund

estimates as of May 2

-

Drought

in Alberta and western Saskatchewan is unlikely to abate during the next two weeks, despite a few showers possible

-

Unusual

warmth occurred in central Alberta Monday with an extreme high of 86 Fahrenheit; many temperatures were in the 70s and lower 80s

-

The

heat will continue into the latter part of this week and then a more seasonably warm temperature regime is expected -

Drought

will continue in Spain, Portugal and northwestern Africa through the coming week and perhaps longer -

Northern

Kazakhstan and southern parts of Russia’s eastern New Lands will continue dry and warm for another week, but some relief may come along in the May 10-16 period.

-

Dryness

has been supporting aggressive spring planting and does not (yet) pose much of a threat to long term crop development unless than pattern resumes later this month or this summer -

U.S.

Midwest excessive wind, cold and showery weather that occurred over the past two days will subside today and should not return again for a while -

Some

structural damage has occurred because of the wind, but the impact on agriculture has been low outside of some delay to farming activity -

West

Texas cotton, corn and sorghum areas will begin receiving some showers and thunderstorms tonight and the precipitation will occur periodically over the next couple of weeks -

A

general soaking of rain is not likely, but these frequent scattering of showers and thunderstorms will bring moisture to the atmosphere which is absolutely necessary if there is ever going to be a greater rain event

-

Texas

Blacklands, Coastal Bend and to a lesser degree South Texas will have opportunity for generalized rain during the coming ten days favoring long term crop development -

Some

of this rain will reach into Louisiana favoring sugarcane and rice areas for rain as well -

Red

River Basin of the North moisture profile will remain abundant to excessive for a little while longer due to rain expected Friday into early next week when 0.30 to 1.00 inch of moisture is expected with local totals to 1.50 inches falls over the already moist

topsoil -

River

flooding continues along the upper half of the Mississippi and in the Red River Basin of the North and this process will continue through much of this month -

Prevent

plant is a possibility for a part of these region’s and in Manitoba Canada, but much will be determined by rainfall that occurs later this month and in June -

A

significant break from rain is needed along with warm temperatures to get fields in better shape for planting -

U.S.

Delta will be plenty moist over the next ten days keeping some farming activity a little slow -

U.S.

southeastern states will see alternating periods of rain and sunshine through the next two weeks maintaining good crop development conditions, but slowing fieldwork at times -

Argentina’s

drier bias will continue over the next ten days maintaining a good summer crop maturation and harvest outlook, but a big boost in soil moisture is needed for winter wheat planting -

Wheat

planting does not usually begin until late this month and June is the most important month for getting crops planted on time -

Center

south and center west Brazil is drying down, but that is normal for this time of year -

Concern

remains over long term soil moisture for the late planted corn -

Rain

will be needed in late May and early June to support the very latest planted crops through reproduction and filling -

Coffee,

citrus and sugarcane in Brazil are maturing favorably with some early harvesting already under way -

Coffee

and citrus production should be high this year while sugarcane yields may be off a little bit because of too much rain at times in the heart of the production region and late season dryness in the minor areas of the north -

Cold

weather will continue to impact northeastern Europe over the next week with the next coldest period of time coming up late this week into early next week

-

No

crop damage is likely except possibly to flowering fruit trees -

Europe

and the western CIS will receive frequent bouts of rain during the next ten days resulting in favorable soil moisture -

This

does not include the Iberian Peninsula or the eastern CIS New Lands where dryness is an ongoing concern -

India’s

weather will continue unsettled over the next ten days and additional waves of rain will impact variously parts of the nation, but big soakings of rain like that of this past weekend is not expected to occur again.

-

The

far north and extreme south will be wettest, though, at least for a while -

Field

working delays have occurred and some of the wettest areas have been suffering from quality declines -

Western

Australia has a very good opportunity for rain this weekend and again next week -

The

two moisture events should bolster topsoil moisture for improved wheat, barley and canola planting, emergence and establishment -

Other

areas in Australia will continue to experience favorable weather for summer crop harvesting and winter crop planting -

All

of eastern China’s agricultural areas will receive rain at one time or another during the next two weeks. -

East-central

and southeastern parts of the nation will be wettest, but the rain will be spread out enough to limit the incidence of flooding -

Crop

conditions should stay mostly favorable, although a little less rain is needed in rapeseed areas to protect crop quality -

Xinjiang,

China continues to battle periods of cool weather and needs to warm up and be consistently warm to support cotton, corn and other crop development.

-

Some

warming is expected this weekend into next week -

Mainland

areas of Southeast Asia are getting more routinely occurring showers and thunderstorms, but resulting rainfall has continued to be lighter than usual

-

Monsoonal

precipitation usually begins in the south late this month -

Indonesia

and Malaysia will continue to experience frequent bouts of rain over the next ten days – no area is expected to become too dry or excessively wet -

Philippines

rainfall will be timely, but there is need for greater rain in the north -

Middle

East soil moisture is greatest in Turkey, but there is need for more moisture in areas to the south and east -

The

environment is not critical, but cotton and rice would benefit from greater rain and improved soil moisture -

Wheat

production was mostly good this year -

South

Africa rainfall will be infrequent and light enough over the next ten days to support most late season crop needs while allowing some harvest progress to continue -

Cotton

areas from southern Mali to Burkina Faso need significant rain to support cotton planting and establishment in unirrigated areas -

Some

showers are possible during the second week of the forecast -

Drought

continues in central and western Mexico while recent rain in the east has improved crop and field conditions -

East-central

Africa precipitation will be sufficient to support favorable coffee, cocoa and, rice and sugarcane development as well as other crops -

Central

Asia cotton and other crop planting is under way and advancing relatively well with adequate irrigation water and some timely rainfall expected -

Today’s

Southern Oscillation Index was 0.49 and it should move erratically higher over the next several days

Source:

World Weather, INC.

Tuesday,

May 2:

- US

Purdue Agriculture Sentiment - Malaysia’s

April 1-30 palm oil exports - New

Zealand global dairy trade auction - HOLIDAY:

China,

Vietnam

Wednesday,

May 3:

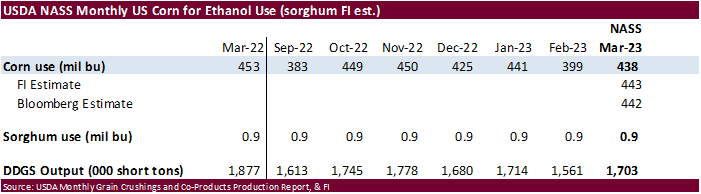

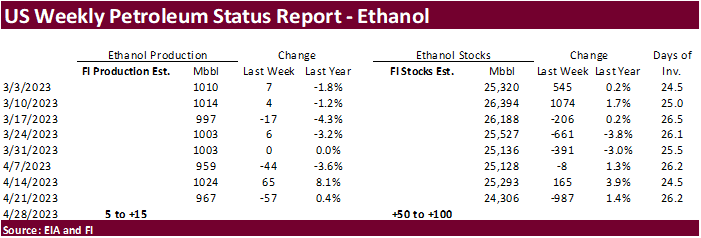

- EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

China,

Japan, Vietnam

Thursday,

May 4:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - New

Zealand Commodity Price - HOLIDAY:

Japan, Malaysia, Thailand, Bangladesh

Friday,

May 5:

- FAO

World Food Price Index - Malaysia’s

May 1-5 palm oil export data - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Japan, South Korea, Thailand

Source:

Bloomberg and FI

Soybean

and Corn Advisory

2022/23

Brazil Soybean Estimate Unchanged at 153.0 Million Tons

2022/23

Brazil Corn Estimate Unchanged at 123.0 Million Tons

2022/23

Argentina Soybean Estimate Unchanged at 23.0 Million Tons

2022/23

Argentina Corn Estimate Unchanged at 36.0 Million Tons

Selected

Brazil export data for the month of April.

Commodity

April 2023 April 2022

CRUDE

OIL (TNS) 5,259,390 4,446,938

IRON

ORE (TNS) 25,203,986 24,728,715

SOYBEANS

(TNS) 14,341,164 11,472,577

CORN

(TNS) 470,805 690,295

GREEN

COFFEE(TNS) 138,018 165,744

SUGAR

(TNS) 971,592 1,316,827

BEEF

(TNS) 110,339 157,360

POULTRY

(TNS) 408,278 386,510

PULP

(TNS) 1,577,720 1,709,151

Source:

Reuters per AgMin

Macros

US

Factory Orders (M/M) Mar: 0.9% (est 1.3%; prev -0.7%)

–

Factory Orders Ex-Trans (M/M): -0.7% (prev -0.3%)

US

Durable Goods Orders (M/M) Mar F: 3.2% (est 3.2%; prev 3.2%)

–

Durable Ex-Transportation (M/M): 0.2% (est 0.3%; prev -0.3%)

–

Cap Goods Orders Nondef Ex Air (M/M): -0.6% (est -0.4%; prev -0.4%)

–

Cap Goods Ship Nondef Ex Air (M/M): -0.5% (prev -0.4%)

US

JOLTS Job Openings Mar: 9.590M (est 9.736M; prev R 9.974M)

Crude-oil

production from OPEC members declined by 310,000 barrels per day in April, according to the latest Bloomberg survey of producers, oil companies and industry analysts.

102

Counterparties Take $2.267 Tln At Fed Reverse Repo Op. (prev $2.240 Tln, 103 Bids)

Brazil

Trade Balance Surplus April: $8.225 Bln (est $8.6 Bln)

U.S.

crude oil futures settle at $71.66/bbl,(dn) $4.00, 5.29 pct

·

Outside commodity markets such as WTI crude oil weighted on CBOT

corn futures. The back months lost ground against July as US corn planting progress advances and traders buying new-crop soybeans over new-crop corn.

·

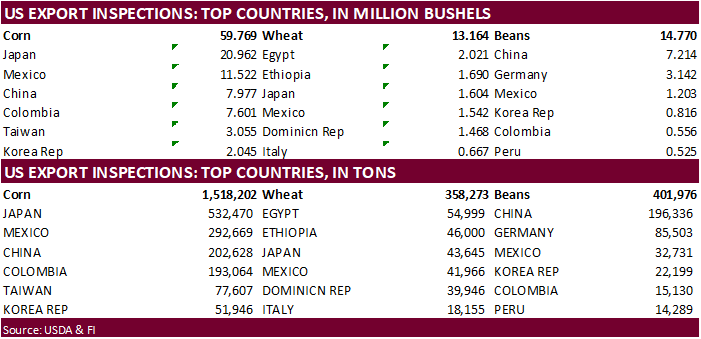

US corn shipments to China are starting to slow per USDA export inspections. Don’t discount additional corn cancelations this week.

·

US weather looks good over the next week for fieldwork progress.

·

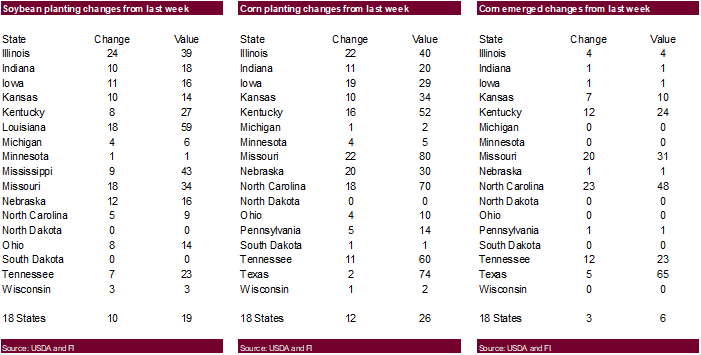

IA was 29 percent complete for corn plantings and IL 40 percent.

·

Some traders continue to point out the increase in global weather events for this summer as El Nino strengthens. There was talk about an increase in May through July Midwestern storms (high winds) and uncertainty over Black Sea

grain development.

·

Brazil see rain over the next week, benefiting second corn crop development.

·

Brazil 2022/2023 total corn crop seen at 131.59 million tons versus 131.34 million tons in previous forecast. Brazil 2022/2023 second corn crop seen at 100.8 million tons versus 100.54 million tons in previous forecast.

Export

developments.

·

None reported

Updated

05/02/23

July

corn $5.00-$6.50

December

corn $4.75-$6.50

·

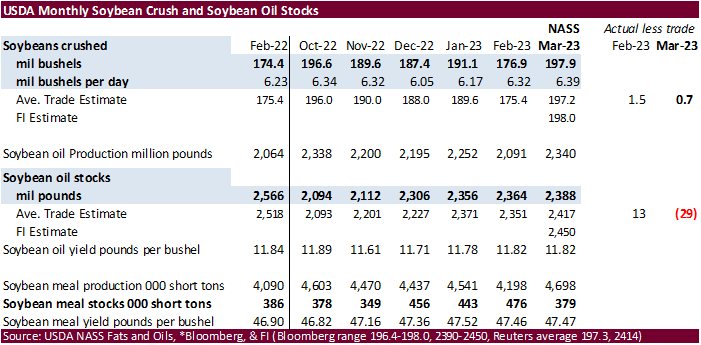

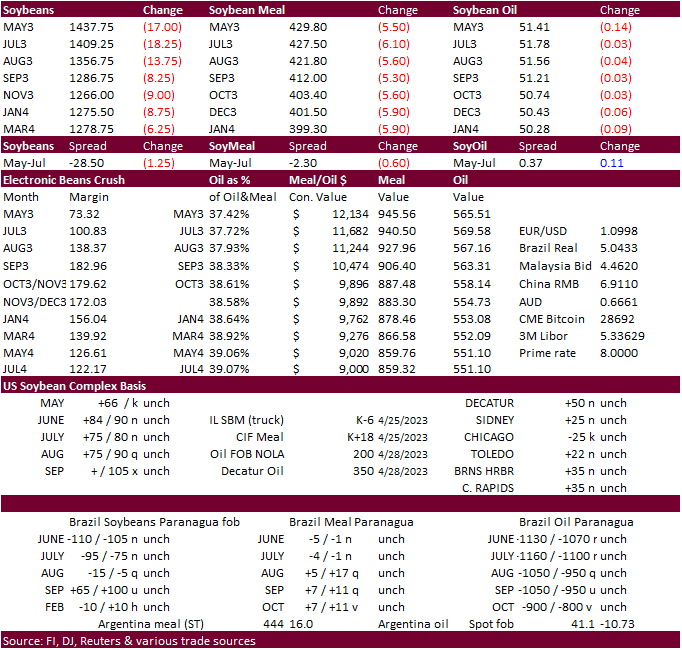

Soybeans, meal and oil were attempted to trade higher earlier but most contracts ended lower on widespread commodity selling. Soybean oil traded higher throughout much of the session but a large decline in US energy prices eroded

gains. Palm oil snapped a 6 session losing streak by trading about 2 percent higher. earlier that spilled over into CBOT soybean oil.

·

The US Midwest will gain see cooler than normal temperatures this week but it shouldn’t have a large impact on early crop development. Look for US soybean planting progress to accelerate this week. IL is already 39 percent done

and IA 16 percent.

·

Argentina grain and oilseed exports during the month of April amounted to 2.4 billion USD, down 23 percent compared to year earlier.

·

Conab reported Brazil soybean harvest progress as of April 29 at 93.7%, up 4.7 points from the previous week. Year ago, it stood at 94 percent. 64% of the summer corn harvest is complete, down from 68 percent year ago.

·

StoneX: Brazil 2022/2023 soybean crop seen at 157.7 million tons versus 157.7 million tons in previous forecast.

·

European Union 2022-23 season soybean imports reached 10.29 million tons as of April 30, down 12% from the 11.76 million in the same period of the previous season. Rapeseed imports so far reached 6.54 million tons, up 46% from

the 4.48 million tons year ago. Soymeal imports totaled 13.05 million tons, down 4% from 13.65 million tons from the prior season.

·

China returns from holiday on Thursday.

·

Malaysian palm oil shipments:

-

ITS:

1,176,432 (-261,642 or down 18.19%) vs 1,438,074 previous month -

AmSpec:

1,104,726 (-297,416 or down 21.21%) vs 1,402,142 previous month

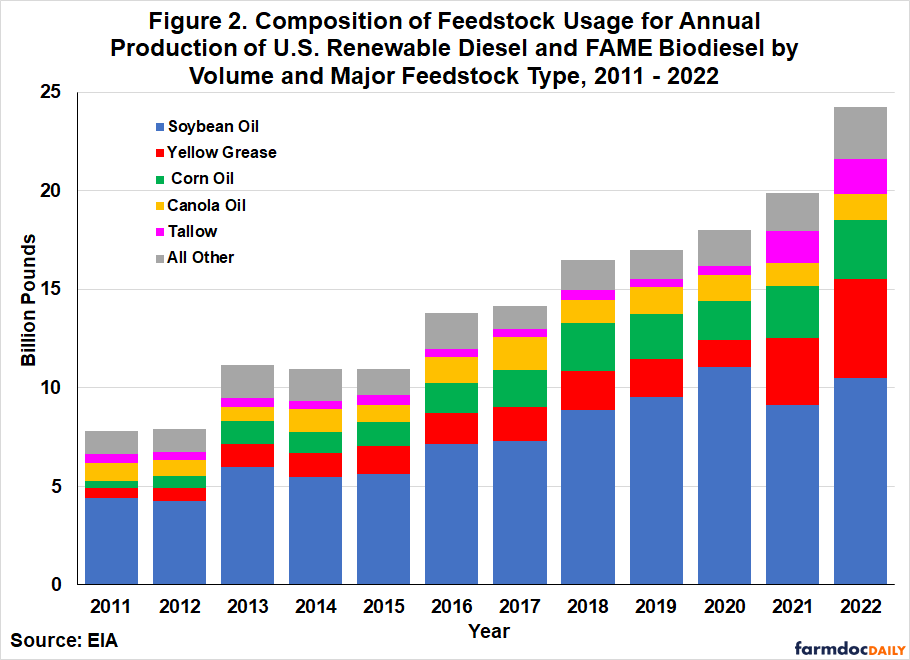

University

of Illinois: Renewable Diesel and Biodiesel Feedstock Trends over 2011–2022

Gerveni,

M., T. Hubbs and S. Irwin. “Renewable Diesel and Biodiesel Feedstock Trends over 2011–2022.”

farmdoc daily (13):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 1, 2023.

Export

Developments

-

Result

awaited: USDA seeks 860 tons of vegetable oil in 4 liter cans for use in export programs. Shipment was scheduled for Jun 1-30 (June 16 to July 15 for plants located at ports).

Updated

04/27/23

Soybeans

– July $13.50-$14.75, November $12.00-$15.00

Soybean

meal – July $375-$500, December $325-$500

Soybean

oil – July 48.50-54.00,

December 48-58

·

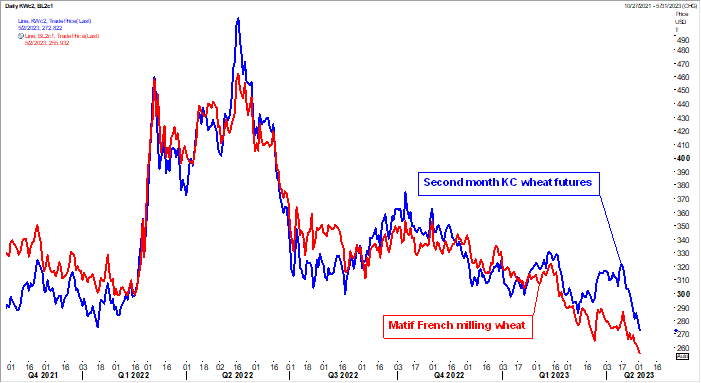

US wheat futures traded lower led by high protein wheat in part to improving North American weather. Multi month lows in Chicago limited losses. Chicago wheat hit its lowest level since April 2021. KC wheat fell to its lowest

level since October 2021.

·

Look for Black Sea headlines to possibly move grain market prices this week as the expiration of the grain export deal is a about a week away.

·

September Paris milling wheat officially closed down 6.75 euros, or 2.9%, at 230.00 euros a ton (about $252.90/ton).

·

April Ukraine grain exports totaled 3.62 million tons compared with 923,000 tons year earlier. 2022/23 season stood at 41.6 million tons as of May 1, including about 14.4 million tons of wheat, 24.4 million tons of corn and about

2.5 million tons of barley.

·

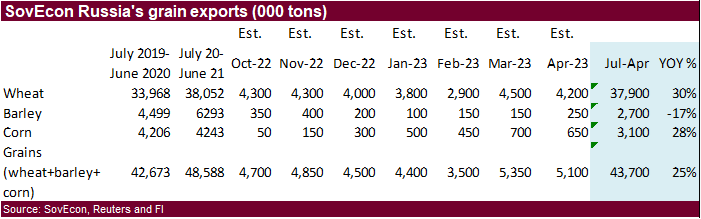

SovEcon sees 2022-23 Russian wheat exports at 44.4 million tons, 100,000 tons below previous.

·

Russia continues to threaten to pull out of the Black Sea grain deal, but the trade might be ignoring the threats as it seems to become a daily routine. May 18 is the deadline for the deal to expire.

·

As of late last week, Russian 12.5 percent protein wheat was quoted around 265/ton fob, about steady from the previous week.

·

StoneX sees large Russian wheat exports for 2023-24 despite a dip in production. Russia should have ample ending stocks for 2022-23.

·

EU soft wheat exports as of April 30 were 25.67 million tons, up 9% compared with 23.46 million a year earlier.

·

The European Commission officially set restrictions ibn Ukraine grain imports until June 5 for five countries (Bulgaria, Hungary, Poland, Romania and Slovakia).

·

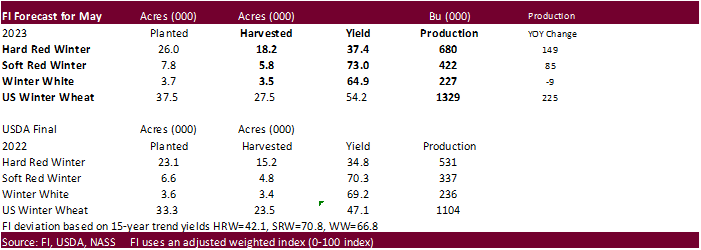

USDA’s May S&D reports will be released a week from Friday. Below is our US wheat by class estimates for the upcoming report. Note USDA will be releasing initial projections for the 2023-24 crop years.

Export

Developments.

·

Jordan bought 60,000 tons of wheat at $288.50/ton c&f for FH October shipment. On April 18 they paid $303 / ton for 50,000 tons of wheat for LH October shipment.

·

Egypt’s lowest offer for wheat was $260/ton fob, Russian origin.

·

Jordan seeks 120,000 tons of feed barley May 3 for October through FH November shipment.

Rice/Other

·

Rice registrations fell 10 lots.

·

(Reuters) – Vietnam’s rice exports in the January-April period are estimated to have risen about 43.6% from a year earlier to 2.96 million tons, government data showed on Saturday. Revenue from rice exports in the period is seen

up 54.5% at $1.6 billion. April rice exports from Vietnam, one of the world’s leading shippers of the grain, were estimated at 1.1 million tons, worth $574 million.

·

Sugar fell for the second day on talk of a good Brazil production.

·

(Reuters) – The global sugar market is heading to a smaller supply surplus of 1.1 million tons in 2022/23 (Oct-Sept) from a March estimate of 2.5 million tons surplus, after frustration with crops in areas such as India, Mexico

and the European Union. According to projections released on Tuesday by broker and analyst StoneX in a presentation that is part of the New York Sugar Week, the situation is expected to improve only slightly in the new season (2023/24) to a global supply surplus

of 1.3 million tons. The broker’s sugar production projection for India, the world’s second largest producer, was cut to 32.8 million tons in the current season that ends in September from 34.1 million tons seen in March. India’s new crop (2023/24) was seen

basically stable at 32.5 million tons. StoneX does not see a recovery in India next season because planted area is expected to fall 4% and the country is seen increasing the diversion of sugarcane from sugar to ethanol production.

Updated

05/02/23

KC

– July $7.00-8.25

MN

– July

$7.00-8.50

#non-promo