PDF Attached

With

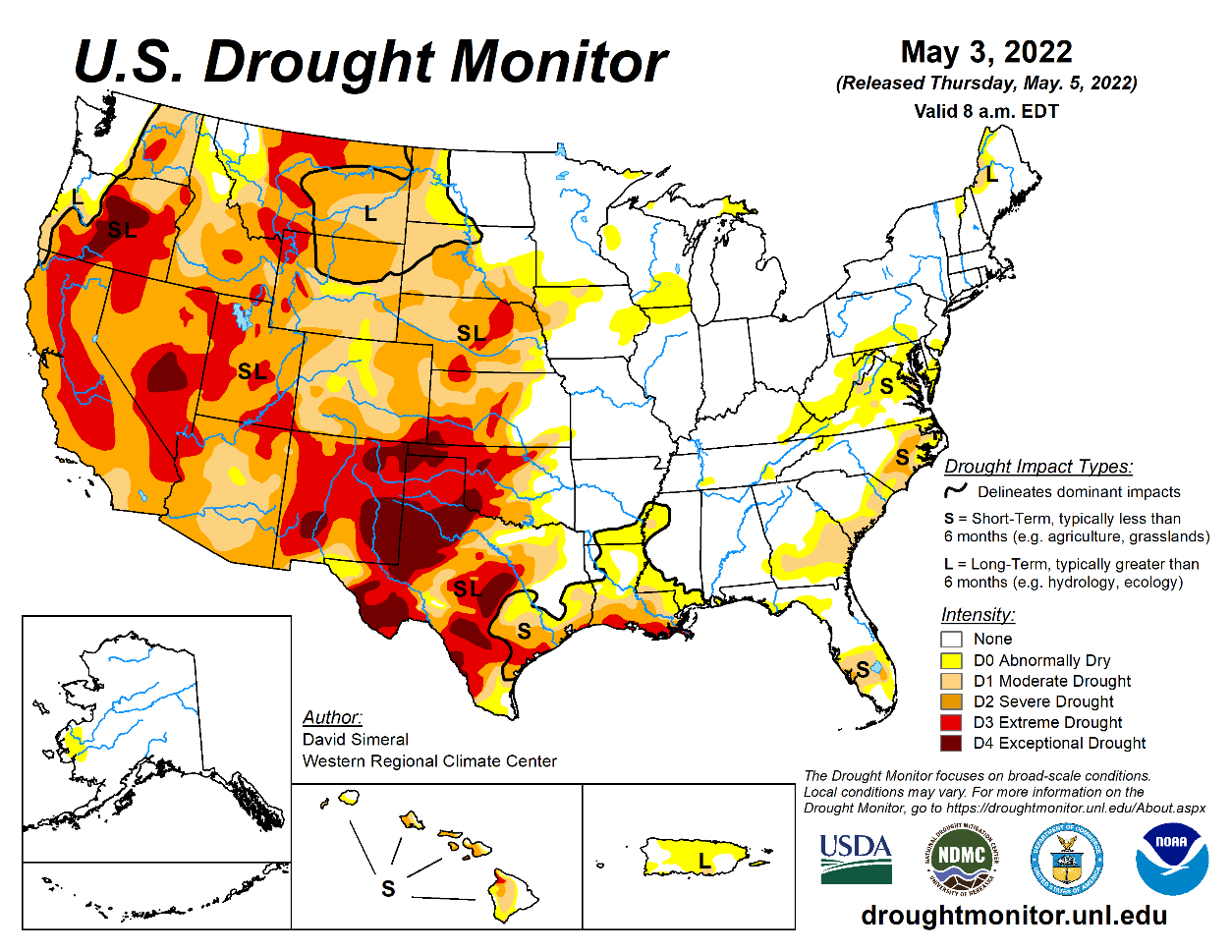

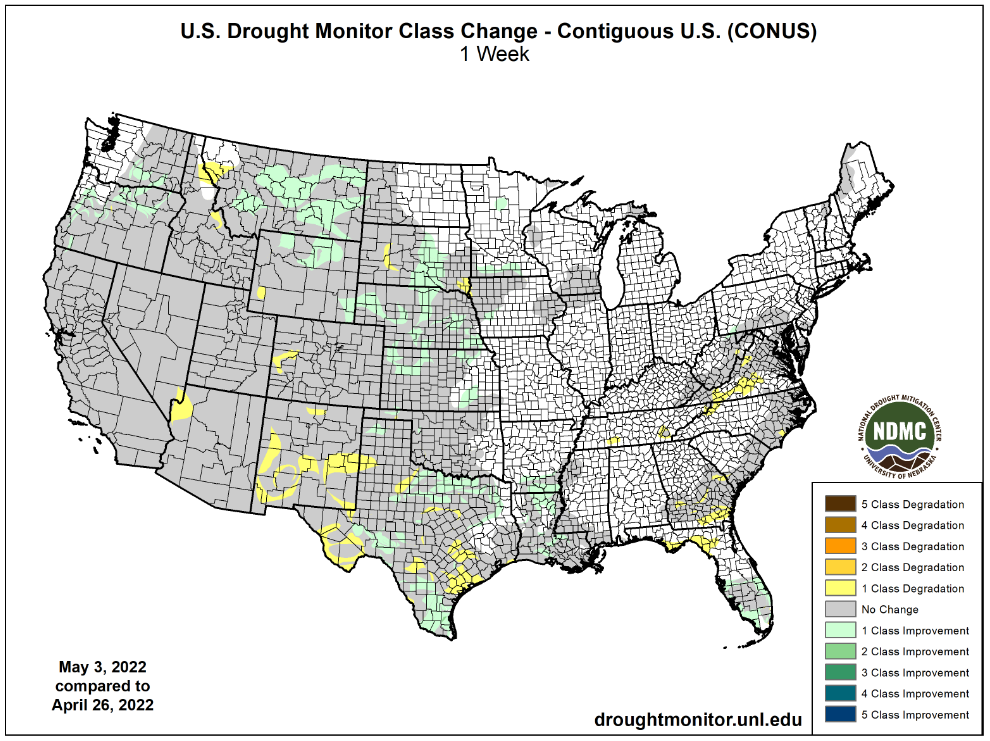

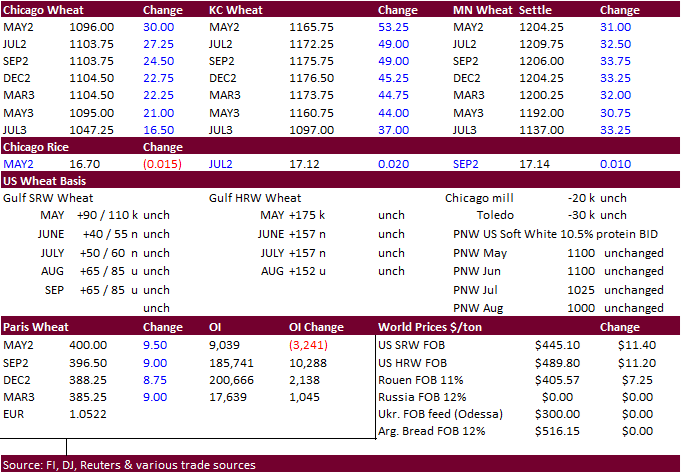

exception of soybean oil, US agriculture markets traded higher. The USD rallied more than 100 points. The US will gradually warm up during the balance of the week, including the southern Great Plains where net drying will occur, further deteriorating the HRW

wheat crop. There were no flash USDA 24-hour sales this morning.

![]()

WEATHER

EVENTS AND FEATURES TO WATCH

- U.S.

hard red winter wheat production areas experienced some rain Wednesday and early today, but the precipitation may have been a little lighter and less significant in western and central Kansas than expected - Precipitation

in the Texas Panhandle, eastern Colorado and western Nebraska was about as expected – sporadic and light - Temperatures

were mild to cool with afternoon temperatures in the upper 40s and 50s Fahrenheit in the northern half of the region while 70- and 80-degree highs occurred in Texas and southern Oklahoma - U.S.

rainfall Wednesday and early today was greatest from the southeastern one-third of Kansas and much of central and interior western Oklahoma into northwestern Arkansas and central Missouri - Some

rainfall totals varied from 1.00 to 3.00 inches with nearly 4 inches in the Green Mountains of Oklahoma - High

pressure is still expected to build over the central and eastern U.S. Midwest during the late weekend through most of next week - The

ridge will suppress rainfall and support warmer temperatures - Several

days of drying are expected with the best days for planting coming along in the second half of next week - Soil

conditions will be wet this weekend and it will take a few days to dry down - Temperatures

will rise into the 80s during the early to middle part of next week with a few extremes over 90 degrees Fahrenheit

- Farmers

could get aggressive in the fields for a few days, but more rain may come along the second weekend of the outlook - An

upper level low pressure center off the east coast of the U.S. this weekend will drift inland and will attempt to undercut the Midwest ridge of high pressure resulting in the potential for scattered showers at the end of next week - Resulting

rainfall should be light, but the moisture might interfere with some planting - U.S.

southeastern states will get rain Friday and Saturday followed by a drying trend - Limited

rain will fall in Florida, southern Georgia and southeastern Alabama through most of next week while some rain impacts the Carolinas and Virginia - U.S.

West Texas rainfall is expected along a nearly stationary frontal system that lies across the region for multiple days next week - Scattered

showers and thunderstorms will develop along the front in the high Plains region Tuesday night into Friday

- The

precipitation will be sporadic and very limited initially, but the chances for greater rainfall will increase as the week progresses and the frontal system lingers - U.S.

hard red winter wheat areas will experience restricted rainfall and warmer temperatures this weekend into early next week - Rain

chances will improve during the middle to latter part of next week from the Texas Panhandle into Nebraska with a few strong thunderstorms possible - U.S.

Northern Plains and eastern Canada’s Prairies and the upper Midwest will experience a boost in rainfall during the weekend and especially next week - Frequent

rain will prolong planting delays in North Dakota, Manitoba and neighboring areas - The

precipitation will expand the area impacted by delayed farming activity, but the moisture will be good in the northwestern Plains for future crop use - The

best drying conditions will occur today and Friday with some areas still drying Saturday - Temperatures

will trend warmer until Sunday and then will trend cooler through most of next week - Southwestern

parts of Canada’s Prairies will continue to struggle for moisture through the next week to ten days, although a few showers of light intensity are expected infrequently - Ontario

and Quebec, Canada will experience dry weather over the coming ten days inducing a much improved outlook for the start of spring planting - Winter

wheat development should be more aggressive as well - Temperatures

will turn much warmer - Argentina

is still expected to be dry during much of the coming ten days - Drying

is great for summer crop maturation and harvest progress - Rain

is needed for future wheat planting especially in the west - Brazil’s

Safrinha crops remain stressed in Mato Grosso and Goias - Rain

is possible sporadically early next week, but resulting rainfall should be a general disappointment with no serious bolstering of soil moisture outside of a few areas - Relief

from dryness would be temporary and mostly too brief to change the bottom line - Corn

has been more seriously impacted by dryness this season in Mato Grosso and Goias than anywhere else

- Cotton

in Mato Grosso has been stressed, but has likely performed much better than corn - Welcome

drying is expected in southern Brazil over the next ten days - Some

rain will linger over the next couple of days, but drying should occur thereafter improving crop conditions after a prolonged period of wet field conditions - Rain

fell Wednesday in Sao Paulo and Sul de Minas as well as Zona de Mata, Brazil coffee areas resulting in a little relief from recent dryness - The

moisture may have disrupted crop maturation and harvesting, but no serious impact resulted - The

region will trend drier again for a while - Some

showers may return briefly Tuesday through Thursday - Eastern

Australia will trend wetter next week - Queensland

and northern New South Wales may turn too wet - Excessive

rain and flooding may impact sugarcane areas along the lower Queensland and upper New South Wales coast - Too

much rain in unharvested cotton and sorghum areas may lead to crop quality issues – especially in cotton areas - Much

of the Queensland, Australia cotton has been harvested - New

South Wales cotton is most vulnerable to the wet weather because previous rain delayed field progress at times - Southern

Australia is waiting on more moisture to support winter wheat, barley and canola planting - Soil

moisture is rated well in central Victoria and briefly improved last week in South Australia - Western

Australia may get some rain during mid-week next week, but more will be needed - India

will continue seasonably warm to hot and dry through the next ten days in central and northern parts of the nation - No

further loss to winter crop production is likely - Northern

cotton areas are benefiting from less oppressive heat - Europe

is expected to turn warmer next week and that will accelerate drying especially in France and Germany where the need for precipitation is expected to rise most significantly - Europe

precipitation will occur periodically through the weekend and into next week supporting spring and summer crop planting and winter crop development - The

precipitation should favor the south-central part of the continent - Some

disruption to fieldwork will be possible periodically - Drying

is expected in western and northern Europe - Spain,

France and Germany are likely to become too dry relatively soon - Frequent

rain from the northern half of the Amazon River Basin through Colombia, western Venezuela and Ecuador to parts of Central America will induce local areas of flooding in the next ten days - Mexico

dryness will continue in the west and north into early next week which is not unusual for this time of year - Drought

has expanded in Mexico in recent weeks due to La Nina and a general lack of rain - Recent

rain in the east was welcome - Temperatures

have been very warm as well - Rain

will develop in central and eastern areas this weekend and prevail next week - A

tropical cyclone will form in the Bay of Bengal over the next few days and may move toward the upper east India and Bangladesh coasts with landfall possible next week, but today’s forecast models leave the storm over open water for quite a while allowing it

to weaken - The

storm needs to be closely monitored for possible impact on India, Bangladesh or Myanmar - Confidence

in landfall has been reduced today - Temperatures

in Europe are expected to trend warmer over the next ten days to two weeks - Temperatures

in western Russia will turn cooler next week - Frost

and freezes will return to some areas and lower soil temperatures may evolve over time - Western

Commonwealth of Independent States weather will include periodic bouts of rain, drizzle and some wet snow during the next ten days - Soil

moisture will continue rated adequate to excessive with areas from southern Belarus and northwestern Ukraine into the middle Ural Mountains region wettest and carrying the greatest need for drier weather - Net

drying is possible in the eastern Russia New Lands and in northern Kazakhstan into the weekend, but some rain will evolve next week

- Moisture

is needed in this region - Fieldwork

will advance a little slower than usual in some western areas because of wet field conditions and some occasional precipitation. Drier and warmer weather would be best in promoting fieldwork, but big changes are not very likely for a while - Southern

portions of Russia’s Southern Region are getting some needed rain and it will continue into the weekend

- Rainfall

will vary from 1.00 to 2.00 inches over that which has already occurred - Western

Kazakhstan will receive some dryness easing rainfall early next week - Most

of Kazakhstan and immediate neighboring areas of Russia are dry and need moisture - North-central

Kazakhstan may remain dry until possibly the second week of the forecast when some rain may fall - North

Africa rainfall over the next week will be most significant in eastern Algeria and Tunisia and it should diminish after being most significant this weekend

- Morocco

will be left mostly dry - Rain

will be good for late filling winter crops, but drying is important for the mature crop and its harvest later this month and next

- West-central

Africa rainfall is expected to be frequent over the next ten days maintaining a very good environment for coffee, cocoa, sugarcane, citrus and some cotton - A

boost in rainfall would be welcome in cotton areas - South

Africa rainfall should be infrequent and light over this coming week to ten days resulting in net drying conditions - Too

much moisture in recent weeks delayed harvesting and reduced cotton and some oilseed quality, but the situation has been and will continue improving - Crop

maturation and harvest conditions should improve - China

weather is expected to be relatively normal for this time of year, during the next ten days to two weeks - Rain

frequency will be greatest near and south of the Yangtze River - Precipitation

in the Yellow River Basin and North China Plain will be most limited, but some beneficial moisture is expected

- Heilongjiang

will also be wetter biased with precipitation both early this week and again during the weekend - Soil

temperatures are warm enough to plant spring wheat and sugarbeets in the northeast of China and warm enough for some corn planting across east-central parts of the nation. Fieldwork should advance around anticipated rainfall.

- China’s

rapeseed crops is in mostly good condition, but a close watch on rainfall is warranted because of the threat frequent rain might have on crop quality and harvest progress next month - Xinjiang,

China precipitation is expected to continue mostly in the mountains, but the precipitation will improve spring runoff potentials in support of better irrigation water supply - Eastern

Turkey, northern Iran and Turkmenistan and will be the wettest Middle East countries over the next ten days - Rain

is still needed in Syria, Iraq and neighboring areas to the south, although it is too late to turn around wheat production - Southeast

Asia rainfall is expected to be abundant in Indonesia, Malaysia and Philippines

- Overall,

crop conditions will remain favorable - Rain

is also expected to occur routinely in mainland areas of the Southeast Asia - Central

America precipitation will occur routinely during the next couple of weeks

- The

moisture will be good for most crops - Today’s

Southern Oscillation Index was +19.54 and it has likely peaked and will slowly decline over the coming week

- New

Zealand weather will be drier than usual during the coming week. Some rain will fall in the north next week

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - HOLIDAY:

Japan, Indonesia, South Korea, Pakistan

Friday,

May 6:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

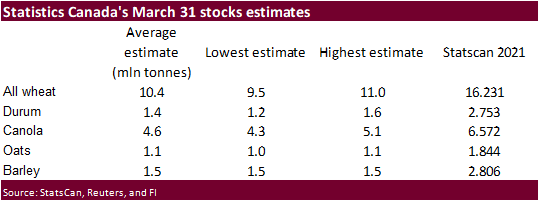

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Statistics

Canada releases stockpiles data for barley, canola and wheat - FranceAgriMer

weekly update on crop conditions - HOLIDAY:

Indonesia

Source:

Bloomberg and FI

USDA

Export Sales

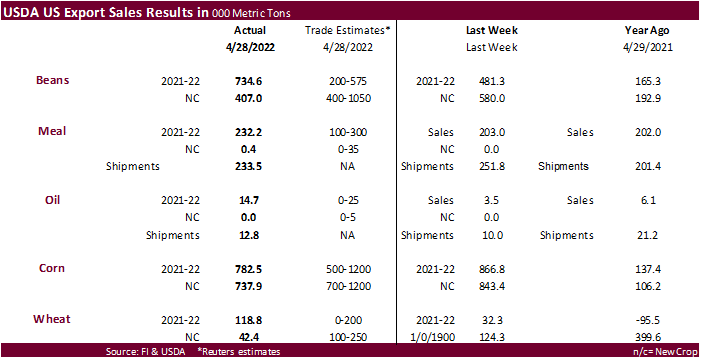

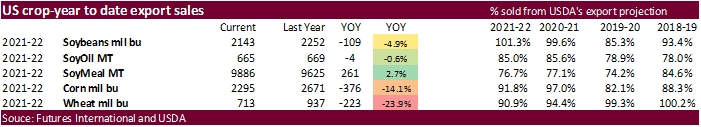

Most

within expectations. Old crop soybean sales were better than expected that included unknown destinations (316,700 MT), China (200,800 MT, including 66,000 MT switched from unknown destinations and decreases of 700 MT), and Egypt (68,800 MT, including 65,000

MT switched from unknown destinations and decreases of 300 MT).

Selected

Brazil commodity exports:

Commodity

April 2022 April 2021

CRUDE

OIL (TNS) 4,727,495 6,472,786

IRON

ORE (TNS) 24,858,386 25,618,380

SOYBEANS

(TNS) 11,575,350 16,114,936

CORN

(TNS) 702,777 130,876

GREEN

COFFEE(TNS) 165,744 207,170

SUGAR

(TNS) 1,325,905 1,788,939

BEEF

(TNS) 157,470 125,474

POULTRY

(TNS) 387,180 362,613

PULP

(TNS) 1,722,906 1,472,514

Macros

US

Initial Jobless Claims Apr 30: 200K (est 180K; prev 180K; prevR 181K)

US

Continuing Claims Apr 23: 1384K (est 1400K; prev 1408K; prevR 1403K)

US

Nonfarm Productivity Q1 P: -7.5% (est -5.3%; prev 6.6%; prevR 6.3%)

US

Unit Labor Costs Q1 P: 11.6% (est 10.0%; prev 0.9%; prevR 1.0%)

86

Counterparties Take $1.845 Tln At Fed Reverse Repo Op (prev $1.816 Tln, 87 Bids)

·

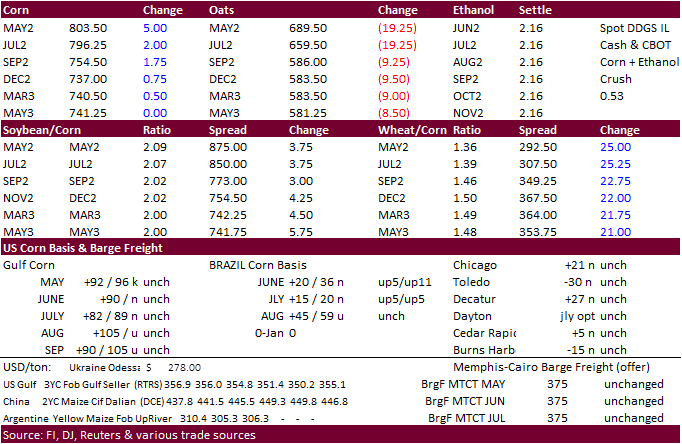

Corn futures traded two-sided, with July ending 3.25 cents higher on a late fund buying bull run. They started higher in part from strength in wheat but soybean/corn spreading and the USD extending its rally pressured corn futures.

US weather improves for US corn plantings this weekend into next week.

·

News was light despite China returning from holiday.

·

Funds bought an estimated net 1,000 contracts.

·

WTI crude oil (traded two-sided) was up $0.82 at the time this was written (2:06 pm CT), well off its intraday high. USD was down a large 113 points.

Export

developments.

·

None reported

Prevent

Plant and 2022 Acres: A Looming Issue

Zulauf,

C., G. Schnitkey, K. Swanson and N. Paulson. “Prevent Plant and 2022 Acres: A Looming Issue.”

farmdoc daily (12):63, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 4, 2022.

https://farmdocdaily.illinois.edu/2022/05/prevent-plant-and-2022-acres-a-looming-issue.html

Updated

4/22/22

July

corn is seen in a $7.25 and $8.65 range

December

corn is seen in a wide $5.50-$8.50 range

·

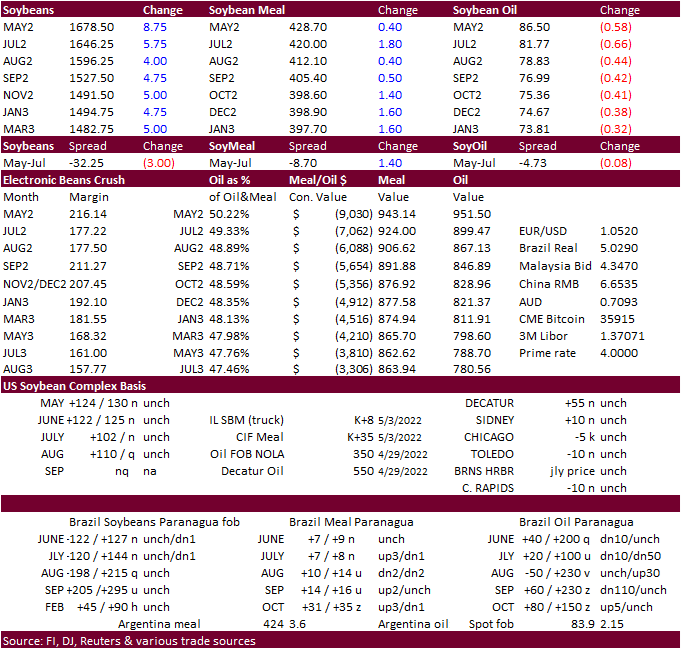

The soybean complex ended mixed with soybean oil lower (following palm) and meal and soybeans higher following strength in outside related markets and fund buying.

·

Brazil exported 11.575 million tons of soybeans during the month of April (we estimated 12.0 million tons), down from 16.115 million tons a year earlier. An early end to Brazil’s export campaign this season should shift business

to the US.

·

We lowered our Jan-Dec Brazil soybean export estimate from 78.9 million tons to 77.9 million, 900,000 above Conab’s April projection and compares to about 88 million for 2021.

·

Funds bought an estimated net 3,000 soybeans, bought 1,000 soybean meal and sold 3,000 soybean oil.

·

China and Malaysia were back from holiday. There were no 24-hour sales announcements.

·

Malaysian palm oil ended 352 ringgit per ton higher to 6,752, or 5%, and cash was down $40/ton at $1,750ton.

·

Malaysia May 1-5 palm oil exports were up 67% from the previous month, according to ITS.

·

Malaysian palm oil block trades were active on Thursday.

·

China looks to sell another 500,000 tons of soybeans from reserves on May 6.

Updated

5/3/22

Soybeans

– July $15.75-$18.25

Soybeans

– November is seen in a wide $12.75-$16.50 range

Soybean

meal – July $400-$5.00

Soybean

oil – July 75-88

·

US wheat futures saw follow through buying from the start on US weather and concerns India wheat exports will be limited next season due to lower than initially expected crop production. Adding to the bullish sentiment were registrations.

An additional 119 CBOT SRW wheat receipts were cancelled in Ohio Wednesday evening.

·

During the day session the USD extended gains, up more than 120 points by mid-morning, and that paired some of the gains in wheat futures. Until buy stops were hit in July Chicago around 11.07-11.17 am CT of about 2,000 contracts.

·

KC was the leader for all three markets. KC July settled 53.75 cents higher at $11.77/bu. Hot temperatures for the southern US Great Plains with limited precipitation in the forecast is supportive for KC type wheat.

·

Chicago July wheat reached its highest level since April 19 during the session and settled 30 cents higher.

·

Funds bought an estimated net 13,000 SRW wheat contracts.

·

September Paris wheat futures are up 9.00 euros to 398, a new contract high.

·

India will continue to see heat waves over the next 4-5 days across parts of the western state of Maharashtra and other wheat growing areas.

·

Ukraine’s deputy agriculture minister said the country has enough food stocks in the territories they still control to feed the population.

·

(Reuters) – Ukraine’s grain exports have reached 46 million tons so far in the 2021/22 July-June season, the agriculture ministry said on Thursday. The ministry said the volume included 132,000 tons exported in May. It did not

give a final figure for April but had exported 763,000 tons through April 29.

·

Tunisia state grain buyer bought 100,000 tons of optional origin soft wheat and 75,000 tons of feed barley for June and July shipment, depending on origin. The wheat was bought in four 25,000-ton consignments at an estimated $445.49,

$463.79, $458.68 and $444.68 all per ton c&f. The barley was bought in three 25,000-ton consignments at an estimated $436.68, at $438.49 and at $432.89 all per ton c&f.

·

Jordan seeks 120,000 tons of feed barley on May 10 for Aug/Sep shipment.

·

Jordan seeks 120,000 tons of wheat on May 11 for Jun/Aug shipment.

Rice/Other

·

None reported

Updated

4/22/22

Chicago

– July $10.50 to $12.50 range, December $8.50-$12.50

KC

– July $10.25 to $12.50 range, December $8.75-$13.50

MN

– July $10.75‐$13.00, December $9.00-$14.00

U.S. EXPORT SALES FOR WEEK ENDING 4/28/2022

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

11.2 |

861.6 |

922.3 |

167.4 |

6,639.6 |

7,779.1 |

17.4 |

591.4 |

|

SRW |

18.2 |

314.0 |

235.3 |

74.2 |

2,558.4 |

1,600.7 |

11.5 |

603.0 |

|

HRS |

54.7 |

686.1 |

909.5 |

68.7 |

4,789.9 |

6,745.7 |

13.5 |

648.9 |

|

WHITE |

34.2 |

280.0 |

877.9 |

66.7 |

3,090.1 |

5,762.4 |

0.0 |

400.3 |

|

DURUM |

0.4 |

0.5 |

69.6 |

0.4 |

195.5 |

595.0 |

0.0 |

64.4 |

|

TOTAL |

118.8 |

2,142.2 |

3,014.6 |

377.4 |

17,273.5 |

22,482.9 |

42.4 |

2,307.9 |

|

BARLEY |

0.0 |

5.7 |

5.1 |

0.1 |

14.8 |

25.5 |

0.0 |

8.6 |

|

CORN |

782.5 |

18,261.1 |

24,353.6 |

1,904.8 |

40,036.9 |

43,503.3 |

737.9 |

4,944.7 |

|

SORGHUM |

88.1 |

1,924.3 |

1,634.0 |

212.2 |

4,880.8 |

5,524.2 |

0.0 |

0.0 |

|

SOYBEANS |

734.6 |

11,020.0 |

4,955.8 |

563.7 |

47,291.8 |

56,328.9 |

407.0 |

11,148.3 |

|

SOY MEAL |

232.2 |

2,664.9 |

2,119.2 |

233.5 |

7,221.4 |

7,506.3 |

0.4 |

370.8 |

|

SOY OIL |

14.7 |

136.4 |

78.1 |

12.8 |

528.7 |

590.7 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

7.9 |

134.0 |

239.1 |

11.7 |

1,089.6 |

1,299.3 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.7 |

5.3 |

0.5 |

12.2 |

23.5 |

0.0 |

0.0 |

|

L G BRN |

0.3 |

5.8 |

2.7 |

0.5 |

45.4 |

36.0 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

9.8 |

45.4 |

14.3 |

77.3 |

109.5 |

0.0 |

0.0 |

|

L G MLD |

8.5 |

92.0 |

29.5 |

2.8 |

626.5 |

523.9 |

0.0 |

0.0 |

|

M S MLD |

-6.6 |

212.6 |

240.6 |

4.4 |

301.0 |

425.7 |

0.0 |

0.0 |

|

TOTAL |

10.1 |

463.0 |

562.7 |

34.1 |

2,152.1 |

2,418.0 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

232.4 |

6,130.8 |

3,929.0 |

426.6 |

8,592.5 |

11,284.0 |

93.2 |

2,939.3 |

|

PIMA |

3.4 |

114.4 |

184.2 |

21.2 |

353.1 |

588.6 |

4.0 |

44.6 |

This summary is based on reports

from exporters for the period April 22-28, 2022.

Wheat: Net sales of 118,800 metric tons (MT)

for 2021/2022 were up noticeably from the previous week and up 53 percent from the prior 4-week average. Increases primarily for Mexico (88,400 MT, including decreases of 13,600 MT), the Philippines (58,300 MT, including decreases of 5,000 MT), El Salvador

(10,400 MT, including 9,600 MT switched from Guatemala), South Korea (5,000 MT), and Colombia (3,300 MT, including decreases of 15,800 MT), were offset by reductions primarily for Nigeria (46,000 MT) and Guatemala (7,200 MT). Net sales of 42,400 MT for 2022/2023

were reported for Mexico (15,900 MT), the Dominican Republic (13,500 MT), Honduras (7,000 MT), and El Salvador (6,000 MT). Exports of 377,400 MT were up 53 percent from the previous week and 8 percent from the prior 4-week average. The destinations were

primarily to Mexico (87,600 MT), the Philippines (55,300 MT), South Korea (55,000 MT), Colombia (48,500 MT), and Japan (41,100 MT).

Corn: Net

sales of 782,500 MT for 2021/2022 were down 10 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for China (465,900 MT, including decreases of 10,200 MT), Colombia (191,600 MT, including 158,000 MT switched from

unknown destinations and decreases of 67,200 MT), Japan (165,800 MT, including 47,600 MT switched from unknown destinations and decreases of 1,600 MT), Spain (157,100 MT, including 98,000 MT switched from unknown destinations and decreases of 2,800 MT), and

Taiwan (82,900 MT, including 66,000 MT switched from unknown destinations), were offset by reductions primarily for unknown destinations (375,500 MT). Net sales of 737,900 MT for 2022/2023 were primarily for China (612,000 MT), Japan (50,600 MT), Guatemala

(46,700 MT), and El Salvador (22,300 MT). Exports of 1,904,800 MT–a marketing-year high–were up 22 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to China (465,800 MT), Mexico (279,800 MT),

Colombia (245,700 MT), Japan (201,200 MT), and Spain (157,100 MT).

Optional Origin Sales: For

2021/2022, the current outstanding balance of 378,300 MT is for unknown destinations (240,000 MT), South Korea (65,000 MT), Italy (34,300 MT), Morocco (30,000 MT), and Saudi Arabia (9,000 MT). For 2022/2023, the current outstanding balance of 35,400 MT

is for Italy.

Late Reporting: For

2021/2022, net sales and exports totaling 15,600 MT of corn was reported late for Venezuela.

Barley: No

net sales were reported for the week. Exports of 100 MT were unchanged from the previous week, but up noticeably from the prior 4-week average. The destination was to South Korea.

Sorghum: Net

sales of 88,100 MT for 2021/2022 were up noticeably from the previous week, but down noticeably from the prior 4-week average. Increases primarily for Spain (86,900 MT, including 83,000 MT switched from unknown destinations), were offset by reductions primarily

for unknown destinations (12,000 MT). Exports of 212,200 MT were up 26 percent from the previous week and 3 percent from the prior 4-week average. The destinations were to China (125,300 MT) and Spain (86,900 MT).

Rice: Net

sales of 10,100 MT for 2021/2022 were down 38 percent from the previous week and 71 percent from the prior 4-week average. Increases primarily for Honduras (8,700 MT), Canada (4,100 MT), El Salvador (3,200 MT switched from Guatemala), Saudi Arabia (2,100

MT), and the United Kingdom (1,200 MT), were offset by reductions for Jordan (5,800 MT) and Guatemala (3,900 MT). Exports of 34,100 MT were down 62 percent from the previous week and 46 percent from the prior 4-week average. The destinations were primarily

to South Korea (16,400 MT), Guatemala (7,900 MT), El Salvador (3,800 MT), Canada (3,000 MT), and Mexico (700 MT).

Soybeans: Net

sales of 734,600 MT for 2021/2022 were up 53 percent from the previous week and 28 percent from the prior 4-week average. Increases were primarily for unknown destinations (316,700 MT), China (200,800 MT, including 66,000 MT switched from unknown destinations

and decreases of 700 MT), Egypt (68,800 MT, including 65,000 MT switched from unknown destinations and decreases of 300 MT), Mexico (63,600 MT, including decreases of 18,400 MT), and Indonesia (32,900 MT, including decreases of 200 MT). Net sales of 407,000

MT for 2022/2023 were reported for China (268,000 MT), unknown destinations (121,000 MT), and Mexico (18,000 MT). Exports of 563,700 MT were down 21 percent from the previous week and 30 percent from the prior 4-week average. The destinations were primarily

to China (178,000 MT), Egypt (173,800 MT), Mexico (81,700 MT, including 9,900 MT – late), Colombia (35,600 MT), and Japan (26,000 MT).

Export for Own Account: For

2021/2022, new exports for own account totaling 29,700 MT were to Canada. The current exports for own account outstanding balance is 62,400 MT, all Canada.

Late Reporting: For

2021/2022, exports totaling 10,900 MT of soybeans were reported late for Mexico (9,900 MT) and Malaysia (1,000 MT).

Soybean Cake and Meal: Net

sales of 232,200 MT for 2021/2022 were up 14 percent from the previous week and 86 percent from the prior 4-week average. Increases primarily for Colombia (121,100 MT, including 22,000 MT switched from unknown destination and decreases of 2,200 MT), Guatemala

(43,400 MT, including decreases of 800 MT), Mexico (28,100 MT), Venezuela (18,500 MT, including 20,000 MT switched from unknown destinations, decreases of 1,500 MT, and 20,000 MT – late), and El Salvador (13,900 MT, including 3,700 MT switched from Guatemala),

were offset by reductions primarily for unknown destinations (18,000 MT) and the Dominican Republic (14,300 MT). Total net sales of 400 MT for 2022/2023 were for Canada. Exports of 233,500 MT were down 7 percent from the previous week, but up 2 percent from

the prior 4-week average. The destinations were primarily to the Philippines (49,800 MT, including 800 MT – late), Colombia (38,400 MT), Ecuador (32,800 MT), Morocco (21,900 MT), and Guatemala (19,900 MT).

Late Reporting: For

2021/2022, net sales totaling 20,000 MT of soybean cake and meal were reported late for Venezuela. Exports totaling 19,300 MT were reported late to Venezuela (18,500 MT) and the Philippines (800 MT).

Soybean Oil: Net

sales of 14,700 MT for 2021/2022 were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for South Korea (12,000 MT). Exports of 12,800 MT were up 29 percent from the previous week, but down 25 percent from the

prior 4-week average. The destinations were primarily to South Korea (11,800 MT) and Canada (600 MT).

Cotton: Net

sales of 232,400 RB for 2021/2022 were up 92 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for China (99,700 RB, including decreases of 13,500 RB), Vietnam (65,800 RB, including 1,000 RB switched from

Indonesia and 400 RB switched from South Korea), Bangladesh (24,000 RB), Turkey (15,400 RB, including decreases of 1,600 RB), and India (14,900 RB, including decreases of 1,200 RB), were offset by reductions for the Philippines (900 RB). Net sales of 93,200

RB for 2022/2023 were primarily for Turkey (36,300 RB), Pakistan (19,800 RB), Guatemala (14,600 RB), Peru (9,600 RB), and Indonesia (6,600 RB). Exports of 426,600 RB were up 11 percent from the previous week and from the prior 4-week average. The destinations

were primarily to China (156,500 RB), Turkey (74,200 RB), Vietnam (65,100 RB), Pakistan (48,000 RB), and Mexico (14,100 RB). Net sales of Pima totaling 3,400 RB were down 74 percent from the previous week and 47 percent from the prior 4-week average. Increases

reported for China (2,800 RB), Vietnam (1,300 RB, including 400 RB switched from Japan and 400 RB – late), Pakistan (1,000 RB, including 900 RB switched from the United Arab Emirates and 900 RB – late), Thailand (600 RB, including 300 RB switched from Japan,

300 RB switched from unknown destinations, and 300 RB – late), and Indonesia (100 RB switched from Japan, including 100 RB – late), were offset by reductions for the United Arab Emirates (900 RB), Japan (800 RB), India (400 RB), and unknown destinations (400

RB). Net sales of 4,000 RB for 2022/2023 were primarily for India (2,600 RB). Exports of 21,200 RB were up noticeably from the previous week and up 72 percent from the prior 4-week average. The destinations were primarily to India (8,300 RB), Peru (3,500

RB), Thailand (1,700 RB, including 300 RB – late), China (1,700 RB, including 1,300 RB – late), and Turkey (900 RB).

Optional Origin Sales: For

2021/2022, the current outstanding balance of 57,200 RB is for Vietnam (52,800 RB) and Pakistan (4,400 RB).

Exports for Own Account: For

2021/2022, the current exports for own account outstanding balance is 100 RB, all Vietnam.

Late Reporting: For

2021/2022, net sales totaling 1,700 RB of pima cotton were reported late for Pakistan (900 RB), Vietnam (400 RB), Thailand (300 RB), and Indonesia (100 RB). Exports totaling 3,900 RB of pima cotton were reported late to China (1,300 RB), Pakistan (900 RB),

Vietnam (400 RB), Switzerland (400 RB), Germany (400 RB), Thailand (300 RB), Colombia (100 RB), and Indonesia (100 RB).

Hides and Skins: Net

sales of 480,800 pieces for 2022 were up 25 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for China (288,400 whole cattle hides, including decreases of 8,400 pieces), Mexico (79,100 whole cattle hides, including

decreases of 600 pieces), South Korea (56,000 whole cattle hides, including decreases of 500 pieces), Thailand (22,100 whole cattle hides, including decreases of 1,500 pieces), and Brazil (9,700 whole cattle hides), were offset by reductions for Italy (1,600

pieces), Taiwan (700 pieces), and Canada (100 pieces). Exports of 428,000 pieces were up 3 percent from the previous week, but down 8 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (225,200 pieces), Mexico (46,800

pieces), South Korea (42,800 pieces), Thailand (39,100 pieces), and Italy (24,400 pieces).

Net sales of 87,700

wet blues for 2022 were up 43 percent from the previous week, but down 30 percent from the prior 4-week average. Increases primarily for China (32,600 unsplit), Vietnam (24,900 unsplit, including decreases of 100 unsplit), Thailand (18,100 unsplit), Taiwan

(7,500 unsplit), and Italy (6,300 unsplit, including decreases of 100 unsplit and 100 grain splits), were offset by reductions for Mexico (4,400 unsplit). Exports of 164,700 wet blues were up 29 percent from the previous week, but down 2 percent from the

prior 4-week average. The destinations were primarily to Italy (42,000 unsplit and 12,100 grain splits), Vietnam (38,300 unsplit), China (35,700 unsplit), Thailand (15,400 unsplit), and Hong Kong (7,400 unsplit). Net sales of 759,000 splits were up noticeably

from the previous week and up 53 percent from the prior 4-week average. Increases reported for Vietnam (758,000 pounds, including decreases of 5,000 pounds), China (4,000 pounds), and Taiwan (1,900 pounds), were offset by reductions for South Korea (4,900

pounds). Exports of 484,300 pounds were up 2 percent from the previous week, but down 27 percent from the prior 4-week average. The destinations were primarily to Vietnam (319,400 pounds) and China (122,100 pounds).

Beef: Net

sales of 14,600 MT for 2022 were up 28 percent from the previous week and 1 percent from the prior 4-week average. Increases were primarily for Japan (4,100 MT, including decreases of 600 MT), South Korea (3,200 MT, including decreases of 600 MT), Taiwan

(1,800 MT, including decreases of 100 MT), China (1,600 MT, including decreases of 100 MT), and Canada (1,200 MT, including decreases of 100 MT). Total net sales of 100 MT for 2023 were reported for Japan. Exports of 20,300 MT were up 16 percent from the

previous week and 7 percent from the prior 4-week average. The destinations were primarily to Japan (6,600 MT), South Korea (5,000 MT), China (3,200 MT), Taiwan (1,300 MT), and Mexico (1,100 MT).

Pork: Net

sales of 23,800 MT for 2022 were down 24 percent from the previous week and 13 percent from the prior 4-week average. Increases primarily for Mexico (11,300 MT, including decreases of 300 MT), South Korea (3,700 MT, including decreases of 1,000 MT), Japan

(3,400 MT, including decreases of 100 MT), Colombia (1,300 MT, including decreases of 200 MT), and Canada (900 MT, including decreases of 500 MT), were offset by reductions for Nicaragua (600 MT) and New Zealand (100 MT). Exports of 32,200 MT were up 8 percent

from the previous week and from the prior 4-week average. The destinations were primarily to Mexico (15,600 MT), Japan (4,100 MT), China (3,600 MT), South Korea (2,600 MT), and Canada (1,500 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.