PDF Attached

Higher

trade on ongoing Brazil weather concerns and sharply higher ICE Canadian canola futures. Brazil’s second crop corn area will see net drying over the next 7-10 days.

![]()

Next

7 days

World

Weather, Inc.

MOST

IMPORTANT WEATHER OF THE DAY

- Northwestern

Iowa experienced a few significant freezes this morning with readings of 28 to 32 degrees Fahrenheit - Any

early emerged corn could have been negatively impacted, but the growing point was below the ground which should allow plant recovery to take place if any of the crop had emerged in that region - Frosty

conditions occurred in other parts of Iowa and the upper Midwest this morning, but the impact on corn and other early emerged crops should have been low - Argentina

experienced greater frost and freeze conditions this morning from southwestern Cordoba and eastern La Pampa into the heart of Buenos Aires - Most

of the freezes were limited to southwestern Cordoba, eastern La Pampa and far western Buenos Aires - An

extreme low of 28 Fahrenheit (-2C) occurred in southwestern Cordoba - World

Weather, Inc. does not believe there was much impact on crops, although faster crop maturation, leaf droppage and harvesting may result from the chilling conditions - Most

crops should have been sufficiently mature to handle frost and the number of freezes that occurred were low as was the duration of sub-freezing conditions which should have minimized the impact - Brazil’s

Safrinha crops will continue to dry down over the next ten days - The

pattern is normal for this time of year, but what is not normal was the early demise of soil moisture in April that has left late planted crops without sufficient moisture to support good yields – production cuts are inevitable

- Argentina

weather will be favorably mixed over the next two weeks with brief bouts of precipitation and periods of dry weather - Crop

maturation and harvest progress should advance well - Northwestern

U.S. Plains and southwestern Canada’s Prairies will experience much needed rainfall Friday into Saturday with moisture totals of 0.20 to 0.80 inch and local totals to 1.50 inches

- The

moisture will be ideal in lifting topsoil moisture for improved crop planting, emergence and establishment conditions - Most

of Saskatchewan (outside of the southwest) and Manitoba will remain quite dry over the next ten days favoring some fieldwork in areas that have favorable planting moisture, but rain will be needed soon to stimulate germination, emergence and establishment - Upper

U.S. Midwest will be drier biased in this first week of the two week outlook while the second week trends a little wetter.

- The

environment should prove beneficial as long as rain evolves next week as advertised.

- U.S.

Delta, lower Midwest and Tennessee River Basin will be a little too wet for a while - Drier

weather is needed to stimulate improved early season crop development and better field working conditions

- U.S.

southeastern states will experience a good mix of rainfall and sunshine during the next ten days maintaining a mostly good environment for crops - Some

rain delay will occur at times, however - West

Texas cotton areas will have an opportunity for rain Friday into Saturday of this week and next week with a few showers during mid-week next week, as well - Despite

the opportunities for rain, most of the precipitation will be a little too erratic and light for a serious bolstering of soil moisture

- Temperatures

will be seasonable this week, but could trend warmer than usual near and beyond mid-month - South

Texas rain chances may improve next week, but the area will continue drier biased for much of the next ten days - Far

western U.S. weather will continue drier biased for an extended period of time. - Brazil

is facing another ten days to two weeks of dry weather in its Safrinha - Europe

will receive waves of rain for the next ten days across some of the central and north improving topsoil moisture in some areas after recent drying - Southern

Europe will be drier the remainder of this workweek - Temperatures

will be cooler than usual in the north and near normal in the south - Temperatures

will trend warmer in eastern Europe next week - Several

waves of rain will impact western Russia, Belarus, the Baltic States and in a few areas of northern Ukraine during the coming ten days maintaining wet field conditions

- Farming

activity will remain restricted in these areas with rising concern over delayed spring planting in Russia - Good

field progress will occur farther to the south where much less precipitation is expected and temperatures will be more seasonable; including southern and central Ukraine and Russia’s Southern Region - Temperatures

will be cooler than usual in the wetter areas of the northwest. - Eastern

Russia New Lands will experience a dry and warm bias through the next two weeks - The

environment will eventually be great for spring planting - North

China Plain weather will be limited on precipitation for the next week and temperatures will be warming - A

steady decline in soil moisture is expected with temperatures trending warmer

- A

rising need for rain is expected later this month - Excellent

planting progress is anticipated for a while until dryness becomes more of an issue - Northeastern

China will experience frequent rain and mild to cool weather over the next week resulting in farming delays, but soil moisture will be bolstered for use later this spring - Southern

China rain will fall abundantly and frequently over the next couple of weeks limiting some farming activity and keeping the region saturated or nearly saturated - Some

local flooding will be possible at times - Australia

precipitation over the next two weeks will be sporadic and mostly light. - The

moisture will support some early season wheat, barley and canola planting, but follow up moisture will be needed - A

few sporadic showers may occur in other areas, but resulting rainfall will not likely be very great except in the Great Dividing Range of the east

- Temperatures

will be near to above average - South

Africa will receive some late season showers again Friday through the weekend

- Next

week will trend drier once again - The

environment will be good for harvesting and late season crop maturation - Production

this year has been very good for nearly all crops - Winter

wheat and barley planting should benefit from the moisture, although rain will soon be needed in the west - India

weather will remain good for winter crop maturation and harvest progress, although showers will continue periodically in some areas - Southern

India will be wetter than usual over the next couple of weeks and rain will also fall frequently from Bangladesh into the far Eastern States - Delays

to harvest progress will be greatest in the south - Showers

in northern India will not be great enough to be much of a factor to crop maturation or harvesting - No

tropical cyclones are present in the world today - Southern

Oscillation Index is mostly neutral at +0.49 and the index is expected to move a little higher over the next couple of the days, but stay mostly in a narrow range - Mexico

drought will continue during the next two weeks, although scattered showers will occur periodically in the east and far south with the south wettest.

- Next

week will be wetter than this week favoring the east half of the nation - Xinjiang

China’s cotton areas experienced mild temperatures and dry conditions Tuesday with warming likely today - Temperatures

will trend warmer again for the next couple of days and then cool off briefly Friday into Saturday and then heat up one more time before cooling again early to mid-week next week - Not

much rain is expected, although a few showers will occur next week in the northeast - Crop

development and additional planting are occurring favorably - North

Africa rainfall will receive erratic rainfall today and Thursday favoring Algeria and Tunisia where crop conditions will be good or getting better. Northwestern Algeria will see the lightest rain - Morocco

is not likely to see nearly as much rain and may experience net drying, but crops are in the best shape in northern Morocco and drying should not induce any harm.

- Southwestern

Morocco is still too dry, though - Most

of northern Africa will be drier biased late this week through much of next week - Temperatures

are trending warmer than usual - West-central

Africa will see a mix of rain and sunshine during the next ten days - Crop

conditions will stay good - East-central

Africa rainfall has been erratic in recent weeks and a boost in rainfall is coming to Kenya, Ethiopia and northern Tanzania during the coming week - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - Greater

rain is needed in the northern and western Philippines and in southern parts of central Vietnam and other mainland crop areas - New

Zealand precipitation for the next two weeks will be lighter than usual in North Island and eastern parts of South Island while moderate to heavy rain occurs along the west coast of South Island possibly inducing some flooding - Temperatures

were above average

Source:

World Weather, Inc.

Wednesday,

May 5:

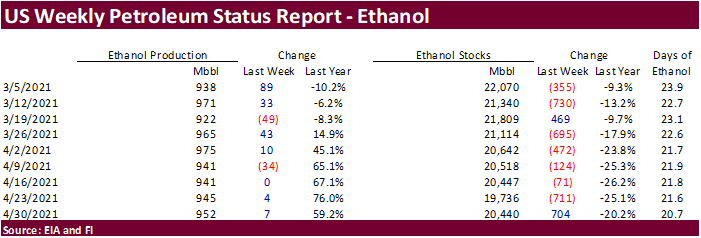

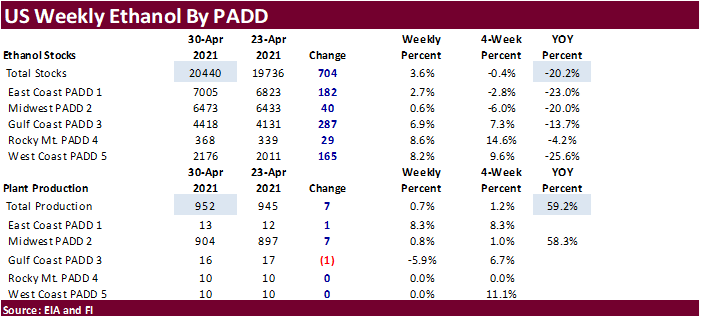

- EIA

weekly U.S. ethanol inventories, production - Malaysia

May 1-5 palm oil export data - New

Zealand Commodity Price - HOLIDAY:

Japan, China

Thursday,

May 6:

- FAO

World Food Price Index - USDA

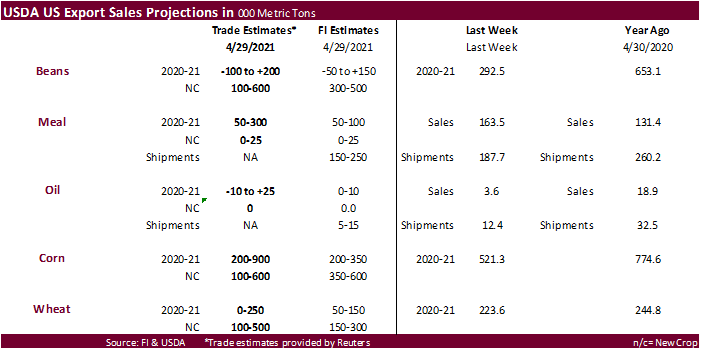

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

May 7:

- China

customs publishes trade data, including imports of soy, edible oils, meat and rubber - ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - CNGOIC

monthly report on Chinese grains & oilseeds - Canada’s

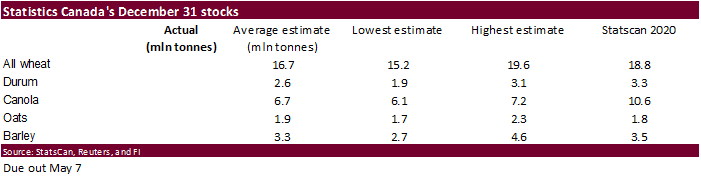

StatsCan to issue wheat, canola, barley and durum stockpile data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

IHS

Markit

Brazil’s

2020 corn production was reduced nine million tons to 95 million.

Argentina’s

2020 corn production was increased one million tons to 47 million.

Canada’s

2021 barley production was increased 1.1 million tons to 12.4 million.

Canada’s

2021 wheat production was reduced 1.1 million tons to 32.8 million.

Russia’s

2021 wheat production was increased three million tons to 80 million.

Ukraine’s

2021 wheat production was increased one million tons to 28 million.

Australia’s

2021 wheat production was increased one million tons to 26 million.

-Trade

as source

Macro

US

ADP Employment Change Apr: 742K (est 850K; prevR 565K; prev 517K)

Brazil

Industrial Production (Y/Y) Mar: 10.5% (est 8.5%; prev 0.4%)

Brazil

Industrial Production (M/M) Mar: -2.4% (est -3.0%; prev -0.7%)

US

Markit Services PMI Apr F: 64.7 (est 63.1; prev 60.4)

–

Composite PMI: 63.5 (est 62.2; prev 59.7)

US

DoE Crude Oil Inventories (W/W) 30-Apr: -7990K (est -2000K; prev 90K)

–

Distillate Inventories: -2896K (est -1300K; prev -3342K)

–

Cushing OK Crude Inventories: 254K (prev 722K)

–

Gasoline Inventories: 737K (est -731K; prev 92K)

–

Refinery Utilization: 1.1% (est 0.4%; prev 0.4%)

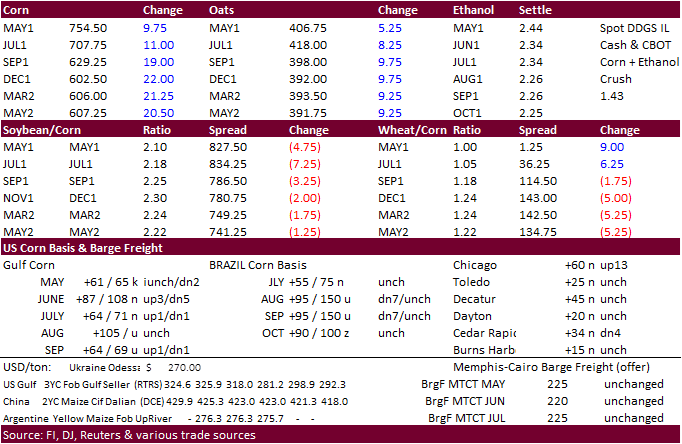

- CBOT

corn

spreading left front month contracts on the defensive on overbought conditions and a China cancelation of two old crop corn boats. July futures were able to test and establish a new contract high of $7.12. July ended at $7.0850, up 11.75 cents. December

rallied a large 24.25 cents to $6.0475. EIA ethanol data was neutral to slightly bearish. The bulk of the Brazil corn will enter the critical pollination stage next week but the weather forecast does not offer widespread rains, at least over the next week.

We are hearing estimates as low as 93 million tons. IHS Markit lowered their estimate by 9 million tons to 95 million tons. Brazil fob corn prices hit another record this week of over $305/ton. Aug was about $20-$30 lower.

- Datagro

sees 2020-21 Brazil corn production at 105.46 million tons from 109.3 million previously.

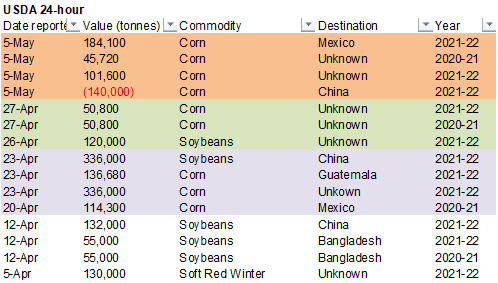

- USDA

announced cancellations 140,000 tons of corn export sales for delivery to China during the 2020-21 marketing year. Note there are 10.7 million tons of accumulated exports to China as of 4/22 and 12.5 million tons of outstanding sales. It’s reasonable to

say 2-3 million tons of corn commitments could be rolled into 2021-22. - We

are hearing some of the corn across the Delta might be ready for harvest second half of July.

- Funds

on Wednesday bought an estimated net 11,000 corn contracts. - The

weekly Broiler Report showed eggs set in the US up 10 percent from a year ago and chicks placed up 9 percent. Cumulative placements from the week ending January 9, 2021 through May 1, 2021 for the United States were 3.17 billion. Cumulative placements were

down 1 percent from the same period a year earlier.

Export

developments.

- USDA

reported the following activity by private exporters: - Export

sales of 184,100 tons of corn for delivery to Mexico during the 2021/2022 marketing year - Export

sales of 147,320 tons of corn for delivery to unknown destination. Of the total, 45,720 metric tons is for delivery during the 2020/2021 marketing year and 101,600 metric tons is for delivery during the 2021/2022 marketing year - Cancellations

export sales of 140,000 metric tons of corn for delivery to China during the 2020/2021 marketing year.

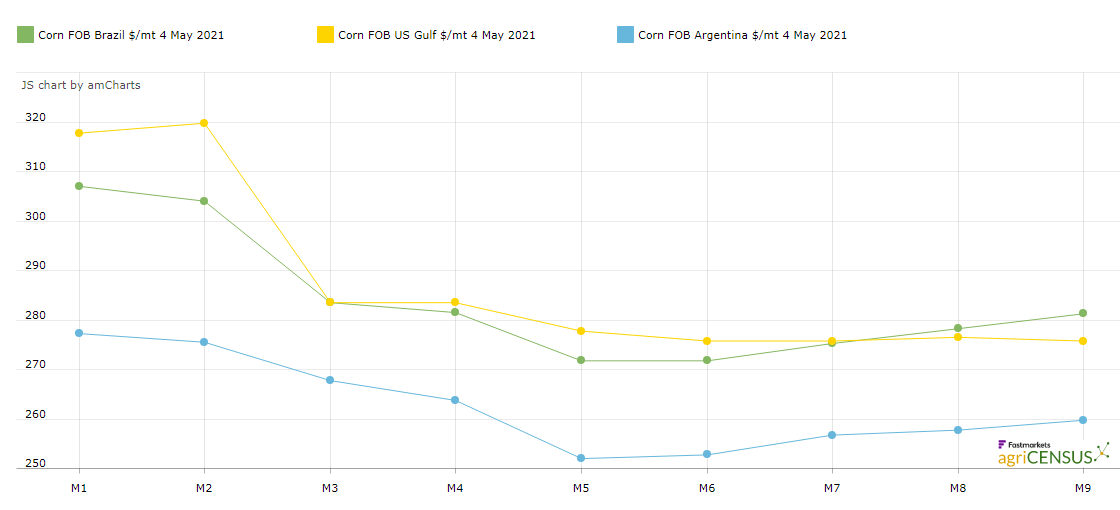

Forward

FOB corn – Brazil, US, & Argentina – M2 is July, M3 Aug, etc.

Source:

AgriCensus

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.00-$6.50 range.

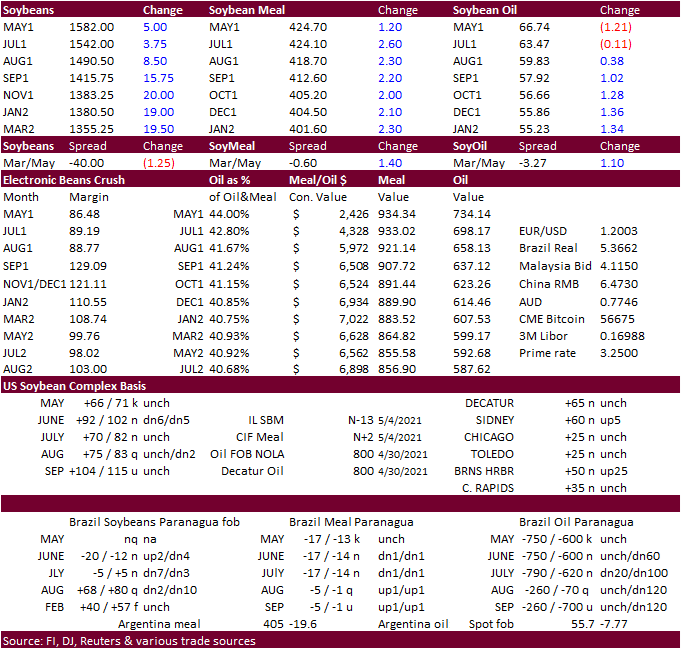

- The

CBOT soybean complex traded mostly higher in part to higher corn and strong ICE Canadian canola prices. Nearby soybean oil fell, including the July contract, from unwinding of bull spreads. US exports are slow due to the rise in SBO basis. Recall yesterday

Census reported March soybean oil exports below 160 million pounds, below expectations. July ICE canola was up $42.90 to 936.90.

- China

will be back from holiday Thursday. - Datagro

sees 2020-21 Brazil soybean production at 136.34 million tons from 135.47 million previously.

- Funds

on Wednesday bought an estimated net 4,000 soybean contracts, bought 3,000 soybean meal and sold 1,000 soybean oil.

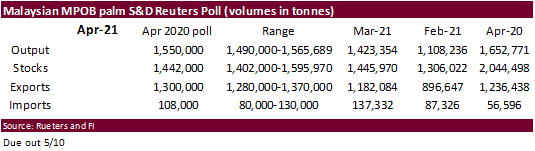

MPOB

SND poll April – Reuters Poll

April

stocks seen down 0.27% m/m at 1.44 mln T

Output

seen up 8.9% at 1.55 mln T – survey

Exports

seen up 10% at 1.3 mln T – survey

- Results

awaited: Algeria

seeks 30,000 tons of soybean meal on April 29 for shipment by June 15. - Results

awaited: Tunisia seeks 27,000 tons of soybean oil and/or rapeseed oil for late June / early July shipment.

Updated

4/26/21

July

soybeans are seen in a $14.75-$16.50; November $12.75-$15.00

Soybean

meal – July $400-$460; December $380-$460

Soybean

oil – July 56-70; December 48-60 cent range

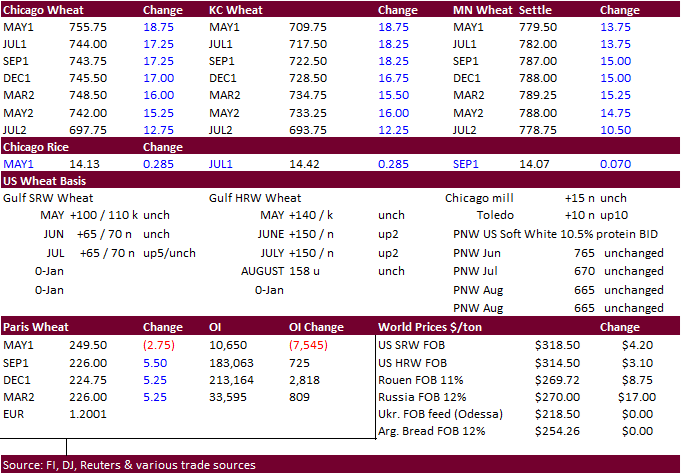

- US

wheat traded sharply higher from higher corn futures that are near an 8-year high. Fresh global import developments were also supportive. July MN wheat briefly hit a new contract high. Feed demand outside the US is expected to be strong through the end of

2021. - September

Paris wheat was up 5.75 euros to 226.00. - Funds

on Wednesday bought an estimated net 10,000 CBOT SRW wheat contracts. - Ukraine

grain exports fell 24 percent to 39 million tons since July 2020, including 15.13 million tons of wheat and 19.14 million tons of corn.

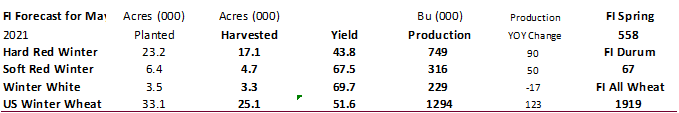

USDA

Attaché – India grain and feed

Export

Developments.

- Tunisia

bought 50,000 tons of optional origin animal feed barley at $278.15/ton c&f for shipment between June 5 and June 20 if from the Black Sea or slightly earlier if form Europe.

- The

Philippines bought about 60,000 tons of Australian wheat for June-July shipment at about $315 to $320 a ton c&f. They were in for 185,000 tons.

- Taiwan

Flour Millers’ Association seeks 89,425 tons US milling wheat on May 13. One consignment of 42,505 tons is sought for shipment between July 2 and July 16. A second consignment of 46,920 tons is sought for shipment between July 19 and Aug. 2. - Thailand

seeks up to 455,000 tons of animal feed wheat and 420,000 tons of feed barley on May 6 in seven consignments of 60,000 to 65,000 tons between June and December. The barley should be sourced from Australia only for shipments between June and December. - Bangladesh

seeks 50,000 tons of milling wheat on May 6.

Rice/Other

·

Results awaited: Offers low as $407.79/ton – Bangladesh seeks 50,000 tons of rice on May 2.

·

South Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

4/26/21

July

Chicago wheat is seen in a $6.75-$8.00 range

July

KC wheat is seen in a $6.60-$7.50

July

MN wheat is seen in a $7.15-$8.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.