PDF Attached

Two-Sided

trade for many markets with most agricultures futures ending on a lower note in part to technical selling and the US dollar pairing some of its earlier losses, despite slow US spring planting progress and a decline in US winter wheat conditions. The US will

significantly warm up next week after seeing a few rounds of precipitation events and below normal temperatures this week.

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

planting delays have been and will continue to be significant for a little longer as a few more days of rain impacts the Midwest, Delta and southeastern states - Returning

rain to the northern U.S. Plains and Canada’s southeastern Prairies is expected this weekend into early next week causing more delay in the resumption of spring fieldwork especially in North Dakota, northern Minnesota and Manitoba, Canada - Southwestern

Canada’s Prairies will continue to deal with dryness and drought raising worry over the long term outlook for crop development in the region - Some

showers may occur briefly late this week and into the weekend, but resulting rainfall will not be enough to seriously bolster soil moisture - U.S.

hard red winter wheat areas received welcome rain again Monday after parts of the region received it last weekend - The

southwestern Plains have been missing most of the rain, but there is potential for rain in those areas tonight and again Wednesday night - Rainfall

could be locally heavy in the drier areas of the southwest, but the precipitation will not be well distributed leaving many areas still in need of significant rain - Improving

soil moisture in Nebraska, northeastern Colorado and parts of both Kansas and Oklahoma recently and that which is expected into the end of this week will be great for inducing a little higher potential yield for winter wheat - The

moisture will also improve spring planting and emergence conditions - U.S.

West Texas cotton areas and those in southwestern Oklahoma will get some showers and thunderstorms tonight and Wednesday night resulting in some locally heavy rain and some risk of severe thunderstorms producing hail and damaging wind - Coverage

of measurable rain will be up from that of Sunday night, but there will still be many areas missed by the moisture and drought will continue - U.S.

Delta, southeastern states and the Pacific Northwest will experience a mix of rain and sunshine over the next ten days to two weeks - The

precipitation will be good for future crop development and fieldwork will advance around the moisture - Southwestern

U.S., including California, will not get much significant precipitation for a while. - Mexico

dryness will continue in the west and north which is not unusual for this time of year - Drought

has expanded in Mexico in recent weeks due to La Nina and a general lack of rain - Temperatures

have been very warm as well - Mato

Grosso and Goias, Brazil will continue to struggle with dryness during Safrinha corn and cotton reproduction and filling - Yields

are slipping lower and will continue to do so over the coming week - Not

much precipitation is expected for a while - Temperatures

are not excessively hot which has been helping to conserve soil moisture to some degree - Argentina

will continue to receive limited amounts of rain during the next ten days - Summer

crop maturation and harvest progress should advance well - Winter

wheat planting will occur later this month and especially in June at which time some timely rainfall will be needed especially in the drier western parts of the nation - Additional

heavy rain is expected in Santa Catarina, northern Rio Grande do Sul and parts of southern Parana, Brazil through Wednesday and then some much needed drying is expected for a little while - Rain

will return more aggressively during the early to middle part of next week

- Some

of these crop areas are too wet - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Quebec

and Ontario, Canada weather will be appealing for early season planting and winter crop development during the next couple of weeks - Canada’s

Prairies will turn quite warm and be dry during the balance of this week before rain and cooling evolve late this week and into the weekend

- Temperatures

in the 50s and 70s Fahrenheit are expected with a few lower 80s - India’s

hot weather will be abating over the next few days - The

recent heat pushed temperatures up beyond 115 degrees Fahrenheit causing stress to livestock and newly emerged cotton and other crops - Winter

crops were already maturing and being harvested leaving little new damage - Winter

crop yields have come downward because of late February and March heat and dryness, but little change has occurred recently - Livestock

stress has been high due to excessive heat and farming activity may have slowed due to some of the heat - Cooler

weather during the remainder of this week will benefit many crops and livestock - A

tropical cyclone will form in the Bay of Bengal over the next few days and could move toward the central or Upper east India coast with landfall possible during the early part of next week - Heavy

rain, flooding and excessive wind speeds may accompany the storm inland - Landfall

is possible along the middle or upper east coast of India - Europe

precipitation will occur periodically through the weekend and into next week supporting spring and summer crop planting and winter crop development - The

precipitation should favor the south half of the continent this week - Some

disruption to fieldwork will be possible periodically - Temperatures

in Europe and the western CIS are expected to be mild this week - Warming

is likely next week especially in Europe - Russia

will be coolest the remainder of this week - Western

Commonwealth of Independent States weather will include periodic bouts of rain, drizzle and some wet snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Net

drying is possible in the eastern Russia New Lands and in northern Kazakhstan into the weekend, but some rain will evolve next week

- Fieldwork

will advance a little slower than usual in some western areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - North

Africa rainfall over the next week will be sufficient to maintain a good outlook for winter crop development - Wettest

in northeastern Algeria and northern Tunisia - Southwestern

Morocco will be driest with only a few sporadic showers - Conditions

will be good for reproducing and filling winter crops - West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be infrequent and light over this coming week to ten days resulting in net drying conditions - Too

much moisture in recent weeks delayed harvesting and reduced cotton and some oilseed quality, but the situation has been and will continue improving - Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited and net drying is expected, but that is not unusual for this time of year - Some

much needed rain fell in western portions of the Yellow River Basin Wednesday offering some relief to dryness recently - Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Rain

in eastern Australia will occur periodically slowing some of the late harvest of cotton and sorghum, - The

moisture will be good for future wheat, barley and canola planting this autumn while not quite so welcome in summer crop areas where harvest progress is under way - Portions

of Kazakhstan have need for more moisture and the region should be closely monitored for dryness later this growing season - Not

much rain will fall this week, but the weekend and next week could trend a little wetter - Southern

portions of Russia’s Southern Region will get some needed rain varying from 1.00 to 3.00 inches in the next week to ten days - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Turkey,

Iran, Turkmenistan and northern Afghanistan will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines while a little erratic in the mainland crop areas during the next ten days - Overall,

crop conditions will remain favorable - Eastern

Mexico will receive sporadic showers over the coming week - Western

areas will be dry biased - Recent

rain in the east has improved soil moisture to some crop areas - Central

America precipitation will slowly increase during the next couple of weeks

- the

moisture will be good for most crops - Today’s

Southern Oscillation Index was +20.04 and it has likely peaked and will slowly decline over the coming week

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in the north next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

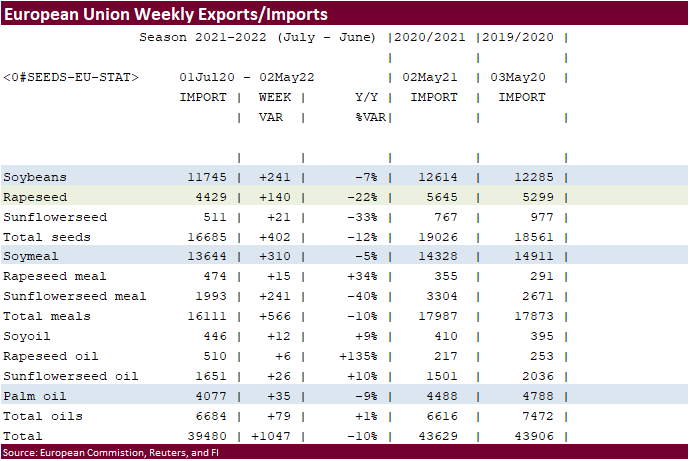

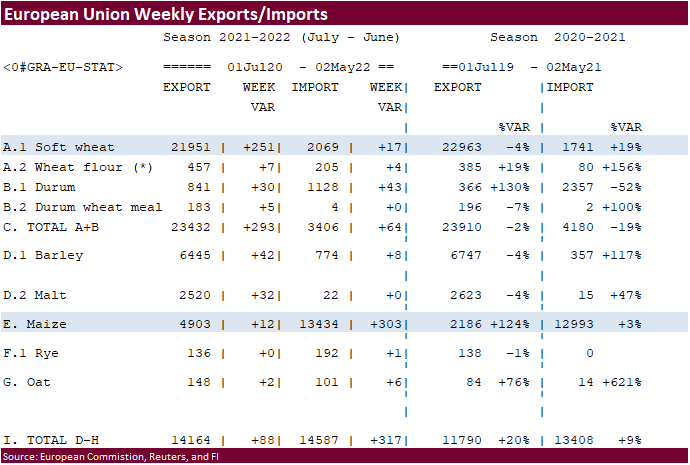

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - Purdue

Agriculture Sentiment - HOLIDAY:

China, India, Malaysia, Indonesia, Singapore, Japan, Vietnam, Pakistan, Bangladesh

Wednesday,

May 4:

- US

Trade Balance - EIA

weekly U.S. ethanol inventories, production, 10:30am - New

Zealand commodity prices - HOLIDAY:

China, Japan, Malaysia, Indonesia, Thailand, Bangladesh, Pakistan

Thursday,

May 5:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Japan, Indonesia, South Korea, Pakistan

Friday,

May 6:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Statistics

Canada releases stockpiles data for barley, canola and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

Soybean

and Corn Advisor

2021/22

Brazil Corn Estimate Lowered 5.0 mt to 107.0 Million Tons

Safrinha

Corn in Mato Grosso Impacted by Driest April in 17 Years

2021/22

Argentina Corn Estimate Unchanged at 49.0 Million Tons

2021/22

Brazil Soybean Estimate Unchanged at 123.0 Million Tons

2021/22

Argentina Soybean Estimate Unchanged at 40.0 Million Tons

US

Crude Oil Futures Settle At $102.41/Bbl, Down $2.76, 2.62%

Brent

Crude Futures Settle At $104.97/Bbl, Down $2.61 Or 2.43%

Central

Chinese City Of Zhengzhou Imposes New Covid Movement Curbs For May 4-10

US

JOLTs Job Openings Mar: 11549K (est 11200K; prev R 11344K)

US

Factory Orders (M/M) Mar: 2.2% (est 1.2%; prev R 0.1%)

–

Factory Orders Ex-Trans (M/M): 2.5% (prev R 1.0%)

US

Durable Goods Orders (M/M) Mar F: 1.1% (est 0.8%; prev 0.8%)

–

Durables Ex-Trans: 1.4% (est 1.1%; prev 1.1%)

–

Cap Goods Orders Nondef Ex-Air: 1.3% (est 1.0%; prev 1.0%)

–

Cap Goods Ship Nondef Ex-Air: 0.4% (prev 0.2%)

·

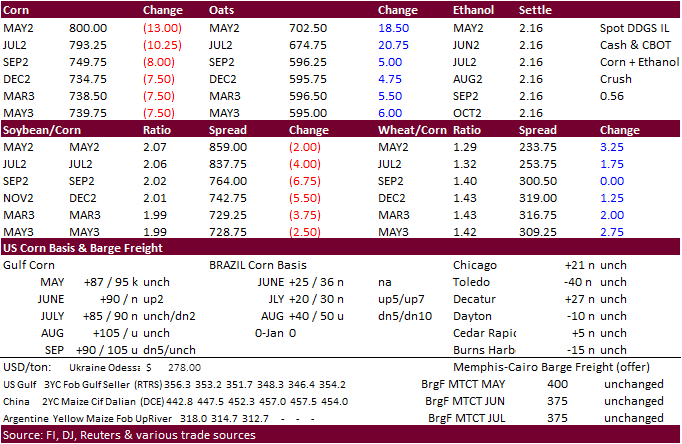

Corn futures traded two-sided, ending lower, despite lower than expected US corn planting progress (slowest since 2013 season). Corn plantings as of Sunday were 14 percent versus 33 average.

·

The charts look technically bearish and with the USD pairing some losses during the morning trade coupled with lower WTI, the trade saw some follow through selling.

·

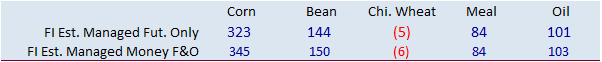

Funds were net sellers of an estimated net 12,000 contracts.

·

The Midwest will see locally heavy rain this week which could continue to hinder fieldwork progress.

·

US crude oil futures settled at $102.41/barrel, down $2.76 or 2.62%.

·

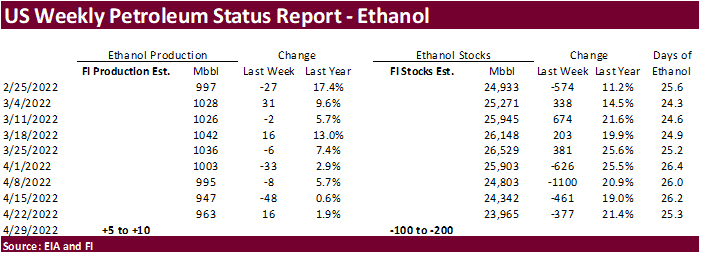

A Bloomberg poll looks for weekly US ethanol production to be up 3,000 barrels to 966 thousand (952-975 range) from the previous week and stocks down 58,000 barrels to 23.907 million.

Export

developments.

·

None reported

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range

·

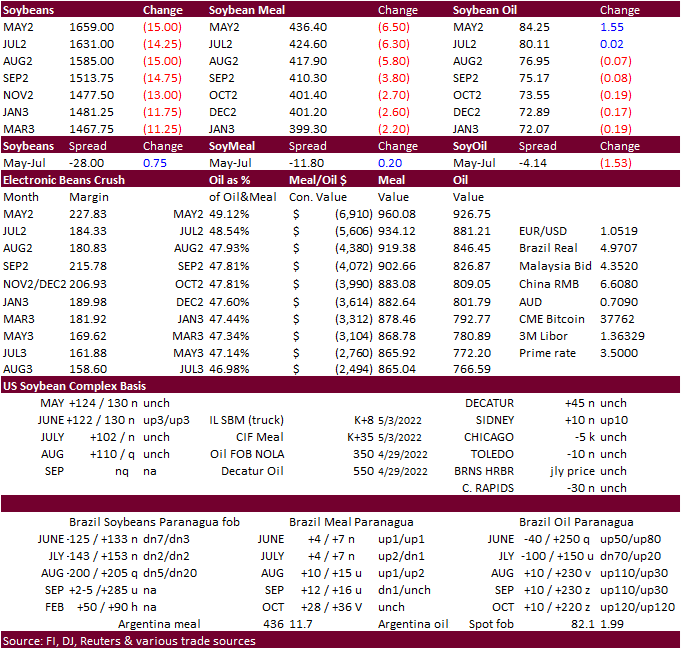

July soybeans fell to an April 8 low on fund selling and sharply lower soybean meal. The products saw a large two-sided range. The complex was higher at the electronic

overnight

close before trading choppy during the day. WTI crude oil was lower but that didn’t stop from soybean oil from ending higher.

·

Funds sold an estimated net 8,000 soybeans, sold 4,000 meal and bought 1,000 soybean oil.

·

Brazil’s AgMin warned high interest rates and securing Treasury resources for the upcoming 2022-23 season could affect funding for producers.

·

Anec: Brazil May soybean exports are seen at 8 million tons. Soybean meal exports were seen reaching 1.68 million tons.

·

(Bloomberg) — There is extensive dryness in parts of Europe including France, Bulgaria, the southern U.K. and northern Germany and Poland, forecaster Maxar says in a note.

·

China looks to sell another 500,000 tons of soybeans from reserves on May 6.

Updated

5/3/22

Soybeans

– July $15.75-$18.25 (down 25 cents)

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $400-$5.00 (down $20)

Soybean

oil – July 75-88 (unchanged, down 200 back end)

·

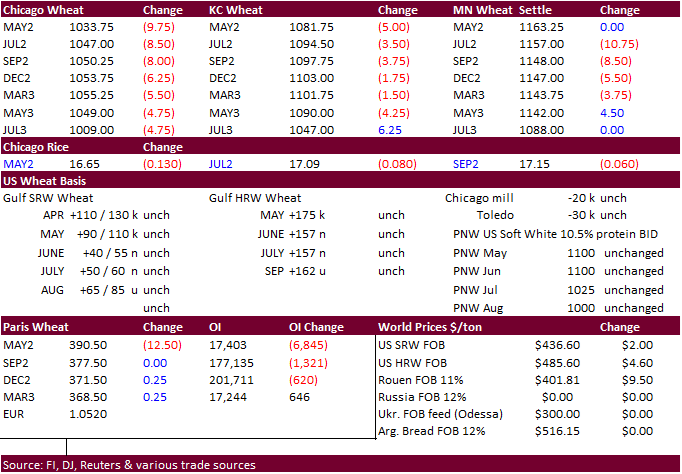

Sideways trading range in US wheat futures. Trading activity was quiet. US wheat ended lower despite a decline in USDA winter wheat ratings and slow spring wheat plantings (19 percent versus 28 average). US winter wheat crop conditions

are worst since 1996. Beneficial rain moving into parts of the Great Plains this week and that may have added to the negative undertone.

·

Funds sold an estimated net 4,000 SRW wheat contracts.

·

There has been no improvement in the Ukraine/Russian situation this week and now Russia is targeting Ukraine grain facilities and machinery. We heard a large silo in Ukraine’s Rubizhne region was destroyed this week.

·

APK-Inform warned Ukraine could see a grain harvest shortage crunch with slow exports. Grain and oilseeds stocks at the end of the current season might reach an all-time high of 21.3 million tons due to exports forecast at 45.5

million tons (86 million produced in 2021). The upcoming winter grain harvest would obviously add to the end of 2021-22 season stocks.

·

Ukraine is nearly a third complete with spring crop plantings, or 4.7 million hectares out of the 11.45 million, 3.5-4.0 million less than last year, according to UGA.

·

September Paris wheat futures were unchanged at 277.25 euros. May old crop was 12.50 euros lower.

·

EU soft wheat exports so far for 2021-22 season reached 21.95 million tons by May 1, compared with 22.96 million tons by the same week in 2020-21.

·

South Korea flour millers seeks 50,000 tons of milling wheat from the US on May 4 for shipment between June 16 and July 15.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Jordan seeks 120,000 tons of wheat on May 11 for Jun/Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago

– July $10.50 to $12.50 range, December $8.50-$12.50

KC

– July $10.25 to $12.50 range, December $8.75-$13.50

MN

– July $10.75‐$13.00, December $9.00-$14.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.